In 2023, the upgrade of Cancun is undoubtedly one of the most critical industry events after the upgrade of Shanghai. The L2 project benefiting from it is also one of the key tracks we are focusing on this year.

According to current news, the Cancun upgrade included in EIP4844 is expected to take place between October 2023 and January 2024. The token prices of the two main L2 projects, Arbitrum (referred to as ARB) and Optimism (referred to as OP), experienced a significant pullback after reaching new highs in the first half of the year. It may still be a better time to position oneself.

Of course, in terms of market value, OP's circulating market value has been hitting new highs since 2023, while ARB has been in a low consolidation phase. In this article, the author attempts to analyze the following:

- The value source and business model of L2

- A comparison of the competitive strengths and business data of OP and ARB

- How the Cancun upgrade will significantly improve the fundamentals of L2

- Potential risks of OP

The following content is the author's interim views at the time of publication, focusing more on business evaluation and less on technical details of L2. This article may contain factual errors and biases, and is intended for discussion purposes only. The author also looks forward to corrections from other industry peers.

1. The Value Source and Business Model of L2

1.1 The Value Source and Moat of L2

L2 provides products similar to L1, namely: stable, censorship-resistant, and open blockchain space. It can also be seen as a specialized on-chain cloud service. Compared to L1, the main advantage of L2 blockchain space is its lower cost. For example, in the case of OP, the average gas cost is only 1.56% of Ethereum's.

Because blockchain space is a specialized cloud service, it means that its demand is not universal. Most internet services do not need to run on L1 or L2. However, in the traditional world where financial services are heavily constrained and lack transparency, there is a rich application practice on the blockchain.

The demand of service builders and users for L2 blockchain space determines the upper limit of L2 value.

Like L1, L2 can build a moat based on network effects.

On L2, the larger and more diverse the user base, the lower the difficulty for people to cooperate on L2, and new service models are easier to emerge, further meeting and introducing users into this network. Each new user entering and residing on the L2 network increases the potential value of this L2 network to other users.

In the Web3 world, the network effect strength of L1 & L2 is second only to stablecoins represented by USDT. The more top-tier L1 & L2, the higher the barriers to entry, and therefore they often enjoy a higher valuation premium.

1.2 The Profit Model of L2

The profit model of L2 is clear and simple. On the one hand, it purchases storage space from a trusted DA (Data Availability) layer to back up its L2 data (so that when there are problems with L2 operation, it can be restored using the backup data). On the other hand, it provides cheaper blockchain space services to users and charges based on this. Its profit comes from: L2 fees (basic fees + MEV income) - the cost of paying DA service providers.

In the case of OP and ARB, their chosen DA layer is Ethereum, the most decentralized and trusted L1. By paying gas to Ethereum, they store their compressed L2 data on Ethereum. The fees they charge are the gas paid by users (including regular users and developers) when using their L2, as well as MEV income. The latter minus the former is their gross profit.

It is called gross profit because this profit has not yet deducted other project expenses, such as labor costs, rewards to the ecosystem, marketing expenses, and so on.

The fee collection of L2 and the cost payment of L1 are both executed by the sequencer of L2, and the profit also belongs to the sequencer. Currently, the sequencers of OP and ARB are both operated by the official team, and the profit also belongs to the official treasury. Of course, centralized sequencers mean extremely high single-point risk, and OP and ARB have long-term commitments to decentralize the sequencers.

The mechanism of decentralized sequencers is very likely to operate on a POS mechanism, that is, decentralized sequencers need to stake the native tokens of L2 such as ARB or OP as collateral. When they fail to fulfill their duties, the collateral will be slashed. Ordinary users can stake as sequencers themselves, or use services similar to Lido's staking service, where users provide collateral tokens, and professional, decentralized sequencer operators perform sequencing and uploading services, and staking users can receive most of the L2 fees and MEV rewards from the sequencers (90% under Lido's mechanism).

At that time, ARB and OP tokens will gain economic value empowerment in addition to pure governance.

1.3 ARB VS OP

- Competitive Advantages of OP

Since its launch, ARB has consistently outperformed OP in various business data on L2. According to the aforementioned L2 network effect, as a leading L2, ARB should enjoy a higher valuation premium than OP. However, this has gradually changed after OP proposed the Superchain strategy in February this year and began to vigorously promote the OP stack.

Op stack is an open-source L2 technology stack, which means that other projects wanting to run L2 can use it for free to quickly deploy their own L2, greatly reducing the cost of development and testing. Superchain is the future blueprint outlined by OP, using L2s based on OP stack. Due to the technical consistency of the architecture, they can achieve secure, efficient, atomic-level communication and interaction of information and assets, similar to Cosmos' "Interchain," which is called Superchain.

After the launch of OP stack and Superchain, it first gained adoption by Coinbase. Its L2 Base built using OP stack, together with the Superchain strategy, was officially launched in February and has been live since August 10. With the demonstration effect of Coinbase, OP stack has gained more and more project adoptions, such as opBNB from Binance, NFT project ZORA invested by Paradigm, Loot ecosystem project Adventure Gold DAO, Public Goods Network (PGN) supported by Gitcoin, leading options project Lyra, well-known on-chain data dashboard Debank, and even Celo, which was originally an L1, chose OP stack as its L2 solution.

The previous service targets of L2 projects were users using their own blockchain space. Superchain and OP stack have expanded the definition of users to include L2 operators, transforming the business from a 2C (here defining L2 developers as C) to a 2B2C, creating new value sources and moats for OP:

- Multi-chain network effect. Expanding the definition of "network" from a single chain to a "multi-chain network," with cross-chain links of funds and information between multiple chains through the standard OP stack. L2 operators are responsible for user introduction and operation, expanding the total user population of the "multi-chain network," which also increases the value of each user and each L2 within the network.

- Economies of scale. The fixed technical infrastructure costs (such as the upgrade and maintenance of OP stack) are borne by OP, but the feedback and improvements provided by other users of OP stack further improve the quality of OP stack, reducing the cost of technical maintenance and upgrades, sequencer and indexer incentives for potential L2 adopters, and increasing the attractiveness of potential L2 solutions.

- Community of interests. By bringing more Web3 industry giants into the OP ecosystem, due to the consistency of interests, it is easier to obtain their support in technology, users, developers, and investment.

By upgrading from a single-chain ecosystem to an interconnected chain ecosystem, OP not only benefits from the expected growth in the total number of users and developers in the entire network, but its main business data on the OP main chain is also continuously approaching or even surpassing ARB, such as:

a. Monthly active addresses: OP/ARB's weekly active addresses have risen from a low of 32.1% to the current 73.6%

b. Monthly L2 profit: OP/ARB's L2 profit has risen from a low of 16.4% to the current 100.2% (overtaking)

c. Monthly interaction times: OP/ARB's monthly interaction times have risen from a low of 22.4% to the current 106.5% (overtaking)

d. On-chain funds: OP/ARB's on-chain TVL has risen from a low of 1/3 to the current 1/2

In line with the rapidly rising business data of OP, the relative valuation of the OP main chain compared to ARB is becoming increasingly attractive.

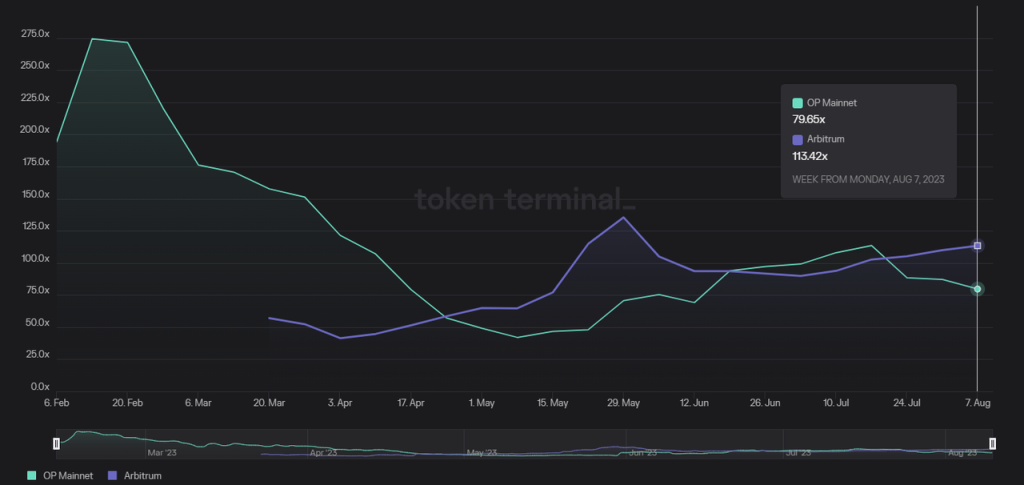

P/E (Market Cap/Annualized Profit of L2): Based on the recent week's revenue as the calculation base, OP's PE has dropped to below 80, while ARB's is at 113. This is achieved even as OP's price has shown significant strength in recent months, with continuous unlocking of circulating supply.

Data Source: tokenterminal

Data Source: tokenterminal

- Rapid Development of New Forces in the OP Ecosystem

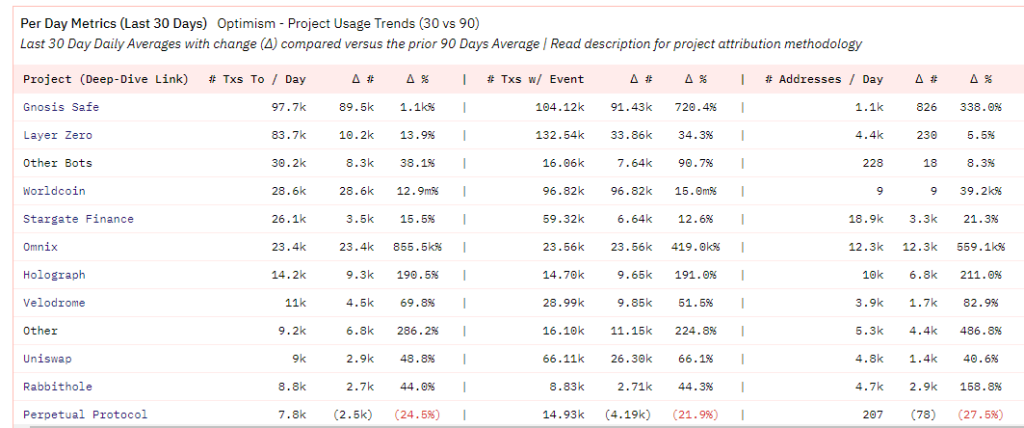

The continuous catch-up of OP's main chain business data relative to ARB, influenced by its own ecosystem recovery, is significant. However, the new business partners joining the OP camp have made a greater contribution. For example, the project that contributed the most transaction volume to the OP main chain in the past 30 days, Gnosis Safe contract operations ranked first, and Worldcoin ranked fourth.

Data Source: https://dune.com/optimismfnd/Optimism

Data Source: https://dune.com/optimismfnd/Optimism

In fact, a large number of transactions in Gnosis Safe are also contributed by the Worldcoin team. As early as the end of June this year, the World App had deployed over 300,000 Gnosis Safe accounts, as a result of the migration from World App accounts to the Optimism mainnet.

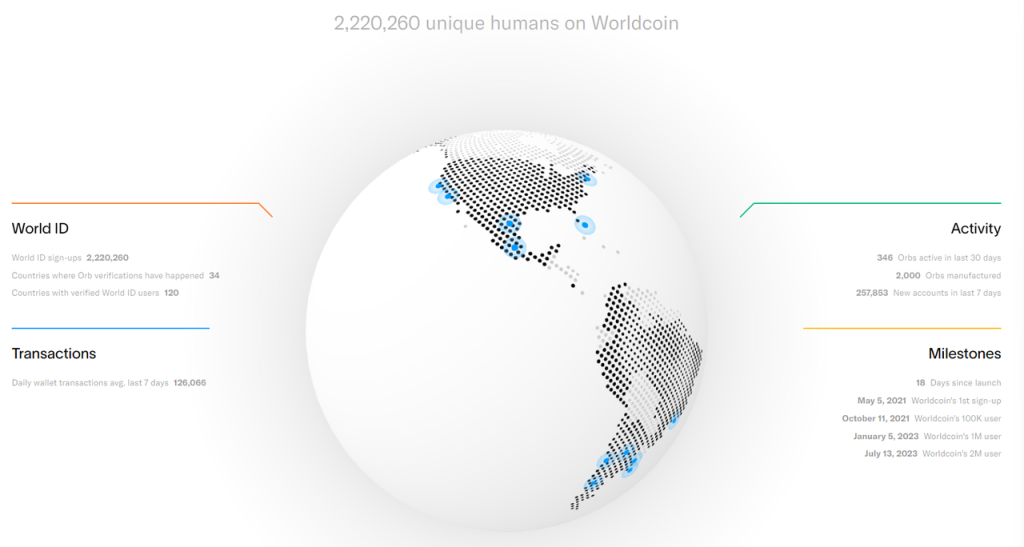

According to the official website data of Worldcoin on August 11, the registered users have exceeded 2.2 million, with 257,000 new accounts created in the past 7 days. The average daily transfer volume of the World app is as high as 126,000, equivalent to about 21% of the current daily transfer volume of the OP and ARB mainnets.

Data Source: https://worldcoin.org/

Data Source: https://worldcoin.org/

Currently, Worldcoin has only migrated its ID system and tokens to the mainnet, and will develop an application chain based on the OP stack in the future, which is expected to bring more active users and developers.

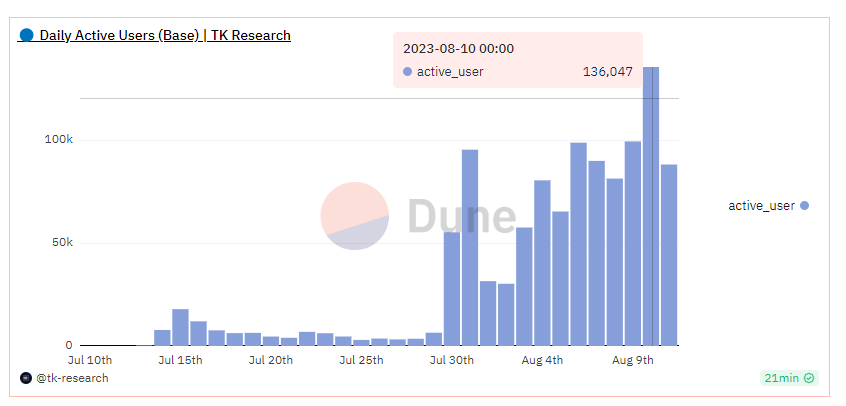

In addition to Worldcoin's contribution to the OP mainnet, the data growth after the launch of Coinbase's Base L2, the first and largest supporter of the OP stack L2, has been very strong. The number of active addresses on August 10 reached 136,000, just a step away from the top L2, ARB, with 147,000.

Data Source: https://dune.com/tk-research/base

Data Source: https://dune.com/tk-research/base

Among all smart contract L1 & L2, this data ranks only after Tron (1.5M), BNBchain (1.04M), Polygon (0.37M), and Arbitrum (0.14M). In addition, the first application to go viral after the official launch of Base on August 10 was not the traditional DeFi or Meme, but a social application called friend.tech, which was a pleasant surprise.

- Challenges Faced by ARB

The challenge for ARB is that, although it has a strong L2 main chain in Arbitrum one, a higher-performance Arbitrum nova, and has also launched the Orbiter L3 stack to compete with OP stack, at a time when L2 is still in its infancy, it is not willing to define itself as L3 and have major projects with Arbitrum one as its DA layer. Projects with better industry resources (users, developers, IP content) tend to prefer building L2, which means a higher valuation ceiling and a broader user base.

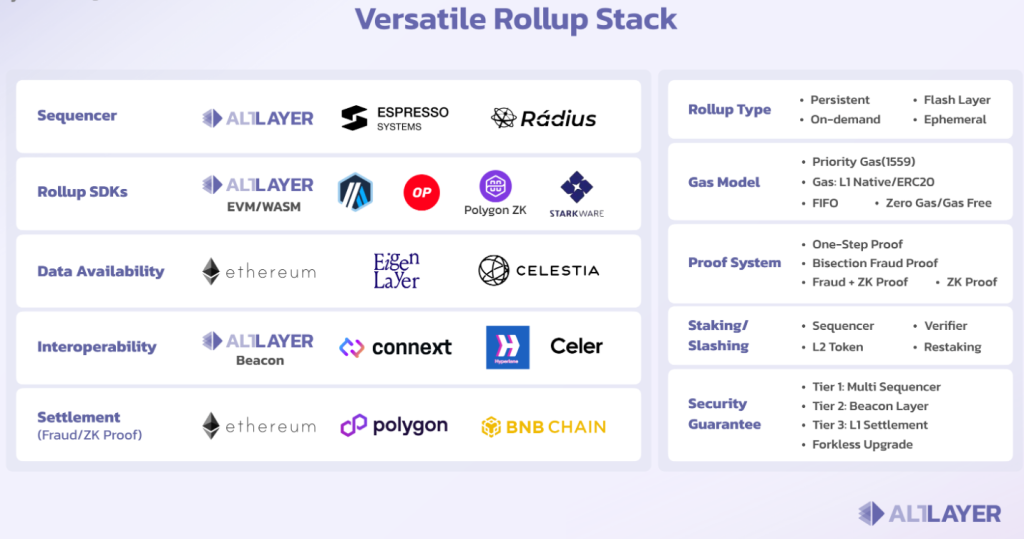

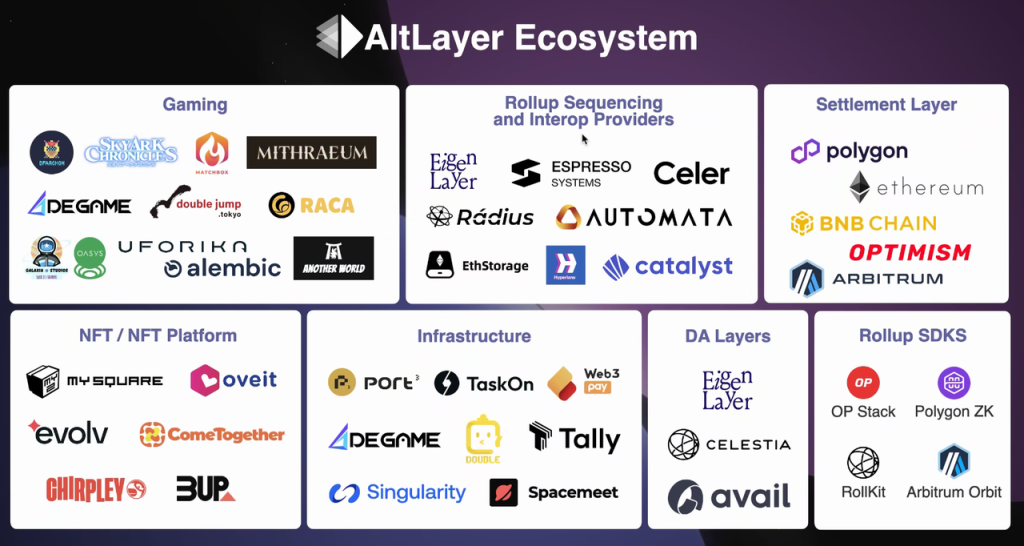

In the smaller Rollup project market, Arbitrum's Orbiter faces competition from RaaS (Rollup as a service) projects represented by ALTLayer. ALTLayer provides low-threshold, low-code rollup construction and operation solutions, integrating various modules of rollup solutions available on the market, allowing users to assemble and combine them like building blocks.

Modular solutions provided by ALTLayer for RaaS

Modular solutions provided by ALTLayer for RaaS

In the Rollup menu provided by RaaS projects, Orbiter provided by Arbitrum is just one of the optional solutions. Small users may choose a cost-effective L2 solution after comparing options, rather than defining themselves as L3.

In this situation, although Arbitrum one maintains a slight lead in business data compared to other L2s, its share of users in the entire L2 market is actually rapidly declining, as a large number of new and old users are flowing to OP and hybrid L2s.

Overall, OP's network effect and economies of scale, formed by introducing users through B2B2C mode with the support of Superchain narrative and widespread adoption of OP stack, may have a significant advantage over the strong single-chain approach of Arbitrum in the long run. If ARB does not adjust its strategy in the future, its position as the king of L2 single chains is also at risk.

2. How the Cancun Upgrade Improves the Fundamentals of L2 Projects

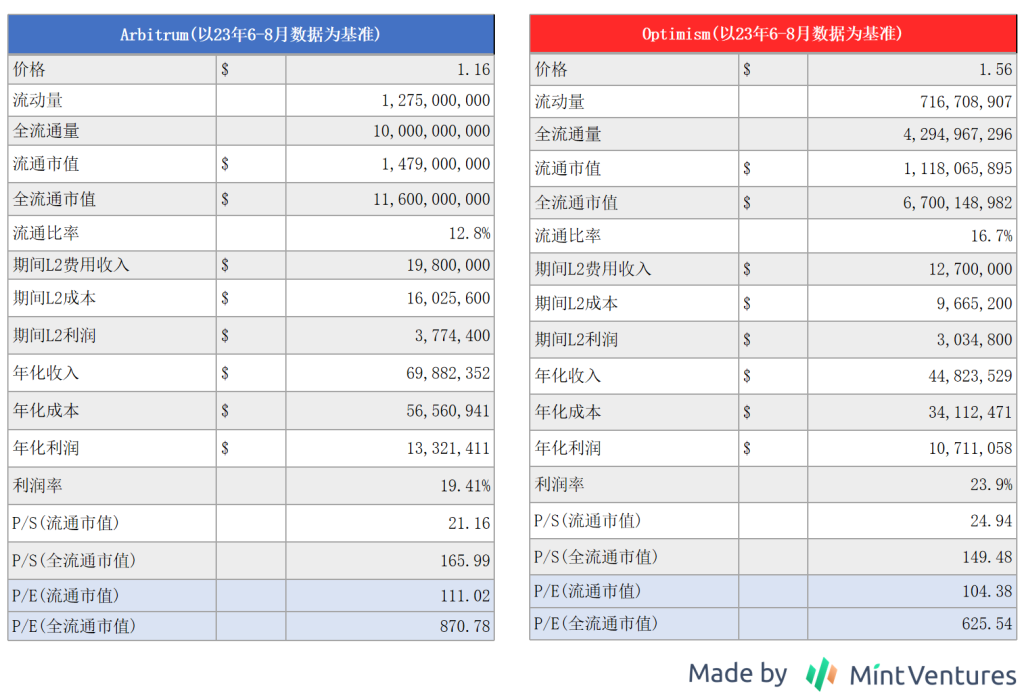

2.1 Current Project Valuation Estimates for ARB and OP

We calculate the valuation levels of ARB and OP based on their revenue data from the past 3 months and their current prices.

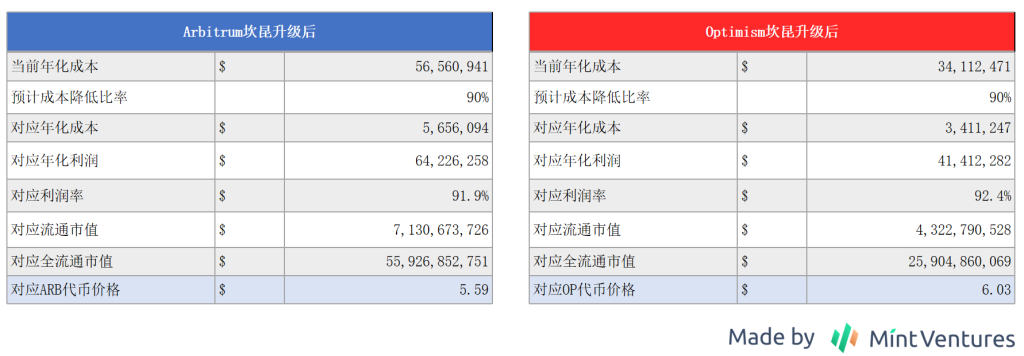

If we assume that the P/E ratio remains unchanged, after the Cancun upgrade, with L1 costs for ARB and OP expected to decrease by 90% (EIP4844 is expected to reduce L2's L1 costs by 90-99%, here we take the conservative value, see reference materials for details), and the L2 fee standards remain unchanged, the estimated prices for ARB and OP are as follows:

The direct impact of the reduction in L1 costs brought about by the Cancun upgrade is an increase in profit, corresponding to an increase in valuation.

2.2 The Impact of the Cancun Upgrade on L2 Valuation

Of course, with the reduction in L1 costs after the Cancun upgrade, both ARB and OP are unlikely to not reduce their corresponding L2 fees. Therefore, when estimating valuations, we also need to consider the inclusion of two variable factors:

- How much of the cost reduction will be passed on to L2 users in the form of reduced fees by ARB and OP

- With the reduction in L2 fees, how much of an increase in transaction activity will be brought about

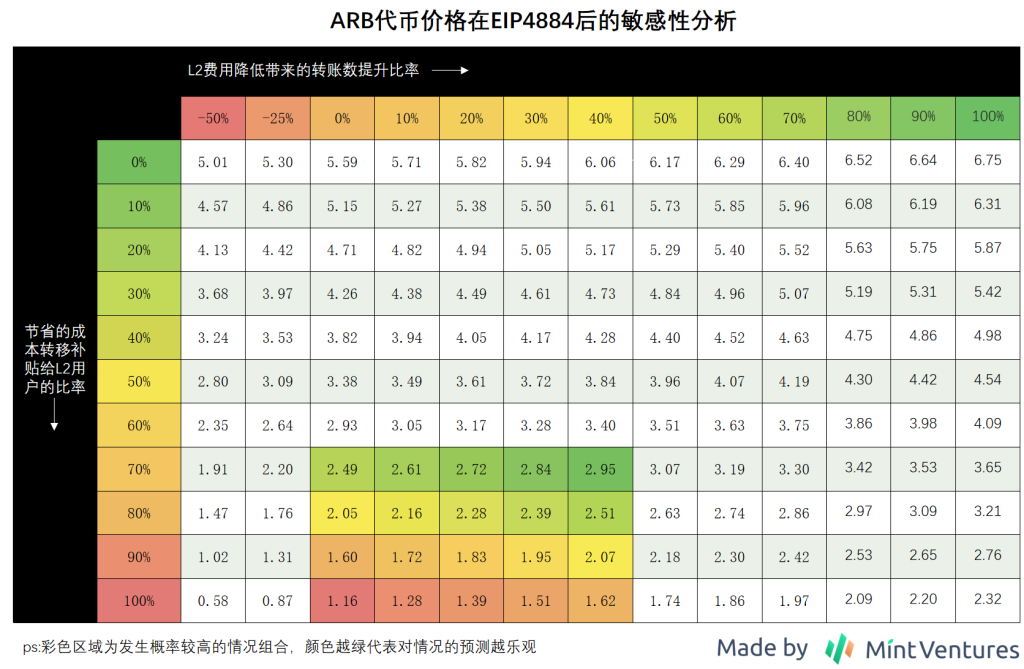

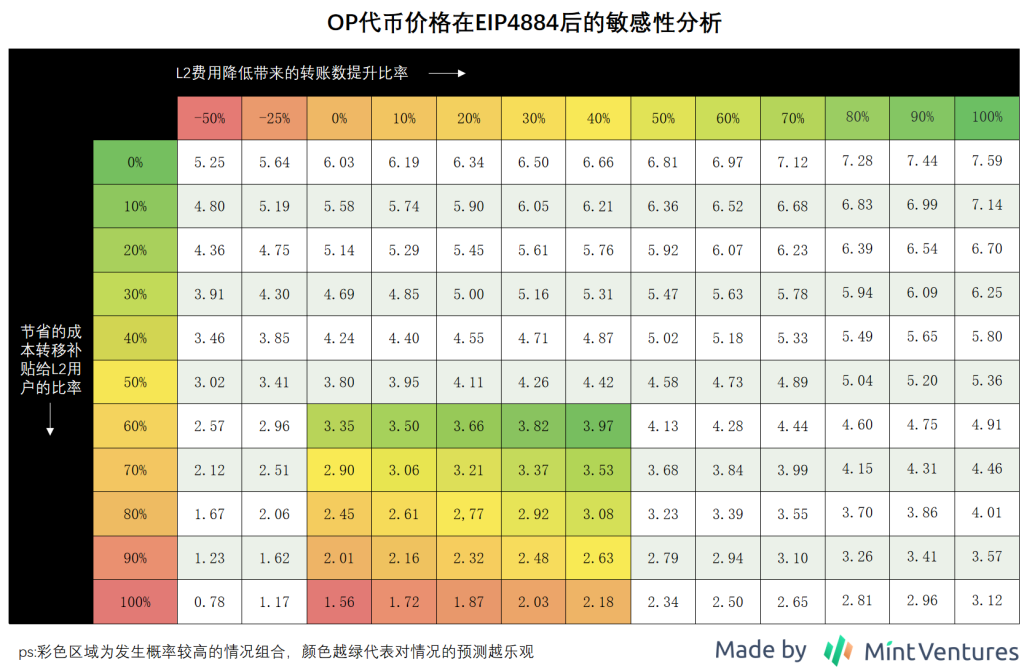

Similarly, based on the premise of unchanged P/E multiples, the author deduces the token prices of ARB and OP after the Cancun upgrade based on the changes in the values of "the ratio of cost reduction converted into fee reduction" and "the ratio of increase in transaction volume brought about by fee reduction":

The core logic of the above two token price estimation tables is:

- The lower the ratio of the cost reduction passed on to L2 users after the Cancun upgrade, the higher the L2 operating profit

- The higher the ratio of increase in transaction activity brought about by the reduction in L2 fees, the higher the L2 operating profit

In addition, because OP's current gas fees are approximately 30-50% lower than ARB, with the reduction in L1 costs, OP has a greater margin to retain the saved costs. Therefore, the author believes that OP will have a space of 60-100% to transfer the saved costs to users, while ARB is at 70-100%.

Based solely on the sensitivity analysis of the prices of ARB and OP after the Cancun upgrade, the current price potential for both OP and ARB is similar.

However, the above sensitivity analysis of the price potential of ARB and OP after the Cancun upgrade is quite mechanical. At least the following factors not considered in this calculation:

- The above calculation is based on the current project P/E, which already includes expectations for the Cancun upgrade

- When the Cancun upgrade arrives, OP is expected to have more token emissions compared to the current situation, and assuming constant circulating market value, the token price should be lower

However, the unchanged logic is that the higher the L2 operating profit, the higher the intrinsic value of its token, and the easier it is to obtain a higher market valuation. The Cancun upgrade, whether in cost savings or increasing on-chain activity, will bring significant marginal improvements to L2 projects.

3. Potential Risks of OP

As mentioned above, with the support of the Superchain narrative and the widespread adoption of the OP stack, OP has upgraded from a single-chain L2 to an interconnected L2 ecosystem, and through the B2B2C mode, it has introduced more ecosystem population with its partners using the OP stack, which in the long run has stronger network effects, economies of scale, and allies with common interests, making it a better business form than ARB. In addition, the main business data of the OP mainnet has been continuously catching up with or even surpassing ARB in recent months, and other OP stack L2s such as BASE are also rapidly developing, further squeezing ARB's market share.

Considering that the potential price appreciation space for the L2 main chains of ARB and OP after the Cancun upgrade is similar, but with the added boost of the Superchain narrative, OP may currently be a better investment target.

However, the competition in the L2 track is still fierce, and the author believes that it is necessary to pay attention to the following risks of OP:

3.1 ARB Chooses to Open Its L2 License, Adopting a Strategy Similar to OP to Compete for the Total Network Population of L2

Currently, Arbitrum still uses a commercial code license (BSL). Other partners who want to use the Arbitrum stack to build the Rollup ecosystem either need to obtain formal authorization from Arbitrum DAO or Offchain Labs (Arbitrum's development company), or develop L3 based on Arbitrum one. However, with the rapid expansion of the OP stack and the surge in network population in recent months, the Arbitrum community is starting to feel uneasy. On August 8th, a team member of ARB, stonecoldpat, posted a discussion on the governance forum, hoping that the community could participate in the discussion on "the conditions and timing for Arbitrum to issue code usage licenses to partners." The specific discussion topics include:

- Understanding the community's attitude towards issuing Arbitrum's code usage licenses to other partners

- Discussing whether additional conditions should be added to the license authorization

- How to establish an evaluation mechanism to determine whether to issue a license to the other party

- Short-term and medium-term roadmap for the above content

- In the short term, determining which qualified partners can be issued licenses

- In the medium term, establishing standards so that any partner meeting the criteria can obtain a license

The discussion post also summarized the feedback received by the official team on this topic, including:

"The Arbitrum Foundation or Offchain Labs has not yet issued licenses for the Arbitrum software stack to large strategic partners, which seems to be a strategic mistake. This hesitation may actually harm the Arbitrum ecosystem."

"We have not received any feedback suggesting that the Arbitrum Foundation should not issue licenses for the Arbitrum technology stack to strategic partners. Most of the focus is on the standards for issuing licenses and the conditions that should be attached, and allowing the DAO to provide preliminary opinions on the process."

Based on the above situation, the future strategic OP-ization of Arbitrum is already a trend, and it will soon join the competition in the "L2 interconnected chain" market. This will inevitably pose a threat to the comprehensive development of the OP stack.

On August 9th, Andre Cronje, co-founder and architect of the Fantom Foundation, stated in an interview with The Block that they are considering solutions for Optimism L2, including both the Op stack and the Arbitrum stack. In the author's view, Fantom, as a former first-tier L1, is unlikely to consider operating as Arbitrum's L3. When AC mentioned the "Arbitrum stack," he should be referring to an L2 solution.

However, the issue is how long it will take for the Arbitrum community to reach a consensus with partners, and for licenses to start being issued. By then, how many core customers will still be available in the market? The longer this process takes, the more collaborators will join the OP stack ecosystem, which will be increasingly detrimental to ARB.

3.2 Intense Competition in the Overall L2 Service Market

In addition to ARB and OP, ZK-based L2 solutions are also rapidly developing or awaiting launch, including ZKsync with impressive business data (although there is a significant bubble due to airdrop hunters), Linea backed by Consensys (with Metamask having 30 million monthly active users and Infura having over 400,000 developers), and the highly anticipated Scroll, among others. In addition, Rollup as a Service platforms represented by Altlayer, through service aggregators, provide extremely low-threshold modular assembly and operation services for Rollup developers and operators, directly entering the upstream of the OP stack, which will also exert pressure on the bargaining power of the OP ecosystem.

Altlayer's product and customer ecosystem

Altlayer's product and customer ecosystem

3.3 Overall Development of the Superchain Ecosystem, Can the Value be Transmitted to the OP Foundation and OP Tokens?

The OP token currently does not have a direct means of capturing value, and among the many adopters of the OP stack, apart from BASE explicitly donating 10% of its L2 profits to the OP foundation, other partner projects have not yet made similar commitments. The validation of value capture for the OP token may have to wait until the formal launch of its decentralized sequencer protocol, to observe the level of acceptance of various major OP stacks. If everyone can support and adopt the decentralized sequencer system with OP as collateral, there will inevitably be a direct demand for OP, completing the value transmission. However, if each L2 continues to execute its own sequencer standards or operates through its own node system, it will not only prevent OP from capturing value but also weaken the synergistic effect between L2s within the OP ecosystem.

3.4 Valuation Risks

As mentioned in the previous section on the valuation of OP, the author's calculation of the price increase for OP after the Cancun upgrade is based on the premise that "the PE of OP L2 after the upgrade remains consistent with the current situation." Considering that the Cancun upgrade is one of the most anticipated events in the market this year, the current PE valuation of OP may have more or less already priced in this expectation. For those with a pessimistic view, they may even believe that the current PE has already overbought the bullish news of the Cancun upgrade.

Reference Materials

- ASXN: EIP-4844 Research Report

- The Block: Fantom is exploring adding optimistic rollups to connect to Ethereum

- Supporting EIP-4844: Reducing Fees for Ethereum Layer 2 Rollups

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。