This article introduces the current popularity of stablecoins and the Binance P2P market in the African region, discusses the challenges faced by Africans in terms of trust, discrimination, and geographical location, proposes Africa's advantageous position in the online economy, and suggests supporting crypto projects in Africa through funding and face-to-face education programs. It also explores cultural differences and perspectives within the African continent.

Author: PATRICK MCCORRY / Source: https://www.cryptofrens.info/p/understanding-crypto-in-afric

Translation: HuoHuo / Plain Language Blockchain

This article represents the author's personal views and insights gathered from conversations with local people during a 9-day trip to Africa. The key points of this article are as follows:

1) USDT and Binance P2P are widely popular

2) Desiring to earn money based on merit rather than geographical location

3) What does the future hold?

Disclaimer: Local people were invited to learn about Ethereum and Layer 2 protocols at each gathering. The audience attending these events is likely to have a strong interest in cryptocurrencies. It may not represent the general population, but as cryptocurrency adoption continues to snowball, the future may be so.

I. USDT and Binance P2P are widely popular

King of Africa: Stablecoins and the use of the US dollar.

King of Africa: Stablecoins and the use of the US dollar.

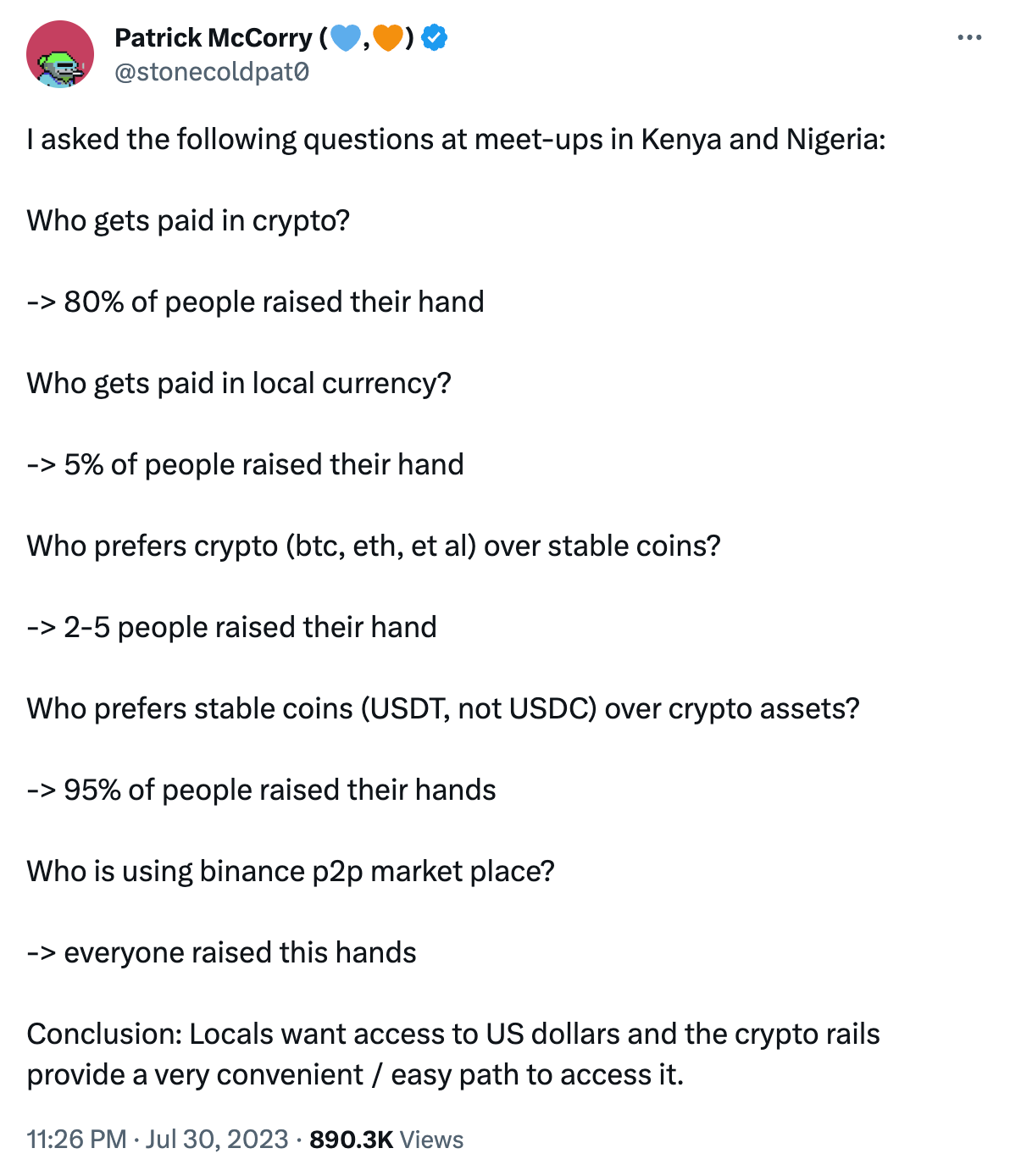

I ask the same questions at every gathering:

1) Who receives payment through cryptocurrencies?

2) Who receives payment in local currency?

3) Who prefers BTC/ETH and other cryptocurrencies?

4) Who prefers stablecoins?

5) Who actively uses Binance P2P market?

In all gatherings, the responses of almost all participants were quite consistent:

1) They receive payment in cryptocurrencies.

2) They prefer to be paid in stablecoins, especially favoring USDT.

3) They use Binance's P2P market to exchange stablecoins for local currency (and vice versa).

4) They are not very interested in holding native cryptocurrencies such as Bitcoin or Ethereum. Furthermore, participants prefer to use networks like Tron or Binance Smart Chain for transactions.

One possible reason is that the transaction confirmation time is "faster" and almost no fees are charged.

- Binance is very popular

Despite the increase in competitors, almost all participants continue to rely on Binance as their preferred platform for trading.

Someone explained to me that Binance entered Africa with Binance Labs around 2018. Over time, Binance realized that Africans wanted access to stablecoins, and this situation arose.

It has become an important market for the company, with a noticeable adoption rate. I saw several locals wearing Binance merchandise, but they had never worked for the company.

To me, the rise of USDT seems coincidental. In 2018, there was no competition in the stablecoin market, and Africa seemed to follow the broader market trend at the time, with USDT replacing BTC as the most liquid and highest volume asset. I wish I could understand more about the preference for USDT over USDC.

2. Cryptocurrencies represent the convenient acquisition of stablecoins

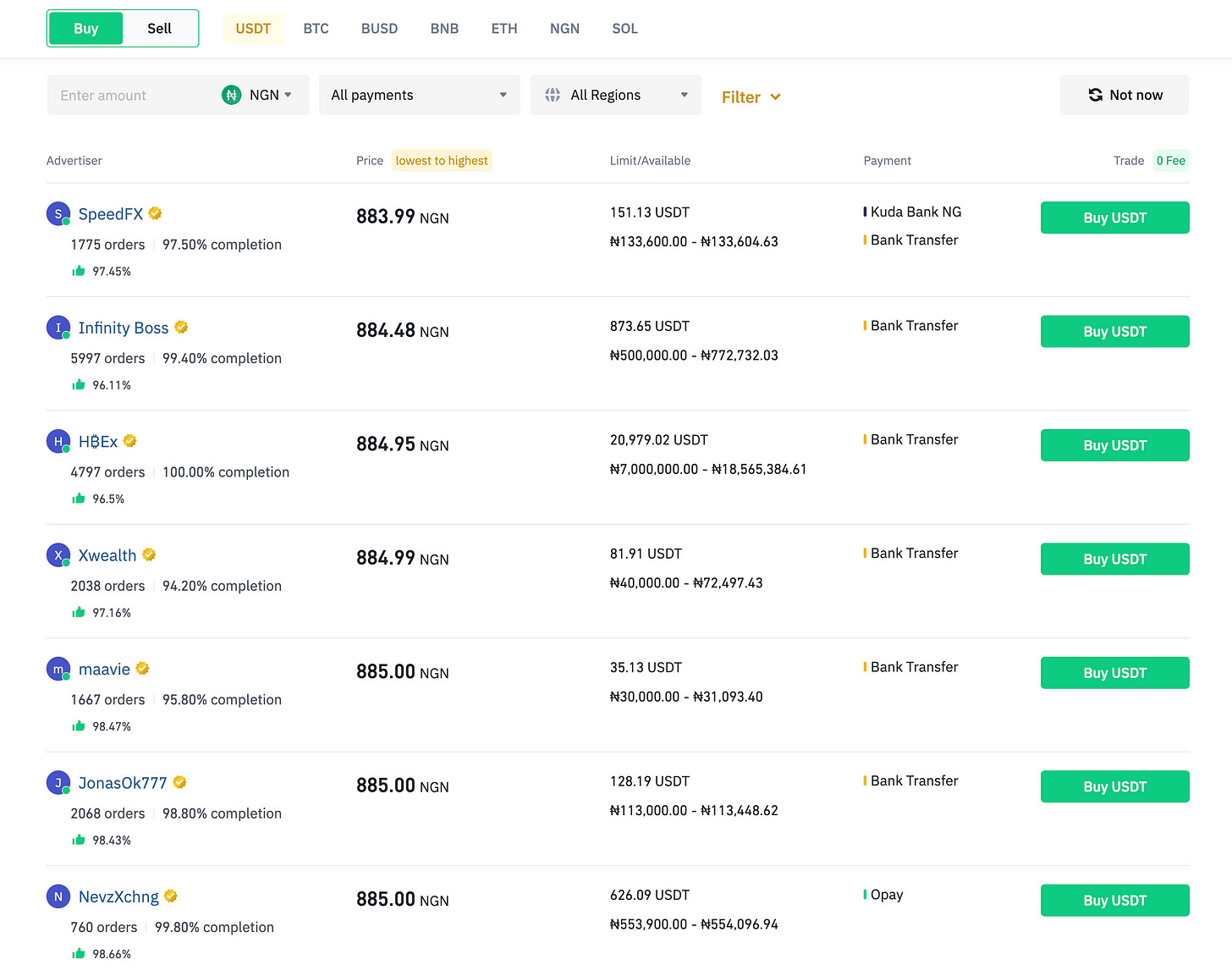

BN P2P market, used to exchange stablecoins for local currency. Very similar to Local Bitcoins.

BN P2P market, used to exchange stablecoins for local currency. Very similar to Local Bitcoins.

The rise of stablecoins cannot be underestimated: from the perspective of Africans, stablecoins represent the most important innovation. It allows for the convenient acquisition of US dollars:

Africans can bypass the local black market.

Africans no longer need to deal with related dangers in the real world.

Africans can exchange based on exchange rates that reflect a broader market.

More importantly, there is no need to stash dollars under the mattress. Everything is digital.

Of course, making stablecoin adoption a reality is not an easy task.

Some readers might think, "Well, if I can represent dollars as on-chain assets, then I've solved the problem!"

This is the first step in solving the problem. The broader issue is to create an online market that can foster a liquid market for exchanging stablecoins for local currency. The market must be able to facilitate a certain scale of swaps and minimize price slippage.

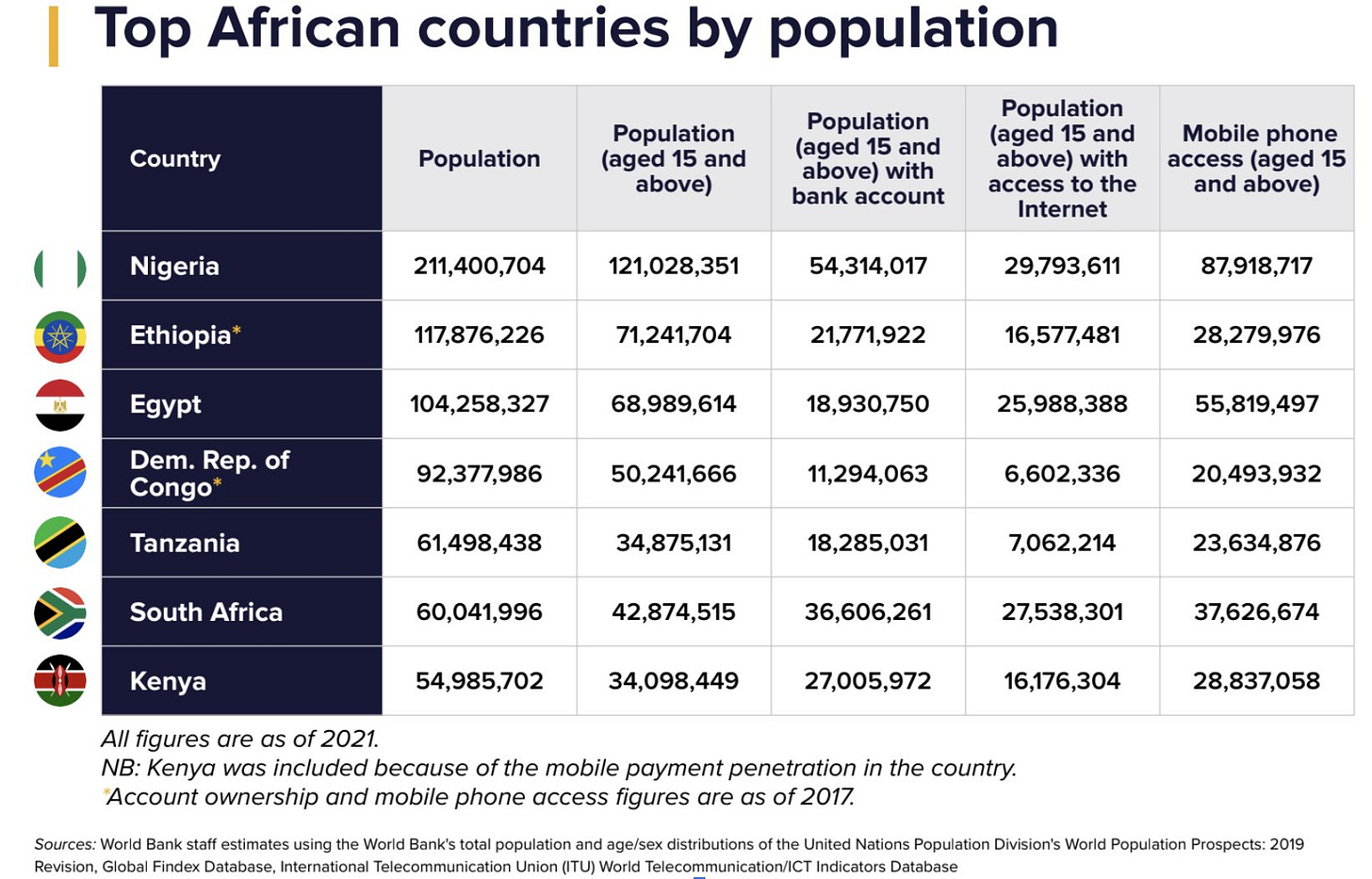

Why is this a real challenge? There are approximately 42 currencies in African countries. We need to foster a liquid market to facilitate the exchange of all local currencies with stablecoins. It requires many local participants to make it a reality.

Fortunately, one thing that the crypto railway is really good at is allowing participants to collaborate and provide liquidity for assets when there is a real demand.

So far, this has been effective in Kenya and Nigeria. I just don't have data to confirm that this is the case for all 42 currencies in Africa.

3. Why choose stablecoins? Why not cryptocurrencies?

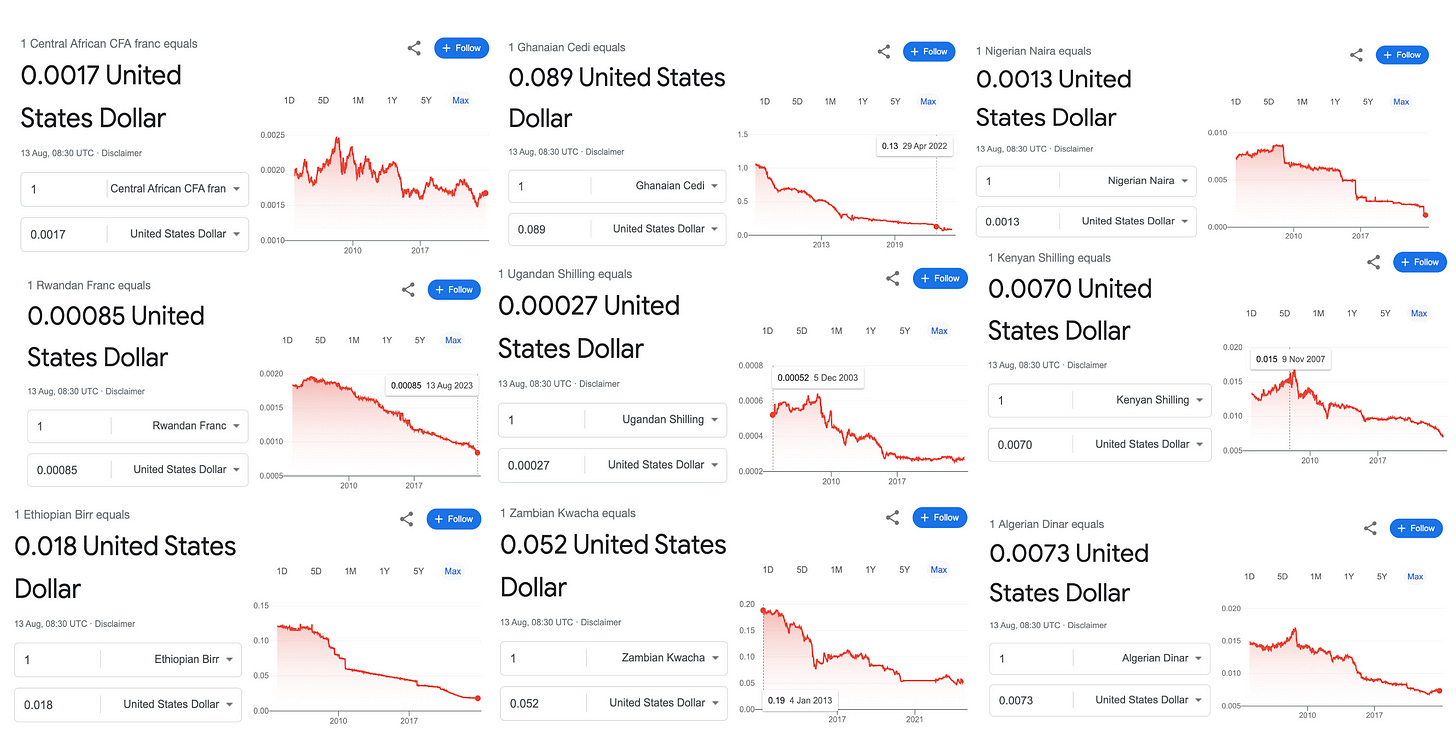

A small random sample from Google search. Many African currencies are depreciating relative to the US dollar. Today, the depreciation trend continues.

A small random sample from Google search. Many African currencies are depreciating relative to the US dollar. Today, the depreciation trend continues.

It may come as a surprise to many, but local currencies in African countries are rapidly depreciating relative to the US dollar. Some currencies, such as Zimbabwe's, have failed due to hyperinflation.

For example—since 2008: the Nigerian Naira has depreciated 7/8 relative to the US dollar. The Kenyan Shilling has depreciated 50% relative to the US dollar.

Given that Kenya's GDP has doubled from 2008 to 2023, the noticeable depreciation of the Kenyan Shilling is striking. Against the backdrop of economic growth, the currency continues to depreciate. People's confidence in the economy is growing, but their confidence in the local currency is waning.

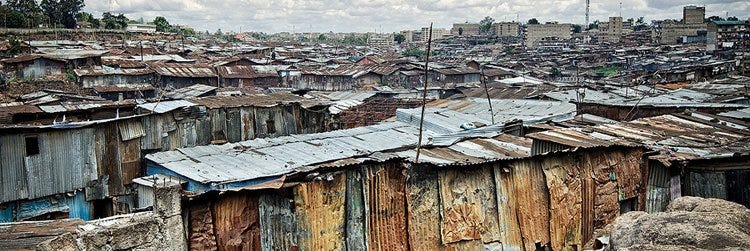

We visited a charity organization working with a young mother from the Kibera slum, and this photo is from Google.

It goes without saying that a large portion of the population in Kenya and Nigeria still lives in absolute poverty.

For Westerners, especially Britons, the concept of poverty is living in government-subsidized (welfare) housing. Families struggle to make ends meet, but they have a place to live and access to healthcare. If we consider homelessness, the UK has about 271,000 people, which is 0.4% of the total population (approximately 67 million).

It is estimated that 60% of Nairobi's population lives in slums. Additionally, the World Bank estimates the proportion in Nigeria and Kenya to be around 50%.

In the slums, an entire family may live in one room ("studio"). Outside their home, there is a small corridor connecting them to the main road. As we experienced, sewage runs through the narrow corridor, which is like an obstacle course that you have to navigate. Many people live on less than $1 a day, and there is almost no social welfare.

This is why the following statement falls flat for Africans, especially those living in slums.

"The real win is helping people understand why Bitcoin is the best long-term savings asset." (https://twitter.com/stephanlivera/status/1685946045014900736)

I don't like to criticize the above comment, but it is disconnected from the real-world situation and the realities faced by local people.

I believe that local people want to have long-term savings goals, but they urgently need to address their immediate expenses. For example, if they fail to pay a bill for some reason, the landlord might pay $10 and threaten the tenants with a group of young men wielding sharp metal.

Considering that there are still landlords in the slums, this is actually quite remarkable.

I don't believe that even stablecoins can help people living in the slums. The solution is to create better market conditions for locals to earn wealth, build better infrastructure, and escape the slums. I can see how individuals seek online work and receive payments through cryptocurrency channels, but this is not a ready-made solution for many people living in these conditions.

In other words: Except for special cases, the crypto railway has not yet reached about 50% of the population in Nigeria or Kenya.

Africans using stablecoins do not live in slums. I believe they have achieved some form of financial stability and are able to cover certain expenses.

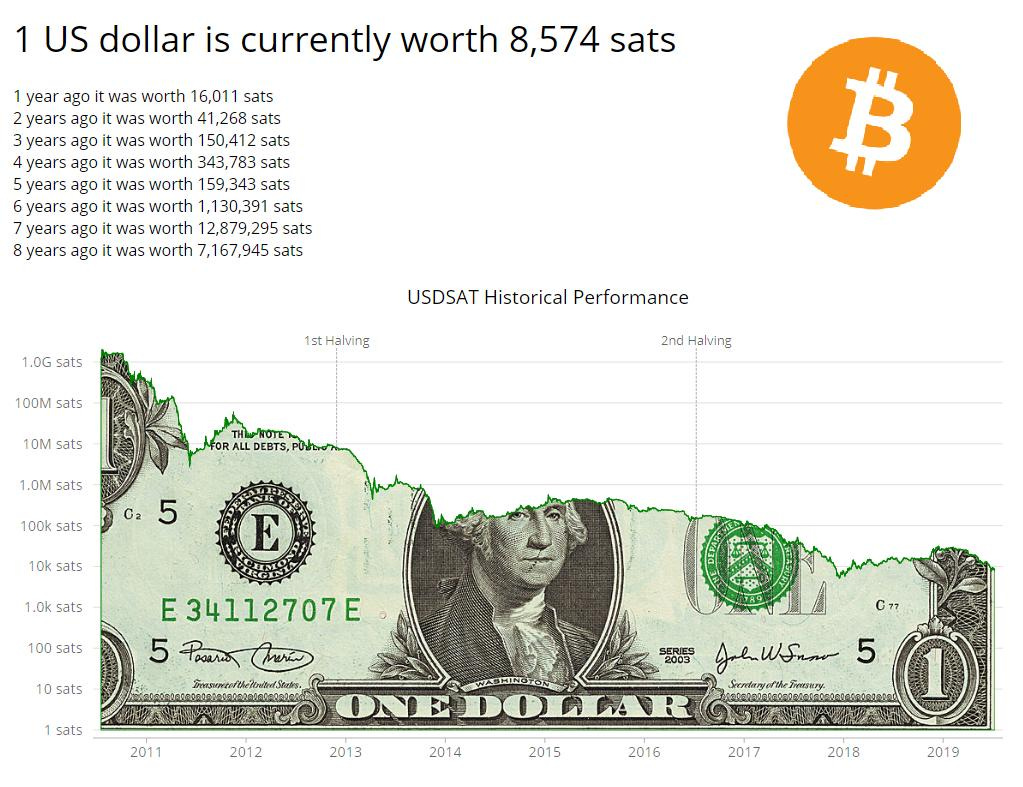

The cryptocurrency meme suggests that holding Bitcoin is a good thing because its value has continued to rise relative to the US dollar over the years.

The cryptocurrency meme suggests that holding Bitcoin is a good thing because its value has continued to rise relative to the US dollar over the years.

Over time, the dollar is losing its purchasing power, and we should keep all our savings in local crypto assets, but this cryptocurrency meme doesn't make sense to them. It's a foreign concept.

The situation in Africa is quite the opposite. The purchasing power of the dollar is only rising relative to the local currency, making it much safer than holding native crypto assets.

For Africans, the dollar is extremely stable, and that's why stablecoins have found a suitable product market.

II. Earning money based on merit rather than geographical location

When we held meetings, there was a large presence of Kenyans and Nigerians, and the demographic of attendees included:

When we held meetings, there was a large presence of Kenyans and Nigerians, and the demographic of attendees included:

1) Community leaders,

2) Software developers,

3) Founders of startups.

This demographic makes sense, as our team represented ETHGlobal, Arbitrum, and Scroll, and received sponsorship from Optimism.

1. Aspiring for success in the background of discrimination and distrust

The locals were not sitting quietly. They asked question after question, many of them technical in nature.

The locals were not sitting quietly. They asked question after question, many of them technical in nature.

The following questions and answers are from the gathering in Nigeria.

Who has had issues with online payment providers like PayPal?

The audience raised their hands and laughed in unison.

Being denied service due to suspicious IP addresses from Africa (especially Nigeria) is a common occurrence for online service providers. Some of us have also been locked out of our accounts.

The end result is that Africans are unable to access the services provided by global fintech companies, while we in the West take it for granted.

Who has questions about KYC?

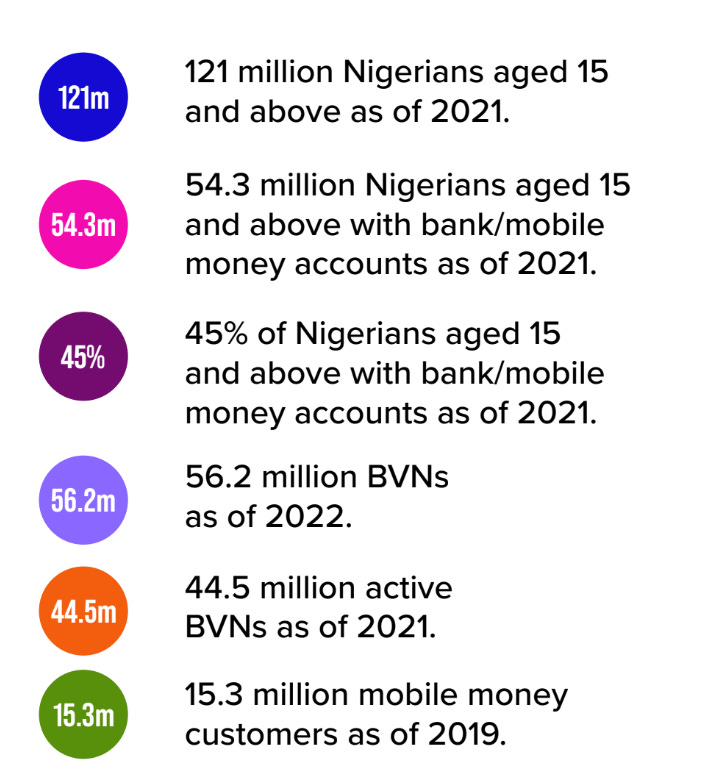

We were told that about 70% of Nigerians do not have passports.

The Nigerian government has a program called the National Identification Number (NIN) for identity verification and KYC purposes, but the program has encountered issues and delays.

Adoption of identity and bank accounts is increasing, but still lacks the majority of participation.

Adoption of identity and bank accounts is increasing, but still lacks the majority of participation.

On the other hand, the Central Bank of Nigeria operates a separate identity verification process called the Bank Verification Number (BVN). It serves as a single identifier for users across all banking services. Only 25% of Nigeria's population (57 million) has signed up for this protocol.

Identity remains a challenge in Nigeria. It will affect companies' ability to meet compliance requirements before sending funds to Nigerians. Regardless of whether cryptocurrencies comply with regulatory frameworks, this identity issue that can comply with regulatory frameworks does need to be addressed.

Who has missed out on opportunities due to lack of trust in you?

This time, no one laughed.

Everyone raised their hands, surveying the room. It was very thought-provoking.

It is disheartening that locals are discriminated against and deemed untrustworthy, especially when it stems from their nationality and geographical location. The Nigerian Prince meme encapsulates this online sentiment.

If there's one point to give to readers, I believe this is why blockchain technology, and Rollup as a technology stack, is so important to our African colleagues.

It weakens the power dynamics between users and operators, allowing parties who wish to transact but do not trust each other to eventually transact with each other in a secure manner.

In other words, it allows users to:

- Lock funds into an operator's service,

- Interact with the service,

- Eventually withdraw funds from the service,

…while not trusting the service operator.

Our ability to define, measure, and reduce trust in financial interactions makes the cryptocurrency space so special. I would go as far as to call it the field of trust engineering.

I hope that one day, the technology stack will enable our colleagues to benefit on a large scale.

To transact on their platforms, pay for their services, and most importantly, not have to care about who they are or where they live.

What is one thing we should tell Westerners about Nigerians?

One participant, along with some comments from others, made an insightful speech in response to this question. I tried to summarize the key points.

"Nigerians are particularly eager for opportunities. They are driven by incentives. Design the right incentive program, and Nigerians will come.

Nigerians learn everything they know from the internet. Give them a Nokia 3310, and they will use it as a tool to go somewhere.

They want to escape their local environment, work online, and join the global workforce. They see blockchain as a great equalizer. Let them earn money based on merit rather than location.

The funding required for projects (in Africa) is less. In the US/EU, for every $1 spent, you get 1 point, but in Africa, you get 1000 points.

As another data point:

"If there are Nigerians involved in this project, it can make money. If there are no Nigerians, it gets tiring." - Local Kenyan

I chuckled, but it does indeed illustrate the eagerness for success.

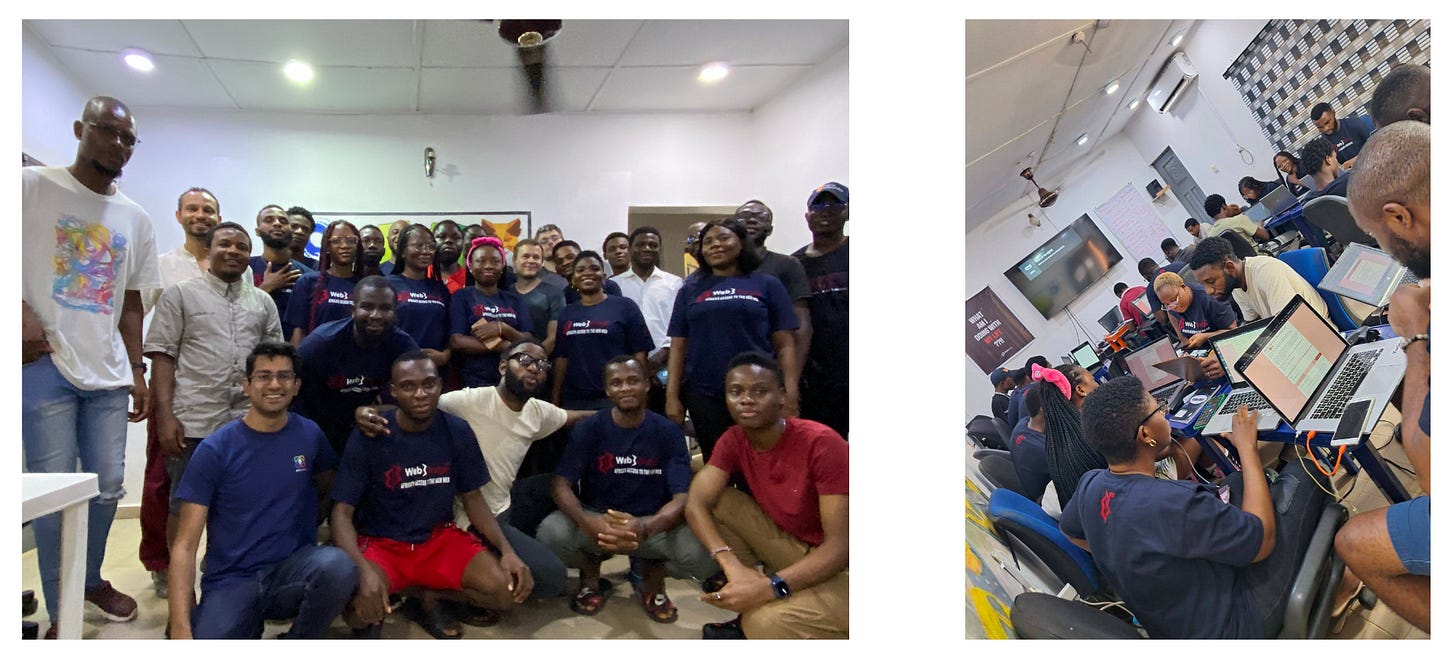

2. Web3Bridge

Providing a 16-week free course for Nigerians aimed at understanding Ethereum and Web3.

Imagine:

Leaving your friends and family for 16 weeks, traveling thousands of miles, and living with 40 other people in a house (bunk beds) to learn about Web3.

Hoping for a life-changing opportunity.

The opportunity to work online, earn income based on performance, and not be discriminated against based on geographical location.

That's Web3Bridge.

The ninth cohort

The ninth cohort

Web3Bridge is an education program that has been running for free since 2019.

The program attracts Web2 developers and aspiring programmers who want to learn how to enter the Web3 industry.

We met a woman who left her husband and three children at home so she could participate. I imagine many others in that room faced similar challenges when leaving loved ones for an extended period, and this courage should not be underestimated.

The curriculum and topics covered are also impressive. It ranges from basic concepts (such as what is blockchain) to implementing your first Solidity (or Cairo) smart contract, and then to learning full-stack implementation of Web3 applications.

The Ethereum Foundation donated to help Web3Bridge purchase a generator. This is because the Nigerian power grid is unreliable and experiences frequent outages.

The Ethereum Foundation donated to help Web3Bridge purchase a generator. This is because the Nigerian power grid is unreliable and experiences frequent outages.

Similarly, the entire program is free to attend, whether in person or online. We learned that the continued existence of Web3Bridge depends on grants from the founder and personal investment (time and money).

Currently, the physical setup consists of several houses, but the founder shared his dream with us. He wants to purchase nearby land and establish a larger campus. With greater physical capacity, he can expand the training scale and teach hundreds of developers at the same time.

I truly hope his vision comes to fruition, and the crypto community should consider how to support Web3Bridge.

III. What does the future hold?

Having had the opportunity to visit Kenya and Nigeria for nine days, I gained some valuable insights that led me to some important conclusions about the future—its workforce, the role of cryptocurrencies, and whether we (in the West) can support their growth.

1. Africa has unique conditions for success

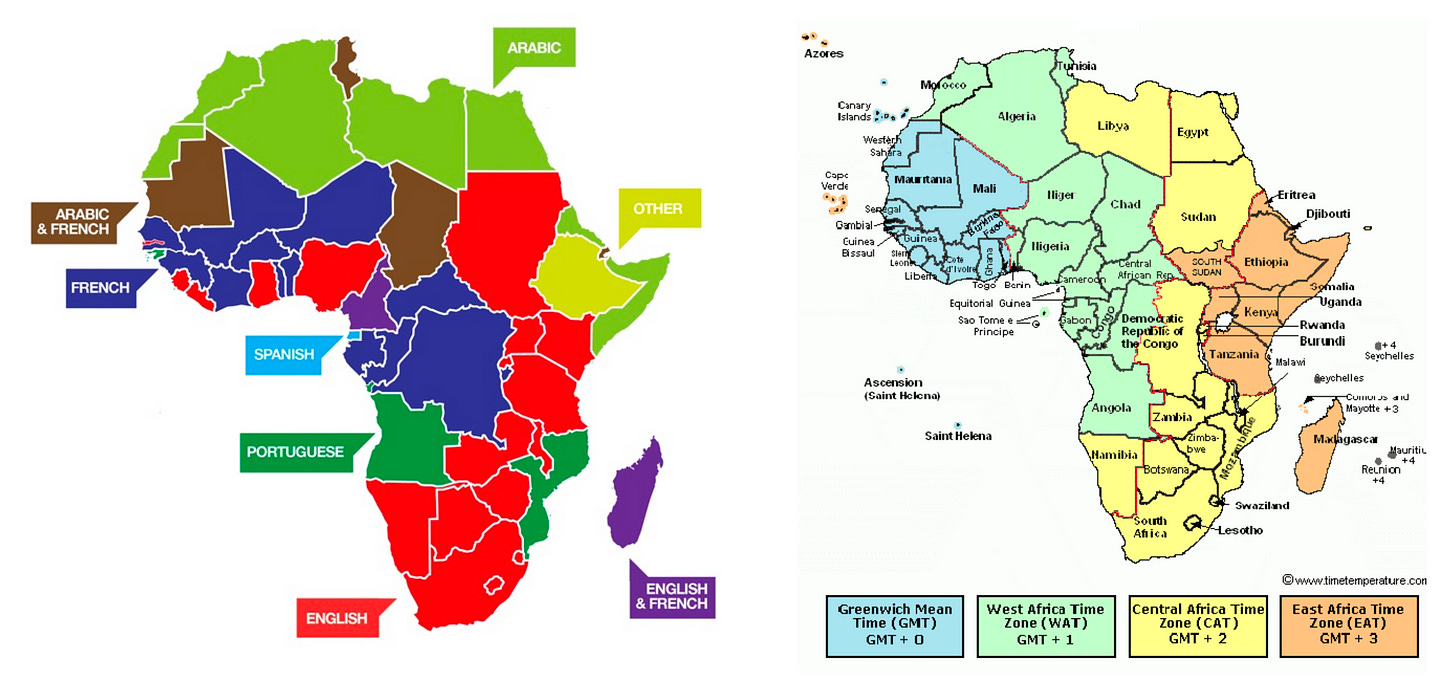

Africans share the same time zone and language as most Europeans.

Africans share the same time zone and language as most Europeans.

In my view:

Africans share the European time zone,

They can speak fluent European languages, especially English and French,

They have a strong desire for success and earning wealth.

Africans are in a favorable position in the digital arena.

In the digital realm, if a specific time zone needs an employee and they can communicate in the same language, whether the employee is in Europe or Africa may not be important.

To me, the primary goal of helping Africans succeed is:

Providing better cryptocurrency channels to offer reliable ways for employing and paying Africans,

Reducing key differences between African and European communities in online communities,

Enabling African developers to utilize crypto as a software stack and eliminating the role of trusted service operators.

In the long run, the two communities of Africans and Europeans should be difficult to distinguish in the digital arena.

Only then can Africans overall have the ability to earn money based on their merit rather than their geographical location.

2. Africans understand cryptocurrencies

Kenyans lining up to receive a Worldcoin airdrop, then immediately selling it via WhatsApp. As a result, Kenyan police are stopping Worldcoin eye scans.

Thanks to the internet and our online community, Africans are not isolated from the broader Ethereum community.

We met the following teams and individuals:

Building projects on Arbitrum,

Participating in ETHGlobal hackathons and winning prizes,

Learning how to implement Cairo smart contracts for StarkNet.

Realizing retrospective funding from Optimism,

Eager to understand ZKP to the extent that Zhang Ye failed to finish his slides at two developer workshops.

Africans do not need our help in understanding how to use cryptocurrencies. If anything, we need their help to showcase use cases.

As described in this article, how Africans conveniently acquire US dollars through cryptocurrencies helps validate all the technology we are building. It provides undeniable evidence that cryptocurrencies have product-market fit and many people rely on it.

On the other hand, we need to better understand the challenges Africans face in participating in the online economy and starting their own ventures in the cryptocurrency space. Some challenges include:

1)Lack of Government Support

Kenya has no crypto laws, but the government seized WorldCoin's hardware, citing undisclosed intentions as the reason (source).

Nigeria prohibits bank involvement but not individual use.

2)Almost No Existence of Venture Capital

Angel investment is feasible but very rare.

Identity issues make legal compliance difficult and could be a barrier to fundraising.

3)No Time for Tinkering

The desire for success makes Africans very focused on developing the next product.

They lack leisure time to simply tinker with technology for fun, which may hinder their ability to come up with innovative ideas.

4)Global Perspectives

There are misconceptions among Westerners about the abilities of Africans and the real-world needs.

Africans can showcase their abilities and strengths, but it requires all of us to amplify it.

4. African Grant Programs

A recurring solution that has been proposed is the need for a grant program specifically for Africans.

Regarding grant programs, I would like to make a few points and provide feedback on any program (not just those targeting Africa):

Grants should be provided to projects and individuals in need of funding,

Funding should be provided to individuals who could benefit from tinkering and better understanding research-oriented ideas,

Grants can reduce the risk in the pre-seed venture capital environment,

Grants should not be seen as a long-term source of funding, as it is easy to continue funding and should allow for failed projects,

Grants should only be disbursed when there is clear and undisputed evidence of work done by the recipient,

Grants can be provided to nurture the environment, connect developers, and develop a community for sharing knowledge.

Any grant program seeking to make an impact in Africa or any geographical location indeed needs local leaders to operate it. Grant managers can be compensated for reviewing and authorizing grants. It is likely a full-time role.

Most people, even prominent local leaders, do not have experience running or participating in grant programs. Like any system, it is best to start small and gradually develop over time. It is wise not to entrust a large sum of money to a brand-new grant program. Grant managers should have time to earn a reputation for how they manage finances and demonstrate the impact of the grants.

Grants are not a panacea for solving local issues, especially in Africa. Treasury is limited and can easily be depleted. It is best to be cautious about how funds are used. Funds should be reserved to help the most promising groups and individuals advance their projects. It is "free" money, but it should not and cannot be widely used.

Looking at the industry, Uniswap is one of the most successful stories. The Ethereum Foundation provided a $50,000 grant to founder Hayden to pay for audit fees. This money was enough to cover audit fees, drive development, and birth the tech giant Uniswap.

Pushing doesn't need to cost a lot of money. Less is often more.

Finally, there are two issues hindering the success of any grant program.

If Africans cannot comply with KYC/AML rules, they may not be eligible for grants.

There is a need to establish a local venture capital network to fund future successful cases.

Both are structural and infrastructural issues outside the crypto field. Especially the venture capital network, you need early founders willing to invest and help new founders build large and sustainable companies.

5. Physical Education

Developer workshops held in Nigeria and also in Kenya. Photo by @charliecodes.

Developer workshops held in Nigeria and also in Kenya. Photo by @charliecodes.

One thing that Africa lacks but the West has in abundance is physical education.

In the West, there are numerous workshops, summer schools, and winter schools for attending and learning about the core technologies driving cryptocurrency development. More importantly, many educational activities are free to attend.

Unfortunately, many Africans face limitations when attending physical events related to cryptocurrencies.

Many Africans do not have passports, and even if they do, the need for visas and the potential economic burden of travel costs pose significant challenges.

They simply cannot come to us.

As an experiment, I and Zhang Ye held a developer workshop in Kenya and Nigeria.

To our surprise, software developers showed up, and in significant numbers (more than expected). They asked many good technical questions. He couldn't finish his slides due to the swarm of questions.

There are many technically proficient developers in Africa who want to understand the core infrastructure of Ethereum and esoteric topics like zero-knowledge proofs.

So far, they have relied entirely on the internet to understand this, but there is nothing better than face-to-face interaction with world experts on a particular topic. Not only from a learning perspective, but also to gain inspiration for pursuing a particular topic, as experts often have a passion for their subject, and that intellectual passion is infectious.

This leads me to take the next step: We really don't need a conference to sell and promote new Web3 projects to Africans. People are eager for knowledge sharing and learning.

The greatest contribution we can make to Africans is to organize and conduct face-to-face education programs. Just like summer schools—inviting experts to teach technical topics.

IV. Conclusion

I saw this painting in a coffee shop, and I love how it highlights the pride of Africans. You can buy it here.

I saw this painting in a coffee shop, and I love how it highlights the pride of Africans. You can buy it here.

Several key points can be derived from the above article:

- Crypto Rails has found product-market fit as a convenient way to acquire US dollars,

- Binance is popular in Africa due to early expansion and promoting peer-to-peer markets,

- Africans want to earn money based on merit rather than geographical location, and they have the ability to pursue this goal,

- The long-term goal should be to reduce the differences between Europeans and Africans in the digital arena.

- Africans face many challenges, including lack of regulatory support, inability to travel, difficulty complying with KYC/AML, almost no venture capital network, and no time to try out new ideas.

- Most importantly, almost all Nigerians admitted to missing out on an opportunity because people could not trust them.

- The educational program of Web3Bridge is doing God's work, and the next step is for Western countries to personally assist in setting up their own summer schools.

One of the impacts we visited is helping to connect communities. Many attendees did not know each other, especially developers. It sounds like some local community leaders will try to continue organizing more events. With more and more people visiting, hopefully it will also help local leaders build a larger community.

I want to discuss the last two topics.

Africans have a playful nature. We may have only visited Nigeria/Kenya, but we met other Africans from Uganda, Ghana, and elsewhere. They were happy to joke about other African countries, like how Nigerians are very dramatic, or how Ghanaians are visited when they need to relax.

The locals were very willing to teach me some fun phrases, like Mubaba, Alagba, m'soupa, which are praises for men and women. I seized every opportunity to say these phrases, and most of the time they laughed, especially the Kenyans.

They even told me that East Africans have round foreheads, and West Africans have flat foreheads. Haha.

As a programmer, it's easy to focus on the broader system and try to assess how to fix it to benefit everyone. However, we must never forget the core figures of this system. Taking the time to understand their customs, sense of humor, and fully understanding what they have to give up to be in the same room with the rest of us is always worth it.

What is Africa?

One striking aspect of Africa is its vast cultural richness and how it influences Africans' view of the African continent.

In West Africa, there is a Schengen-like arrangement allowing visa-free travel across multiple countries. However, travel from East Africa to West Africa (and vice versa) is difficult and uncommon. It requires visas, is economically costly, and also takes time. For example, a flight from Lagos to Nairobi takes about 5 hours, and the return flight cost could exceed $600.

I noticed that East Africans and West Africans recognize each other as part of the African identity. On the other hand, they do not hold South Africa or North Africa to the same standard as "African." South Africa is considered more Europeanized, and North Africa more Islamized.

The sentiment is borne out, at least from those I asked, as no one has been to Algeria or expressed any intention to do so. This is interesting because my stepfather grew up in Algeria and very much considers himself African.

I am curious about this and speculate that it may be related to cultural differences and the colonial history of Africa. I would be grateful for any comments that are of significant reference value!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。