Using the Asymetrix protocol, you can earn multiple times the annual interest rate through ETH staking, even with a small deposit.

Written by: VIKTOR DEFI

Translated by: TechFlow

The enduring charm of winning has always been a key factor in fans' continued loyalty to sports events. The anticipation of those high moments generates and sustains people's fervor for the game. This applies not only to sports but also to premium securities.

A typical example is the premium securities in the UK, with over 23 million people currently investing over £120 billion. Research shows that the success of premium securities in the UK is attributed to two reasons: first, investors are not worried about capital loss; second, the thrill of winning.

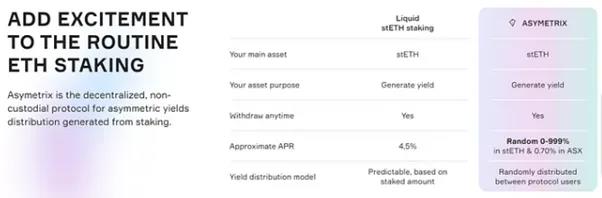

Correspondingly, in recent months, the ETH staking business has been rapidly growing, attracting a large number of developers and users. However, the average annualized return of LSD is only 4-5%, and the staking and reward distribution process lacks excitement. This is where the Asymetrix Protocol comes in.

"Our team has invented a protocol where you can earn multiple times the annual interest rate through ETH staking, even with a small deposit. And a little bit of luck." - Rostyslav Bortman, Chief Technology Officer of Asymetrix.

What is Asymetrix

Asymetrix is not your typical LSDfi project; it is an innovative staking protocol full of excitement and luck. It is a decentralized, non-custodial protocol specifically designed to support asymmetric yield distribution. Built on Ethereum, Asymetrix allows users to earn high returns through ETH staking.

As mentioned earlier, the concept of Asymetrix is inspired by the success of premium securities in the UK. Asymetrix has borrowed from the traditional successful model, providing new opportunities in the crypto space, encouraging users to stake ETH to win substantial rewards. In the months following its launch, the project quickly became a leading LSDfi protocol in terms of Total Value Locked (TVL), clearly demonstrating the market fit of its product and the effectiveness of its Bonding model.

Technology: How It Works

You might be curious about how Asymetrix works. Taking an actual example, 200 users deposit a total of 200 stETH into the Asymetrix protocol. Then, the pool generates a staking reward of 10 stETH. Asymetrix collects and randomly distributes 10 stETH to one user. The lucky winner can receive up to a 500% staking reward, while the other 199 stakers, although not earning any returns, can still retain their initial deposits.

Step 1: Deposit and Minting

Users first deposit stETH into the Asymetrix smart contract, which mints Pool Share Tokens (PST) at a 1:1 ratio to the user's stETH deposit and sends them to their wallet. The minted PST confirms the user's deposit, reflects their share in the pool, and is required for withdrawal. As of the time of writing, the minimum deposit threshold for the Asymetrix protocol is 0.1 stETH.

Step 2: Yield Distribution

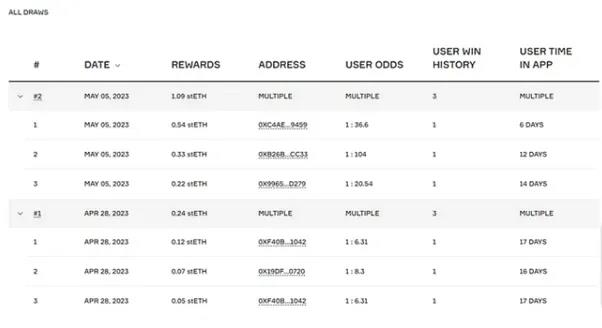

Over time, Asymetrix accumulates rewards from staked stETH and distributes the earnings to the winners. Every 604,800 seconds, approximately one week, a random draw takes place. Subsequently, the algorithm randomly selects and rewards the winner, assisted by Chainlink VRF.

No one can influence the draw results, not even the DAO. The probability of winning for each user is determined by the Time-Weighted Average Balance (TWAB) formula, which calculates the user's contribution to the pool and the time their deposit is held between two draws. Then, Chainlink's VRF generates a random number and matches it with the selection to determine the winner.

Step 3: Winners

After the draw, the winner automatically receives PST rewards (equivalent to the amount of stETH won). This increases the user's balance and their chances of winning rewards in future draws. Users can withdraw their tokens at any time, maintaining complete control over their funds.

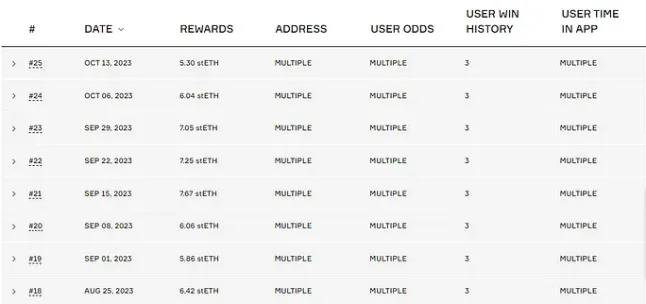

To date, Asymetrix has distributed 87.95 stETH to 28 lucky stakers through weekly draws over 14 weeks. Compared to traditional staking, this gives stakers the opportunity to achieve so-called annualized returns in a single draw.

Token Economics

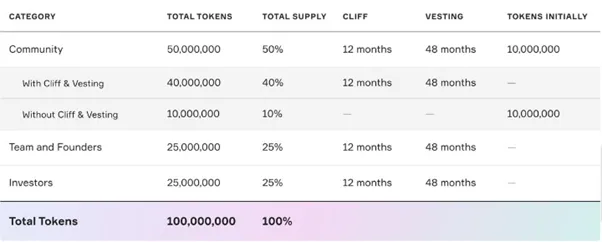

ASX is the governance and utility token of Asymetrix. The total supply is 100 million tokens, with 50% allocated to the community, 25% to investors, and 25% to core contributors. The team has reserved 10% of the community's 50% for incentivizing early protocol users.

Hacken, a well-known crypto audit company, has audited Asymetrix. Additionally, they are running an ongoing bug bounty program to help secure the platform and reward bug bounty hunters.

Recently, the protocol announced the release of Asymetrix 2.0. While the V1 version was already impressive, the V2 version has comprehensive improvements in the ASX token design. Three upcoming features of the V2 version are particularly noteworthy: esASX, BOOST, and Mini Pools.

As the name suggests, esASX stands for Encumbered ASX, and technically, it holds the same value as the governance token - ASX. EsASX is a non-transferable token designed to serve long-term purposes and project sustainability. Users will need a 100-day vesting period to convert their esASX to ASX at a 1:1 ratio - this will help alleviate selling pressure and curb early selling.

With the arrival of V2, esASX will become the default token for early user incentives and will be distributed in the next phase of incentive allocation. The tokens for the second phase of early incentives are divided into two parts. 1,000,000 esASX/ASX will be distributed to all users depositing in Asymetrix, as before. The other part, 3,000,000 esASX/ASX, is specifically designed for users obtaining BOOST in the esASX/ASX allocation.

Asymetrix's V2 introduces two novel boosting mechanisms: ODDS BOOST and esASX BOOST. Whenever users provide and lock liquidity on the Asymetrix smart contract, they receive ODDS BOOST, increasing their chances of winning in the weekly draw. On the other hand, esASX BOOST is an additional reward given to liquidity providers to enhance the distribution of esASX tokens.

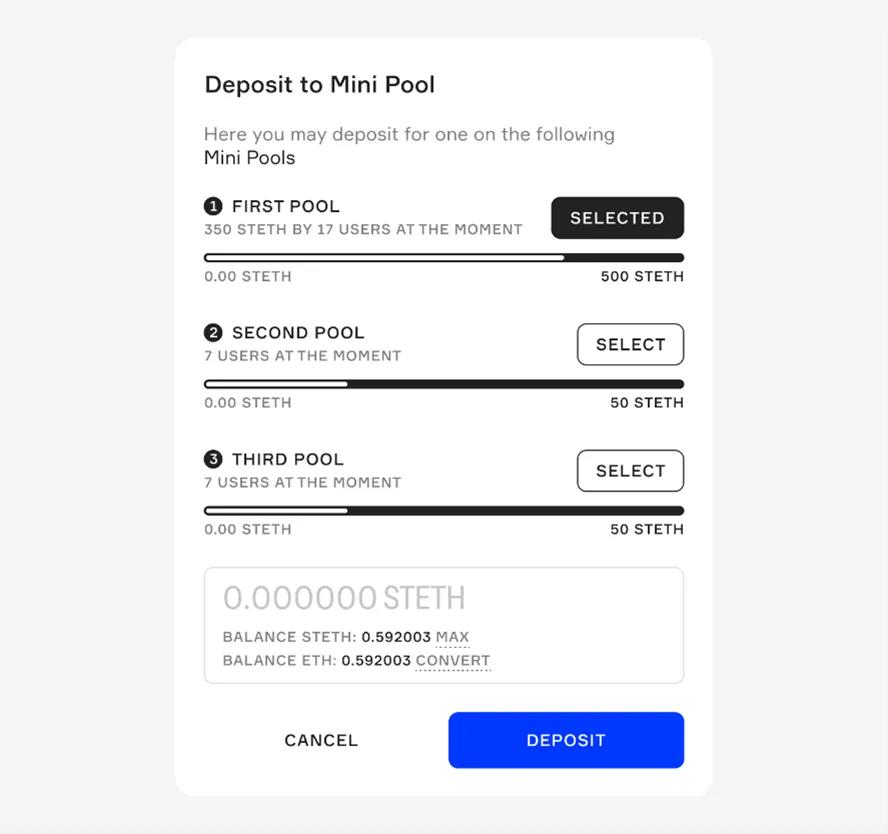

Mini pools can be seen as a support group, enabling small depositors to fully participate in the Asymetrix ecosystem. In essence, mini pools are a collective of small deposit users who pool their funds to participate in the weekly draw. Additionally, rewards earned will be distributed to participants based on their share in the pool.

Conclusion

In the early days of decentralized finance, people primarily joined to try out a new and increasingly popular internet financial system. But now, they primarily join for better returns and the thrill of winning. Imagine earning a huge 500% return and the excitement it brings.

Even if you don't win, you will get back your initial deposit and some esASX/ASX rewards. In the long run, this model will enjoy the same scale effect as the UK premium bonds. With growing statistics and the upcoming V2 version, Asymetrix leading the LSDfi narrative is only a matter of time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。