Authors: Jay Jo & Yoon Lee

Translation: Felix, PANews

TL;DR

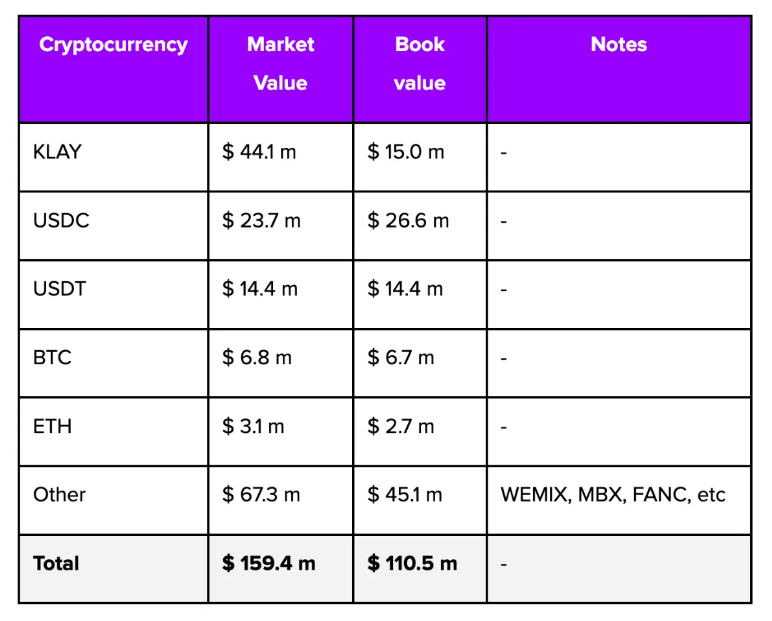

Despite the continuous decline of the cryptocurrency market in South Korea, the amount of cryptocurrency held by companies has increased. In fact, 37 listed companies hold cryptocurrency assets worth 201 billion Korean won (approximately $160 million).

The companies with the largest share directly issue cryptocurrencies for operating cryptocurrency-related businesses. They also hold stablecoins and other assets as investment reserves, or have purchased BTC and ETH for investment purposes.

In the future, disclosure of cryptocurrency holdings by companies will become mandatory, leading to a more transparent and secure investment environment.

Introduction

While the cryptocurrency market in South Korea continues to decline, the amount of cryptocurrency held by companies is on the rise. In fact, according to a survey by the Financial Services Commission, as of June 2022, a total of 37 domestic listed companies have acquired and hold cryptocurrency assets. Furthermore, the estimated market value of the cryptocurrency assets held by these companies issued by third parties is approximately 201 billion Korean won (approximately $160 million). These survey results indicate that South Korean companies are expanding their cryptocurrency-related businesses and actively investing in this market.

South Korean listed companies' virtual asset holdings (tokens issued by third parties), data source: Financial Services Commission

Current Status of Cryptocurrency Holdings by South Korean Listed Companies

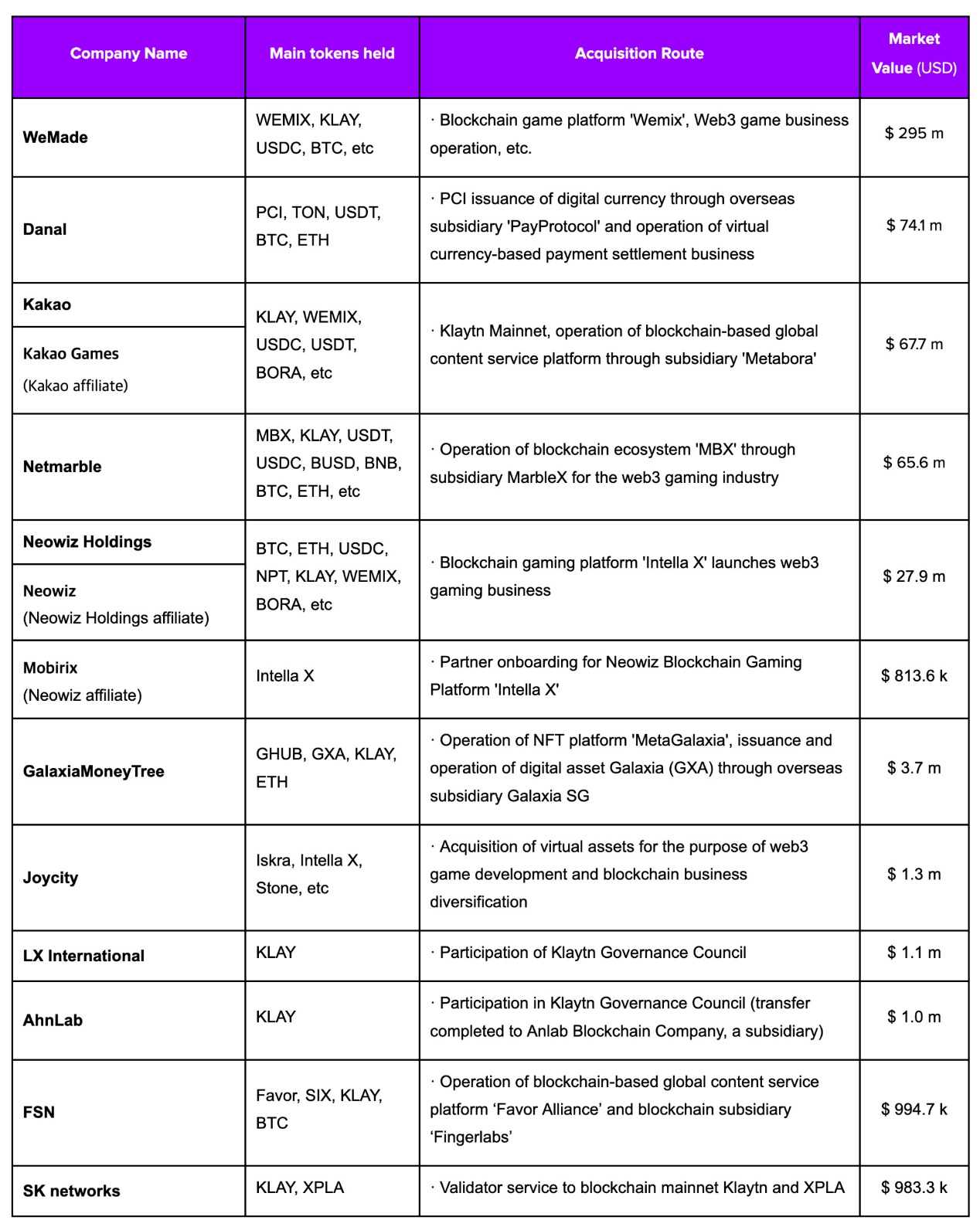

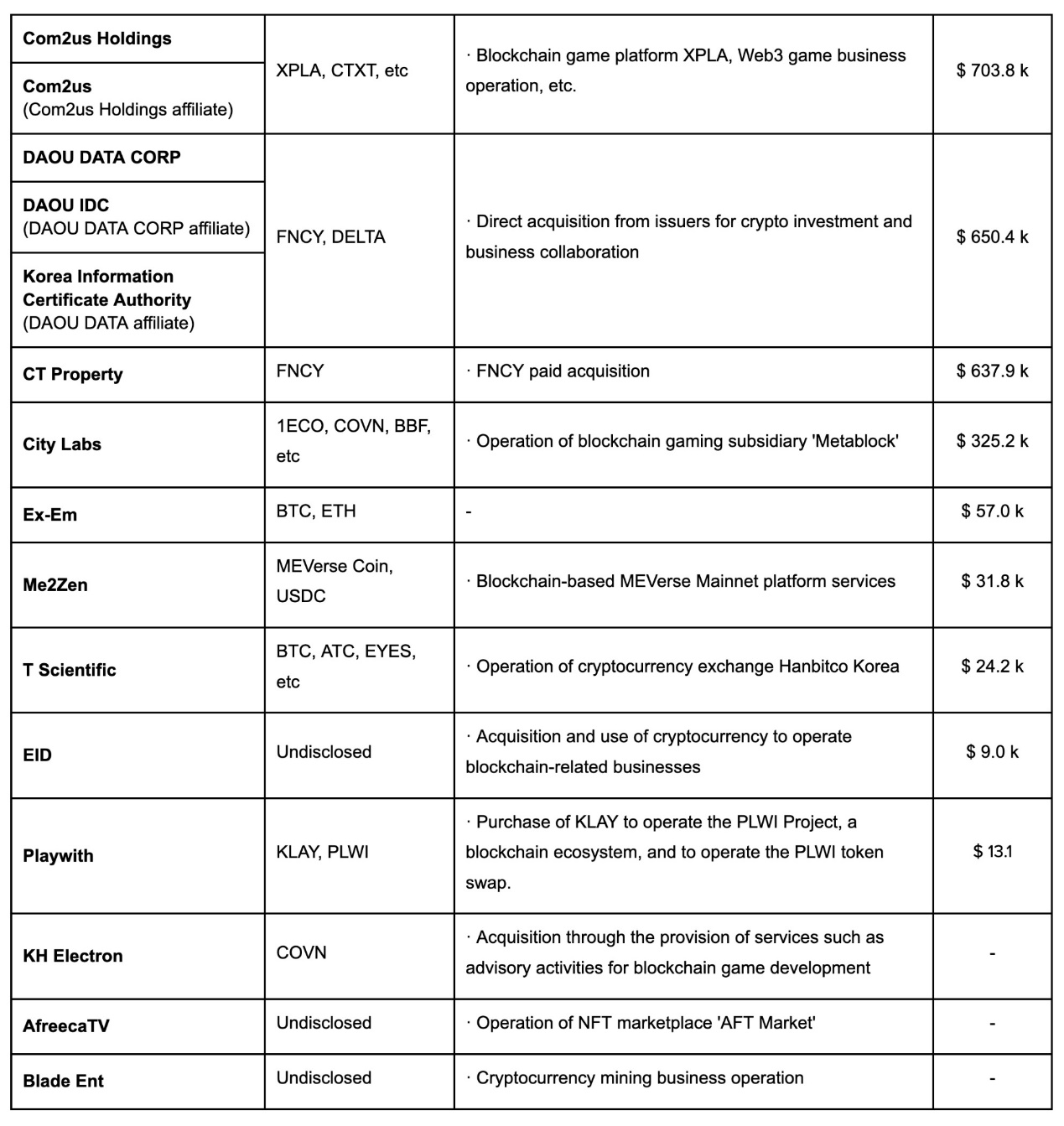

The "2022 Survey on Cryptocurrency Holdings by Domestic Listed Companies" by the Financial Services Commission did not disclose detailed company names, making it difficult to determine which companies hold cryptocurrency. Through independent research, it was found that as of December 2022, several listed companies hold cryptocurrency assets. Most of these are gaming companies such as Neowiz, WeMade, Netmarble, or companies operating payment settlement businesses such as Danal, GalaxiaMoneyTree, among others. The amount of virtual assets held by them is also quite substantial. Their methods of acquiring cryptocurrency are as follows (Note: The "2022 Survey on Cryptocurrency Holdings by Domestic Listed Companies" by the Financial Services Commission reflects the survey results as of June 2022, while the author's research is based on the financial statements of confirmed listed companies as of December 2022, so there may be differences in the overall cryptocurrency holdings):

- Paid acquisition: Acquiring cryptocurrency through cryptocurrency exchanges, ICOs, private placements, etc.

- Free acquisition: Acquiring cryptocurrency through self-developed cryptocurrencies, airdrops, etc.

- Exchange acquisition: Acquiring virtual assets by exchanging tokens issued by third parties with tokens issued and held by the company.

- Service provision: Acquiring virtual assets through providing consulting and development services (participating as members of various foundation governance committees and node validators)

- Blockchain mining rewards: Directly acquiring virtual assets through operating virtual asset mining businesses, staking services, etc.

Therefore, listed companies acquire and hold cryptocurrency through various means, mainly by operating cryptocurrency-related businesses through direct issuance of cryptocurrency by overseas subsidiaries.

Cryptocurrency holdings by 29 domestic listed companies in South Korea (excluding self-issued), data source: respective companies

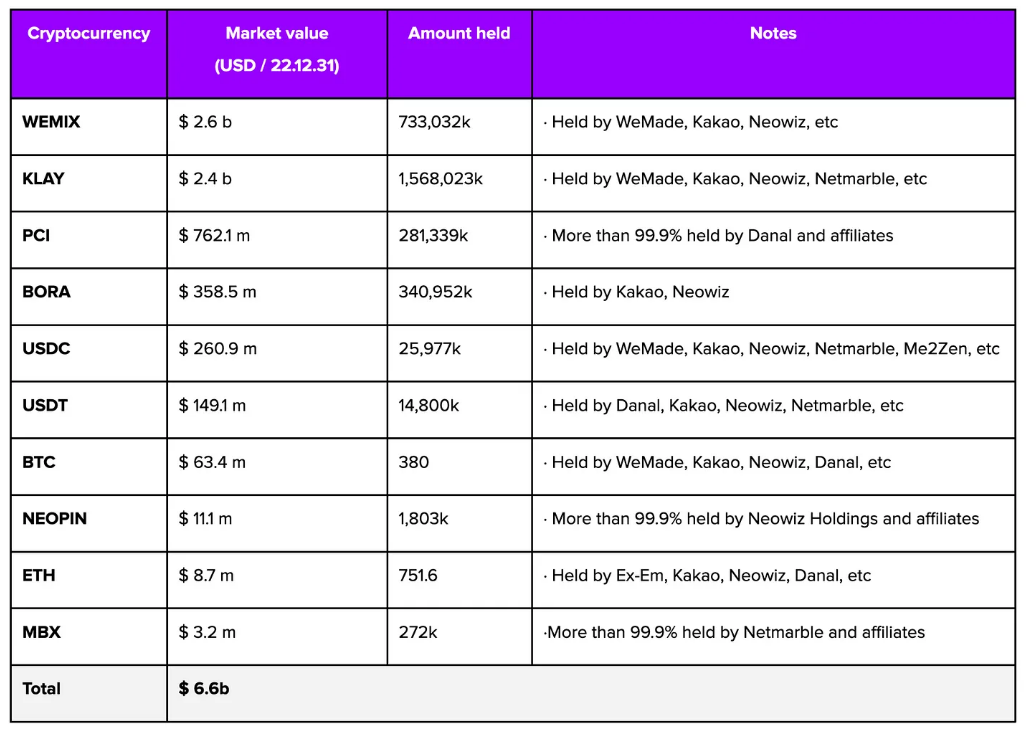

Types of Cryptocurrencies Held by South Korean Listed Companies

The top 10 cryptocurrencies held by South Korean listed companies are as follows. These companies mainly have the following three characteristics:

They directly issue or purchase cryptocurrencies to conduct their own blockchain businesses, with the largest share of cryptocurrency holdings being in blockchain game-related cryptocurrencies issued mainly in South Korea, such as WEMIX, BORA, NEOPIN.

Approximately 51.7 billion Korean won (approximately $39.8 million) is invested in stablecoins such as USDC and USDT. These funds are either used as reserve funds for providing funds for blockchain projects through ICOs, or for marketing and commission purposes.

Cases were also found where major cryptocurrencies such as Bitcoin and Ethereum were purchased for investment purposes.

Types of Cryptocurrencies Held by Private Companies

It has been confirmed that private companies also acquire and hold virtual assets, and transparently disclose them through annual audit reports. This mainly includes companies operating virtual asset trading businesses such as Dunamu, Bithumb, Coinone, Cobit, Gopax (Streamy). In addition, there are companies that acquire a certain amount of cryptocurrency by logging into Web3 games on gaming platforms such as Gurobal Games, XL Games. Cryptocurrency investment companies such as Uprise hold cryptocurrency as investment assets, such as Bitcoin or Ethereum. Even in private companies, cryptocurrency assets are mainly held by companies operating or planning to operate cryptocurrency-related businesses, such as gaming companies, investment companies, and IT-related companies. Furthermore, even if they do not directly operate cryptocurrency-related businesses, there are cases where they acquire cryptocurrency by participating as validators on the Klaytn and XPLA mainnets.

Conclusion

Many South Korean companies are acquiring and holding virtual assets, and are attempting to disclose these assets through public information. Despite these efforts, many companies still face difficulties due to the current ambiguity of virtual asset accounting standards.

Furthermore, the disclosure of virtual asset holdings is not yet mandatory. Many companies have not yet disclosed their virtual asset holdings, or have not explained the methods of acquiring virtual assets, which further confuses investors. However, starting next year, a new regulation will be established requiring holders of cryptocurrency assets to disclose the following information. From that time on, listed companies will be able to disclose their cryptocurrency holdings more transparently, creating a safer investment environment. The expected disclosed information includes:

- General information of virtual assets (name, characteristics, quantity, etc.)

- Accounting policies applicable to virtual assets (account classification, cost and revaluation models, etc.)

- Information on the acquisition methods, acquisition costs, book value, market value, etc. of virtual assets

- Virtual asset market value calculation information (exchange names, calculation time, etc.) and price fluctuation risks

- Information on the nature of risks related to holding virtual assets

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。