The purpose of the Livepeer token is to coordinate, guide, and incentivize participants to ensure that the Livepeer network is as cheap, efficient, secure, reliable, and useful as possible.

By Lisa, LD Capital

1. Project Introduction

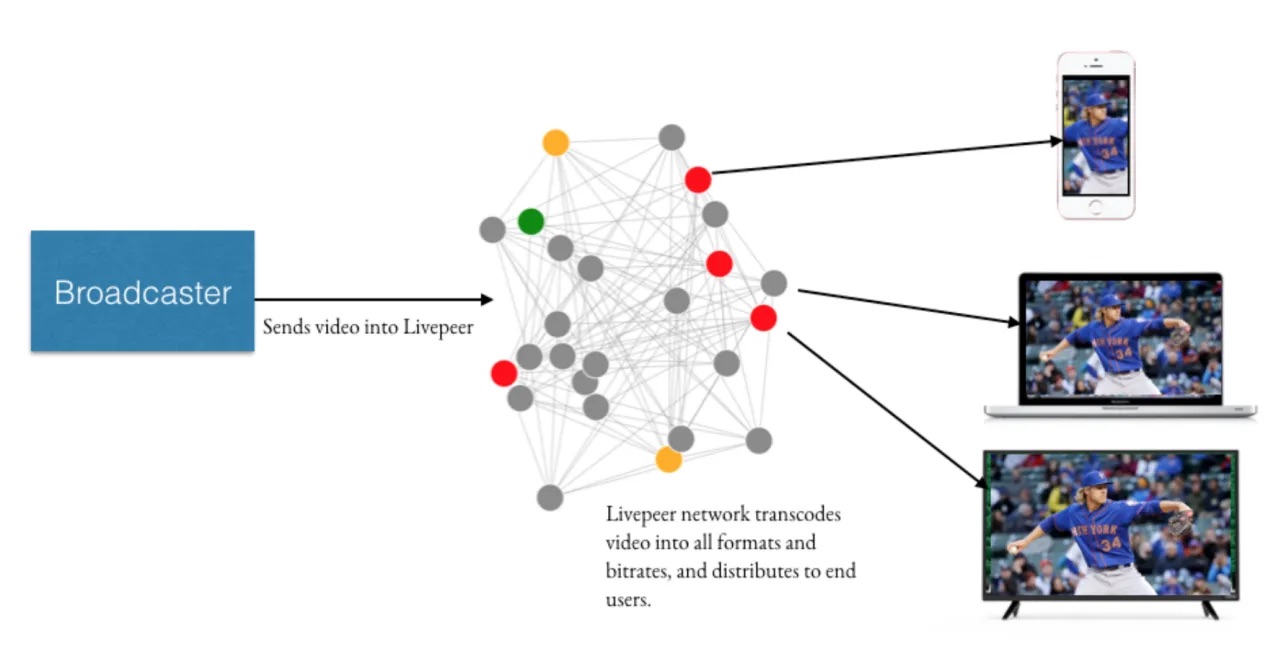

Livepeer is a decentralized video streaming network built on Ethereum. As a scalable platform-as-a-service, it provides a solution for the real-time media layer in the decentralized development stack for developers who want to add live or on-demand video to their projects. Livepeer can improve the reliability of centralized broadcast service video streams while reducing associated costs by as much as 50%. Currently, video streaming consumes 80% of all internet bandwidth, and companies distributing video on the internet need to transcode the video to ensure the best viewing experience regardless of bandwidth or device. Livepeer can significantly reduce these costs. The following example illustrates how Livepeer operates.

Alice is an application developer who is using Livepeer to add real-time video functionality to her high school sports event live streaming app. Bob, as the event coordinator, is responsible for live streaming his high school's basketball game using Alice's app. When Bob opens the app and starts recording, the app sends the real-time video and live streaming fees to the Livepeer network, while Livepeer transcodes the video into a format that viewers can receive.

There are two main roles in the Livepeer network to ensure the quality of live streaming: Orchestrators and Delegators. Anyone can join the network and become an "Orchestrator" by running software that allows them to contribute their computer resources (CPU, GPU, and bandwidth) for transcoding and distributing videos in order to earn fees. To have the right to perform this work on the network, one must own Livepeer tokens, or LPT. The purpose of Livepeer tokens is to coordinate, guide, and incentivize participants to ensure that the Livepeer network is as cheap, efficient, secure, reliable, and useful as possible. Delegators are Livepeer token holders who participate in the network by "staking" tokens with Orchestrators. When broadcasting companies pay fees to the network, both Orchestrators and Delegators receive a portion of these fees as a reward for ensuring a high-quality and secure network.

2. Token Economic Model

The LPT token is in a fully circulating state, with a market value of 219 million USD, ranking 143rd.

In Livepeer, new tokens are minted in each round and allocated to Delegators and Orchestrators. Here, rounds are measured in Ethereum blocks, with one round equal to 5760 Ethereum blocks. The average block time in Ethereum is 14 seconds, meaning a round lasts approximately 22.4 hours. The current inflation rate of LPT is 0.03165%, with a total supply of 28,904,976.38 Livepeer tokens. The next round will reward a total of 9,264.04 newly minted Livepeer tokens, equivalent to approximately 70,000 USD. Based on the current inflation rate, the corresponding annualized inflation rate is approximately 12%.

The Livepeer inflation rate will automatically adjust based on the staking rate, which is currently 44.72%. Livepeer refers to this as the "participation rate." Livepeer assumes a healthy compromise target ratio of 50% between network security and token liquidity. When the participation rate is below this level, the inflation rate per round will increase by 0.00005%, and when the participation rate is above this level, the inflation rate per round will decrease by 0.00005%.

3. Financing Information

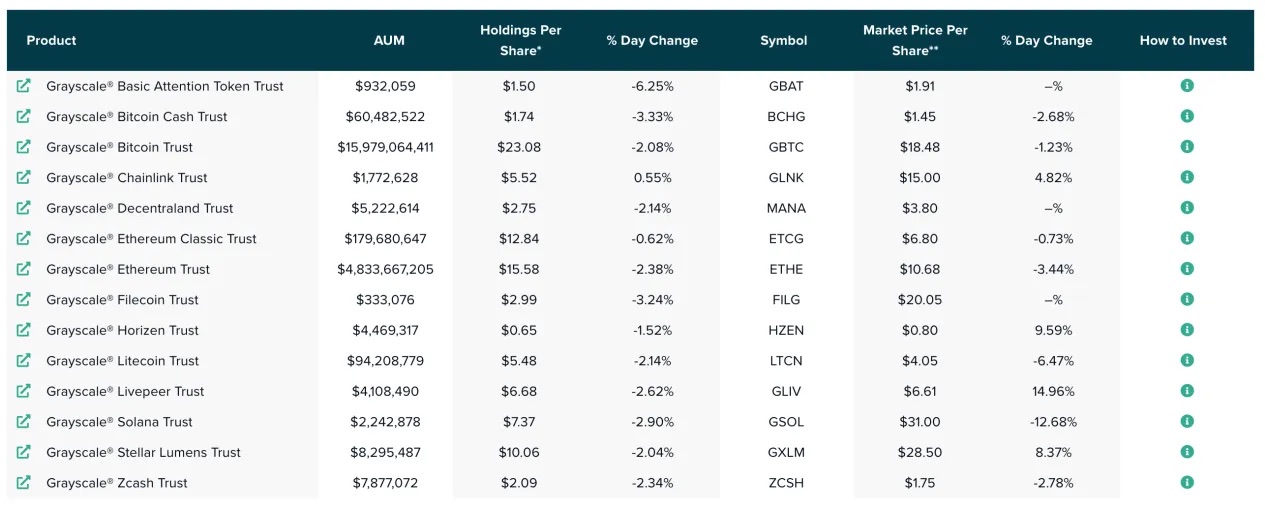

LPT is also one of the currencies held by Grayscale Funds. As of September 1st, Grayscale holds 4.108 million USD worth of LPT, ranking 10th among 14 currencies.

4. Price Performance

LPT was launched in 2018, with its highest price occurring in November 2021, and the current price has dropped by 92.3% from its peak.

The recent market trend began on August 7th this year, with LPT rising from 4.98 to 5.87 in a single day, a 43% increase. On August 13th, it reached a high of 9.26, doubling in a week. This morning at 9:30, it surged by 12%, but has not yet broken through the previous high. Although the price is attempting to challenge the $8 mark again, the contract holdings of LPT are relatively low since the start of this market trend, and the increase in holdings has not been significant alongside the price increase. The funding rate has now dropped to below -1%, with the long/short position ratio and the large account long/short ratio falling to 0.81 and 0.72, respectively.

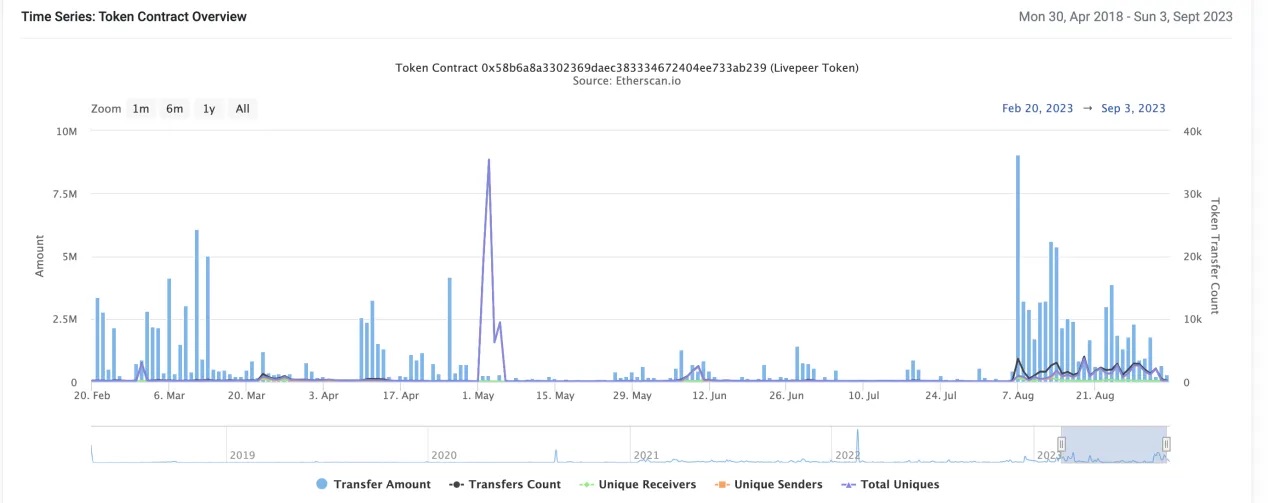

On the same day as the market started, large transfers were observed in on-chain data, and the frequency of on-chain transfers in August was significantly higher than in the previous period.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。