Author: Jiang Haibo, PANews

Recently, Cosmos Hub completed the "Gais v12" upgrade, introducing the "Liquidity Staking Module" (LSM). Similar to other blockchain projects using the PoS mechanism, there are already multiple projects in the Cosmos ecosystem that provide liquidity staking services, including Stride, pSTAKE, Quicksilver, Stafi, etc. What is LSM, why is it specifically introduced, what functions and limitations does it have, and what impact does it have on the Cosmos ecosystem? In this article, PANews will answer these questions one by one.

What is LSM? Why is LSM needed? How is it implemented?

LSM is an alternative staking solution for ATOM in the Cosmos Hub, allowing users to convert staked ATOM into liquidity staking derivatives (LSD), aiming to promote the adoption of ATOM liquidity staking more securely and efficiently. In other words, it not only promotes the development of ATOM liquidity staking but also serves as a form of regulation, establishing a secure framework and controlling the adoption of liquidity staking through governance.

While Cosmos Hub needs to embrace liquidity staking, Cosmos DeFi needs more high-quality funds, and LSD that can generate income is a good source of funds. However, more funds participating in liquidity staking also bring risks, such as governance risks if the staked amount accumulated by liquidity staking service providers exceeds one-third of the total staked amount; to prevent validators from malicious behavior, the interests of validators and stakers need to be aligned; and to prevent a large amount of LSD used as collateral from triggering a chain liquidation, the adoption of LSD needs to be restricted.

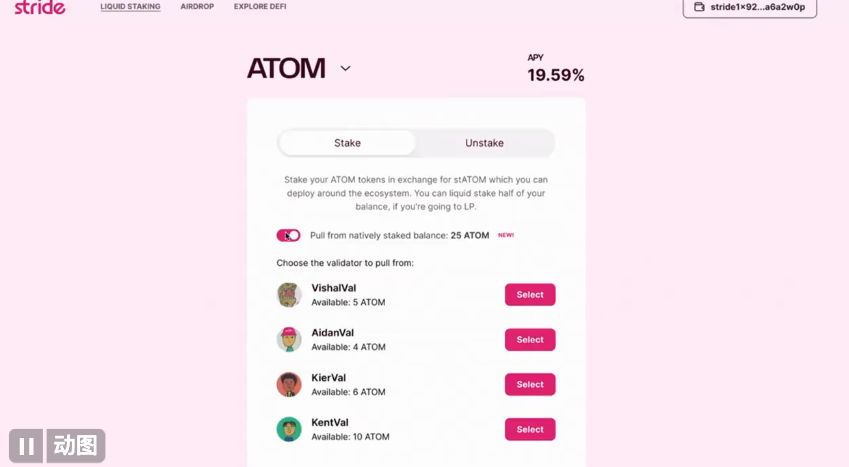

In practice, the method of converting staked ATOM in the Cosmos Hub to LSM is very simple. Currently, Stride has compiled a tutorial to convert staked ATOM to stATOM in three steps:

- Select "Extract from native staking balance" on the Stride staking page to use the staked ATOM.

- Choose a validator and the amount of ATOM for liquidity staking.

- Sign and confirm the steps for liquidity staking.

What functions and limitations does LSM have?

- Can convert staked ATOM into LSD

After staking ATOM directly in the Cosmos Hub, it requires a 21-day unbonding period before redemption. According to CoinGecko data as of September 15, the market value of ATOM is $2 billion, ranking 30th; Stakingreward data shows that the staking rate of ATOM is 68.12%, with a staking yield of 20.42%. This indicates that many people and a large amount of funds are participating in ATOM staking, and the 21-day unbonding period is longer than most PoS public chains, causing inconvenience for users.

The main function of LSM is to convert staked ATOM in the Cosmos Hub into various LSD, such as Stride's stATOM. For users who want to exit promptly, they can directly sell these LSD on a DEX to bypass the 21-day unbonding period.

The introduction of this feature by Cosmos Hub aims to promote the development of ATOM liquidity staking. LSD is an important source of funds in DeFi. When PANews conducted a survey of various liquidity staking schemes in the Cosmos ecosystem in April of this year, the results showed that the proportion of ATOM staked through liquidity staking accounted for only 1.15% of the total staked ATOM, which is less than 1% of the total ATOM. Promoting the adoption of ATOM liquidity staking can provide more liquidity for Cosmos DeFi.

Related reading: "Analysis of Cosmos Liquidity Staking Ecosystem: ATOM Liquidity Staking Accounts for Only 1.15% of Total Staked ATOM, Stride Currently Leads the Cosmos LSD Race"

- Validators need to stake ATOM themselves to accept staking delegation

LSM introduces an additional security feature, requiring validators to stake a certain amount of ATOM themselves in order to accept delegated staking from liquidity staking service providers.

This involves a parameter called the Validator Bond Factor, which means that for every 1 ATOM staked by the validator, they are eligible to receive a certain amount of delegated staking from liquidity staking service providers. The current setting for this parameter is 250.

Through this parameter, validators are required to have a certain degree of "interest alignment" with the Cosmos ecosystem, and the commission earned from liquidity staking service providers can cover the cost of the validator's own staking, preventing excessive burden.

- Limit the proportion of liquidity staking to 25%

According to current data, the proportion of liquidity staking in PoS public chains is about 23% for ETH. Due to Lido's market share in ETH staking exceeding 30%, there have been discussions about centralization issues in Lido.

LSM limits the proportion of ATOM staked through liquidity staking service providers to 25% of the total ATOM. When the proposal to introduce LSM was initiated in April, there were 223 million staked ATOM, so the staked ATOM through liquidity staking would be limited to 56.9 million. This figure still has a significant gap compared to the actual situation we observed, where the proportion of ATOM staked through liquidity staking was less than 1% of the total ATOM. In other words, it is difficult to reach the 25% upper limit in the short term.

This limitation is to prevent liquidity staking service providers from collectively controlling one-third of the staked ATOM and to prevent collusion among nodes.

Likely to promote the adoption of liquidity staking, with a greater impact on leading projects

Since the current proportion of ATOM liquidity staking is far from reaching the 25% limit, the LSM update is more of a positive development for the Cosmos ecosystem.

LSM is beneficial for increasing the proportion of ATOM liquidity staking and the funds participating in DeFi in Cosmos. As ATOM staked in the Cosmos Hub can also be converted into LSD after the introduction of LSM, it may promote the adoption of LSD. Furthermore, after the introduction of LSM, it can be assumed that these liquidity staking service providers are to some extent supervised by the Cosmos Hub, which may make stakers more accepting of liquidity staking providers.

The benefits for leading liquidity staking service providers may be even greater. Both in Ethereum and Cosmos, the market share of the largest liquidity staking service providers far exceeds that of the second-place provider, giving them better network effects. The LSD they issue has more applications and liquidity, making them the optimal choice when the yield is similar. In the Cosmos ecosystem, the largest project in the liquidity staking field is currently Stride, and the price of its native token STRD is also influenced and has risen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。