Today's Headline Highlights:

- The Monetary Authority of Singapore has finalized the regulatory framework for stablecoins, and issuers must meet multiple requirements such as "disclosure"

- The Pingnan Court is holding a public trial for the case of Lai Mouhang, a leader of the Timespace Cloud pyramid scheme, involving over 600 million RMB

- The Dongyang Court has initiated the first round of fund recovery work for a 380 million RMB cryptocurrency fraud case

- Zhengzhou officially introduces the "Metaverse Industry Development Policies" and will establish a 10 billion RMB special fund

- Safe Wallet releases the interoperability protocol Safe{Core} for modular smart accounts

- CyberConnect airdrop is now open for claiming, with CYBER price at around $7

- Data: An address that has been dormant for over 12 years transferred 1005 BTC last night, with a value appreciation of over 20,000 times

Regulatory News

The Monetary Authority of Singapore (MAS) has announced on its official website that it has finalized the regulatory framework for stablecoins. The MAS framework will apply to single-currency stablecoins (SCS) pegged to the Singapore dollar or any G10 currency. Issuers of such SCS must meet key requirements in the following aspects: 1. Value stability: SCS reserve assets will be subject to requirements in their composition, valuation, custody, and audit to ensure high value stability; 2. Capital: Issuers must maintain minimum base capital and liquid assets to reduce bankruptcy risk and orderly wind up operations when necessary; 3. Redemption at face value: Issuers must return the face value of SCS to holders within five working days after redemption requests; 4. Disclosure: Issuers must provide appropriate disclosures to users, including information on SCS value stability mechanisms, SCS holder rights, and reserve asset audit results.

Only stablecoin issuers that meet all the requirements under this framework can apply to MAS for their stablecoin to be recognized and labeled as "MAS-regulated stablecoin." This label will enable users to easily distinguish MAS-regulated stablecoins from other digital payment tokens. Anyone misrepresenting a token as "MAS-regulated stablecoin" may be penalized under the MAS stablecoin regulatory framework and listed on MAS's investor alert list. If users choose to trade stablecoins not regulated by MAS, they should make wise decisions regarding the associated risks.

InvestHK: The Hong Kong government is considering creating a public chain specifically for Hong Kong

Terry, Senior Manager of InvestHK, stated in an interview with IQ Times that the Hong Kong government is considering creating a public chain specifically for Hong Kong, which would allow global participants to use this public chain.

According to the WeChat public account "Pingnan Court Publicity," the Pingnan County People's Court publicly held a trial at the first trial court of the Gangnan District People's Court in Guigang City, involving the case of Lai Mouhang and 4 others organizing and leading pyramid scheme activities, with an amount involved exceeding 600 million RMB. The public prosecution agency believes that Lai Mouhang and others, under the guise of mining FIL coins on the Timespace Cloud platform, required participants to pay for the purchase of mining machines or mining machine leasing fees to qualify for participation, and to form a hierarchy in a certain order, directly or indirectly using the number of developed personnel as the basis for rebates, luring participants to continue developing others to participate with high returns as bait, deceiving property, disrupting economic and social order, with serious circumstances, and their actions constitute the crime of organizing and leading pyramid scheme activities. In order to expedite the trial process, the presiding judge continued the trial for two consecutive days after a brief one-hour recess at noon. During the trial, the court conducted a judicial investigation into the facts alleged in the indictment, and the prosecution and defense fully expressed their opinions on the facts, evidence, and sentencing issues under the court's guidance. The collegiate bench also separately heard the final statements of the defendants. The case is currently under further trial.

The Dongyang City People's Court released a "Notice on the Fund Recovery of the Zhou Sheng, He Yan, and others' Fraud Case," stating that based on the effective criminal judgment documents such as Zhe0783 Xing Chu 560 and the verification and registration status of the funds already collected, the first round of fund recovery work for the involved funds has been initiated. The specific matters of the announcement are as follows: The fund recovery registration work will start from the date of the announcement and will last for one month. The fund recovery targets are investors who have suffered losses from false cryptocurrency platforms such as SIE (later renamed BTUE), CFEX, LKF, and GDbit. The amount to be recovered in this round is determined based on the amount of losses and the funds already collected, using a unified refund ratio calculation. The fund refund will be carried out through the WeChat public account, by entering information through links and scanning QR codes to access the app for registration, and the backend will conduct the verification and confirmation. After verification, the funds will be transferred with the assistance of the Industrial and Commercial Bank of China Dongyang Branch.

It is reported that in August 2019, the Dongyang Public Security Bureau launched an investigation into the SIE, CFEX, LKF, GDBIT, and other cryptocurrency fraud platforms. The key members of this fraud group were successively arrested and brought to justice. This fraud group fabricated engagement in blockchain technology development, developed cryptocurrency trading platforms through a technical team, and formed a complete fraud industry chain. In September 2021, all 171 defendants in this series of cryptocurrency fraud cases involving an amount of 380 million RMB were tried and sentenced.

NFT

Data from the CryptoPunk official app shows that CryptoPunk 3997 was sold at a price of 6.9 ETH in the early morning today, far below the current floor price of 48.99 ETH for CryptoPunks. The seller's ENS domain name is cryptopunks-eth, and the buyer's ENS domain name is bids.cryptopunk. It is worth mentioning that CryptoPunk 3997 was last sold on June 23 for a price of 47.69 ETH.

Metaverse

According to the Henan Daily, on August 14, the Zhengzhou Municipal Government Office released the "Zhengzhou Metaverse Industry Development Policies," providing substantial support for the development of the metaverse industry. Zhengzhou has introduced more than 10 policy measures, providing up to 200 million RMB in start-up capital support for leading companies and major research platforms in the metaverse field that relocate to Zhengzhou or establish regional headquarters, and providing "move-in ready" and "move-in office" support; strengthening financial support for the development of the metaverse industry, establishing a total of 10 billion RMB special fund for the development of the metaverse industry, and jointly establishing a 50 billion RMB special fund with national ministries, provincial financial departments, and social investment institutions to support the development of the metaverse industry; encouraging metaverse companies to go public, providing a one-time reward of 20 million RMB for companies listed on the main board.

To develop the metaverse industry, Zhengzhou has set a new goal: by 2025, the core industry of the metaverse will exceed 50 billion RMB in scale, driving related industries to exceed 200 billion RMB in scale. It aims to introduce and cultivate "100+" leading metaverse companies, cultivate "300+" innovative small and medium-sized enterprises, and create "50+" typical application scenarios. After 3 years of effort, Zhengzhou aims to establish itself as a leading city in metaverse innovation, industry, and integrated application.

Project Updates

Safe Wallet releases the interoperability protocol Safe{Core} for modular smart accounts

Wallet service provider Safe (formerly Gnosis Safe) has released the Safe{Core} protocol to advance the transition to smart accounts in a secure, modular, and interoperable manner. The first design of the Safe{Core} protocol proposes an open-source modular standard with an additional abstract layer "manager" to manage various complexities and interdependencies. The protocol addresses issues such as fragmentation, vendor lock-in, and security, ensuring the composability of DApps and tools through standardized modules (plugins, hooks, function handlers, signature validators, etc.), ensuring the interoperability and portability of accounts in a vendor-agnostic manner, and introducing registries to reduce smart contract risks.

According to the Hong Kong Economic Daily, Leung Tak-ming, Senior Manager of Digital Entertainment at Cyberport, stated that Cyberport currently has over 170 Web3.0 startups. The Hong Kong government's financial budget allocated HK$50 million to Cyberport to accelerate the development of Web3.0. Cyberport will announce more details on the direction of the funding usage and specific plans within this week.

friend.tech will start airdropping reward points to test users from August 18

The decentralized social platform friend.tech officially announced that it will start airdropping reward points to application test users this Friday (August 18). During the testing period, the points will be collected off-chain, and when the application enters the official release status, the points will have special uses. 100 million points will be distributed over 6 months.

PayPal hires former Intuit executive Alex Chriss as the new CEO

According to Bloomberg, PayPal has hired former Intuit executive Alex Chriss as the new CEO and President. Chriss previously served as Executive Vice President and General Manager of Intuit's Small Business and Self-Employed Group. He will take over as PayPal's CEO from Daniel Schulman on September 27 and will join the company's board. In February of this year, PayPal announced that Schulman would retire in the coming months and continue to serve on the board until the next annual shareholders' meeting in May next year. According to previous reports, PayPal announced the launch of the USD stablecoin PYUSD on Ethereum.

Blockchain detective ZachXBT tweeted that "Brother Huang" Huang Licheng has agreed to voluntarily withdraw the lawsuit. He expressed disappointment that the matter initially took a legal route but is grateful that both parties were able to find a solution. He also expressed gratitude to everyone who donated and supported during this process and will soon announce the procedure for refunding unused legal defense funds. Earlier in June, Huang Licheng filed a defamation lawsuit against ZachXBT. ZachXBT subsequently raised legal defense funds from supporters, with funding support from Binance and Coinbase, among others. Later today, ZachXBT stated that he expects to refund 90% of the legal defense funds and will complete the refund next week.

According to the official blog, Web3 gaming platform Immutable has announced that its Immutable zkEVM testnet has officially launched. Existing smart contracts and Solidity code can be migrated for free directly to Immutable's zkEVM testnet environment. Immutable zkEVM is a gaming-specific chain that provides EVM compatibility, low cost, scalability, and enterprise-grade security. It combines the advantages of zk-rollup technology with the functionality of the Ethereum ecosystem, while also providing access to the entire Immutable gaming product suite.

The Immutable zkEVM testnet offers the following features at launch: EVM compatibility, Immutable product compatibility, native L2 faucet for Test-IMX, deposit bridge from Sepolia to Immutable zkEVM, withdrawal bridge from Immutable zkEVM to Sepolia, and Immutable Relayer (coming soon). In this testnet, MATIC will be used as the sole staking token, and Test-IMX will be used as the sole native gas token. The testnet will be anchored to Sepolia (not Goerli). For the mainnet, Immutable zkEVM will anchor to the Ethereum mainnet in the future.

Immutable plans to continue improving the testnet experience while driving the mainnet release. The Immutable zkEVM mainnet is currently scheduled for release in the fourth quarter of this year. Although Immutable zkEVM is currently leveraging Polygon Edge, it plans to deploy Polygon Zero in future versions and gradually increase reliance on proof of validity.

Ark Invest and 21Shares have submitted three Bitcoin futures ETF applications to the SEC

According to Blockworks, since August 11, Ark Invest and 21Shares have submitted three Bitcoin futures ETF applications to the U.S. Securities and Exchange Commission (SEC). The proposed first ETF is called "Ark 21Shares Active Bitcoin Futures ETF (ARKA)," which will invest in cash-settled Bitcoin futures contracts traded on the Chicago Mercantile Exchange (CME) and may also hold U.S. Treasury bonds, money market instruments, and repurchase agreements. The second ETF is called "Ark 21Shares Active On-Chain Bitcoin Strategy ETF (ARKC)," which will allocate at least 25% of the amount to Bitcoin futures contracts or ARKA, with the remaining assets in cash and cash equivalents. The last ETF is called "Ark 21Shares Digital Assets and Blockchain Strategy ETF (ARKD)," which will invest in Bitcoin futures contracts or ARKA, as well as stocks of companies in the blockchain, digital assets, and fintech industries. Earlier this year, both companies also reapplied for a Bitcoin spot ETF. Last Friday, the SEC postponed a decision on Ark Invest's Bitcoin spot ETF application, with September 2 being the next deadline for a decision.

According to the official blog, Coinbase has announced the establishment of the Stand with Crypto Alliance, a crypto advocacy organization aimed at mobilizing the crypto community to directly participate in the legislative process. Members who join the alliance will help drive clear and reasonable regulations to ensure the future of cryptocurrencies in the United States.

Coinbase wrote: "Building on the recent historic bipartisan legislative momentum in Congress, the Stand with Crypto Alliance is the first true grassroots movement for crypto, organizing on-chain. By providing a Launchpad, the alliance is mobilizing the full force of the decentralized crypto community to tell lawmakers: recess is over. This fall, as Congress votes on common-sense legislation to protect consumers and their crypto rights, America's crypto voters are taking responsibility for protecting consumers and their crypto rights and will vote on common issues in Congress this fall."

It is reported that two crypto bills are set to be voted on by the full House of Representatives, with one bill directing regulators to create a clear path for how digital assets transition from securities to commodities, and the other creating a comprehensive framework to regulate payment stablecoins. Both bills passed through certain committees in the House of Representatives last month.

According to The Block, Take-Two Interactive Software, the publisher of the multi-billion-dollar hit "Grand Theft Auto," is set to launch its first Web3 game. Take-Two announced in a statement that it will launch a Web3 game called "Sugartown" on Ethereum through its mobile game publishing subsidiary Zynga, which it acquired last year for $12.7 billion. The two companies also referred to this release as the first instance of a "major mobile game developer" building a crypto game "from the ground up."

The companies stated that players will enter the game "Sugartown" using Ethereum (or ERC-721) tokens, where they will be able to stake to "earn energy" that allows them to play the game and earn Oras token rewards. Oras is a "game-usable in-game token" that will be minted later this year, with Zynga set to release 10,000 access tokens in the "initial run."

According to Cointelegraph, cryptocurrency custodian Prime Trust has filed for bankruptcy under Chapter 11 in Delaware after facing a shortage of client funds. The company stated in the filing submitted on August 15 that it has between 25,000 and 50,000 creditors, estimated liabilities between $100 million and $500 million, and estimated assets valued between $50 million and $100 million. The company stated in an accompanying press release: "The company believes that the initiation of the Chapter 11 case will provide a transparent and value-maximizing process for the benefit of the company's clients and stakeholders." Prime Core Technologies Inc., Prime Trust, LLC, Prime IRA LLC, and Prime Digital, LLC are listed as the entities applying for Chapter 11 relief.

It is worth noting that the U.S. Bankruptcy Code consists of 13 chapters, with "Chapter 11" referring to the "reorganization" chapter of the U.S. Bankruptcy Code and is one of the most commonly used chapters by companies seeking bankruptcy protection. It provides companies with court protection to reorganize their business or capital structure before meeting creditor claims.

Base ecosystem project RocketSwap suffers an attack, losing approximately $868,000

According to CertiK Alert monitoring, the Base ecosystem project RocketSwap has been attacked, with the attacker bridging the stolen assets to Ethereum, resulting in a loss of 471 ETH (approximately $868,000).

Binance applies for a protective order in response to the SEC's "fishing expedition" for evidence

According to Cointelegraph, in a filing submitted to the court on August 14, Binance filed a motion for a protective order after receiving a notice of testimony and evidence disclosure request from the U.S. Securities and Exchange Commission (SEC). Binance claims that the SEC's actions constitute a "fishing expedition."

The exchange wrote: "BAM Trading (Binance's parent company) has been working in good faith, but the SEC insists on an agreed order giving it unfettered authority to investigate BAM's asset custody business without any apparent limits." Binance claims that the SEC is requesting "dozens of topics of communications since November 2022, many of which are unrelated to customer assets."

Binance also objected to the SEC's request for six employees and managers of BAM, including its CEO Zhao Changpeng, to testify. Binance argued, "The SEC also seeks testimony from most of BAM's senior management, even though they do not have unique firsthand knowledge of facts such as the security, custody, and transfer of customer assets, and these employees are also required to testify."

Binance to delist SNM, SRM, and YFI

According to an official announcement, Binance announced that it will cease trading and delist the following tokens on August 22 at 11:00: Sonm (SNM), Serum (SRM), DFI.Money (YFII). Binance stated that the platform will regularly review the quality of listed digital assets, conduct in-depth project reviews when tokens no longer meet listing standards or when there are significant industry changes, and may delist them.

According to the official blog, the public chain Sei Network announced the SEI token economics, which has 6 major use cases: 1. Network fees: paying transaction fees on the Sei blockchain; 2. DPoS validator staking: SEI holders can choose to delegate their token shares to validators or stake SEI to run their own validators to ensure network security; 3. Governance: SEI holders can participate in future protocol governance; 4. Native collateral: SEI can be used as native asset liquidity or collateral for applications built on the Sei blockchain; 5. Fee market: users can pay fees to validators to prioritize their transactions, which can be shared with users delegating to that validator; 6. Transaction fees: SEI can be used as fees for exchanges built on the Sei blockchain.

Regarding airdrops, a portion of the SEI supply is allocated to airdrops, incentive testnet rewards, and ongoing plans to distribute SEI quickly to users and the community. These SEI airdrops and incentives are designed to reward truly active and pioneering users in the cryptocurrency field. 3% of the SEI token supply has been allocated to the first reward pool, called "Season One."

CYBER price is approximately $7 as CyberConnect airdrop opens for claiming

According to the CyberConnect airdrop claiming page, the CyberConnect (CYBER) airdrop is now open for claiming. CYBER is currently listed on Binance, with a price of approximately $7, representing a 300% increase. Additionally, CoinList announced the listing of CYBER.

According to official information, Sei has now opened the airdrop query page, where users can check their eligibility for the airdrop through the official website. Whitelisted users must bridge eligible assets to Sei, including the following networks: Solana, Ethereum, Arbitrum, Polygon, Binance Smart Chain, and Osmosis. The airdrop will be available for claiming at the launch of the public mainnet.

Around 8 PM, there was news that Sei mainnet has gone live. However, the SEI official announcement later stated that Atlantic and airdrop rewards will be available for claiming after the initial warm-up period in the Sei ecosystem is prepared. Coinbase announced the upcoming listing of SEI.

Funding News

Web3 enterprise equity trading company Dinari completes a $7.5 million seed round of funding

According to The Block, Web3 enterprise equity trading company Dinari has secured $7.5 million in seed funding. Investors in this round include Third Kind Venture Capital, 500 Global, former Coinbase CTO Balaji Srinivasan, Sancus Ventures, Version One VC, and members of Susquehanna International Group company SPEILLLP.

In addition to announcing the seed funding, Dinari also stated that it will launch a trading platform called dShare, which will match tokens with underlying securities at a 1:1 ratio. Due to regulatory reasons, the dShare platform will offer services for users outside the U.S. to access securities such as Apple or Tesla stocks using wallets on the Arbitrum network.

Important Data

According to blockchain analyst Yu Jin's monitoring, on August 14 at 23:56 Beijing time, an address dormant for over 12 years transferred 1005 BTC to an address starting with bc1q. At the time, these 1005 BTC were worth approximately $1,316 (at a price of $1.31 each), and are now valued at $29.68 million, an increase of 22,560 times.

PANews APP Points Mall Officially Launched

Free redemption of hardcore prizes: imKeyPro hardware wallet, First Class Cabin Research Report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections. First come, first served, experience now!

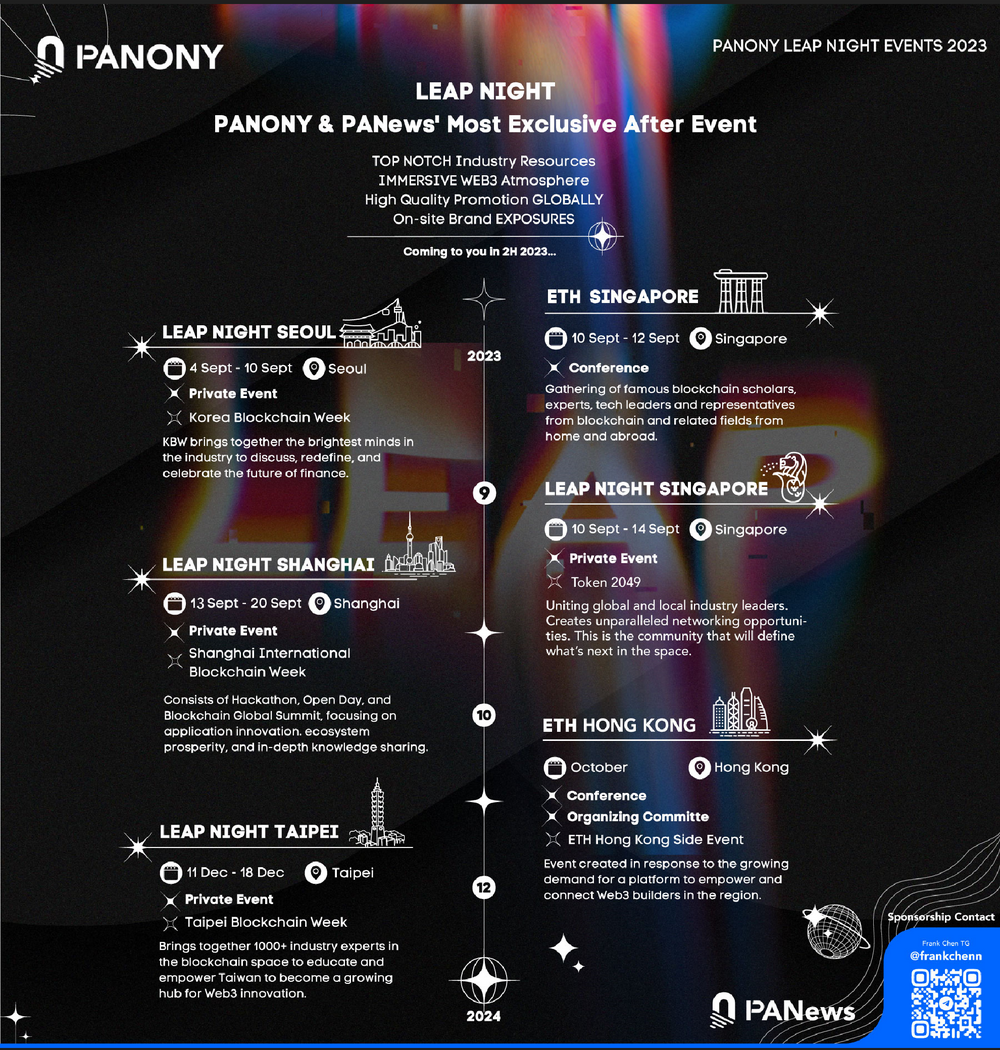

PANews Launches Global LEAP Tour!

Seoul, Singapore, Shanghai, Taipei, multiple locations will come together from September to December to witness a new chapter in globalization!

?Collaboration welcome for events in multiple locations, contact now!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。