In July of this year, MEV operator Flashbots completed a $60 million Series B financing at a valuation of $1 billion. Currently, over 91% of the Ethereum validator market share is using the MEV Boost system.

In addition to Flashbots, Manifold Finance is also a protocol that can bring additional MEV revenue to Ethereum stakers. Founded by Sam Bacha in 2020, Manifold Finance helps create MEV by acting as an efficient block builder for users and validators on the Ethereum blockchain. In April of this year, Manifold announced the development of their own LSD protocol—mevETH. mevETH will be a cross-chain token using LayerZero technology, which will provide stakers with non-extractive MEV revenue.

To launch the protocol, Manifold acquired Cream Finance's validator set, meaning that users staking ETH on Cream Finance will now stake with Manifold's liquid staking protocol. This will give them control of over 20,000 ETH when the protocol launches.

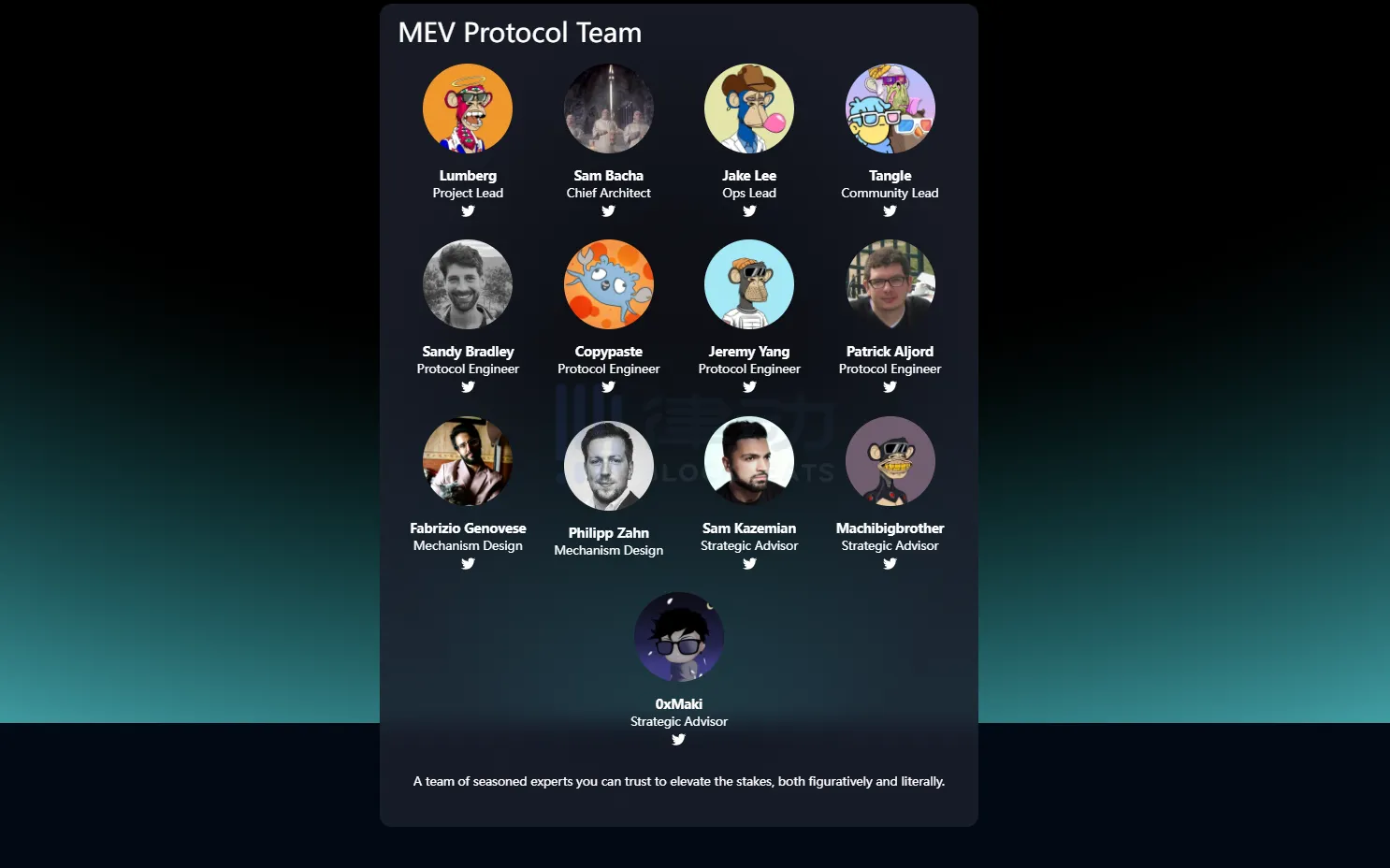

Team Introduction

The project is a collaboration between Manifold Finance and Cream Finance, led by Cream Finance co-founder Leo Cheng, and with Sam Bacha, founder of Manifold Finance and a contributor to Yearn Finance, serving as the chief architect. Additionally, the team has hired prominent figures in the Ethereum community, including Frax founder Sam Kazemian and 0xMaki, as advisors.

mevETH

On October 5th, Manifold Finance officially launched the MEV Protocol and integrated the liquid staking token mevETH. Unlike the existing Flashbots MEV Boost system, the mevETH introduced by Manifold features a new MEV auction system that supports multiple winners per time period, rather than just one.

The team stated that this protocol adopts a vertically integrated approach, fully leveraging the potential of relayers, block proposers, and block builders to enhance the MEV supply chain. This strategy aims to provide the most efficient path for capturing value within the system. In this innovative framework, reward pathways are diversified, including validator base fees, liquidity provider incentives, and the groundbreaking MEV concept, allowing for multiple auction winners during block construction.

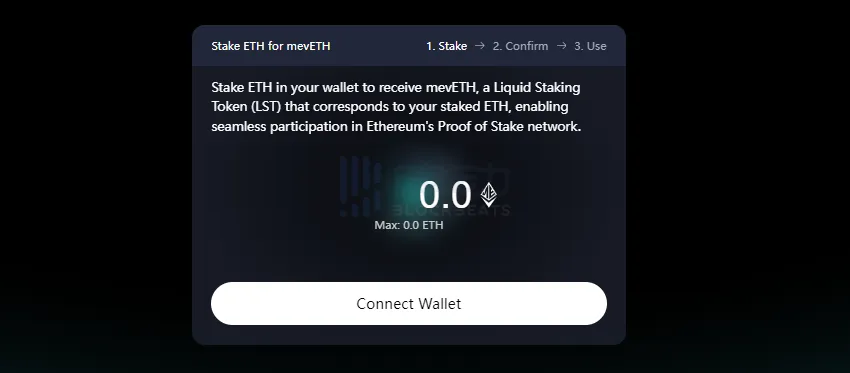

Users can earn additional revenue from multiple MEV strategies supported by the stack by using ETH to mint mevETH. Initially, the protocol will generate revenue through arbitrage between ETH and mevETH. Additionally, as they will be running their own validators, they will be able to create custom blocks and ensure their inclusion on the chain.

Manifold Finance stated that since August, over 28,000 ETH has been staked in the MEV protocol's mevETH and rewards have already begun. The team has also introduced a simplified process, allowing users to deposit ETH directly on the website and mint mevETH.

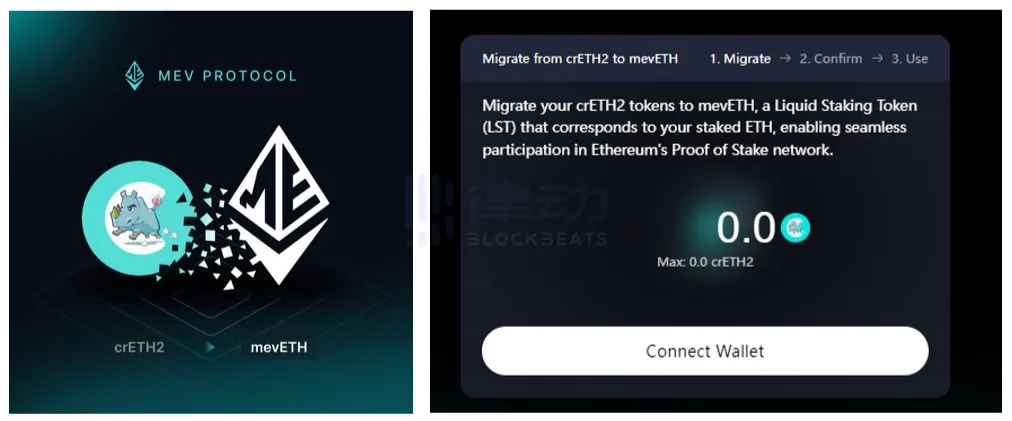

Furthermore, the team has collaborated with Cream Finance, and the migration from CRETH2 to mevETH is now live. ETH staked under crETH2 is now staked on the MEV protocol validators. To mint mevETH, the crETH2 token is treated as ETH. The exchange rate from crETH2 to ETH is completed through a redemption ratio, with 1 crETH2 exchanging for 1.13 ETH.

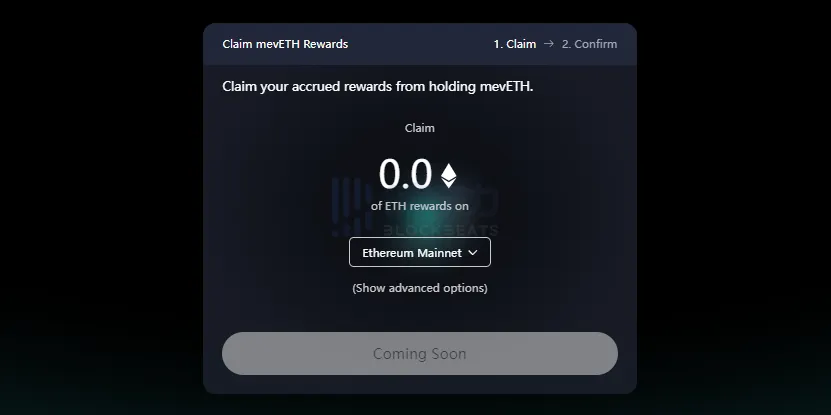

Users will accumulate rewards through the protocol's usage in the initial stage, which will be distributed to them in the form of ETH. After a period of operation and testing (earliest next month), the protocol will enable the withdrawal of ETH, allowing users to extract the value they have accumulated in the protocol in the form of ETH.

The team stated that this new auction system will provide a solid foundation for supporting more advanced applications, including futures markets for handling priority-sensitive transactions, multi-period bidding for block builders, and renewed support for ERC-20 tokens. Additionally, the protocol plans to support new lending protocols and integrate with DeFi platforms such as Yearn.

After the Shanghai upgrade in April, Ethereum activated the staking withdrawal function, reducing the difference between ETH and staked ETH, further strengthening the adoption of LST. In the Ethereum PoW era, the main participants in MEV included searchers and miners, with miners taking the lion's share of MEV income. Since the merge, due to changes in the block generation process and the diversity of validators, Ethereum's PoS mechanism has changed the original MEV ecosystem.

Combined with MEV's LSD, which can bring users more real income, Manifold Finance's emphasis on "non-extractive MEV" may promote the marketization and fairness of the MEV market, better allocating the interests of block users, validators, and searchers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。