Bumper represents a striking value proposition and a paradigm shift in DeFi risk management.

Written by: Ryan Allis

Translated by: Deep Tide TechFlow

In the complex world of decentralized finance (DeFi), risk management and yield optimization are crucial.

Traditional financial models such as the Black-Scholes equation are used for pricing options and managing risk, but the crypto space requires innovation, and Bumper is one of the pioneering participants in this evolution.

Bumper is a DeFi protocol that eliminates the downside volatility of crypto assets by combining an innovative spot pool risk model with a novel rebalancing mechanism, offering significant improvements over traditional Black-Scholes Option platforms.

The protocol is the culmination of a three-year research and development plan. It has received $20 million in early funding and collaborated with the Swiss Crypto Economics Center, known for its work on Synthetix, and was developed by the renowned developer Digital Mob, who has previously worked on protocols such as Barnbridge, Gnosis, and Filecoin.

Beyond Black-Scholes

The Black-Scholes model is the cornerstone of financial derivative pricing, relying on continuous-time mathematics and assuming constant volatility. While it is a valuable tool in traditional finance, applying it in the highly volatile and fragmented crypto market poses challenges.

Bumper takes an innovative approach by creating an efficient protection protocol through the combination of decentralized risk markets and a novel rebalancing mechanism. This new model is approximately 30% cheaper than put options on platforms like Deribit and provides liquidity providers with an annual yield of 3-18% in USDC.

Bumper Protocol: Protection and Yield

The Bumper protocol has two core functions: protection and yield. Here's how it works:

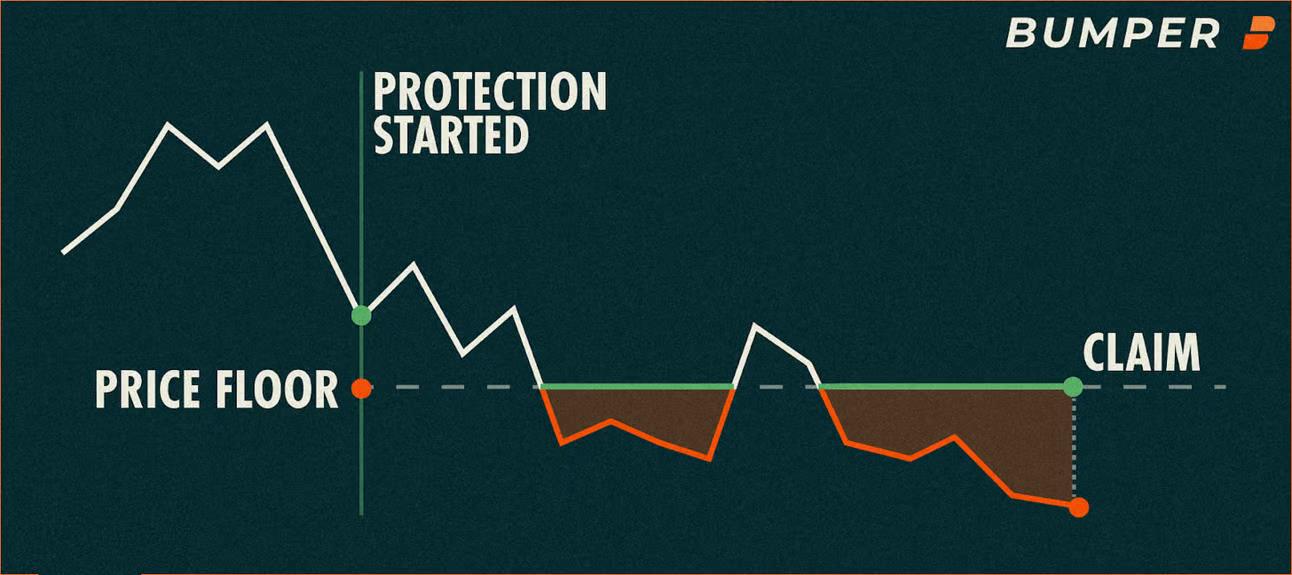

Protection (Takers): Users lock their crypto (initially ETH) in the protocol, choose the amount, floor price (similar to the strike price of an option), and term (30, 60, 90, 120, or 150 days). If the ETH price is below the floor price at contract expiration, users can receive stablecoins at the floor price. If not, they can retrieve the locked crypto. In either case, a dynamically calculated premium is paid, forming the basis of liquidity provider earnings.

Yield (Seekers of Yield): Liquidity providers commit to providing USDC, choose the term and risk level, and start earning income paid by the protection acceptors. These earnings are paid in USDC, constituting a sustainable source of income and dynamically calculated based on protocol health, market volatility, and the degree of price proximity to the floor price.

Simulated Data: A Validated Model

Bumper commissioned financial modeling scientists from the Swiss Crypto Economics Center and CADLabs to build an agent-based model. This provides the ability to simulate backtested price data with high fidelity, which is crucial for testing parameter configurations, achieving reliability, and experimenting with new protocol features.

Applications of Protection and Yield

For Venture Capital and Funds: Bumper's protection mechanism allows venture capitalists to hedge their crypto investments without facing the complexities of traditional options trading desks. The protocol's decentralized nature ensures transparency and accessibility.

For High Net Worth Individuals: Investors can use Bumper to protect their crypto assets while participating in yield optimization.

For Hedge Fund Managers: Bumper provides a unique opportunity to diversify risk management strategies through a decentralized platform and increase returns.

Incentives: Driving Adoption

To reward early adopters of the protocol, Bumper has launched a bootstrapping program offering incentives worth $250,000. These incentives will be allocated to users of protection and yield based on holding size, term length, and early or late participation time. Additionally, there are extra incentives of 200,000 BUMP tokens to encourage users of Deribit, Hegic, Opyn, Premia, Lyra, or Ribbon.

Summary: A New Era of DeFi Risk Management

Bumper represents a striking value proposition and a paradigm shift in DeFi risk management. By surpassing the limitations of traditional models like Black-Scholes, it provides a more tailored solution for the crypto space.

With its real-time protocol, token rewards, and attractive applications for venture capitalists, funds, and high net worth individuals, Bumper has the potential to redefine how investors protect and yield in the decentralized world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。