Author: Cointelegraph

Translation: DeFi.io Community

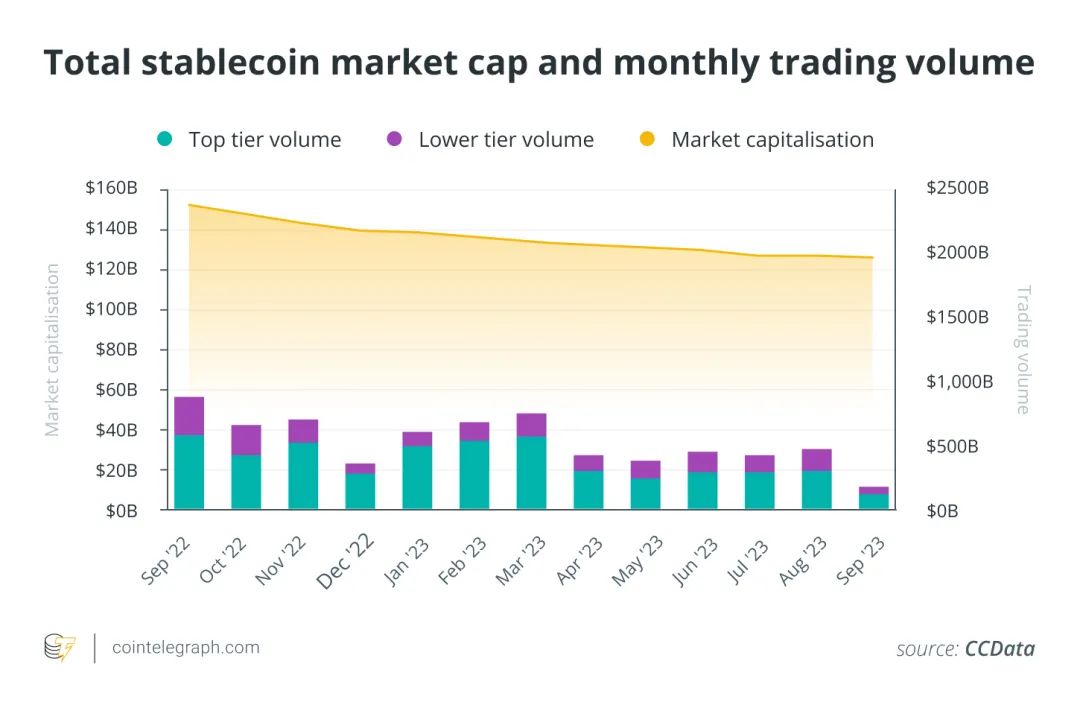

In a year full of uncertainty in the cryptocurrency field, a new trend is emerging: the exodus of stablecoins has been ongoing for 18 months, and the market dominance of stablecoins has dropped to 11.6%.

According to a report by CCData, the total market value of stablecoins in July was $124 billion, and most major stablecoins have been affected during the 18-month decline. While Pax Dollar (USDP), USD Coin, and Binance USD have experienced declines, the largest stablecoin by market value, Tether USDT, has continued to grow.

Stablecoins are a type of cryptocurrency that attempts to maintain price stability through various methods. Most mainstream stablecoins are backed by fiat currency, but there are also stablecoins backed by cryptocurrencies or commodities, or based on algorithms.

The reasons for the recent outflow of funds are not entirely clear and may be multifaceted.

After the U.S. Securities and Exchange Commission filed a lawsuit, fiat deposits on Binance.US were suspended, and MakerDAO also removed USDP from its reserves due to a lack of additional income, both of which have had an impact on the industry.

According to CCData's report, stablecoin trading volume increased by 10.9% in August, reaching $4.06 trillion, but trading activity on centralized exchanges is struggling, and overall trading volume is "expected" to continue to decline in September.

CCData's report points out that the U.S. Securities and Exchange Commission (SEC) has filed lawsuits against leading cryptocurrency exchanges Binance and Coinbase, and there is also a rush to list Bitcoin spot markets. The competition for listing Bitcoin exchange-traded funds (ETFs) is a factor contributing to the increase in stablecoin trading volume.

These factors indicate that stablecoins are still a safe haven for investors, which means that the outflow of funds may be related to other factors, such as investors cashing out stablecoins to purchase traditional assets when exiting the cryptocurrency field, or taking advantage of the rising yields of fixed-income securities.

For example, the yield on 10-year U.S. Treasury bonds has been soaring as the Federal Reserve raises interest rates to curb inflation. In 2020, the yield on these bonds was briefly below 0.4%, but it has now reached 4.25%.

Kadan Stadelmann, Chief Technology Officer of the blockchain platform Komodo, told Cointelegraph that one of the reasons investors buy Treasury bonds is that there is "greater certainty behind Treasury bonds." Even though "governments like the U.S. may face significant debt issues, the vast majority still consider them stable." Stadelmann added:

"At the same time, stablecoins are considered riskier because the cryptocurrency market is still largely unregulated. In addition, the returns on stablecoins are also not guaranteed. This means that if the interest rates on both options are similar, investors are more likely to choose Treasury bonds over stablecoins."

Looking deeper, the decline in the market value of stablecoins could have a significant impact on the broader cryptocurrency market. Stablecoins are typically used as a medium of exchange and store of value in cryptocurrency trading, which means that a decrease in demand for stablecoins could reduce the liquidity and efficiency of the entire cryptocurrency market.

Long-Term Explosive Circulating Supply of Stablecoins

While the total market value of the stablecoin industry has been declining for 16 consecutive months, CCData's report details that trading volume has not suffered the same fate.

Becky Sarwate, Communications Director of the cryptocurrency exchange CEX.IO, pointed out in an interview with Cointelegraph that some changes in the stablecoin space, including the rise of USDT and a slight decline in August, have historical precedents, indicating an increase in demand.

Sarwate noted that several projects experienced "significant fluctuations" this year, such as USDC, which saw a decoupling after the collapse of Silicon Valley Bank in March, where Circle was reported to have $3.3 billion stuck in the financial institution. She said this "likely set the stage for Binance to shift its holdings of stablecoins to BTC and ETH." Sarwate added:

"At the same time, due to the over-collateralization requirement of USDC, it has been ubiquitous in the DeFi space, pushing other stablecoins like Dai to the sidelines for a long time."

She also pointed out that after Paxos was forced to stop issuing new tokens, Binance's flagship stablecoin BUSD continued to decline. Subsequently, Binance adopted TrueUSD (TUSD) and First Digital USD (FDUSD), "both of which saw their market values grow by about 240% and 1950% in 2023," respectively.

Thomas Perfumo, Strategy Director at the cryptocurrency exchange Kraken, told Cointelegraph that the market value of stablecoins "meets market demand" and added:

"Over the past three and a half years, the circulating supply of stablecoins has grown from about $5 billion to about $115 billion, marking the massive growth of stablecoins given the attractiveness of hedging volatility and the globally transferable flexibility."

Peli Wang, Co-founder and COO of the decentralized finance options trading platform Bracket Labs, pointed out that from June 2022 to September 2023, the market value of leading stablecoins USDT and USDC decreased by 23%, while the market value of the cryptocurrency field decreased from $3 trillion in November 2021 to about $1 trillion in September 2023, a decrease of 66%.

In Wang's view, many cryptocurrency investors are "highly opportunistic and follow the trend of yields." When traditional financial rates were low, they took advantage of better yield opportunities in cryptocurrencies, and now with the rise in traditional financial rates, they have turned back to traditional finance.

Yields

Wang is not the only one holding this analysis: Kraken's Perfumo told Cointelegraph that the decrease in the supply of stablecoins may be related to the attractiveness of other cash equivalents that earn higher interest rates (including government bonds).

Perfumo added that the Federal Deposit Insurance Corporation reported that in the case of rising yields, U.S. banks lost more deposits "than at any time in the past forty years," which may be because funds were moved to higher-yielding government bonds or money market funds.

Pegah Soltani, Head of Payments Product at the fintech company Ripple, told Cointelegraph that as early as 2020, when traditional financial rates were low, "holding non-yielding stablecoin assets had almost no opportunity cost, as the yields on Treasury bonds and other fixed-income securities were close to 0%."

Soltani added that with the rise in interest rates, holding stablecoins instead of yielding instruments has become less attractive:

"Now, with Treasury bond yields at +5%, holding stablecoin assets incurs an actual cost compared to holding Treasury bonds. Risk is a more apparent factor, but economic dynamics may play a larger role in market value highs and lows."

In Sarwate's view at CEX.IO, there is "no doubt" that rising rates make traditional finance more attractive to investors seeking fixed income. She added that the adoption of stablecoins was initially "a conduit for participants interested in cryptocurrencies to access more advanced services in the digital economy."

Tokenized Fiat Currency

In 2023, major stablecoins USDC and USDT stopped trading at one point, shaking investor confidence. Coupled with the recent collapse of the cryptocurrency exchange FTX and the Terra ecosystem (which includes an algorithmic stablecoin that almost lost all its value), the stablecoin market is clearly facing serious challenges, and many industry participants still vividly remember this.

Sarwate concluded that these industry participants want to feel secure while seeing investment growth, which means that until stablecoins can "meaningfully address both of these issues, we are likely to continue to see lackluster performance for this specific use case."

Regarding the shift to fixed-income securities being a temporary or long-term trend, Soltani told Cointelegraph that tokenized assets like fiat currency "have greater utility than non-tokenized assets," especially when issued on high-performance blockchains:

"Tokenized fiat is the future trend - whether it's issued by banks, Circle, Tether, or other institutions remains to be seen. The shift to Treasury bonds, whether short-term or long-term, indicates success in the economy and regulation."

She added that if stablecoins can offer the same yield as Treasury bonds while maintaining the same compliance, many cryptocurrency users may prefer to hold assets in stablecoins because they are easier to move and trade.

In simple terms, the enthusiasm for holding stablecoins seems to be declining, while the enthusiasm for holding cash and other traditional fixed-income securities is on the rise.

Can PayPal's Stablecoin Reverse the Trend?

In August of this year, global payment giant PayPal launched a new stablecoin called PayPal USD, or PYUSD. This is an Ethereum-based stablecoin pegged to the U.S. dollar, issued by Paxos, and fully backed by deposits in U.S. dollars, short-term Treasury bonds, and other cash equivalents.

This stablecoin is the first of its kind to be backed by a major U.S. financial institution, which may enhance investor confidence in it. Sarwate of CEX.IO pointed out that others are tired of its centralized nature and have concerns about some of its controversial features, including address freezing and fund erasure.

Sarwate added that "many feel that this overall control goes against the promise of cryptocurrencies," which she believes may explain why PYUSD has struggled to gain traction.

However, PayPal's stablecoin may help revive the industry, even by introducing new users who have never used cryptocurrencies before. Erik Anderson, Senior Research Analyst at ETF firm Global X, told Cointelegraph in an interview that PYUSD could lower the barrier to entry for cryptocurrencies:

"We believe that the launch by PayPal has the potential to make this technology more accessible, less intimidating, and beneficial for adoption to a large user base (about 430 million active users)."

Sarwate seems to agree with this assessment, saying that the name behind PayPal in the stablecoin space could "be a selling point for newcomers and help establish PYUSD as a gateway cryptocurrency."

Pegah Soltani of Ripple also shares this sentiment, saying that if the stablecoin is listed and available in a broader cryptocurrency ecosystem and is accepted by merchants working with Tether, it could "create substantial inflows for stablecoins and significantly change existing market share."

In Soltani's view, the stablecoin market will naturally "consolidate into a few trusted names," otherwise "liquidity will be too fragmented."

Ultimately, the reasons for the exodus of stablecoins seem to be the relative stability of the cryptocurrency market and investors seeking refuge in yielding assets during a period of consolidation in the cryptocurrency market, thus feeling secure in holding these assets.

As for whether stablecoins will begin to offer yields from the fixed-income securities behind them, or whether their on-ramps and off-ramps will become so seamless and efficient that the market begins to experience significant volatility, we will have to wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。