Through WOOFi mining, WOOFi provides Supercharger Earn Vaults, which is a one-way income product that does not cause impermanent loss.

Written by: ASXN

Compiled by: Deep Tide TechFlow

WOOFi is a cross-chain decentralized exchange where users can swap assets, earn income, and stake on 10 different chains. The exchange uses a novel Synthetic Proactive Market Making (sPMM) algorithm to price assets, which involves retrieving order book data from centralized exchanges and a complex hedging mechanism to operate as a market maker. Compared to traditional Automated Market Making (AMM) mechanisms, this can achieve more accurate pricing, more efficient liquidity, minimal impermanent loss, and protection against front-running.

Over the past year, WOOFi has actively pursued a positive cross-chain expansion strategy and has often been one of the first non-native decentralized exchanges to be launched on newly listed EVM-compatible chains.

Through WOOFi mining, WOOFi provides Supercharger Earn Vaults, which is a one-way income product that does not cause impermanent loss. Supercharger Earn Vaults is essentially a low leverage borrowing product, similar to Maple Finance, that can generate real income.

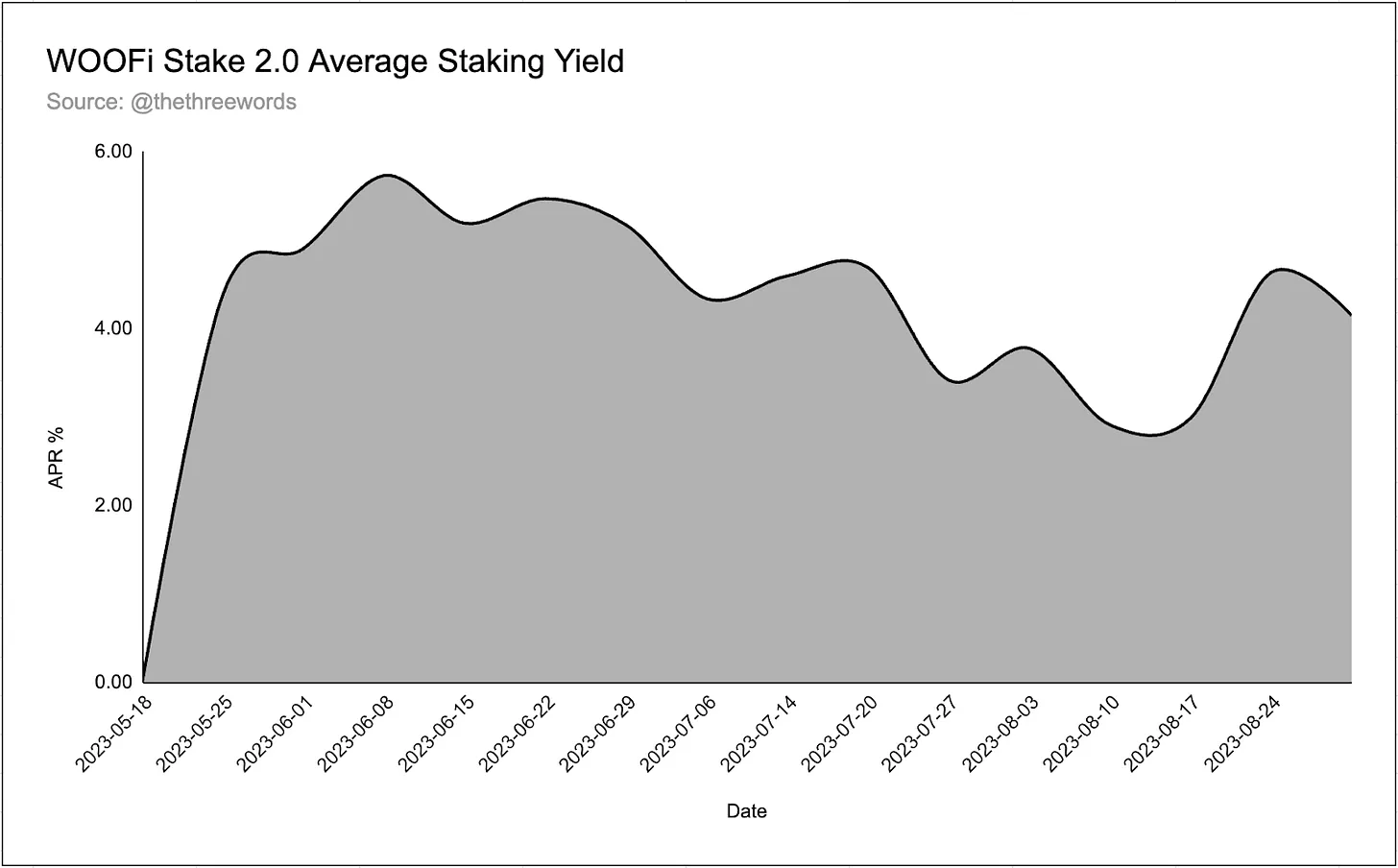

WOO token holders can benefit from protocol fees through WOOFi staking. WOOFi staking allows users to stake WOO on multiple chains and earn protocol fees, with WOO stakers maintaining a yield of around 4%, rewarded in the form of USDC.

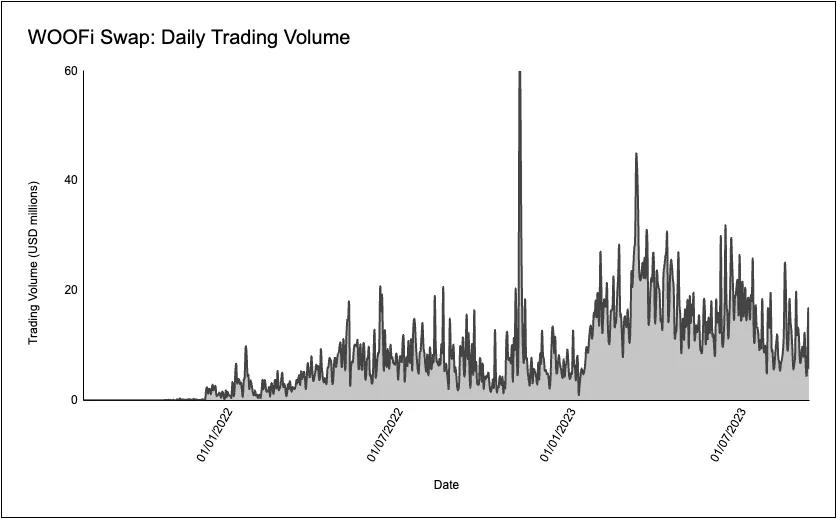

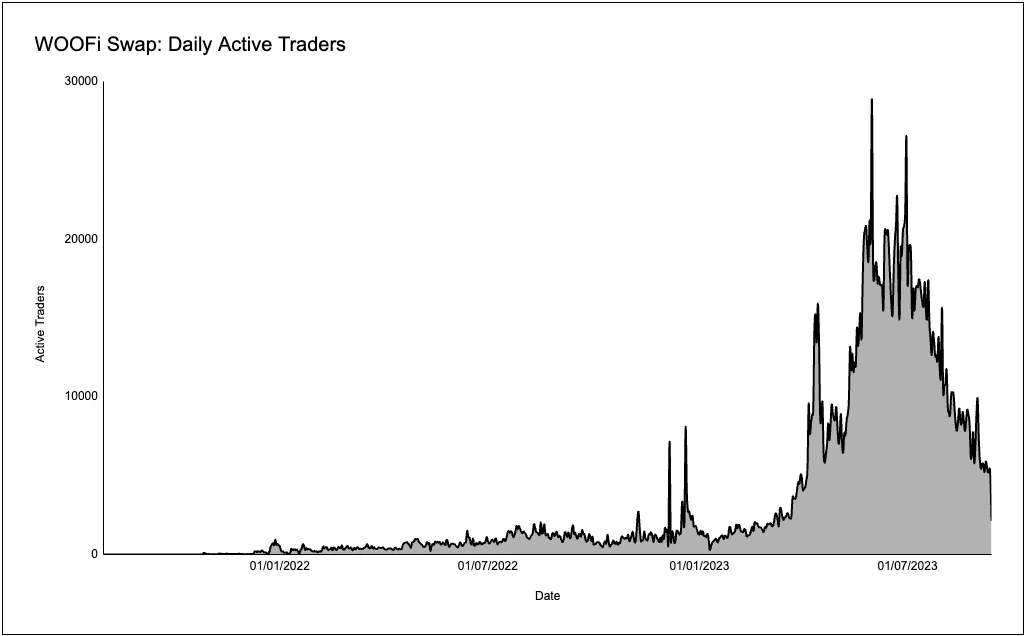

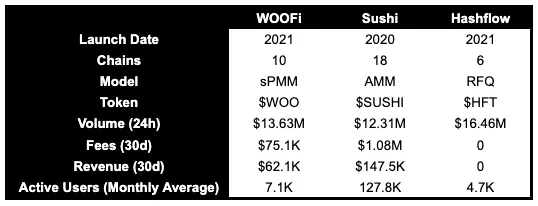

In the past month, WOOFi's daily average trading volume reached $13.63 million, making it the 20th decentralized exchange in terms of trading volume in the blockchain field. Additionally, WOOFi had an average of approximately 7,000 active traders during this period.

Trading Mechanism

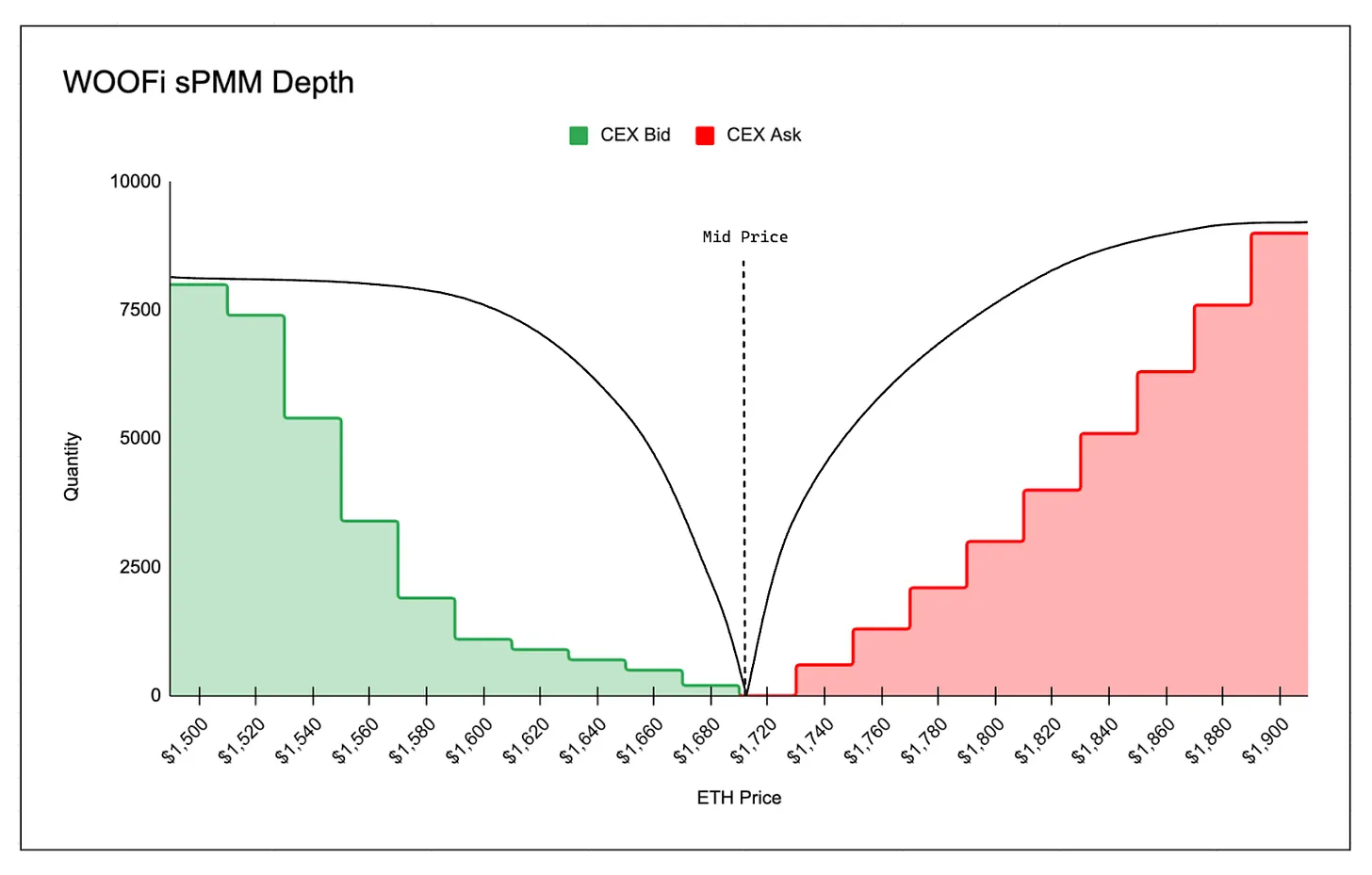

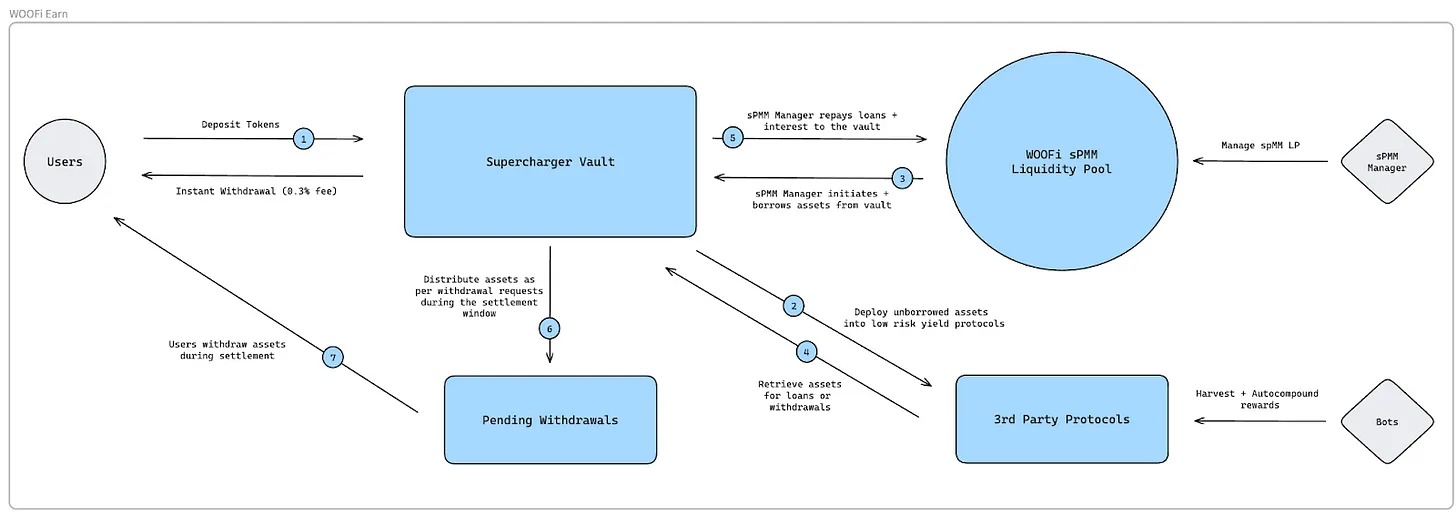

WOOFi exchange uses the sPMM algorithm, which aims to simulate centralized exchange quotes, bid-ask spreads, and market depth.

In contrast, most decentralized exchanges operate as Automated Market Makers (AMM) and use the constant product market maker model. These models rely on the xy = k function to calculate the price between two tokens based on the available reserve balances of each token (x and y). This curve is based on the principle that trading should not change the product of the reserve balances (x and y). According to the constant product formula, the price of token x is calculated as price x = reserve token y / reserve token x.

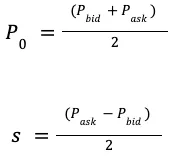

On the other hand, the sPMM algorithm receives order book data from centralized exchanges and uses the mid-price (P0) (the average of buy and sell prices), bid-ask spread (s) (the ratio of the difference between sell and buy prices and the mid-price), and slippage to determine the trading price.

The centralized exchange providing order book data is chosen by the market maker and depends on where the market maker chooses to hedge. Custom on-chain price oracles are used to receive the data. The oracles actively push price updates, meaning that as the price changes on the centralized exchange, new prices replace old ones. When users make exchanges, they receive prices based on the latest valid parameters on-chain. On-chain data is determined by the market maker based on price deviations and is typically updated by about 0.1% (i.e., updated when the price changes by 0.1%).

In addition to mid-price and bid-ask spread data, WOOFi also uses a slippage coefficient (k) to simulate the liquidity of the centralized exchange from which the order book data is extracted. It is used to ensure that on-chain slippage matches the slippage on the order book of the centralized exchange, so that users executing the same trade on the centralized exchange and WOOFi exchange experience similar slippage.

The slippage coefficient ensures that on-chain quotes are competitive enough to attract aggregator flow, while also managing the risk associated with hedging on-chain flow to maintain market neutrality and profit.

Price of asset x:

AMM:

Where: y is the balance of token y in the pool, and x is the balance of token x in the pool

WOOFi Swap:

The following is an overview of how WOOFi Swap works:

For example, if a user wants to buy ETH with USDC:

- The user initiates the trade to buy ETH with USDC.

- The sPMM algorithm retrieves mid-price and bid-ask spread data from the order book of the centralized exchange through custom on-chain price oracles.

- Based on the bid-ask spread and liquidity, the estimated amount of ETH the user will receive is calculated to match the centralized exchange.

- The user receives ETH from the liquidity pool and pays USDC.

- The sPMM pool manager hedges to maintain market neutrality, taking the same position as the user. (i.e., if the market maker sells ETH to receive USDC, they will buy ETH to pay USDC, or use other tools such as perpetual contracts to increase their ETH position).

WOOFi Exchange Overview

Minimizing Impermanent Loss

Users providing liquidity to traditional AMMs face significant impermanent loss. AMM pools rebalance by arbitrage traders buying tokens at a low price and selling tokens at a high price until the AMM price matches the broader market. This profit is extracted from liquidity providers, who suffer impermanent loss and bear negative slippage to rebalance the pool.

In the sPMM model, user deposits are managed by sPMM managers. There is no malicious arbitrage flow that extracts profits from liquidity providers. sPMM managers hedge their positions to maintain market neutrality, so even if the swap pool is unbalanced, they can make up for the assets on WOO X.

For example:

- A user buys 10 ETH with 20,000 USDC from WOOFi Swap.

- The pool would theoretically become unbalanced, with less ETH and more USDC.

- The sPMM manager hedges the position by buying 10 ETH off-chain to compensate for the imbalance.

Preventing MEV

Since WOOFi Swap does not use the AMM pricing model, i.e., prices do not come from underlying asset pools, it is not affected by frontrunning bots, and users are protected from sandwich attacks, and liquidity providers (and users) are protected from flash loan attacks.

First, sandwich attacks work by causing users to execute at unfavorable prices:

- The user submits a transaction to purchase asset X through AMM.

- Frontrunning bots see the pending transaction in the trading pool and place a trade before and after the user's transaction.

- Since the asset price in AMM is derived from the balance in the AMM liquidity pool, frontrunning bots can inflate the price of asset X by buying it.

- The user ultimately purchases asset X at the inflated price.

- The bot sells asset X at the inflated price.

Flash loan attacks are a bit more complex. In most cases, flash loans actually provide users with better exchanges. The process works as follows:

- The user submits a large-scale exchange transaction using a DEX that uses AMM pricing. Typically, it's an AMM with centralized liquidity.

- Frontrunning bots/searchers see this transaction in the trading pool, aiming to profit from the exchange transaction fees of the liquidity providers in this pool.

- Before the exchange occurs, the frontrunning bot adds liquidity to a specific pool that will process the transaction. This liquidity is usually concentrated where the most relevant price movement (in centralized liquidity) occurs.

- The exchange takes place, and the bot earns the fees for providing the necessary liquidity for the exchange.

- After the exchange is completed, the liquidity and any accumulated fees are immediately withdrawn.

- The frontrunning bot may hedge its inventory risk on another trading platform, and the bot's ultimate profit will be the difference between the trading fees related to hedging, adding/removing liquidity fees, and the earned LP fees.

- This often results in better exchange prices for the exchanger, as they are exchanging with deeper liquidity providers. However, passive liquidity providers suffer because the active flash liquidity dilutes their transaction fee earnings. They are not compensated proportionally to the risks they take.

- It has recently been discovered that if sandwich attacks are implemented simultaneously, flash liquidity can actually lead to worse exchange prices for the exchanger.

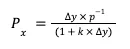

Cross-Chain

Over the past year, WOOFi has actively pursued a positive cross-chain expansion strategy and has often been one of the first non-native decentralized exchanges to be launched on newly listed EVM-compatible chains (such as Linea and Base). This initiative is driven by their cross-chain interoperability. Through LayerZero's cross-chain messaging protocol and Stargate's liquidity, WOOFi trades can execute cross-chain transactions with a single signature.

However, it is worth noting that WOOFi Swap relies on Stargate for token bridging, which is often more expensive compared to other bridging solutions. To address this issue, WOOFi has announced future support for LayerZero's OFT (cross-chain fungible token) standard and Chainlink's CCTP.

Limited Number of Listings

WOOFi exchange cannot provide exchanges for many coins because their sPMM model relies on pricing from centralized exchanges. The decision to list new coins considers the applicability of hedging, so the platform prioritizes tokens with strong liquidity from centralized exchanges—especially tokens with strong liquidity in the perpetual contract market. So far, WOOFi exchange only supports 11 native trading pairs: USDC, USDT, WOO, ETH, BTC, ARB, AVAX, BNB, MATIC, FTM, and OP.

Unfortunately, despite the advantages of reducing impermanent loss and minimizing frontrunning, one of the main drawbacks of the sPMM model is the inability to quickly list new coins, as it requires meeting liquidity requirements, especially perpetual liquidity requirements.

Additionally, the current number of listings is limited because adding more assets would increase the risk for all assets if one asset were to drop to zero. This is because WOOFi uses a single pool design. WOOFi is exploring the possibility of providing independent pools for long-tail assets to support more listings. WOOFi has integrated 1inch to address the issue of limited listings: assets that are not tradable on WOOFi will be routed through 1inch.

For example, if a user is trading asset A (not available on WOOFi):

- The user exchanges asset A on the Ethereum blockchain for ARB on the Arbitrum blockchain.

- 1inch executes the exchange of asset A for USDC.

- WOOFi executes the cross-chain exchange of USDC and ARB.

Capital Efficiency

Traditional AMMs require a large amount of liquidity and have relatively low capital efficiency because most trades are completed within a narrow price range. WOOFi exchange requires less total locked value but can achieve similar pricing because it uses order book data for pricing and professional market makers, rather than underutilized "lazy liquidity."

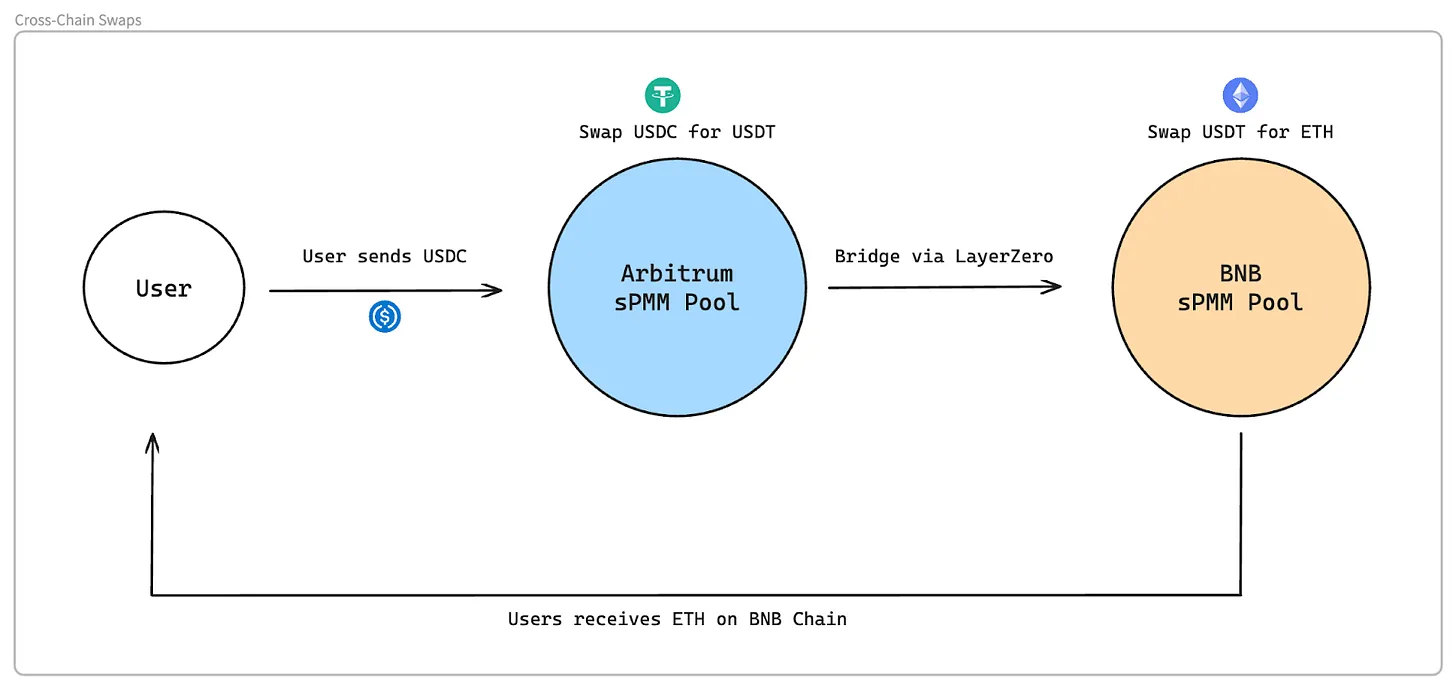

WOOFi Mining

WOOFi provides Supercharger Earn Vaults through the WOOFi mining interface, which is a one-way income product that does not cause impermanent loss. Supercharger Earn Vaults allow users to borrow tokens from sPMM pool managers at a fixed borrowing rate by depositing assets into the insurance pool. It is important to note that sPMM pool managers do not provide collateral for their borrowing. Essentially, WOOFi has built an uncollateralized borrowing and asset-backed security product similar to Maple Finance.

The sPMM pool manager borrows from recharging users and deposits it into the liquidity pool. Users only interact with the liquidity pool for settlements.

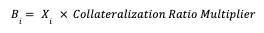

The borrowing rate is calculated by estimating the borrowing rate for non-stablecoin loans and applying a multiplier based on the collateral ratio.

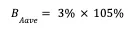

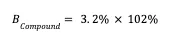

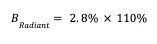

Where: B_i is the borrowing rate for a single platform i, X_i is the over-collateralized borrowing rate for non-stablecoin assets on platform i, and the collateral ratio multiplier comes from the borrowing platform.

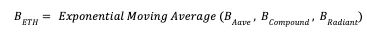

The final borrowing rate B is calculated using multiple borrowing platforms and an exponential moving average of Bi.

For example, if the borrowing rate for ETH only considers three platforms: Aave, Compound, and Radiant:

Aave: Borrowing rate: 3%, Collateral ratio: 105%

Compound: Borrowing rate: 3.2%, Collateral ratio: 102%

Radiant: Borrowing rate: 2.8%, Collateral ratio: 110%

Then the final borrowing rate for ETH is:

sPMM Pool Managers can lend up to 90% of the assets in the insurance pool. The operational cycle of the insurance pool is 7 days, and within the last 24 hours, the manager must settle the loan with the users. Users can withdraw their deposits for free during this 24-hour settlement period. Additionally, users have the option to withdraw immediately for a fee of 0.3%.

Through Supercharger Earn Vaults, users who borrow assets from sPMM managers can earn borrowing fees while taking on counterparty risk. Additionally, Supercharger Earn Vaults minimize impermanent loss.

WOOFi Staking Mechanism

WOOFi Staking 1.0

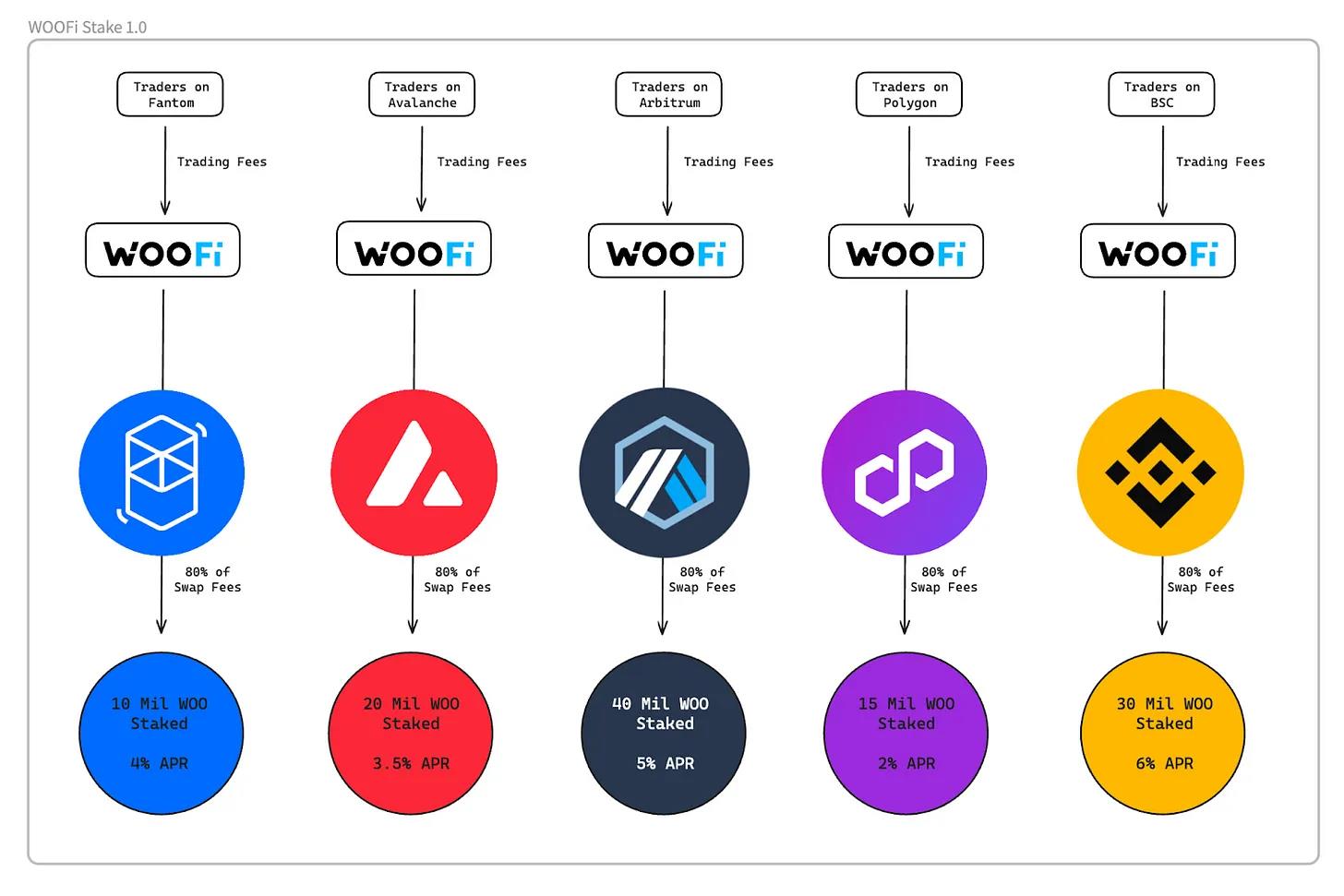

The WOO token is given utility through a real yield staking mechanism in the WOOFi protocol, with a sustained yield rate of 4% for WOO stakers, paid in USDC. Initially, WOOFi implemented WOO token staking in December 2021, utilizing unique staking contracts for each chain to allocate 80% of all swap fees on each chain to WOO stakers on that chain. The redemption period for WOO stakers is 7 days, or immediate redemption with a 5% fee. In this version, users can stake on Polygon, Arbitrum, BNB Chain, and Avalanche.

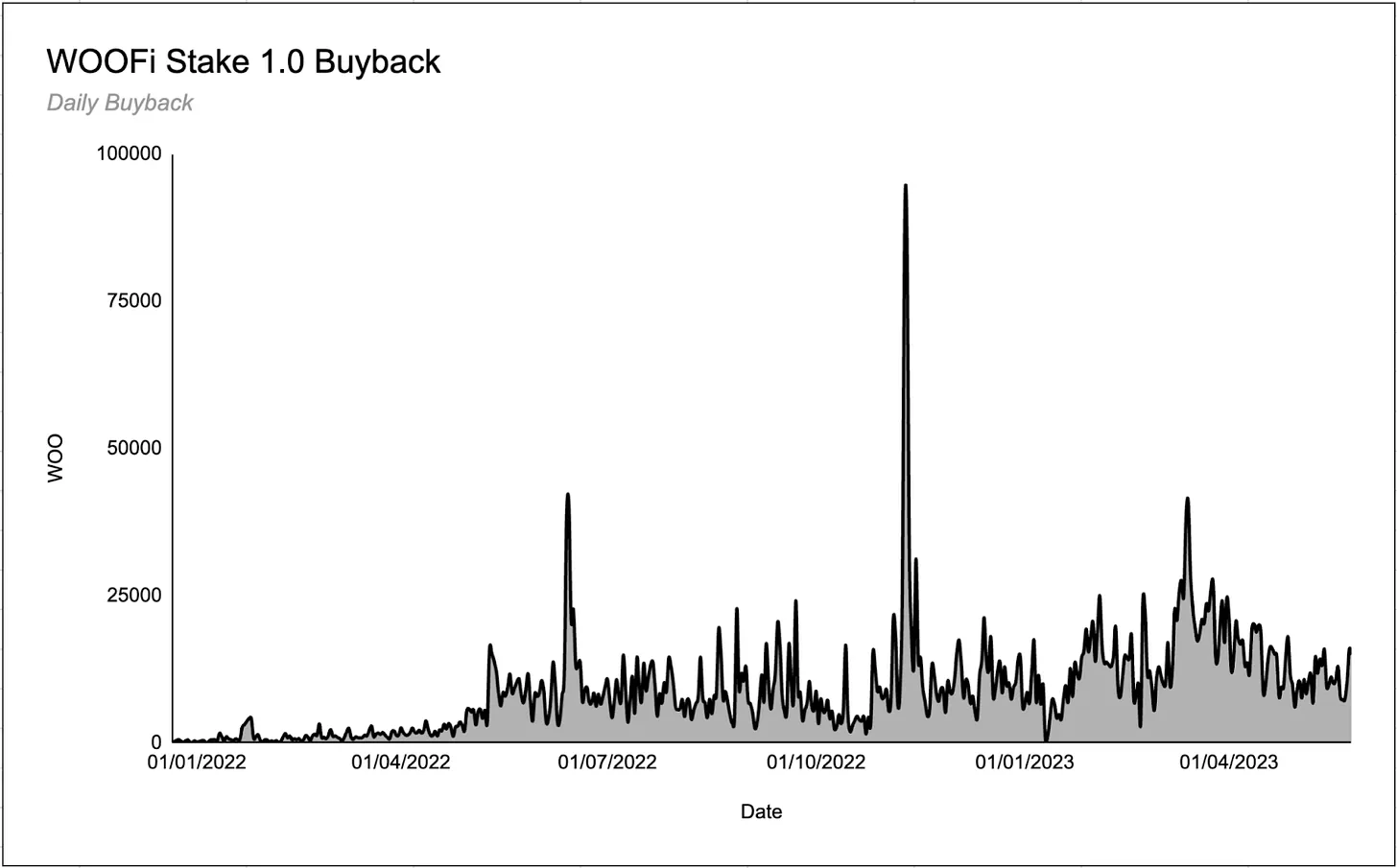

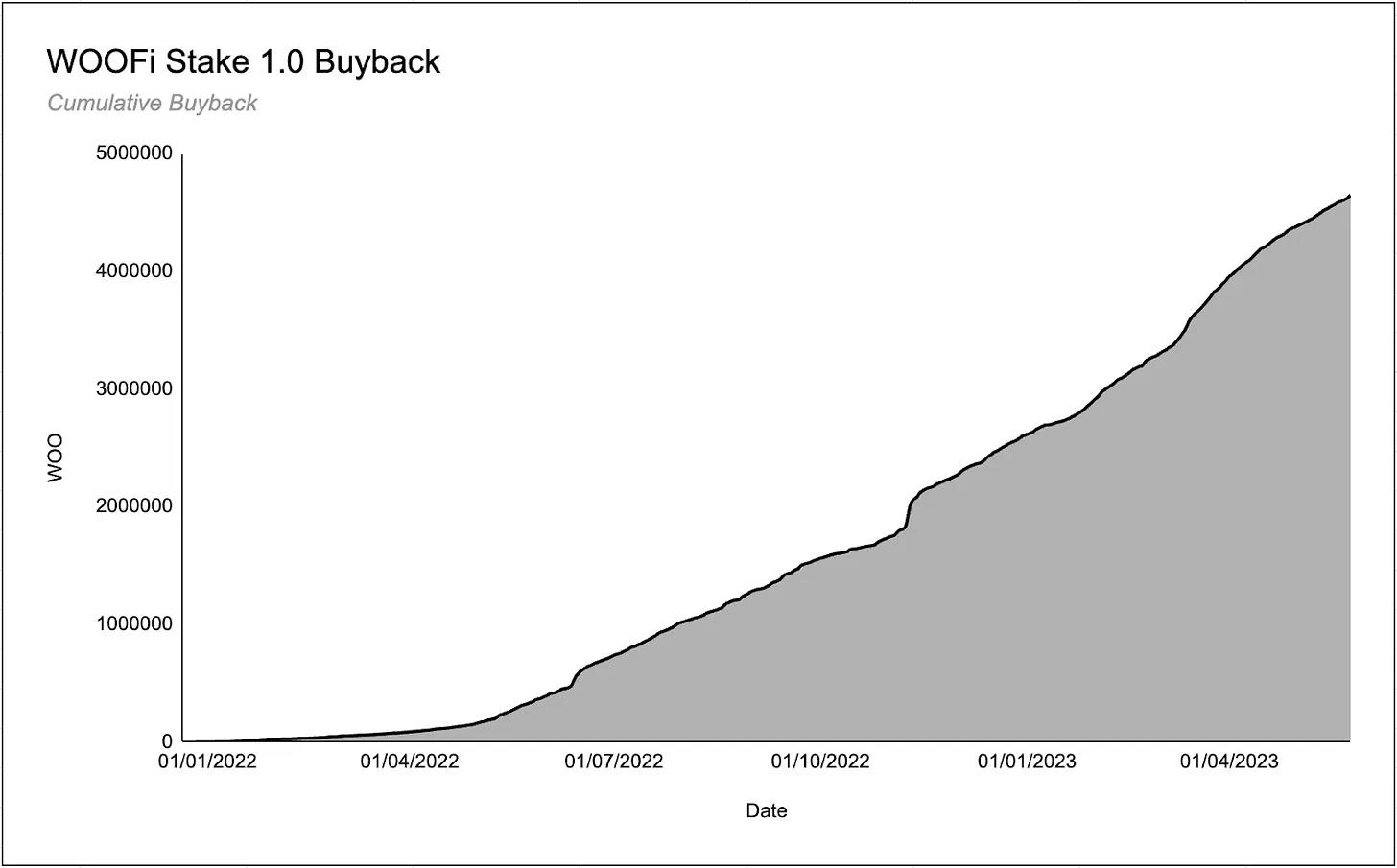

In the first version of the staking mechanism, the WOO protocol used 80% of the swap fees generated by WOOFi to repurchase WOO tokens and distribute them to WOO stakers. This was very successful, with over 100 million tokens staked across multiple chains, and stakers collectively earning 4.6 million WOO tokens.

However, WOOFi is deployed on multiple chains, each with unique staking contracts, leading to differences in staking APR between different chains. This means that users staking WOO on chains with high swap volume and staked WOO amounts can earn higher APR. This design was not ideal and led to the birth of WOOFi Staking 2.0.

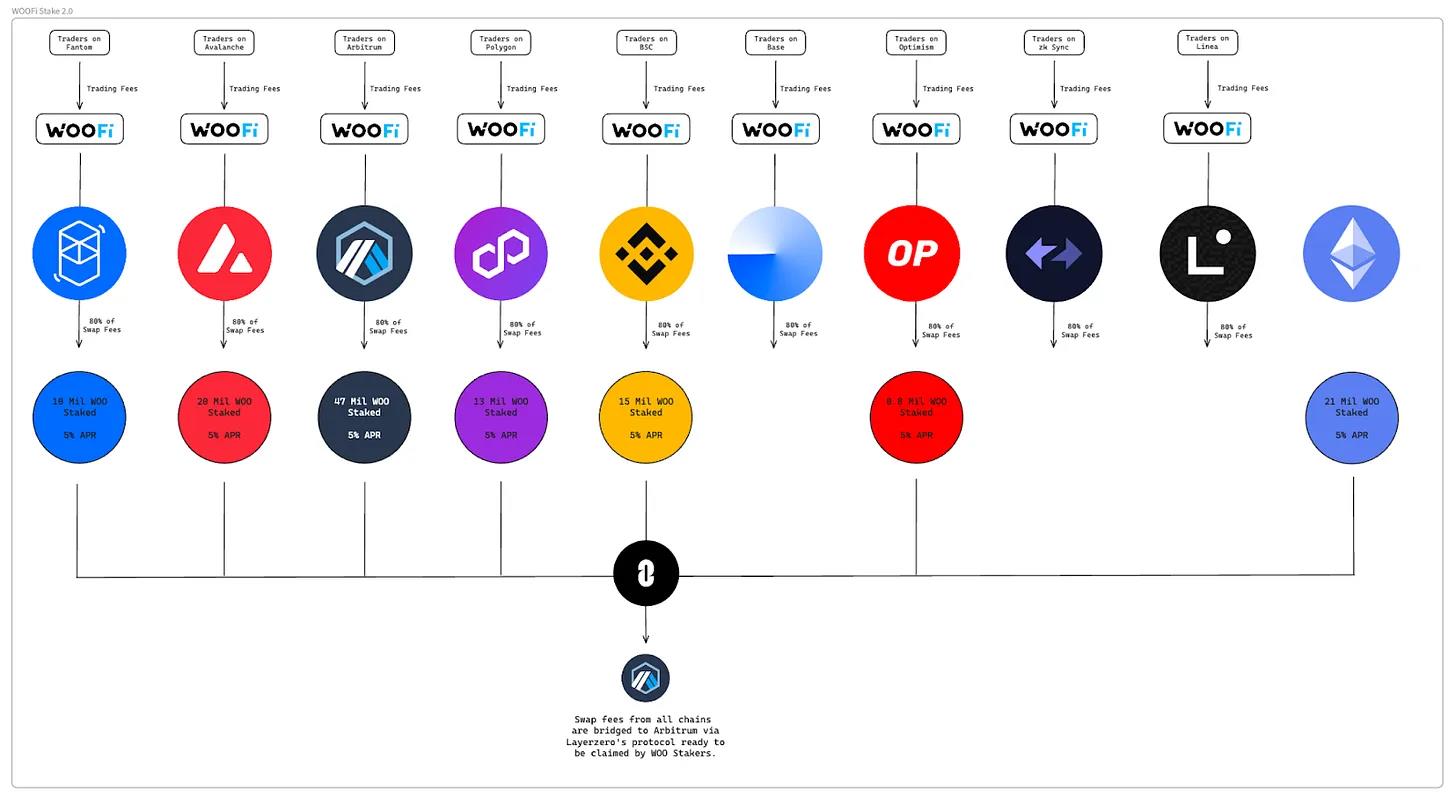

WOOFi Staking 2.0

After addressing some of the drawbacks of WOOFi Staking 1.0, WOOFi introduced WOOFi Staking 2.0, or cross-chain staking. By integrating with Layerzero's cross-chain messaging protocol, WOOFi allows users to stake WOO on multiple supported chains and earn the same yield, regardless of the position of WOO staking. All WOOFi fees on each chain are collected in the native currency of that chain (except for USDT on BSC), and the yield is paid in USDC instead of the previous method of repurchasing and distributing WOO tokens.

The staking page has added an "Auto-Reinvest" feature, where users need to claim their USDC earnings, then exchange them for WOO tokens and stake the WOO tokens. This is the source of WOO repurchases in Staking 2.0, which has repurchased over 1 million WOO tokens since its launch.

Cross-Chain Mechanism:

- Users can stake WOO on these chains: Polygon, Arbitrum, BSC, Avalanche, Optimism, and Ethereum.

- WOOFi collects 80% of the swap fees deployed on each chain.

- Every Thursday, these swap fees are bridged to Arbitrum via Layerzero's protocol and then flow to WOO stakers in the following 7 days.

- The calculation of this yield considers the total WOO balance staked by the user on all chains (and decimal points).

Multiplier

In Staking 1.0, the redemption period for WOO stakers was 7 days, or immediate redemption with a 5% fee. Staking 2.0 eliminates these redemption restrictions and instead incentivizes long-term WOO staking through a multiplier point (MP) system similar to GMX. This multiplier point system rewards long-term WOO stakers without increasing inflation.

The multiplier system works as follows:

- Users stake their WOO tokens on any supported chain.

- All WOO stakers earn MP at a base annualized rate of 50% (e.g., staking 1000 WOO for a year accumulates 500 MP).

- These MP can also be staked, with each MP having the same yield potential as 1 staked WOO token (1 staked MP earns the same USDC yield as 1 staked WOO token).

- If a user decides to redeem a portion of their WOO tokens, an equivalent amount of MP will be destroyed, meaning they lose the yield potential of those MP. For example, if a user stakes 1000 WOO and 1000 MP and earns the USDC yield equivalent to 2000 staked WOO, if they then decide to redeem 100 WOO (10% of the total staked WOO), 10% of the MP (100 MP) will be permanently destroyed.

Challenges (MP APR Boost)

As mentioned earlier, the base annualized yield rate for MP is 50%. However, by completing "challenges" or specific tasks in the WOOFi protocol, users can boost the rate at which they earn MP to a maximum of 109.85% annualized yield.

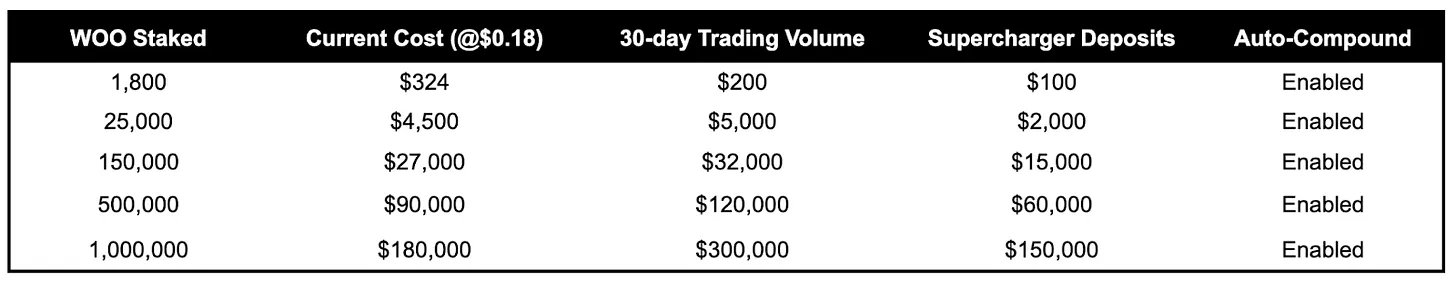

There are 3 ways to boost the MP yield: WOOFi swap volume, Supercharger insurance pool deposits, and using the Auto-Reinvest feature. To complete these challenges, WOO stakers need to stake at least 1800 WOO, and there is a tiered system based on the user's staked WOO amount. If a user completes all challenges corresponding to their staking tier, they will receive a 1.3x boost in MP yield for each of the three categories discussed. To earn these yield boosts from MP, their MP must be staked.

Example: A user staking 2000 WOO would be in the lowest effective staking tier. To earn a 1.3x boost in MP yield from swap volume, the user needs to accumulate at least $200 in swap volume over a 30-day period (including cross-chain swaps). Similarly, they need to deposit at least $100 in the Supercharger insurance pool and maintain it for 30 days. To earn the final 1.3x boost, WOO stakers must enable the Auto-Reinvest feature.

WOOFi NFT Enhanced Yield

In the future, WOOFi will introduce new ways to enhance WOO staking yield through NFTs. There are two types of planned NFTs that can be used to enhance WOO staking yield:

- Consumable NFTs - These NFTs are obtained through tasks or challenges and can be staked to receive temporary yield boosts. The magnitude of the yield boost is based on the rarity of the obtained NFTs.

- Avatar NFTs - These NFTs provide permanent staking yield boosts.

WOOFi Staking 2.0 Metrics

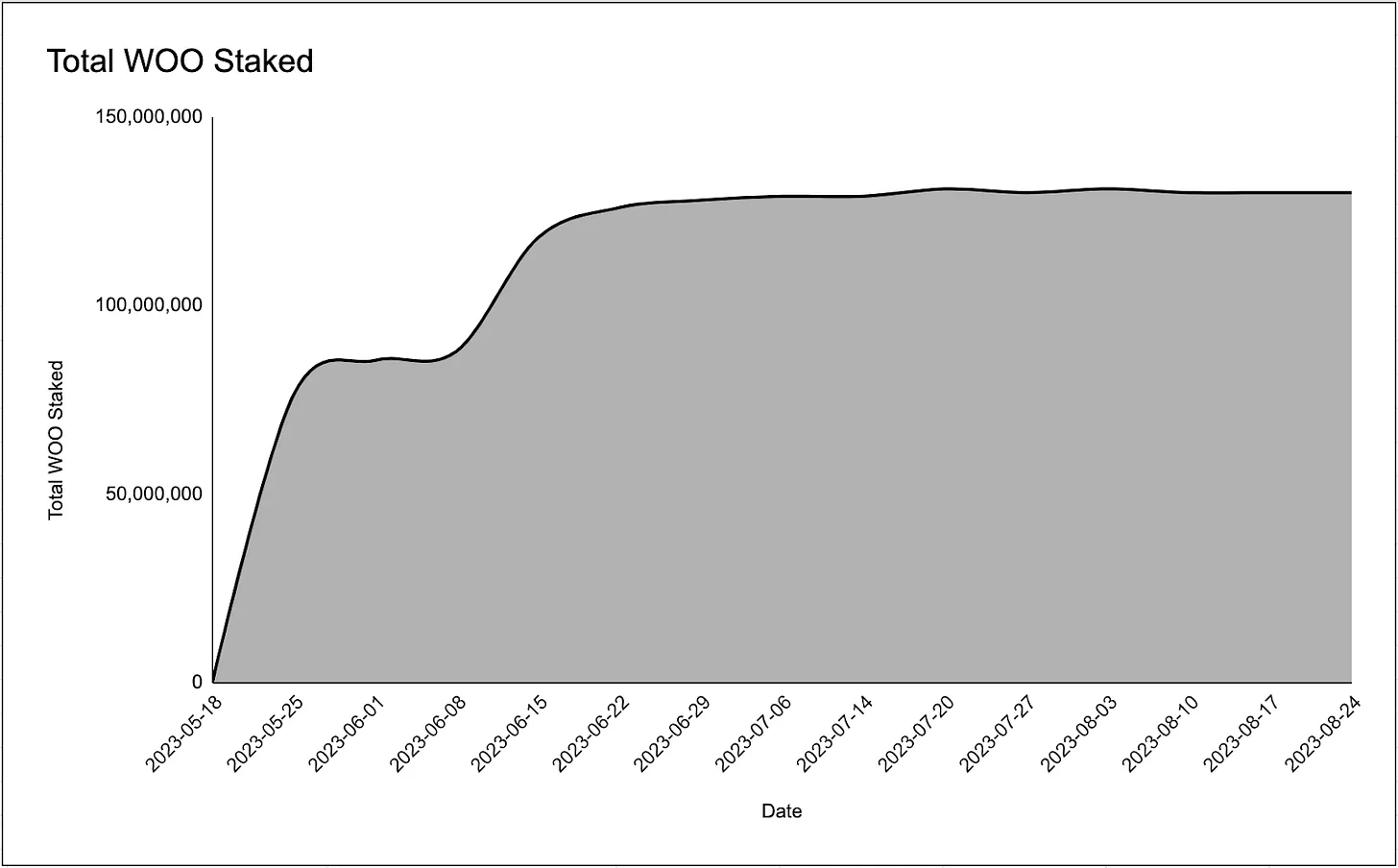

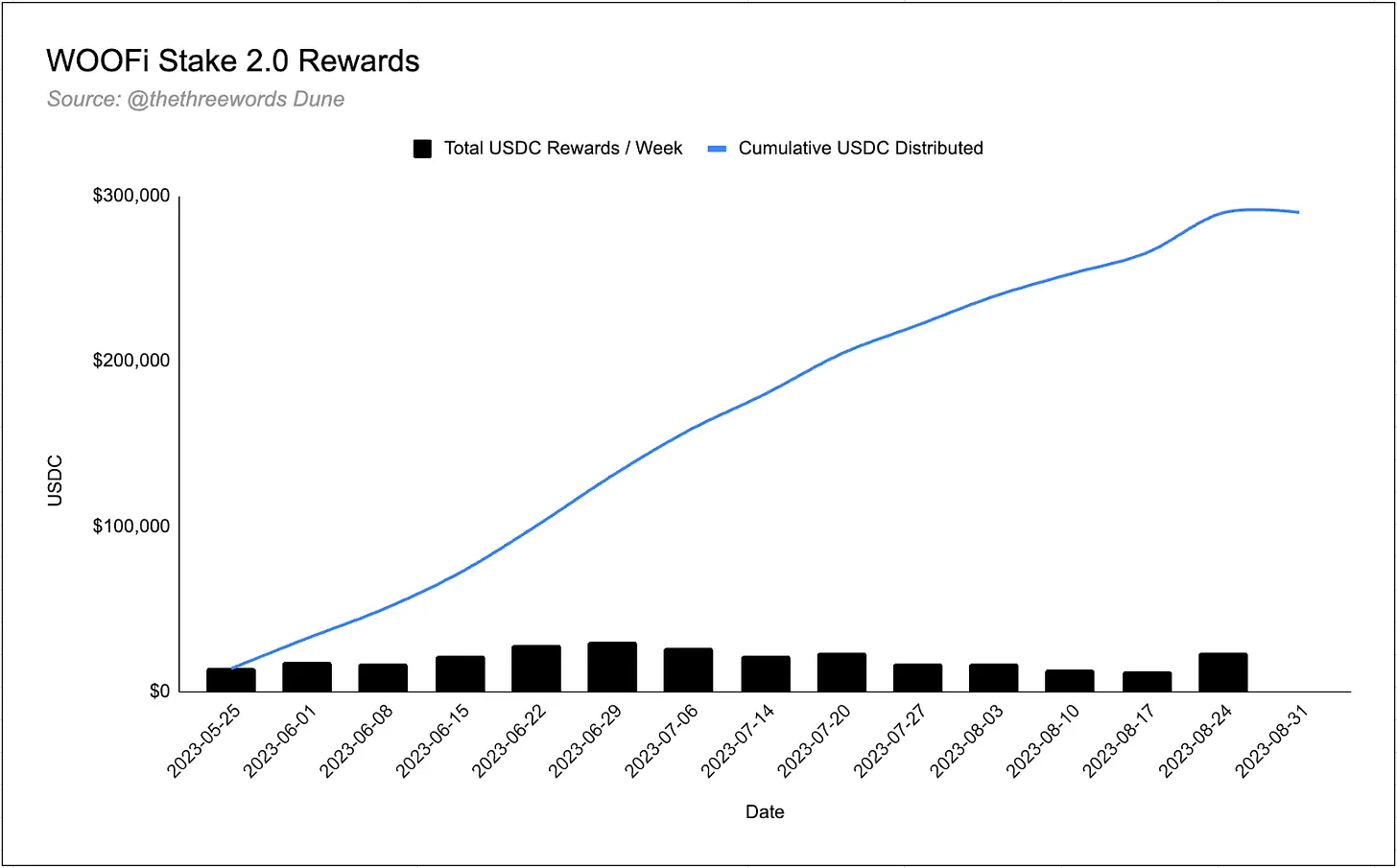

Since the migration from WOOFi Staking 1.0, a total of 132 million WOO tokens have been staked in WOOFi. These WOO tokens have earned over $300,000 USDC in yield since May 18th, with an average annualized yield of 4.15%.

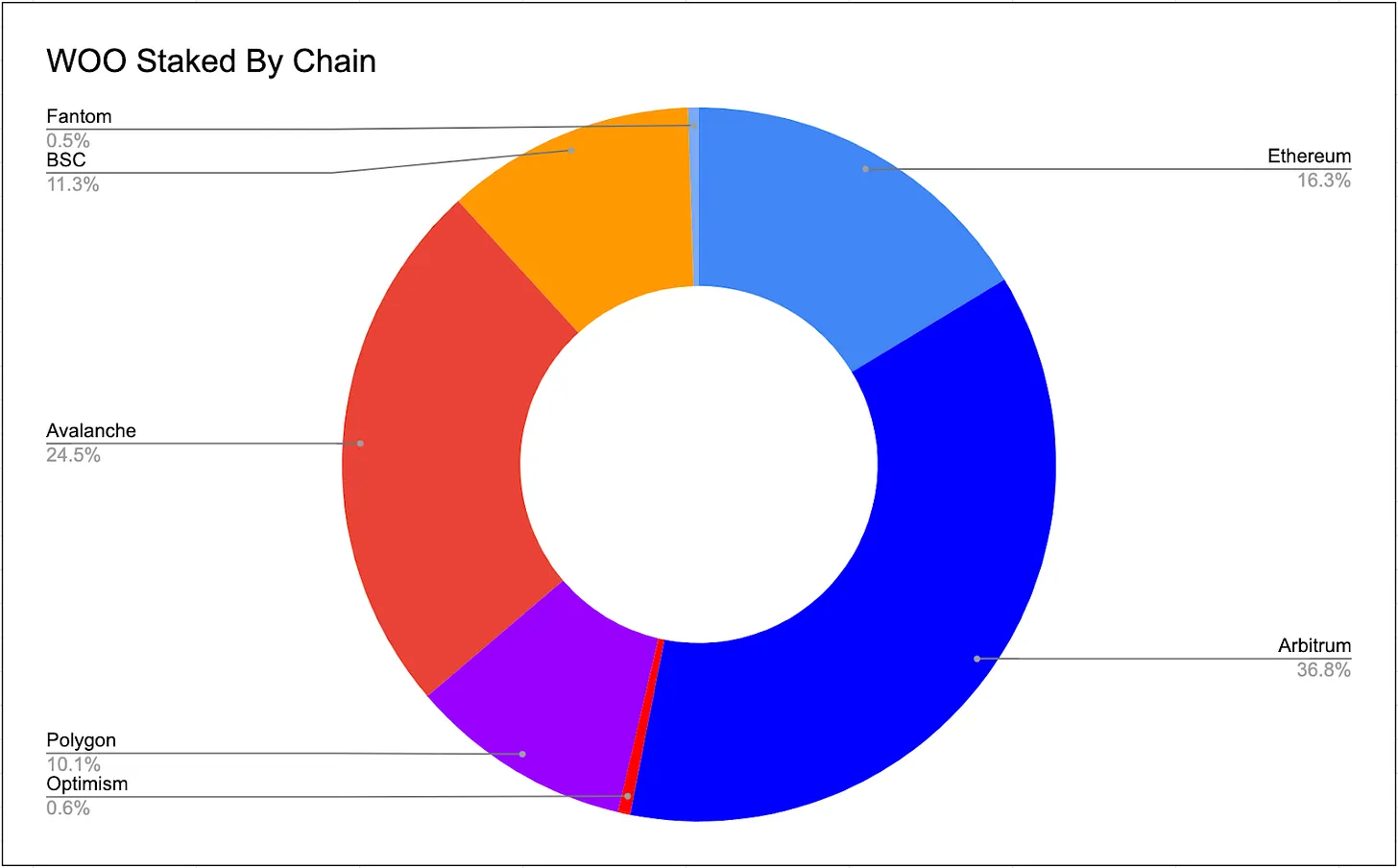

Despite users being able to stake on 7 different chains, the staking is concentrated in Arbitrum (36.8%), Avalanche (24.5%), and Ethereum (16.3%).

WOOFi Pro

In addition to the standard sPMM implementation on EVM chains, WOOFi is also experimenting with a Central Limit Order Book (CLOB) model in the experimental center. CLOB is built on the "plug-and-play CLOB" exchange protocol of the Orderly network, allowing WOOFi to outsource risk engines, matching engines, and asset pools.

WOOFi Pro is aimed at professional traders, allowing for more complex order types, the use of professional trading interfaces and tools, while also allowing those traders to self-custody their assets.

The initial implementation of WOOFi Pro is on Near. The CLOB trading volume for these spot and perpetual contract markets is very low, with a total daily trading volume in the low six figures, which may be partly due to the overall low activity on Near.

The team has shifted focus from Near to becoming cross-chain and will support cross-chain deposits from Arbitrum, Optimism, BSC, Ethereum, Base, Linea, and Polygon. Additionally, the trading fees for WOOFi Pro will be shared with WOOFi stakers after the mainnet launch (expected to launch in the fourth quarter of 2023).

Competitive Landscape

Currently, cross-chain swaps are relatively underdeveloped in this field, with only a few protocols, mainly Hashflow and SushiXSwap, implementing relevant solutions in addition to the WOOFi exchange.

SushiSwap

SushiXSwap is a cross-chain AMM built by Sushi using LayerZero's Stargate. Sushiswap was initially launched on Ethereum in 2020 as a fork of Uniswap.

SushiXSwap is currently integrated with Optimism, Arbitrum, BSC, Avalanche, and Polygon. SushiXSwap will aggregate more bridges in the future, focusing on building SushiXSwap in a modular, composable manner. SushiXSwap leverages Sushi's liquidity on each chain in cross-chain transactions.

Hashflow

Hashflow is a decentralized exchange, similar to the WOOFi exchange, offering non-AMM cross-chain swaps. Unlike AMMs, Hashflow uses a professional market maker's RFQ model.

An off-chain RFQ engine receives quotes from market makers managing liquidity pools on the management chain. The RFQ model handles settlement and asset swaps on-chain, while market makers price assets off-chain.

Comparison

Sushi adopts the AMM model, which uses the xy = k function to determine prices for two tokens based on their respective reserve balances (x and y).

In contrast, WOOFi's sPMM algorithm and Hashflow use order book data from centralized exchanges to set trading prices. Because the pricing mechanisms of Hashflow and WOOFi do not rely on AMM pricing models, they are less susceptible to manipulation by arbitrage trading bots, protecting users from sandwich attacks and protecting liquidity providers and users from front-running attacks.

Additionally, it is well known that traditional AMMs pose risks to liquidity providers. Those who provide liquidity to these AMMs often suffer significant impermanent loss.

As of September 2023, Sushi spans the most chains, with a total of 18 chains, followed by WOOFi, spanning 10 chains, and Hashflow, spanning 6 chains. In terms of 24-hour trading volume, Hashflow leads with approximately $16.46 million, followed by WOOFi with $13.63 million, and Sushi at $12.31 million.

However, in terms of fees earned over the past 30 days, Sushi dominates, earning up to $10.8 million, while WOOFi generated only $751,000, and Hashflow did not earn any fees. In terms of revenue, Sushi leads again, reaching $14.75 million, with WOOFi coming in second at $6.21 million. In terms of average monthly active users, Sushi has a significant advantage, with up to 1.278 million users, far surpassing WOOFi's 71,000 and Hashflow's 47,000.

It is worth noting that even though WOOFi's user base is only a fraction of Sushi's, its daily average trading volume is higher than Sushi's. Additionally, compared to Sushi, WOOFi has a relatively higher ratio of revenue to fees, indicating that WOOFi's revenue generation is more efficient.

History and Partnerships

Overview

WOO Trade and the WOO ecosystem were founded by Kronos Research in 2019. Kronos is actively involved in various trading strategies such as market making, arbitrage, commodity trading advisory services, and high-frequency trading. They had gained some notoriety in the digital asset market, reaching daily trading volumes of $5-10 billion at that time.

Initially, the WOO token was known as KRON, and it was later rebranded to WOO in December 2019. Progress continued for WOO products at the end of 2019 and the beginning of 2020, with the successful launch of WOO Trade 2.0. Their success caught the attention of top capital allocators in the field, and on September 28, 2020, they successfully completed a $10 million seed round of financing, with investors including Dragonfly Capital, Distributed Capital, QCP Capital's venture arm, Hashkey, and 3AC.

Throughout 2020, the platform continued to set new highs in trading volume, attracting institutional traders and establishing strategic partnerships with major players in the field. On October 29, 2020, the WOO token started trading on Gate.io, and the next day it was listed on Huobi. However, the WOOFi exchange did not officially launch until 2021, much later than the time when the Woo team had proven themselves in the centralized exchange space.

WOOFi Development Roadmap

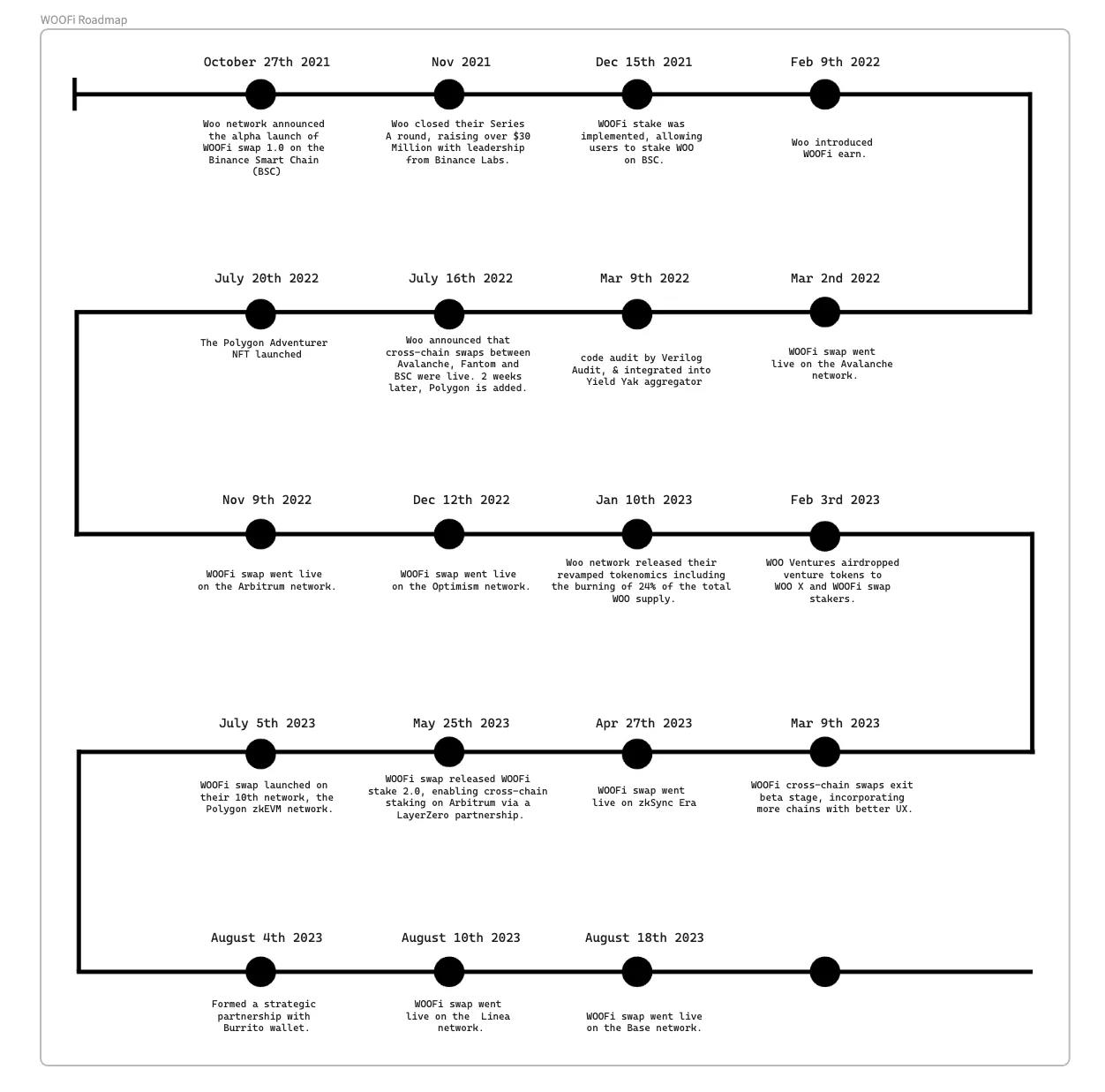

On October 27, 2021, Woo Network announced the alpha launch of WOOFi Swap 1.0 on the BSC. This marked Woo's official entry into the world of on-chain liquidity and participation in DeFi.

In November, Woo completed a Series A financing, raising over $30 million from Binance Labs.

On December 15, 2021, the first version of WOOFi Staking was launched on BSC, allowing users to stake WOO.

On February 9, 2022, Woo launched WOOFi Mining.

On March 2, 2022, the WOOFi exchange went live on the Avalanche network.

On March 9, Woo announced a series of developments for WOOFi: completion of Verilog code audit, integration with Yield Yak aggregator, and simultaneous launch with Debank.

On April 14, 2022, the WOOFi exchange went live on the Fantom network.

On March 19, 2022, Woo launched WOOFi Broker.

On July 16, 2022, Woo announced the launch of cross-chain swaps between Avalanche, Fantom, and BSC. Two weeks later, Polygon was added.

On July 20, 2022, Polygon Adventurer NFT was released, showcasing the functionality of WOOFi's cross-chain NFT infrastructure.

On November 9, 2022, the WOOFi exchange went live on the Arbitrum network.

On December 12, 2022, the WOOFi exchange went live on the Optimism network.

On January 10, 2023, Woo Network released a revised token economic model, including burning 24% of the total supply.

On February 3, 2023, WOO Ventures airdropped venture tokens to WOO X and WOOFi exchange stakers.

On March 9, 2023, WOOFi cross-chain swaps exited the testing phase, integrating more chains and providing a better user experience.

On April 27, 2023, the WOOFi exchange went live on zkSync Era.

On May 25, 2023, the WOOFi exchange released WOOFi Staking 2.0, enabling cross-chain staking on Arbitrum through a partnership with LayerZero.

On July 5, 2023, the WOOFi exchange launched on its 10th network, Polygon zkEVM network.

On August 4, 2023, a strategic partnership was formed with Burrito wallet.

On August 10, 2023, the WOOFi exchange went live on the Linea network.

On August 15, WOOFi exchange launched on the Base network.

WOO Token Economics

Token Utility

The WOO token is integral to the DeFi and CeFi products in the WOO ecosystem. Therefore, various market participants hold WOO tokens for several reasons:

Real Yield - When WOO tokens are staked, they earn 80% of WOOFi's exchange and yield fees, paid in USDC. Currently, the staking annualized return for WOO is approximately 5%, with over 1.3 billion WOO tokens staked.

Trading Discounts - WOO tokens also derive utility from the WOO X centralized exchange. Similar to other exchange token models, WOO can be staked to unlock feeless trading zones, providing significant fee reductions for CeFi trading. Other benefits include referral bonuses, free withdrawals, and fee discounts for perpetual contracts and API trading.

Institutional Benefits - Trading firms and market makers on WOO X are incentivized to stake WOO to receive fee reductions and increased API limits.

Token Supply

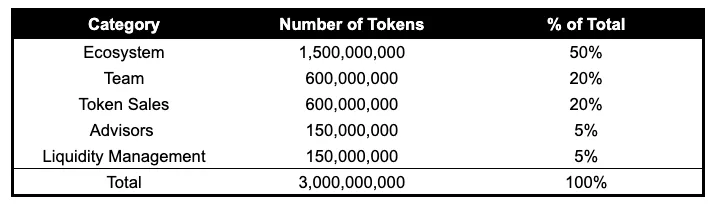

The initial token allocation for WOO was as follows:

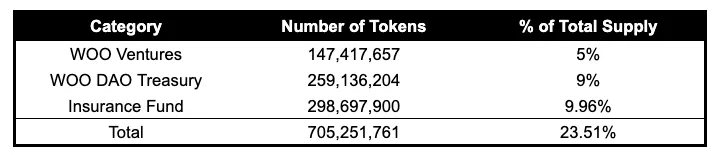

However, due to various reasons mentioned in the Q1 token economics upgrade article for WOO, the team decided to burn approximately 705.2 million WOO tokens (23.51% of the total supply) from the ecosystem and team portions.

Firstly, WOO Ventures was discontinued, and WOO Network decided to burn the remaining tokens (5% of the total supply allocated to the WOO Ventures team). This resulted in 147.4 million WOO tokens being sent to a burn address.

Secondly, WOO DAO was discontinued. This led WOO Network to burn the 259.1 million WOO tokens allocated to WOO DAO and send 5 million WOO tokens to the newly formed WOO Force, which will focus on community engagement.

Finally, the remaining 298.6 million WOO tokens were burned from the insurance fund. Given the events in 2022 (CeFi collapses, FTX borrowing against their volatile tokens), WOO Network decided to use WOO tokens to support the insurance fund for WOO X, which were related to WOO X issues and were volatile, which was not ideal. Therefore, they decided to allocate $10 million in stablecoins owned by the company to form an insurance fund, which will act as the first loss layer in case of losses to WOO Network or default of liquidity sources. As a result, the WOO tokens in the insurance fund were burned.

The results of the Q1 token economics burn led to better token distribution and a reduction in the planned allocated token amount. Currently, the circulating supply of WOO tokens is 1.741 billion, while the total supply is now 2.2 billion tokens. Therefore, 79.81% of WOO tokens are in circulation.

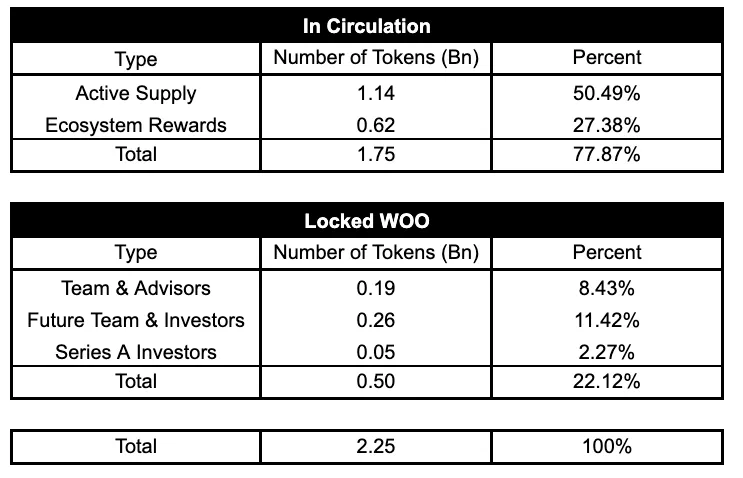

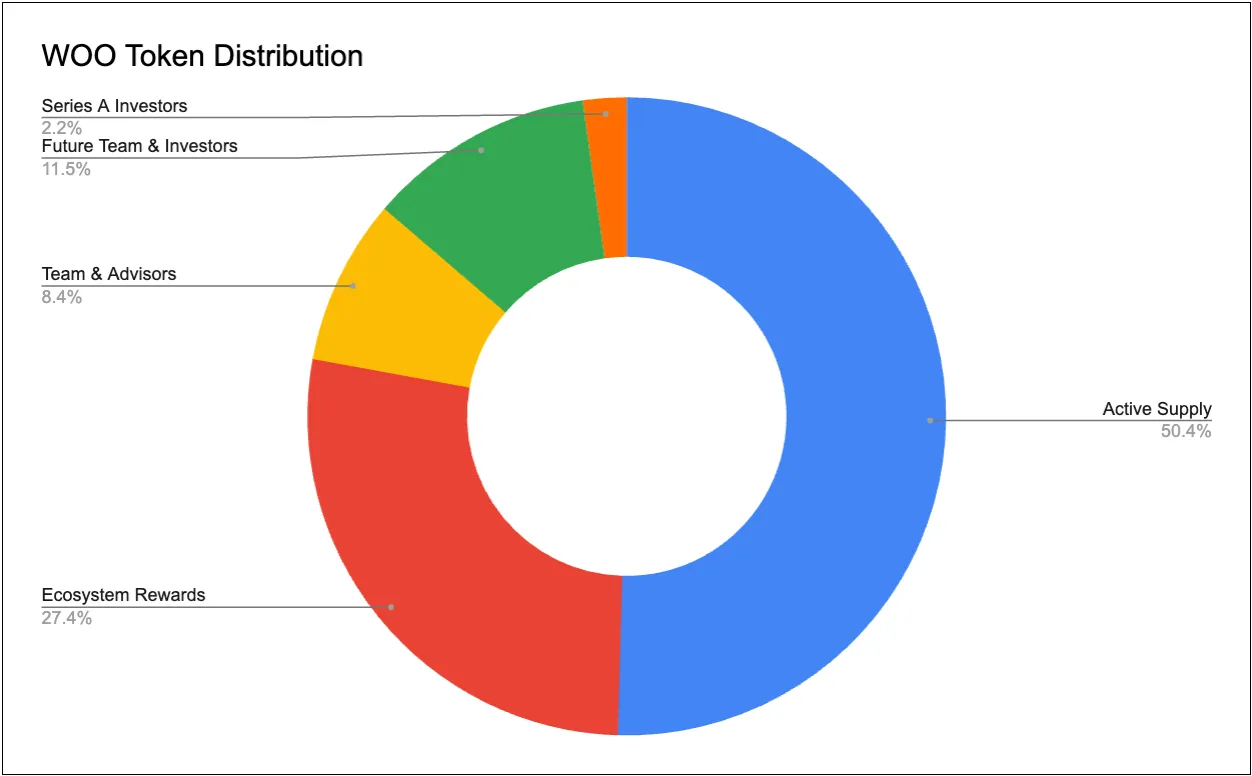

Token Distribution and Issuance

The current token distribution after the Q1 token economics upgrade is as follows:

Investors

WOO token has received support from some of the largest capital allocators and venture capital firms in the space from the early stages, divided into several rounds. WOO Network raised funds through three methods: seed round, launchpad, and Series A.

Seed Round

On September 28, 2020, WOO concluded their seed round after securing a total of $10 million investment from Dragonfly Capital, Three Arrows Capital, IOSG Ventures, QSN (the venture capital arm of QCP Capital), Defi Capital, Fenbushi Capital, Chain Capital, One Boat Capital, Vector Capital, AKG Ventures, Evernew Capital, Krypital Group, Axia8 Ventures, The Cabin Capital, Hashkey Capital, SNZ, and Fenbushi Capital.

Launchpad

On October 30, 2020, Huobi Global launched WOO trading on its platform. WOO Network provided 9 million WOO (10% of their initial circulating supply) to Huobi Global.

Investors

All investors are fully invested, except for the Series A investors who own 2.27% of the total supply (71 million WOO). The Series A lock-up period is 3 years with a 6-month cliff. The lock-up began on November 1, 2021. There are approximately 13 months remaining until the Series A investors are fully vested. It is worth noting that in January 2022, a small portion of 2.25 million WOO completed the lock-up period.

Team and Advisors

The team and advisors portion (8.43%) is locked and has an independent vesting schedule based on each team member and their joining time. When a WOO employee joins, they receive WOO tokens within a 4-year lock-up period starting from their joining date.

Risks

Smart Contract Risks

WOOFi, like all decentralized applications, faces the risk of exploitation/failure due to the nature of smart contracts. This is an unavoidable reality for DeFi, and we still see well-tested and respected projects like Curve and Balancer being exploited. There is also a layered smart contract risk as spMM uses third-party protocols to earn yield when the spMM manager is not using the Supercharger insurance vault assets. WOOFi has taken measures to mitigate this risk by conducting multiple contract audits to check for vulnerabilities. WOOFi audits:

- In October 2021, WOOFi Exchange was audited by Certik and Verilog.

- In December 2021, WOOFi Stake was audited by Certik.

- In February 2022, WOOFi Earn was audited by Certik.

- In July and August 2022, WOOFi Earn Supercharger Vaults were audited by Certik and Peckshield, respectively.

- In October 2022, WOOFi Swap v2 was audited by Certik.

- In May 2023, WOOFi Staking v2 was audited by Certik.

Centralization Risks

Kronos Ventures, the venture arm of Kronos, incubated WOO Network, so in its current state, WOOFi is heavily reliant on an sPMM manager, Kronos Research. If Kronos Research encounters any financial issues or has to stop managing the spMM, WOOFi's liquidity and functionality could deteriorate significantly. Initially, WOO X heavily relied on Kronos Research as a market maker, but with the progress of the exchange, more market makers have joined and shared Kronos's trading volume. This is a healthy state for the exchange, and we also encourage and welcome more sPMM managers to join WOOFi.

Supercharger Vault Risks

Users lend to Kronos Research, the sPMM Manager, without collateral, to earn yield through Supercharger Vaults. This introduces significant counterparty risk and could lead to fund loss if Kronos Research is unable to repay the loans due to smart contract exploits, losses in hedging processes, or other issues.

Cross-Chain Bridge Risks

WOO tokens are multi-chain, allowing users to stake WOO on many different chains. While this is helpful for staking availability and simplicity, a large amount of WOO tokens locked in various cross-chain bridge contracts represents a tail risk due to the vulnerabilities of these protocols. Cross-chain bridges are very susceptible to exploitation, partly due to the complexity of cross-chain bridges and the favorable nature of these contracts being exploited.

Regulatory Risks

WOOFi faces regulatory risks, much like most DeFi. The underlying mechanisms for yield aggregation and distribution may violate U.S. securities laws and classify WOO as an unregistered security. Additionally, operating WOOFi/WOO X may constitute operating an unlicensed exchange, similar to the situation currently faced by Coinbase and Binance in the U.S. judicial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。