By purchasing the Huobi Shark Fin product, investors can enjoy the basic annualized return while pursuing higher floating returns, allowing the principal to be unaffected by market fluctuations.

According to the official announcement from Huobi HTX, the new Huobi Finance product - Shark Fin - will be open for subscription on September 14th at 20:00 (UTC+8).

It is reported that the expected return range for this period is 8% to 38%, with a limited-time subsidy from the platform. The basic return is 8% (the actual yield will fluctuate with the actual market conditions, subject to the actual yield generated by the product).

All Huobi HTX platform users can subscribe through the main account on the "Huobi Finance" -> "Shark Fin" page during the subscription period.

So what exactly is the magical product Shark Fin? This article will provide a detailed breakdown.

What is Shark Fin? Pros and cons of Shark Fin

Shark Fin is a structured product, and Shark Fin options, also known as knock-out options, have trigger conditions for contract failure or effectiveness, known as the knock-out price and knock-in price.

Simply put, for example, if BTC is at a low point and we speculate that it is likely to rise significantly in the future, we can buy a bullish product. Shark Fin is divided into two types: "Shark Fin Bullish" and "Shark Fin Bearish."

By purchasing Shark Fin products, investors not only have the opportunity to achieve the highest returns, but even if the purchased direction is incorrect, there is still a basic return. Its return curve resembles the shape of a shark fin on the water's surface, which is why these products are vividly called "Shark Fin."

Profit principle of Shark Fin:

If the price of the underlying currency does not exceed the price range during the product observation period, investors can achieve a higher yield.

Conversely, if it rises above or falls below the price range, a certain basic yield rate will be obtained.

Advantages of Shark Fin:

Short term, relatively good liquidity.

The principal and basic return are guaranteed, and the yield rate is relatively high in the industry. The 8% annualized basic return is relatively higher than fixed income. Even if the purchased direction is incorrect, it does not waste too much time and cost.

The bearish structure provides a risk hedging tool, and users do not need to bear the risk, relying on platform risk control for reliable asset security.

One-click subscription, simple and convenient operation.

Disadvantages of Shark Fin:

High cognitive threshold, requiring judgment of short-term market direction, suitable for friends with some trading experience.

There will be a certain opportunity cost. The annualized return is relatively fixed. If the market is expected to be good in the short term, the contract yield will be higher, but it does not have a basic return, so it requires a significant psychological cost. Both have their pros and cons.

Each product is suitable for different market conditions. In different market conditions, it is necessary to dynamically adjust strategies to achieve long-term asset allocation and withstand market fluctuations, traversing bull and bear markets.

Huobi HTX Shark Fin product, a good product to traverse bull and bear markets

According to the official announcement from Huobi HTX, the structured product Shark Fin will be open for subscription on September 14th at 20:00 (UTC+8), including options for bullish BTC, bearish BTC, bullish ETH, and bearish ETH. The product cycle is 7 days, the investment currency is USDT, and the expected return range for this period is 8% to 38%, with a limited-time subsidy from the platform. The basic return is 8% (the yield rate will fluctuate with actual market conditions, subject to the actual yield generated by the product). On the maturity date (every Friday) around 18:00, the principal and returns will be transferred to the fund account.

The rules of Huobi HTX Shark Fin product follow the basic gameplay mentioned above:

Bullish Shark Fin

Scenario 1: The highest index price during the interest period is higher than the knock-out price.

If the highest index price is $34,000, because this price is higher than $33,000, your annualized yield is 6%.

Total return = 1,000 × 6% × 7/365 = 1.150 USDT.

Scenario 2: During the interest period, the index price at any time is lower than or equal to the knock-out price, and the index price at settlement is within the price range.

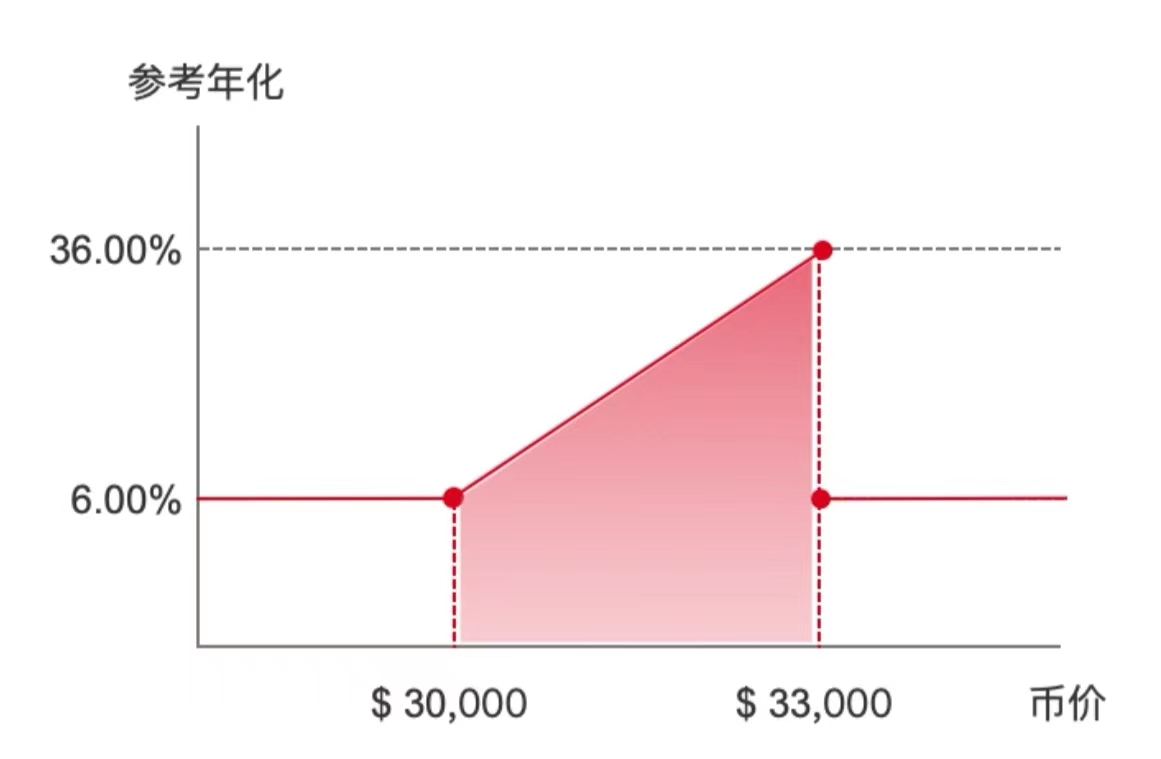

If at any time before settlement, the index price is consistently lower than $33,000, and the index price at settlement is $31,000, because it is between $30,000 and $33,000, your annualized yield is 16%.

Annualized yield = 6% + (31,000-30,000)/(33,000-30,000) × (36%-6%) = 16%.

Total return = 1,000 × 16% × 7/365 = 3.068 USDT.

Scenario 3: During the interest period, the index price at any time is lower than or equal to the knock-out price, and the index price at settlement is lower than the price range.

If at any time before settlement, the index price is consistently lower than $33,000, and the index price at settlement is $29,000, because this price is lower than $30,000, your annualized yield is 6%.

Total return = 1,000 × 6% × 7/365 = 1.150 USDT.

Bearish Shark Fin

Scenario 1: The lowest index price during the interest period is lower than the knock-out price.

If the lowest index price is $29,000, because this price is lower than $30,000, your annualized yield is 6%.

Total return = 1,000 × 6% × 7/365 = 1.150 USDT.

Scenario 2: During the interest period, the index price at any time is higher than or equal to the knock-out price, and the index price at settlement is within the price range.

If at any time before settlement, the index price is consistently higher than $30,000, and the index price at settlement is $31,000, because it is between $30,000 and $33,000, your annualized yield is 26%.

Annualized yield = 36% - (31,000-30,000)/(33,000-30,000) × (36%-6%) = 26%.

Total return = 1,000 × 26% × 7/365 = 4.986 USDT.

Scenario 3: During the interest period, the index price at any time is higher than or equal to the knock-out price, and the index price at settlement is higher than the price range.

If at any time before settlement, the index price is consistently higher than $30,000, and the index price at settlement is $34,000, because this price is higher than $33,000, your annualized yield is 6%.

Total return = 1,000 × 6% × 7/365 = 1.150 USDT.

Regardless of market fluctuations, Shark Fin can provide USDT returns for users. The principal is fully guaranteed and unaffected. During the product interest period, if the index price at any time and at settlement falls within the expected price range, a higher annualized yield can be enjoyed. If the index price exceeds the knock-out price at any time, the user will receive a certain basic return.

The subscription opening time for Huobi HTX Shark Fin products is from Thursday 20:00 to Friday 20:00 (UTC+8) every week, and all Huobi HTX platform users can subscribe through the main account during the subscription period. By purchasing Huobi HTX Shark Fin products, investors can enjoy the basic annualized return while pursuing higher floating returns, allowing the principal to be unaffected by market fluctuations.

Basic return + super high return? Is Huobi HTX Shark Fin worth buying?

Huobi HTX Shark Fin products are very eye-catching, but whether they are worth buying needs to be analyzed based on returns and risks.

Firstly, the expected maximum annualized return can reach 38%. It is important to note that the return rate of traditional financial management is far lower than that of digital assets. Many bank financial products have dropped to below 5%. Among digital asset financial products, Shark Fin is undoubtedly outstanding, offering an opportunity to achieve a return as high as 38%.

Secondly, the cost of trial and error is low, and at least the principal is guaranteed, with a minimum return of 8% and low risk. It is important to note that there is a high possibility of losing the principal when trading contracts.

This type of financial product with a large return range, enjoying a basic return and having a super high return, is not unique to Huobi. Many other exchanges also issue similar products, but the specific rules may vary and need to be carefully discerned to choose the product that suits oneself.

As a new type of financial product, "Shark Fin" has a complex structure and is not suitable for everyone.

It is mainly suitable for those with a certain amount of financial capital, risk tolerance, basic market judgment, but are not yet ready to enter the market directly. In other words, it is for those who want to achieve high returns but are afraid of losing money. It is suitable for markets with relatively small fluctuations and is suitable for conservative investors or financial enthusiasts with a preference for low risk.

Purchasing Shark Fin allows you to enter the market, experience market gains and losses firsthand, and participate in obtaining partial returns. However, you may not earn as much as contract players, but you will also lose less than contract players. For interested friends, if you have some coins that are not urgently needed, it is worth trying.

As a stable virtual asset allocation tool, Huobi Finance has professional experience in virtual asset custody and a variety of products that are highly praised by users, meeting various financial needs. It is reported that during the initial launch of Huobi Shark Fin products, the platform will offer limited-time subsidies, which is worth paying attention to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。