In this article, we will introduce the importance of interoperability, the challenges it faces, and the current methods.

Authors: Superscrypt, Jacob

Compiled by: Deep Tide TechFlow

With the increase of Layer 1, Layer 2, and application chains, secure, low-cost, and efficient communication between blockchains has become more important than ever.

In this article, we will introduce the importance of interoperability, the challenges it faces, and the current methods, which is the first part of the interoperability series.

Diffusion of Blockchain

The first public blockchain Bitcoin was launched in 2009. In the past 14 years, public blockchains have shown explosive growth, with the current number reaching 201 according to DeFiLlama's data. Although Ethereum dominates on-chain activities, accounting for approximately 96% of the total locked value (TVL) in 2021, in the past two years, this proportion has decreased to 59% with the launch of alternative Layer 1 blockchains such as Binance Smart Chain (BSC) and Solana, as well as the emergence of second-layer scaling solutions such as Optimism, Arbitrum, zkSync Era, Starknet, and Polygon zkEVM.

According to DeFiLlama's data, there are currently over 115 EVM-based chains and 12 Ethereum Rollup/L2s, and for various reasons, the trend of activities on multiple chains will continue to exist:

- Major second-layer solutions such as Polygon, Optimism, and Arbitrum initially positioned themselves as Ethereum's scaling solutions, raised significant funds, and established themselves as low-cost application deployment grounds (in the past year, the development team on Arbitrum grew by 2779%, Optimism by 1499%, Polygon by 116%—although the base is small, there are approximately 200-400 developers);

- Continuously launching optimized L1s for specific needs. Some chains optimize throughput, speed, and settlement time (such as Solana, BSC), while others target specific use cases such as gaming (ImmutableX), DeFi (Sei), and traditional finance (such as Avalanche subnets);

- Applications with sufficient scale and users are launching their own Rollups or application chains to capture more value and manage network fees (dydx);

- Several frameworks, software development toolkits, and "Rollup as a Service" providers have emerged in the market, allowing any project to easily create their own Rollup, reducing technical difficulty (such as Caldera, Eclipse, Dymension, Sovereign, Stackr, AltLayer, Rollkit).

We live in a multi-chain, multi-layer world.

Increasing Importance of Interoperability

The proliferation of these Layer 1, Layer 2, and application chains highlights the importance of interoperability, which refers to the ability and method of transferring assets, liquidity, messages, and data between blockchains.

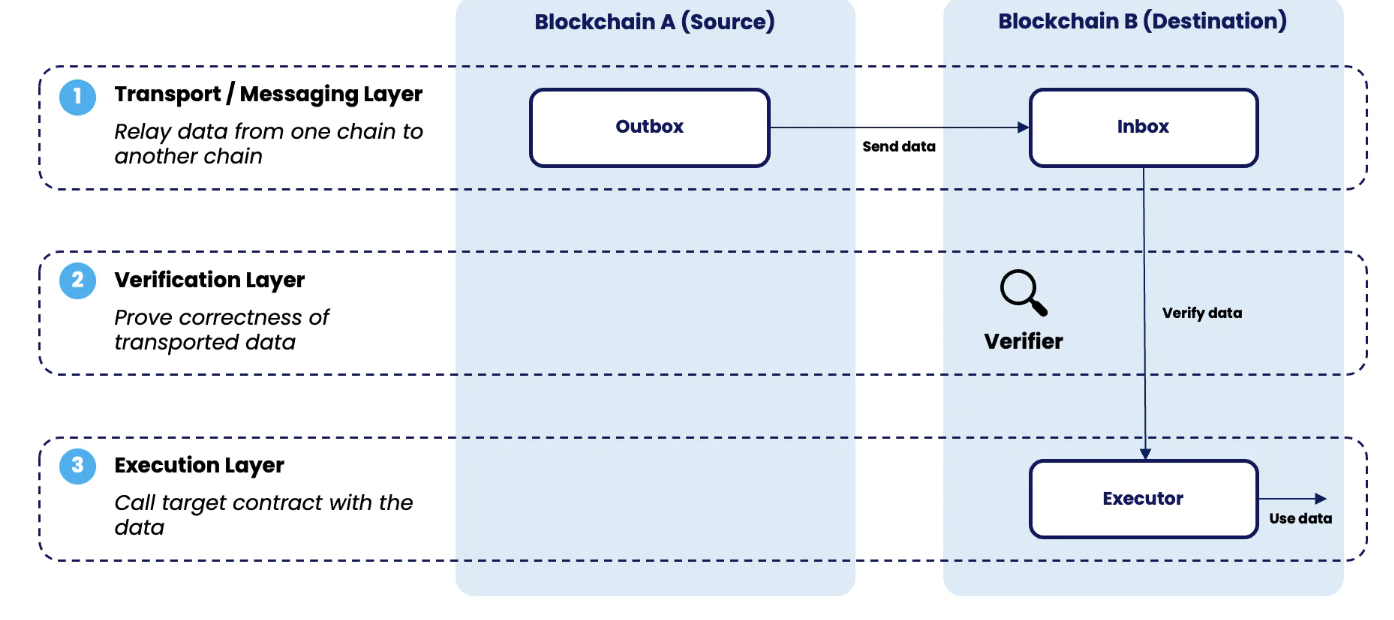

As suggested by Connext, blockchain interoperability can be divided into three parts:

- Transmission: transferring message data from one chain to another;

- Validation: proving the correctness of the data (usually involving proving the consensus/state of the source chain);

- Execution: the process of the target chain processing the data.

The benefits of being able to transfer assets and liquidity between chains are obvious—it allows users to explore and transact in new blockchains and ecosystems. They will be able to take advantage of the benefits of new blockchains (such as trading on a low-cost second layer or trading) and discover new profitable opportunities (such as accessing higher-yield DeFi protocols on other chains).

The benefits of transmitting messages unlock a whole set of cross-chain use cases without moving their original assets. Messages sent from Chain A (source) trigger code execution on Chain B (target chain). For example, a dapp on Chain A can pass messages about user assets or transaction history to Chain B, and then they can engage in activities on Chain B without moving any assets, such as:

- Borrowing on Chain B and using assets on Chain A as collateral;

- Participating in community benefits on a low-cost Rollup (such as minting new NFT collections, claiming event tickets and merchandise) without moving their NFTs from Chain A;

- Leveraging their decentralized identity and on-chain history established on one chain to participate in DeFi on another chain and get better rates.

Challenges of Interoperability

Despite the many benefits interoperability brings, it faces many technical challenges:

- Firstly, blockchains often do not communicate well with each other: they use different consensus mechanisms, encryption schemes, and architectures. It is not a simple process to use tokens on Chain A to purchase tokens on Chain B.

- Secondly, at the validation level, the reliability of interoperability protocols depends on the chosen validation mechanism to verify the legitimacy and validity of the transmitted messages.

- Thirdly, development in multiple places leads to the loss of composability in applications, which is a key building block of Web3. This means that developers cannot easily combine components on another chain to design new applications and unlock greater possibilities for users.

- Finally, the multitude of chains means that liquidity is fragmented, reducing the efficiency of participants' funds. For example, if you provide liquidity on Chain A to earn yield, it is difficult to use the LP tokens of that transaction as collateral in another protocol to generate more yield. Liquidity is the lifeblood of DeFi and protocol activity, and the more chains there are, the more difficult it is for them to thrive.

There are currently some interoperability solutions to address these issues, so what is the current situation?

Current State of Interoperability

Today, cross-chain bridges are the main facilitators of cross-chain transactions. There are currently over 110 cross-chain bridges with different functionalities and trade-offs in terms of security, speed, and supported number of blockchains.

As outlined by LI.FI in their article, there are several different types of cross-chain bridges:

- Wrapped and minted cross-chain bridges—protect tokens on Chain A in a multi-signature manner and mint corresponding tokens on Chain B. In theory, wrapped tokens should be of equal value to the original tokens, but their value depends on the security of the cross-chain bridge—i.e., if the cross-chain bridge is hacked, wrapped tokens will not be exchangeable back to the original tokens when users attempt to bridge from Chain B to Chain A (Portal, Multichain).

- Liquidity networks—parties provide token liquidity on both sides of the chain to facilitate cross-chain exchanges (e.g., Hop, Connext Amarok, Across).

- Arbitrary message cross-chain bridges—can transfer any data (tokens, contract calls, chain states), such as LayerZero, Axelar, Wormhole.

- Specific use case cross-chain bridges (e.g., stablecoin and NFT cross-chain bridges) release stablecoins/NFTs on Chain B after destroying them on Chain A.

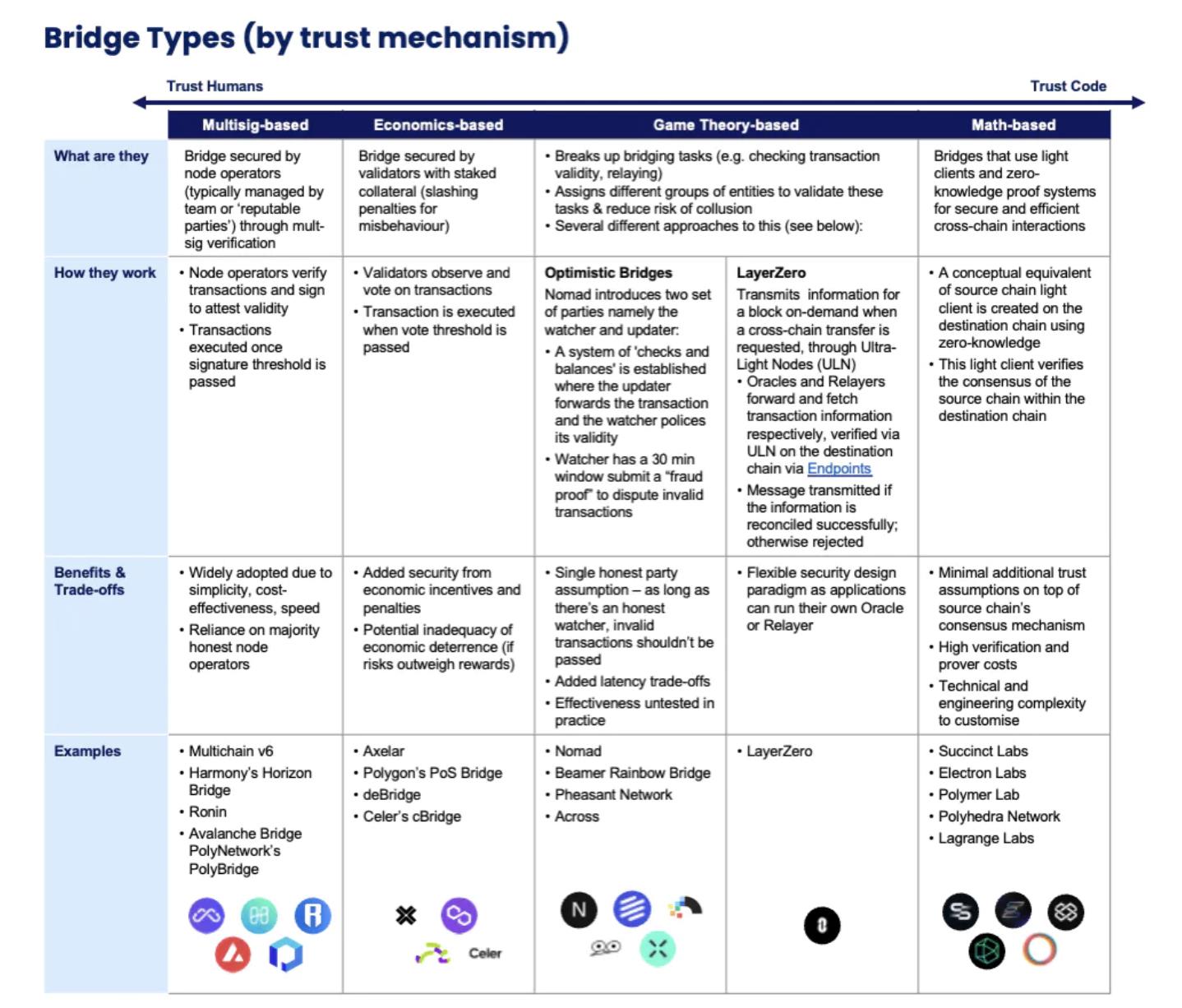

These cross-chain bridges adopt different trust mechanisms, supported by different trusted parties and incentive measures, and these choices are crucial:

- Team Human relies on a set of entities to prove the validity of transactions;

- Team Economics relies on a set of validators with collateral at risk, where the assets they collateralize are at risk of being slashed to prevent malicious behavior. This mechanism only works when the economic benefit of malicious behavior is lower than the slashing penalty.

- Team Game Theory assigns various tasks (such as checking the validity of transactions; relaying) during the cross-chain process to different participants.

- Team Math verifies the on-chain state using lightweight client verification and utilizes zero-knowledge technology and succinct proofs to verify the state on another chain before releasing assets to it. This approach minimizes human intervention and is technically complex.

Ultimately, the range of trust mechanisms spans from human to economically incentivized human to math-based verification. These methods are not mutually exclusive— in some cases, we see some methods being combined to enhance security— for example, LayerZero's game theory-based cross-chain bridge incorporates Polyhedra (which relies on zk proofs for verification) as an oracle for its network.

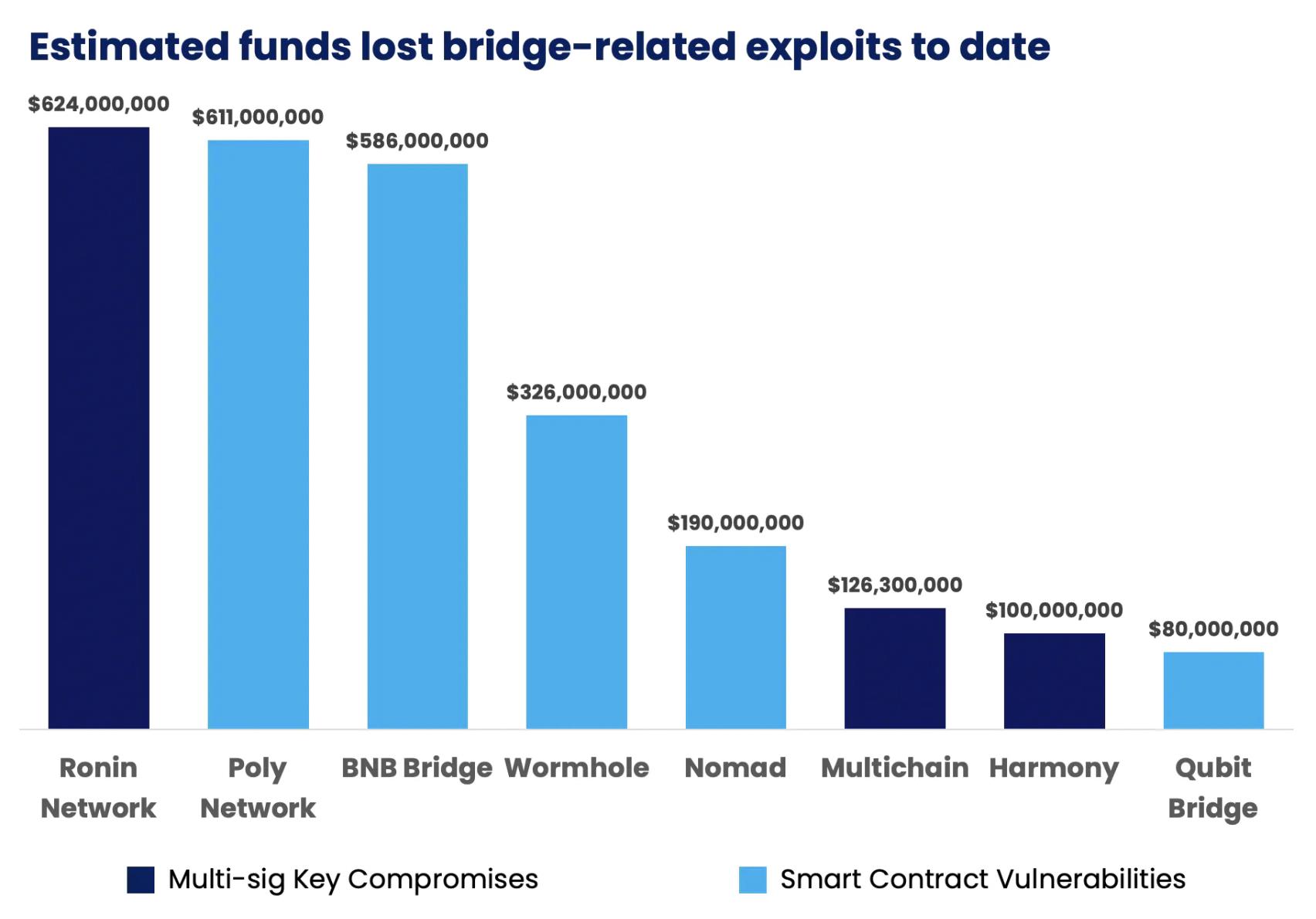

So far, how have cross-chain bridges performed? To date, cross-chain bridges have facilitated the transfer of a large amount of capital— in January 2022, the total locked value (TVL) of cross-chain bridges reached a peak of $60 billion. Due to the involvement of such a huge amount of capital, cross-chain bridges have become a major target for attacks and hacking activities. In 2022 alone, there was a loss of $2.5 billion, including a combination of multisignature key leaks and smart contract vulnerabilities. For a financial system, an annual 4% capital loss rate is unsustainable, as it cannot thrive and attract more users.

Attacks continued in 2023, with multi-chain addresses being drained of $126 million (50% of the assets of the Fantom cross-chain bridge and 80% of the assets of the Moonriver cross-chain bridge), while revealing that their CEO had been in control of all "multisignature" keys. In the weeks following this hack, the total locked value (TVL) on Fantom dropped by 67% (a large amount of assets were bridged through the multi-chain cross-chain bridge on Fantom).

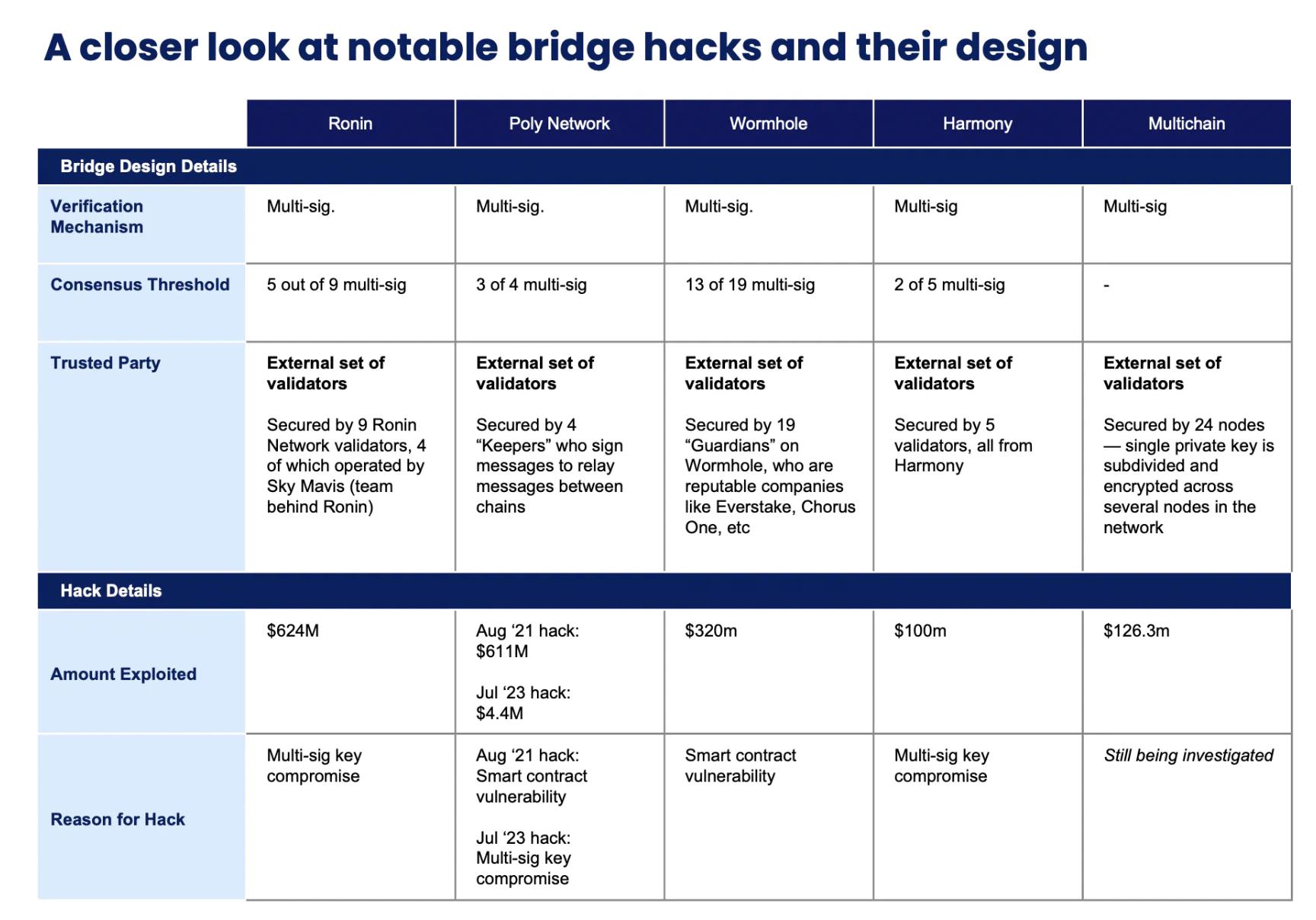

Ultimately, some of the biggest cross-chain bridge attacks and their subsequent consequences can be attributed to multisignature vulnerabilities (Ronin $624 million, Multichain $126 million, Harmony $100 million), highlighting the importance of the trust mechanism adopted by cross-chain bridges.

Having a small (Harmony) or pooled (Ronin) or single (Multichain) set of validators is one of the key reasons for some of these attacks, but attacks can come from many different avenues. In April 2022, the Federal Bureau of Investigation (FBI), the Cybersecurity and Infrastructure Security Agency (CISA), and the U.S. Department of the Treasury issued a joint cybersecurity advisory focusing on some of the tactics used by the Lazarus Group, supported by the North Korean government. These tactics include social engineering, email, Telegram, and phishing of centralized exchange accounts.

So what do we do next?

It is clear that ultimately relying on human-based validation mechanisms is prone to attacks, but the need for secure and efficient interoperability still exists. So where do we go from here?

We are now seeing the emergence of trust-minimized validation methods, which is exciting for us:

- In the second part, we will introduce proof of consensus, which is used to prove the latest consensus of the source chain (i.e., their state/"truth" in the recent blocks) to facilitate bridging;

- In the third part, we will introduce proof of storage, which is used to prove historical transactions and data in old blocks to facilitate various cross-chain application scenarios.

Both of these methods are centered around trust-minimized validation, aiming to mitigate reliance on humans and their flaws, and laying the foundation for the future of interoperability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。