Following on from the previous article, after understanding what a "Machiavellian DAO" is, the next step is to design a specific governance framework.

Author: Miles Jennings, General Counsel at a16z crypto

Translation: Babywhale, Foresight News

Web3 should triumph over Web2 because Web3 can achieve decentralization, which will reduce censorship and promote freedom. Freedom makes it possible to oppose authority, and opposition to authority drives greater progress. But first, we need to address the issue of decentralized governance.

As decentralized governance is still in its early stages, many Web3 protocols and DAOs are still researching solutions to the issues that arise in decentralized governance. As someone closely following the decentralized governance practices of the entire Web3 (including how it impacts decentralization and how to incorporate it into various decentralized models), I believe that applying Machiavellian principles to the decentralized governance of Web3 can address current shortcomings. This is because Machiavellian philosophy developed on a pragmatic understanding of power struggles in society at the time. These social power struggles are similar to the ones experienced by protocols and their DAOs, which often have unclear, mutable, or inefficient social hierarchies.

In another article, I outlined four Machiavellian principles as guidelines for designing a more powerful and effective decentralized governance, namely the "Machiavellian" DAO: embracing minimal governance; establishing a balanced leadership that is constantly challenged by opposition; providing avenues for continuous changes in leadership; and strengthening the sense of responsibility of the leadership team. In this article, I will share the factors, strategies, and tactics to consider when creating a "Machiavellian" DAO.

The strategies and tactics I propose are not suitable for all DAOs, as these solutions bring inefficiency and friction to decentralized governance, making them potentially unsuitable for highly dynamic and evolving systems or those with citizen-like characteristics. However, for protocols in development that focus on maintaining credible neutrality while prioritizing economic growth, such as the hypothetical Web3 market protocol "Blockzaar" used as an example in this article, the benefits of introducing friction may outweigh the costs.

Two steps to implement before designing a DAO

Before sharing the design principles, it is crucial to determine who the stakeholders are in the ecosystem. Once these different stakeholders are identified, the DAO can determine their intrinsic motivations, which is a prerequisite for balancing the power of these stakeholders.

After these two preliminary steps, the builders can implement the four Machiavellian design principles.

Step One: Identify Protocol Stakeholders

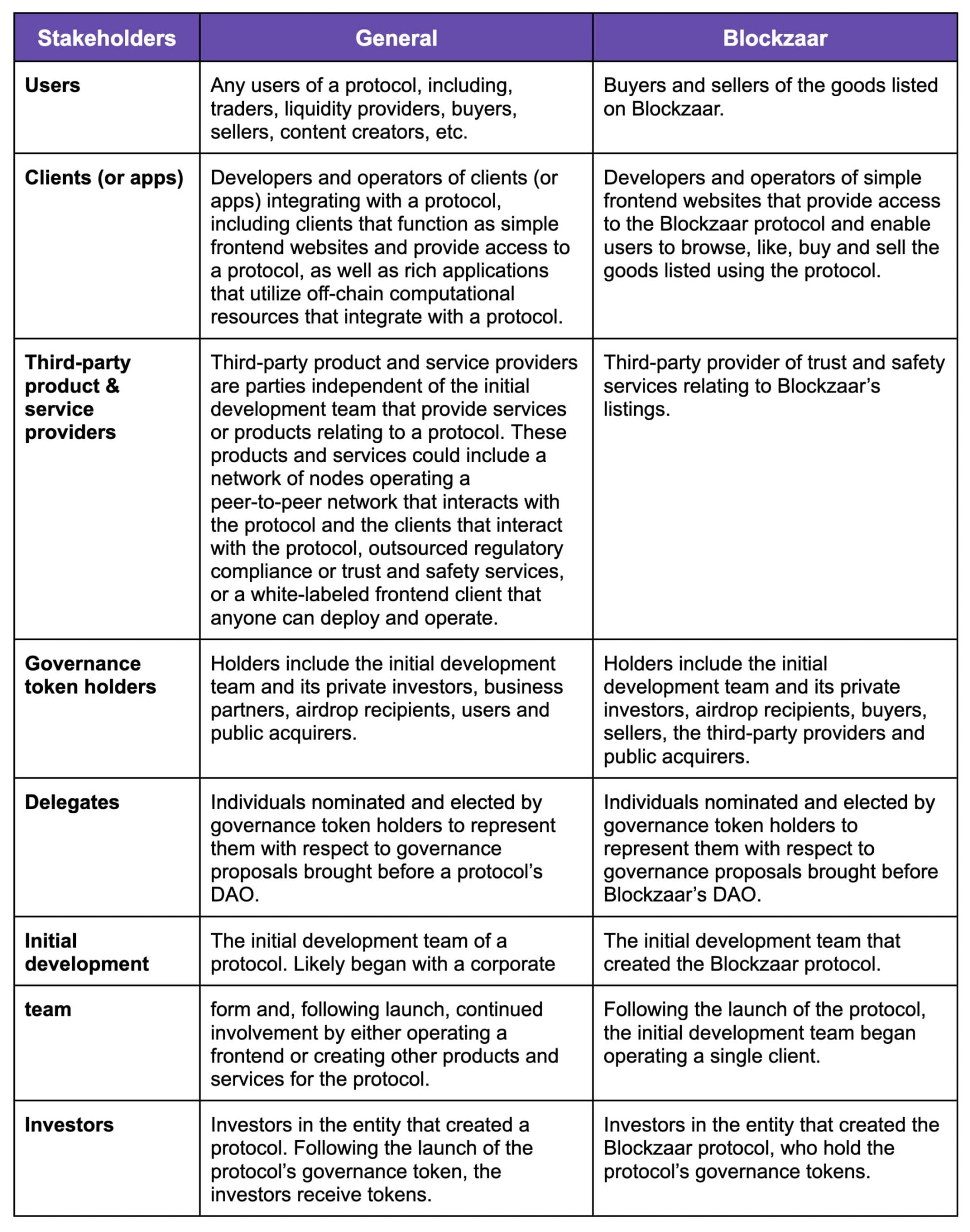

The stakeholders of Web3 protocols include various participants such as users, applications (or clients), third-party product or service providers, governance token holders, representatives, initial development teams, and investors:

Step Two: Understand the Incentive Structure

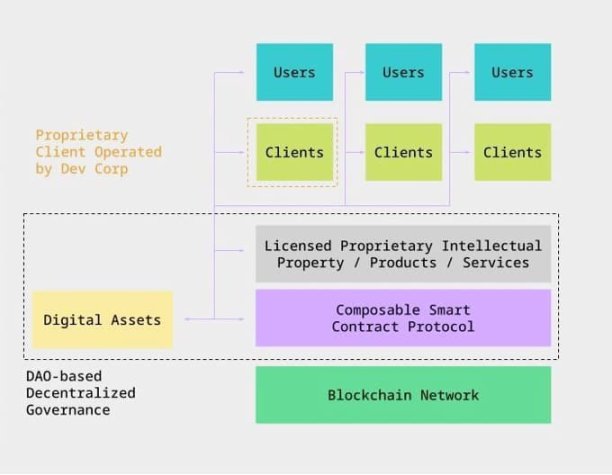

The more active stakeholders (as opposed to passive investors) there are—and the more economically motivated they are to see the protocol grow and develop—the more parties there are available to effectively manage the protocol. This is why encouraging the creation and operation of independent clients/applications (client layer) on top of shared smart contracts/blockchain infrastructure (protocol layer) and encouraging independent third parties to create off-chain products and services for the ecosystem's stakeholders (third-party layer) is best suited for leveraging the Machiavellian structure in Web3 systems (refer to the discussion of open decentralized models here).

Here is an ecosystem model using these two incentive structures:

The goal of these incentive schemes is to make independent third parties profitable, allowing them to operate as independent businesses on top of the protocol and create tools and other shared intellectual property and services for use by protocol clients and users. These elements help promote the decentralized economic prosperity of the protocol and provide fertile ground for designing more effective decentralized governance by giving independent participants a vested interest in the success of the decentralized economy.

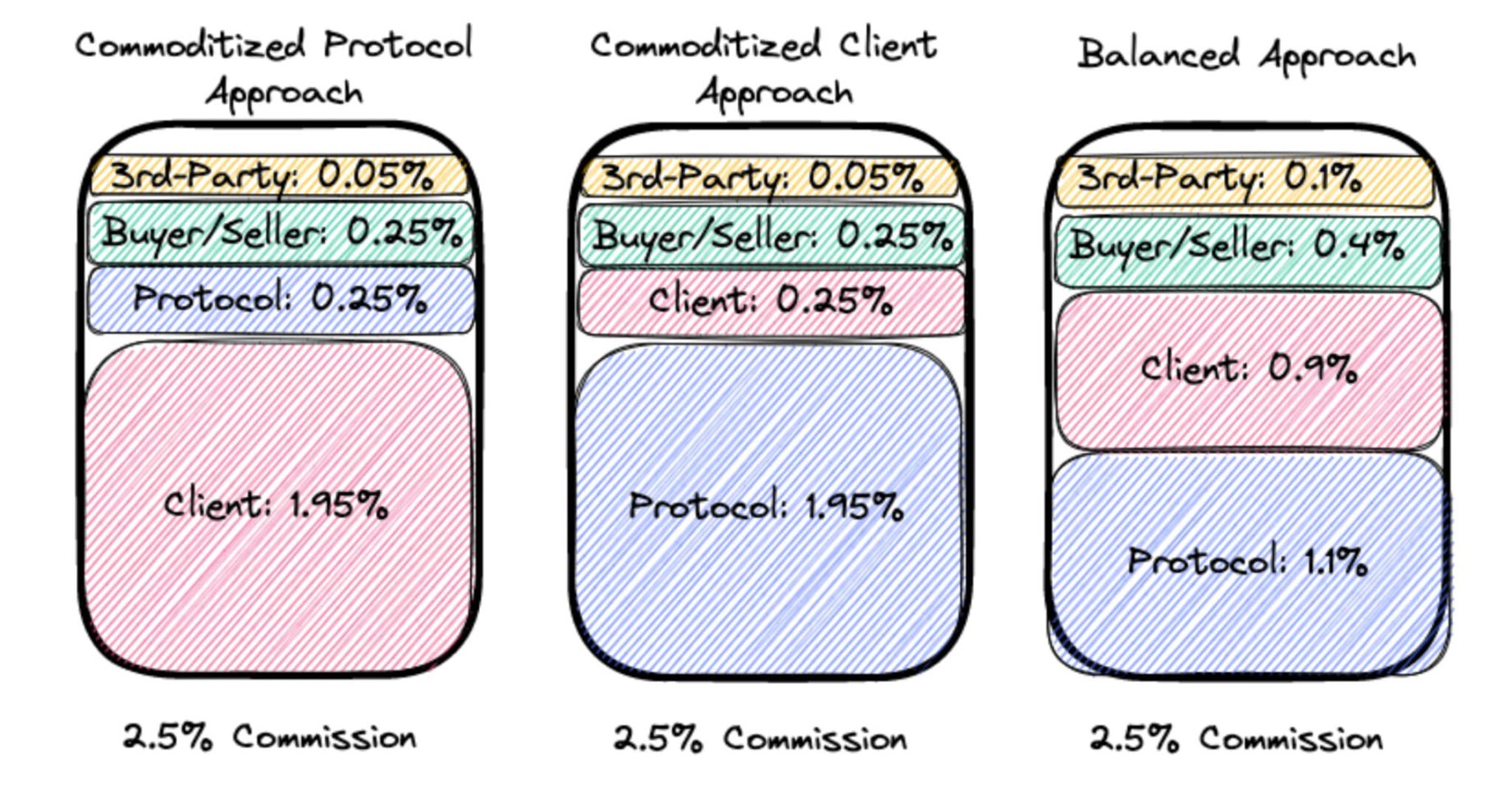

When designing incentive mechanisms, DAOs must balance the interests of the protocol/DAO (including token holders) with the interests of other ecosystem stakeholders (users, client operators, and third-party product and service providers). Token holders of the protocol may not support the commodification of the protocol layer (where all value accrues to users, clients, and third-party product and service providers) as it would deprive them of economic benefits. This commodification also runs counter to the goal of accumulating network effects.

At the same time, the commodification of the client layer—where all value accrues to the protocol (also known as "fat protocols")—is unlikely to produce a rich client ecosystem, as builders cannot profit from developing clients. Both extremes would jeopardize the decentralized economy of the entire system. Therefore, many ecosystems should adopt a more balanced approach; to illustrate this point, here is a very simple incentive scheme, using "Blockzaar" as an example, a hypothetical Web3 market business:

- The purpose of the protocol is to incentivize buyers to purchase products, sellers to sell products, client operators to maintain such clients, and third-party service providers to develop and provide products and services to the ecosystem.

- The benefits generated by the protocol are a 2.5% commission on all buying and selling transactions, which can be distributed to stakeholders through the allocation of profits from such transactions or the distribution of governance tokens.

- Buyers and sellers only benefit when participating in buying and selling transactions. Client operators only benefit when transactions are completed through their clients. Third-party product and service providers only benefit when transactions are completed by customers using their products or services (in this case, when customers use the third-party provider's trusted and secure services).

The benefits represented by the commissions earned by Blockzaar can be distributed among stakeholders as follows:

As shown in the above figure, out of the 2.5% commission, 1.1% belongs to the protocol, 0.9% belongs to the initiating customer, 0.4% belongs to the buyer or seller, and 0.1% belongs to the third-party service provider. Therefore, token holders (through the benefits generated by the protocol) and other stakeholders will be rewarded for the execution of transactions.

Why incentivize stakeholders? There are two additional considerations:

First, a balanced incentive structure may not only be feasible but may be necessary for certain systems. Regulatory actions in the United States have made it clear that systems that facilitate regulated activities need to find ways to comply with regulations. In most cases, compliance cannot be built into the protocol itself, so it needs to be implemented at the interaction points between users and the protocol, i.e., the client layer of the protocol. Therefore, operators facilitating regulated activities need to generate revenue from operating the client layer to cover compliance costs. Abandoning compliance is not an option: it not only exposes client operators to risks, but also exposes the protocol's DAO to legal risks from funds collected from illegal activities.

Therefore, the "fat protocol theory" is not viable in cases where the protocol facilitates regulated activities, and a balanced approach must be taken.

Second, in any decentralized model that empowers a strong client layer, a balance of power between clients must be achieved. If a single client can capture too many users, its position in the client layer will jeopardize the decentralization of the system. Therefore, the protocol's design must be able to resist the risk of client dominance. To achieve this, the DAO can implement controls on clients that exceed a predetermined client dominance threshold (e.g., 50% of user transaction volume). To avoid manipulating such a mechanism to censor certain clients, it should be as autonomous as possible and have upper and lower limits set for the client dominance threshold. For example, for Blockzaar, only when a client's transaction volume exceeds 50%, will this mechanism be triggered, resulting in a reduction of its commission distribution from 1.4% to 1.0%, with the remaining 0.4% going to the protocol.

Four principles for designing a Machiavellian DAO

Now that we understand the interaction between protocol stakeholders and the incentive structure of the protocol, the protocol's DAO can be designed based on the four principles formulated by Machiavelli.

Principle One: Minimal Governance

Machiavellians believe that organizations tend towards autocratic leadership, which ultimately discriminates to perpetuate its own privileges and power. This suggests that the DAO should prioritize minimal governance to protect its credible neutrality as much as possible. In other words, since every decision that affects the protocol could discriminate against stakeholders and harm the ecosystem's credible neutrality, such subjective decisions should be minimized.

The general consensus on minimal governance is that protocol governance should be reduced to three categories of decisions that must be made:

- Complex parameter settings, such as collateral ratios in DeFi lending protocols;

- Fund management, such as diversification of funds, grant programs, including funding for public goods, etc.;

- Protocol maintenance and upgrades, including changing oracles, deploying upgraded smart contracts, etc.

The number and scope of decisions in any of the above categories for a specific DAO will largely depend on the type of protocol it manages.

It is certain that as Web3 protocols become more complex, the number and scope of decisions will also increase. However, this does not necessarily mean that decentralized governance at the protocol layer needs to become equally complex. On the contrary, the DAO can use an incentive-based decentralized model to address this trend and further promote minimal governance.

In particular, the DAO can safeguard its credible neutrality by "pushing" many governance decisions to the client layer and/or third-party layer. For example, decisions that only affect the client-user relationship can be made by individual operators of the client. While these operators can use decentralized governance to manage their clients, the inefficiency of decentralized governance may make it impractical.

Fortunately, decentralized governance at the client layer is likely not necessary, as users do not directly participate in the governance of the client layer and can either accept the decisions of individual client operators and continue using those clients, or circumvent those decisions by switching to different clients, thereby influencing the client layer. Similarly, third-party product and service providers can offer products and services with different features and prices, allowing customers and users to choose according to their preferences.

Therefore, a strong client layer and third-party layer can reduce the need for decentralized management while increasing user choice.

This is similar to the "fork-friendly" environment advocated by Ethereum founder Vitalik Buterin and others, which is a remedy for addressing decentralized governance issues, but it goes beyond the protocol layer. Essentially, each client is a fork of other available clients; each third-party product and service is a fork of other available products and services. This dynamic promotes competition, allows for rapid experimentation, provides more diverse choices for users, and maintains the credible neutrality of the protocol layer.

For example, in a Web3 social network, if a client operator wants to remove all hate speech from their client, users can accept this censorship by continuing to use that client, or they can circumvent it by using a client that does not take such measures. However, this censorship does not apply to the protocol layer, which will maintain neutrality in speech. This is more preferable than the current content moderation approach in Web2, where users do not even know which speech is restricted, who is restricting it, or why it is restricted. The problems of Web2 social media and the arbitrary, subjective decisions of a few strongly point to a better solution: Web3 protocols with minimal governance.

Forking at the client layer and third-party layer also avoids several key flaws that hinder forking at the protocol layer, including the fragmentation of liquidity when forking DeFi protocols, or the fragmentation of user groups/audiences in Web3 social protocols. Forking at the protocol layer ultimately consumes the network effects generated by the protocol, making it undesirable for protocol developers and early adopters. For Blockzaar, minimal governance and the related concepts I shared can be implemented by the DAO in the following ways:

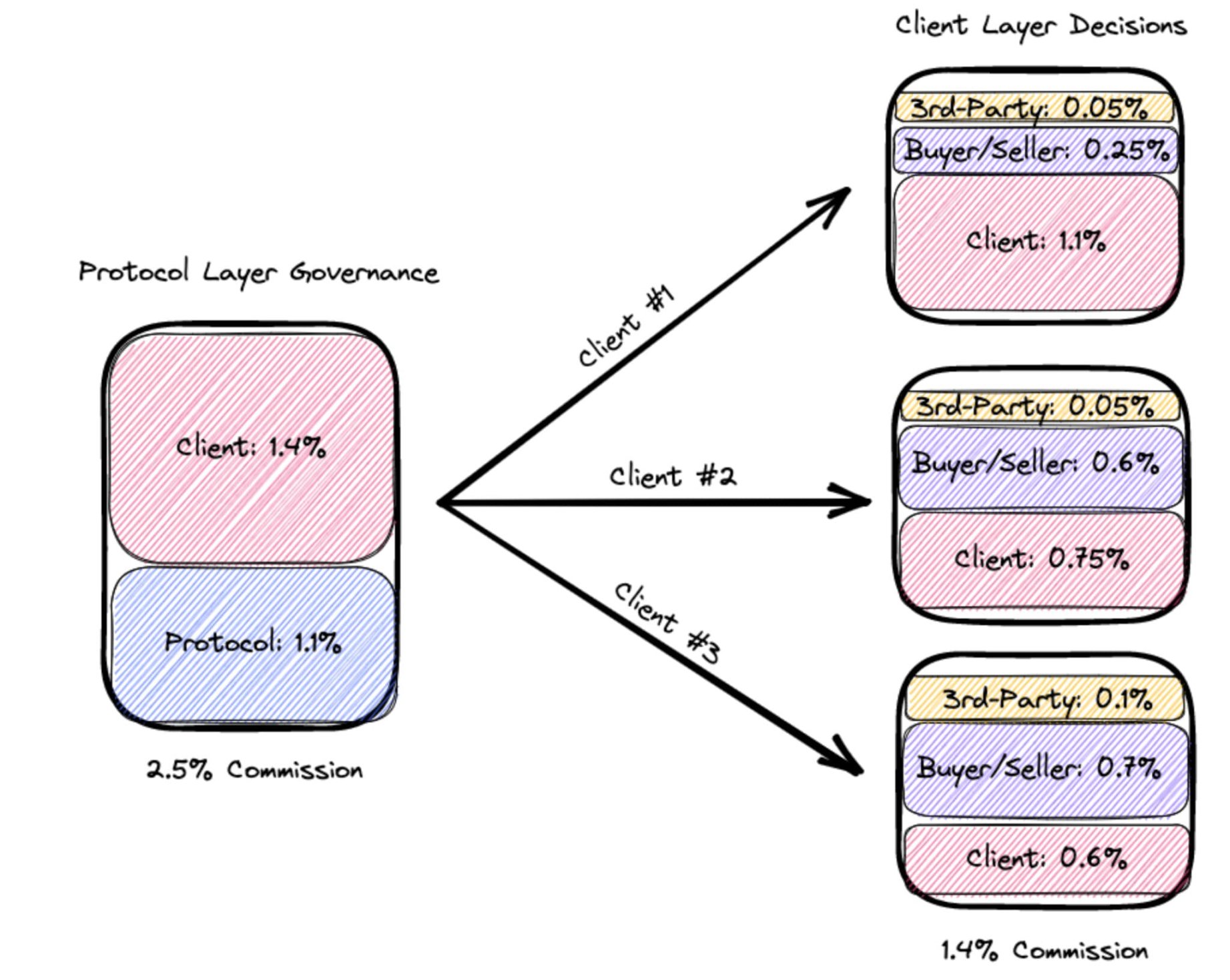

Complex parameter settings. For the simplest version of Blockzaar, the only parameter that the DAO can change may be the commission rate applicable to transactions, and the distribution of this commission rate between the protocol layer and the client layer. As shown below, the commission ratio between the client/user/third-party product and service provider can be "pushed" to the client layer, and each client can decide how to allocate the commission received from the protocol to its users and third-party product and service providers:

Fund Management. The simplest governance design for Blockzaar may still empower the DAO to engage in fund management activities. This would include creating grant programs, providing funding for the development of public goods in the market ecosystem, and offering support for other third-party products and services for clients and users.

Protocol Maintenance and Upgrades. The simplest governance design for Blockzaar may still authorize the DAO to maintain and upgrade the protocol. This will help keep up with the pace of competition, especially considering the rapid pace of technological iteration in Web3.

Overall, if Blockzaar can achieve minimal governance, it can significantly limit the number of decisions that need to go through decentralized governance processes, thereby reducing the governance burden on the protocol. Nevertheless, the protocol can still achieve a degree of variability and experimentation by nurturing a strong ecosystem composed of incentivized clients and third-party products and services.

Principle Two: Balanced Leadership

Given the increasing complexity of Web3 protocols and the fact that even the most extreme minimal governance is unlikely to eliminate all human factors, the DAO must take additional measures to ensure that the decisions it must make are effectively executed. For example, in the case of Blockzaar, if a new version of the protocol is released, the DAO will need to decide whether to accept it.

Considering that most political systems tend towards autocratic leadership (as observed by Machiavellians), the DAO should seek to establish a leadership "tier" for the ecosystem to more effectively handle the remaining governance affairs. However, the key is to balance the power of any leadership tier through design, so that any emerging leader can always be subject to public opposition.

While the DAO can attempt to use non-token-based voting designs (such as proof of personhood) to overcome autocracy, Machiavellians have concluded, based on observations of controversial politics, that such designs are unlikely to succeed in the long run. Even if "proof of personhood" can eliminate differential rights based on token ownership, DAOs using this method are likely to integrate token holders into new groups based on new property rights and new class differentiations. Therefore, while "proof of personhood" can mitigate the vulnerability of the DAO to attacks, it is unlikely to eliminate autocracy.

Establishing a system of checks and balances is a better choice. Fortunately, the incentive for decentralization provides fertile ground for exploring other tools to balance leadership power.

Below, I will share a potential DAO design that uses a bicameral governance structure—different from the U.S. Congress with its House of Representatives and Senate.

Stakeholder Council

If a protocol can incentivize a strong ecosystem composed of independent operators of clients, third-party products, and service providers, and these operators have a vested interest in the management of the protocol, it is reasonable for them to be involved in decentralized governance of the protocol. Their livelihoods may depend on the survival of the protocol. Additionally, the most active users of the protocol may also be vested interests in the protocol's management, especially if their usage is related to businesses they are operating.

Given their vested interests, these stakeholders are best suited to participate in the decentralized governance of the protocol. However, under the current token-based voting format, these stakeholders are unlikely to have sufficient agency in decentralized governance, thus limiting the potential for promoting true stakeholder capitalism in these ecosystems.

This challenge can be overcome by providing each stakeholder with their own Stakeholder Council through non-token-based voting. In particular, non-transferable NFTs (also known as soulbound NFTs) can be granted to certain individuals in each constituency, giving them the right to propose and vote on issues facing the DAO.

When designing any such leadership tier, the DAO should:

Fully disperse the power of the leadership tier, so that it cannot be said that any individual or related group controls the DAO. First, the establishment of the leadership tier may have negative implications under U.S. securities laws. Power should be granted to a leadership tier composed of multiple members elected by the DAO from each constituency.

Assess the interests of each stakeholder to determine where there are conflicts and alignments of interests. While assessing these interests is challenging, it is more direct than assessing the interests of anonymous token holders, as we can start from on-chain incentive mechanisms. For example, for Blockzaar, the incentive structure combines the interests of users, client operators, and third-party product and service providers with the interests of the protocol, involving the distribution of earned commissions. As mentioned above, this is a complex parameter setting determined by the DAO.

Meanwhile, the interests of these stakeholders may not align when it comes to fund management and/or protocol maintenance and upgrades. For example, users may want DAO funds to be used for products and services beneficial to users, rather than those beneficial to client operators; third-party product and service providers may oppose such expenditures due to concerns about increased competition.

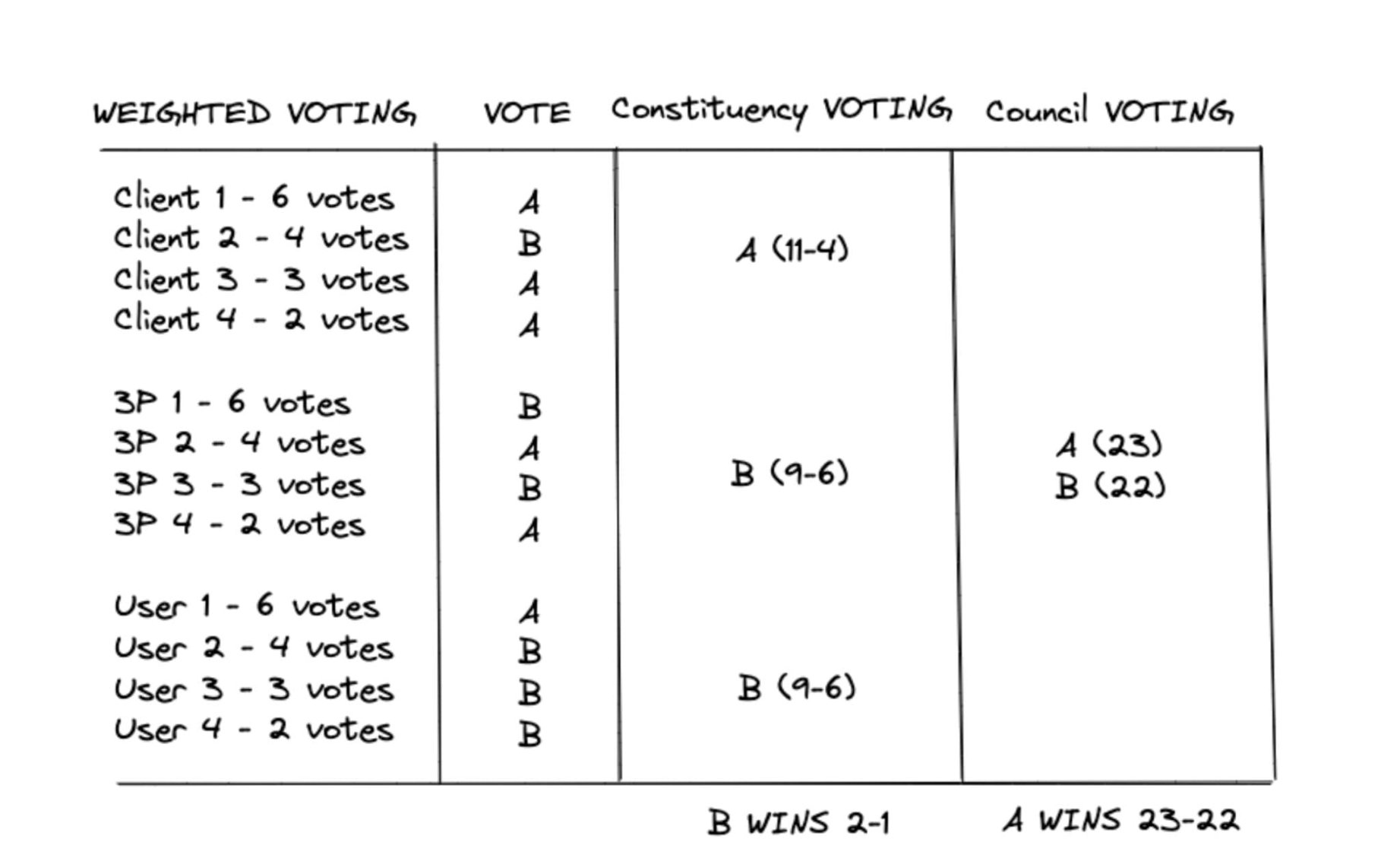

Balance the voting rights of stakeholders based on their interests. This can be achieved through weighted voting, where the best-performing representatives in each constituency receive the most votes, promoting competition and confrontation among stakeholders. Additionally, single-council voting or individual constituency voting can be used, as shown in the following figure:

If the same or related parties control multiple clients and/or third-party product and service providers, any Stakeholder Council will face the risk of "hostile takeover." However, this risk can be partially mitigated by requiring all such parties to have different taxpayer identification numbers in the U.S. or use some form of personal identity protocol.

Representative Council

The power of the Stakeholder Council should be balanced by token holders, as token holders inherently have vested interests in protocol governance that may be opposed to the interests represented by the Stakeholder Council.

The DAO can control the common problems brought by direct democracy (such as low participation and uninformed voters) through the implementation of representative democracy, most likely in the form of authorization. Representatives should be independent of any members of the leadership tier and should be appropriately compensated for their role in system management, apart from other matters.

The Stakeholder Council and Representative Council jointly have the authority to approve proposals submitted to the DAO. One or both councils can be the initial governance tier responsible for creating new proposals, while the other governance tier has either negative power (a proposal approved by one council will only pass if not vetoed by the other council) or positive power (a proposal approved by one council will only pass if approved by the other council).

Although this setup is similar to the bicameral structure used by Optimism, the key difference is that the Stakeholder Council of the Blockzaar DAO (similar to Optimism's Citizen’s House) will systematically consist of the most productive stakeholders in the system. These stakeholders are more likely to be vested interests in promoting such systems, as opposed to outstanding participants who are not clearly incentivized. Since the livelihood of these stakeholders ultimately depends on the protocol, they are more likely to take governance of the protocol seriously than good actors who participate in decentralized governance out of civic duty. This arrangement helps make the functionality of the DAO more like an industry consortium rather than a homeowner association.

In other areas, including constitutional and international law, the concept of relying on self-interested parties rather than altruistic or noble social designers has been explored, with self-interested parties becoming the overwhelming victors.

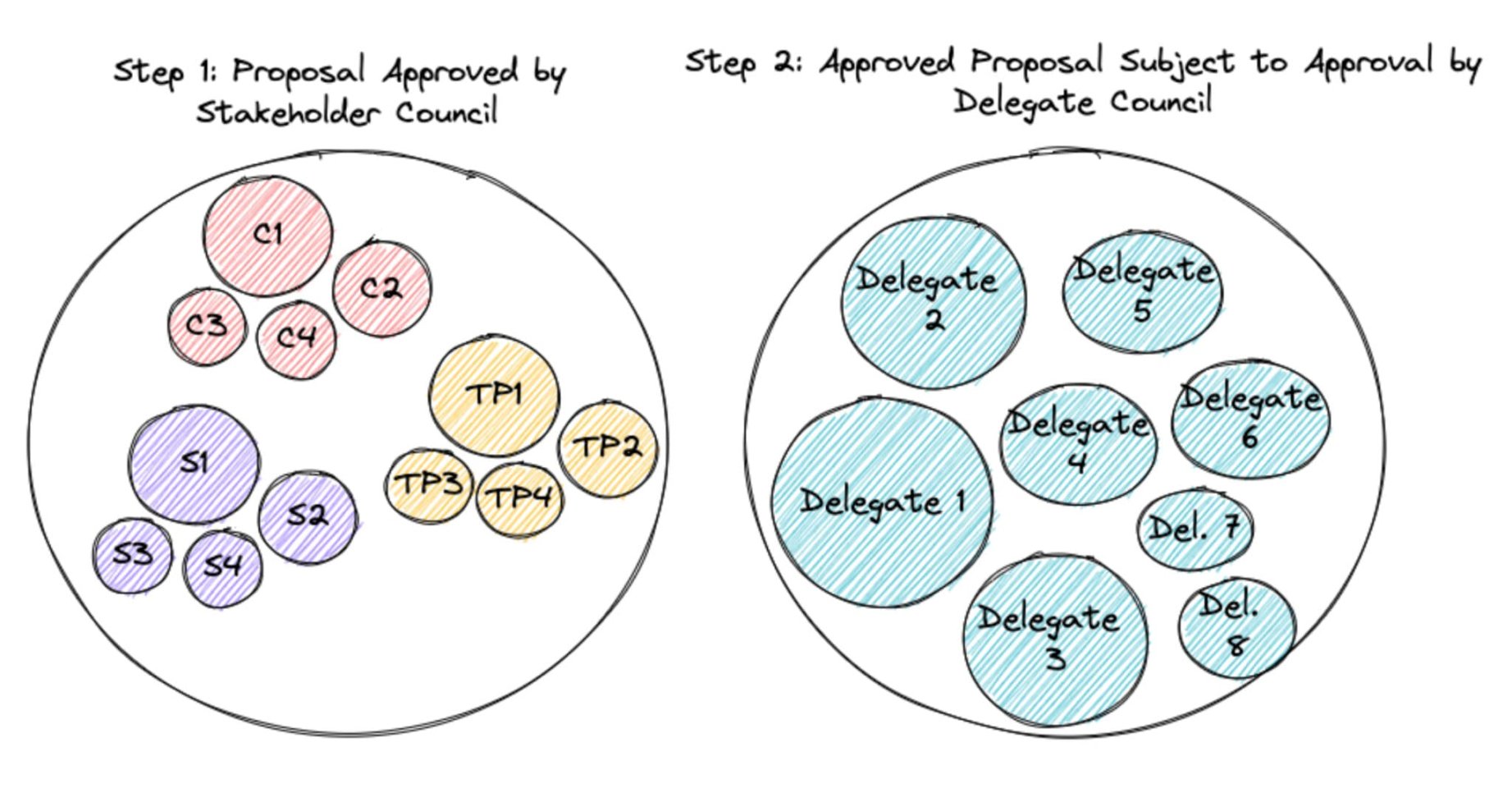

For Blockzaar, the leadership and governance structure of the DAO can be set as follows:

- The Stakeholder Council is composed of the following individuals: the top four client operators (measured by transaction volume); the top four third-party product and service providers creating products and services (measured by the transaction volume of clients using these products and services); and the top four sellers (measured by transaction volume).

- The voting rights of the leadership tier are weighted by constituency and divided into three independent series (as shown in the figure above). The leadership tier votes as a single council.

- The Representative Council is composed of 8 representatives elected by token holders and approved, with voting rights proportionally allocated based on token holdings.

- By default, no governance changes will occur in the DAO, so any proposal approved by the Stakeholder Council will not take effect unless approved by the Representative Council.

The governance system of Blockzaar is illustrated as follows:

Principle Three: Continuous Leadership Change

Machiavellians believe that institutions should not only have a continuous opposition but also allow new leaders to forcibly enter the leadership tier, creating turmoil and avoiding a stagnant balance of power. According to Machiavellians, this change must be forced, as the leadership tier will always oppose it to maintain its position and privileges.

Broad community participation is a hallmark of Web3 spirit and often extends to the DAO leadership tier, with community members frequently becoming formal contributors to the DAO. However, in a token-based voting system, the ability of community members to gain real power is often limited, as obtaining such power encounters financial barriers.

Nevertheless, DAOs that wish to adhere to Machiavellian principles (i.e., the need for continuous leadership turmoil) can introduce turnover in the leadership tier in several different ways, including:

Setting term limits for stakeholders in the Stakeholder Council. For example, the performance standards set by the DAO for promoting stakeholders to the Stakeholder Council can be periodically reassessed, allowing the Stakeholder Council to re-include stakeholders who performed best in the previous period.

Allowing token holders to freely replace representatives, otherwise representative terms will end periodically and representatives must be reappointed.

Empowering token holders to directly elect some stakeholders in the Stakeholder Council (client operators, third-party product and service providers, and users), establishing that previous performance is not the only way to promote stakeholders to the Stakeholder Council.

Principle Four: Strengthening Leadership Accountability

If a large group of people fundamentally cannot hold their leaders accountable (as predicted by Machiavellians), the DAO should take measures to strengthen accountability throughout its ecosystem.

By implementing the above three principles, a Machiavellian-style DAO can have stronger accountability than current DAOs, especially:

- Since the number of participants in the leadership tier is small (compared to the large number of token holders), each member of the leadership tier can better hold other members accountable for their voting history. Given the inherent tension between the Stakeholder Council and the Representative Council, this situation is particularly likely to occur between members of the Stakeholder Council and the Representative Council.

- If the client ecosystem becomes too dominant, users can hold client operators (including those promoted to the leadership tier) more accountable by simply ceasing to use certain clients and switching to others. Similarly, a dominant layer of third-party product and service providers can hold users and client operators accountable for these providers, as they have the ability to switch to other products and services.

- Regularly replacing representatives and term limits provide an opportunity for stakeholders to lobby token holders, in turn holding representatives accountable for their previous votes.

If client operators, third-party product and service providers, and users are required to "lock" a certain amount of governance tokens, the DAO can also increase the accountability of its Stakeholder Council and Representative Council. They can lock these tokens in a smart contract before joining the Stakeholder Council, only releasing them after a certain period. However, since members of the Stakeholder Council may not trust their fellow stakeholders and may not want to risk their assets, this mechanism may also be difficult to implement. Therefore, if any locking mechanism is introduced, it may also need to allow stakeholders to "rage quit," similar to the mechanism implemented by Moloch DAO.

If implemented properly, a locking mechanism will help promote greater alignment of incentives between the Stakeholder Council and the broader token holder community.

In conclusion

A problem often mentioned by ruling elites in the U.S. corporate system is that shareholders, directors, and executives often have unchecked power. As a result, we see CEOs' compensation far exceeding that of employees, or we see boards implementing stock buyback programs instead of reinvesting these resources in the organization's health, among a host of other issues.

While this concentration of power sometimes allows these companies to act more effectively, their mistakes and misjudgments have led to countless failures, with other stakeholders in these organizations having no recourse. Blockchain, smart contracts, and digital assets make the design of Web3 systems unique. DAOs prioritize minimal governance, which will help them maintain trusted neutrality, enabling them to develop emerging ecosystems composed of client operators, third-party products, service providers, and users.

Enabling these stakeholders to play a meaningful role in the governance process and giving DAOs a real chance to achieve "stakeholder capitalism," something traditional equity/corporate forms seem unable to achieve. Therefore, we should push for Web3 systems to adopt incentive structures that promote improvement in their systems' actions, making them more productive and better serving all stakeholders, rather than using incentive structures optimized for the benefit of a few owners.

Once again, it is emphasized: Web3 should triumph over Web2 through decentralization, as decentralization reduces censorship, promotes freedom, and freedom in turn leads to opposition to tyranny, driving greater progress. By incentivizing competition, empowering adversaries, and using non-token voting, DAOs can help accelerate this cycle.

But the premise is that we must accept and adapt to this system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。