Author: Anastasia Melachrinos

Translation: Wu Shuo Blockchain

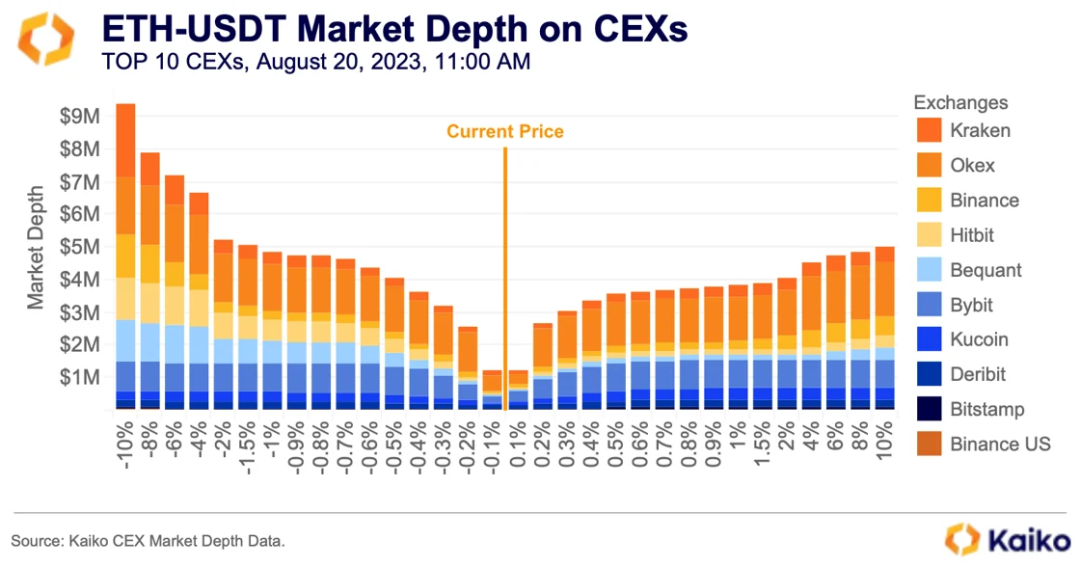

Market depth is a commonly used indicator to measure liquidity, usually calculated through the order book of cryptocurrency pairs on centralized exchanges (CEX). It provides the quantity of buy and sell orders at different distances from the mid-price, ranging from 0.1% to 10%.

The chart shows the cumulative ETH-USDT buy and sell volume at various levels on the top ten centralized exchanges. Each exchange's order book at each time point has its own liquidity characteristics, allowing traders to choose the most suitable platform based on their execution strategy.

In general, the greater the market depth, the higher the liquidity, making it easier to buy or sell assets near the expected price. It also helps traders better estimate the slippage that larger orders may produce. Greater market depth corresponds to lower slippage, meaning the market can accommodate larger trades without significantly changing market prices.

UniswapV3 Market Depth

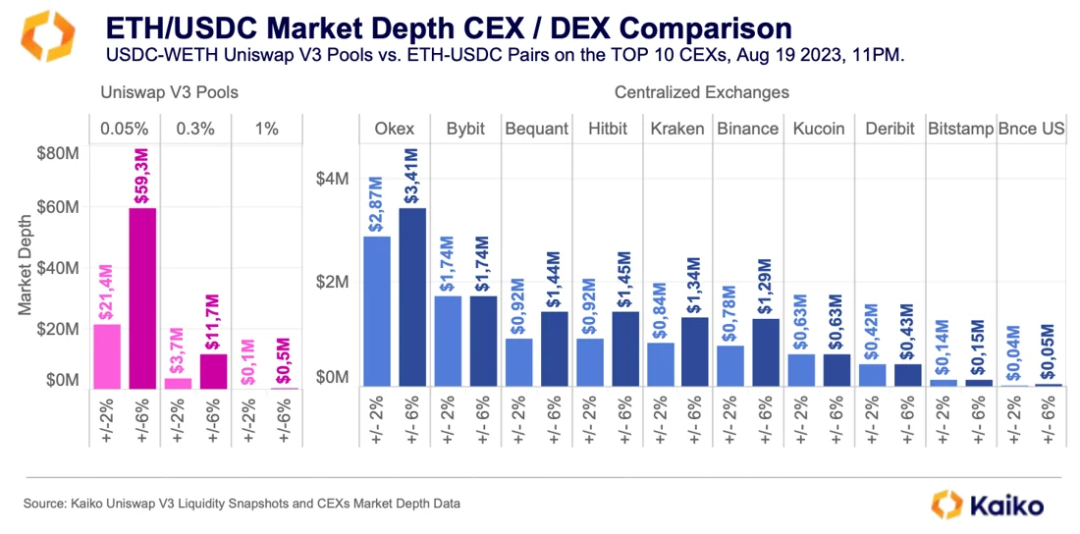

However, merely observing CEX liquidity is not enough; DEX accounts for a significant portion of trading volume for certain tokens. For example, on August 20th, Ethereum DEX accounted for 25% of the trading volume of USDC and over 80% of DAI. But comparing liquidity in the cryptocurrency market between DEX and CEX is quite complex due to the different price discovery mechanisms between them.

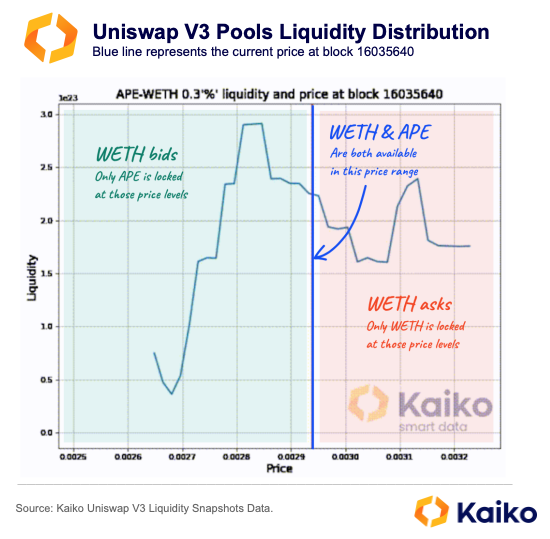

Most DEXs do not use order books but instead use automated market makers (AMM). AMM determines asset prices by evaluating the quantity of each asset in various liquidity pools at different price levels. These pools obtain tokens from liquidity providers (LPs), allowing traders to directly trade these assets. Although most AMM-based DEXs do not use order books, certain liquidity pools (such as Uniswap V3) heavily rely on what we call concentrated product AMM, which can be modeled as an order book because LPs hold tokens within certain price ranges. An example can be seen in the wETH-APE 0.3% fee pool below.

To ensure that all cryptocurrency markets have accessible and comparable liquidity data, Kaiko provides users with all the data and tools needed to compare market depth between CEX and DEX.

Taking a closer look at Uniswap V3 market depth: we calculate it for specific Uniswap V3 pools and blocks according to the α level (percentage of the current block price). Using Kaiko's Uniswap V3 liquidity snapshot data, we track liquidity, including the quantity of tokens available from liquidity providers within different price ranges that have been initialized. We then apply Uniswap V3's equation to find out how many tokens can be exchanged before the price changes by 1 + α. The range of α compared to the market price is from -/+0.1% to +20%.

Comparing UniswapV3 and CEX Market Depth

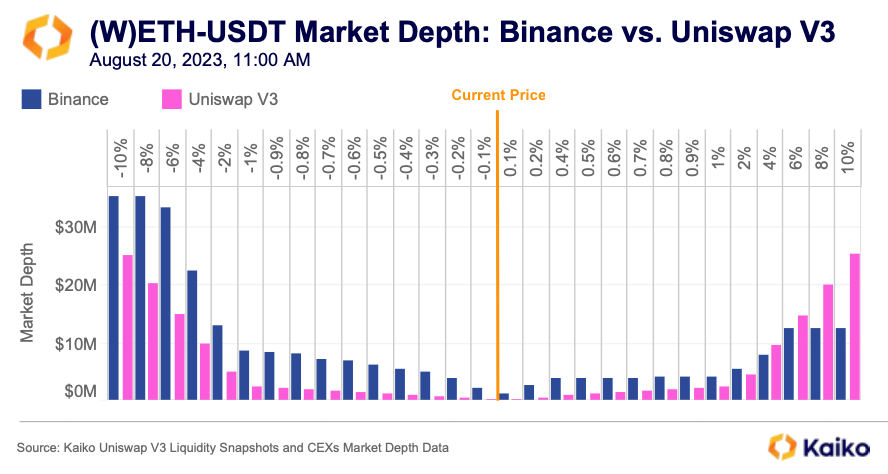

With this in mind, let's take a look at the market depth of one of the most liquid cryptocurrency pairs, (w)ETH-USDT, on Binance and Uniswap V3.

The liquidity of the Uniswap V3 wETH-USDT 0.3% fee pool is generally lower than that of Binance at most price levels, with Binance's liquidity being over four times that of Uniswap at certain price levels. However, Uniswap does have more liquidity at certain price levels further from the mid-price. It's worth noting that this is just one of Uniswap V3's wETH-USDT pools; there are two additional pools with different fee levels. When combining the liquidity of these pools, their liquidity near the mid-price is slightly lower than Binance's, but higher further from the mid-price.

Overall, the liquidity distribution of Uniswap V3 is surprisingly symmetrical, indicating that the liquidity is widely distributed enough to effectively capture most price movements.

Exchange Market Depth Breakdown

Although Uniswap V3 loses to Binance in the liquidity competition for the (w)ETH-USDT pair, it outperforms all major CEXs in the (w)ETH-(w)BTC market. For price ranges between 0% and 6%, the 0.3% and 0.05% fee pools for this pair provide 6 times and 3 times the liquidity, respectively.

Considering the popularity of wETH and wBTC as base and quote assets on Uniswap, these findings are not surprising. These markets provide efficient paths for trading; for example, exchanging wBTC for a niche coin is likely to be done through this pair. Therefore, the concentration of liquidity here is reasonable.

In total, there are over 13,000 liquidity pools on Uniswap V3, among which:

- Approximately 1,500 pools use wETH as a base or quote asset, accounting for about 11% of the total pools.

- Over 500 pools include USDC, accounting for about 4.50% of the total.

- Approximately 100 pools include wBTC, accounting for about 0.75% of the total pools.

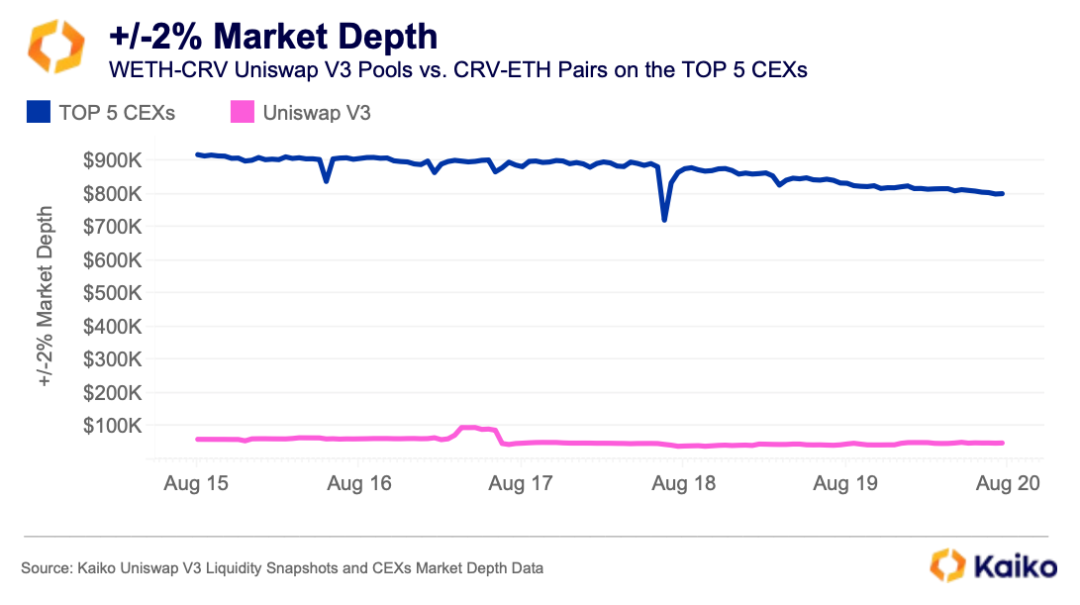

Surprisingly, for small tokens like CRV, the liquidity on Uniswap is lower compared to the top 5 most liquid CEXs offering the CRV-(w)ETH market.

Considering the challenges faced by the CRV token recently, it is expected that the liquidity of these markets will be limited. In March 2023, most CRV trading occurred on decentralized exchanges, especially during times of pressure. Uncertainty among CRV holders arose as the token was used as collateral by Curve's founders for loans on platforms like Aave. Subsequently, vulnerabilities in certain Curve pools exacerbated uncertainty, reducing the incentive for users to provide liquidity, potentially absorbing harmful liquidity.

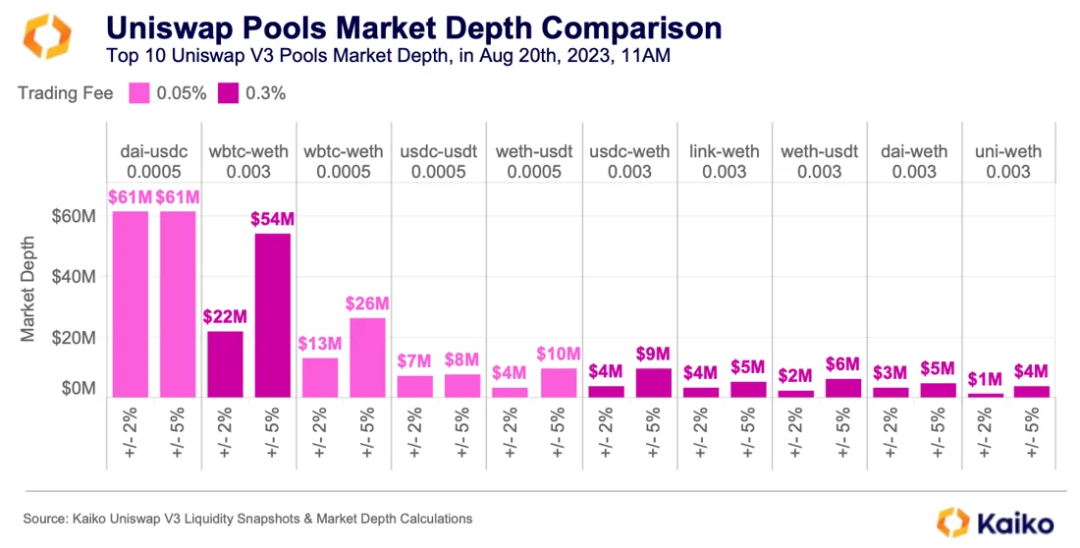

Most Liquid UniswapV3 Pools

Taking a broader view of Uniswap V3 liquidity, it can be seen that four out of the top five most liquid Uniswap V3 pools have a trading fee of 0.05%, the second lowest option on Uniswap. It appears that liquidity providers (LPs) have found a balance, where 0.05% provides the optimal balance between trading volume and fees.

Compared to CEX, Uniswap V3 provides a competitive market for traders; due to ample liquidity at different price levels, these markets are particularly attractive to arbitrageurs, despite potential differences in trading costs. This standardized CEX/DEX market depth dataset not only helps us understand the impact of recent market events on liquidity but also reveals the role of market microstructure in shaping liquidity dynamics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。