Market Preview for This Week (10.16-10.22), Interpreting the Impact of Data such as the Three-Month High in USDT On-Chain Active Addresses, Narrowing of Grayscale GBTC Discount Rate, and Decrease in Ethereum Staking Scale on Future Market Trends

○/Author: DC Research Institute - Lao Li Mortar

Table of Contents for This Week's Research Report:

I. Key Events Forecast for Macro-Economic Data and the Cryptocurrency Market this Week;

II. Review of Key News from Last Week;

III. Community Interaction and Sharing from Last Week;

IV. Important Events and Data and Analysis by the DC Research Institute;

V. Top Gainers in the Cryptocurrency Market Last Week and Selection of Community Hot Coins;

VI. Mainstream Holdings and Increase in Holding Addresses in the Cryptocurrency Market;

VII. Attention to Negative Data on Project Token Unlocks;

VIII. Top Gainers in Cryptocurrency Market Concept Sectors;

IX. Overview of Global Market Macro Analysis;

X. Future Market Analysis by the DC Research Institute.

I. Key Events Forecast for Macro-Economic Data and the Cryptocurrency Market this Week:

October 16 (Monday): US October New York Fed Manufacturing Index; Philadelphia Fed President Harker's speech on economic outlook. JPMorgan Chase bans cryptocurrency-related transactions for UK customers; OKX delists multiple tokens; Arbitrum's second-week Odyssey event will restart on October 16; Metaverse project ZepetoX launches ZTX token.

October 17 (Tuesday): US September Retail Sales MoM; US September Industrial Production MoM; Speeches by New York Fed President Williams, Richmond Fed President Barkin, and Philadelphia Fed President Harker. Coinbase removes 80 non-USD trading pairs.

October 18 (Wednesday): China's Q3 GDP YoY; Eurozone September CPI YoY final value; 2023 Global Industrial Internet Conference will be held in Shenyang from October 18 to 20; State Council Information Office holds a press conference on the operation of the national economy; Morgan Stanley, Netflix, Tesla, IBM release earnings reports. Ethereum Foundation holds EOF implementer conference call.

October 19 (Thursday): US September Existing Home Sales Annualized MoM; Federal Reserve releases Beige Book on economic conditions; Federal Reserve Vice Chairman Jefferson delivers a speech.

October 20 (Friday): China's October LPR quote; Japan's September CPI and Core CPI YoY; Speeches by Federal Reserve Chairman Powell, Chicago Fed President Evans, and Philadelphia Fed President Harker; Bank of Japan Governor Kuroda delivers a speech; EU-US summit held. Valkyrie's Bitcoin Futures Leveraged Strategy ETF filing becomes effective.

October 16 to October 22, FLOW, APE, AXS, and ID tokens will be unlocked, with two significant unlocks: AXS will unlock 15.13 million tokens (approximately $64.59 million) on October 20, accounting for 11.5% of the circulating supply; ID will unlock 18.49 million tokens (approximately $3.41 million) on October 22, accounting for 6.46% of the circulating supply.

II. Review of Key News from Last Week (Exclusive Compilation):

In terms of data, long-term holders of Bitcoin own 69% of the supply; Bitcoin has reached a historic high in hash rate, reaching 455 EH/s; Total staked amount for ETH 2.0 has reached 30.5771 million; Since withdrawals, ETH staking has increased by 50%, growing from 18 million ETH to 27 million ETH within 6 months. Grayscale Bitcoin Trust GBTC discount rate has significantly narrowed by 16.5%; Total on-chain transactions on Base have exceeded 50 million; Bitcoin Lightning Network has grown by 1212% in the past two years; Bitcoin Lightning Network capacity has returned to over 5000 BTC, growing by approximately 11% in the past 30 days; USDT active addresses have reached a new high in three months; Exchange USDT supply has reached $9.99 billion, the highest since March.

In terms of projects and platforms, the total market value of meme coins has shrunk by over $3 billion in the past 9 months. Perpetual contracts accounted for approximately 96% of trading volume on CEX in the past 7 days; The reserve fund for stablecoin DAI in the USDR treasury has been completely depleted, with illiquid assets dominating; Web3 Foundation plans to deploy $22.08 million and 5 million DOT next year to promote Polkadot's development; Despite being sanctioned by the US Treasury, Tornado Cash remains the largest mixer on Ethereum; The Ethereum Foundation still holds approximately $500 million, with a total of 531,000 ETH and WETH.

In terms of macro policies and regulations, the SEC will not appeal the Grayscale Bitcoin Trust case, leading to an increase in NFT trading volume; Minutes from the Federal Reserve meeting: Most Fed officials believe that another rate hike is appropriate; New York Fed survey: Large banks expect the Fed to stop shrinking its balance sheet in Q3 next year.

Institutional research reports and viewpoints indicate that the bullish trend of Bitcoin may stimulate the purchase of certain altcoins; A report suggests that the market value of tokenized assets could reach $10 trillion by the 2030s; ARK Invest submits an updated prospectus for a spot Bitcoin ETF; Grayscale report: With the continuous increase in blockchain adoption, token valuations will experience nonlinear growth; Analysis by K33: Holding BTC may be the safest investment option at present; Report: The polarization between the Korean won market exchanges and the token market exchanges has deepened; Bloomberg analyst: It is unlikely that the SEC will appeal the Grayscale ruling, with a 75% chance of ETF approval by the end of the year.

III. Community Interaction and Sharing from Last Week:

In the past few days, the overall funding rate for Loom has been quite exaggerated. After checking the history, Binance's funding rate for Loom has been abnormal since midnight on October 15. There should be a considerable amount of funds using Loom for arbitrage before settlement. However, due to the current high volatility, if the price fluctuation is opposite to the direction of the position and greater than the funding rate, it may result in losses. Unless there is a significant reverse and large fluctuation in the funding rates between different markets, entering and exiting at the same price level before settlement may yield good profits.

IV. Important Events and Data and Analysis by the Deepcoin Research Institute:

Regarding last week's Santiment data, Tether's on-chain activity has increased, with active addresses reaching a new high in three months, mainly due to the increase in deposits on exchanges. In addition, wallets holding 1 million to 10 million USDT have been accumulating, indicating that buyers are interested in continuing to hoard USDT for the future.

The Deepcoin Research Institute believes that the new high in USDT on-chain active addresses is driven by a large amount of coin deposits on exchanges from a data perspective. Specifically, whales are accumulating more USDT, and we speculate that the current main players choosing to hold USDT essentially reflects a lack of optimism about the future market in the short to medium term. This can be compared to Warren Buffett's choice to hold a large amount of US dollars and take a wait-and-see attitude towards the stock market, outperforming many US stock traders. Furthermore, in the long term, whales holding USDT may also be preparing for suitable buying opportunities and positions in the future.

The concentration of USDT in large holding addresses indicates that retail investors have suffered more losses in the past three months, while institutional funds have profited from the wide-ranging volatile market conditions.

On the other hand, since most USDT users are Chinese, the recent positive premium of USDT against the real exchange rate of the US dollar to the Chinese yuan has led to many users engaging in arbitrage and high-level buying and selling behaviors, increasing trading activity. Additionally, with the current round of Fed rate hikes pushing the federal funds rate to 5.25%-5.5%, and many users facing restrictions on currency exchange, some users may choose to conduct transactions in the form of equivalent tokens such as the US dollar. We believe that these factors collectively contributed to the new high in USDT on-chain active addresses.

Regarding data shared by the President of ETFStore, the discount rate of Grayscale Bitcoin Trust GBTC has significantly narrowed from approximately 43% in June this year to a "relatively optimistic" 16.5%. It is widely believed that fluctuations in this indicator are a sign of changing market confidence in the approval of a spot Bitcoin ETF by the SEC. Due to the lack of ETF options, many people have chosen GBTC as a channel to gain exposure to Bitcoin. However, the significant discount of GBTC is due to multiple factors. Historically, GBTC has traded at a high premium, but with increased competition and the prospect of a Bitcoin ETF becoming more realistic, the trust fund has begun trading at a discount. Analysis suggests that the US Securities and Exchange Commission may gradually approve a spot Bitcoin ETF.

Deepcoin Research Institute believes that due to the continuous news of major institutions applying for Bitcoin ETFs, and many industry insiders also expressing optimism about the SEC's future approval, this has to some extent boosted market expectations. Additionally, as a pioneer in Bitcoin-related derivative investments, Grayscale is also expected to be among the first ETFs, so the market's valuation of GBTC has gradually increased. This has to some extent slowed down the unlocking and redemption of GBTC shares, leading to a narrowing of the discount rate. However, the extent of this in the future is uncertain, as the approval of a spot Bitcoin ETF will influence the fluctuation of Grayscale GBTC's discount rate.

In terms of platform research reports, Coinbase stated in a research report on Friday that since the Shanghai upgrade in May, the Ethereum blockchain validator queue has been cleared for the first time, indicating that investor demand for ETH staking is stabilizing. With the peak of validators entering in recent months, the staking yield has decreased from over 5% to 3.5%. Additionally, Ethereum's on-chain activity remained stable in the third quarter, while the total transaction volume increased. Coinbase stated that if the basic activity and transaction fees on the network remain consistent, and with the slowdown in validator growth, the staking yield is expected to remain stable.

Deepcoin Research Institute believes that this report indicates that investors favoring relatively stable returns are gradually reducing their demand for Ethereum staking yields. On one hand, the decrease in staking yield from 5% to a bank fixed deposit-like 3.5% has lost its attractiveness. On the other hand, since the Shanghai upgrade in May, the overall price of ETH has fallen, causing stakers to have concerns about future prices and refrain from continuing to stake. Additionally, the recent weaker trend of ETH compared to BTC, which we analyzed in the previous research report (hackers exchanging ETH for BTC on a large scale, total locked amount decreasing leading to ETH inflation, among other factors), with only 6.1 million monthly active users on Ethereum, these factors have led to the flow of funds from previous stakers to BTC.

V. Top Gainers in the Cryptocurrency Market Last Week and Selection of Community Hot Coins:

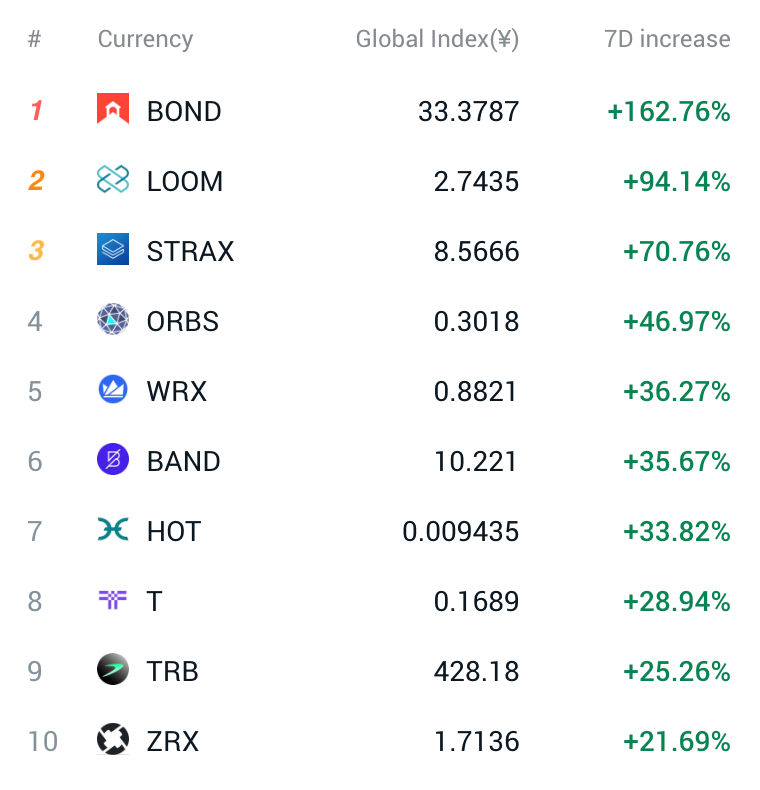

In the past week, the top gainers in the altcoin market are as shown above. BOND had a gain of over 160%, LOOM had a gain of nearly 100%, with LOOM being a coin we recommended paying attention to two weeks ago. STRAX had a gain of approximately 70%, ORBS had a gain of nearly 50%, and WRX/BAND/HOT had gains of over 30%. There are also some coins at the top of the list that are worth paying attention to this week, considering market trends and strength.

The following are hot coins discussed in the DC community, with the following selections for reference only and not constituting trading advice:

GRT is currently testing the previous daily downtrend line. If it can break through, it is expected to test the next resistance near $0.1.

CAKE hit a historic low over the weekend and is fundamentally a weak coin. Short-term rebound resistance is around $1.282 and $1.35.

LDO is being watched to see if it can break the triangle convergence pattern, with a chance of reversal. The current resistance of the downtrend line is near $1.63, indicating a breakthrough state.

MKR broke the upward trend line on the hourly chart last week, but has not broken the upward trend line on the four-hour chart.

BCH currently has support from the upward trend line near $202, which is also a previous retracement position with resonant support.

UTK and REQ both belong to the payment concept and Coinbase comprehensive concept, with REQ having a larger market value than UTK. From the daily trend, UTK is not suitable for buying, as it has been in a clear downtrend, hitting a historic low last month, with many upper shadows during previous rallies. Short-term highs and lows, with a greater decline than the high, are not recommended for buying.

VI. Mainstream Holdings and Increase in Holding Addresses in the Cryptocurrency Market:

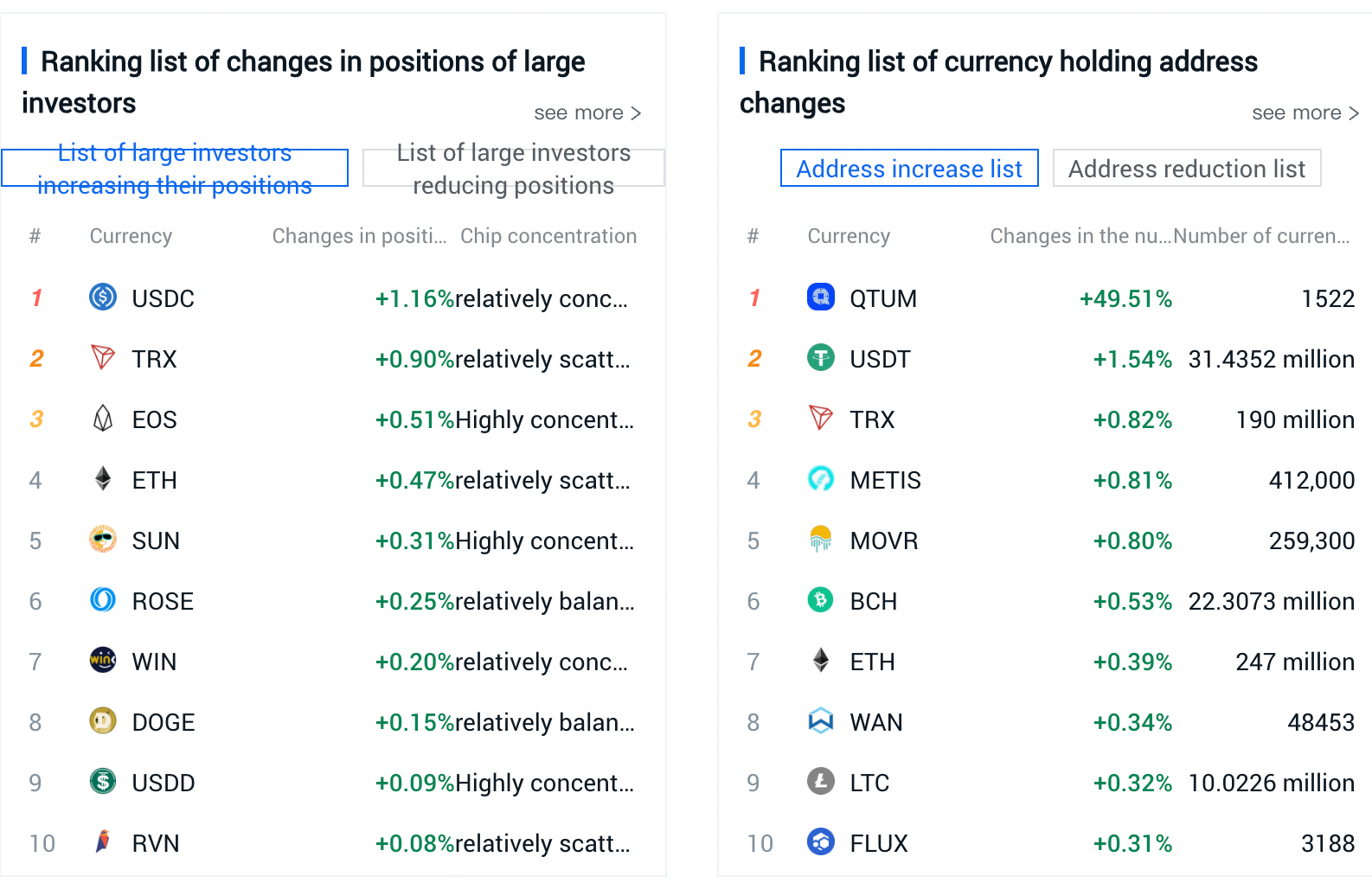

In the list of major holders' increases, apart from stablecoins, TRX/EOS/ETH/SUN/DOGE and other established coins are at the forefront. It is important to pay attention to the movements of the main players and the situation of whale increases. Additionally, it may also be the project party and trading platform consolidating holdings, so careful selection is necessary. For example, today there was news that Arkham transferred 1.5 million ARKM to Binance for internal transfers.

In terms of changes in holding addresses, TRX/METIS/MOVR/WAN/LTC all saw significant increases, and their market trends should be closely monitored. Additionally, there may be project parties engaging in volume brushing behavior, so independent judgment is required.

VII. Attention to Negative Data on Project Token Unlocks:

According to Token Unlocks data, from October 16 to October 22, FLOW, APE, AXS, and ID tokens will be unlocked, including:

- Flow token FLOW will unlock 7.29 million tokens (approximately $3.23 million) on October 16 at 08:00, accounting for 0.7% of the circulating supply.

- ApeCoin token APE will unlock 15.6 million tokens (approximately $16.66 million) on October 17 at 08:00, accounting for 4.23% of the circulating supply.

- Axie Infinity token AXS will unlock 15.13 million tokens (approximately $64.59 million) on October 20 at 21:10, accounting for 11.5% of the circulating supply.

- SPACE ID token ID will unlock 18.49 million tokens (approximately $3.41 million) on October 22 at 08:00, accounting for 6.46% of the circulating supply.

This week, attention should be paid to the negative effects of these token unlocks, avoiding spot trading and seeking short opportunities in contracts. Among these, AXS and ID have significant unlock amounts and should be closely monitored.

VIII. Top Gainers in Cryptocurrency Market Concept Sectors:

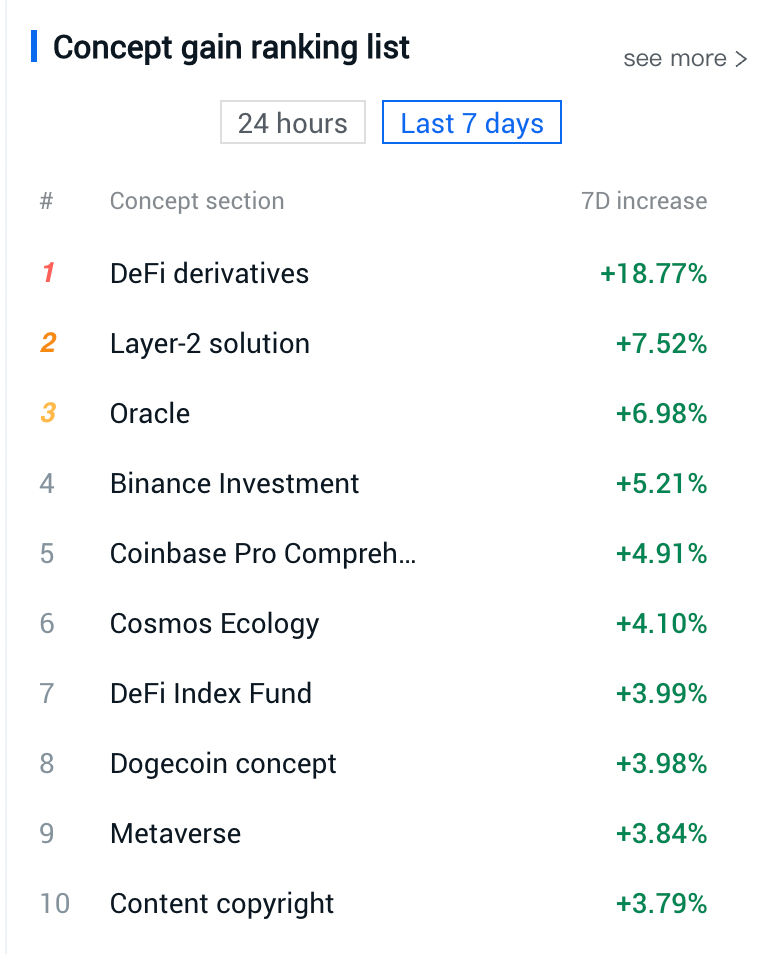

In the past week, the performance of concept sectors is as shown above, divided by the degree of increase and decrease. In the last seven days, DeFi derivatives, Layer-2 solutions, oracles, and Binance investments have seen significant increases. It is important to pay attention to the rotation and speculation opportunities of leading coins in the above-mentioned sectors.

IX. Overview of Global Market Macro Analysis:

Last week, the three major US stock indexes fluctuated lower, with poor performance from star tech stocks, while the gold and silver sectors closed higher, and the oil and gas sector rose throughout the day. At the close, the Dow rose by 0.12%, the Nasdaq fell by 1.23%, and the S&P fell by 0.5%. The yield on the US ten-year Treasury fell by 1.788% to 4.615%, compared to a -45 basis point difference in the two-year Treasury yield. The VIX fear index rose by 15.76%, and Brent crude oil closed higher by 5.34%. Spot gold has been rising since November 2022 and has been falling since May 2023, rising by 3.3% yesterday to $1930.58 per ounce. The US dollar index has been continuously falling from its high in October 2022, with some rebounds, and rose by 0.09% yesterday to 106.68.

Looking back at the global market performance last week, while A-shares' main stock indexes continued to fluctuate, US and European stocks also showed fluctuating and divergent trends. In comparison, the previously declining stock markets of Japan and South Korea showed a more obvious rebound.

This week, a series of heavyweight economic data will be released, and the global market is waiting with bated breath. Developed countries such as Canada, the UK, and Germany will release inflation data. On October 19, the US will release initial jobless claims for the week ending October 14. The Federal Reserve will release the Beige Book on economic conditions, and Federal Reserve Chairman Powell will deliver a speech. In terms of financial reports, important listed companies such as Tesla, TSMC, and Netflix will release their latest financial reports.

The intensification of the new round of conflict between Israel and Palestine is considered an uncertainty factor for the global market. The Palestinian Ministry of Health announced that as of now, this round of conflict has resulted in 2,726 deaths and over 10,800 injuries on the Palestinian side. According to local reports from Israeli media, this round of conflict has caused at least 1,400 deaths on the Israeli side. In addition, according to a report from the Israeli Ministry of Health cited by the Israeli newspaper "Israel Times," as of the evening of the 15th, this round of conflict has resulted in 3,842 injuries in Israel, with 369 people still receiving treatment in hospitals. So far, the new round of conflict between Israel and Palestine has resulted in over 4,100 deaths on both sides.

X. Future Market Analysis:

BTC experienced a pullback last week, with a weak trend after breaking the upward trend line on the small time frame. We mentioned in the community judgment that after testing the breakthrough position of the downtrend line, it is expected to run within the cross space in the short term. After five days of continuous oscillation, a significant rebound appeared on Monday this week, which can be seen as a confirmation of the effective breakthrough behavior after testing the trend line extension position following the breakthrough of the downtrend line. The short-term resistance above BTC is around $28,580. If it breaks through, it will turn strong overall, with the potential to test around $29,695 and $30,245. However, if it is under pressure near $28,580, there is a chance of a pullback, with support below at around $27,000 and $25,990.

ETH accelerated its upward trend after oscillating, with current resistance above around $1595-1599. Support below is around $1550 and $1500.

Follow us: Lao Li Mortar

DC Research Institute

October 16, 2023

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。