Recently, the GambleFi field has risen unexpectedly, among which Rollbit (RLB) has gained particularly strong momentum. Today, let's take a look at this project and why its popularity has been soaring recently.

Overview of Rollbit Platform and RLB Token

Rollbit Platform: A Diverse GambleFi Leading Platform

Rollbit is a comprehensive GambleFi platform founded in February 2020, offering a variety of products including casinos, sports betting, futures trading, and an NFT marketplace. Rollbit currently has a market value of over $633 million and, according to the official website, has over 1 million registered users.

In March 2021, Rollbit upgraded to V2, making improvements in rule design and user experience. In terms of participation, Rollbit caters to both Web 2.0 and Web 3.0 players, making it user-friendly. You can register an account via email, log in through Steam and Twitch accounts, or directly participate in platform activities by connecting an encrypted wallet (currently only supports MetaMask).

In terms of products, like most GambleFi platforms, Rollbit adopts a "game lobby" model, providing different games in various sections. In addition to some common and traditional games, Rollbit also has many innovative features.

The platform has set up many games in the Casino section to enhance user interaction, including challenges that any user can initiate and bonus battles in which users can interact and compete with the balance in the prize pool. In the sports betting section, Rollbit supports players to bet on a wide range of sports events, including but not limited to NFL, NBA, Soccer, UFC, and esports. Furthermore, the platform's another major feature is trading over twenty leading cryptocurrencies in the futures trading section, with leverage of up to 1,000 times.

RLB Token: 100% Airdrop

RLB is the utility token of the Rollbit platform, initially introduced as part of the Rollbit Lottery product. Holders can earn rewards through staking and participate in lottery draws and other activities.

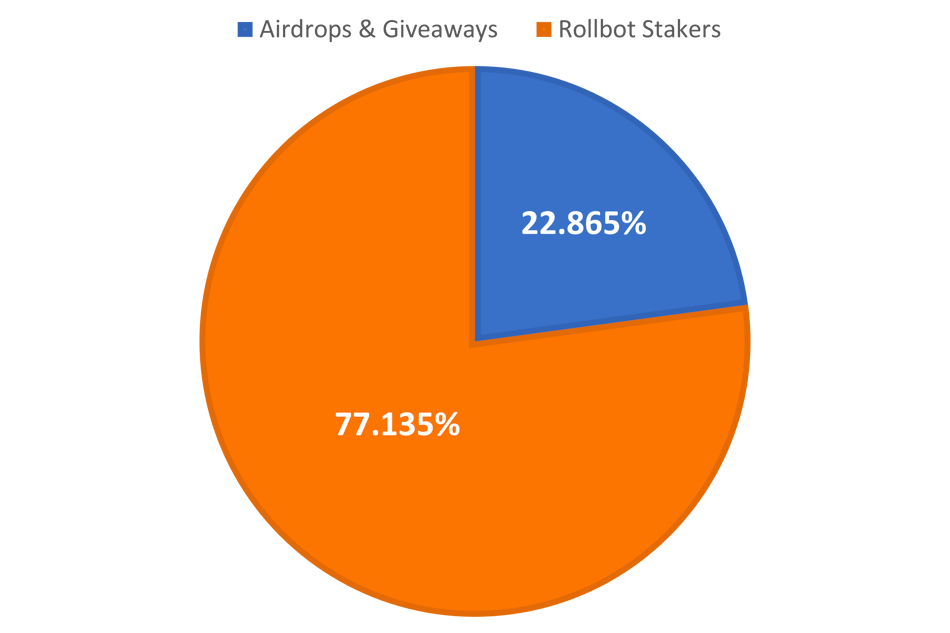

RLB was not issued through the usual ICO process. In other words, it did not raise funds or conduct OTC trading during its issuance, and 100% of the tokens entered the market through free airdrops.

This issuance model attracted the first batch of "believers" for Rollbit. Why is that?

Looking back at a similar case: the token of yearn.finance in the DeFi field. Its token gained market attention at the time of issuance because the team did not conduct any fundraising for the project and did not reserve any $YFI tokens, aiming to truly belong to every token holder. This is also known as the "Fair Launch" model. This not only earned praise for being a "true embodiment of decentralization spirit," but its token price also once surpassed Bitcoin, breaking through $60,000.

Following this logic, compared to projects in the same field that reserved a portion of tokens, the distribution of RLB, which is similar to a Fair Launch, undoubtedly aligns more with the spirit of blockchain decentralization and is easier to gain user recognition.

Why RLB Has Been So Hot Lately

Implementation of Token Buyback and Burn Plan

On August 9, Lucky, co-founder of Rollbit, announced through his Twitter account (@Lucky_Rollbit) that in order to further enhance the importance of the RLB token for the entire project ecosystem, the platform will launch a "token buyback and burn plan."

According to the plan, the platform will set aside a portion of the daily fee income to purchase RLB on the open market and send it to an address not controlled by any entity to achieve the purpose of burning. The token purchase funds include 10% of casino revenue, 20% of sports betting revenue, and 30% of futures trading revenue.

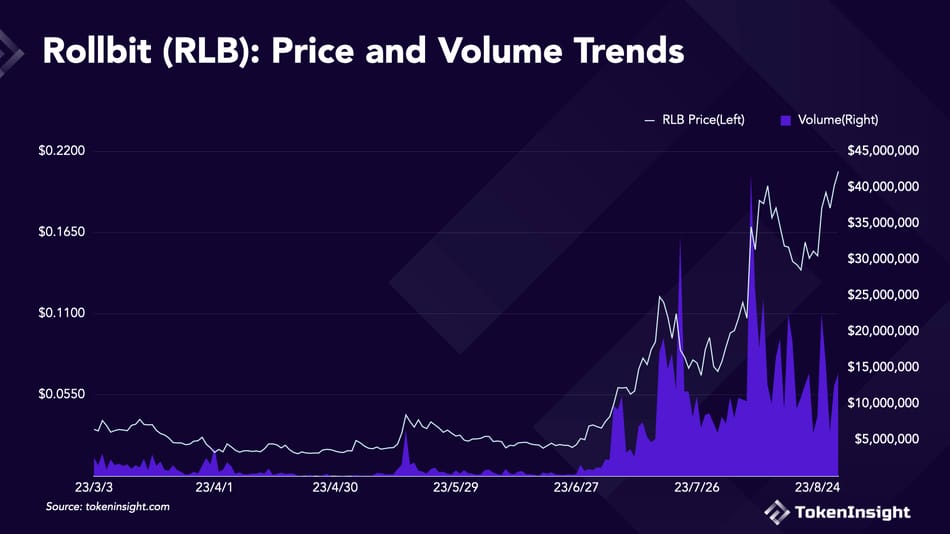

This plan will continuously reduce the circulation of RLB in the market, providing sustained buying pressure for the token and supporting its price increase. Moreover, since the buyback funds come from a share of the platform's income, the more the platform earns, the more funds will be available for daily token buybacks, resulting in a larger daily amount of RLB being burned and providing more momentum for the token price increase. This story of mutual achievement between the platform and token holders is quite touching to the market, and as a result, the price of RLB soared by nearly 70% on that day.

On August 10, another co-founder, Razer (@Razer_Rollbit), further announced that the RLB buyback and burn plan had entered the automated execution phase, with execution occurring every hour. This news also slightly boosted the surge in RLB price, breaking through $0.20.

NFT Holder Dividend Plan

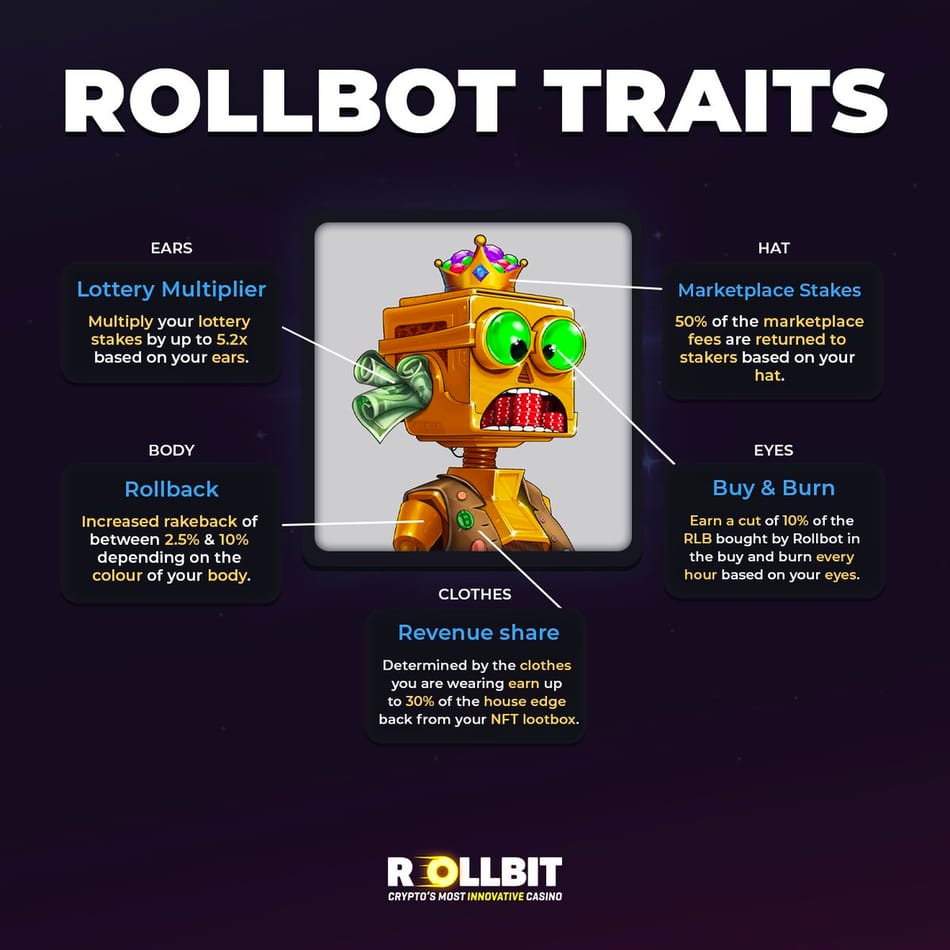

On August 12, Rollbit took advantage of the momentum and released another piece of good news: holders of the platform's NFTs (Rollbot) can receive a 10% dividend from the hourly RLB buyback and burn.

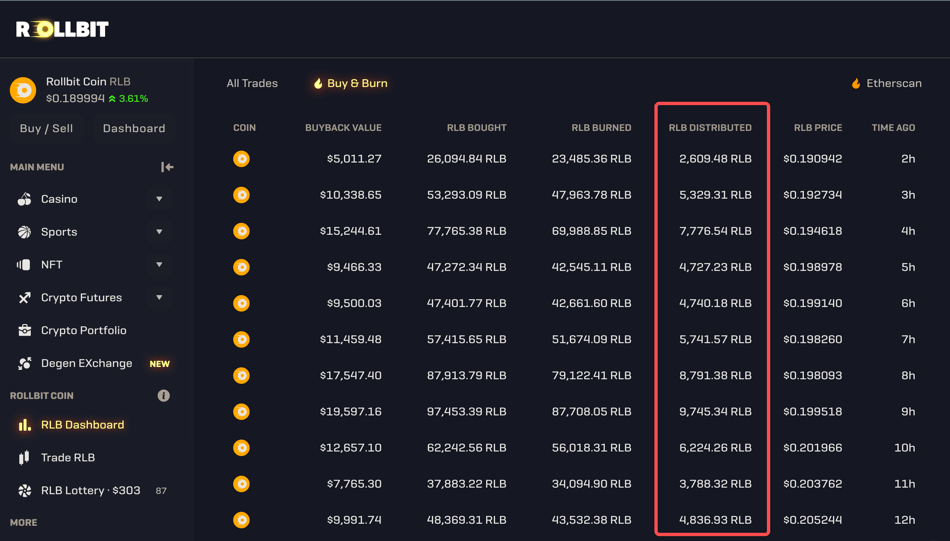

Based on real-time data from the Rollbit Dashboard, we can roughly estimate the benefits that this plan can bring to Rollbot stakers.

As shown in the figure below, the approximate amount of RLB distributed to users from the buyback plan per hour is around five thousand tokens, with RLB's unit price being approximately $0.20. Therefore, the platform will distribute around $1,000 in rebates to users every hour, with a total daily rebate of approximately $25,000 to $30,000—this is definitely generous in the current sluggish market environment.

Migration to the Ethereum Network

This event occurred at the end of June, and although it was a while ago, it clearly set the stage for RLB's strong performance later.

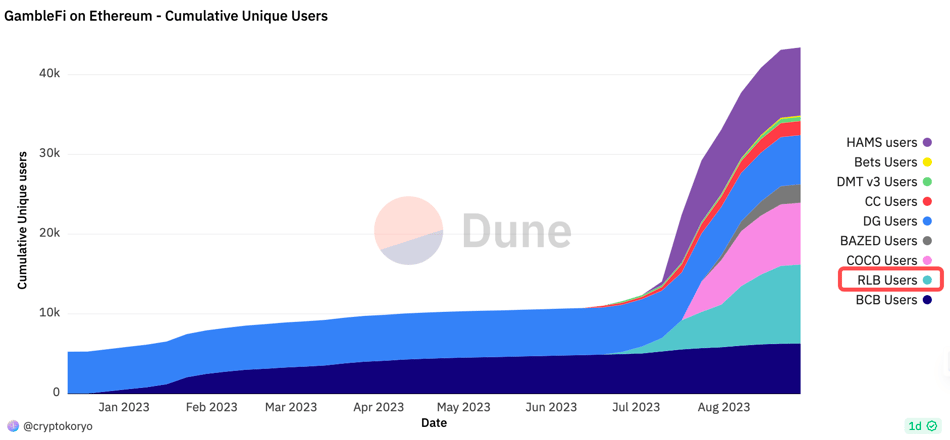

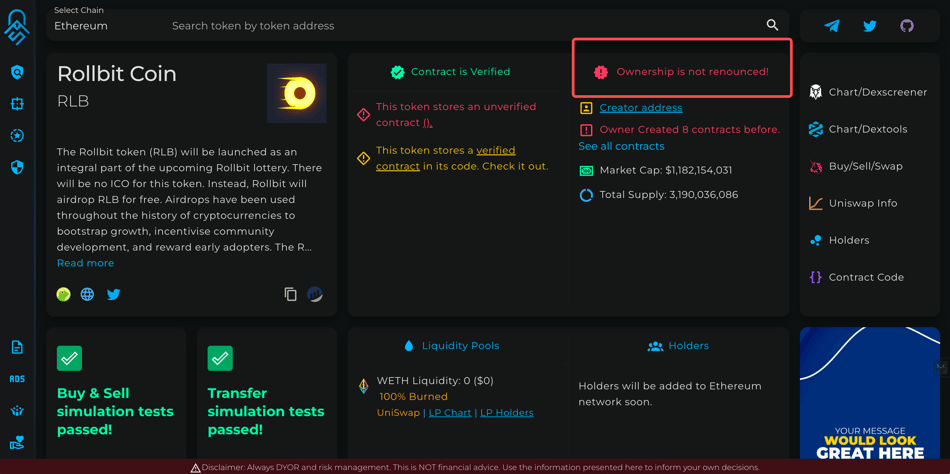

RLB was initially deployed on the Solana blockchain. The FTX collapse last year brought a series of negative impacts to Solana and its ecosystem projects. On June 28 this year, considering the development bottleneck brought by the Solana blockchain, Rollbit migrated RLB to the Ethereum network.

What exactly happened to Solana? Please refer to the research article: Solana Rating Update - Solana Network or Solana Not-Work?

As a giant in the crypto market, Ethereum's active ecosystem brought vitality and more attention to RLB. In the 10 days after Rollbit announced the token migration, RLB's price rose from $0.021 on June 28 to a historic high of $0.0695, an increase of over 230%.

In the announcement, the Rollbit team also stated that users will be given ample time to migrate their RLB to Ethereum, and their holdings will not be affected in any way.

GambleFi Narrative in a Bear Market

In the current market with insufficient liquidity, many users may choose to turn to meme coins or gambling projects to seek entertainment or profit. This may be not only because these areas have lower entry barriers, but also because they typically have higher user activity and liquidity—this is very attractive to users who want quick in-and-out transactions.

Furthermore, compared to traditional platforms, GambleFi platforms that incorporate blockchain technology have more attractive qualities for attracting players, such as fairness, transparency, and decentralization. These qualities may attract users who value game rules or anonymity.

Doubts Accompanying Rollbit's Popularity

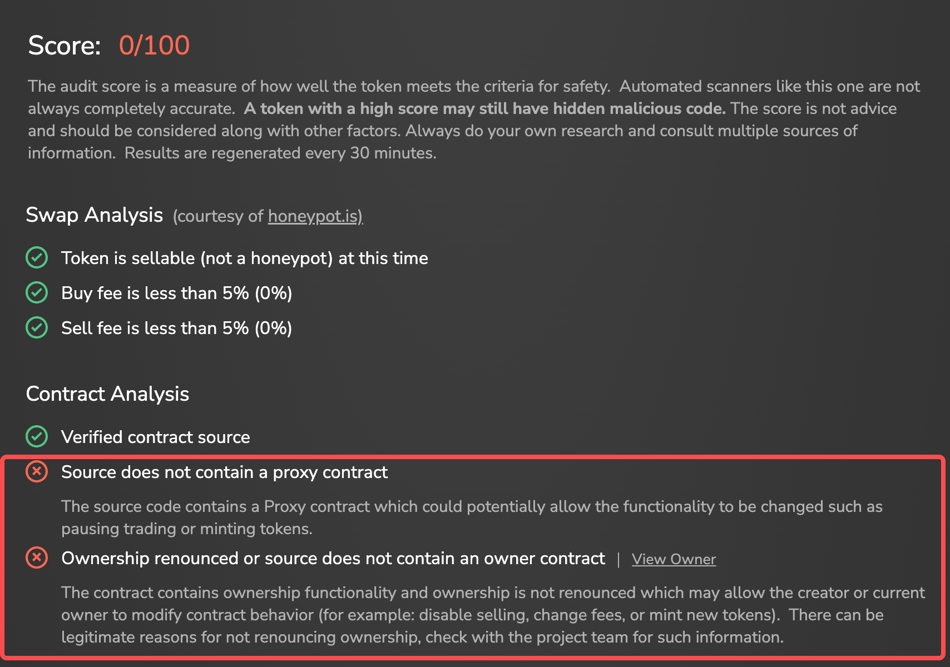

Although many users in the market have been bullish recently, and the trend of RLB token price has not disappointed (so far), with this wave of popularity, many people have raised doubts about Rollbit and even dug up some "dark history" of the project.

Concerns about Transparency Triggered by Suspected "Invisible Market Making"

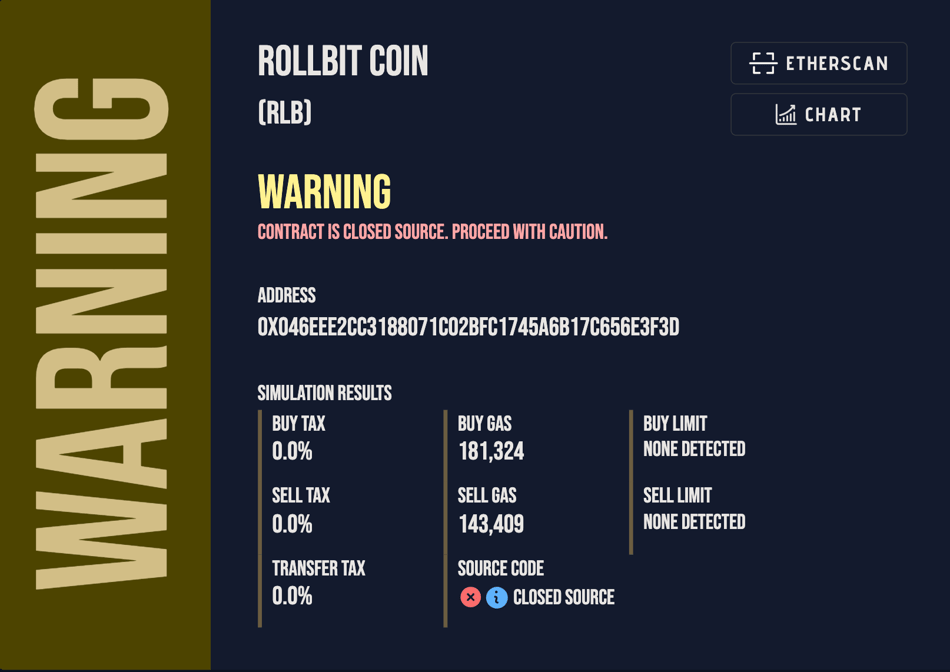

Currently, Rollbit is not operating in a fully on-chain state. If we speculate with "the worst intentions," the data on bets, income, and turnover that users see on the platform's front end may all be generated from a black box.

On August 20, Twitter user thiccy (@thiccythot_) claimed that there seemed to be invisible market makers among the large RLB holders on Rollbit.

According to thiccy's observations, multiple large holder addresses have been continuously selling RLB, with each sale involving tens of thousands of tokens. Although some of the sales occurred before the implementation of the token buyback and burn plan (i.e., during the period of RLB's significant surge), this periodic reduction in holdings can also be seen as normal arbitrage behavior. However, this also raises the question: in terms of transparency, the Rollbit team could indeed do better—without decentralization and transparency, what advantages does GambleFi have over traditional gaming platforms? Is it the anonymity enjoyed by market makers?

Dark History of KOLs Pumping and Dumping

This "surprise" comes from the discovery made by user Alisko2000 in the largest cryptocurrency community on Reddit, r/CryptoCurrency.

This user claimed to have accidentally discovered some suspicious past activities related to "RLB Shillers". For example, KOL @gainzy, who was once targeted by the so-called "blockchain detective" ZachXBT, was suspected of accepting sponsorship from Rollbit while selling RLB tokens, with the amount of sales even exceeding three million dollars at the all-time high.

Of course, inviting influential people to help promote a project is not a sin in itself, as sometimes good products need promotion to reach a wider audience. However, in the crypto market, it is not uncommon for KOLs to collude with project teams to exploit retail investors, and Rollbit, with such a history, has had various KOLs helping to promote the recent surge. This inevitably raises the question: are they here to harvest again?

Can the Rising Flywheel Keep Turning?

In Rollbit's story, the platform now has a very attractive "rising flywheel," where the platform makes money, takes a cut, and gives it to users, leading to increased user confidence and market buying pressure, which in turn allows the platform to continue making money and giving a cut to users.

Let's review the token buyback and burn plan and the staker dividend plan mentioned earlier. In general, this win-win situation between the platform and users is formed as follows: the platform makes money and then allocates some to users. And they are all based on the same foundation: the profitability of the Rollbit platform—put more bluntly, the money the platform makes from players participating in games. It must be said that this model is somewhat "pyramid-like." Generally, "pyramid" type stories are particularly attractive for a period of time, but they are difficult to sustain in the long run.

Returning to Rollbit, the platform and token holders make money from players, with wins and losses in the games, but holding tokens and sharing the profits is "a stable happiness." So, for a GambleFi platform that does not have more advantages in terms of business than traditional online casinos, how long can Rollbit continue to attract players to "give away money" in its game? If it cannot maintain player stickiness and improve its continuous customer acquisition capabilities, this "flywheel" may inevitably slow down or even stall at some point in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。