IGNAS | DEFI RESEARCH

Compiled by: Deep Tide TechFlow

Last month, I shared bullish views on two emerging areas in DeFi: Liquid Restaked Tokens (LRT) and Bitcoin DeFi.

Both are intriguing and currently in development, but this article focuses primarily on LRT, and I believe now is the best time to pay attention to LRT.

What is Restaking? Key Points to Know

Restaking is a feature of EigenLayer, a middleware that allows you to stake your ETH to multiple protocols, called "Active Validation Services (AVS)," providing security for multiple networks/services at once.

These services are typically responsible for their own security, including bridges, oracles, and sidechains, but we will see some crazy new ideas and concepts emerge in the future.

How it Works

EigenLayer acts as a cross-chain bridge, allowing you to "restake" your already staked ETH to various protocols—AVS. You can choose to restake ETH directly or use liquid staked tokens such as stETH, rETH, or cbETH.

Advantages

Capital Efficiency: Users can earn returns from multiple protocols with the same capital.

Enhanced Security: EigenLayer allows new protocols to leverage Ethereum's existing security layer.

Developer Freedom: Saves developers time and resources in building new security layers.

Risks

Penalty Risk: Increased risk of losing staked ETH due to malicious activity.

Centralization Risk: If too many stakers move to EigenLayer, it could pose systemic risks to Ethereum.

Return Risk: High-yield competition between protocols may dilute staking rewards.

Restaking provides a way to maximize staking rewards and protocol security, but it also comes with its own set of risks, especially regarding penalties and centralization.

Introducing Liquid Restaked Tokens (LRT)

EigenLayer's restaking model has a significant drawback for DeFi: once your Liquid Staked Tokens (LST) are locked in EigenLayer, they become illiquid. You cannot trade them, use them as collateral, or use them anywhere else in DeFi.

Liquid Restaked Tokens (LRT) provide a solution by unlocking this liquidity and adding another layer of leverage to enhance returns. Unlike depositing LST directly into EigenLayer, you can choose to deposit through a liquid restaking protocol. This is similar to our logic of using Lido.

Key advantages of LRT include:

Liquidity: Unlocking previously staked tokens for use elsewhere in DeFi.

Higher Returns: Increasing returns by adding leverage.

Governance Aggregator: DAO or protocol manages restaking without manual operation.

Compounded Returns: Saving gas fees while optimizing returns.

Diversification and Risk Reduction: If you restake on EigenLayer, you can only delegate to 1 operator. LRT allows delegation to multiple different operators, reducing the risk of a single bad actor.

Why I'm Bullish on LRT

Liquid restaking is building a high-yield house of cards for early adopters.

LRT offers higher returns for the most valuable crypto asset, ETH. With LRT, we can earn Ethereum staking rewards (~5%) + EigenLayer restaking rewards (~10%) + LRT protocol token issuance (~10% and above). It's not hard to imagine earning 25% returns from ETH before a true bull market arrives.

Airdrops: EigenLayer + AVS + LRT protocol token airdrops.

I believe the liquidity unlocked by LRT (otherwise locked in EigenLayer) will create more leverage for DeFi, similar to what we experienced in the 2020 DeFi summer, pushing up all TVL figures and ETH prices.

We are still early. EigenLayer is still in the testing phase, restaking capacity is limited, so I believe the real fun will start when EigenLayer raises limits and new AVS requiring restaking are launched.

Token Economics and the Upcoming "LRT War"

Even though LRT protocol tokens have not yet launched, I see a potential game here.

The token economics prospects of LRT protocols look very appealing, and I believe they will develop in a manner similar to veTokenomics.

When new AVS launch secure pools on EigenLayer, they will offer something valuable to attract restaked ETH. New tokens and compelling narratives will emerge. The first launched AVS may find it easier to attract liquidity because we have fewer choices.

However, deciding which protocol to restake with takes time and requires expertise. Most users will tend to favor the AVS offering the highest returns.

New AVS may find it more cost-effective to influence LRT protocols to direct deposits to them rather than directly attract users/TVL. Obtaining LRT tokens for voting on token issuance may be more effective than offering native token rewards.

For example, a new Bridge X launches, requiring consensus layer ETH to secure the protocol. The Bridge X team can target restaked ETH whales and retail investors on EigenLayer by offering their own token rewards. However, lobbying for a significant amount of restaked ETH for LRT protocols may be easier.

In turn, this dynamic increases the demand for LRT tokens, especially those that successfully attract a large amount of restaked ETH.

As we saw in the "Curve Wars," there may be fierce competition between AVS for DAO votes. However, be wary of the stories they sell: these tokens may be highly inflationary.

Protocols to Watch

Since we are still in the early stages and EigenLayer is still in its initial launch, there are currently no LRT protocols live on the mainnet. This is good news if you want to participate in airdrops and need time to follow up on research.

Some promising LRT protocols include:

Stader Labs

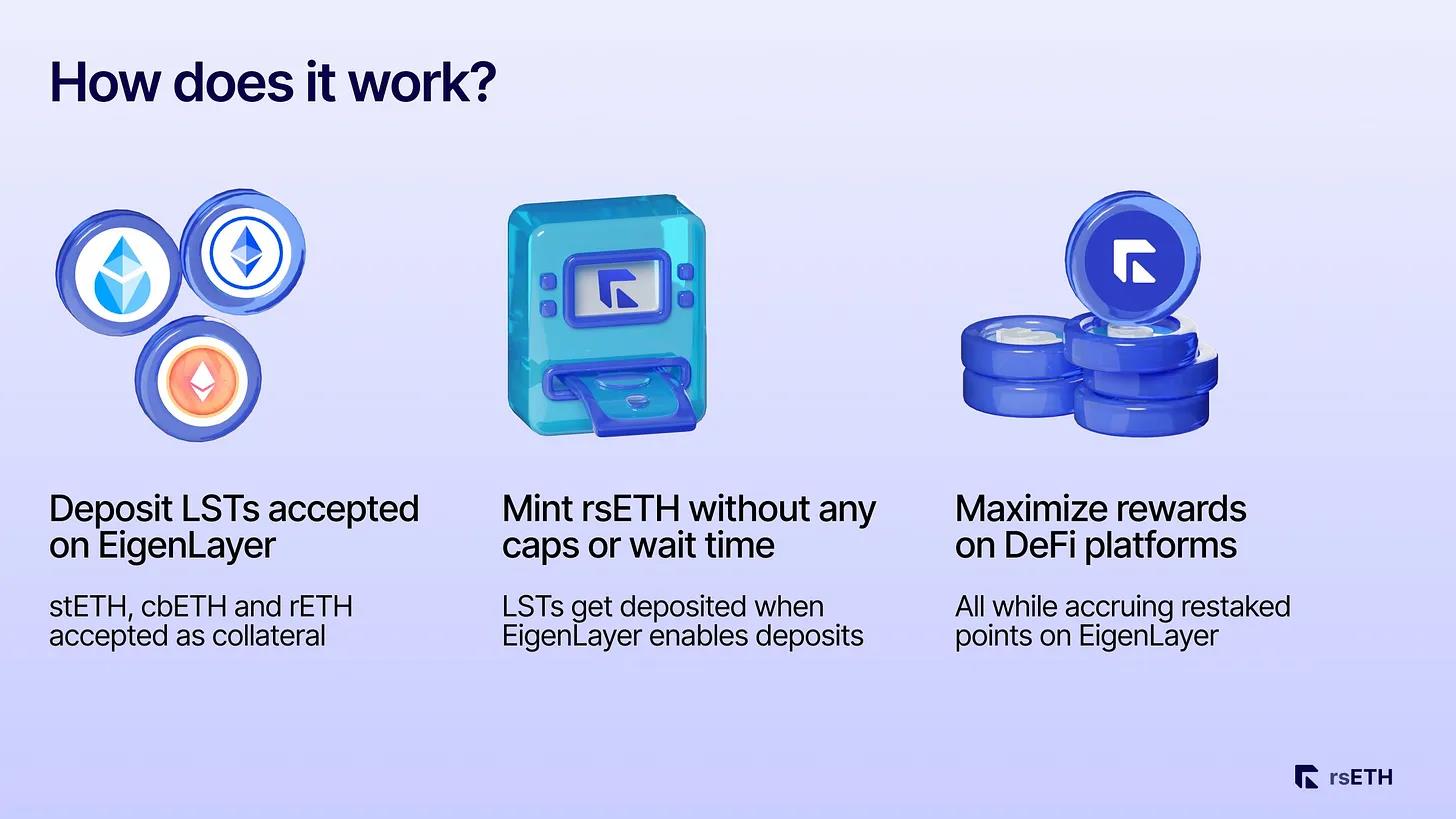

They have launched rsETH, backed by LST accepted by EigenLayer.

rsETH is currently on the testnet. Additionally, Stader is not just an LRT protocol. Two months ago, it launched a liquid staking token called ETHx, which has attracted $32 million in deposits. While Stader may be a bit late to the LST game, it is early in the era of LRT.

Stader already has a token, SD, which may rule out the possibility of an airdrop. However, as the LRT narrative gains momentum, SD may become an attractive bet.

Astrid Finance

Unlike Stader, Astrid has two LRTs instead of one.

You can deposit stETH or rETH (LST) into a pool and receive LRT (rstETH or rrETH) as a reward. These pooled tokens are then restaked on EigenLayer and distributed to various operators by the Astrid DAO.

The earned rewards will compound automatically, and the balance of rstETH or rrETH holders will be recalculated through rebalancing.

InceptionLST

Another new protocol on the testnet.

You can deposit stETH or rETH to receive LRT called inETH2.

Astrid and InceptionLST do not have tokens, so interacting with them now may be advantageous for potential airdrops.

Finally, Lido and Rocket Pool may also expand to LRT. I hope not, as new LRT projects offer opportunities for higher returns.

Script

I plan to do the following:

Learning: LRT is new, so it's important to familiarize oneself with various protocols and closely monitor updates from EigenLayer.

Due Diligence: Before the launch of any protocol, I will test each one. I will join their Discord channels, inquire about their roadmap, upcoming upgrades, and overall strategy.

Market Dynamics: Once EigenLayer raises deposit limits, real action will begin. It will be important to monitor which LRT protocol gains the most TVL. I anticipate the LRT market will mirror the LST market, with one protocol potentially dominating up to 80% market share.

Risk Management: Protecting my ETH principal through conservative market-making. Specifically, I will not allocate more than 5% of my total ETH holdings to each protocol. I will steer clear of anything too esoteric; after all, vulnerabilities, attacks, and exploits are inevitable.

Token Strategy: My bet is on compelling "Ponzi tokenomics" governance tokens that can build a self-sustaining flywheel. These tokens should offer attractive staking rewards, real yield rewards, and voting rights on which AVS receives restaked ETH. Additionally, they need to have a low enough inflation rate to offset any selling pressure from miners.

Exit Strategy: When the market is euphoric, when everyone is discussing how LRT governance tokens are creating a new "metaverse" of intergenerational wealth, I will cash out and rotate back into ETH. It's best to sell in batches as the price rises, rather than all at once.

Review and Adjust: Hoping the market will offer us something we haven't seen before, be attentive to learning and adjusting. These are the best bets.

Risk: How It Could Collapse

Like any financial leverage mechanism, liquid restaked tokens also come with risks. Essentially, we are stacking leverage, similar to the early days of DeFi, which makes the system more susceptible to market fluctuations and system failures.

Vitalik himself warned that restaking could introduce complex scenarios that threaten the security of the mainnet, such as penalties from third-party chains. The co-founder of EigenLayer also agrees, stating that while restaking can be used for low-risk purposes, unnecessary complexity that could jeopardize Ethereum's security should be avoided.

However, if the past can teach us anything, it's that restaking could be overused. By maximizing it through launching AVS that don't require access to the Ethereum consensus layer.

However, while Ethereum may be fine, a large number of new AVS and LRT could dilute the dollar amounts and attention entering this industry, leading to a collapse in the price of their governance tokens.

So, as you can see—liquid restaked tokens are opening a new chapter for DeFi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。