Author: Yilan, LD Capital

I. Understanding MEV

When Ethereum was still using the PoW mechanism, MEV stood for "Miner Extractable Value." Under the PoS mechanism, miners have been replaced by validators, and MEV represents the "Maximum Extractable Value." Unlike the few opaque mining pool operators controlling transaction ordering and benefiting under PoW, under the PoS mechanism, the arbitrage rights for transaction ordering within blocks are open to anyone, allowing participation in the block space arbitrage open market by playing different roles. Paradigm's GP Dan classifies MEV as EIP-1559 burn, hedging, rebalance loss, and price changes before and after transactions. Breaking down the understanding of this obscure term MEV, any portion/all value captured through transaction ordering privileges on-chain can be categorized as a form of MEV. Therefore, on-chain arbitrage behavior is sometimes collectively referred to as MEV, and MEV is also seen as a by-product in the blockchain, an incentive measure without permission, allowing users to extract based on a first-come, first-served basis.

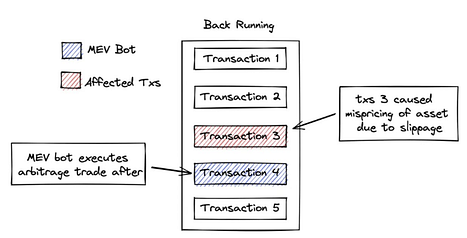

For example, suppose User A sells 100 ETH in an AMM. Due to the AMM algorithm, the price of the asset decreases with each sale, leading to a slippage if a large amount of the asset is sold, causing the price of the asset to fall below the current market price. MEV searchers, upon discovering such transactions, will buy ETH at the new price and sell at the market price to complete the arbitrage. In this example, the transaction initiated by the MEV searcher needs to be the first transaction after User A's in order to successfully complete the arbitrage. It can be seen that MEV searchers face significant competition among themselves, and how to become the first transaction before and after a certain transaction, usually depends on the priority fee paid, to be included in the block first. MEV searchers participate in the gas fee auction market to ensure timely transaction packaging by miners, leading to intense competition and driving up the cost of gas fees.

Source: wikibit

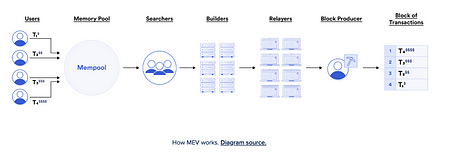

A more traditional explanation is that on the Ethereum blockchain, all new transactions must first wait in the public memory pool (or "mempool") before being placed in a block and added to the blockchain. In the past under the POW model, miners decided which transactions to include in a block and in what order, simply selecting transactions with the highest transaction fees and not caring about the order of transactions. However, in the vast transaction ecosystem fostered by Ethereum, MEV searchers quickly realized that they could profit by rearranging transactions, reviewing transactions, or creating new transactions based on transactions in the mempool, and these profits are MEV. Although searchers are the initiators of MEV, most of the profits are typically allocated to other participants in the MEV value chain, such as validators, rather than the searchers themselves.

From the perspective of user and ecosystem sustainability, MEV activities can be roughly divided into two types: arbitrage activities that help with price discovery, beneficial MEV such as liquidation, and simple front-running trades, or more complex sandwich attacks (inserting two new orders between a legitimate buy order, buying the target token at a higher price and selling it) and other unfavorable MEV activities, which can lead to ordinary DEX traders getting worse prices.

II. Overview of the MEV Track

1. Track Characteristics

The MEV track belongs to the underlying basic track and is strongly associated with all tracks related to trading in the block space. It has characteristics such as high income effect, the more complex and favorable the trading scenarios, the more advantageous for income acquisition, and relatively low risk, and it grows in tandem with the expansion of the entire L1 ecosystem in the market.

2. Track Development

(1) Solving the MEV problem is an important part of Ethereum's roadmap. On November 5th last year, Ethereum co-founder Vitalik Buterin (V God) published an updated Ethereum development roadmap, which included three major changes, including adding a new phase to the roadmap - "The Scourge," ensuring reliable and fair trusted neutral transactions and solving the MEV problem. This represents increased attention to protocols that address the centralization of MEV, and the attention to this track will gradually increase.

(2) The future development of MEV should focus on cross-chain MEV acquisition, minimizing value loss, minimizing the potential negative impact of MEV on protocol real users, and ensuring fair distribution of participants.

3. Track Scale

The income scale of this track is almost synchronous with the trading volume of the crypto market. Two main factors affect the scale of MEV: there is a positive correlation between arbitrage frequency and price fluctuations, and there is also a positive correlation between arbitrage volume and total trading volume.

Looking at Flashbots' income, the total gross extractable profit is 713.95 million, which is considered good MEV, positively impacting price discovery, core DeFi functionality, and DEX trading volume. The income from sandwich attacks is 1206.11 million, considered unfavorable MEV, and most MEV-protected DEXs hope to control and democratize this portion of the profit.

If we use the cumulative fee income of the top three Uniswap, Pancakeswap, and Sushi as anchors, the cumulative fees of the three DEXs are 5.21 billion, roughly estimating that the MEV income obtained through Flashbots accounts for 37%. In fact, besides the main DEXs, other dapps on Ethereum, alt L1, and L2 also generate considerable MEV income. Estimating the scale of these fees in the entire value chain to form the scale of various segmented tracks requires analyzing how MEV profits are distributed among different participants.

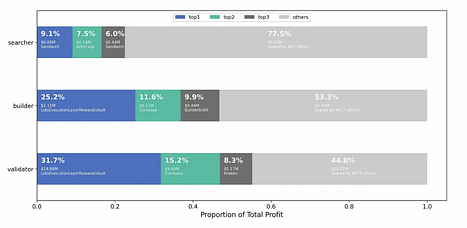

According to Eigenphi's data, in January and February 2023, MEV searchers obtained $48.3 million from all users' transactions through wallets and RPC, of which $34.7 million flowed to builders. The builders then sent $30.3 million to validators.

Profit distribution: Searchers - $7.3 million (17.4%); Builders - $4.4 million (10.5%); Validators - $30.3 million (72.1%). (The roles of these participants will be discussed later.) It is easy to see that the majority of the profit (72%) is still captured by downstream validators.

Out of $48.3 million, $6.3 million was used for EIP 1559 burning. The priority fees for ordinary transactions transferred from wallets and RPC to builders and then to validators amounted to $32.554 million. Ordinary transactions from wallets and RPC burned $227.2 million for EIP 1559.

During the bull market in 2021, the overall income ceiling was $476 million. Calculating with a lower 10x PS, the overall track scale is nearly $5 billion. The track scale of each segmented track can be estimated based on the proportion, with searchers exceeding $1 billion and validators exceeding $3.5 billion, which is only a rough estimate.

However, robots profiting from on-chain transactions may still bear the cost of many failed transactions and the impact of other off-chain hedging costs, which are not included in the calculation. Moreover, this is only the income calculation for direct participants, and does not account for indirect participant markets. In reality, the scale of the entire track will far exceed the above figures.

4. The Landscape of the MEV Track from Two Perspectives

(1) Value Chain

- Upstream (RPC Providers): Upstream refers to service providers that provide on-chain transaction information and data, usually Ethereum node operators or RPC (Remote Procedure Call) service providers. These service providers provide necessary data interfaces to middle and downstream participants, enabling them to obtain information about transactions and blocks to better participate in MEV-related activities, such as Uniswap sending user-initiated transactions (TX) through RPC (Remote Procedure Call), which enter the Ethereum mempool.

- Middle (Tools and Infrastructure): The middle includes various tools, platforms, and infrastructure that help connect upstream and downstream participants, thereby achieving the distribution of MEV value. These middle tools may include search engines, transaction builders, relayers, etc., enabling searchers, builders, block producers, etc., to more effectively discover, execute, and allocate MEV opportunities.

- Downstream (MEV Profit Receivers): The downstream covers participants who truly benefit from MEV value, including validators and other individuals or entities that actually receive MEV profits. Validators are nodes participating in block validation in a Proof of Stake (PoS) network, and they can receive rewards from transaction fees and the network's base interest, which are brought about by middle and upstream activities. Downstream validators include crypto exchanges (CEX), liquidity staking platforms, institutional stakers, and individual stakers.

(2) Direct and Indirect Participants

MEV Value Chain Transmission Process

Source: https://chain.link/education-hub/maximal-extractable-value-mev

Direct participants include searchers, builders, relayers, and block producers, also known as validators, which together form the supply chain layout of MEV. Tools that provide better services to these direct participants, such as infrastructure aimed at addressing MEV-related challenges, including Flashbots, which recently raised $60 million in funding at a valuation of $1 billion and intends to use this funding to develop the SUAVE platform.

SUAVE (Single Unified Auction for Value Expression) is an infrastructure designed to address MEV-related challenges, with the vision of becoming a common ordering layer for different chains. SUAVE focuses on separating the roles of the mempool and block generation from existing blockchains, forming an independent network (ordering layer) that can serve as a plug-and-play mempool and decentralized block builder for any blockchain, acting as the mempool and builder for other chains. The main purpose of SUAVE is to provide a more decentralized and fair ecosystem for participants related to MEV, such as users, block builders, and validators. By separating all chains' mempools and builders from other roles, specialized management is achieved to enhance overall chain efficiency, resulting in a win-win situation where the blockchain itself becomes more decentralized, validator income increases, searchers/builders can set preferences and potential income increases, and users can conduct private transactions at the lowest cost.

· Searchers write code, typically supported by proprietary complex algorithms, to identify MEV opportunities in the mempool, responsible for monitoring the public transaction pool and Flashbots' private transaction pool. They compete to submit "bundles" in response to builders and provide a gas bid, expressing the maximum cost (priority fee) they are willing to pay.

· Block Builders compete in the real-time market to execute block building on behalf of validators. Any user who downloads MEV-Boost can become a Block Builder. Builders accept transactions from searchers and further select profitable blocks from them, then send the blocks through MEV-Boost to relayers.

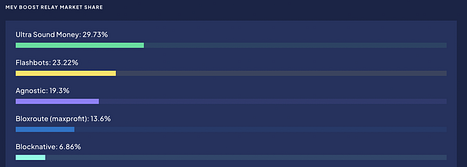

· Relayers act as intermediaries between block builders and block proposers, allowing validators to provide their block space to block builders. Some relayers include transactions of ETH passed through the Tornado Cash protocol in the past, while others exclude or "review" these transactions. MEV relayers are controversial due to review issues. In August 2022, Tornado Cash was blacklisted by the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC), making it illegal for U.S. citizens, residents, and companies to receive or send funds through the protocol. Since then, validators must carefully consider the relayers they use to obtain MEV income and decide whether to exclude such relayers considered "OFAC compliant." Given the high number of Ethereum nodes in the U.S., many validators in the U.S. are likely to choose to comply with regulatory scrutiny and avoid non-compliance risks, which contradicts the principle of anti-censorship. Flashbots' own relayer is the first MEV-Boost relayer and chooses to review non-compliant transactions, explaining its initial dominance in OFAC-compliant block production on Ethereum. With more relayers available, including non-reviewing relayers, this trend has reversed, and now less than half of the blocks are OFAC-compliant. It can be seen that Flashbots' relayer market share has declined, currently at 23%.

MEV Boost Relay Market Share

Source: https://www.rated.network/relays?network=mainnet&timeWindow=30d

· Block Producers/Validators are entities responsible for validating and proposing to add blocks to the blockchain under PoS. They are often the largest beneficiaries of MEV income. Any user can stake 32 ETH to become a Validator. Currently, Lido is the largest Validator. Validators can use MEV-Boost to select the most profitable blocks from proposals by multiple relayers and collect a priority fee, after which one validator is randomly selected from many validators as the Proposer to submit the final transactions (block production).

Indirect participants include almost all underlying L1, L2, and application-layer projects that generate transactions. The application layer is further divided into DEX, lending, and LSD (MEV activities permeate the entire DeFi ecosystem, including increasing fees, aiding liquidations, and helping validators increase the execution layer's APY), and then extends to protocols that help users avoid MEV in specific trading scenarios (including tool providers and benefiting protocols) such as Unibot and other TGbot protocols.

Leading Projects for Different Participants

- Lido

Source: https://eigenphi.substack.com/p/30m-72-of-searchers-mev-revenue-went

MEV remains important for the Ethereum economy, accounting for over 15% of all Ethereum transactions and increasing the reward rate for stakers and validators by 25%. Lido, as the largest beneficiary among downstream validators, accounts for 31.7% of the total income among all validators, amounting to 19.86 million (for the two months of January and February this year). For example, the execution layer APR of Lido DAO is mainly based on MEV income, accounting for about one-third of the total stETH income. This percentage can even reach nearly 70% when on-chain transaction activity is high. Therefore, it is speculated that during a bull market, MEV income will still account for 70% of the total stake income, indicating a high correlation between the development of the MEV track and the LSD track.

- Uniswap

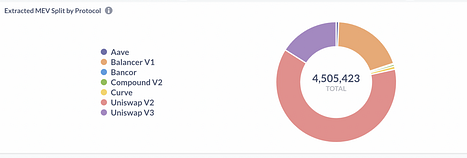

MEV Extraction Share for Different DEX Protocols

Source: Dune Analytics

The profit from MEV transactions on Uniswap amounts to 252 million. In 2022 alone, arbitrage robots extracted at least $85 million from market price asymmetries involving Uniswap V3 liquidity pools; sandwich robots extracted at least $47 million from users of Uniswap V3 liquidity pools; and JIT robots extracted $6 million from exchange fees on Uniswap V3.

The total value extracted by these three types has exceeded 25% of the supply-side income, i.e., $540 million.

For real users of Uniswap, the future UniswapX, after internalizing MEV income, can significantly enhance the benefits for swappers. UniswapX's aggregator and the mechanism for matching off-chain orders in the RFQ chain will be a significant step forward for anti-MEV (although sacrificing decentralization). For cross-chain MEV acquisition, the cross-chain technology planned to be launched by UniswapX is a key infrastructure.

Unibot

The current market value of the TG Bot track is less than $200 million, with the leading Unibot occupying approximately 75% of the market share.

Considering the volume of 800 million users on Telegram, Unibot attempts to open a huge traffic entry point through feature integration. Although the robot's functions are still in the early stages, providing one-stop trading in the traffic pool is a method that is clearly different from most DeFi applications in terms of customer acquisition. Although most transactions are ultimately conducted on Uniswap. Currently, the daily active users of Unibot increased from about 400 to a peak of 1700 in two weeks in July, indicating significant growth potential. However, this user group is quite special, usually remaining active during meme market trends, and the overall market value is still small. The business logic is sound, and the token has a reasonably fair revenue-sharing mechanism (40% revenue sharing to holder), with a high growth ceiling. In the long run, only users who are not price-sensitive will use Unibot, compared to a 5% tax on direct trading on Uniswap. However, such protocols also have obvious shortcomings, as robots have different settings, but usually allow users to create dedicated wallets or connect existing wallets. In both cases, the robot will access the private key, which may add an extra layer of risk for users.

- Valuation Aspect

- Unibot peak Vol/FDV = 12mln/182mln= 0.06

- Uniswap: Vol/FDV = 429mln/6193mln=0.069

- Velo: Vol/FDV 7.5mln/100mln=0.075

From the Vol/FDV indicator, the market has pushed the price of Unibot into a reasonable valuation range, but as meme popularity wanes, the trading volume of Unibot will also decrease significantly.

Apart from the Ethereum ecosystem, there are also MEV track opportunities in other ecosystems. Moreover, more complex cross-chain trading scenarios in the future will significantly amplify MEV activities.

III. Dynamic Balance of MEV and DEX Ecosystem

There is a positive correlation between MEV trading volume and total trading volume. Eigenphi data shows that the correlation coefficient between trading volume (excluding arbitrage trading volume) and arbitrage trading volume is 0.6, and the correlation coefficient between trading volume (excluding sandwich trading volume) and sandwich trading volume is 0.62. Therefore, the larger the total trading volume, the larger the MEV trading volume. As more DEXs increase their total locked value (TVL) on multiple chains, liquidity pools for the same assets will be formed on multiple channels, creating new opportunities for trading and MEV.

Other factors that may affect MEV activities include the level of gas fees (lower fees potentially lead to higher profits, but searchers may still raise the overall network gas for a large transaction) and market volatility (higher market volatility leads to more sandwich arbitrage opportunities).

AMMs are where most MEV is extracted. The introduction of concentrated liquidity ranges with Uni V3 allows traders to trade within smaller price ranges, reducing some price differences and thereby reducing the profit potential for certain MEV activities. Additionally, Uni V3's more refined pricing mechanism usually results in smaller slippage, theoretically reducing potential MEV profit opportunities and helping to reduce some MEV activities. In simple terms, the deepening of liquidity at a certain price range and the finer price setting by users lead to smaller slippage, resulting in a significant decline in potential profits that MEV can arbitrage.

Further anti-MEV DEXs aim to protect regular users through the following mechanisms:

(1) Order Transparency and Predictability - DEXs can publicly disclose order details before submission using auction mechanisms, employing off-chain matching mechanisms similar to order books to reduce the opportunity for front-running attacks. By disclosing information in advance, traders can better predict market behavior, reducing the likelihood of attacks.

(2) Time-Locked Transactions - Implementing time locks restricts transactions from being executed until after a specific block. This can reduce the impact of flash loan attacks, as attackers cannot execute multiple transactions within the same block.

(3) Batch Transactions - DEXs can allow traders to submit multiple transactions and process them as a batch. This can increase transaction privacy and reduce the ability of attackers to analyze transactions.

So, how does this anti-MEV approach affect trading volume? For anti-MEV DEXs, the benefits are transferred to their own users. While the reduction or transformation of sandwich behavior into non-direct fee-generating actions may lead to a decrease in trading volume, maintaining a good trading environment is ultimately beneficial for the sustainable development of any trading system.

MEV has different impacts on traders, liquidity providers, and miners/validators. For traders, MEV, especially adverse MEV, increases transaction costs, requiring traders to pay higher fees to ensure their transactions are prioritized on the blockchain, increasing their costs, especially during high network congestion. Additionally, MEV leads to information asymmetry, allowing some parties to gain unfair advantages by controlling transaction order, creating a risk of information asymmetry for other traders. For liquidity providers, there is an increased risk in providing liquidity, including the risk of sandwich trades and potential loss of cost-effectiveness. As for miners/validators, MEV may lead to optimization of their mining strategies to earn more transaction fees and rewards, but it also intensifies competition among miners/validators, leading to increased gas fees and network congestion.

IV. Solutions to Prevent Adverse MEV

There are various solutions to prevent adverse MEV at the consensus layer, execution layer, app layer, L2, and MEV tools.

At the consensus layer, Ethereum's "The Scourge" phase aims to ensure reliable and fair neutral transactions and address the MEV issue. At the transaction execution layer, peer-to-peer transactions and gasless transactions can prevent adverse MEV. Peer-to-peer transactions involve direct trading between the two parties, reducing the possibility of intermediaries' intervention and malicious behavior. Gasless transactions and separation from the mempool can reduce the opportunity for malicious actors to gain an advantage by raising gas fees. Additionally, some innovative attempts provide new ideas for preventing adverse MEV. For example, EigenLayer attempts to introduce MEV-boost and auction mechanisms in some blocks, providing new approaches for modular MEV stack design.

At the Layer 2 level, the Taiko project takes a very different approach by outsourcing block creation to L1, offering a potential solution to leverage the capabilities of the Ethereum base layer to address the complexity of L2 MEV.

At the app layer, MEV tools aim to minimize harm to users through Dex aggregators (which have not been given much attention in terms of anti-MEV efforts, as they reduce slippage impact by placing orders on different routing channels, preventing adverse MEV from finding trading opportunities), backrunning services, and off-chain order matching, auctions, or batch order processing (batch order processing with unified pricing internally fundamentally solves the MEV sandwich problem. Since the trading interface matches directly between peers, there is no issue of transaction order).

In terms of MEV tools, Flashbots aims to mitigate the negative impact of MEV on the entire ecosystem and different participants, such as on-chain congestion. Flashbots has introduced several products, including Flashbots Auction (including Flashbots Relay), the Flashbots Protect RPC, MEV-Inspect, MEV-Explore, and MEV-Boost. The upcoming SUAVE, as a common ordering layer for different chains, will focus on user preferences and optimizing trading paths to create the most efficient routes based on the searcher's search desires.

V. Conclusion

In terms of the importance of the track, MEV is a by-product of block production and can even be said to be the future of the crypto world. The strong cash flow characteristics continue to have a strong income effect on the roles of searchers, builders, relayers, and validators, as well as on tool products and services optimized around these roles. However, since there are not many protocols that initially capture MEV income for searchers and validators to issue tokens, there are fewer secondary investment opportunities. However, some applications at the application layer will gain an additional edge by entering the MEV track, and tool projects also present good investment opportunities in the primary market. However, these tool projects need to consider how to capture value for their protocols rather than just enhancing the profitability of existing participants.

Although adverse MEV has a certain negative impact on users, the proper use and existence of MEV can also bring many positive factors, such as arbitrage traders ensuring the consistency of token pricing across various AMMs, meeting the anchoring mechanism of stablecoins, ensuring smooth liquidation of DeFi loans, and maintaining incentives for block proposers to increase the security of the blockchain (by providing higher execution layer rewards).

In conclusion, the development direction of the MEV track is focused on several key areas: cross-chain MEV acquisition, minimizing value loss, mitigating the potential negative impact of MEV on protocol real users, achieving income democratization, promoting decentralization of sorters, and ensuring fair distribution among participants. Currently, we can observe that the cross-chain technology of UniswapX plays a crucial role in achieving cross-chain MEV acquisition. Overall, the value of the MEV market is related to more complex trading scenarios and market volatility in the future, which will bring more opportunities for traders. To address the potential negative impact of MEV on protocol real users, measures can be taken at the consensus layer to adopt fair distribution and privacy protection methods, and at the protocol layer to implement off-chain order matching and reduce slippage mechanisms. Additionally, the stackization and decentralization of MEV participants are crucial components of the Ethereum roadmap and will help build a more robust and secure MEV ecosystem.

In achieving income democratization, there are still many areas worth exploring in depth. For anti-MEV DEXs, a portion of the income initially obtained by searchers is transferred to their trading users. While anti-MEV designs may reduce or change sandwich attacks, potentially leading to a decrease in trading volume, maintaining a good trading environment is crucial for the sustainable development of any trading system. Positive MEV income gradually contributes to the healthy development of the entire on-chain trading ecosystem.

A fair market competition environment provides fertile ground for innovation, while more efficient profit distribution mechanisms and decentralized architectures are the cornerstones of achieving this goal. Searchers and block building technology itself are neutral, and their impact on the entire trading environment depends on how they are utilized.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。