Original Author: Crypto KOL Poopman

Translated by: 0x711, Logicrw, BlockBeats

Original Title: "In-depth Analysis of SSV Network Technology Principles and Development Prospects"

In early September, Ethereum LSD protocol participants such as RocketPool, StakeWise, and Stader Labs made a joint commitment to limit their market share to no more than 22% of the total staking amount, aiming to address the increasing centralization of the Ethereum staking market. However, the market leader Lido Finance, with a market share as high as 32%, did not make a statement, sparking community controversy. In response, Crypto KOL Poopman posted on his social platform, stating that Distributed Validator Technology (DVT) plays an important role in preventing single point of failure and achieving decentralization, and conducted an in-depth analysis of the related SSV Network protocol.

BlockBeats has compiled the following translation and analysis.

Background

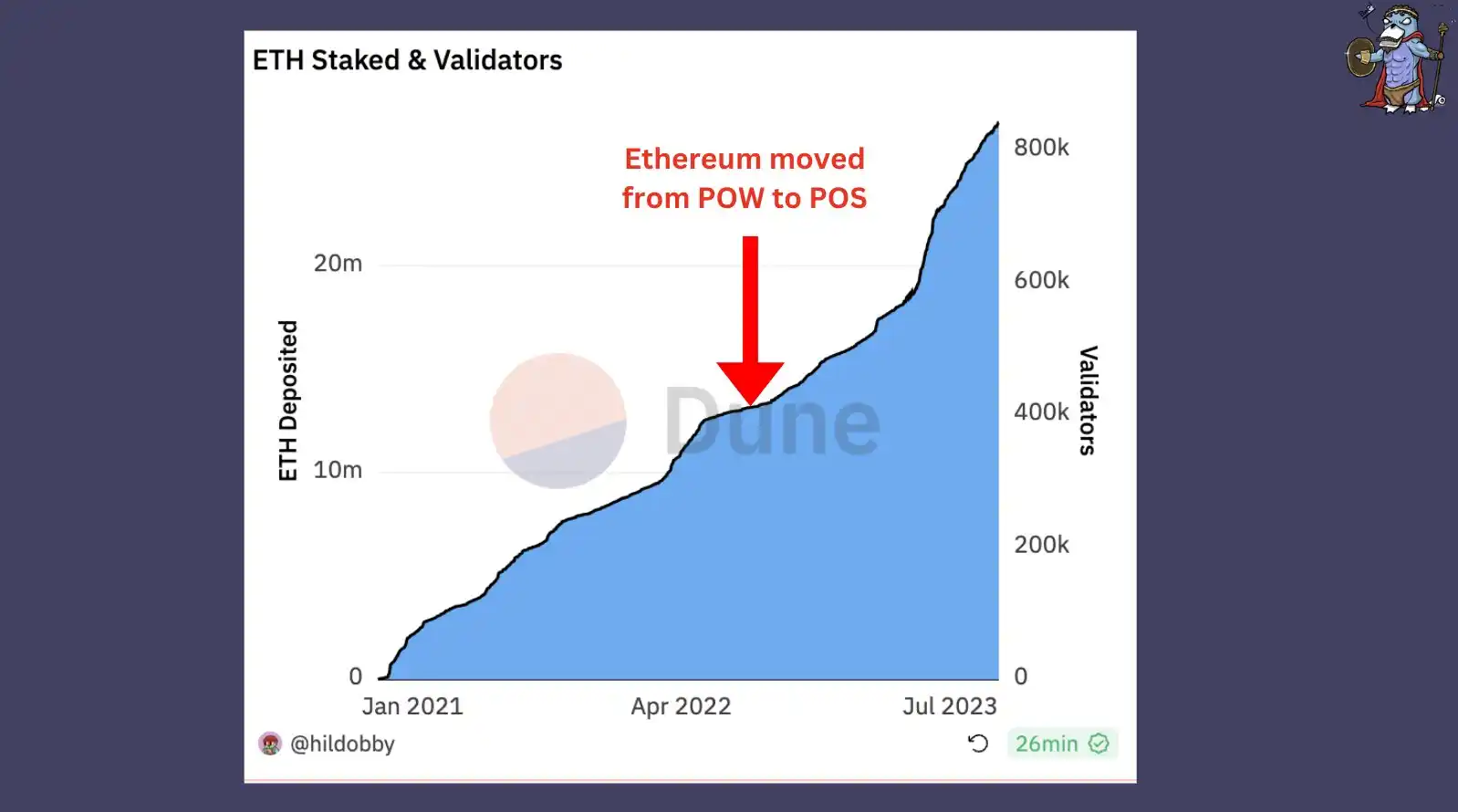

After the Ethereum merge, the consensus mechanism has transitioned from PoW to PoS. Meanwhile, PoS has accelerated the growth of staking solutions such as Lido, and also accelerated the protocol's centralization risk (approximately 33% market share).

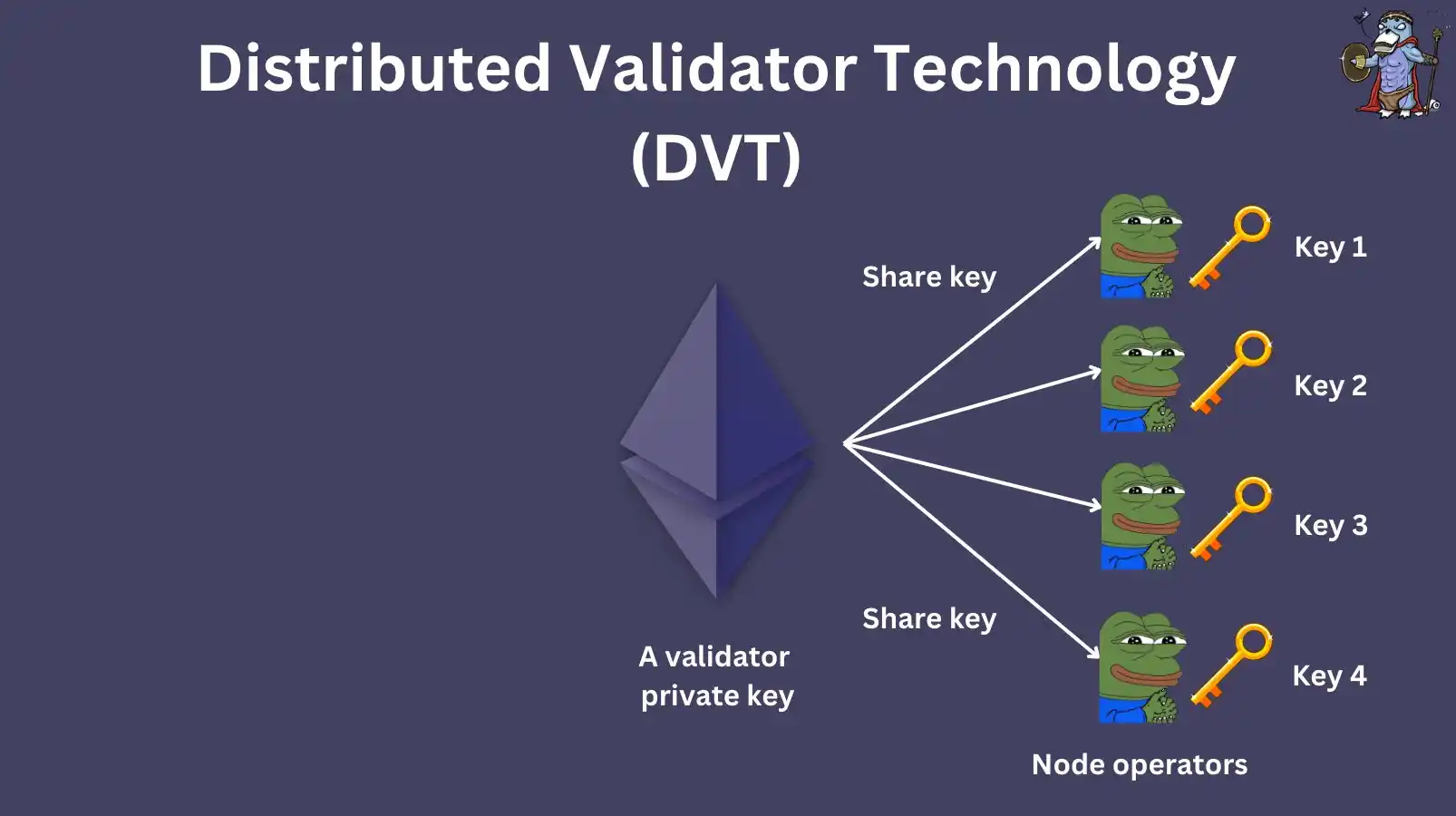

DVT stands for Distributed Validator Technology. This technology distributes the validator's private keys across multiple computers to prevent single point of failure, etc. In simple terms, DVT can be seen as a solution similar to multi-signature.

It is necessary to explain the concept of validator node keys. After PoS, validator node keys are introduced. These keys are responsible for signing on-chain operations, such as block proposals and proofs. However, the keys must be stored in hot wallets.

Operation of DVT Technology

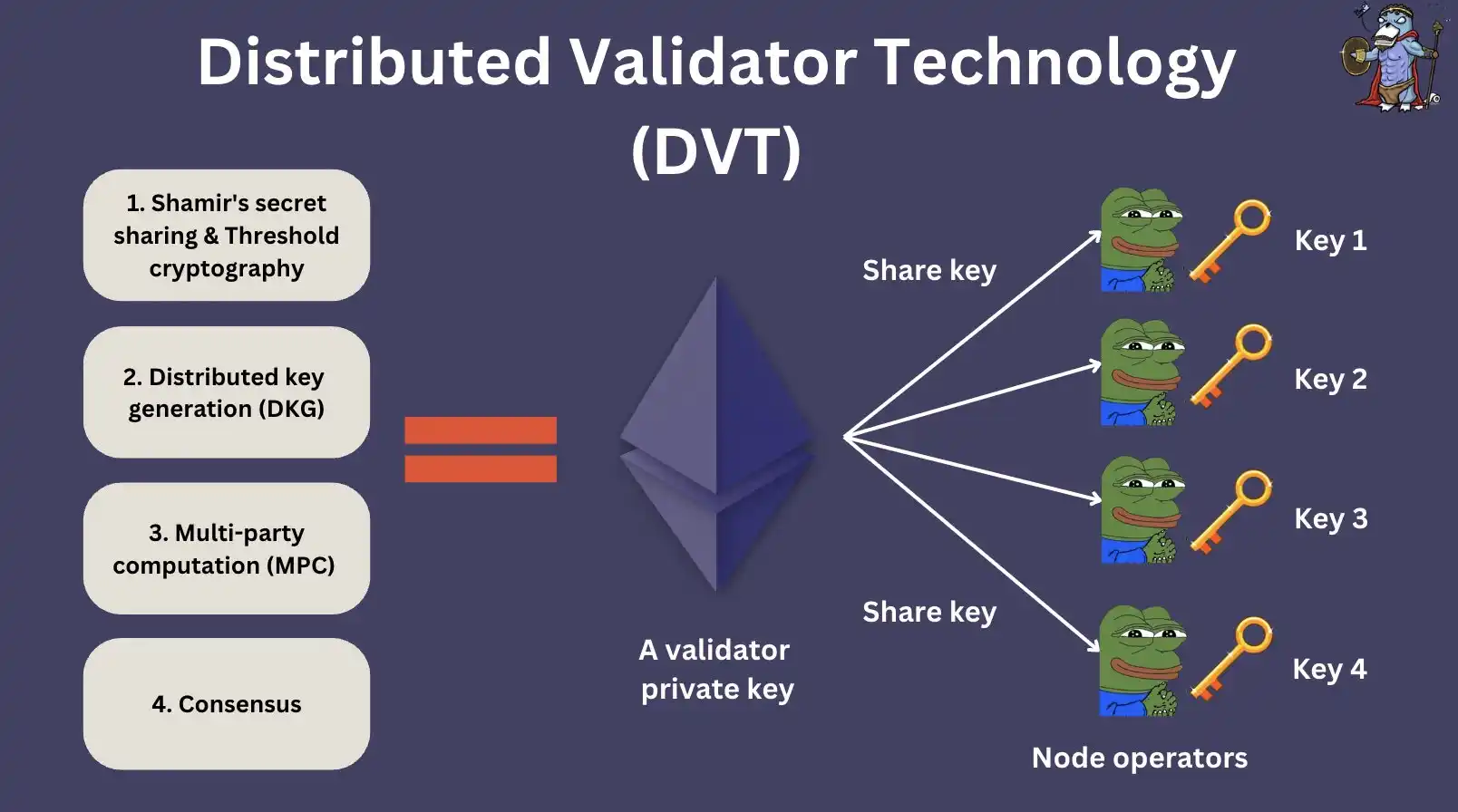

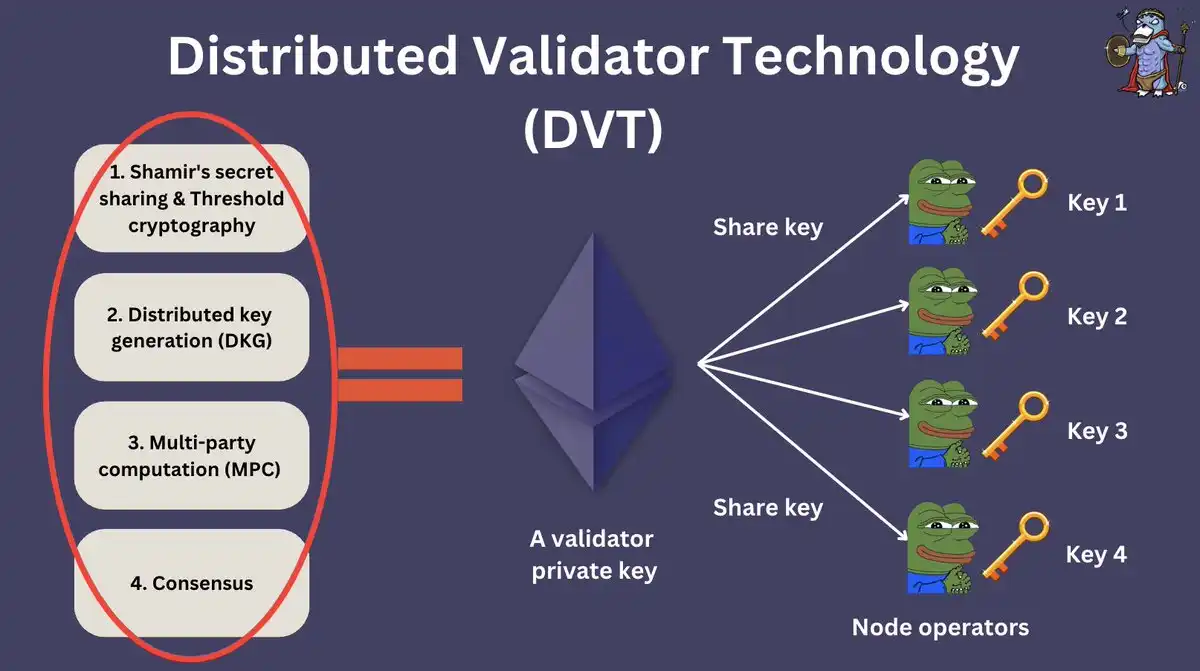

To understand how it works, we first need to understand the 4 pillars of DVT:

- Shamir's Secret Sharing and threshold cryptography;

- Distributed Key Generation (DKG);

- MPC;

- Consensus.

Shamir's Secret Sharing

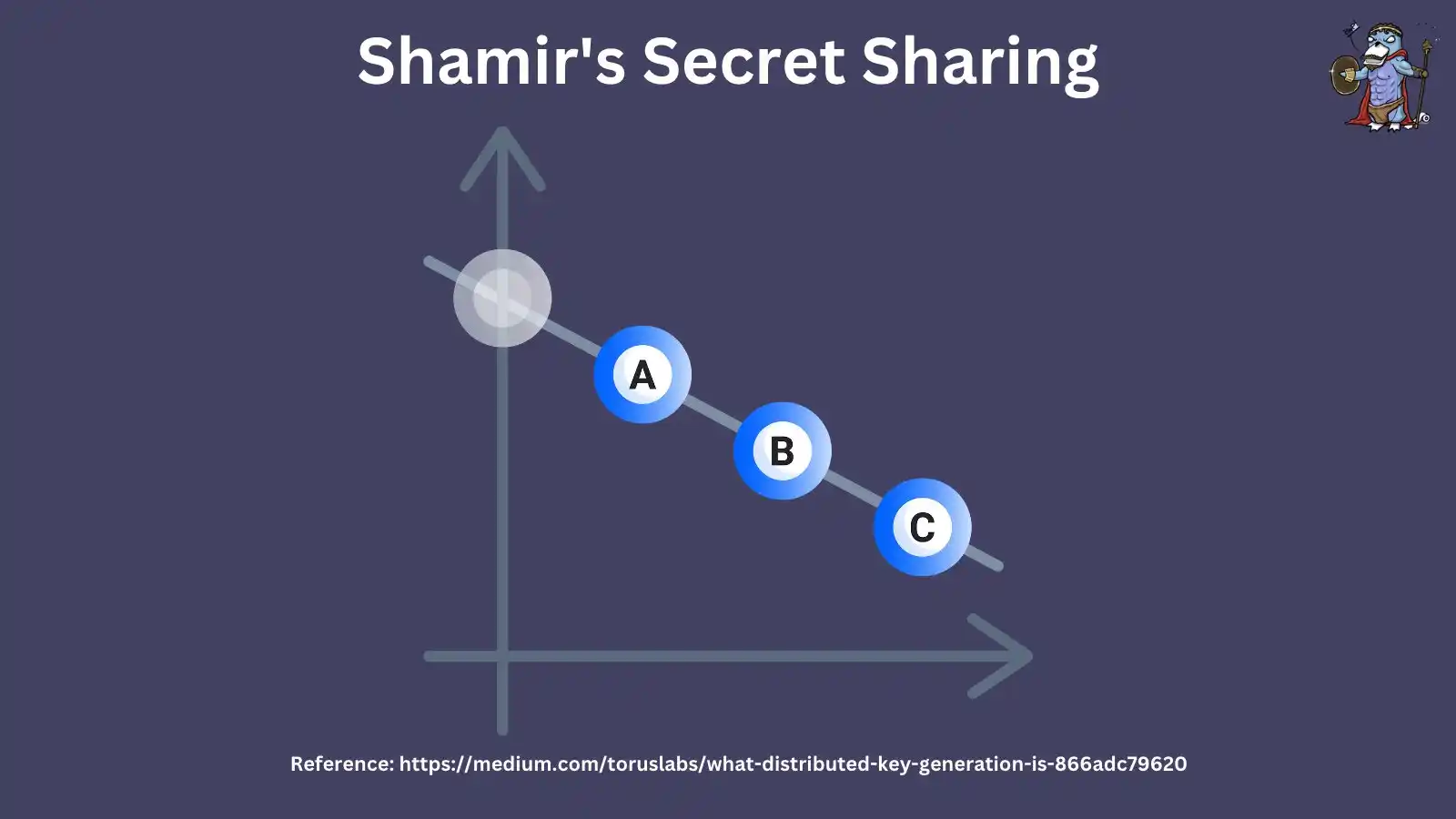

Imagine a graph where an encrypted message is on the Y-axis, and a private key is divided into 3 parts and sent to nodes A, B, and C. To decrypt the message, at least 2 parts are needed to connect the lines.

This is called ⅔ Shamir's Secret Sharing. In simple terms, Shamir's Secret Sharing is an algorithm that divides the private key among multiple nodes. Each node holds only a small part of the key, and unless the voting threshold (such as 3/4 or 5/7) is reached, no single node can sign the message.

In addition, PoS uses BLS signatures, allowing multiple signatures to be aggregated into a single signature. Therefore, when nodes sign transactions, BLS signatures combine all signatures into one that can represent the validator node's private key.

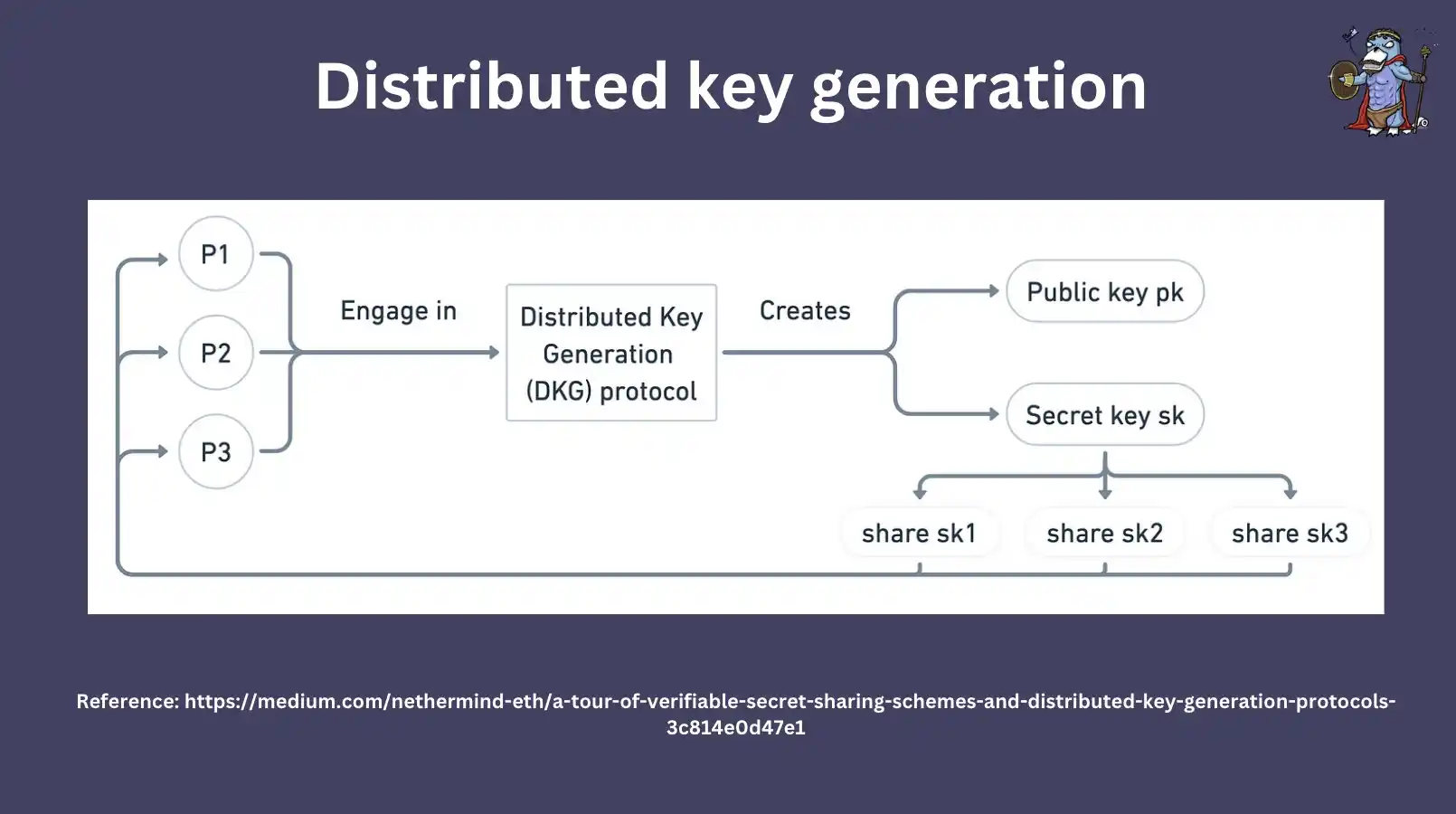

Distributed Key Generation (DKG)

However, in reality, no party should know the validator node's private key, as this is very insecure for the validator. In this case, DKG attempts to solve this problem by:

Each participant creates a secret share; Then all these shares are added together to obtain the final result.

Thus, DKG is a process of creating key shares and distributing them to each node. This process requires each participant to calculate the key and provide "randomness" so that no party can know the user's private key.

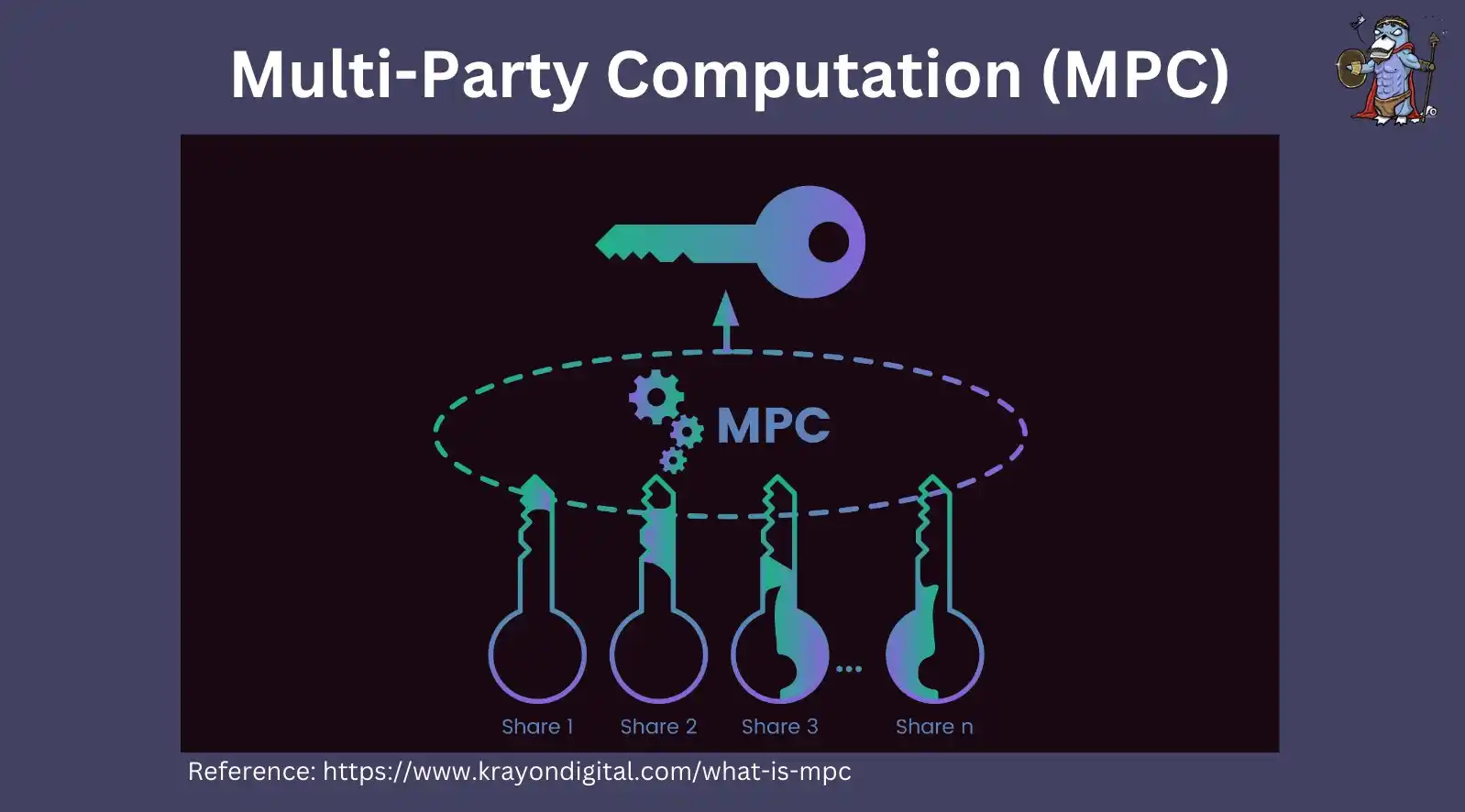

Multi-Party Computation (MPC)

MPC is an important pillar of DVT. MPC allows operators to sign messages using only their secret shares, without needing to reconstruct the complete private key on any single device. This helps to reduce the risk of private key centralization.

Consensus Mechanism

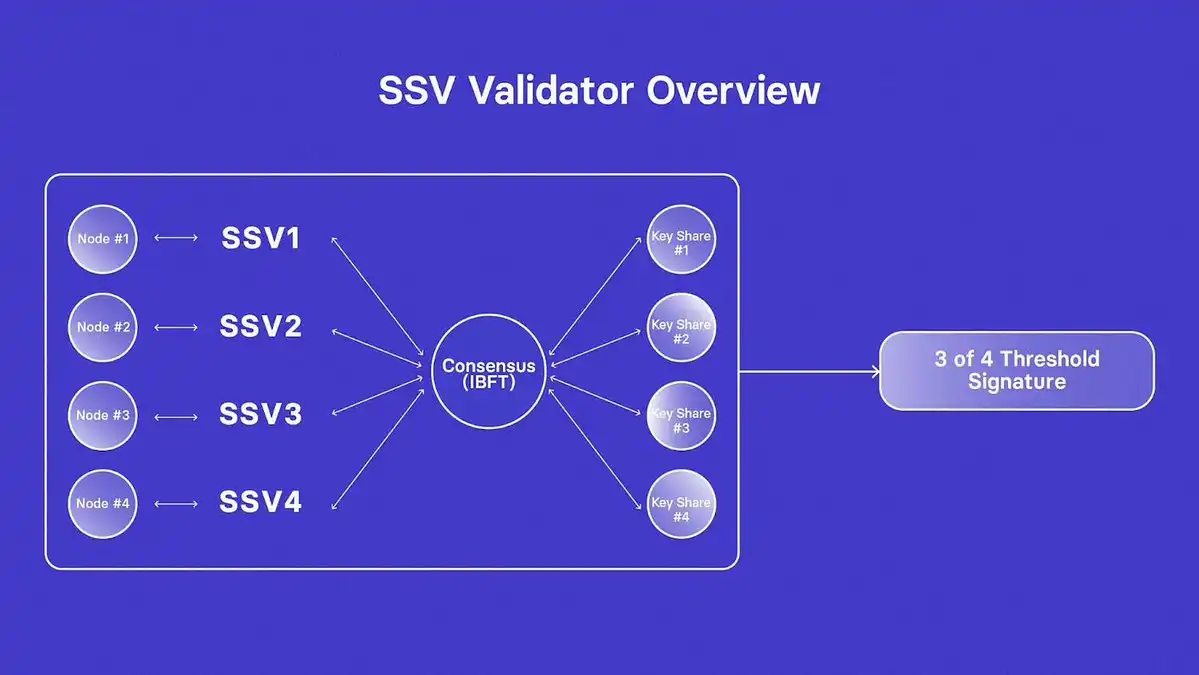

To reach consensus among nodes on a certain block, the IBFT algorithm selects a node as the block proposer and shares the block with other nodes. If consensus is reached, meaning approximately 66% of nodes agree that the block is valid, the block is proposed for packaging.

However, if the block proposer goes offline due to hardware/software issues in DVT, the IBFT consensus will select another DVT node as the block proposer within 12 seconds, and the fault-tolerance mechanism will take effect. (This to some extent ensures the robustness of the blockchain.)

Brief Summary of DVT

In short, the following four technologies constitute the foundation of DVT:

- Shamir's Secret Sharing and threshold cryptography

- DKG

- MPC

- Consensus

Now that DVT has been understood, let's explore the SSV network.

What is the SSV Network?

SSV stands for Secret Shared Validators, recently referred to as DVT.

The concept of SSV originates from research papers collaborated with Ethereum Foundation members, aiming to distribute validator tasks to a group of nodes.

How Does the SSV Network Operate?

SSV = DVT

SSV distributes the validator's private keys (or shares) to a group of nodes, ensuring:

No centralization of keys One node does not need to trust another node to operate

In addition, SSV also has a token and a P2P market.

Use of SSV Token

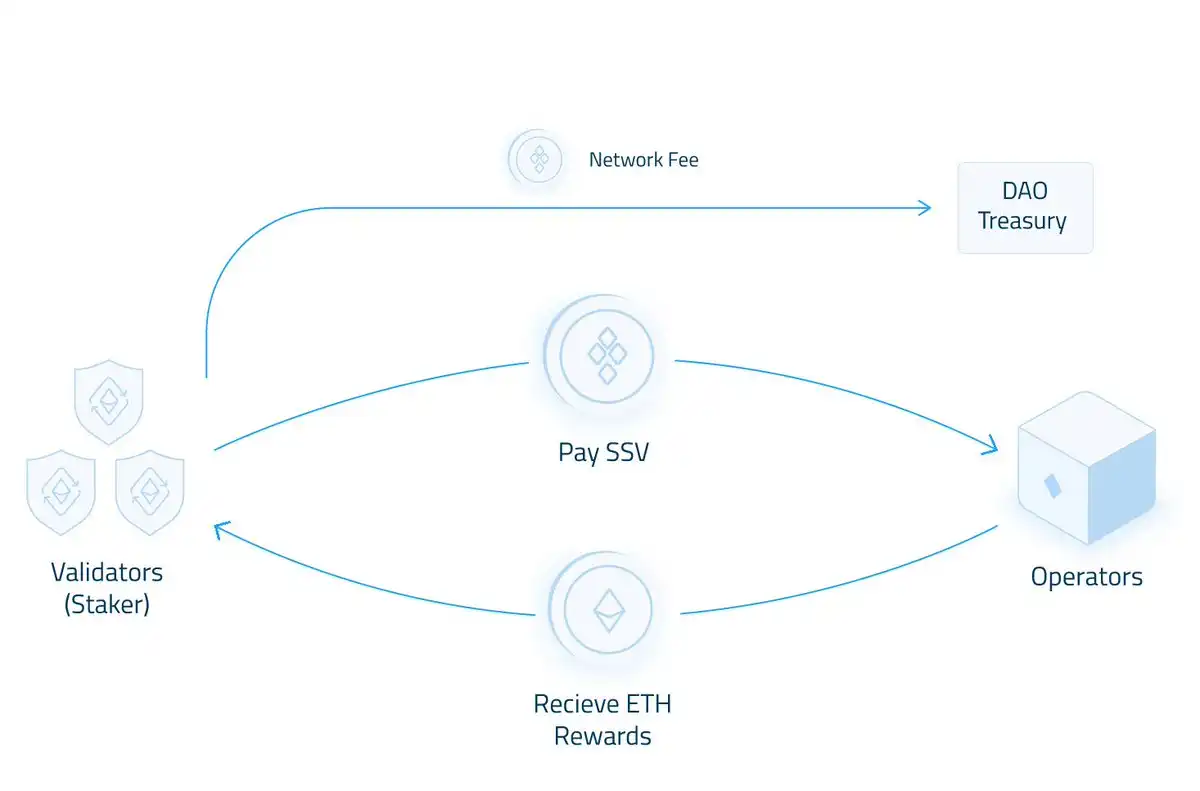

As the SSV network provides higher security and decentralized services, users must pay SSV fees to the network and operators for incentives.

There are two main participants in the SSV network: stakers and operators.

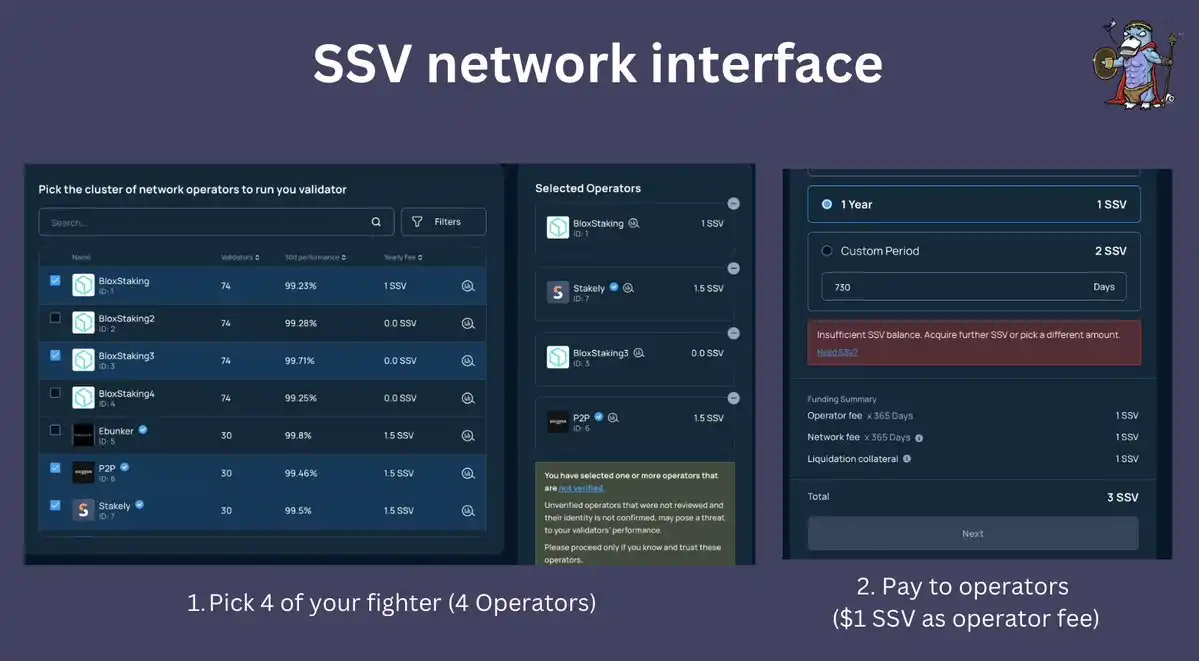

Stakers can select 4 operators from the list, then deposit SSV to these operators and directly earn ETH on-chain based on the term they choose (e.g., 1 year, 6 months).

Each operator can set their own fees and compete with other operators in the P2P market.

More importantly, operators do not hold the staker's ETH assets or rewards, as their role is solely to maintain and operate the validators on behalf of the stakers. However, both operators and the network will charge operational and network fees to users utilizing the SSV network.

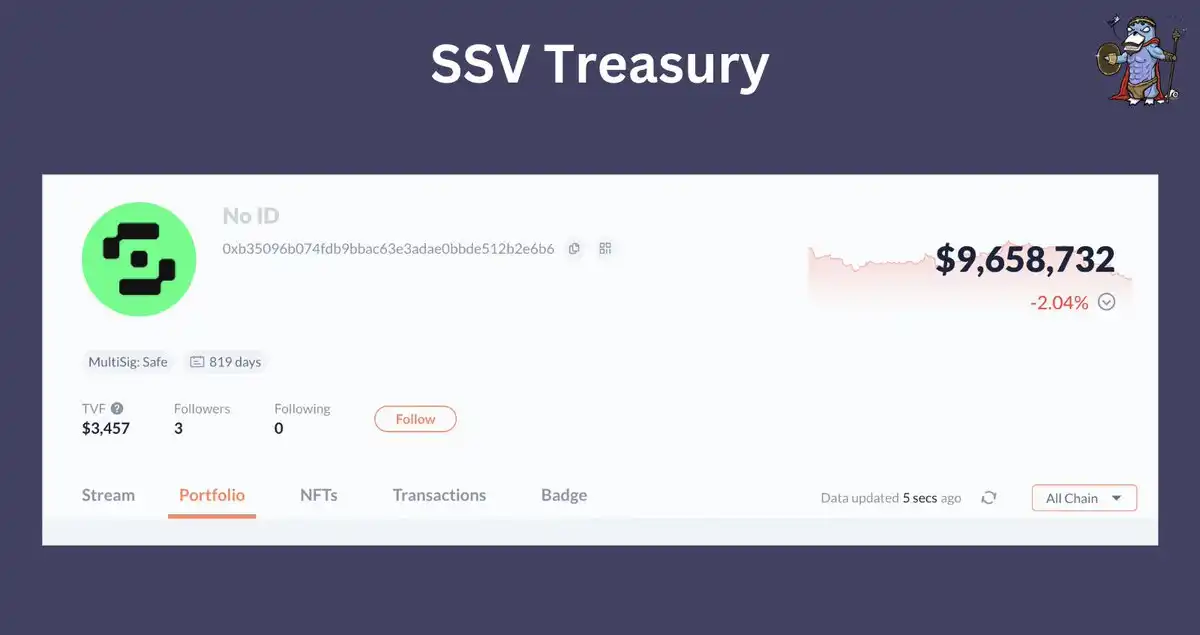

The network fee is a fixed cost for each validator designed by the DAO and flows directly into the DAO treasury (0xb35096b074fdb9bbac63e3adae0bbde512b2e6b6). The fee is deducted over time from the staker's SSV balance and currently has accumulated approximately $10 million TVL.

SSV DAO

SSV token holders can participate in the governance of the SSV DAO, making decisions on:

Designing and adjusting network fees Operator ratings (based on operator performance) Development and decisions for any protocol

Feasibility Insights for SSV

Firstly, the SSV network is expected to see increased adoption. This will lead to more stakers depositing SSV with operators to gain higher security and decentralized services, reducing the circulating supply in the market.

In this scenario, the most straightforward action is to trade SSV on the secondary market.

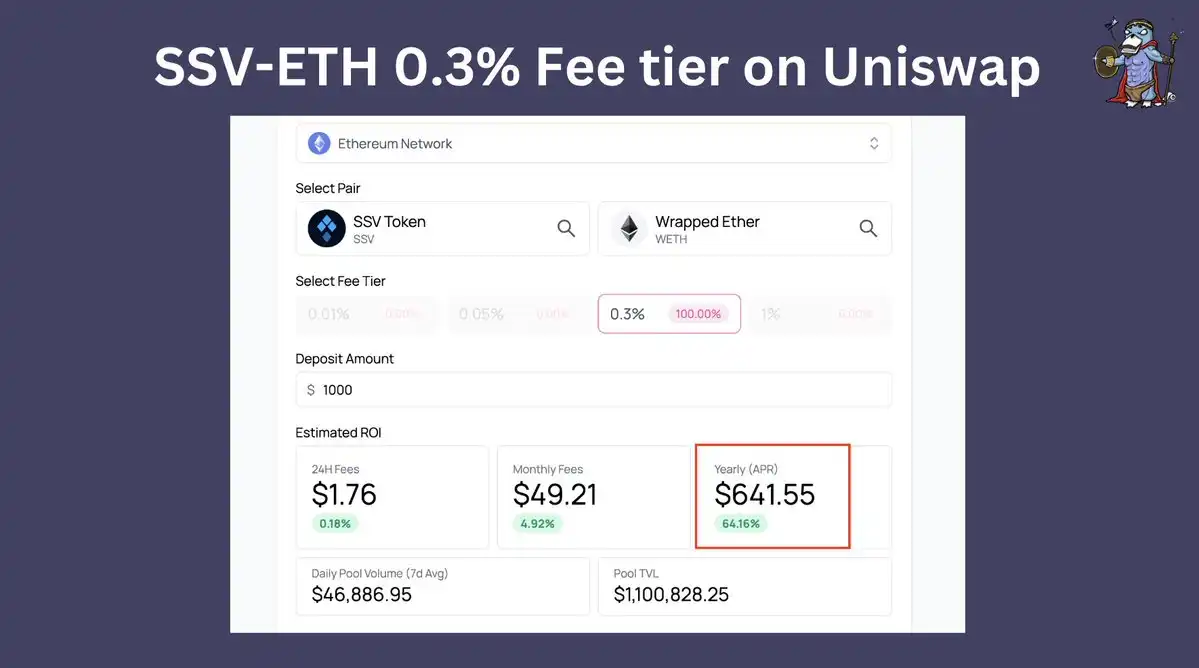

Alternatively, you can provide liquidity for the SSV-ETH pair on Uniswap (0.3% fee tier) and earn approximately 64% APR, earning about $1.76 per day for every $1000 of liquidity provided.

On the other hand, running nodes in the SSV network and earning SSV as service fees can also be considered. The more managed key shares, the more SSV can be earned.

However, operators should note that the appreciation of SSV does not necessarily lead to higher income. In fact, when the price of SSV rises, operators typically lower fees to attract more stakers. Similarly, they may raise fees when the price of SSV falls. The dynamic changes in fees are also influenced by the number of stakers and operators in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。