After the outbreak of a large-scale conflict between Israel and Palestine, many Web3 projects based in Israel have attracted industry attention, and related concept tokens have also seen significant increases. As a globally recognized technology powerhouse, Israel, despite its small size, has become a force to be reckoned with in the field of encryption technology. This article by PANews will take stock of the Israeli Web3 projects that have issued tokens, covering various areas such as Layer2, DeFi, Layer1, NFT, and gaming, with StarkWare being valued as high as $8 billion.

Infrastructure

Layer2 Developer StarkWare (STARK, not yet online)

Headquartered in Netanya, Israel, Ethereum Layer2 developer StarkWare was co-founded by Professor Eli Ben-Sasson of the Israel Institute of Technology in 2018. It provides STARK-based zero-knowledge proof technology to improve the scalability, security, and privacy of blockchain. StarkWare has developed two STARK-based Ethereum scaling solutions: StarkEx and StarkNet.

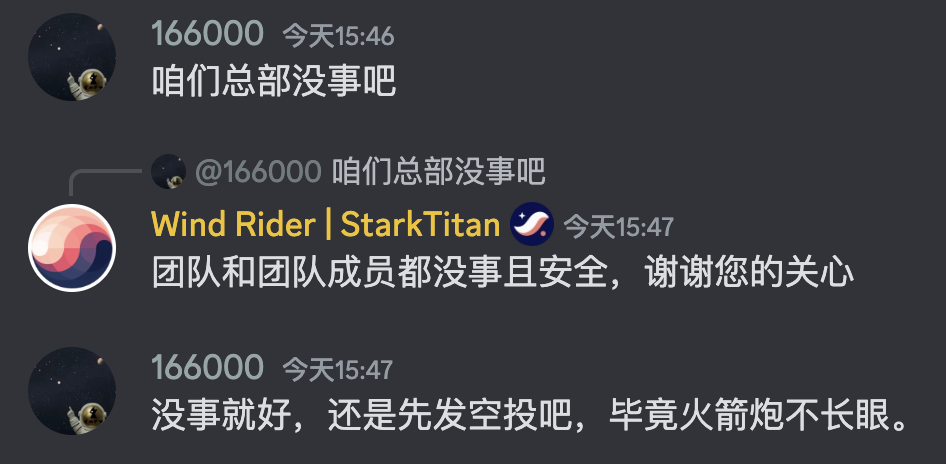

In September of this year, StarkWare announced the StarkNet token economic model, with a maximum supply of 10 billion STRK tokens, 7% allocated to investors, 32.9% to core contributors, and 50.1% donated to the StarkWare Foundation. Additionally, 8.1% of the tokens are yet to be allocated, with the specific method to be determined by the community. According to the latest news, STRK may see its first unlock on November 29. Following the outbreak of a new round of large-scale conflict between Palestine and Israel, community members inquired about the project's safety and asked about token airdrops.

To date, StarkWare has raised a total of $273 million in seven rounds of financing, with a valuation of $8 billion. In January 2018, StarkWare completed a $6 million seed round of financing, with Ethereum founder Vitalik Buterin, Pantera Capital, Paradigm, and Naval Ravikant among the investors. In July of the same year, StarkWare received a $12 million grant from the Ethereum Foundation. In October of the same year, StarkWare completed a $30 million Series A financing round with investments from Intel and Sequoia Capital, among others. In March 2021, StarkWare completed a $75 million Series B financing round led by Paradigm, and in November of the same year, it completed a $50 million Series C financing round led by Sequoia Capital, with other investors including Paradigm, Alameda Research, and Three Arrows Capital. In May 2022, StarkWare completed a $100 million Series D financing round, with Greenoaks Capital and Coatue leading the investment, and Tiger Global among the participants.

Blockchain IaaS Platform Orbs (ORBS)

Current circulating market value: $81.946 million

Orbs is an Israeli blockchain IaaS platform that provides infrastructure for large-scale applications, positioning itself as an "independent execution layer between Layer1/Layer2 solutions and the application layer," dedicated to building a decentralized public platform to help the software application industry transition to blockchain technology.

Orbs' President, Daniel Peled, is the co-founder and CEO of the Israeli fintech startup PayKey and a senior member of the Israeli Bitcoin community. His partner, Uriel Peled, was the former group leader of the Israeli high-tech company Mellanox and founded the VR startup Visualead, which was acquired by Alibaba. In May 2018, Orbs announced a $118 million financing round with participation from 21M Capital, Kakao Ventures, Nexus One, and others. In March of this year, Orbs announced plans to raise $10 million from the venture capital firm DWF Labs.

Cryptocurrency Payment Infrastructure Fuse (FUSE)

Current circulating market value: $9.192 million

Fuse is a mobile-centric cryptocurrency payment infrastructure based on Ethereum, providing fast and powerful plug-and-play solutions at low cost, as well as a platform for stablecoin issuance and management. To address the scalability issues of public chains, Fuse Network has launched the Flutter Layer 2 Payments (FL2P) extension solution, which is also an SDK that supports developers in integrating ZK rollups directly into mobile cryptocurrency wallet software. As of October 10, the Fuse official website shows that it has completed over 128 million transactions with over 100 ecosystem partners. Additionally, Fuse's CEO, Mark Smargon, founded Israel's first Bitcoin exchange.

In May 2022, Fuse completed a $5 million financing round, with investors including Aleph, Black Edge Capital, Blockchain Founders Fund, Collider Ventures, and Tectona Digital Assets, among others.

DApp Application Platform ChromaWay (CHR)

Current circulation: $51.842 million

Chromia is an innovative cross-functional platform created by the Swedish company Chromaway, which provides developers with an easy-to-use environment for building scalable decentralized applications (dApps). The team is distributed in Israel, Sweden, and Ukraine. In January 2022, ChromaWay announced a $10 million financing round with participation from CSP DAO, GEM Capital, Insignius Capital, and MiH Ventures, among others.

Layer1

Privacy Public Chain Secret Network (SCRT)

Current circulating market value: $53.751 million

Secret Network is a privacy-protected smart contract public chain built on the Cosmos technology architecture and is the first blockchain with privacy-protected smart contracts, originating from a project called Enigma at the Massachusetts Institute of Technology.

In 2017, Secret Network raised $45 million through an ICO. In 2021, Secret Network completed a $11.5 million seed round of financing led by Arrington Capital and Blocktower Capital. In early 2022, Secret Network announced a $400 million ecosystem fund, with investors including DeFiance Capital, Alameda Research, CoinFund, and HashKey, among others.

Space-Time Consensus Protocol Public Chain Spacemesh (SMH, not yet online)

Based in Israel, Spacemesh is a fair and distributed blockmesh operating system supported by a unique space-time consensus protocol, aiming to achieve a highly decentralized, high-throughput, and highly secure blockchain network. In July 2023, Spacemesh announced that the mainnet had gone live and was operational, allowing any user with a standard consumer-grade PC to mine and earn Smesh coin. It is important to note that Spacemesh has not yet been listed on mainstream exchanges.

In May 2018, Spacemesh announced a $3 million seed round of financing with participation from Iangels, Sinopac Bancorp, and BRM Capital. In September of the same year, Spacemesh completed a $15 million Series A financing round led by Polychain, with participation from MetaStable, Paradigm, Coinbase Ventures, Bain Capital, and 1kx, among others. In December 2021, Spacemesh received an additional $4 million in new financing, with investors including Leland Ventures.

Privacy Project Beam (BEAM)

Current circulating market value: $3.723 million

Beam is a privacy coin project developed based on the MimbleWimble protocol. Unlike Monero and Zcash, MimbleWimble coins enforce privacy at the protocol level rather than adding layers on top of the original blockchain to achieve privacy.

In February 2019, Beam completed a $5 million financing round with investment from Recruit Strategic Partners. In May 2021, Beam completed a $2 million financing round with participation from Collider Ventures, Altonomy, LionsChain, and Alternity Capital, among others.

DeFi

DEX Bancor (BNT)

Current circulating market value: $76.267 million

Bancor was launched by the Bprotocol Foundation in 2017, founded by a group of Israelis with Silicon Valley entrepreneurial backgrounds. The foundation is based in Zug, Switzerland, and operates a research and development center in Tel Aviv, Israel. In June 2017, Bancor raised $153 million worth of ETH through an ICO.

Bancor is a DEX based on Ethereum, allowing the creation of liquidity pools for asset trading and aiming to execute algorithmic token trading and on-chain liquidity pool smart contracts. Bancor was the first project to adopt AMM, but its development was overtaken by later projects like Uniswap due to centralization and security issues. According to DefiLlama data, as of October 10, Bancor's total value locked (TVL) is approximately $68.6 million, a decrease of about 97.2% from its peak of $2.4 billion.

On-Chain Service Tool Dot Finance (PINK, not yet online)

Dot Finance was originally a decentralized finance (DeFi) protocol based on BSC and announced its migration to the Polkadot parachain Moonbeam in January 2022, providing users with access to a wide range of smart contract services built on the fast, secure, and flexible Polkadot platform, including various on-chain services. PINK has not yet been listed on mainstream exchanges.

Liquidity Protocol B.Protocol (BPRO)

Current circulating market value: $3.027 million

B.Protocol is a liquidity support protocol designed to better handle liquidations on DeFi lending platforms, allowing the DeFi ecosystem to expand safely and stably to the level of CeFi. Its creator, Yaron Velner, was the CTO of Kyber Network and a co-designer of the WBTC protocol.

In December 2021, B.Protocol announced the completion of a $2.2 million seed round of financing led by 1kx, with participation from Robot Ventures, Spartan Group, Primitive Ventures, and Angel DAO, among others.

DeFi Platform Voltage Finance (VOLT)

Current circulating market value: $0.307 million

Voltage Finance is a decentralized finance platform based on the Fuse network, which launched the Voltage DAO and the Volt (VOLT) governance token. In February 2022, Voltage Finance completed a $3.4 million financing round, with investors including Spark Capital, TRGC, Collider Ventures, GBV Capital, and Tectona, among others. However, a month later, Voltage Finance suffered a hack resulting in the theft of approximately $4 million.

Others

Web3 Education Platform Open Campus (EDU)

Current circulating market value: $77.142 million

Open Campus is the Web3 version of the education platform TinyTap, a technology startup based in Tel Aviv, Israel, that focuses on user-generated content (UGC) and was acquired by the venture capital firm Animoca Brands in June 2022.

Open Campus is a Web3 education protocol platform that combines blockchain technology, aiming to create a more fair and inclusive ecosystem for learners, educators, content creators, and provide them with more ways to access resources, new compensation opportunities, and true ownership of educational content, shaping a new community-defined educational paradigm. Open Campus is the 31st Launchpad project of Binance and raised $6 million in a private token sale in 2022.

Cryptocurrency Exchange INX Limited (INX)

Current circulation: $62.20 million

INX Limited is a privately held Israeli company registered in Gibraltar, founded in 2017. In 2019, INX Limited planned to raise $129.5 million through an IPO, marking the first security token offering registered with the U.S. Securities and Exchange Commission (SEC).

P2E Game Kryptomon (KMON)

Current circulating market value: $5.402 million

Kryptomon is a play-to-earn (P2E) game combined with NFTs, inspired by classic games like Pokemon and Tamagotchi. Players can search for and mint NFTs on the blockchain through the "Full Moon Treasure Hunt" game in the real world. Kryptomon set two records for NFT blind box sales on the Binance platform and achieved a $13 million on-chain NFT transaction volume within five months.

In August 2021, Kryptomon raised approximately $1.2 million through an ICO. In May 2022, Kryptomon announced the completion of a $10 million financing round led by NFX, with other investors including PLAYSTUDIOS, Griffin Gaming Partners, Tal Ventures, and former Citigroup CEO Vikram Pandit.

NFT Platform NFTrade (NFTD)

Current circulating market value: $0.582 million

Established in 2021, NFTrade is headquartered in Tel Aviv, Israel, and is a decentralized cross-chain NFT platform that allows anyone to easily create, buy, sell, trade, and earn NFTs, creating a one-stop shop for all NFT-based operations.

In September 2021, NFTrade completed a $3.7 million seed round of financing with participation from SparkPoint, Magnus Capital, AU21 Capital, and Autonomy Capital, among others. In March 2022, the BNB Chain Fund announced the strategic acquisition of NFTrade's utility and governance token NFTD.

Cryptocurrency App Store Magic Square (SQR, not yet online)

Magic Square is a multi-chain, community-driven cryptocurrency app store that combines the functionality of Web2 app stores with Web3's DAO mechanism, helping users easily access high-quality crypto products through community review mechanisms, including various applications, CeFi and DeFi, NFTs, games, and other services.

In February 2021, Magic Square completed a $1 million Pre-Seed financing round. In July 2022, Magic Square completed a $3 million seed round of financing led by Binance Labs and Republic, with participation from KuCoin Labs, GSR, IQ Protocol, Gravity Ventures, and Alpha Grep, among others, and completed a $10 million financing round at a valuation of $74 million in September of the same year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。