Written by: Lao Bai, Partner of ABCDE Capital Research

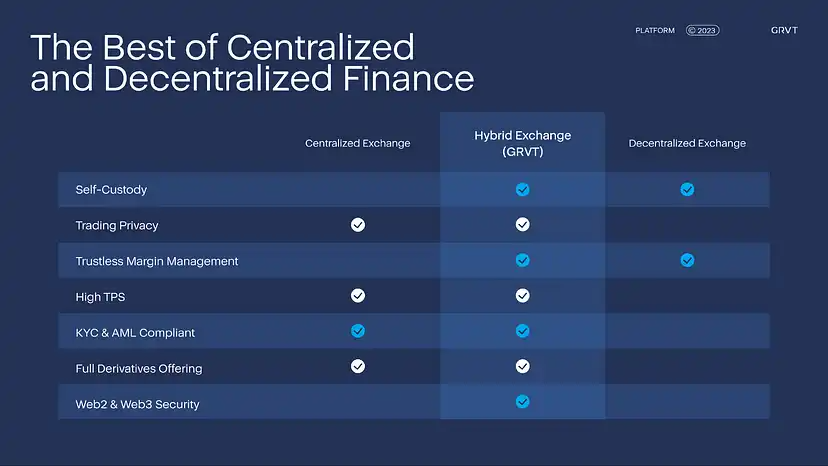

GRVT (Gravity) is a hybrid on-chain trading platform—Hybrid Exchange (Hex), combining the user experience of Cex with the fund security of Dex. Gravity will become the leading derivative trading protocol on zkSync, alongside gmx on Arbitrum and Dydx, which originated from Starkex, and will be launched on the testnet in Q4.

ABCDE has invested in Gravity in the seed round, and other participating institutions in this round include Weixing China, Delphi Digital, C² Ventures, and other institutions.

I. The Way Out for On-Chain Derivatives

In the era of EtherDelta in 2017, spot trading on-chain was "awkward," despite waving the flag of decentralization and shouting the slogan "Not your Key, not your Asset." However, 99.9% of trades still occurred on centralized trading platforms.

Later, Uniswap emerged, revolutionizing the AMM paradigm. After several years of development, the proportion of Dex relative to Cex spot trading volume has climbed from less than 1% to 10%-20%, establishing the duopoly of Uniswap and Curve in the Dex field. For new Dex platforms to break through in the spot trading domain, perhaps only a new chain in the wilderness period still holds opportunities.

In the derivatives field, compared to the crowded spot trading, it is still in a transition period from a blue ocean to a red ocean. On-chain derivative trading accounts for only 1%-2% of centralized trading platforms, similar to the starting point of spot Dex during the DeFi Summer period. Although GMX and DYDX seem to occupy a duopoly similar to Uni+Curve, their dominance is incomparable, as evidenced by the lack of change in coin price and trading volume after the recent releases of GMX V2 and DYDX V4.

So, where is the direction for on-chain derivatives?

The fundamental reason why on-chain derivatives have always been popular but not successful lies in the inability to provide a differentiated experience from Cex. Uniswap initially relied on "permissionless cloning" (commonly known as "forking") and liquidity mining to start, while Curve established absolute advantages in stablecoin trading with ultra-low slippage, pools for assets like stETH, and innovative veToken. These are all services and experiences that Cex cannot provide. However, derivative Dex platforms can only provide futures or options services for mainstream or blue-chip assets due to the nature of derivatives, failing to truly differentiate from Cex. Under the premise that performance and liquidity experiences are inferior to Cex, ordinary users who are willing to switch from Cex to Dex are few and far between, except for Degen or whales who highly value security and financial autonomy.

In other words, users may come to the on-chain platform for functionalities not available on Cex, "coincidentally" embracing decentralization. However, they will not abandon the performance and experience of Cex just for the sake of "political correctness."

So, why not take a different approach? If, without sacrificing the performance and experience of Cex, your assets can be made more secure and autonomous through decentralized means, would users be enticed? Could this be the possible breakthrough for on-chain derivatives?

II. FTX's Scandal—An Opportune Moment for Assistance

Security issues are never truly valued—until the moment when security issues occur.

No one could have foreseen that FTX, the world's second-ranked cryptocurrency exchange platform, which may have the best overall trading experience, would collapse within a few days, causing significant losses for many users and institutions. The security issues of Cex have finally attracted the attention of users, and "Not your Key, Not your Asset" has once again sparked discussions.

This incident has also brought about a new paradigm in the derivatives field—Hybrid Exchange (Hex).

III. Hybrid Trading Platform—Gravity

Overall, as a hybrid trading platform, Gravity's positioning leans more towards Cex. However, compared to Cex, it has a core mechanism that sets it apart—Self Custody Trading, which refers to the previously mentioned fund self-custody. For Degen, they can easily trade using Metamask or Wallet Connect, similar to DYDX or GMX. For new users who are familiar with Cex but not active on-chain, Gravity will provide a user-friendly experience, such as email registration to generate an MPC Wallet similar to Web3Auth, eliminating the hassle of mnemonic phrases and private key management. This minimizes the entry barrier while ensuring the security of self-owned funds.

Compared to common Dex platforms like DYDX and GMX, Gravity's differentiation is significant, including the following main features:

Privacy in Trading—Current on-chain derivatives are essentially "transparent," but Gravity uses Validium technology to ensure that each user's trades are not visible to other users on-chain.

High-Performance Orderbook—A highly efficient off-chain CLOB order matching system, capable of achieving up to 600KTPS and a 2ms latency, essentially matching the trading experience of Cex.

User Portfolio Management—The system provides a series of user panels and management functions commonly seen on centralized derivative trading platforms, such as SPAN analysis, portfolio margining, and cross-market hedging.

Simultaneous Provision of Options and Futures—Usually, on-chain derivative options and futures are completely separate projects, but Gravity leans towards the style of Cex, simultaneously providing options and futures contract trading, creating an all-in-one platform for derivatives.

Embracing Regulation and Compliance—Strict KYC and AML (Anti-Money Laundering) support.

IV. Integration of Professional Finance and Web3 Experience Team

In addition to the product itself, the team and market positioning are also major factors in our decision to invest in Gravity.

The team consists of individuals with backgrounds in traditional "financial veterans" such as Goldman Sachs and DBS Bank, as well as Crypto "native OGs" from Bybit and OKX.

The team is deeply rooted in South Korea and has a strong understanding of the South Korean market, where trading enthusiasm is significantly higher than in other countries. The product initially radiates from the South Korean market, making the cold start relatively easier.

Gravity will be launched on Zk-Sync, which has recently been troubled by various "fork" projects and a lack of original projects, urgently needing an innovative high-quality project to revitalize the entire ecosystem. GMX achieved this with Arbitrum, and we see the potential for Gravity to lead the Zk-Sync ecosystem.

In the previous round of DeFi Summer, the focus was on spot trading, and on-chain derivative trading was essentially absent. In the next bull market, on-chain derivative trading, especially innovative hybrid trading platforms that combine the advantages of Cex and Dex, are bound to occupy a place.

The team will launch the testnet in Q4 of this year and the mainnet in Q1 of next year. We are very much looking forward to the hybrid trading experience brought by Gravity, taking over the baton from Dydx's departure from Starkex and becoming the "new Dydx" on Starkex, ushering in a new chapter for on-chain derivatives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。