On August 21st, THORChain's cross-chain lending service officially went live. At the end of July, THORSwap introduced the "Streaming Swap" feature, which is a price optimization strategy similar to Time Weighted Average Price (TWAP) trading. It allows large trades to be split into smaller transactions over specific time intervals without incurring additional Layer 1 fees.

These two updates have led to an over 80% increase in the price of THORChain's native token, RUNE, this month. The lending business of THORChain and projects like Aave have fundamental differences, including no liquidation, no interest, and no maturity date. The key points are summarized as follows by PANews:

- During the establishment and closure of loans, RUNE is continuously destroyed and minted, leading to deflation and inflation. If inflation causes the issuance of RUNE to reach the upper limit of 500 million, a circuit breaker will pause the lending function.

- Debts are denominated in TOR, a non-transferable accounting unit fixed to the value of the US dollar at the time of borrowing.

- The THORChain protocol and all RUNE holders act as counterparties behind each loan, enabling them to earn real income from transaction fees, but also exposing them to dilution risks from inflation.

- Currently, only one-third of the destroyed RUNE is available for lending, with a loan limit of 5 million RUNE, approximately $8 million. The limit may increase as the amount of destroyed RUNE increases.

- As of August 22nd, the value of BTC and ETH collateral was approximately $884,000, with limited usage of the lending service, possibly due to lower capital utilization and higher fee erosion compared to other lending protocols.

Implementation of THORChain Lending Functionality

THORChain Lending supports cross-chain borrowing using BTC and ETH (more Layer 1 native assets will be supported in the future) as collateral, which can be achieved through the Lending feature on THORSwap and the Borrowing feature on Lends.so. Debts are denominated in TOR, an internally non-transferable unit pegged to the value of 1 US dollar, with the specific price derived from the median value of all stablecoins on THORChain, including USDC, USDT, BUSD, LUSD, DAI, etc.

The collateral ratio (collateral value/debt, CR) ranges from 200% to 500%, and the collateral ratio will increase with the loan amount. This means that for assets of the same value, the initial borrowing capacity is highest, and it gradually decreases as the collateral ratio increases.

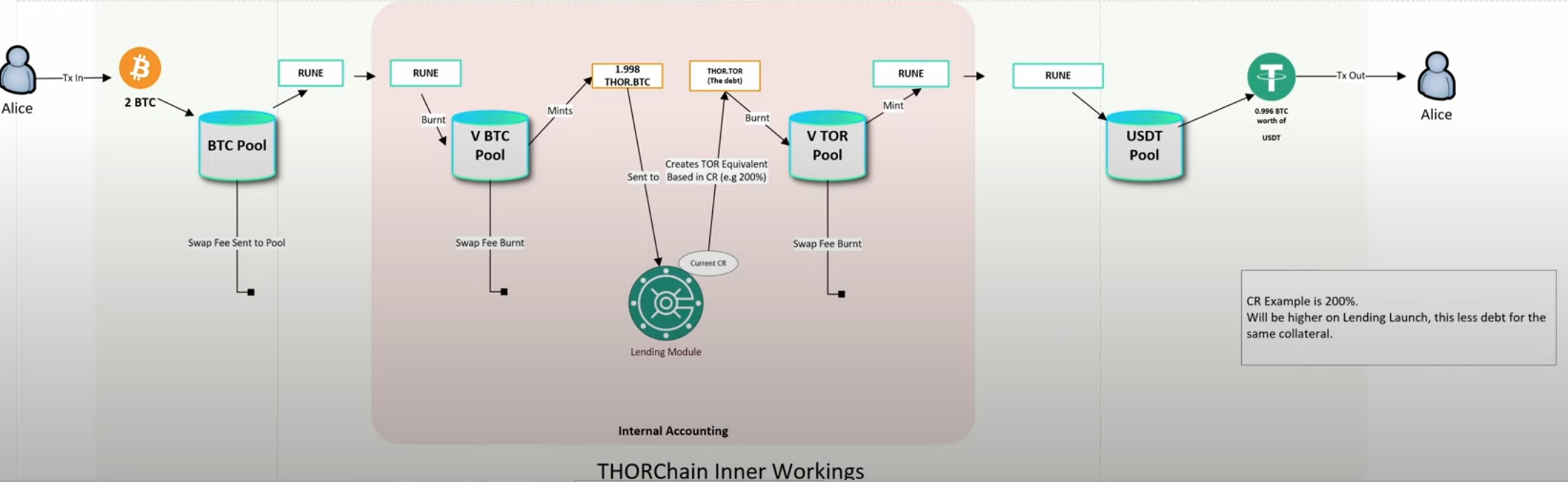

The establishment and closure of debts involve multiple transactions and steps of RUNE minting and destruction. The process of setting up a loan with BTC collateral is as follows:

- User deposits BTC collateral, which is exchanged for RUNE in the BTC Pool, and the RUNE is destroyed in the virtual BTC pool, minting THOR.BTC.

- THOR.BTC serves as collateral in the lending module.

- TOR is generated based on the collateral ratio.

- The quantity of TOR represents the dollar-denominated debt, which remains fixed until repayment and does not change in subsequent steps.

- TOR is destroyed in the virtual TOR pool, minting RUNE.

- The RUNE is exchanged for the desired asset in other pools, such as exchanging for USDT in the USDT pool.

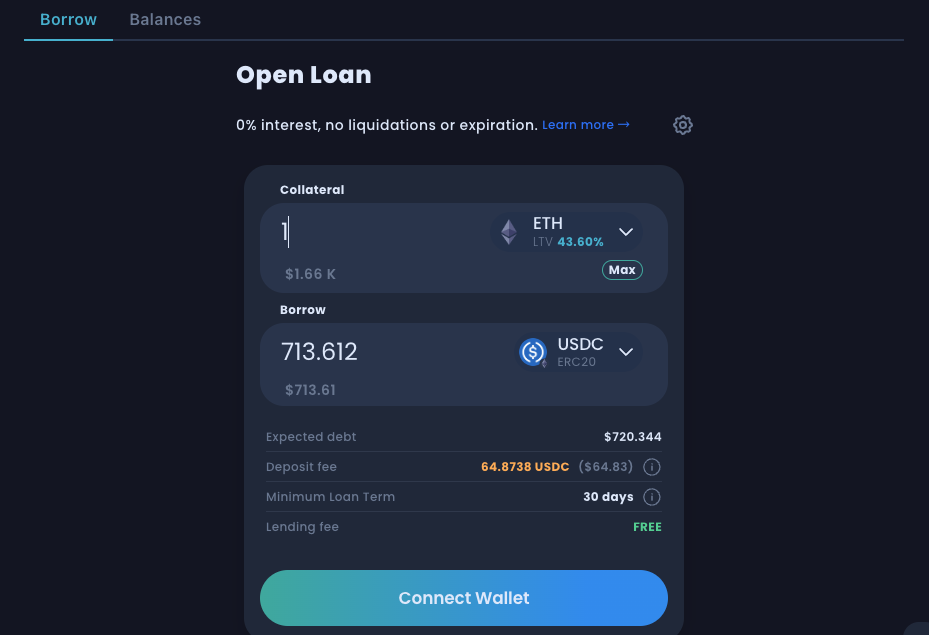

Depending on the collateral ratio, this process may involve up to 4 exchanges or destructions/mintings, all of which generate fees for THORChain, and there is also a transaction slippage. Therefore, although this lending service claims to have no interest, it also generates fee income. As shown in the official website image below, attempting to collateralize 1 ETH worth $1660 to borrow USDC incurs a deposit fee of 64.87 USDC. LTV=1/CR, and the current CR can be calculated based on the LTV value in the image.

BTC collateral is first exchanged for RUNE, then destroyed, and finally minted into RUNE for the desired asset. In this process, the difference between the collateral value and the debt, minus the fees, corresponds to the net destruction value of the corresponding RUNE.

Similarly, the redemption process also involves minting new RUNE, leading to inflation. Therefore, THORChain does not want users to redeem collateral and requires repayment only after at least one month of borrowing. Loans can be repaid with any asset supported by THORChain, corresponding to the amount of TOR borrowed.

The lending function will bring several benefits to the THORChain network, such as increased trading volume, higher capital utilization in liquidity pools, and the creation of real income from more transaction fees, as well as reducing the circulating supply of RUNE.

However, the THORChain protocol and all RUNE holders are also counterparties behind each loan, and may face additional risks due to the minting of RUNE exceeding the destruction of RUNE during the redemption process, which will be discussed further below.

Risks

The biggest risk in THORChain lending is the minting of more RUNE during loan closure than the destruction of RUNE during loan setup, which occurs when the price of RUNE relative to the collateral price drops. Therefore, various parameters must be used to limit this risk and prevent a death spiral like in LUNA/UST.

Firstly, the issuance of RUNE is capped at $500 million, and when this value is reached, the built-in circuit breaker will pause lending, and the reserve will intervene to cover the remaining collateral expenses.

When setting the loan limit, THORChain also considered the upper limit of RUNE, which is currently set at 5 million RUNE. This is in consideration of the fixed upper limit of 500 million RUNE, with 15 million RUNE previously destroyed due to the failure to upgrade from BEP-2 and ERC-20 RUNE. Considering the potential downside of RUNE relative to the collateral, if RUNE falls to one-third of the collateral value, it could lead to the issuance of up to twice the value of the collateral in RUNE. Therefore, only one-third of the destroyed RUNE, or 5 million RUNE, is available for lending, equivalent to approximately $8 million.

As more RUNE is destroyed, additional loans can be created, and the price ratio between RUNE and collateral may also cause the loan amount to fluctuate.

Data

According to the official NineRealms dashboard, as of the evening of August 22nd, a total of 286,000 RUNE had been destroyed during the lending process, with the destruction volume increasing.

There is a total of 24.4 BTC and 156 ETH in collateral, valued at $636,000 and $258,000, respectively. The value of the destroyed RUNE is $474,000, accounting for approximately 53% of the collateral value.

Overall, the usage of THORChain Lending is not extensive. This is attributed to the higher collateral ratio, higher fees, slippage, and the loan limit compared to other lending protocols. Additionally, THORChain has been subject to multiple hacking incidents in 2021, which may also limit the adoption of THORChain Lending.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。