Authors: Sharon, Lucy, Jaleel, Joyce, BlockBeats

Since the deep bear market in the second quarter of this year, the investment strategies and scale of major VCs in the encryption market have been shrinking. According to incomplete statistics from BlockBeats, in the past few months, the weekly financing in the encryption field has remained at around 10 transactions, while last year, this number was around 30 transactions per week, and at its peak, there were even 60 financing transactions in a week.

However, at the end of the third quarter, some first-tier encryption VCs became active again. Taking a16z as an example, in just over a week, it consecutively led investments in 4 encryption projects, with a total financing scale of 76.6 million US dollars. The "a16z group" seems to have started bottom fishing in the encryption industry.

What has the encryption market experienced in the past six months without the "a16z group"?

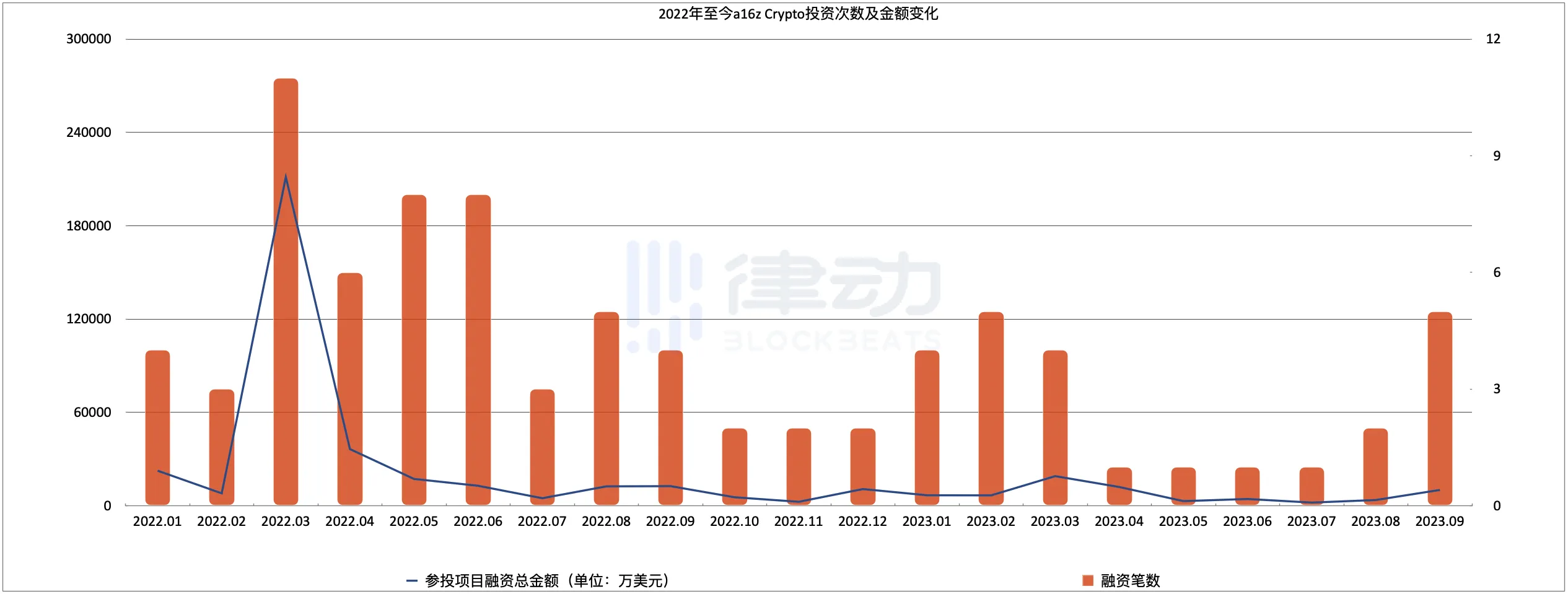

The industry leader a16z has also experienced this. According to incomplete statistics from BlockBeats, in 2022, a16z participated in a total of 58 investments in the encryption field, with the highest total financing amount in March 2022, exceeding 2.1 billion US dollars. At the same time, in 2022, the highest investment led by a16z was given to Yuga Labs, with an amount of 450 million US dollars.

However, after entering 2023, its investment frequency and amount showed a downward trend. In the first quarter of 2023, a16z completed 13 investments, and the total financing amount of the projects it participated in decreased by 86.7% compared to the same period last year. The highest amount led by it was 150 million US dollars, given to the AI startup Character.AI. The highest leading investment amount decreased from 4.5 billion in 2022 to 150 million in 2023. The extent of the shrinkage is evident.

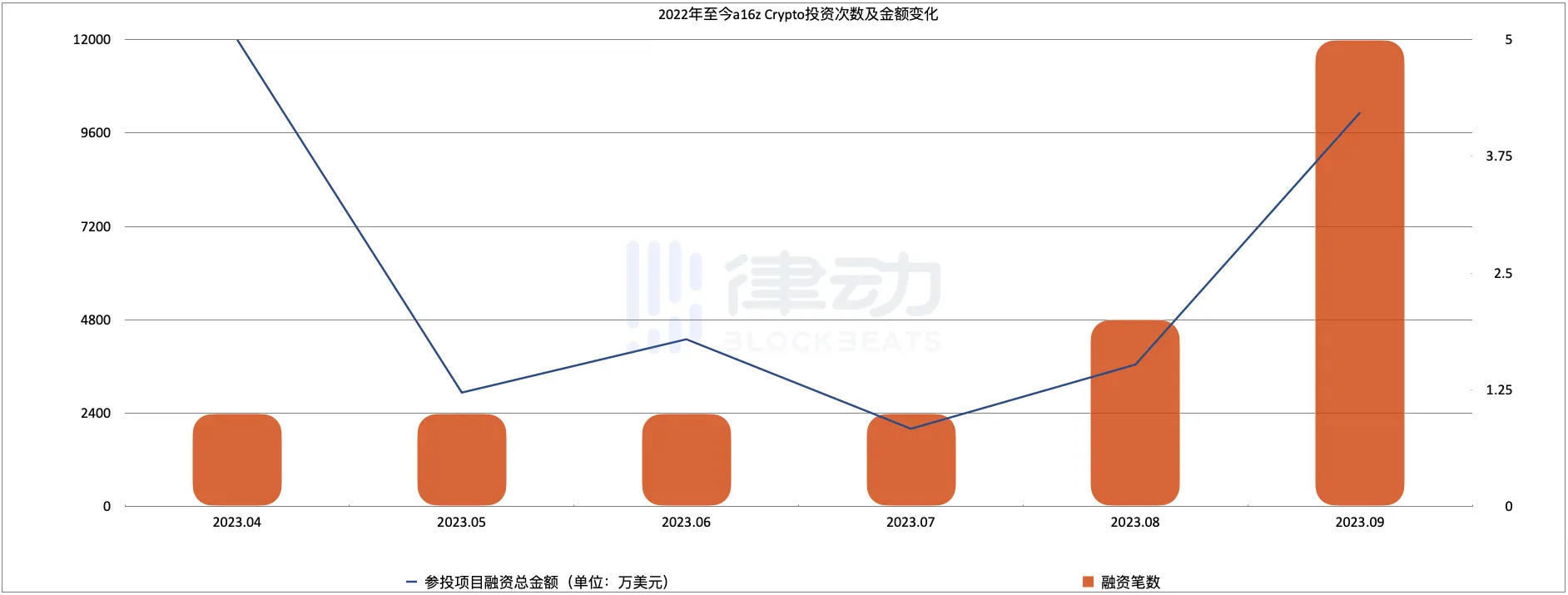

In the second quarter, a16z entered a relatively quiet period. From April to August, a16z only completed 4 leading financings, including 29.3 million US dollars in seed round financing for the on-chain IP infrastructure Story Protocol, 43 million US dollars in Series A financing for the blockchain-based AI computing protocol Gensyn, 20 million US dollars in Series A financing for the open-source software security solution Socket, and 16.5 million US dollars in seed round financing for the generative AI tool Ideogram AI.

In the past second quarter, the encryption VCs can be said to have experienced a "withdrawal tide". In addition to a16z, Paradigm also modified its official website information at the end of May, claiming to be a "research-driven technology investment company" rather than a company specializing in "disruptive encryption/Web3 companies and protocols," seemingly indicating an intention to exit the encryption market.

Institutions with the attribute of "spiritual leader" in the industry successively faded out of the market, and the industry gradually entered a chaotic stage, akin to a headless fly, with memes and dog coins flying around.

In March, Arbitrum's airdrop opened a brief and grand wealth creation movement in the coin circle. Legendary stories of "creating thousands of accounts," "obtaining hundreds of thousands of tokens," and "sudden freedom" spread widely once again. The community suddenly entered a period of mass airdrop participation, and the daily active users of zkSync and StarkNet increased by more than 10 times.

After a brief period of airdrop participation, the BRC20 season took over. In May, the BRC20 token Ordi broke through 10 US dollars in price, with a market value exceeding 200 million US dollars, creating a FOMO atmosphere in various communities. Compared to airdrop participation, the wealth creation effect of BRC20 tokens seemed to be easier. Users did not need to participate in on-chain operations or worry about meeting stringent conditions. They only needed to mint tokens at the time of issuance, and even in the early days of the Bitcoin chain when it was not congested, they only needed to pay a few U in gas fees to obtain a large number of Ordi tokens.

During the BRC20 era, memes also did not show weakness and took turns to enter the stage. A meme token named PEPE quietly went online and rose thousands of times in just four days. The myth of sudden wealth made PEPE famous, and the successive surges of PEPE once again brought meme coins and dog coins to the forefront of the encryption market. In a matter of days, dozens of meme coins were born, with gains of tens of times, causing half of the market to revel in the myth of wealth creation and the other half to continue to be anxious in FOMO.

Returning to the recent hot public chain Base. Without relying on an "odyssey" or airdrop publicity, the Layer2 network Base launched by Coinbase, with a meme myth of a thousandfold increase in the BALD token, attracted countless attention and achieved a roughly 2000-fold increase in about 14 hours.

However, after just over 3 hours, BALD revealed its fangs and destroyed everything. The project party suddenly withdrew a total of 8660 ETH and 179 million BALD tokens in liquidity within 7 minutes, achieving a RUG pull. Interestingly, some on-chain detectives believe that SBF or BALD is behind this.

Are the "leading sheep" coming to bottom fish?

On the other side of chaos, some people are leaving the scene in dismay. Since the beginning of this year, multiple projects have successively announced dissolution, closure, and the rate of projects ceasing operations has been increasing, from an average of 1 project per month to an average of 5 per month. In September alone, 4 projects announced closure, including the NFT platform Voice, DeFi projects Gro Protocol and Fuji Finance, and the DeFi and NFT trading robot None Trading, most of which ended due to "insufficient funds."

The reason for "insufficient funds" may be seen from an article published last week by Jocy, the founder of IOSG, one of China's largest encryption industry venture capital institutions. After the TOKEN 2049 conference, Jocy pointed out in the article that the cold air brought by the bear market may cause many project parties to not survive until this winter, and also pointed out that the current investment institutions in the encryption industry are more inclined to tighten their belts.

In stark contrast to the Asian market, the hot scene of the return of the "leading sheep" from Western encryption investment institutions is evident.

Following Paradigm's change of its homepage description to "research-driven technology investment company" in May, removing any mention of cryptocurrencies, just over a month later, Paradigm revoked this change and announced its return to the cryptocurrency field. Paradigm co-founder Matt Huang stated that the previous removal of all mentions of cryptocurrencies from its website login page was "a bit absurd and a mistake." He emphasized that Paradigm will not give up its investment in cryptocurrencies.

After returning to the encryption industry, Paradigm immediately entered the "most competitive" MEV market and participated in the 60 million US dollars Series B financing completed by Flashbots in July, increasing its valuation by over 1 billion US dollars. In the past few months, what is even more impressive about Paradigm is its selection and investment in friend.tech, a Web3 social newcomer with a market value of over 100 million US dollars in just two months.

In addition to investments, Paradigm's official website blog has also become unusually active. In July, Paradigm released a "Collaborate with Paradigm" announcement, stating that they hope to collaborate with more outstanding talents in the encryption field and calling on entrepreneurs or projects in the seed stage or Series A financing stage to fill out a form to introduce their projects to Paradigm.

Yesterday, Matt Huang published another lengthy article, not only refuting the pessimistic view of the current excessive speculation and slow development in Crypto from another perspective, but also expressing confidence in the future of Crypto.

With the high-profile return of Paradigm, a16z has also regained its vitality.

As can be seen from the chart below, from April to July this year, a16z seemed to have fallen silent in the entire second quarter, with an average of 1 investment per month. However, starting from August, a16z seemed to have become active again, increasing from 2 investments in August to 5 investments in September, equivalent to the total of the past few months. And in the latter half of September alone, a16z made 4 consecutive investments within 10 days.

On September 12, a16z led a $15 million Series A financing for Pahdo Labs, a metaverse platform development studio. On the 18th, a16z led a $25 million seed round financing for Bastion, a startup providing cryptocurrency custody and other services. On the 20th, a16z led a $3.6 million seed round financing for Freatic, a decentralized information market protocol, and then the next day, it led a $33 million seed round financing for Proof of Play, a blockchain gaming startup.

In a market situation where multiple projects are ceasing operations and Eastern capital is struggling, the high-profile appearance and frequent actions of the "a16z group" seem to indicate bottom fishing in the encryption industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。