Author: James Trautman, Bankless Analyst

Translation: Luffy, Peng SUN, Foresight News

Over the past 21 months, the cryptocurrency industry has been in turmoil. The bear market that arrived at the beginning of 2022 has almost caused damage to all cryptocurrency projects, especially Solana.

Throughout 2022, Solana has been facing challenges such as network interruptions and the collapse of FTX. During this year, the market value of SOL plummeted by about 93%, and the network TVL dropped by 96%. By the end of 2022, people seemed to have no hope for the future prospects of Solana, and it was widely speculated that Solana was about to spiral into a death spiral.

Despite facing many challenges in the past, the future of Solana seems to be bright.

The narrative surrounding network performance and downtime has undergone a transformation. Solutions such as the local fee market have helped improve the stability of network operations and have also increased the value of Solana's native token SOL. Technologies such as state compression and compressed NFT are bringing new use cases, and new catalysts such as grant programs, Solang, Neon EVM, and AI are also about to emerge.

It seems that Solana has ushered in a moment of hope amidst the adversity. Next, we will delve into the health and development prospects of Solana.

Current Situation

Network Status

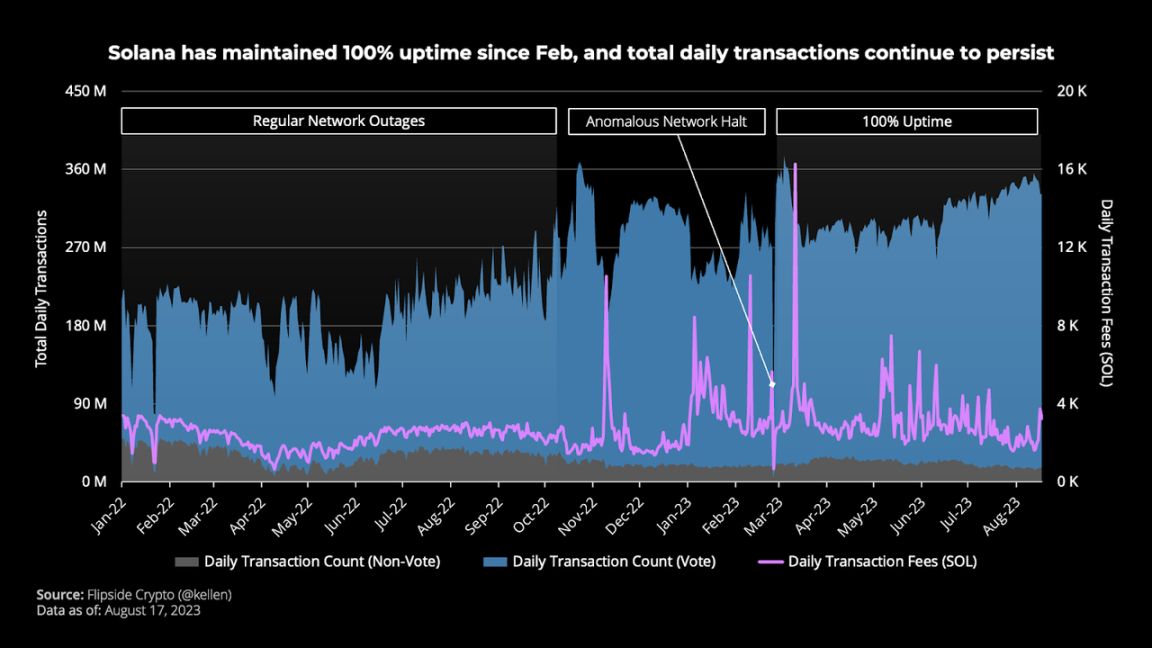

In 2023, discussions about downtime have rarely occurred. Apart from a brief network interruption in February due to an abnormal consensus error, Solana has maintained 100% normal operation time since the beginning of the year, and the daily trading volume has been on the rise.

The improvement in network performance is attributed to remedial measures taken to address the network spam issue originating from Gulfstream, which is an alternative solution to Solana's Mempool for managing pending transactions. Network upgrades include QUIC, Quality of Service (QOS) weighted by stake, and the local fee market (priority fee).

The priority fee mechanism has raised the barrier for entry of network spam. It has proven crucial in eliminating Solana's historical downtime issues, which were primarily caused by suboptimal transaction processing.

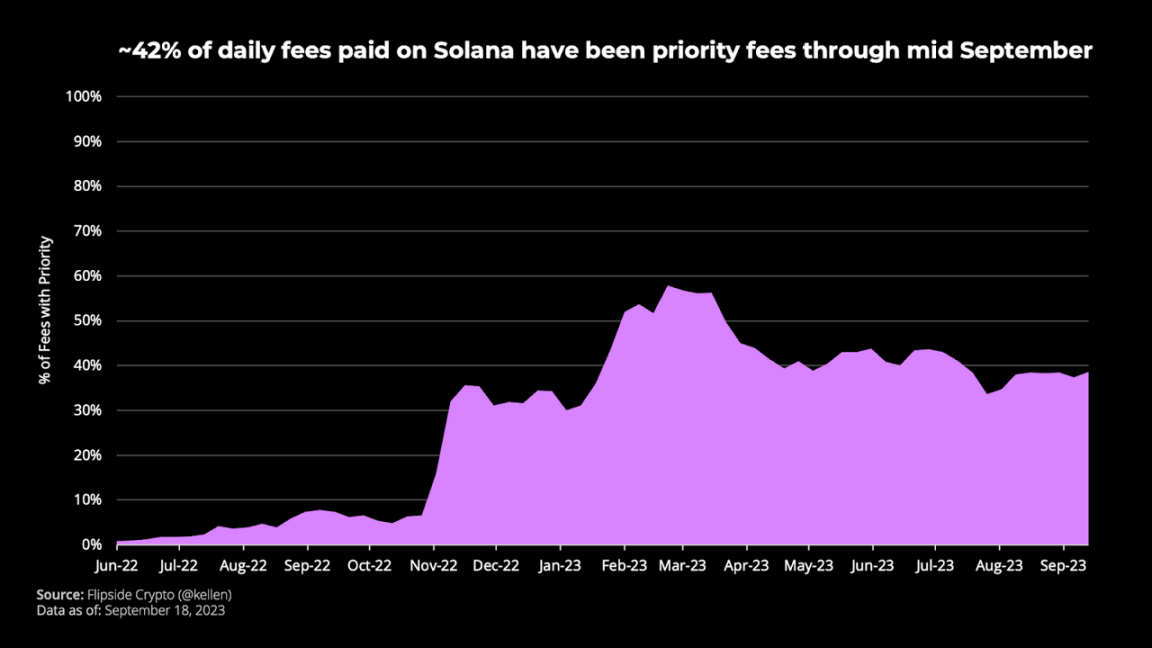

In 2023, approximately 42% of daily transaction fees are paid by users who choose to prioritize their transactions. With an increasing number of wallets and applications (such as Jupiter, Solflare Wallet, and Phantom) adopting the priority fee, this figure is expected to rise.

Furthermore, the elimination of downtime is only part of the role of the priority fee mechanism; it is also one of the sources of protocol revenue. Compared to the previous year, Solana's revenue (in terms of SOL) has increased by about 42%.

Given that Solana burns 50% of all transaction fees, the priority fee has become an additional force for value accumulation. Despite the recent SEC's accusation of classifying SOL as a security causing downward pressure on the token, after a significant 92% decline in market value in 2022, it has risen by about 111% so far this year.

Ecosystem Highlights

After suffering a severe setback during the collapse of FTX at the end of 2022, how is the status of the Solana DeFi ecosystem?

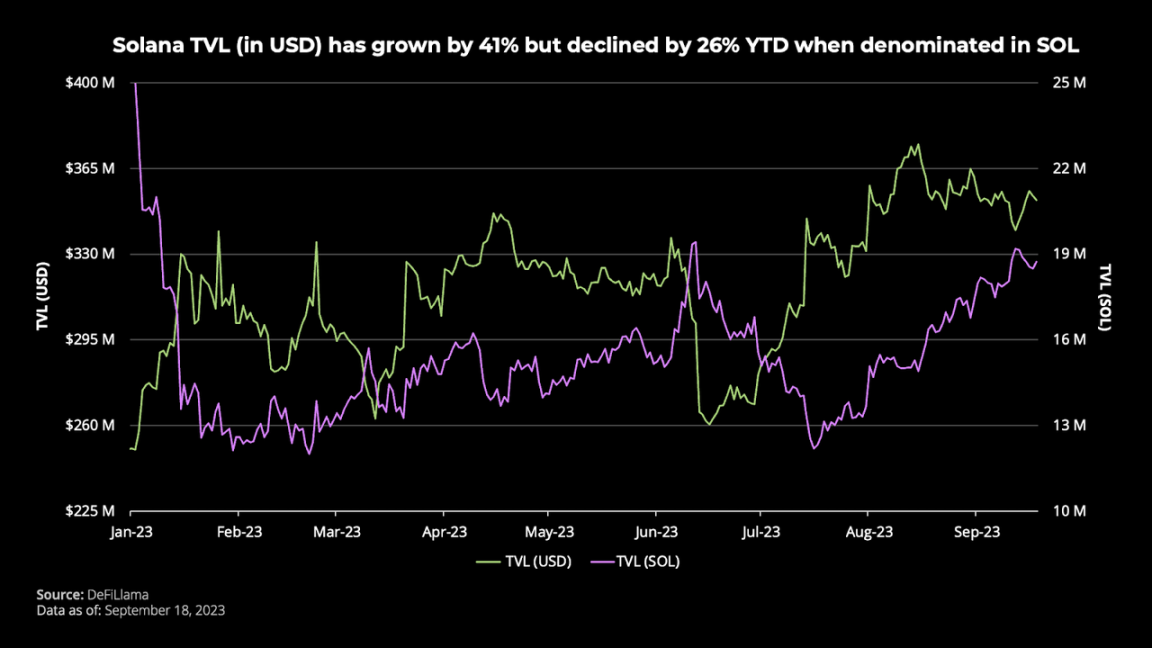

Since the beginning of the year, the TVL priced in USD has seen a recovery, growing by 41%. However, when priced in SOL, the TVL has decreased by about 26%, indicating that the growth in TVL is mainly due to the appreciation of SOL against the US dollar.

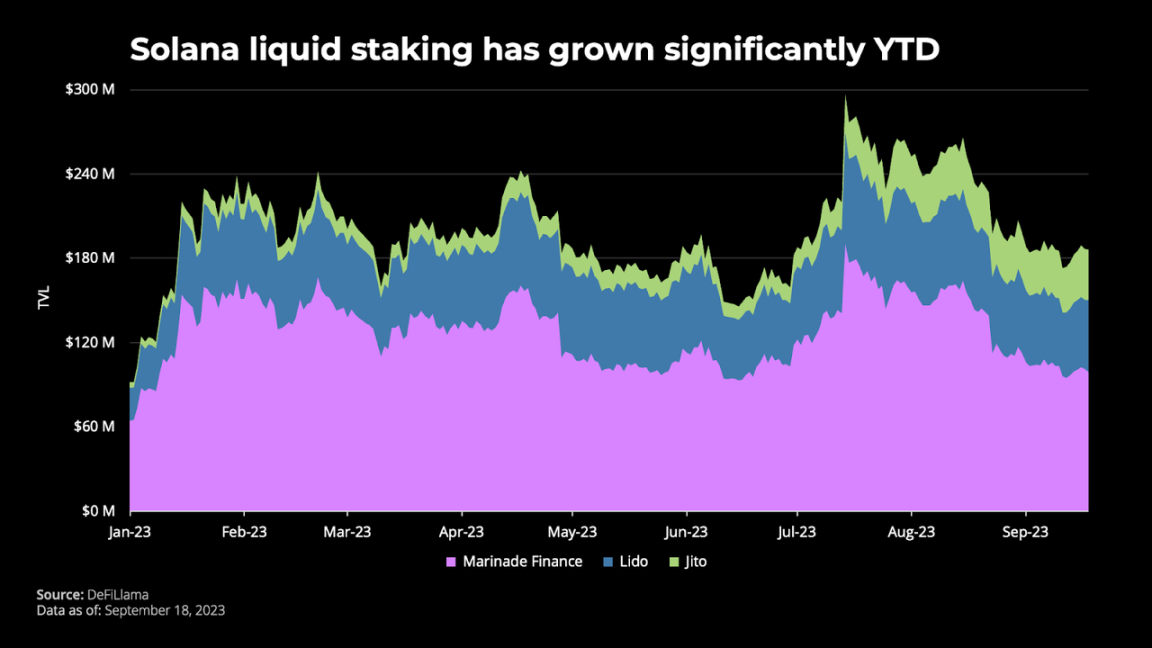

It is worth noting that during 2023, liquidity staking derivatives (LSD) have played an important role in consolidating Solana and its DeFi landscape. Although they are not included in the above TVL statistics to prevent double counting, platforms such as Marinade Finance, Lido, and Jito have achieved triple-digit growth rates in TVL and now rank stably in the top ten.

While the expansion of DeFi remains a core goal of the Solana ecosystem, there has been a noticeable shift in user participation from DeFi to a broader range of DApps, covering NFTs, games, and various consumer-oriented areas.

What has caused this situation?

In April of this year, the Solana Foundation released state compression technology, a method that significantly reduces the cost of on-chain data storage. Under the collaboration of Metaplex, Solana Labs, and other ecosystem contributors, state compression technology was first applied in the NFT field. Compressed NFTs have lower costs compared to non-compressed NFTs.

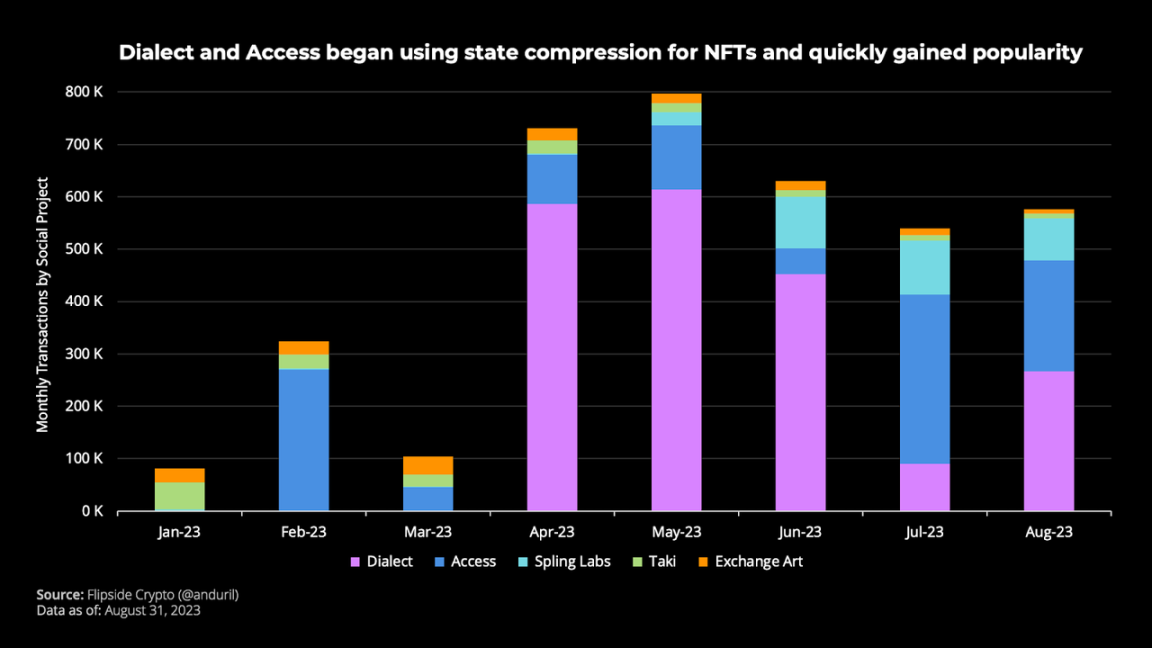

Subsequently, the information platform Dialect and the content creator application Access also adopted state compression technology to compress NFTs. These applications quickly caught the interest of users, with an average monthly transaction volume reaching hundreds of thousands.

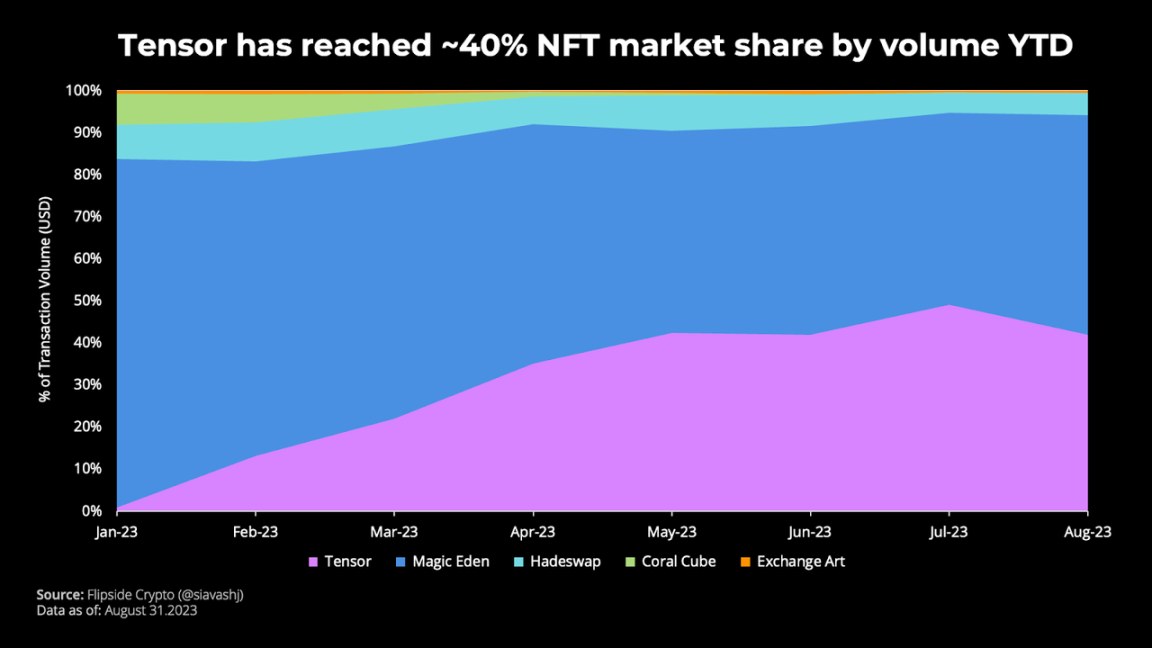

In addition, Tensor has launched a compressed NFT trading market, providing users with the ability to trade, place orders, and bid on compressed NFTs. Tensor holds a 40% market share of the compressed NFT trading market.

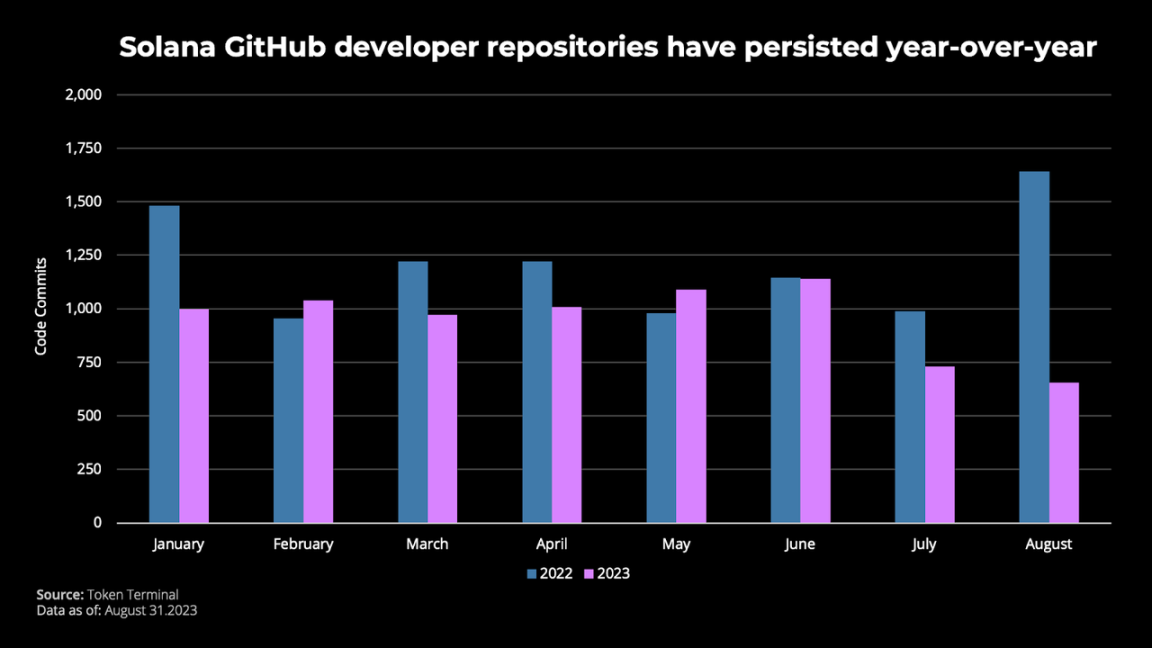

After the turmoil at FTX, Twitter became a hotbed for various speculations, with many believing that the development momentum of Solana had extinguished, and the departure of core Solana developers was imminent.

Although there was a noticeable decrease in the number of Solana ecosystem developers in August, the annual data shows that the number of GitHub developer repositories has remained relatively stable, indicating that rumors of a mass exodus of developers in 2023 have been exaggerated.

Future

So, what has kept the Solana network and its ecosystem on a positive development trajectory? There are several factors worth noting, including:

Neon EVM: Solana's Neon EVM was launched in July, allowing Ethereum-based applications to run on Solana without code changes.

Solang: In July, Solana Labs released Solang. This new compiler allows developers to build projects on the Solana network using Solidity, bridging the gap between EVM developers and the Solana ecosystem.

Eclipse: Eclipse aims to combine the Ethereum ecosystem with the execution environment of Solana.

With the above potential gateways, Solana's development and user activity may further grow with network effects.

Move: Although the Move language is in its early stages, introducing Move as a smart contract language on Solana could stimulate more developers to participate in the Solana ecosystem.

The Solana ecosystem will also benefit from the recently launched growth initiatives, including:

Convertible Grants: The Solana Foundation recently introduced Convertible Grants to support projects within the Solana ecosystem. If a project achieves specific milestones and growth targets, it will receive investment.

AI: The Solana Foundation recently launched a $10 million artificial intelligence funding fund, signaling a potential expansion into the field of artificial intelligence.

Finally, detailed information on SOL held on the FTX balance sheet:

FTX: A recent court ruling on the sale of FTX tokens will prevent the market flooding of SOL, as liquidation will be limited in quantity.

Conclusion

The Solana network has maintained 100% normal operation time and has achieved value accumulation through the priority fee mechanism. Coupled with the continuously developing ecosystem marked by breakthrough technologies such as state compression, past performance issues, and the FTX crisis are no longer significant. The upcoming catalysts, including grant programs, Solang, Neon EVM, and the AI fund, all bring new hope for the future of Solana.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。