Author: Mia, ChainCatcher

For a long time, initial public offerings (IPOs) have been favored by various funds as a high-winning investment method in the investment market. From US stocks to Hong Kong stocks, new stock subscriptions have also been recognized by investors and are referred to by some investors as "risk-free returns." Binance has brought this "IPO" model of purchasing new stocks to the cryptocurrency field, combining it with the exchange's own situation to create the "Launchpad" IEO model.

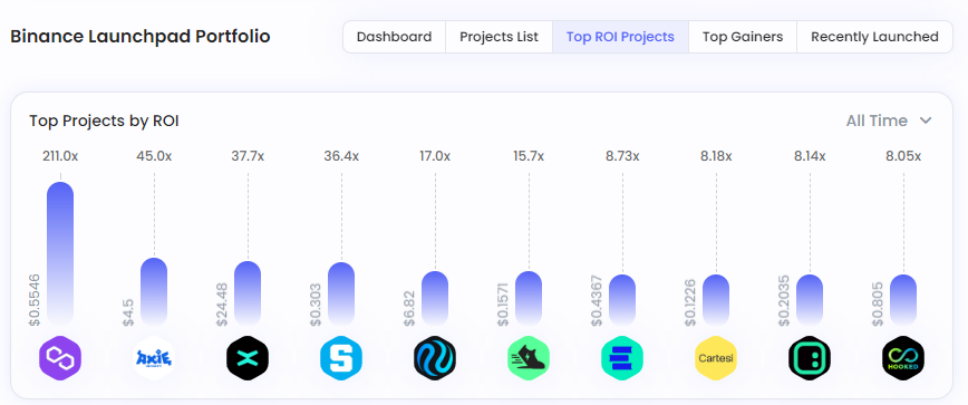

Since its launch, Binance Launchpad has become the platform for potential projects that are most likely to generate hundreds or even thousands of times the return on investment. As of September this year, the Launchpad platform has launched a total of 31 cryptocurrency projects, and "seizing the Launchpad" has gradually become a guide for users. After all, following smart funds has always been a good strategy for profit in the investment world. Who can be smarter than the largest cryptocurrency exchange? And the IEO model has become the most favored way for users to participate in new stock subscriptions due to its low risk and low entry threshold.

Now, with the arrival of the bear market and the increasingly depleted market liquidity, the Launchpad model, with its stable return rate, is becoming the new focus of competition for exchanges to attract users. Major exchanges have successively launched their own Launchpad products, all wanting to get a piece of the pie. However, Binance's LPD product has always been far ahead with high-quality projects and stable wealth creation effects. So, what strategic intentions and challenges should not be overlooked behind its wealth effect in this round of bear market? ChainCatcher will explore the intentions and optimization of the future system behind the wealth effect of Binance Launchpad in this bear market.

Mechanism Features and Strategic Intentions

It is well known that IEO stands for Initial Exchange Offerings, which refers to the behavior of exchanges issuing tokens directly to their users and helping project parties raise funds directly on the exchange. Unlike the ICO model, IEO bypasses the stage of public offering to the public and directly trades asset shares on the secondary market.

Binance Launchpad, as Binance's exclusive token issuance platform, provides Binance users with priority subscription rights to high-quality projects to support the cryptocurrency industry's ecosystem. Users need to hold a certain amount of BNB to participate in the new stock subscription. The final allocation of new coins depends on the ratio of the amount of BNB invested by users to the total amount of BNB invested by all participants. Each user's token allocation has a hard cap to ensure fair distribution among all participants in the Launchpad project.

However, the intention behind Binance's launch of Launchpad is not limited to providing a convenient platform and market for high-quality new projects using its own liquidity advantage, achieving mutual benefit, or simply valuing user experience and wanting to reward users. Instead, it has more far-reaching strategic intentions to expand its share in the cryptocurrency industry.

1. Achieving User Growth

The habitual thinking of product growth is "the product itself creates value, user growth conveys value, and the ultimate goal is to complete value transformation." Binance has injected this thinking into the Launchpad product. Launchpad creates value for Binance users with its "guaranteed profit" wealth effect, which has become an important factor in attracting users. As more and more investors begin to pay attention to Launchpad and are willing to try it, the stable returns of Launchpad also allow these users to taste the sweetness.

As the wealth effect of Launchpad begins to circulate and expand among investors, external cryptocurrency users naturally choose to invest in Binance, and Launchpad also attracts external liquidity while achieving value transformation, gradually becoming a tool to increase the platform's user base. In addition, while increasing the platform's trading volume, Launchpad also increases Binance's market share and consolidates its position as the world's leading digital asset exchange.

2. Maintaining BNB Price

From ICO to IEO, exchanges are trying to seek a new balance, that is, the "platform token." Inspired by the IPO in the US stock market, Binance cleverly combines the platform token "BNB" with the IEO model. Users only need to hold a certain amount of BNB to participate in LPD project subscriptions, and the amount of funds invested (BNB quantity) is linked to the allocation of subscription tokens. This mechanism greatly stimulates the market purchasing power of BNB. When the wealth effect of LPD projects is formed, it also brings a large amount of external liquidity into the BNB market.

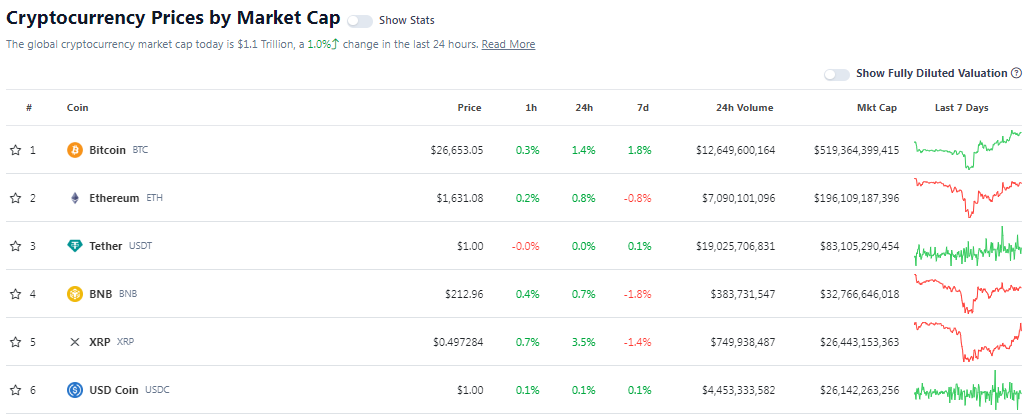

Of course, we can also consider LPD projects as another empowerment of BNB. Each time a new LPD project is launched, it always causes fluctuations in the BNB market, and most holders value the long-term holding returns of BNB. According to data disclosed by CAPITALISMLAB earlier (from 21 to April this year), if the tokens are sold on the first day, the total return rate of BNB is 36%, with an annualized return of 14%, even higher than the returns from ETH Staking during the same period. This has made BNB the most valuable cryptocurrency for long-term investment in the minds of investors after BTC and ETH.

Data source: capitalismlab

This is especially true in the bear market. Even as the cryptocurrency market value has dropped to historic lows, according to CoinGecko data, BNB's market value currently ranks fourth, second only to USDT. The stabilizing effect of Launchpad on BNB cannot be underestimated.

Data source: CoinGecko

In summary, with the support of Binance's "top" influence, Launchpad attracts a large number of internal and external investors to participate. Investors not only hold BNB for returns but also have the right to participate in IEO, greatly increasing the return rate of BNB and maintaining the stability of the BNB market. Launchpad acts as a moat for the BNB market in the bear market, stabilizing the coin price while continuously mobilizing liquidity.

3. Increasing Listing Power

The birth of Launchpad is a key step for Binance to revitalize its platform token, but it also contains its ambition to control the power of listing. From SFP to GMT and then to HOOK, Binance's LPD products have never failed to meet expectations. By promoting high-quality projects, Launchpad has established a good reputation of "guaranteed profit" between users and project parties, as well as gaining trust and attention for Binance Launchpad.

"Listed on Binance" is gradually becoming the belief and "rally warning" for every holder. Under the impetus of profit-seeking mentality, more and more investors are starting to believe in Binance, and Binance has become the ultimate destination for various projects. The abundant liquidity advantage, a large user base, and enthusiastic market response have all increased Binance's power to list and brand influence. The emergence of Launchpad has become the home for various new projects.

4. Cultivating User Loyalty

In fact, with the development in recent years, Binance has already achieved a complete lead in both market share and user growth. Due to factors such as regulation, Binance's development strategy has gradually shifted from competing for market share to cultivating user loyalty.

Since its inception, Launchpad has become one of the main ways for Binance to share and reward platform dividends with users by providing high-quality projects. By meeting the needs of user interests, it also attracts user attention and recognition, thereby enhancing user acceptance and loyalty to the exchange. Binance combines the stable returns of Launchpad with the long-term holding returns of BNB, increasing the sources of income for BNB holders and effectively increasing the platform's user stickiness and cultivating long-term user loyalty.

In addition, the emergence of Launchpad has also built a more complete digital asset ecosystem for Binance: by introducing high-quality projects through Launchpad to attract new users to benefit existing users, Binance's suite of products provides users with more investment opportunities and channels for project participation, continuously expanding the ecosystem, retaining and converting attracted users, and retaining more existing users.

Where Does the Wealth Effect of Launchpad Go?

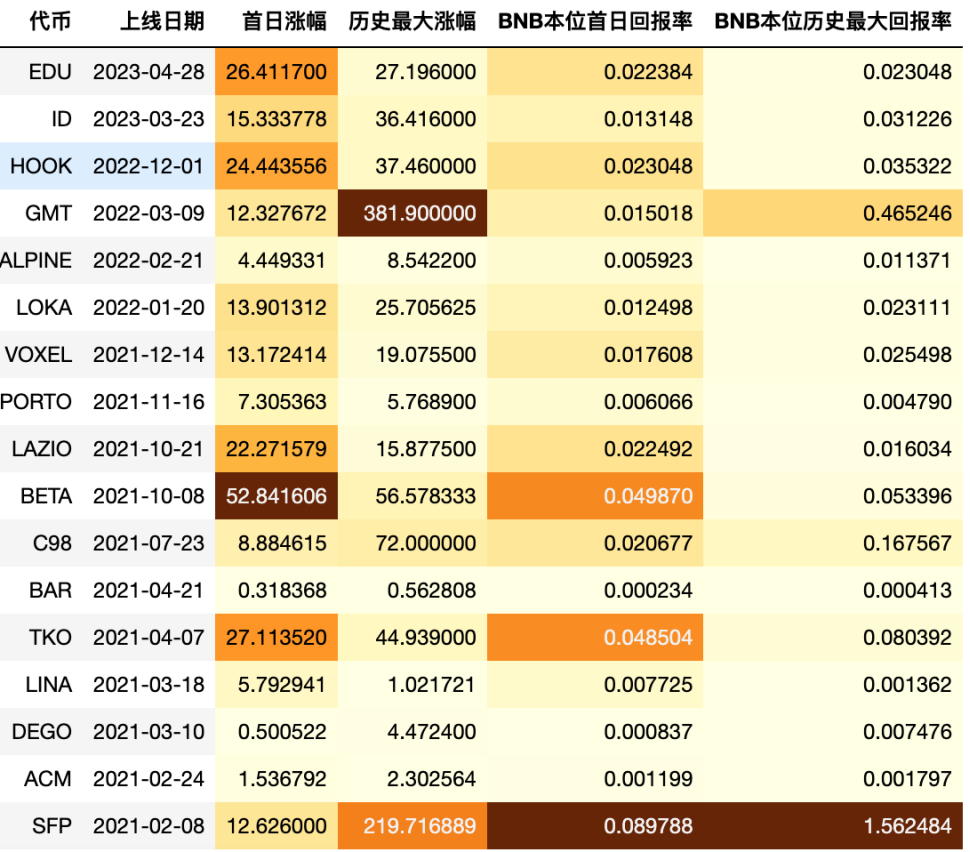

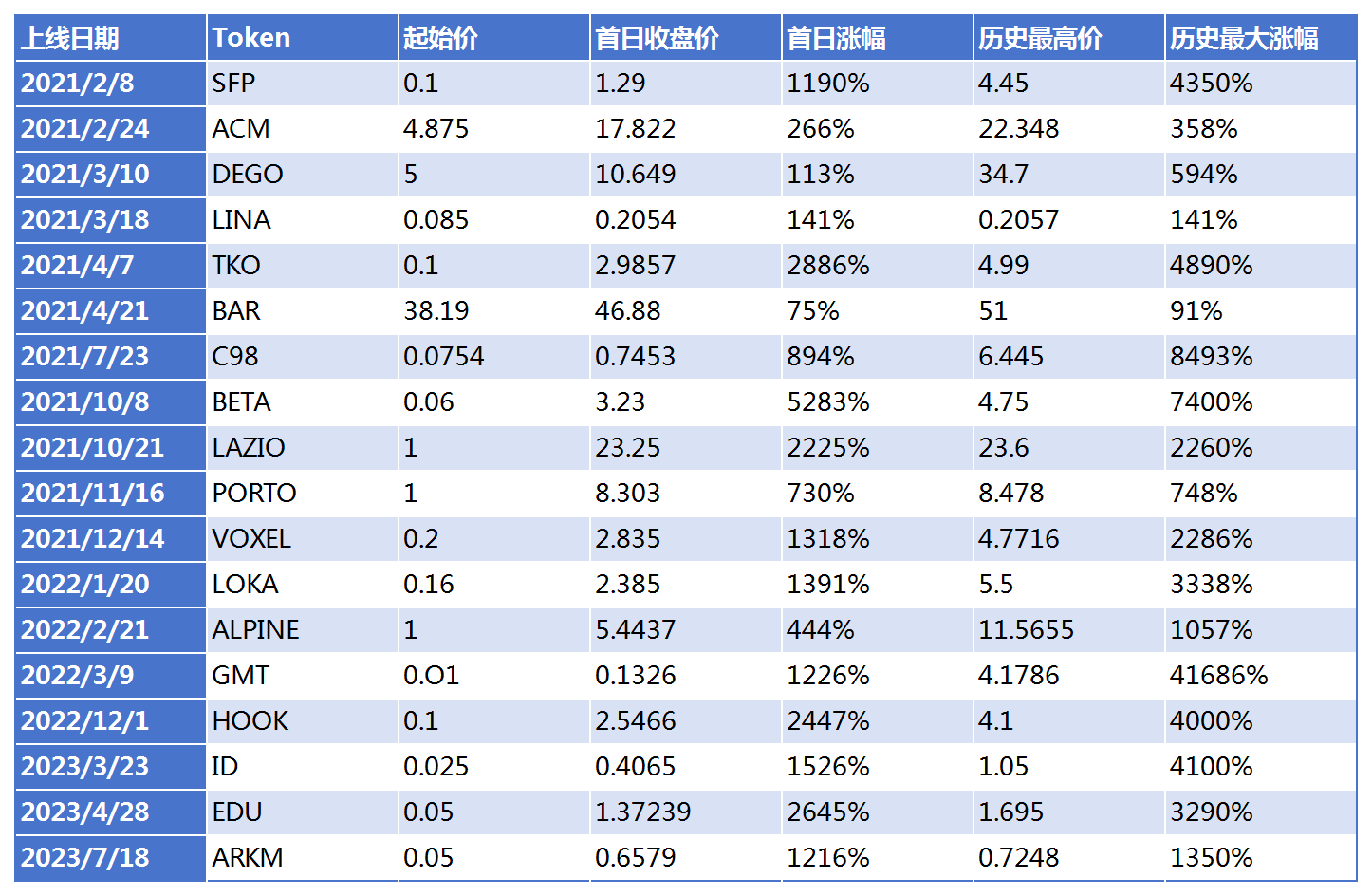

According to ChainCatcher's data, from 2021 to the present, a total of 18 IEOs have been conducted, with an average first-day increase of 1445% and an average highest increase of 50.24%. Among them, GMT ranks first with a highest increase of 41686%, making it the most successful project in the history of Launchpad.

Note: Data is based on USDT trading pairs. The first-day increase is calculated based on the closing price at UTC+0, and the highest increase does not take into account the extreme fluctuations in the first hour of listing.

From the above table, it is not difficult to see that at each stage, from wallets to fan tokens, to decentralized domains, and the education sector, Launchpad has had its own shining projects. However, as the market enters a bearish phase and trading volume shrinks, the wealth effect of Launchpad products also faces a challenge. After reaching the "myth of blessing" of GMT, the highest increase in history has slightly declined, although the overall return rate far exceeds previous projects before GMT, it seems difficult to reach the heights of GMT.

1. "Uncertainty" of Project Quality

In fact, since the launch of Launchpad, Zhao Changpeng has always emphasized that "the core of the IEO model lies in finding good projects, and the original intention of Launchpad is to help entrepreneurs and industry development." However, in the development of Launchpad, we can also see that from fan tokens to the "Move to Earn" Web3 application, although they were all new LPD projects at the time, their market performance is still uneven.

Ignoring the so-called "psychological account" factor (projects with low initial prices are more likely to be favored by investors), which causes projects with low initial prices to have higher average increases, this may be related to the quality of the projects themselves. From "bff gate" HOOK to the "education trend" EDU, there has always been a small number of voices in the market about Binance's "listing preference," and some users have begun to question the "criteria for new listings" of Launchpad.

However, according to research by CapitalismLab, the three tokens launched since HOOK have all performed at a relatively high level. The median first-day increase is 24.4 times, which is 1.9 times the historical median, and the historical maximum increase is 1.4 times the historical median. The first-day return rate for BNB is 1.5 times, and the historical maximum return rate for BNB is 1.3 times. In other words, these projects launched during the bear market are actually more profitable than most projects launched during bull markets.

Looking at the entire market, the controversy surrounding "bff gate" is largely due to the impact of the bear market environment, leading to overall wealth loss in the market and a decline in the wealth effect of Launchpad products, resulting in market appearances. The various controversies among investors are also the "inevitable products" of the bear market. As mentioned in a previous public response, Binance does not have phenomena such as "insider trading," "relative coins," or so-called "bff coins." Binance still cares about the wealth effect, and its current performance is still the best.

"Rumors stop with the wise." For the market itself, how to control the overall quality of listings from the source, adhere to the idea of selecting "good projects" for Binance, and create more positive value for users is still the direction that Binance Launchpad needs to consider in maintaining the wealth effect during the bear market.

2. Amplification of "Speculative" Psychology in the Bear Market

With the successive launch of Launchpad products, the way in which their prices increase has become predictable, and attentive investors have also begun to discover patterns, leading to a surge of profit-seekers. With the fixed thinking generated under the established LPD product model, short-term speculative arbitrage behavior has intensified. Similarly, due to the impact of the bear market crisis, investors' patience and trust have begun to decline, and there are fewer and fewer long-term holders.

Under the standard mode of Launchpad, users are gradually becoming numb. In the eyes of some investors, Launchpad is no longer the incubator for early-stage new projects, but has become a tool for short-term speculators to arbitrage. Of course, some investors view their returns as "BNB holder financial returns" rather than eagerly anticipating the next new coin to "create wealth myths." When this investor mentality is reflected in the market, the wealth effect of Launchpad is "disappointing."

But in fact, in terms of the overall increase in the projects on the Launchpad platform, we can see that projects like Injective Protocol (INJ) and Polygon (MATIC) have experienced a stable period or several stable periods before experiencing a true value explosion driven by market trends, creating wealth myths with returns of over a hundred times. In other words, there is no "absolute" pattern of increase in the Binance Launchpad market. The so-called "speculative mentality" may face greater investment risks, and only long-term wealth accumulation through investors' DYOR and market conditions is a more reliable way to achieve returns.

3. Intensified Market Competition

There has always been a distinction between "Binance Launchpad" and other IEOs in the IEO field. With the rapid development and intensified competition in the industry, coupled with the arrival of the bear market and the depletion of liquidity, the Launchpad platform has become a "must-win" for major exchanges. More and more CEXs are starting to follow in the footsteps of Binance and adopt this model. Binance Launchpad is inevitably facing greater challenges. However, in the current market context, Binance Launchpad is undoubtedly the best investment target in a calm market, and its market share still ranks first.

Source: https://chainbroker.io/platforms/

From the above, although there is some noise surrounding Binance Launchpad, we can still see that the reasons for the controversy are mainly related to the current market environment. As mentioned by He Yi earlier, "Binance's listing is not determined by one person. It tries to take into account the needs of the majority of users." Just like "everything has its light and shadow," Launchpad is the same. In the vast capital market, it is not easy to take into account the needs of every project party and user, especially in a bear market. The overly impetuous market environment has also increased the pressure on the Launchpad market, and what Launchpad can do at present is to try to take into account the needs of the majority of users and project parties.

In fact, many LPD users we interviewed still have expectations for the wealth effect of Binance Launchpad. The vast majority of users believe that the projects on Binance Launchpad are of higher quality and have potential. They still have confidence in its wealth effect and hope to participate in Binance Launchpad to gain benefits and increase their wealth.

"The wealth effect of Binance Launchpad can continue. Basically, the opening price of LPD will be more than 10 times the cost price, even 20 times. The projects on Binance Launchpad are all assessed by Binance Labs, and Binance Labs is undoubtedly still one of the top venture capital institutions in the cryptocurrency field. Their vision is not too bad."

- Ryan

"Binance's leading position is still stable, and its brand image is deeply rooted in people's hearts, which means it still has strong bargaining power for most projects. This provides a continuous stream of high-quality projects for Launchpad to solidify user loyalty. Therefore, I believe that the wealth effect of Launchpad can continue, even in a bear market."

- Jacob

How to Continue to Lead in the Launchpad Market?

Since a series of black swan events such as FTX occurred last year, the global cryptocurrency market has been in a liquidity shortage crisis. However, Binance Launchpad still remains deeply ingrained in people's hearts with its "top" brand image and stable returns. In the face of user doubts and competition from peers, how should Binance respond and continue to lead in the Launchpad market?

In fact, in the long river of development in the traditional investment market, there have been similar challenges to Binance Launchpad, including issues such as "uncertainty of lottery results," "market fluctuations," "intense competition," and "IPO pricing," which also affect the feedback on new stock subscriptions. Resolving these challenges requires the joint efforts of brokerage firms and investor market conditions. Similarly, when applied to Launchpad, it requires joint efforts from Binance and investors.

1. Education and Training for Investors

Drawing on the history of traditional brokerage development mentioned above, strengthening investor education is crucial. Binance has an obligation to provide investors with comprehensive and detailed project whitepapers and related information, regularly release market reports to analyze market trends, and assess project risks to provide risk warnings, helping investors gain a more comprehensive understanding of the basic situation of the projects. At the same time, Binance should also provide risk management education to investors, strengthen their investment capabilities and decision-making abilities, further improve the quality of Launchpad from the user level, and thereby enhance the platform's competitiveness and influence, pulling ahead of other competitors.

In fact, Binance has been making efforts to explore investor education and training. Currently, Binance has launched Binance Research, dedicated to the most cutting-edge research in the blockchain field, and regularly releases "project research reports" on the blockchain industry and the cryptocurrencies listed on Binance. By improving industry transparency, it focuses on solving the problem of information asymmetry between project parties and investors, reducing investors' investment risks, and providing them with investment guidance.

2. Strengthening Project Selection and Screening

To address the uncertainty of project quality, Binance can further strengthen the selection and screening of projects to ensure that each project has innovative, potential, and sustainable development characteristics. In the current bear market crisis, where funds are less active, users tend to prefer short-term hotspots. While Binance should strengthen the selection of high-quality projects, it should also be more sensitive to market changes and proactively explore short-term trend projects.

Regarding the controversy mentioned earlier about the project parties, Binance Launchpad may need to adopt relatively flexible listing rules for projects with high popularity and potential, making the rules more fair and applicable to truly good projects. Because only through truly high-quality projects can Binance Launchpad win more attention and recognition from users and investors.

3. Introducing More Flexible Subscription Methods

In fact, Binance's original intention of "launching Launchpad to promote the development of high-quality cryptocurrency projects and provide investment opportunities for investors" has not changed. However, as time goes on and the market changes, the established new stock subscription model may not receive the same market response as before. Therefore, "how to reinvigorate market enthusiasm through the model" becomes a question that Binance Launchpad needs to consider in maintaining the wealth effect.

In response to users' perception that the current Launchpad market response is "bland," Binance may need to introduce more flexible subscription methods, such as tiered subscriptions, public auctions, etc., to meet the needs of different investors, increase user participation in projects, and improve the fairness and transparency of the subscription process. In addition, for high-net-worth BNB long-term holders, Binance can also provide priority subscriptions and exclusive subscription services to increase the returns for long-term holders.

4. Strengthening Project Review for Launchpad

He Yi previously mentioned that "Binance monitors the project party's wallet and market maker accounts for Launchpad, and the Launchpad project token currently requires the project party's token to be held by multiple parties, as part of mutual supervision." In fact, Binance has always maintained a strict attitude towards listing review and supervision and has been exploring more comprehensive regulatory methods.

For listing review, Binance can introduce various audit methods, such as technical review, financial review, compliance review, etc., to comprehensively evaluate the feasibility and risks of projects, improve the quality and reliability of projects. At the same time, it can learn from the governance model of DeFi and promote community governance mechanisms for the Launchpad platform, allowing investors holding platform tokens to participate in project decision-making and management, increasing user participation and trust in the platform.

For Binance, controlling the "quality of project parties" and the "threshold for investors" is equivalent to controlling the risks at both ends of "entry and exit." How to "not forget the original intention" and place oneself in an equal position with project parties and investors, while focusing on the interests of users while providing high-quality projects, is also something that Binance needs to consider.

Of course, from the various controversies mentioned above, it can be seen that in the face of the noise surrounding Launchpad, Binance may appropriately delegate power to users, project parties, and the market, listen to all parties' voices, and this is also the key to revitalizing Launchpad. Currently, Binance has opened up public social channels such as Twitter and Binance Square to better "pool wisdom" in the market and grasp the development trends in the cryptocurrency field.

Conclusion

From financial storms to the subprime mortgage crisis, the survival of the US stock subscription model to this day also proves the correctness of its system and the wealth effect. Inspired by this, Binance Launchpad will continue to build on this foundation in the future.

In the bear market, there are cries of despair everywhere, but Binance's market share still ranks first, and the role of Launchpad is beyond doubt.

As Zhao Changpeng previously mentioned in an AMA, "the bear market environment has brought more projects seeking help," and how to carefully select good projects, increase exchange users and trading volume to activate the market, enhance the right to list and brand influence, expand the ecosystem, and provide more investment opportunities and create value for users is the long-term direction that Binance Launchpad needs to consider, and it is also the "only way" to achieve its strategic intent.

In the current liquidity crisis, which easily leads to runs and stampedes, the strategic focus of Launchpad is gradually shifting from the initial market share to the cultivation of user loyalty and the development of reputation. This is the necessary path for a company to grow into a "century-old" enterprise, and it is also the top priority for stabilizing the platform market in the bear market. The current development direction of Launchpad is how to better meet users' profit expectations.

Currently, Binance has launched Launchpool based on Launchpad to further increase the annualized return rate for long-term BNB holders through "BNB mining and staking." According to CAPITALISMLAB data (from 2021 to April this year), the total return rate in BNB terms is 52%, with an annualized rate of 21%, more than double the earnings from ETH staking during the same period.

In addition, based on market preferences, user preferences, and platform preferences, Binance Launchpad has also made adjustments to the listings. According to data from chainbroker, we can also see that recent IEO projects (HOOK, ID, and EDU) rank in the top ten, with higher quality and higher average return rates compared to previous projects.

Source: https://chainbroker.io/platforms/

According to data from the Binance official website, Binance Launchpad has raised over $100 million for projects.

In the current global cryptocurrency market liquidity crisis, "with great power comes great responsibility." Binance, with its huge influence and strong market liquidity, has become a mainstay in the bear market, and Launchpad is still a powerful competitive tool for Binance to expand its market share and increase the wealth effect. As the market gradually recovers, the wealth effect of Launchpad may continue and expand, because Binance Launchpad is more capable than ever of raising funds for excellent projects in distress during the bear market, creating more eye-catching wealth effects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。