Author: Mia, ChainCatcher

Recently, there have been continuous on-chain activities of ARB whale selling. Since the beginning of this week, whale addresses, including market maker Wintermute Trading, have successively transferred tens of millions of ARB to Binance. Coupled with the overall market panic caused by the "FTX selling digital assets," ARB's price dropped to a historic low of $0.744 on Monday, with a 12% decline over the past 7 days.

Facing the price collapse caused by whale selling, a large number of ARB holders began to voice their complaints. In order to stabilize the price, Arbitrum initiated a self-rescue plan and announced the launch of a 100 million ARB ecosystem funding plan on the 12th. Currently, ARB has partially recovered from the decline, with the price rising to $0.8.

Incentive plan turns into "dumping plan"

According to CoinGlass data, on September 11, long positions worth $2.2 million were liquidated, the highest level since the ARB crash in August. The bullish signal before the liquidation came from PlutusDAO, the native governance aggregator of Arbitrum, which initiated a proposal in the Arbitrum community this month to "activate ARB staking." The proposal suggested that Arbitrum DAO mint 1.75% of the total supply of ARB as inflation and distribute it as incentives to ARB token holders over a year to stimulate the ARB market atmosphere, increase long-term holder profits, and combat short-term arbitrage. However, this approach has been questioned by some holders, who believe that it may dilute the token's value and lead users to lose information if it relies solely on inflation rather than being linked to genuine platform usage and economic activity. It is reported that PlutusDAO has currently locked 9.5 million ARB, which is clearly using the pretext of benefiting Arbitrum for personal gain.

In fact, the exploration of incentive plans to stimulate the Arbitrum ecosystem and the ARB token market vitality has been ongoing. Just on the 4th of this month, Arbitrum proposed to distribute ARB token incentives to the community, aiming to allocate up to 75 million ARB from the DAO treasury to active Arbitrum protocols to meet short-term community needs. This proposal has also been controversial, with the main point of contention being that the distribution of 75 million ARB to ecosystem protocols within the next 2-3 months will bring a significant selling pressure to the ARB secondary market. In addition, short-term token incentives have little effect on the long-term growth of the Arbitrum ecosystem and will instead increase the pressure for sustained ecosystem growth.

According to Token Unlocks, Arbitrum will unlock 11.1 billion ARB tokens worth $12.4 billion at a market price of $1.12 on March 16 next year. The unlocked amount is equivalent to 87% of the token's circulating supply of 12.75 billion, of which at least 12.75% of the current ARB token supply has been used in circulation. The massive unlock amount, coupled with the token incentive plan, will undoubtedly bring greater selling pressure in the future.

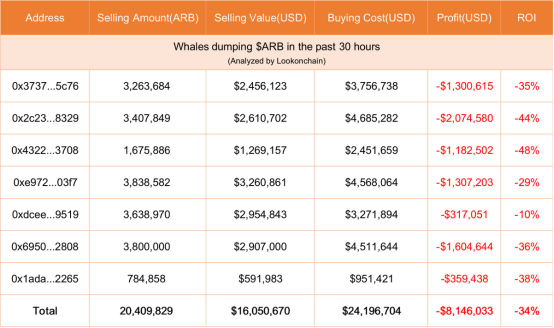

These factors have led to a wave of whale selling, with many whale addresses choosing to sell at a loss. According to Lookonchain data monitoring, on Monday alone, a total of 7 whale addresses sold 20.41 million ARB at a loss (approximately $16.05 million), resulting in a total loss of $8.15 million.

The originally launched ecosystem incentive plan has evolved into a whale dumping plan, which is undoubtedly "unexpected" for Arbitrum. However, the solution to the panic caused by token selling pressure may only be addressed through ecosystem development, and the Arbitrum ecosystem is also facing challenges.

"Wealth effect" weakening, Arbitrum ecosystem growth in crisis

In fact, as the "L2 era," Ethereum L2 has experienced explosive growth this year, similar to the previous public chain boom, with a large number of projects beginning to layout the L2 track, from Arbitrum and Optimistic to the recent Base, more and more L2 projects have emerged. As the track becomes increasingly crowded, the Arbitrum ecosystem has also begun to face challenges in ecosystem growth.

Like conventional L2 products, Arbitrum focuses on achieving Ethereum scalability while ensuring security and decentralization, and has already implemented a complete fraud proof in its first version. Subsequently, Arbitrum's development team, Offchain labs, has made multiple updates to the technical stack products, introducing nitro, stylus, and bold. However, compared to projects like zkSync, Starknet, and Base that still have airdrop expectations, the growth of users and TVL for Arbitrum, which has already completed airdrops, has begun to slow down.

Unlike Optimism, which is mainly supported by large VCs, Arbitrum's native applications are mainly funded by the community, with profits from individual native projects flowing back to the community as a whole, and community profits quickly flowing back to other projects in the ecosystem, forming a self-circulating ecosystem. However, in the current unstable user base and lack of liquidity, this purely internally supported ecosystem model is extremely vulnerable. The overall lack of liquidity in the Arbitrum ecosystem has compressed its survival environment in L2, and as later entrants like zkSync and Base begin to exert their efforts, the market competitiveness of Arbitrum has started to decline, with its market share being divided.

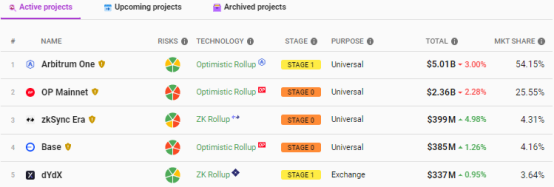

According to L2BEAT data, the current TVL of the Arbitrum network has fallen from a peak of $7 billion in April to the current $5.1 billion, and its market share has also dropped from 67% to 54.15%.

Looking at the development of the Arbitrum ecosystem, in order to better serve Web 3 developers, from nitro to the recent stylus, Arbitrum has been focusing on the development of new technology stacks. In addition, the Arbitrum ecosystem has also seen hot projects such as the DeFi ecosystem GMX and the game sector's Treasure, all of which have attracted a large number of ecosystem builders to explore the user base of the Arbitrum ecosystem, triggering a small boom in the Arbitrum ecosystem earlier this year. However, with the bearish market and sector rotation, the weakening of the wealth effect of Arbitrum ecosystem projects has gradually led to a "flash in the pan" phenomenon for these high-quality projects.

In fact, most of the users catered to by the Arbitrum ecosystem are those with a preference for leverage and high risk tolerance. After the small climax of the Arbitrum ecosystem has passed, apart from the latest development environment stylus, there have been almost no new ecosystem projects that can stimulate investor enthusiasm and bring wealth appreciation. In other words, apart from developers who truly enjoy the convenience brought by technical development, most of the ecosystem user base can be said to be "working for love," which is also the reason for the recent "whale selling" after the exposure of the incentive plan.

How useful is the exploration of L3?

As the L2 track becomes increasingly competitive, in addition to adhering to the advantages of "low cost and high efficiency," the L2 industry has begun to explore new trends in modularity, increased scalability, and the construction of L3: in the same track, Optimism has shifted to Op Stack multi-chain infrastructure and is moving towards the direction of superchains; zkSync has proposed a customizable trustless linked blockchain Hyperchain to achieve better scalability and improved composability; StarkWare has begun developing a multi-layer solution, exploring L3 for customized expansion. Arbitrum is no exception, as it has initiated a vertical exploration of the L3 network through Arbitrum Orbit and introduced a new development environment, Stylus, for developers.

Stylus is an open-source SDK developed by Arbitrum that supports the construction of applications in multiple languages, allowing developers to use traditional EVM tools on Arbitrum while also using WASM-compatible languages such as Rust, C, and C++ to build applications. Compared to using traditional Solidity, WASM makes Dapps execution more efficient, significantly reducing gas costs, and L3 XAI, benefiting from Arbitrum's technical stack Nitro+ BOLD+ Stylus, can be natively integrated with BOLD and Stylus.

Compared to Op Stack, which profits from access to its shared sequencer infrastructure, Arbitrum attempts to profit from its proprietary development environment codebase. L3 XAI is defined as Arbitrum's L2 smart contract, and its transactions will be settled through Arbitrum L2 (Arbitrum One or Nova). In addition, XAI, as an L3 dedicated to gaming, can achieve higher performance and has dedicated computing and storage resources, making it possible for on-chain resource-intensive use cases. The emergence of XAI will help improve the scalability of the Arbitrum ecosystem while diversifying its execution environment and security model.

With the launch of L3 XAI and the update of the development environment Stylus, Arbitrum is attempting to create new possibilities for its ecosystem: Stylus expands its supported language categories, while L3 creates a more diverse execution environment. In the future, the Arbitrum ecosystem will attract developers who seek more control and customization, allowing them to fork and freely adjust the Arbitrum source code according to specific needs to form a so-called "custom chain."

Conclusion

The Arbitrum team has been trying to embark on self-rescue.

Author: Mia, ChainCatcher

To rescue the token price, Offchain Labs has repurchased ARB multiple times using the address starting with 0xb41. Just this week, as the token price dropped, Offchain Labs once again stepped in to buy back 1.799 million ARB (approximately $1.4 million) from Binance at an average price of $0.78. According to Spot On Chain data, since August 23, Offchain Labs has repurchased a total of 7.166 million ARB from Binance at an average price of $0.9. In addition, Arbitrum has launched an ecosystem funding plan, providing over 100 million ARB in funding support for four tracks: gaming, developer tools, new protocol concepts, education, community development, and activities.

After a series of "emergency rescues," ARB has now risen above $0.8. However, overall, the ARB price is still sinking at the bottom, with no significant signs of a major increase.

Looking back, the previous rise in ARB token price probably came from the outbreak of the Arbitrum ecosystem, and the fundamental rescue of ARB lies in the activation of the Arbitrum ecosystem. As for the expansion of the Arbitrum ecosystem mentioned above, the Odyssey event for XAI has been launched and will provide developers with substantial rewards, but the overall operation is still in its early stages and needs long-term validation over time. In the future, whether L3 XAI will see widespread application and whether Stylus will attract more dApp developers to join the Arbitrum ecosystem and develop projects with greater wealth effects to regain users are still unknown.

Facing the serious "internal competition" in the L2 track and the strong pursuit of later entrants, Arbitrum may have to step up and fight with its back against the wall.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。