The article investigates the current status of DAO treasuries, starting with an in-depth exploration of Safe (formerly Gnosis Safe), which is the preferred tool for managing DAO treasuries.

This research article is presented by ThePASS team. ThePASS is a pioneering DAO aggregator and search engine that plays a crucial role in providing insights and analysis for DAOs.

Intro

As decentralized autonomous organizations (DAOs) continue to evolve, they are being entrusted with increasingly diverse roles and expectations. Against this backdrop of tremendous growth, asset management has become a critically important issue. As DAOs continue to expand, efficient wallet solutions are needed for handling assets, whether they are fungible tokens (FT) or non-fungible tokens (NFT).

The primary challenge is asset security. Due to the complexity of DAO structures, vulnerabilities can arise from both technical and inherent design aspects. In addition to security, the scalability of asset management is also crucial. The seamless integration with various ecosystem applications determines the extent to which asset management paradigms can be executed, directly impacting the degree to which DAO organizational functions are realized.

Given these factors, multi-signature mechanisms have become the preferred method for on-chain asset management within DAOs. The article investigates the current status of DAO treasuries, starting with an in-depth exploration of Safe (formerly Gnosis Safe), which is the preferred tool for managing DAO treasuries.

Overview of Safe

Smart Contract Accounts

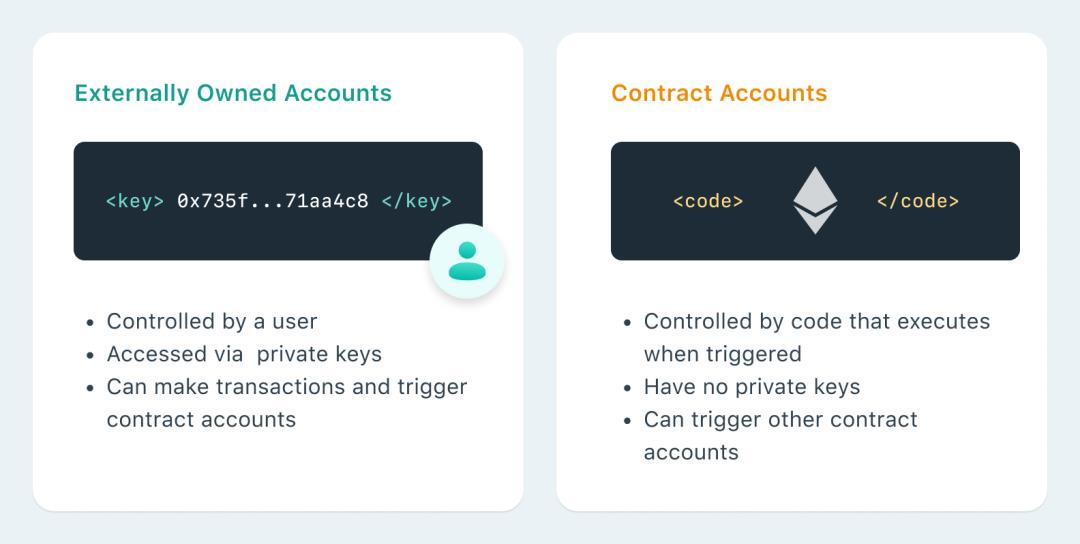

Currently, Ethereum supports two types of accounts (also known as wallets):

- Externally Owned Accounts (EOA): Accounts controlled by private keys, which most wallets currently belong to, such as Metamask;

- Smart Contract Accounts: Accounts accessed and controlled through smart contract code (rather than private keys), allowing for almost unlimited expandable functionality.

External vs. Contract Accounts

Typically, most on-chain users are accustomed to using EOAs, but there is a risk of funds being stolen if the private key is compromised. In July 2023, Ethereum's monthly active users for external accounts reached 5 million, while smart contract accounts only amounted to 10,000, showing a significant 500-fold difference.

Moreover, for managing encrypted assets within multi-person organizations (such as DAOs), EOAs are not the best choice. Allowing everyone to independently access funds increases centralization of power and creates a single point of failure. If someone intentionally or unintentionally exposes the private key, funds may irreversibly disappear.

However, smart contract accounts manage funds through code, determining who can access these funds under what conditions, among other functions. Due to the versatility of smart contracts, in addition to breaking users' reliance on private keys, smart wallets also provide advantageous new features and offer a user experience similar to traditional financial services applications (TradFi). Some features provided by different smart wallets include:

- Multi-signature: A transaction approved by two or more users to enhance security. Smart wallets can also enable offline authorization of multi-signature transactions, saving users' time;

- Amount limits: Transaction amount limits can be set to help reduce costly user error opportunities and prevent attackers from emptying wallets in a single transaction;

- Whitelist: Users can specify that transfers can only be made to known addresses, helping prevent phishing incidents;

- Batch transactions: For convenience, multiple interactions with Dapps can be executed in a single "batch" transaction;

- Emergency freeze: In the event of a lost or stolen device, the account can be locked to ensure the security of funds;

- Account recovery: Various account recovery options (such as social recovery) help eliminate the significant risk of lost private keys and mnemonic phrases;

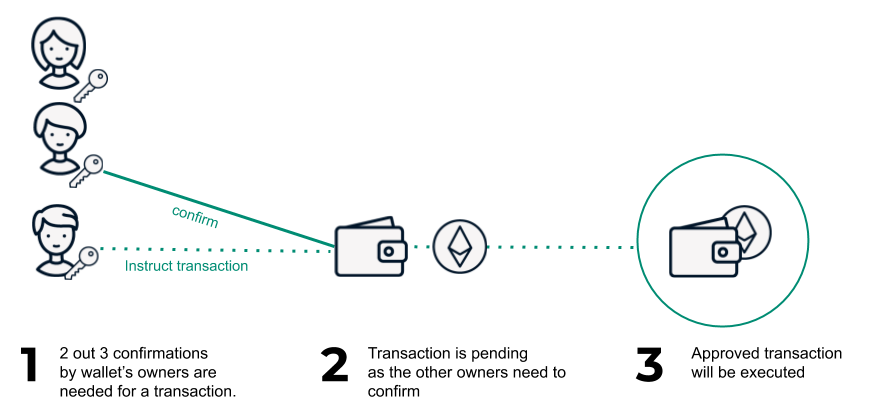

Multi-signature

Among these features, the most easily implemented and meeting the urgent needs of DAOs is multi-signature. Multi-signature wallets provide another layer of security by allowing DAOs to create "shared ownership" on a single wallet (instead of a single founder holding the private key).

Multi-signature process

Multi-signature involves multiple branch accounts participating in the management of the main account's funds. Before any transaction is executed, consensus from all branch accounts supervising the multi-signature wallet is required. These branch accounts collectively constitute the owners of the wallet.

Only when a certain number of owners pre-determined within the smart contract collectively validate the transaction, will the transaction be authorized. This multi-signature wallet effectively prevents malicious activities that may occur from a single node (such as a manager or asset handler) in the management of public funds. It also mitigates the risk of asset loss due to improper wallet private key management.

Safe

In 2018, Gnosis introduced an open-source on-chain multi-signature wallet solution, namely Gnosis Safe. This solution underwent a split and reorganization in 2022, giving rise to Safe. The implementation of shared fund management by multiple parties in Safe aligns with the concept of DAOs. In DAOs, decisions typically require member voting for approval, followed by execution by a core signing team. Notable DAOs such as BitDAO have already adopted Safe as an important financial management tool.

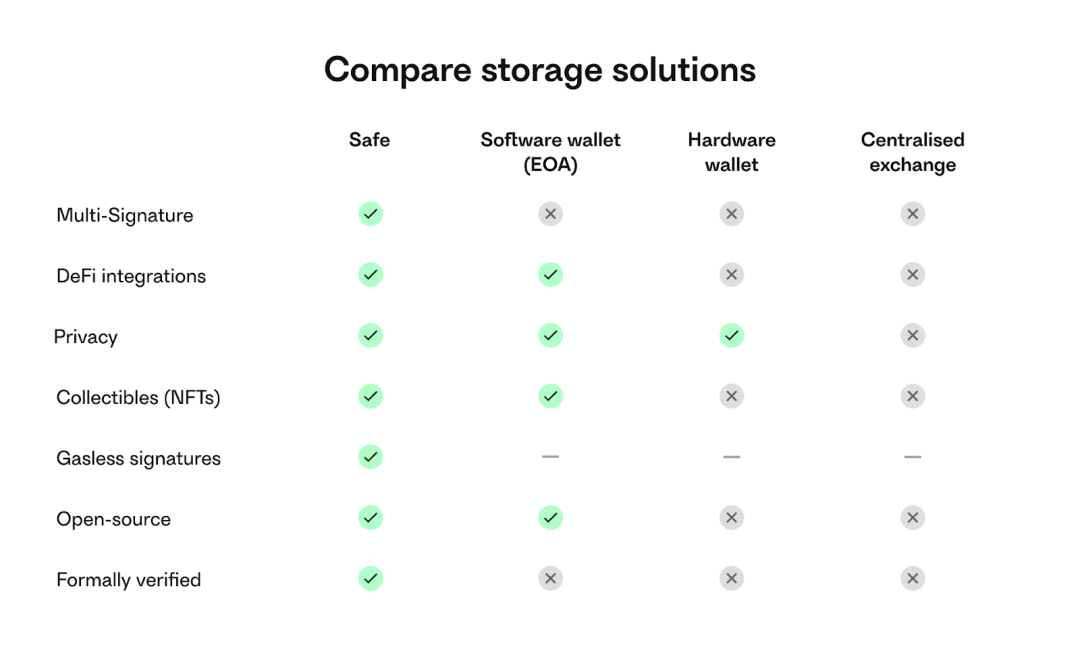

The following chart provides an overview of Safe compared to other cryptocurrency wallets.

Safe vs. Other Solutions

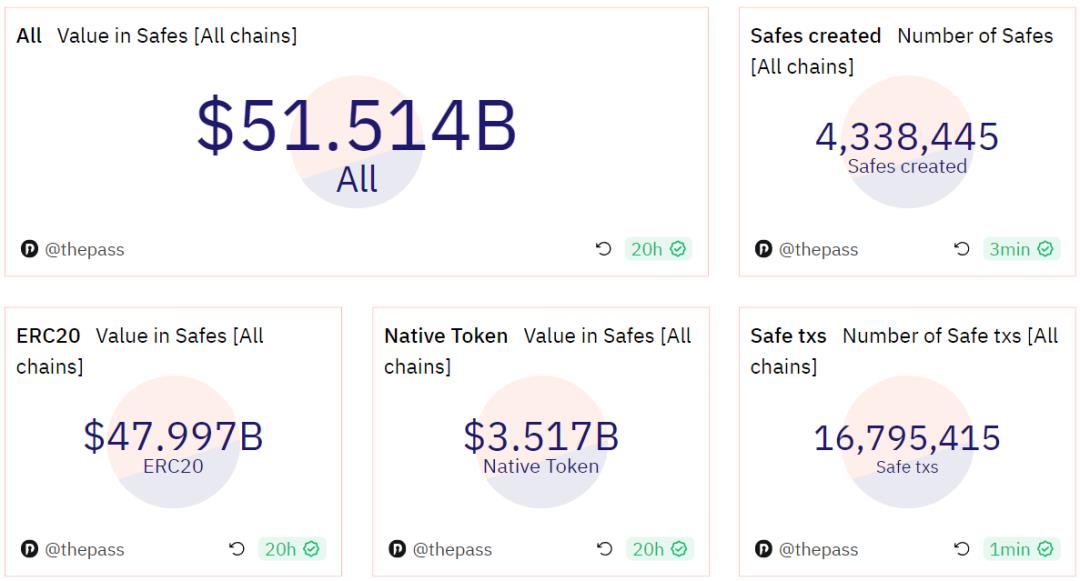

Data Analysis

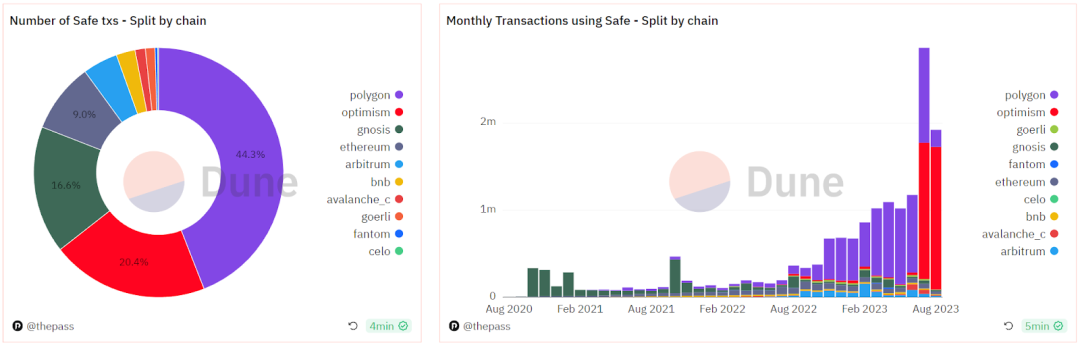

After 5 years of evolution, Safe has expanded from Ethereum to other Layer1 and Layer2 solutions, covering numerous mainstream EVM-compatible smart contract platforms. The cumulative result of this expansion is reflected in the creation of over 4.3 million Safe accounts, generating a remarkable 16.8 million transactions. It is noteworthy that each address holds an average of 4 transactions.

Safe Data Status

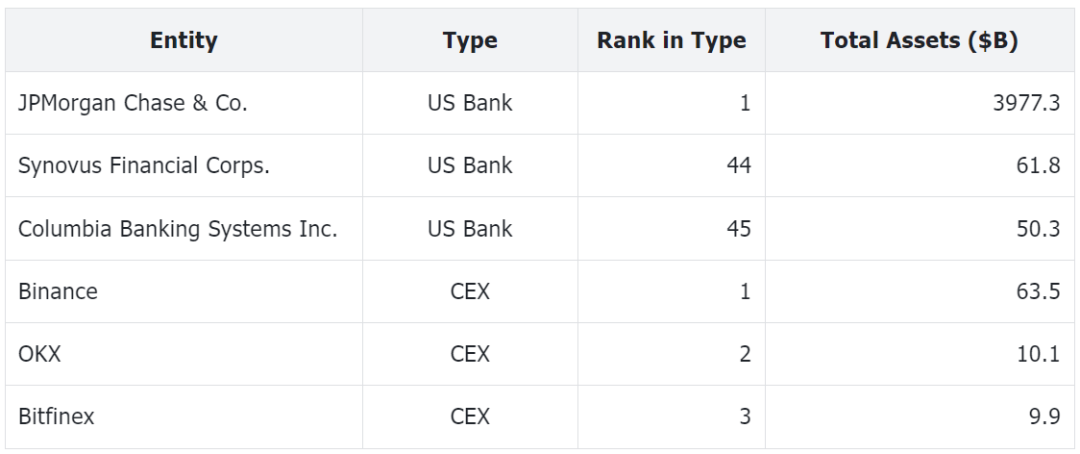

These addresses collectively hold an astonishing $50 billion in assets. If Safe were a centralized exchange (CEX), this remarkable accumulation would surpass OKX, making it the second largest exchange after Binance. On the other hand, if Safe were considered a bank in the United States, it would rank as the 45th largest bank, surpassing 4,799 other banks.

Total Asset Rankings

Multi-chain

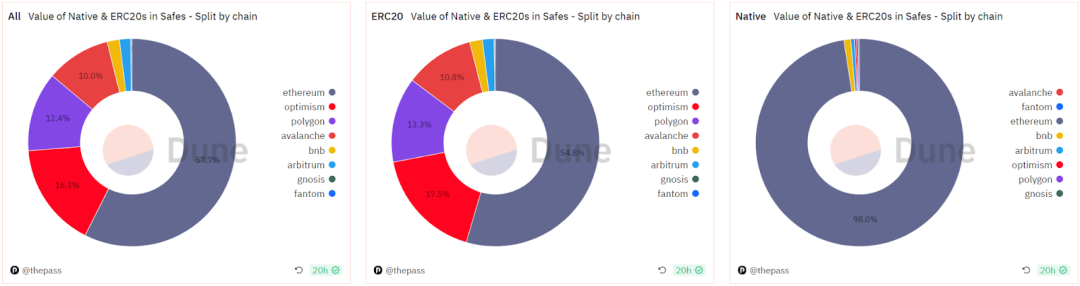

In terms of asset distribution across different blockchains, Ethereum accounts for approximately 60% of the total value, followed by Optimism, Polygon, and Avalanche, each representing around 10% of the total market value. The majority of funds are concentrated in ERC-20 tokens rather than native tokens (such as ETH, BNB, etc.).

Safe Address Value - Multi-chain

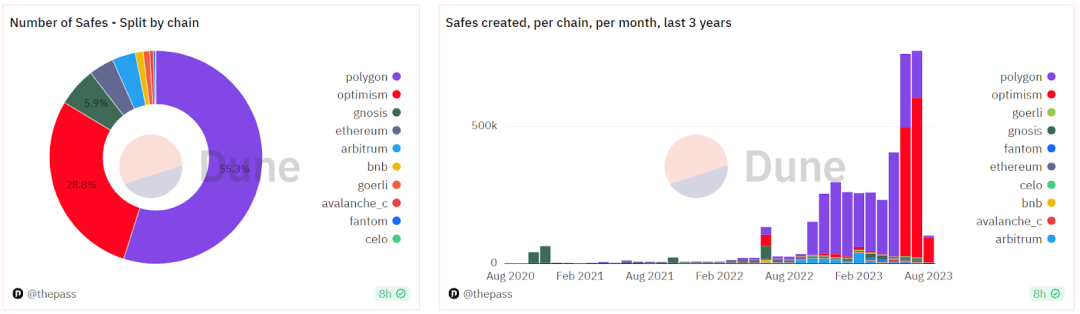

Focusing on Safe addresses on different chains, it is surprising that 85% of these addresses come from Polygon and Optimism. Since the beginning of the DeFi summer in 2020, the influx of new Safe addresses has shown a continuous upward trend. It is noteworthy that Polygon experienced explosive growth since the end of 2022. Similarly, Optimism also experienced its own surge in June 2023.

Part of the reason for this surge may be attributed to the launch and adoption of Worldcoin. The beta version of the Worldcoin App is on Polygon, but in June 2023, they encouraged old users to migrate to Optimism. Worldcoin's choice of Safe is influenced by its user-friendly Web2-style interface, which helps simplify the adoption of cryptocurrencies, catering to users with almost no prior experience with cryptocurrencies. This strategic move enhances accessibility and usability in the cryptocurrency field.

Monthly New Safe Builds - Multi-chain

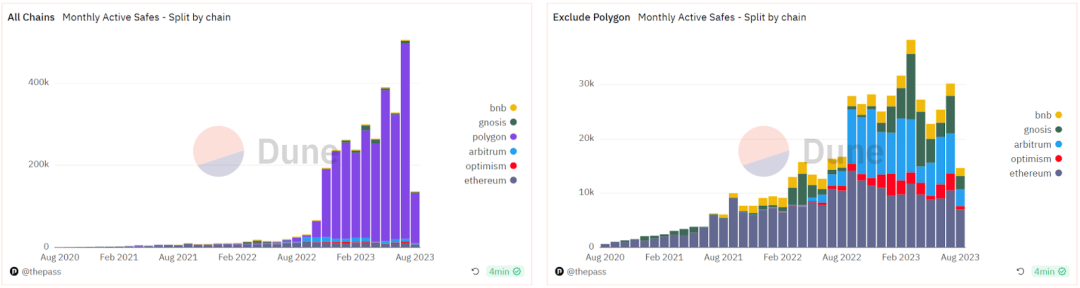

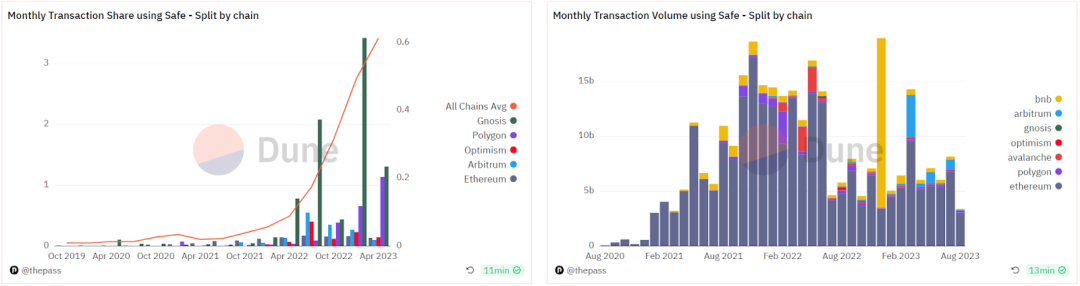

The monthly active addresses exhibit a fluctuation pattern similar to new addresses, with Polygon showing explosive growth and taking the lead since the end of 2022. Excluding Polygon, active addresses on other chains show a steady upward trend, hovering around 30,000 since the end of 2022, especially Ethereum and Arbitrum showing prominent performance.

Monthly Active Safe - Multi-chain

The transaction volume follows the trajectory of new addresses and active addresses. Before 2022, Gnosis Chain led in terms of transactions. However, the situation changed in 2022, with Ethereum and Polygon experiencing a surge in transaction volume. After August 2022, due to their low transaction fees, Safe transactions mainly shifted to Polygon, Gnosis, and Optimism.

Monthly Safe Transactions - Multi-chain

The proportion of transactions involving Safe addresses on different chains shows a continuous upward trend. Currently, approximately 0.6% of all transactions on Ethereum, Polygon, Optimism, and Arbitrum are attributed to Safe addresses.

In comparison to transaction volume, Ethereum's dominance in transaction volume is mainly due to the concentration of assets on the platform. It is noteworthy that the peak of transaction volume differs from the trends of transaction quantity and active addresses. This peak occurred in November 2021 and gradually decreased thereafter. However, as mentioned earlier, transaction quantity and active addresses continue to increase. This difference is partly influenced by the significant drop in token prices after the peak. This trend indicates that even during periods of declining token prices, Safe users remain actively engaged in transaction activities.

Transaction Share and Volume using Safe - Multi-chain

Ethereum

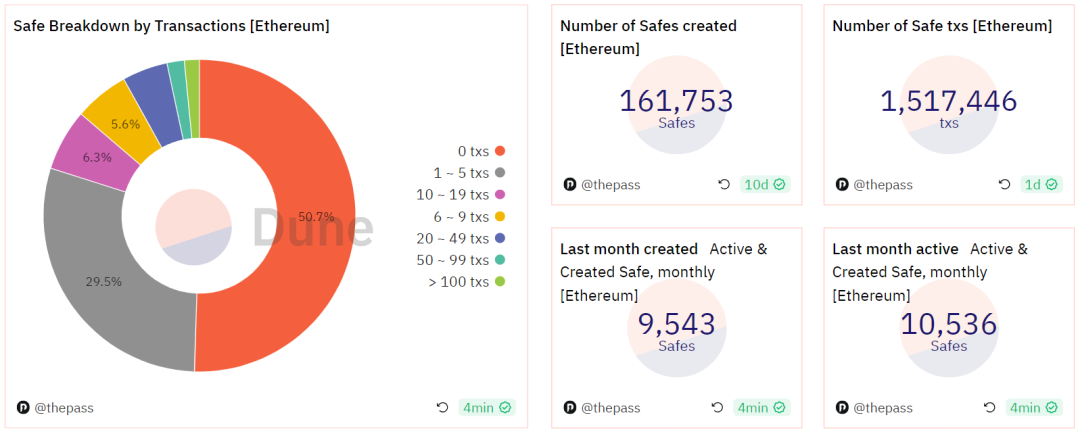

Ethereum dominates among major smart contract platforms, hosting significant transactions and fund activities, including activities of mainstream DAO treasuries. In this context, we shift our focus to the role of Safe in the Ethereum ecosystem. On Ethereum, Safe addresses collectively hold nearly $30 billion in assets (excluding NFTs), including $3.4 billion in ETH and a substantial $26.3 billion in ERC20 tokens. These figures cover over half of the total assets held by Safe addresses on different chains.

Safe Address Value [Ethereum]

These substantial assets are distributed across approximately 162,000 addresses, resulting in a cumulative transaction count of 1.5 million. The average number of transactions per address is 10. Both new addresses and active addresses last month were around 10,000 each.

Safe Overview [Ethereum]

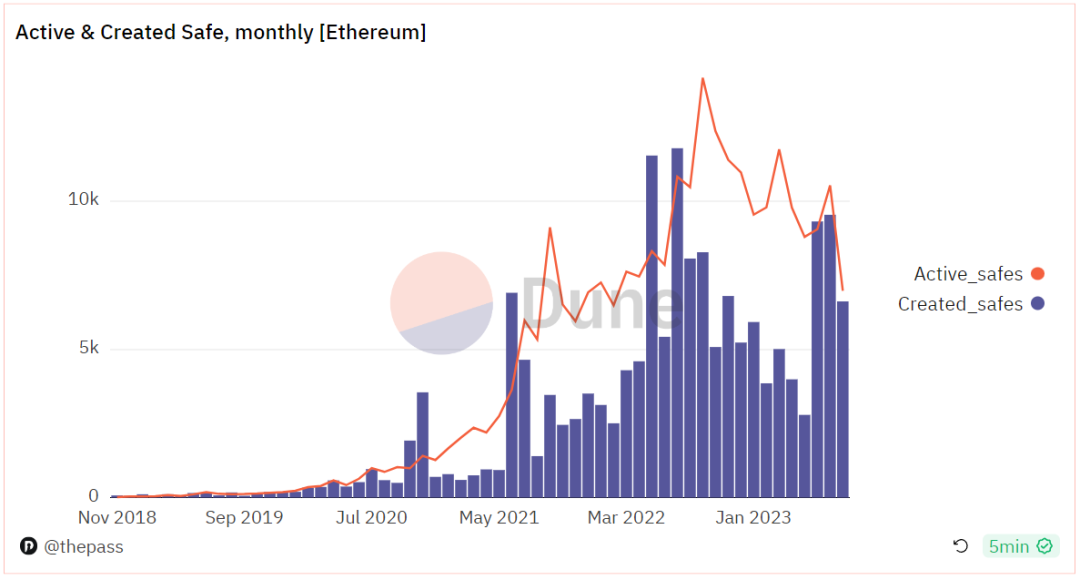

Since the DeFi summer of 2020, new Safe addresses on Ethereum have shown a steady upward trend. The peak of new addresses occurred in July 2022, reaching approximately 12,000, but experienced a decline after a period of cryptocurrency market turmoil and changes. However, from June 2023, the number of new addresses has surged again. Even in challenging external environments, the unique appeal of Safe continues to attract new users.

In addition to the monthly influx of new addresses, the number of active addresses has been steadily increasing. Active addresses reached a peak in September 2022, at around 15,000. Despite a decrease in the number of new addresses per month, highlighting user loyalty to Safe, the number of active addresses has remained stable at around 10,000 since then.

Monthly Active & New Safe [Ethereum]

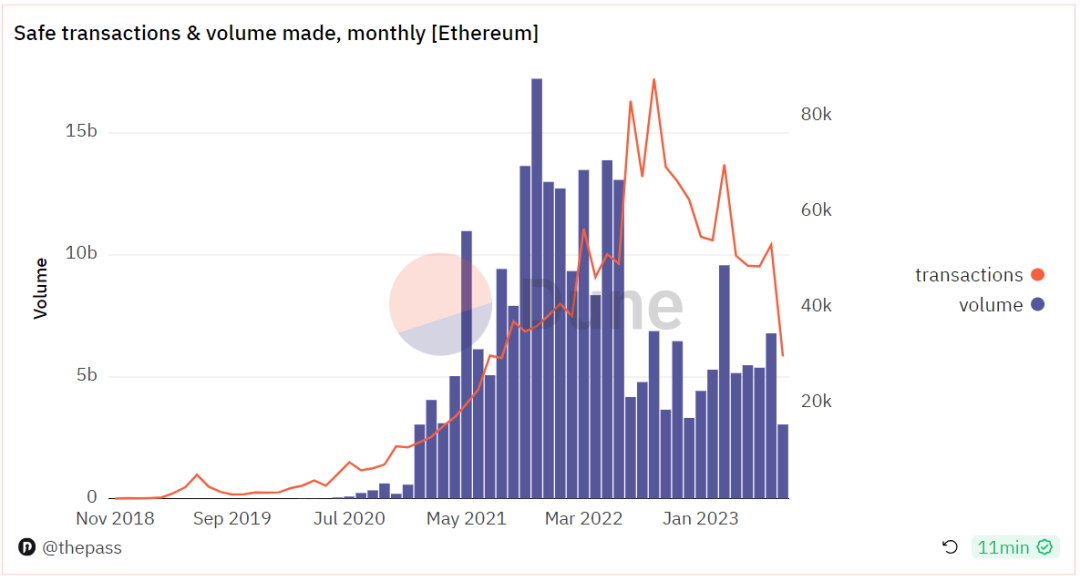

The trend of transaction volume and active addresses parallels a steady increase since the summer of 2020, reaching a peak in September 2022, maintaining a level of over 60,000. In contrast, the peak of transaction volume occurred in November 2021.

Transactions & Volume using Safe per month [Ethereum]

Polygon

As the blockchain with the highest number of Safe addresses and transactions, Polygon deserves a more detailed examination. Safe addresses on Polygon collectively hold over $6.3 billion in assets (excluding NFTs), with the majority being ERC20 tokens. These assets account for over 12% of all Safe address assets across all blockchains, making Polygon second only to Ethereum and Optimism in this regard.

Value in Safe [Polygon]

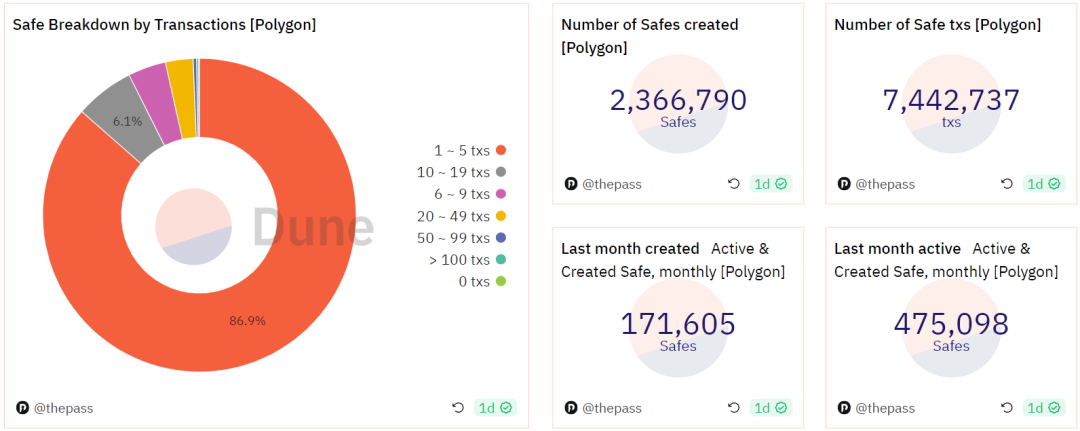

These tokens are distributed across approximately 2.4 million addresses on Polygon, resulting in 7.4 million transactions. The average number of transactions per address is 3, less than the 10 on Ethereum. The majority of addresses (87%) have only conducted 1-5 transactions. Last month, around 170,000 new addresses were added, and active addresses exceeded 475,000, representing a tenfold increase compared to Ethereum.

Safe Overview [Polygon]

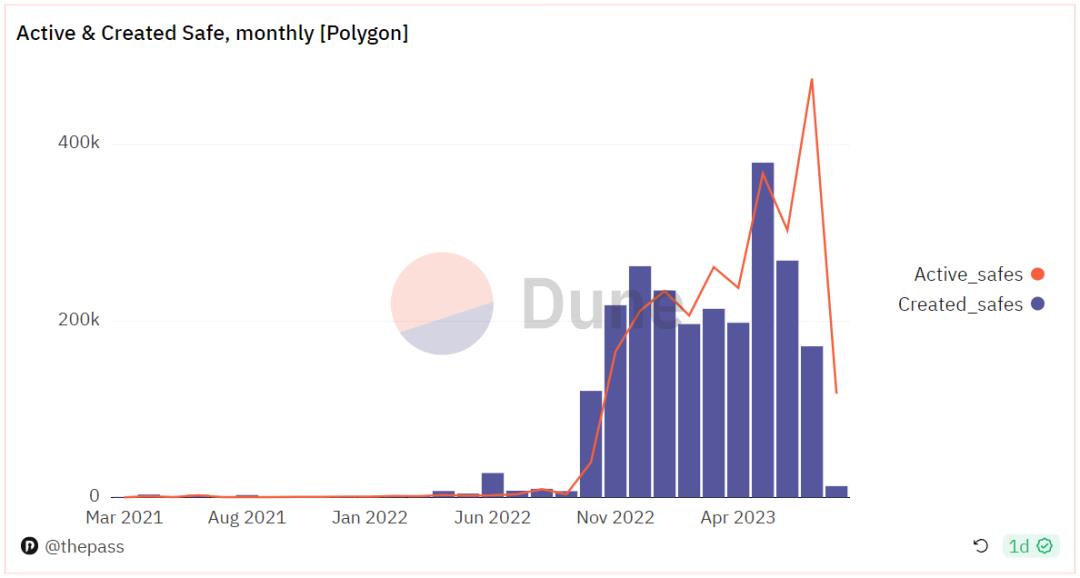

Unlike Ethereum, the growth of new Safe addresses on Polygon has been unstable. It experienced a sudden surge starting from October 2022, averaging an increase of 200,000 addresses per month, a trend that continues to this day. This growth is largely attributed to Worldcoin. Meanwhile, active addresses have also been steadily increasing, reaching approximately 470,000 last month.

Monthly Active & New Safe [Polygon]

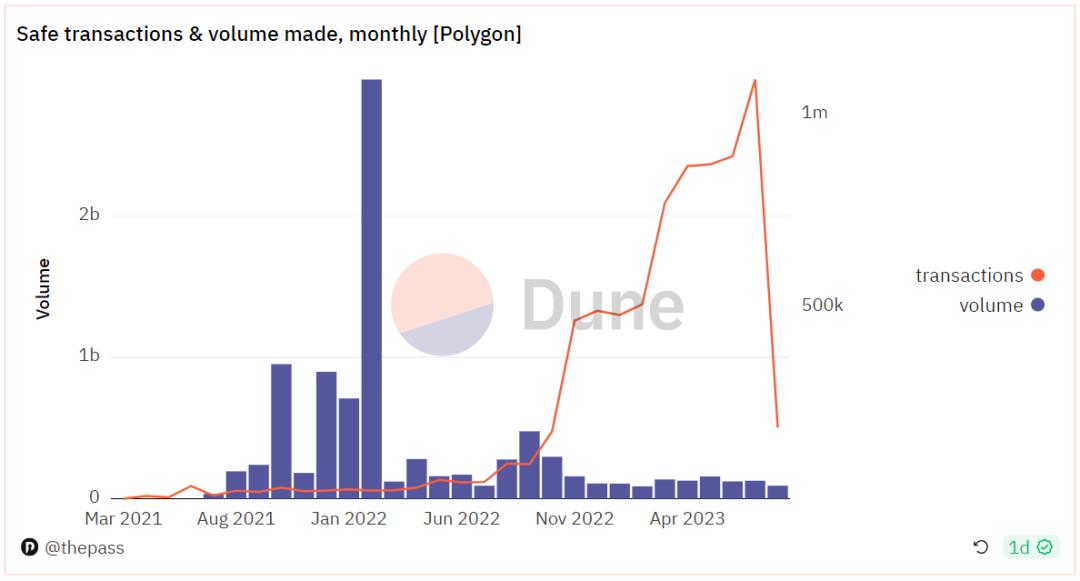

The monthly transaction volume and the number of active addresses exhibit a sudden explosive growth trend starting from October 2022. In contrast, the peak of transaction volume occurred in early 2022, and has since remained at around $200 million.

Monthly Safe Transactions & Volume [Polygon]

DAOs

Activities

We selected well-known DAOs using Safe for treasury management on Ethereum as our sample for analysis, utilizing data provided by ThePass. It is worth noting that while most mainstream DAO treasuries are indeed on Ethereum, not all DAOs use Safe for treasury management. Even DAOs using Safe may have other addresses, which may or may not be Safe. However, for security reasons, we strongly believe that in the DAO space, multi-signature wallets may become the standard for treasury management.

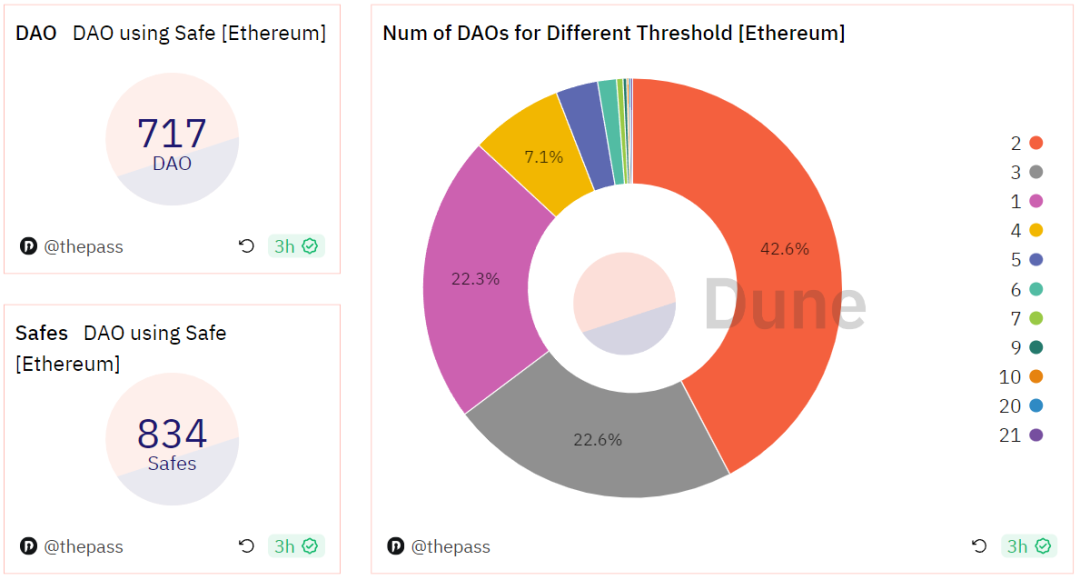

ThePass covers the majority of DAOs, with approximately 3,400 DAOs on the Ethereum network alone, with a combined treasury total of around $16 billion. Among them, over 700 DAOs use Safe, with a total of over 800 Safe addresses. Some DAOs choose to use multiple addresses to enhance flexibility and security.

The threshold of signers in these multi-signature wallets is mainly concentrated in the range of 1 to 3, with 87.5% of wallets falling into the 1-3 threshold category. However, for multi-signature treasuries of DAOs, too few signers may imply concentration risk and single point of failure.

DAO Treasury using Safe Overview [Ethereum]

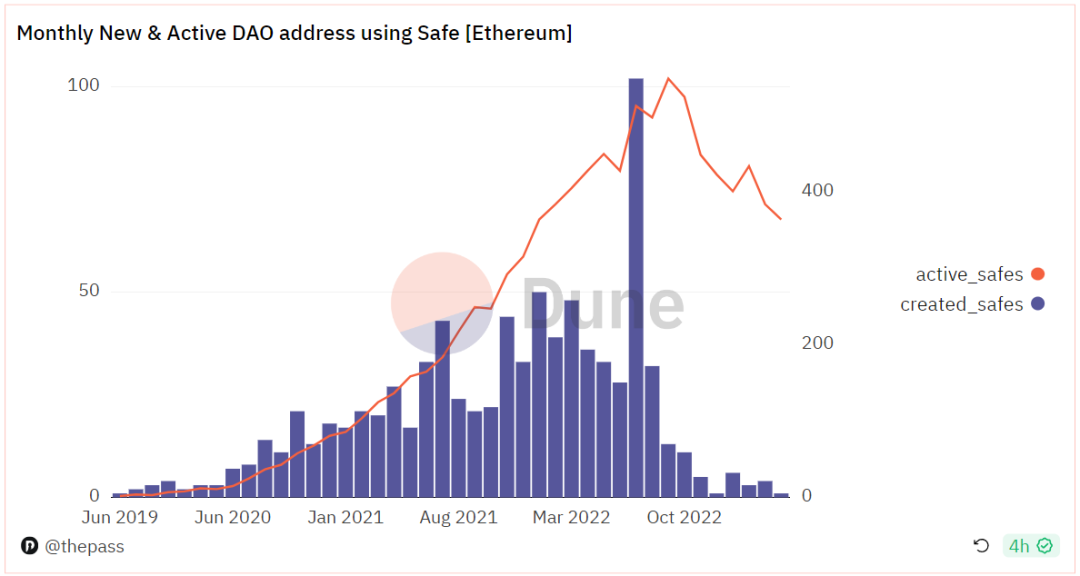

Since the beginning of 2020, the adoption of new Safe addresses by DAOs has been steadily increasing every month. This trend peaked in the second half of 2021 and gradually slowed down from April 2022. The growth of new Safe addresses is accompanied by the cumulative surge of active addresses, highlighting the continued participation of these addresses after creation.

DAO Activities using Safe [Ethereum]

Treasury

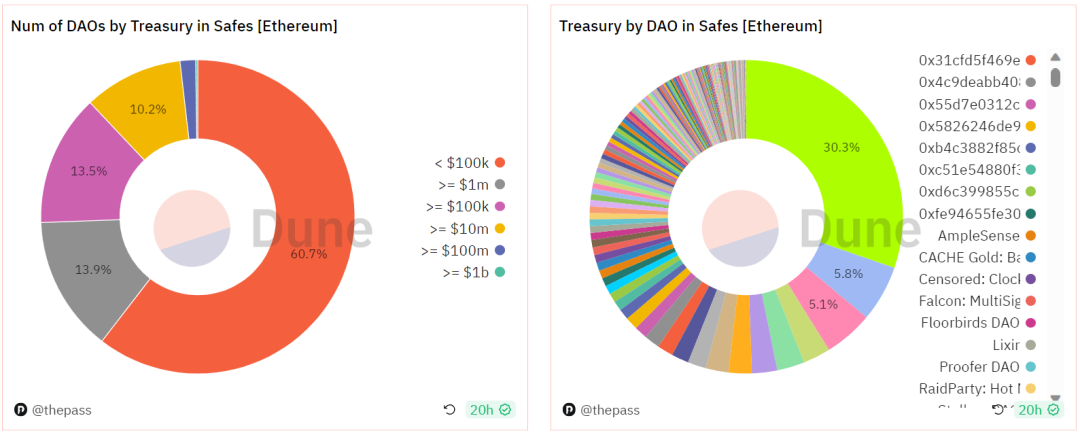

In just over 800 DAO Safe addresses, nearly $7 billion in assets (excluding NFTs) are stored. This accounts for nearly one-seventh of all funds stored in Safe addresses on Ethereum. This substantial pool of funds includes $6.265 billion in ERC20 tokens and $677 million in ETH.

DAO Treasury using Safe [Ethereum]

When ranking DAOs by treasury size, it is evident that Infra and DeFi projects dominate the top. In terms of asset distribution in DAO treasuries, DAO treasuries with less than $1 million account for over 70% of the surveyed DAOs. A notable example is BitDAO, whose treasury holds a substantial $2.17 billion, representing over 30% of the total surveyed DAO treasury assets, demonstrating a clear top-heavy effect.

Different types of DAOs require varying scales of funds to achieve their diverse goals. The fourth-ranked Crypto Relief is a community-operated fund dedicated to providing aid during the Covid crisis. Compared to ambitious projects focused on building Layer2 solutions (such as BitDAO), those focused on DeFi protocols (such as Frax Finance and Synthetix) relatively require smaller funds.

DAO Treasury Leaderboard using Safe [Ethereum]

DAO Treasury Analysis using Safe [Ethereum]

Apart from BitDAO, which receives stable income from Bybit, most DAOs hold more ERC20 assets than their ETH holdings. This indicates that the majority of DAO treasuries are primarily composed of their governance tokens. However, the over-concentration of these tokens may introduce risks to an unhealthy balance sheet.

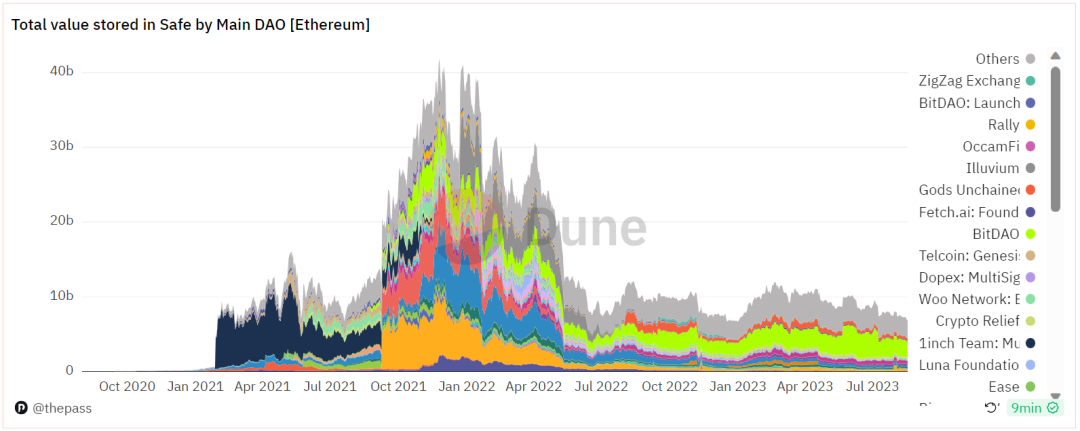

The assets within these treasuries, in terms of both the number of DAOs and the cumulative amount, have experienced rapid growth since early 2021. In the first few months of 2021, the most influential DAO was 1inch, managing nearly $10 billion in significant funds. In October 2021, prominent DAOs such as YGG and BitDAO made significant contributions to the substantial growth of DAO treasury assets, but gradually decreased in early 2022.

Currently, almost all DAO assets have experienced a significant contraction compared to their peak, dropping by nearly three-quarters from around $40 billion in early 2022. This decline is mainly attributed to the decrease in the price of their native governance tokens. Holding a large amount of native tokens means that price fluctuations can greatly impact the treasury's value. Failure to build the treasury in a low-risk manner could result in sharp fluctuations in the value of the portfolio when volatility occurs.

Historical Changes in DAO Treasury using Safe [Ethereum]

Conclusion

DAOs have broken away from the top-down approach in traditional business and shifted towards a more community-driven operation. However, the downside of doing so is that this field is still young, lacks regulation, and has almost no tools to meet its unique needs. There are almost no guidelines for managing treasuries in DAOs. DAO treasuries need to be increasingly standardized and transparent to help DAO participants better achieve their goals and maintain security.

Safe is a secure and scalable asset management platform that securely stores close to $60 billion in assets. Safe is moving towards the standard for DAO treasuries. The tools are ready, and what is needed next is the innovative voice of DAO participants. We have witnessed the flaws brought about by over-reliance on governance tokens, and there is a long journey ahead of us.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。