Project Introduction

Puffer is an innovative technology-driven project that focuses on achieving low barriers to entry, high returns, and decentralization in the LSD track of the cryptocurrency field. As an emerging project, Puffer stands out with its unique technological advantages. Puffer is a liquidity staking protocol based on Eigenlayer, with its nodes also serving as operators of AVS (Active Verification Service) nodes on Eigenlayer.

Puffer's staking mechanism allows participants to earn dual staking rewards, with a portion coming from the Ethereum network and another portion from the Eigenlayer network. Additionally, Puffer utilizes its proprietary Secure-Signer (remote signing tool) and RAV technology to address slashing issues in the Ethereum and Eigenlayer networks, thereby providing participants with low-risk dual rewards.

Author

Elma Ruan, a senior research analyst at Shi Lian Investment Research, holds dual master's degrees in market/finance from Ivy League schools and has 5 years of experience in WEB3, specializing in DeFi, NFT, and other tracks. Before entering the crypto industry, she worked as an investment manager at a large securities firm.

1. Research Highlights

1.1 Core Investment Logic

Since Ethereum officially transitioned from POW to POS in September 2022, more attention has been drawn to its staking method. After the Shanghai upgrade, the withdrawal of the beacon chain was opened, and the ETH staking rate has significantly increased. Staking refers to locking a certain amount of Ether on the Ethereum network to obtain the right to validate transactions and corresponding rewards. Currently, the requirement for a single staking node on the Ethereum network after the transition to POS is 32 ETH. As a result, much ETH is staked on centralized exchanges, large mining pools, and leading LSD protocols such as Lido. According to Dune data, Lido's ETH staking rate has reached 23.01%, significantly exceeding the initial staking cap threshold of 15% proposed by Vitalik, indicating a certain degree of market monopoly tendency. Clearly, due to the technical and economic barriers to staking, the concentration of validation nodes in the network has increased, affecting the network's decentralization and security. Puffer is a new staking solution aimed at increasing the decentralization and security of the Ethereum network. Additionally, Puffer is deeply integrated with EigenLayer to increase the yield and maintain staking willingness. Puffer is an early-stage project but has already received support from some well-known investors, including the founder of Eigenlayer, the head of staking at Coinbase, and Ethereum core researcher Justin. Furthermore, the Ethereum Foundation has also funded Puffer's Secure-Signer technology to reduce slashing risk and maximize the number of independent operators, thereby achieving network decentralization.

Puffer is an advanced staking solution for an early-stage project aimed at increasing the decentralization and security of the Ethereum network. It employs a series of technical means, including anti-slashing technology, re-staking services, and remote signing, to minimize slashing events and highlight the advantages of individual stakers. In short, participating in Puffer's staking allows for dual rewards from ETH and Eigenlayer, and then solves slashing issues in the Ethereum and Eigenlayer networks through the original Secure-Signer and RAV technology, providing stakers with the lowest risk dual rewards. Through Puffer's innovative mechanism, participants can achieve lower risk with less capital and enjoy stable returns from both networks. This solution maximizes stakers' earnings.

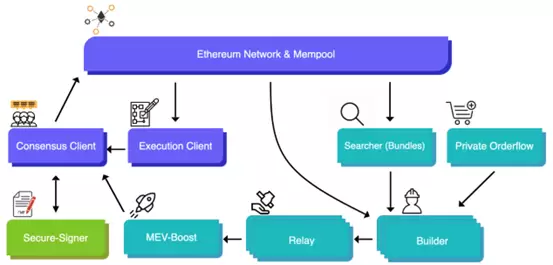

The core logic of Puffer is to enhance staking security and yield through technical means to attract more individual nodes to participate in staking. Puffer Finance is built on the Eigenlayer protocol. As a Puffer node, it serves as a validation node for Ethereum and a native node on Eigenlayer, simultaneously operating as an AVS (Validation Node Service). The first cooperative AVS of Puffer is EigenDA. Therefore, the node can receive rewards from Ethereum and Eigenlayer re-staking rewards, and as a node on Eigenlayer, it does not require additional collateral. The security of the node's private key and anti-slashing issues are supported by Secure-signer, RAV software, and TEE hardware, similar to a cold wallet for private keys. Hardware efficiency is improved because the node hardware performs dual validation services, i.e., Ethereum PoS and Eigenlayer's AVS, thereby increasing efficiency. Both Ethereum and Eigenlayer have penalty mechanisms, with Eigenlayer's being programmable penalties, and Secure-signer can effectively reduce this penalty risk. Puffer nodes perform dual validation and, with the help of Secure-signer technology, effectively reduce the risk of LSD and LSDFI assets. Compared to existing LSD tokens and liquidity re-staking tokens, this approach is safer and more reliable.

In summary, Puffer first adopts anti-slashing technology, which involves dispersing staked Ether across multiple addresses during staking to reduce the risk of attack. Additionally, Puffer employs re-staking, which involves staking the staked Ether again on other validation nodes to increase yield and reduce risk. Furthermore, Puffer utilizes remote signing technology, which involves transferring the signing process from the local node to a remote node to enhance security and reduce risk.

Furthermore, as a technology-driven emerging project, Puffer's significance lies in innovatively addressing some core issues in Ethereum staking. Regarding the staking threshold issue, Puffer attracts more participants by reducing the required ETH amount for staking. Simplifying operations is also a key challenge for Puffer. In the Ethereum network, block construction and proposal are carried out by randomly selected validators, and a validator committee is required to prove the validity of these blocks. For ordinary stakers to avoid double signing to prevent slashing, it requires a significant amount of time and effort, which is not easily achievable in reality. To address this issue, Puffer lowers the staking threshold and provides tools for automatic anti-slashing, making it more convenient for general users to set up validation nodes. Additionally, the Ethereum Foundation highly values and funds the development of such technology. Among them, SecureSigner technology is one solution that minimizes slashing risk by executing the final signing operation in a secure and isolated environment. Therefore, SecureSigner technology is effective in addressing slashing issues caused by poor key management.

Since the emergence of the LSD track, numerous projects have emerged, all focusing on three main directions: lowering barriers to entry, increasing returns, and enhancing decentralization. Lowering barriers to entry and increasing returns are key factors that users can directly perceive and benefit from, so these projects are striving to enhance returns, even surpassing Ethereum's benchmark APR (increasing returns). Currently, Puffer is fully aligned with the goals of the current LSD track. In addition to lowering the staking threshold, Puffer also aims to increase network decentralization as much as possible through the secure signing technology funded by the Ethereum Foundation, further enhancing network decentralization. Additionally, Puffer achieves re-staking and MEV-Smoothing through lowering protocol fees and deep integration with Eigenlayer, thereby increasing yield. These improvement measures aim to provide a better user experience and higher system security, while attracting more individual nodes to participate in staking. Only when the network is sufficiently decentralized and secure can it attract more users and applications, thereby achieving the sustained development and maximized value of the Ethereum network.

In conclusion, Puffer is an emerging staking solution aimed at increasing the decentralization and security of the Ethereum network. The emergence of Puffer is significant for the Ethereum network, as it contributes to achieving a higher level of decentralization and network security, laying a solid foundation for the network's long-term development. However, Puffer also faces some challenges and risks, such as the complexity of technical implementation and the intensity of market competition. Nevertheless, as the Ethereum network continues to grow and develop, Puffer is expected to become an important staking solution, contributing to the network's long-term development.

Currently, the Puffer testnet has not yet been launched, so it is unclear whether it can become a dark horse in the LSD track and break the monopoly position of Lido after all the technology is implemented, further enhancing the decentralization characteristics of Ethereum. Finally, it is worth noting that Puffer is an early-stage project, and investors should pay attention to the implementation of the project's technology and its operation after launch before making investment decisions. Currently, Puffer can be observed as a mid-term project, with close attention to its development progress.

1.2 Valuation

Due to the project's testnet not yet being launched and the valuation of the seed round financing not publicly disclosed, an accurate valuation cannot be determined.

2. Project Overview

2.1 Business Scope

Puffer.fi's business scope is to provide a trust-minimized liquidity staking protocol, optimize staker reward mechanisms, and increase the accessibility of liquidity staking by lowering collateral requirements and using anti-slashing environments. These measures aim to promote the decentralization of the Ethereum network and provide a more competitive liquidity solution. Through these measures, Puffer.fi makes household staking a viable option.

2.2 Past Development and Roadmap

Date Event

2022-12-24 Developing a liquidity staking protocol that uses SGX technology as a practical hedge against zk-rollup SNARK vulnerabilities

2023-03-23 Two founders of the Puffer team jointly authored a paper proposing a permissionless liquidity staking protocol that allows staking requirements to be reduced to below 16 ETH without the need for internal protocol modifications or additional trust conditions.

2023-05-04 Building a trust-minimized and permissionless liquidity staking protocol and attempting to integrate with Secure-Signer technology

2023-05-06 Open-sourcing the first public product Secure-Signer, officially supported by a grant from the Ethereum Foundation; expanding anti-slashing technology to implement ZK-2FA (multi-proof system)

2023-05-10 Taking a step towards permissionless liquidity staking tokens; developing a capital-efficient, fully permissionless liquidity staking protocol (LSP)

2023-05-18 Releasing Secure-Signer as a public product, encouraging community forks and the development of their own versions; Secure-Signer is supported by Intel SGX

2023-08-30 Publishing updated documentation about Puffer.fi

Future Roadmap:

Puffer is currently in the early stages of development and is expected to launch on the testnet in the second half of 2023, with plans to release the mainnet in 2024. Additionally, the project's official Discord community indicates that Puffer Fi is planning to optimize the LSD protocol's technology, such as pDVT and privacy-related ZK-2FA.

2.3 Team Overview

2.3.1 Overall Situation

According to LinkedIn, the company's team consists of five core members with expertise in Python, C language, Java, SolidWorks, JavaScript, and blockchain. Their professional backgrounds include computer science, electrical engineering, and marketing. The team members have extensive knowledge and skills to provide comprehensive support and solutions for the company. Currently, the team is recruiting technical personnel with years of experience in Solidity smart contract development.

2.3.2 Founders

Amir Forouzani Co-Founder & CEO

Amir Forouzani is the co-founder and CEO of Puffer. He holds a master's degree in electrical and electronic engineering from the University of Southern California and has a background in data science and NASA. He has previously served as a research assistant.

Jason Vranek Co-Founder & CTO

Jason Vranek holds a master's degree in computer science and engineering and has experience in market design and blockchain front-running trading. He uses Chisel to build hardware accelerators and is interested in teaching, automated theorem provers, and deep reinforcement learning. He is currently pursuing a Ph.D. in verifiable computing.

2.3.3 Core Members

Christina Chen Marketing Operations

Christina is a professional with years of experience in marketing, public relations, brand promotion, and business development in the Silicon Valley tech community. She has extensive experience in the Web3 and blockchain fields, specializing in DeFi, NFT, metaverse, P2E, DAO, and DAO funds.

Jeff Zhao Developer and Software Engineer

He holds a Bachelor of Computer Science from the University of Toronto and has worked as a full-time software engineer at companies such as Puffer, Alder Labs, Alice, and Circle, participating in projects such as cryptocurrency exchange products, smart contracts, and L2 MATIC integration. During his internship at IBM, he worked on the development and maintenance of the Java virtual machine.

2.4 Financing Situation

1) Initial Financing:

A. The initial funding for team expansion was obtained through a Pre-Seed round led by Jump Crypto, with a funding amount of $650,000.

B. The Ethereum Foundation provided a total of $138,000 in funding for the research and development launch of Secure-Signer technology.

2) Seed Round Financing:

A total of $5.5 million was raised, led by Lemniscap and Lightspeed Faction, with other participants including Brevan Howard Digital, Bankless Ventures, Animoca Ventures, DACM, as well as community funds such as 33DAO, WAGMI33, and others. Additionally, support was received from institutions and individuals such as Eigenlayer, Curve, Coinbase Institutional, Canonical Ventures, and Obol Labs.

3. Business Analysis

3.1 Target Audience

The project's target audience mainly includes the following categories:

1) Individual Users: Individual users can utilize the liquidity staking protocol provided by the project to stake their tokens in the staking pool to earn corresponding rewards. By participating in staking, users can increase the liquidity of the Ethereum network and earn profits.

2) Validators: The project targets individual users who want to become Ethereum validators. By using the services provided by Puffer.fi, validators can lower the staking threshold and stake their tokens in the staking pool. This allows them to participate in the validation process of the Ethereum network and earn corresponding rewards.

3.2 Business Categories

1) Staking Service: The project provides a staking pool (Puffer Pool) that allows users to stake their tokens to participate in the validation process of Ethereum.

2) Technological Innovation: The project employs unique technologies and strategies such as lowering collateral requirements and providing re-staking services to increase the capital efficiency of nodes and provide better hardware efficiency and risk management measures.

3) Decentralization Promotion: By increasing the feasibility and participation of home validators, the project aims to promote the decentralization of Ethereum, increase the number and dispersion of nodes, and thereby enhance the security and stability of the entire network.

In summary, the business categories of this project include staking services, technological innovation, and decentralization promotion.

3.3 Business Details

1. Puffer Protocol

The Puffer Protocol is built on Eigenlayer and its rules can be referred to as Active Verification Service (AVS) or middleware. AVS is a service or middleware that validators choose to join, and it can programmatically penalize validators' 32 ETH deposits. For example, if fraudulent behavior occurs during the re-staking process of Optimistic Rollup, a validator's 32 ETH deposit can be programmatically slashed. If a validator violates the AVS rules of the Puffer Protocol, their ETH will be programmatically slashed and returned to the pool.

1) To protect Puffers' ETH from inactivity penalties, the current balance of each validator must be maintained above the threshold set by Puffer DAO. This threshold should be low enough to allow for reasonable downtime and high enough to incentivize good performance. In other words, the threshold should be a compromise that encourages validators to remain active while allowing them flexibility to accommodate potential downtime.

2) MEV-Smoothing is crucial for curbing internal centralization within the protocol. It allows nodes distributed in individual homes to earn more rewards than centralized staking operations and reduces the economies of scale of centralized staking operations. Block proposers need to share execution rewards with the pool. If on-chain theft is proven to exist, violating validators will be penalized.

Puffers (Stakers)

Puffers refer to individuals who stake ETH on the Puffer Protocol to receive pufETH liquidity staking tokens. When a Puffer stakes 0.01 ETH or more, it is added to an ETH pool. A portion of this pool is provided to nodes to meet the 32 ETH requirement for activating Ethereum validators, while the remaining portion is used to provide liquidity for Puffers who want to redeem their pufETH tokens for ETH.

Nodes

In the Puffer Protocol, protecting staked ETH is a top priority for the protocol, crucial for maintaining stability. To achieve this goal, the protocol requires all nodes to undergo economic bonding to provide appropriate incentives. In the event of any misconduct, the corresponding penalty will first be deducted from the node's economic bonding. To minimize potential penalty risks, the Puffer Protocol employs strategies supported by covert areas and Guardian to reduce the likelihood of node penalties and effectively address node inactivity. This allows the protocol to provide a more secure and stable environment, protecting users' staked assets from potential risks.

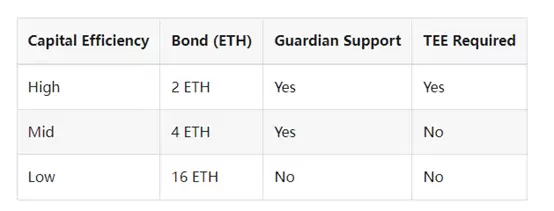

To accommodate different risk preferences and ETH requirements, nodes can choose from three different operating modes. These operating modes correspond to different capital efficiencies and corresponding requirements. Nodes with Secure-Signer have higher capital efficiency and can access a set of validators specific to covert areas. Currently, nodes with less than 16 ETH in collateral require Guardian support to prevent penalties until EIP-7002 removes this requirement. Prior to this, nodes with 16 ETH in collateral could join without Guardian support.

- Rewards

pufETH is a reward token similar to Compound's cToken, with good compatibility in the DeFi space. As the protocol continuously generates rewards, the amount of ETH supporting pufETH increases, thereby increasing the exchange rate between the two. This allows pufETH holders to gradually earn rewards from staking and restaking while still participating in DeFi activities.

- Puffer Rewards

Puffers deposit ETH into the PufferPool contract to mint pufETH. Initially, the exchange rate is one-to-one, but if the protocol performs well and accumulates rewards exceeding penalties, the exchange rate will increase, making the value of pufETH higher than ETH. Therefore, Puffers holding pufETH can expect its value to grow over time.

- Node Rewards

After registering validator keys, Puffer nodes mint pufETH equivalent to their collateral and lock it until exiting the protocol. Due to the rewards for consensus generation, execution, and restaking, they receive liquidity ETH as rewards based on the commission rate set by Puffer DAO, with the remaining portion sent to the PufferPool and financial coordination account. As nodes hold locked pufETH, they also share rewards generated by other nodes in the protocol. This helps achieve efficient MEV and maintain consistency in the node incentive mechanism.

- Slashing Mechanism

The consensus mechanism is a set of rules that support the operation of a given blockchain, determining how the blockchain operates. It manages the operational rules of the blockchain, how users interact with it, and how to prevent manipulation of the network, which could have catastrophic consequences for the entire blockchain. Typically, this is achieved by ensuring that network nodes have a "stake." This means that for optimal results at an individual level, network nodes must also align with the interests of the network to maintain their incentive consistency. Slashing is part of a proof-of-stake consensus mechanism used to penalize validators with malicious intent. In many proof-of-stake networks, validator nodes must "stake" a certain amount of tokens initially locked on the blockchain, known as staking. In simple terms, by making a personal investment on the blockchain, the consensus mechanism of the blockchain can prevent malicious or inefficient behavior through penalties, which is Slashing.

In general, Slashing often penalizes the following key behaviors:

1. Downtime

Downtime refers to validator nodes being offline for any period, thus unable to participate in the network's consensus process. This unreliability is harmful to the normal operation of the network and is typically considered punishable behavior.

2. Double-Signing

To avoid Downtime, many validator nodes have backup devices. However, this also brings its own Slashing risk: if the network detects the same validator key running on two different servers, it may view this as a risk (because this behavior is unexpected and may even lead to conflicting information provided by the nodes), making it a behavior that could be subject to Slashing penalties.

3. Manipulating the Network

Finally, any attempt to manipulate the consensus process, such as signing two different blocks for the same slot, will also face Slashing penalties.

The Slashing mechanism is designed to ensure that validators in a proof-of-stake protocol not only need to actively participate in consensus but also actively avoid any behavior that is detrimental to or delays the network's consensus process.

- Guardians

Guardians are a group of licensed nodes whose task is to ensure the smooth operation of the protocol. They currently have two responsibilities, but will gradually be replaced by EIP-4788 and EIP-7002 in future hard forks:

Reporting the amount of ETH supporting pufETH: To calculate the conversion rate between ETH and pufETH, the main contract needs to explicitly state the current amount of ETH supporting the protocol. This involves adding up the balances of all active validators on-chain with the balances on the beacon chain. Currently, Guardians are responsible for performing this calculation, but after EIP-4788, it will be replaced by a trustless zero-knowledge proof.

Exiting nodes violating Puffer Protocol AVS: The first rule of Puffer Protocol AVS is designed to protect offline nodes from harm. However, since EIP-7002 has not been implemented, validators cannot complete the exit operation on-chain and need to sign an exit message using their validator key. To maintain decentralization until EIP-7002 is implemented, Puffer Protocol requires nodes with less than 16 ETH in collateral to encrypt their validator keys into shards and store them in the secure execution environment of Guardians. The design of these secure execution environments allows them to sign exit messages using validator key shards. After the implementation of EIP-7002, the role of Guardians will no longer be required.

To mitigate counterparty risk, Guardians have taken many preventive measures. Guardians are composed of public community members with a high degree of alignment with Ethereum's principles and reputation. Guardians must use secure execution environments to increase the security of their actions and require a high proportion of Guardians (e.g., 8/9 signatures) to agree to execute a certain operation.

- Withdrawals

Puffer Withdrawals

Puffer provides a withdrawal function, allowing Puffer holders to destroy their pufETH to redeem the original ETH and accumulated rewards when there is sufficient liquidity in the withdrawal pool. To ensure withdrawal liquidity, a portion of all Puffer deposits, rewards, and node withdrawals will be added to the withdrawal pool.

- Node Withdrawals

After participating in the Puffer protocol, nodes can fully exit by proving that the node has exited the beacon chain. Upon complete exit from the Puffer protocol, the locked pufETH of the nodes will be destroyed, and they will be redeemed with liquidity ETH equal to their original collateral plus accumulated rewards minus the penalty amount. For example, a node with a 2 ETH collateral exiting with a validator balance of 32 ETH, if the pufETH:ETH ratio doubles since registration, the validator will receive 4 ETH, and 28 ETH will return to the withdrawal pool.

- Governance

Puffer is committed to establishing an unimpeded decentralized protocol that can continue to grow and operate without relying on the core Puffer team. To achieve this goal, Puffer strives to minimize the governance role in the protocol. The PUFI token is primarily used for the following purposes: pausing and upgrading contracts to address vulnerabilities and Ethereum hard forks, voting to determine protocol parameters such as commission rates, managing the Puffer protocol's financial fund, including grants and whitelisting AVS providers compliant with Ethereum principles.

- Restaking Service

Puffer is built on Eigenlayer, and all Puffer nodes can become local restakers to increase their rewards. The scope of restaking includes important middleware such as bridges and oracles, as well as services such as data availability layers and L2 sequencers. Additionally, nodes supporting secure execution environments can participate in Puffer's unique AVS activities, such as privacy-preserving L2 and ZK-2FA. Puffer is committed to supporting AVS that have no adverse impact on Ethereum.

DVT (Distributed Validator Technology) in Puffer

The Puffer protocol is compatible with DVT. When combined with the Secure-Signer component, this combination provides optimal decentralized validation protection. Additionally, Puffer introduces an extension mechanism called DVT fractalization, which can only be achieved in a secure execution environment. Through DVT fractalization, the scale of the DVT cluster can be expanded beyond the standard DVT range, enabling larger-scale decentralized operations and reducing collateral requirements. This extension feature allows the Puffer protocol to flexibly adapt to different validation needs while maintaining high security and reliability, providing users with a better user experience.

- Burst Threshold

The burst threshold is set to ensure that the size of the Puffer pool remains within a reasonable range to maintain the decentralization of Ethereum. The threshold is set at 22% of the maximum capacity. Once the Puffer pool reaches 22% of the validator set, the minting of pufETH and the addition of nodes will be paused. This ensures that the Puffer pool never exceeds the dangerous consensus threshold of 33%, thereby protecting the stability of Ethereum.

2. Secure-Signer

• Definition and Principle

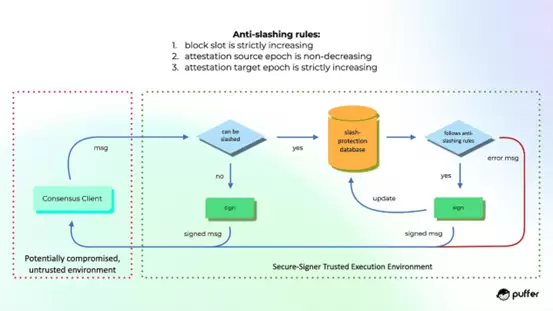

Puffer's Secure-Signer is a remote signing tool funded by the Ethereum Foundation, designed to prevent Slashing attacks using Intel SGX.

Secure-Signer is a remote signing tool introduced by Puffer, which utilizes Trusted Execution Environment (TEE) technology, currently implemented in the form of an Intel SGX enclave. To reduce single points of failure, Puffer plans to implement Secure-Signer on devices from different vendors, including AMD's SEV TEE and future new hardware.

The use of TEE can provide guarantees of confidentiality and integrity. In the SGX environment, an enclave is a protected memory area used to store code and data. This ensures that the code is not tampered with during execution and protects the encryption and security of the data. The physical hardware's characteristics also ensure that these properties are maintained. By combining these technologies, Secure-Signer can provide secure and reliable remote signing functionality.

• Operation Process

Secure-Signer is a remote signing tool that can manage validator keys on behalf of the consensus client. It can run locally on the consensus client or on a remote server. From the perspective of node operators, setting up their validators is almost indistinguishable. If they have hardware that supports SGX, they can install and run Secure-Signer and instruct their chosen consensus client to use Secure-Signer as the remote signer.

Preventing Slashing

To prevent potential double-signing attacks, Secure-Signer generates and protects all BLS validator keys in its encrypted and tamper-proof memory. These keys can only be accessed at runtime and remain encrypted in a static state unless used to sign unforgeable block proposals or proofs.

This binding and encryption method ensures that the keys are not used across multiple consensus clients, protecting nodes from accidental penalties due to double-signing. Additionally, even in the event of an attack, these keys are effectively protected.

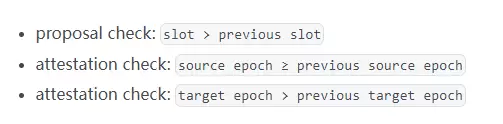

In addition to protecting validator keys, the secure signing program also maintains an integrity-protected database following EIP-3076 to store previous signature content. Through this database, the secure signing program can prevent double-signing attacks. When the consensus client passes blocks or proofs to Secure-Signer, all validator key signatures must meet specific requirements and assertions.

By eliminating the risk of penalties due to accidents or consensus client errors, Secure-Signer significantly reduces the risk for nodes and allows the Puffer Pool to safely lower staking requirements. This not only ensures that nodes can continue to operate in the event of an operating system intrusion but also protects nodes from the impact of catastrophic consensus client errors. This is because Secure-Signer operates in an independent environment and maintains its integrity-protected slash protection database.

Significance

Secure-Signer is a public good that reduces the risk of individual validators losing funds due to penalties by protecting validators using Trusted Execution Environment (TEE). Compared to Distributed Validator Technology (DVT), Secure-Signer provides a more cost-effective option to enhance validators' ability to resist penalties. Secure-Signer and DVT are complementary technologies, and using Secure-Signer can protect keys while at rest and provide stronger penalty protection at runtime, similar to the security of a cold wallet.

By using TEE to protect validators, Secure-Signer ensures the security of individual validator keys and reduces the risk of the entire validator set facing highly correlated penalty events. Therefore, Secure-Signer provides a secure and reliable way for the entire validator set to benefit from it.

3. RAVe (Remote Attestation Verification)

RAVe is the second component granted by the Ethereum Foundation to Puffer, representing Remote Attestation Verification. This important smart contract collection allows the secure environment to interact with the blockchain safely and helps the Puffer Pool achieve permissionless features. Through RAVe, entirely new application scenarios that were previously impossible to achieve can be realized.

Remote Attestation

Remote Attestation is a process that allows an untrusted party to prove that it is running in a specific SGX (Software Guard Extensions) isolated execution environment. SGX isolated execution environments only allow the execution of their initialized code, so remote attestation allows one party to prove to another that it can only run specific programs. When SGX is used in communication applications (such as Signal), remote attestation allows these applications to prove to user devices that they are running privacy-protecting software.

The goal of RAVe (Remote Attestation Verification) is to allow anyone to prove to a smart contract that they are running in an isolated execution environment. This is highly useful in the blockchain environment, as it can provide highly trusted, off-chain confidential computing. RAVe enables smart contracts to verify the running environment of participants, ensuring that it meets specific security requirements, thereby enhancing the protection mechanisms and computational privacy of the blockchain system.

RAVe v1

RAVe v1 uses remote attestation based on Enhanced Privacy ID (EPID) and interacts with Intel Attestation Service (IAS). At a high level, the isolated execution environment can submit 64 bytes of user data, including in its remote attestation report. The report also includes secure-related information about the device, as well as the MRENCLAVE and MRSIGNER fields. MRENCLAVE is the measurement of the isolated execution environment, uniquely identifying the program to be run, while MRSIGNER identifies the entity that built the isolated execution environment.

After successful remote attestation verification, IAS returns the remote attestation evidence to the secured SGX device. The remote attestation evidence includes the remote attestation report, IAS-signed remote attestation report, IAS root CA certificate, and x.509 signing certificate used to sign the report. The RAVe smart contract verifies the origin of these reports and the validity of various report fields, then extracts the 64-byte payload.

RAVe in Puffer Pool

RAVe in the Puffer Pool is used to verify whether nodes are running Secure-Signer. The RAVe smart contract verifies the remote attestation evidence to allow nodes to enter the pool. When a validator key is generated, the Secure-Signer isolated execution environment commits its validator public key in the USERDATA field of the remote attestation report. RAVe verifies the remote attestation evidence of the node, extracts its validator public key, and registers it on the blockchain. This allows the node to prove to the pool that it is running the Secure-Signer isolated execution environment and generate a new validator key within it. Anyone can verify the fact that the Secure-Signer program never leaks keys by reviewing the source code.

RAVe in Restaking

In restaking, zero-knowledge proofs (ZKPs) can be used to prove the correct execution of a program. However, isolated execution environments can prevent users from running anything other than the correct program. This is particularly attractive for middleware on Eigenlayer, especially considering that isolated execution environments have lower overhead compared to ZKPs. By using isolated execution environments and RAVe, the issue of "potential restaking" can be addressed.

3.4 Industry Space and Potential

3.4.1 Background and Classification

The LSD (Liquid Staking) track refers to the mechanism of staking PoS tokens in a staking pool and simultaneously receiving liquidity proof assets representing these staked tokens. On Ethereum, the "three major narratives" formed a complete ecosystem around the liquidity staking.

The first narrative is LS protocols and LSD. They provide liquidity staking services and create liquidity and returns for staked assets through LSD. Current mainstream protocols include Lido's stETH/wstETH, Frax's sfrxETH, Rocket's rETH, Swell's swETH, and others.

The second narrative is the LSD application scenario LSDFi. LSD is a strong consensus interest-bearing asset with programmable, composable, and free-flowing characteristics that can be applied to various DeFi scenarios, meeting investors' different needs for capital liquidity, capital efficiency, return strategies, and risk management, thus forming various LSDFi business forms. For example, in Pendle, depositing stETH can earn PT (principal token) and YT (yield token), providing different returns and risk strategies.

The third narrative is decentralized solutions. There are currently two mainstream decentralized solutions aimed at ensuring the security and decentralization of blockchain networks. One is DVT technology, with related implementation protocols such as SSV.Network, Obol Labs, and others. The other is Re-staking, such as EigenLayer. These solutions are mainly aimed at addressing the "centralization" trend and risks brought about by the rapid development of liquidity staking protocols.

The development of the LSD track has formed a preliminary pattern. If classified hierarchically, service providers such as SSV Network, Obol Labs, and others using DVT technology can be considered as L0. LST (Liquid Staking Token) issuers such as Lido, Ankr, Coinbase, and others can be considered as L1. These L1 projects allow users to earn POS rewards through a commission model and occupy the vast majority of the market share, with Lido holding 74.45% of the liquidity staking share. Additionally, there are other LST issuers in the liquidity staking market, but their market share is relatively small.

Furthermore, Ethereum's PoS mechanism requires 32 ETH to become a validator, raising the barrier to entry for validators compared to the previous PoW mechanism and reducing the likelihood of a centralized entity acquiring more than two-thirds of the validator set. This also helps reduce Ethereum's energy footprint.

The PoS mechanism incentivizes validators to participate through consensus and execution rewards and implements penalties to ensure that validators perform their tasks honestly and diligently. These mechanisms will also be important factors in the development of the LSD track in the liquidity staking field.

Additionally, updates and upgrades to Ethereum's PoS mechanism, such as the Shanghai/Capella update, will further enhance validator liquidity and improve user experience. Validators can now fully withdraw their ETH when needed, and POS rewards over 32 ETH will no longer be paid in a lump sum but in batches approximately every week to the execution layer address. This will improve liquidity and make liquidity staking more flexible and efficient.

Based on the given classification, the Ethereum LSD track can be divided into the following categories, with each category explained in detail:

1) Liquid Staking: This category refers to staking Ethereum tokens and using the staked tokens to conduct transactions and provide liquidity through the issuance of liquid proof-of-stake tokens.

2) Unidentified: This category refers to stakers who have not been clearly defined or classified. This may be due to a lack of data or an inability to determine which clearly defined category they belong to.

3) Centralized Exchanges (CEX): This category refers to users staking on centralized exchanges. These exchanges typically offer staking services, allowing users to stake their Ethereum tokens in the exchange's wallet without having to operate the staking process themselves.

4) Staking Pools: This category refers to staking pools where multiple stakers collectively participate. Stakers deposit their Ethereum tokens into the staking pool to pool resources for staking, increasing the opportunity to earn staking rewards.

5) Independent Stakers: This category refers to individuals or entities that choose to stake independently. Independent stakers manage and operate their staked tokens on their own and directly participate in the Ethereum network's consensus process.

6) Others: This category refers to stakers who cannot be classified into the above categories, possibly due to special circumstances or uncommon staking methods.

3.4.2 Market Size

- Overall Situation

According to current data, the total staked amount of Ethereum in the entire blockchain market has reached approximately 26.44 million Ethereum, accounting for 22% of the total supply. These staked Ethereum tokens are distributed among 826,000 stakers and 137,600 staking addresses. In the current market dominated by liquid staking, the market share of liquid staking is 36.73%, with staking through Lido occupying 32.39% of the market share. Therefore, it can be seen that Lido is the current leader in the LSD track.

- Specific Data

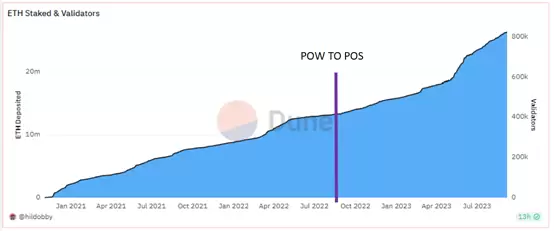

From the chart of Ethereum staking and validators, it can be observed that the staked amount of Ethereum has been continuously increasing since Ethereum transitioned to the Proof of Stake consensus mechanism in October 2022. Especially starting from April 2023, possibly influenced by the Ethereum Shanghai upgrade, the staked amount has shown a sharp upward trend. As of now, the staked amount has increased from approximately 400,000 ETH in August 2022 to around 800,000 ETH, nearly doubling. This indicates that Ethereum's Proof of Stake mechanism is attracting more users to participate in staking, gradually improving the network's security and decentralization.

According to DefiLama's data as of September 7, 2023, the Total Value Locked (TVL) of Liquid Staking has reached $20.076 billion. In this track, the number of Liquid Staking protocols is approximately 117. In comparison, in the Lending field, there are 296 protocols, but the TVL is only $13.332 billion, ranking second. In the Dexes field, there are 993 protocols, but the TVL is only $11.967 billion, ranking third. These data reflect the significant leading position of Liquid Staking in terms of TVL in the LSD track.

3.5 Business Data

• Operational Data

As the project is currently awaiting the launch of the testnet, there are no available operational data at the moment.

• Technical Data

Contributors

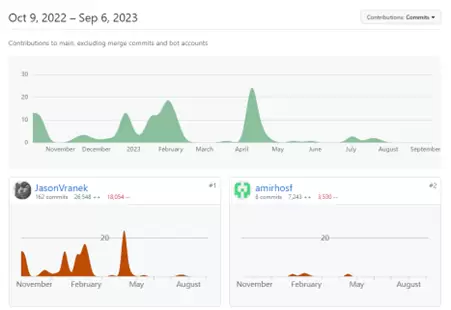

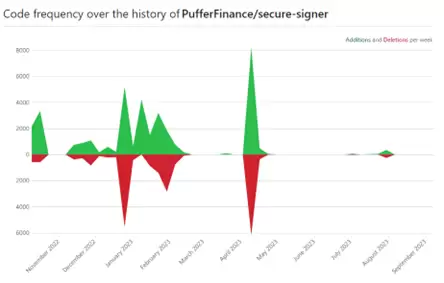

Since October 2022, the number of code contributors to the project on GitHub has gradually increased from the initial few dozen to a peak of 22 contributors. However, starting from May 2023, the number of contributors has remained at a low level, staying below 5, and the project's activity has decreased.

Commit

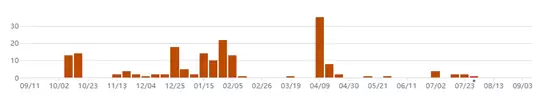

The project's code commit frequency shows instability. From November 2022 to June 2023, there were almost no code commit records. However, during the beginning of 2023 and in May 2023, the code commits reached their peak, with the number of commits on the highest peak day exceeding 8,000. The average number of code commits at the beginning of the year was around 4,000. Additionally, the frequency of code commits is similar to the level of involvement of project contributors.

• Social Media Data:

Twitter Data: 4949 members

Discord Data: 2517 members, 294 online

3.6 Project Competitive Landscape

3.6.1 Project Introduction

- Lido

Lido is a leading liquid staking solution that provides users holding digital assets with a simple way to stake and earn rewards. By staking with Lido, users can maintain the liquidity of their tokens and use them in various DeFi applications to earn additional rewards.

Lido manages secure and stable infrastructure to operate validator clients, ensuring the security of protocol users' funds and the correctness of validator operations. With Lido staking, users do not need to own 32 Ethereum tokens, but all their staked Ethereum assets still remain liquid and can be traded at any time. Additionally, the benefits of Lido are not limited to Ethereum; users can also enjoy similar benefits through PoS chains such as Kusama, Polygon, and Solana.

- Rocketpool

Rocket Pool is an Ethereum Proof of Stake protocol designed to achieve community ownership, decentralization, and trustlessness, compatible with Ethereum's Proof of Stake. The project was conceived in 2016 and launched in October 2021.

Considering that most players lack the technical ability to run nodes or do not have enough funds to own 32 ETH, Rocket Pool aims to meet the needs of two main user groups. Firstly, it provides a low-threshold tokenized staking solution, allowing users with as little as 0.01 ETH to participate in staking. Secondly, it offers an opportunity for users who want to stake ETH and run nodes to earn higher investment returns than traditional staking by earning commissions. The core idea of the protocol is to ensure that the network is not controlled by any single party, aligning with the core principles of Ethereum and ETH.

3.6.2 Project Comparison

1) Target Users

Lido: Targeted at users who want to delegate their digital assets to professional node operators for validation to earn stable returns.

Rocket Pool: Targeted at users who want to become Ethereum validators but are unable to run nodes independently due to technical or financial limitations.

Puffer: Targeted at users who want to run nodes at home and earn returns.

2) Minimum Staking Amount

Lido: No minimum staking amount; users can delegate any amount of digital assets to Lido nodes, with Lido charging a 10% protocol fee.

Rocket Pool: Minimum staking amount is 0.01 ETH, with Rocketpool charging a 15% protocol fee.

Puffer: Minimum staking amount is 2 ETH, with a 2.5% protocol fee.

3) Number of Nodes

Lido: Lido has a single set of nodes operated by professional node operators.

Rocket Pool: Rocket Pool consists of multiple nodes operated by different node operators.

Puffer: Puffer consists of multiple nodes operated by different node operators.

4) Node Rewards

Lido: Lido node rewards are paid in the form of ETH and LDO tokens.

Rocket Pool: Rocket Pool node rewards are paid in the form of ETH and rETH tokens.

Puffer: Puffer node rewards are paid in the form of ETH and PUFF tokens.

5) Node Security

Lido: Lido nodes use multi-signature technology and decentralized storage to ensure security.

Rocket Pool: Rocket Pool nodes use smart contracts and decentralized storage to ensure security.

Puffer: Puffer nodes use TEE environment and decentralized storage (DVT) to ensure security.

6) Revenue Distribution

Lido: Lido uses a portion of node rewards to buy back and burn LDO tokens to reduce supply and increase token value. Another portion is used to pay node operators and DAO financial expenses.

Rocket Pool: Rocket Pool uses a portion of the node rewards to buy back and burn rETH tokens to reduce the supply and increase the token value. Another portion is used to pay node operators and the Rocket Pool Foundation's financial expenses.

Puffer: Puffer uses a portion of the node rewards to buy back and burn PUFF tokens to reduce the supply and increase the token value. Another portion is used to pay node operators and DAO financial expenses.

7) Governance

Lido: Lido uses a DAO for governance, where the DAO holds LDO tokens and represents the community in voting for the selection of node operators and changes to protocol parameters.

Rocket Pool: Rocket Pool uses a DAO for governance, where the DAO holds RPL tokens and represents the community in voting for the selection of node operators and changes to protocol parameters.

Puffer: Puffer uses a DAO for governance, where the DAO holds PUFF tokens and represents the community in voting for the selection of node operators and changes to protocol parameters.

8) Token Types

Lido: Lido uses ERC20 LDO tokens.

Rocket Pool: Rocket Pool uses ERC20 RPL tokens and ERC20 rETH tokens.

Puffer: Puffer uses ERC20 PUFF tokens.

9) Comparison of Decentralization Mechanisms with Traditional LSD Track

- Ethereum Staking:

- Requires depositing 32 ETH to activate one's Validator node.

- Requires maintaining the node's normal operation to ensure the chain's security and correct block production.

- In return, new ETH is released to the stakers.

- SaaS Service Staking:

- Requires owning 32 ETH.

- Delegates a third party to handle DevOps work, while the staker holds the withdraw key.

- Risks of the delegate misusing the validator key and trust in their technical capabilities.

- Centralized Exchange Delegated Staking:

- The simplest way, with no capital restrictions.

- Staking funds are subject to opacity and exchange risks.

The common problem with traditional staking methods is the lack of liquidity for the staked funds. However, through LSD (Liquidity and Staking Derivatives), a derivative, this problem can be solved. Through liquid staking, the staked ETH can circulate in the form of another token (such as sd tokens or LST), allowing for earnings in the DeFi space. The role of LSD providers is to help stakers overcome the barriers of capital, technology, and maintenance, and issue LSD tokens, enabling stakers to gain liquidity and earn more in DeFi.

The Ethereum staking industry is becoming increasingly centralized, and low-profit operations of running nodes are most easily filled by institutions. This sets up barriers to entry for individual stakers who may not have the funds or technical expertise to participate in staking. In comparison to traditional LSD staking methods, Puffer achieves lower entry barriers and decentralization through reducing the collateral requirement and providing re-staking services.

Puffer addresses this issue by lowering the collateral requirement to only 2 ETH, which is much lower than the collateral requirements of other staking solutions. This means that more people can participate in staking and help secure the Ethereum network, even if they do not have a large amount of funds to invest. By lowering the entry barrier, Puffer can increase the number of nodes on the network, thereby contributing to increased decentralization.

Compared to Lido and Rocket Pool, Puffer's entry barrier is not significantly reduced. While Puffer's collateral requirement is indeed lowered to 2 ETH, Lido and Rocket Pool also have relatively low collateral requirements, at 0.01 ETH each. In addition to the low collateral requirement, Puffer also provides re-staking services, allowing individual stakers to pool their resources and form DVT clusters. This helps to distribute staking rights more evenly and reduce centralization risks. By pooling resources, stakeholders can also increase their chances of being selected as validators, which is important as validators are responsible for validating transactions and maintaining network security.

However, Puffer's approach to lowering entry barriers is not solely focused on reducing collateral requirements. Puffer also provides re-staking services, allowing individual stakers to pool their resources and form DVT clusters, which helps to distribute staking rights more evenly and reduce centralization risks. By pooling resources, stakeholders can also increase their chances of being selected as validators, which is important as validators are responsible for validating transactions and maintaining network security.

Additionally, Puffer's use of the penalty-proof TEE environment and Secure-Signer tool helps to reduce the risk of penalties, which are imposed on validators for malicious behavior or failure to fulfill their duties. This helps to enhance the confidence of individual stakers, as they may hesitate to participate in staking due to the risk of losing funds.

Overall, Puffer's approach to lowering entry barriers focuses on making it easier for individual stakers to participate in staking and form DVT clusters. By doing so, Puffer can distribute staking rights more evenly and reduce centralization risks. This contrasts sharply with traditional LSD staking methods, which often require a large amount of funds and technical expertise to participate in staking.

Overall, Lido, Rocket Pool, and Puffer are all designed to increase the decentralization of Ethereum, but they differ in their target users, number of nodes, minimum staking amounts, node rewards, node security, revenue distribution, governance, and token types. Users can choose the platform that best suits their needs and preferences.

3.7 Token Model Analysis

- Total Token Supply and Distribution

According to the official statement, tokens have not been issued yet, and the project is waiting for the testnet to go live. At the same time, the project team is actively building the token model.

Based on the information available on the official website, although the token model is still under construction, initial information about the tokens can be found: Puffer Protocol has two types of tokens: pufETH and PUFI.

- pufETH (Staking Certificate):

- pufETH can be minted by depositing ETH through the PufferPool contract.

- The exchange rate of pufETH to ETH is determined by the rewards generated by the protocol, and as the rewards accumulate, the value of pufETH may exceed that of ETH.

- Holders of pufETH can gradually earn staking and re-staking rewards and still participate in DeFi activities.

- pufETH can be used in other DeFi protocols, including for providing liquidity and participating in mining activities to achieve compounding returns.

- PUFI (Governance Token):

- PUFI is used for protocol governance and decision-making, and can be used to pause and upgrade contracts to address vulnerabilities and Ethereum hard forks.

- Holders of PUFI can vote on protocol parameters, such as the commission rate.

- PUFI is used to manage the financial fund of the Puffer protocol, including grants.

- PUFI can be used to whitelist AVS that align with Ethereum's principles.

In summary, pufETH is a staking certificate, allowing holders to earn rewards through staking and re-staking, and achieve compounding returns in other DeFi protocols. PUFI is a governance token, allowing holders to participate in protocol governance decisions and manage the financial fund.

4. Preliminary Valuation Analysis

4.1 Core Issues

Does the project have reliable competitive advantages? Where do these competitive advantages come from?

Puffer's competitive advantage comes from its unique liquid staking protocol approach. Puffer operates based on principles of improving capital efficiency, increasing economic opportunities, and maintaining decentralization within a broader group of validators. To achieve these principles, Puffer has implemented several key features.

1) Lowering the collateral requirement to 2 ETH, allowing individual validators to participate in staking and earn rewards without needing to invest a large amount of funds, improving capital efficiency and making participation more accessible to a broader audience.

2) Puffer uses penalty-proof TEE (Trusted Execution Environment) and Secure-Signer to ensure peak hardware efficiency and reduce risks. By reducing penalty risks, Puffer can provide users with a safer and more reliable staking experience.

3) Puffer provides a unique re-staking service, allowing node operators to run web3 infrastructure and services. This provides additional economic opportunities for home validators and helps to increase the overall economic potential of the Ethereum ecosystem.

Overall, these features make Puffer an attractive choice for home validators and help to reduce centralization risks within the Ethereum ecosystem by improving capital efficiency, providing additional economic opportunities, and maintaining decentralization.

What are the main variable factors in the project's operations? Are these factors easy to quantify and measure?

The main variable factors in Puffer's project operations include the number of nodes, node security, protocol fee revenue, and more. These factors will impact the operation and development of Puffer, and therefore need to be monitored and analyzed.

1) The number of nodes is a key factor in Puffer's operations. The more nodes there are, the higher the decentralization of Puffer, and the better the security and reliability. Additionally, an increase in the number of nodes can also enhance Puffer's revenue and the demand for PUFF tokens, thereby increasing the token price. Therefore, Puffer needs to closely monitor changes in the number of nodes and take measures to attract more nodes to participate.

2) Node security is also an important factor in Puffer's operations. Puffer uses TEE technology to protect node security, but there are still some risks, such as hardware failures and network attacks. Therefore, Puffer needs to continuously improve security and take measures to protect node security.

3) Protocol fee revenue is another important factor in Puffer's operations. Protocol fees are another operational variable for managing the staking process. These rates determine the amount of rewards allocated to validators and are set by the community through a voting process. This variable is also easily quantifiable and measurable, as it is a fixed percentage set by the community.

Therefore, Puffer needs to take a comprehensive approach to monitor and analyze these variable factors, including regular data analysis, market research, and user feedback. Additionally, Puffer needs to be flexible in adjusting strategies and measures to adapt to the constantly changing market and technological environment.

4.2 Major Risks

1) Technical Compatibility Risk:

Puffer Protocol Compatibility Risks:

The Puffer protocol is compatible with DVT technology, but using DVT technology may lead to a decrease in system efficiency, thereby reducing block production opportunities, especially as the node scale expands. This compatibility risk may have a negative impact on the earnings of node operators.

2) Ethereum 2.0 Upgrade Risk:

According to the Puffer whitepaper, one of the major risks the project faces is the incompatibility with the Ethereum 2.0 upgrade. Puffer relies on Ethereum 2.0 as the foundation for validator nodes, and if the upgrade to Ethereum 2.0 results in Puffer being unable to operate normally, it could have a negative impact on the stability and sustainability of the project. Close attention must be paid to the progress of the Ethereum 2.0 upgrade to mitigate this risk.

3) Development Stage and Testnet Launch Risks:

The Puffer protocol is currently in its early stages, and its testnet has not yet gone live. This means that the functionality and security of the protocol have not been fully validated. During the early development stages, the project may face unknown technical and security challenges, which could potentially impact its long-term success.

5. References

- https://www.Puffer.fi/ - Puffer Official Website

- https://twitter.com/Puffer_finance - Official Twitter

- https://github.com/PufferFinance - Official Github

- https://dune.com/jackjin/LSD - Dune Data Dashboard

- https://defillama.com/ - Defillama Data Dashboard

- https://medium.com/@Puffer.fi - Puffer Medium

- https://Lido.fi/ - Lido Official Website

- https://rocketpool.net/ - Rocket Pool Official Website

- https://www.bitget.com/zh-CN/news/detail/12560603799731 - Three Major Narratives Leading the Ethereum LSD Track

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。