Author: Kit, CatcherVC

The Black Swan event has always been a mirror of blind confidence for individual and institutional investors in overconfident data interpretation and statistical probability. From the release of the Bitcoin white paper to the present, the crypto market has experienced multiple Black Swan events such as Mt Gox, The DAO, bans, exchange delistings, and FTX's insolvency incident in 2022, which once again brought the warning "Not your keys, not your coins" to everyone's attention. As a result, CEXs jointly issued nominal deposit proof PoR, MPC, homomorphic encryption wallets, and zero-knowledge proofs, which have rekindled the crypto community's interest in DEXs and self-custody.

At this juncture, GRVT emerged. GRVT is a Layer 3 exchange that offers cross-asset hedging perpetual contracts and options, built on the Layer 2 data availability foundation of ZKSync, and plans to use the Validium solution to provide users with a trusted high-performance trading experience. Co-founded by Hong Gyu Yea, Matthew Quek, and Aaron Ong, their original intention was to use existing ZK encryption, blockchain technology, and high-performance trading systems to create a new generation of hybrid exchange (HEX) to address the dilemma between high-performance trading and user fund security faced by centralized exchanges. According to GRVT founder Hongyea, GRVT is scheduled to launch its testnet in the fourth quarter of 2023 and plans to go live on the mainnet in the first quarter of 2024.

Key Point 1: CEX/DEX Status Quo

- Spot Trading: From 2017 to 2023, the average daily trading volume of cryptocurrencies on CEXs increased from $500 billion to $5 trillion. The emergence of on-chain liquidity exchanges such as Uniswap during the period from 2019 to 2023 has distinguished DEXs from centralized exchanges. DEXs, from non-existence to now, occupy 15% of the spot market trading ratio, and native Ethereum applications such as Uniswap and Curve have established an oligopoly on EVM-based chains.

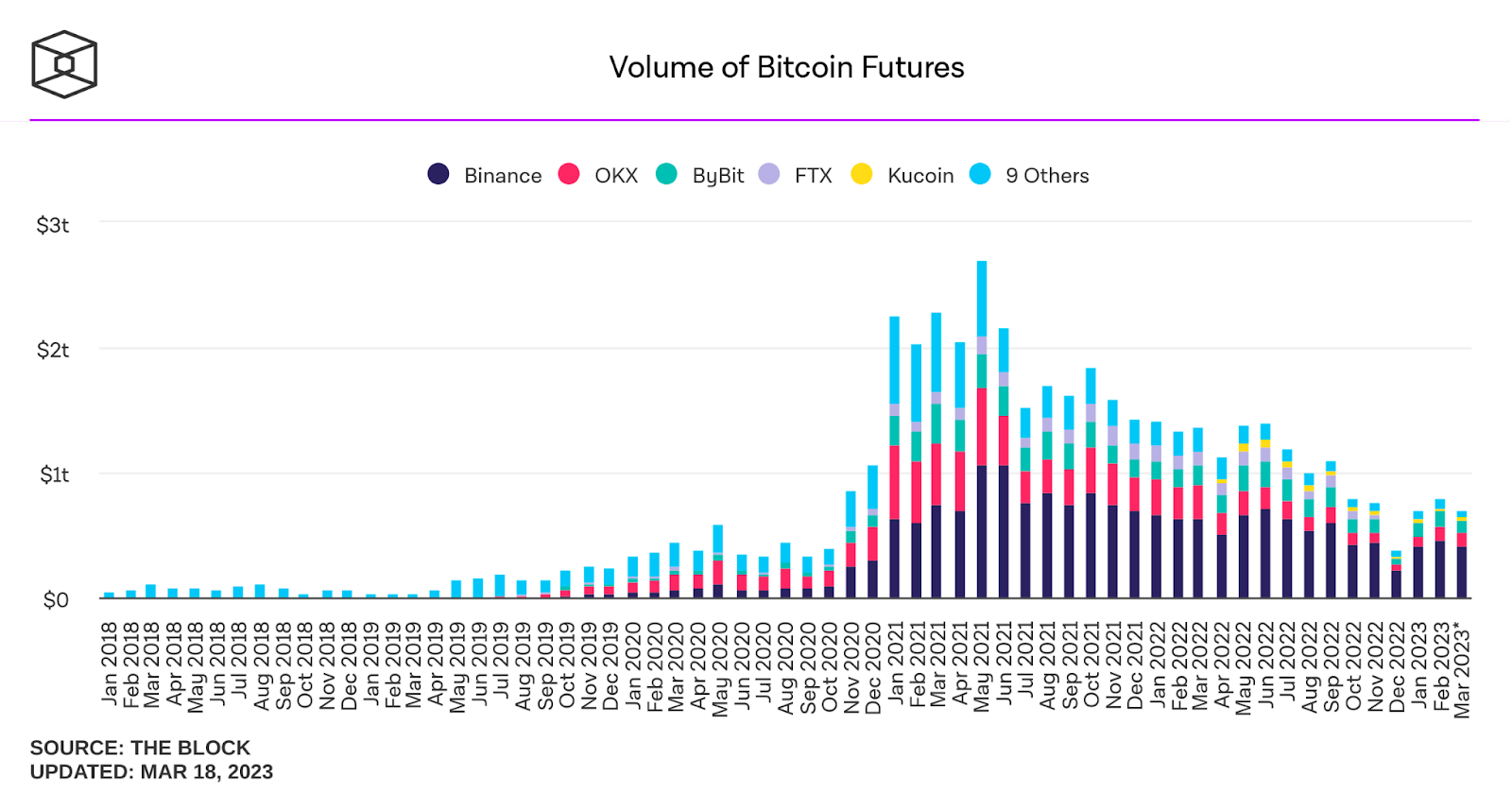

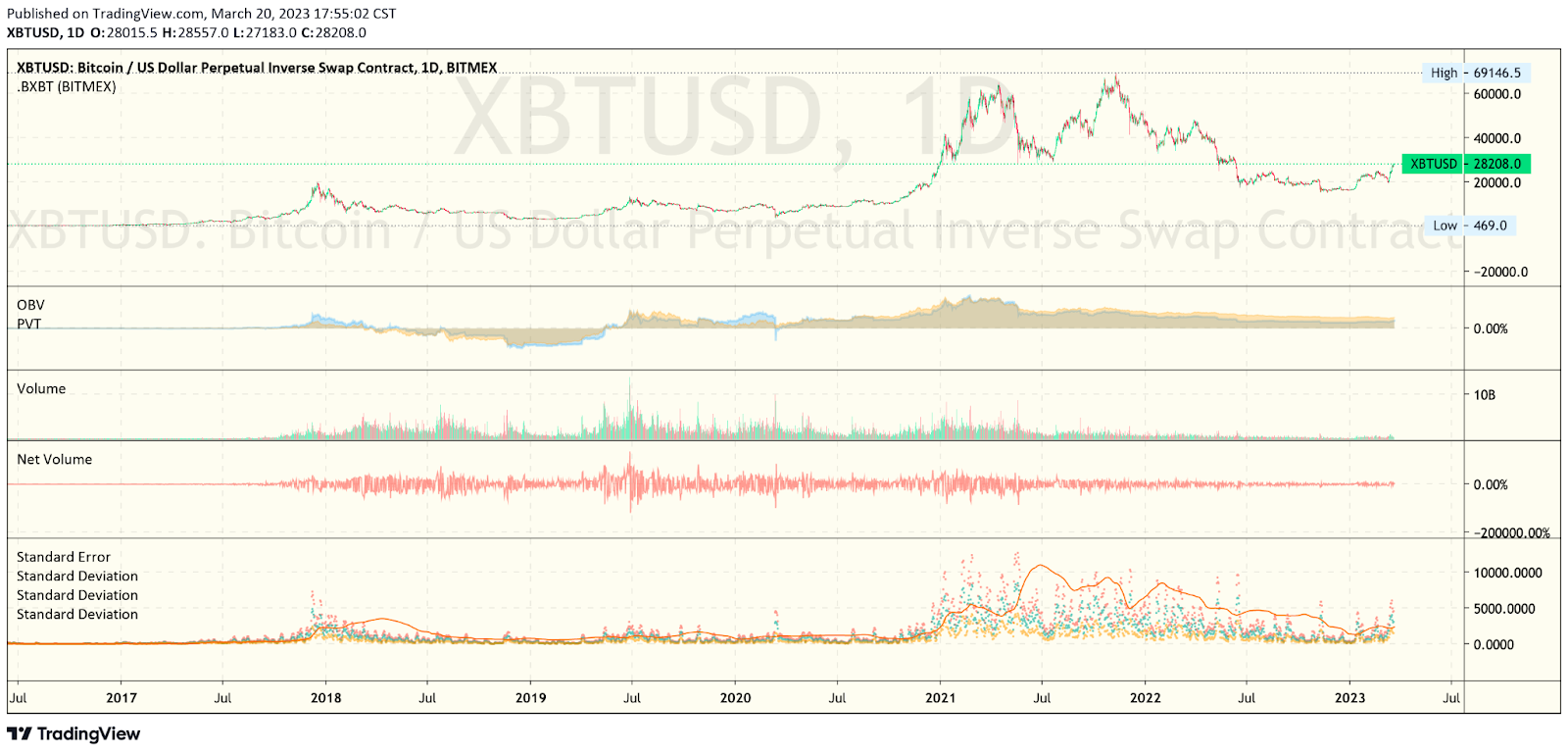

- Perpetual Contracts: Since Bitmex introduced perpetual contract trading in 2016, major exchanges have also launched leveraged contract trading systems. The low trading costs and high-performance experience of centralized trading systems provide convenient custody services for investors and bring substantial profits to exchanges. At the same time, centralized services have been criticized for their opaque "wash trading," single point of failure, hacking, and misappropriation of user assets. According to TheBlock data, the monthly average trading volume of BTC and ETH perpetual contracts exceeded the total monthly average trading volume of all cryptocurrencies in 2022, which precisely indicates that if Old Money institutions and market makers enter, their biggest concern should be the counterparty trading risk on centralized exchanges. Leveraged trading should be a double-edged sword for market funds, not a black hole for counterparties.

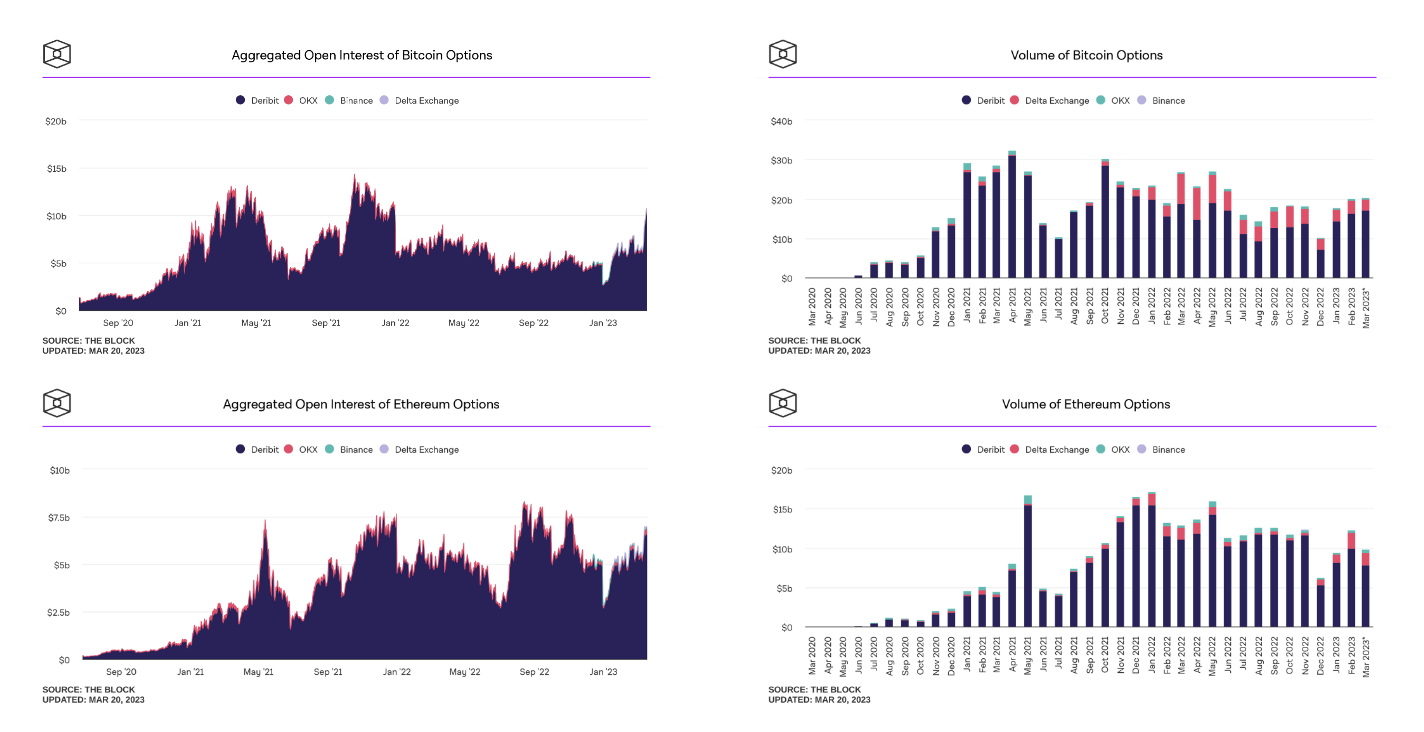

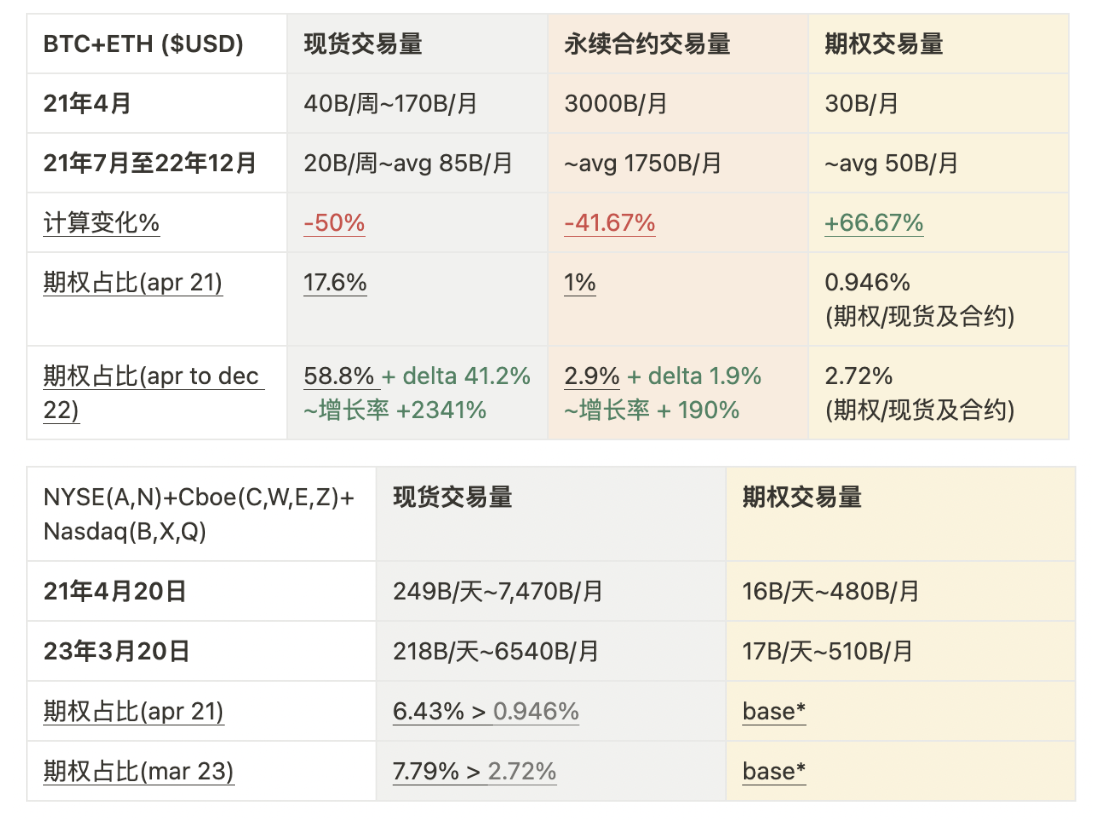

- Options: Cryptocurrencies have experienced two cycles of rapid growth. We have seen a new trend: "The emergence of professional investors and mature derivative trading tools has led to a decrease in market volatility returns (distribution chart price fluctuation 123Sigma), while the activity and trading volume of the options market are rapidly increasing." This not only reflects the importance of options as hedging tools but also reveals their significant growth potential. As of March 2023, TheBlock data shows that the options market trading volume for BTC and ETH reached $45 billion per month during the bull market from 2020 to 2021, and in the first quarter of 2023, it had returned to the high point of the previous bull market cycle and maintained strong trading volume. This understated data fully demonstrates the activity and growth potential brought by professional traders entering the options market. With changes in the macro market environment and uncertainty about the next halving, the demand for hedging tools by professional traders is also increasing.

- Traditional Options Market: Compared to traditional Nasdaq and CBOE options markets, although the hedging level of the current cryptocurrency options market is relatively low, its growth rate and potential cannot be ignored. Especially in the case of shrinking spot and perpetual contract trading volumes, the increase in options trading volume demonstrates its significant position in the market. The dominant player in crypto options, Deribit, officially launched collateralized asset options and quickly captured a large trading market starting in 2020. Subsequently, OKX launched an internal customer options market, accounting for only 1%-5%. The market share of Delta Exchange reached its peak at 10%-15% in 2021. In fact, products such as Binance's Binance Options, Amber's Shark Fin, and OKX's options have been available for a long time, but due to the positive correlation of cryptocurrency's volatility returns and the aforementioned counterparty risk, these structured products, which are based on traditional large trading volumes and vanilla, heterogeneous options fixed income products, did not receive enough attention in the early stages of the industry. In the second quarter of 2023, the official launch of Binance's one-sided options trading section and OKX's introduction of snowball products also demonstrate that centralized exchanges are sensing subtle market changes and are determined to seize the high-certainty growth derivatives track.

Solution: RFQ + Cross-Asset Full Margin Hedging

The GRVT team believes that an options trading market without futures or full-margin collateral trading options cannot provide complex trading strategies and low capital utilization. Conversely, a derivatives exchange without options trading cannot provide professional traders with sufficient hedging tools. Therefore, the original intention of their product design was to include full-margin hedging options. In addition, the RFQ inquiry system on Telegram and API can help traders and institutions quickly and conveniently inquire about customizing and executing complex structured strategies. The margin system and on-platform hedging function are key designs that greatly improve the utilization of collateral. Therefore, the open ecosystem of on-chain derivative interfaces and off-chain matching and delivery can provide large traders with a secure, rich, and powerful one-stop comprehensive trading platform while the underlying crypto technology continues to develop.

Key Point 2: Custody Service Trust Crisis

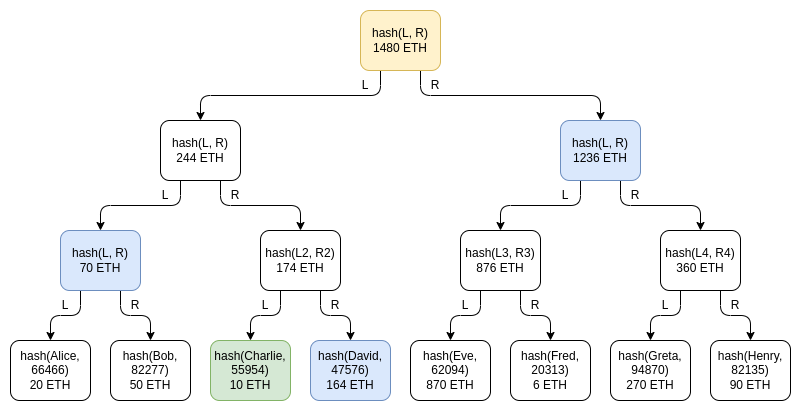

(Source: Vitalik, https://vitalik.ca/general/2022/11/19/proofofsolvency.html)

In 2022, the FTX insolvency incident led to the collapse of a company worth $40 billion within a week due to insolvency, leaving $8 billion in user assets unpaid. This made investors deeply aware of the internal accounting chaos and centralization of centralized exchanges, and also forced exchanges like Binance to lead other exchanges in introducing hot wallet deposit proof (Proof of Reserve, "PoR"). In fact, PoR was first proposed by Kraken in 2014, and then Vitalik Buterin called for the use of zero-knowledge proofs (ZKP) of polynomial commitments (KZG) to replace the deposit certificates currently generated by Merkle trees, in order to ensure higher security and privacy.

However, deposit certificates cannot prove a CEX's solvency. Customer assets only represent part of the liabilities and do not include the exchange's credit and other business. Although public assets and addresses allow investors to track and analyze suspicious behavior, when insolvency and runs occur, user assets still cannot provide data scrutiny of the exchange's solvency, or frozen user assets during the recovery litigation phase. In fact, the third-party liquidator of Mt Gox has always delayed applications to seek investors' interests.

Solution: High-Performance Engine + ZK Complete Body

The original intention of HongYea in founding GRVT was to protect user assets and enable users to achieve one-click trading and low-latency experience under self-custody accounts that are no different from centralized exchanges. It is reported that GRVT's off-chain order book matching engine has a high throughput of 600,000 TPS and a latency of less than 2 milliseconds. When combined with its trading execution and Validium ZK proofs, users can not only ensure the security of their assets through Validium's data committee, similar to DYDX (StarEx version), but also ensure the privacy of trading execution details such as position information and liquidation lines, greatly reducing the counterparty risk of the current CEXs solution.

GRVT's system is designed to be compatible with ZK proofs from the beginning and is built on the ZKSync Era Rollup. According to the current ZKSync proof submission speed, the assets and settlements of all traders can be confirmed and circulated on the Ethereum main chain within 2 to 24 hours. Confirmation speed is very important for the natural large-volume fund suction effect of TradeFi. Assuming that these large funds flowing into ZKRollup need to go through a "third-party centralized cross-chain bridge" or a "7-day optimistic resolution challenge period," the risks of theft, market instability, time dimension, and settlement fees faced by these large funds are significant, and the faster settlement speed of ZKRollup is one of the important factors needed by TradeFi Layer2. Therefore, compared to derivative applications such as GMX and Lyra built on optimistic resolution, users using GRVT on ZK scaling solutions bear less risk and are more secure due to the 7-day challenge period and third-party cross-chain bridge confirmation, and the future potential for zero-knowledge expansion is also higher.

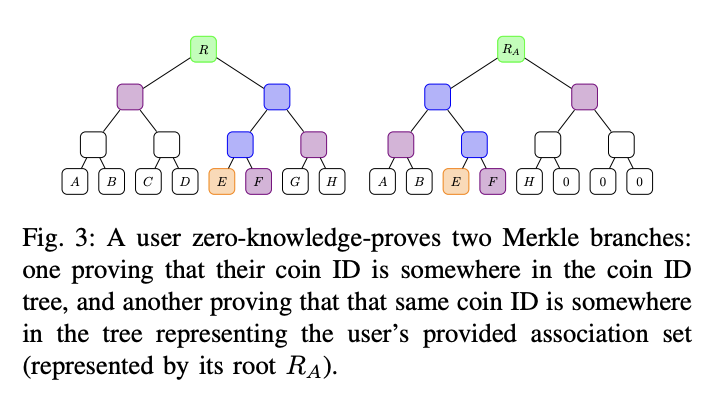

Although Validium proofs cannot fully preserve all historical trading execution records, with the evolution of ZK proof algorithms, Zhang Ye of Scroll Tech has stated that ZK scaling solutions can achieve mandatory proof recovery. In the event of a black swan event in the market or illegal data tampering, users can challenge the security of funds through mandatory ZK proof submission, thereby recovering frozen or lost funds. Compared to PoR's "guarantee of correct total funds," GRVT adheres to Vitalik Buterin's advocacy of using ZK proofs to guarantee users' "absolute withdrawal" rights.

Key Point 3: Compliance and Review and Compliance

With the collapse of SBF and FTX, the decision for the United States to step into the crypto industry has been urgently halted. Uncertainties have led to A16Z announcing the establishment of a European office, Coinbase's Brian Armstrong announcing a strong development of Coinbase's derivatives trading platform in South America, the suffocation of the U.S. digital asset inflow and outflow channel Silvergate, and the SEC summoning Binance. These pieced-together clues form a comprehensive crackdown by the United States on the crypto industry, including its territoriality, cultural differences, racial faces, and offshore funds. Due to regulatory pressure and the crackdown on giants, the start of the new generation of decentralized exchanges will be more difficult than the previous cycle, and future on-chain regulations and restrictions will become more stringent and centralized. The arrest of Tornado developers, Consensys Metamask default IP monitoring RPC, and Uniswap integrating centralized purchasing channels also indicate the potential compromise of on-chain crypto natives to the potential AML/KYC for large-scale users. In fact, Vitalik Buterin has also called for the use of ZK proofs to provide partial auditability to law enforcement agencies to address the increasingly severe on-chain audit system's AML deficiencies that the Tornado project cannot address.

(Source: Vitalik, Blockchain Privacy and Regulatory Compliance: Towards a Practical Equilibrium, https://papers.ssrn.com/sol3/papers.cfm?abstractid=4563364)

Solution 3: Team Experience + AML/KYC

The GRVT team has extensive experience in privacy data development and traditional financial compliance operations. Founder HongYea, from South Korea and based in Hong Kong, is an experienced trader who has worked as a financial executive at Credit Suisse and Goldman Sachs in Hong Kong for 9 years. Matthew, as the Chief Operating Officer, led the blockchain and payment team at Standard Chartered Bank in Singapore to research traditional financial applications of blockchain. Aaron, the Chief Technology Officer of GRVT, served as the technical director of two data privacy frameworks at Meta. According to the GRVT team, the project will provide a new generation one-stop trading platform for global digital asset derivatives trading users based on AML/KYC compliance, security, and high performance.

According to the disclosed seed and pre-seed round financing, the seed round was led by Matrix Partner with cross-domain venture capital experience and ABCDE with a background in founding digital asset exchanges. Other institutions that invested in the seed and pre-seed rounds include Delphi Digital, a U.S.-based digital asset research-driven media, QCP Capital, a seed investor in Deribit, SIG, HackVC, Folius Ventures, Metalpha, CMS Holdings, Appworks, Fisher8 Capital, Kronos Research, 500 Global, Token Metrics Ventures, Primal Capital, and CatcherVC.

Conclusion

In summary, the innovation of the GRVT team lies in their commitment to creating a completely new and unique digital asset derivatives trading platform, which will establish a new hybrid trading standard between existing exchanges, decentralized trading platforms (DEX), and investors, as well as between spot, futures, and options. They utilize existing on-chain encryption blockchain technology and combine it with off-chain high-performance matching engines and OTC RFQ bots to provide a new hybrid trading platform (HEX) for the crypto industry, which is under regulatory pressure, facing centralized opaque risks, and low trust.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。