Author: Jiang Haibo, PANews

MakerDAO officially increased the DSR (DAI Savings Rate) to 8% in the early morning of August 7th Beijing time in a short-term subsidized manner. Due to Maker's investment in RWA exceeding $2 billion, only about 20% of DAI is currently earning interest in the DSR contract. Therefore, providing a higher short-term subsidy to the DSR will not lead to Maker incurring losses. However, this also reduces Maker's profit expectations and may indicate that Maker's growth has entered a bottleneck period. The following PANews will interpret the background, process, and impact of this event.

Insufficient Stablecoin Reserves in PSM

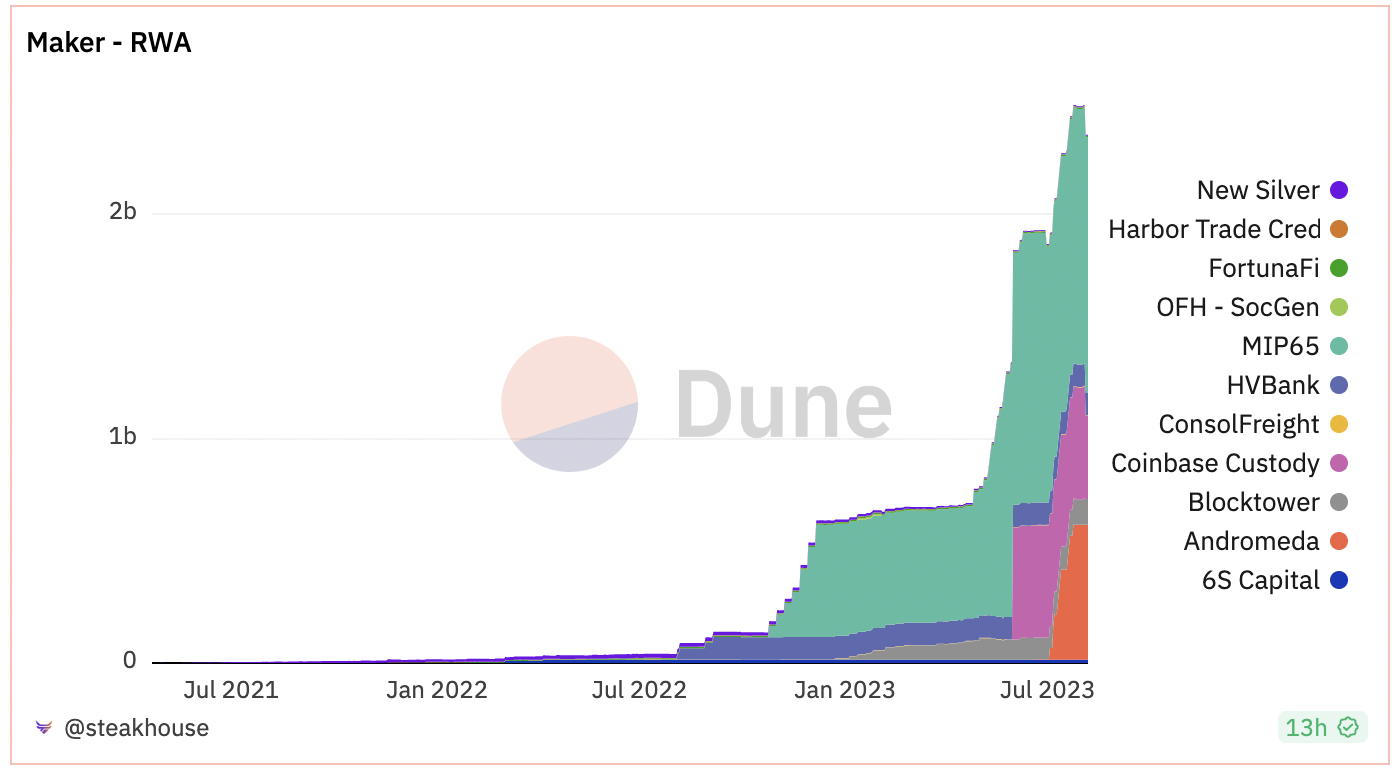

With the decrease in DAI issuance and the increase in investment in RWA, the stablecoin reserves in Maker's Peg Stability Module (PSM) have been continuously decreasing. According to data compiled by @SteakFi on Dune, Maker's investment in RWA has reached $2.35 billion.

The USDC in PSM is the main source of liquidity for DAI withdrawals. According to Etherscan and DeBank data, the reserve asset value in the Maker: PSM-USDC-A contract has decreased from a peak of $5.5 billion to $180 million on August 3rd. If liquidity is exhausted and DAI cannot be redeemed for USDC, it will affect user confidence in DAI and Maker.

This situation has been mentioned in our previous article, reference reading: "Interpreting the Current Development of MakerDAO: Expected Increase in Profits, Repurchase Rules May Be Adjusted to Capture Protocol Value."

If certain incentives can attract more funds to mint DAI using USDC, Maker will exchange USDC for dollars to purchase US bonds, and in the process, distribute some of the earnings to DAI depositors in the DSR. This could potentially realize Maker's growth flywheel. Thus, a proposal to increase DAI deposit returns was born, which is a short-term incentive measure, and the retention of funds after the end of the incentive needs to be observed.

Dominated by Rune, Unopposed Voting

On July 19th, MakerDAO co-founder Rune Christensen initiated a discussion on the forum for the rapid implementation of "Enhanced DSR" (forum link). It was mentioned that Enhanced Dai Savings Rate (EDSR) is a temporary mechanism to increase the effective DSR available to users in the early guidance stage when the DSR utilization is low. EDSR will be a one-time, one-way temporary mechanism that will decrease over time. Currently, there is a need to increase demand for DAI and DSR to ensure that more user groups will participate in mining SubDAO and other Endgame products in the future.

On July 24th, a poll was conducted for the implementation of EDSR, with a 99.93% approval rate, 0.07% abstention rate, and no opposition.

On August 2nd, the proposal, along with other proposals such as increasing the Spark debt ceiling, entered the executive voting stage. It was ultimately passed on August 4th and took effect from the early morning of August 7th Beijing time.

According to the previous design, the DSR is determined by the yield of US bonds, reserving a portion of the profit for Maker based on the yield of US bonds. However, this time, directly increasing the DSR to 8% has exceeded the yield that can be obtained from US bonds. Since the DAI that can help Maker generate income (DAI issuance - stablecoin reserves in PSM) is much higher than the DAI deposits in the DSR, this approach will not lead to Maker incurring losses.

However, this approach will also significantly reduce Maker's short-term profit expectations, potentially harming MKR holders' interests. The fact that no one opposed the proposal in the nominal survey stage indicates that Rune currently holds an absolute dominant position in Maker's decision-making. Prior to this, the venture capital firm a16z had already sold all of its MKR holdings.

Potential Impact of Increasing DSR

Previously, the DSR had become the primary source of income for the main stablecoin in major DeFi protocols. The introduction of EDSR in this aggressive manner will have some impact on Maker.

- Increase in DAI Issuance

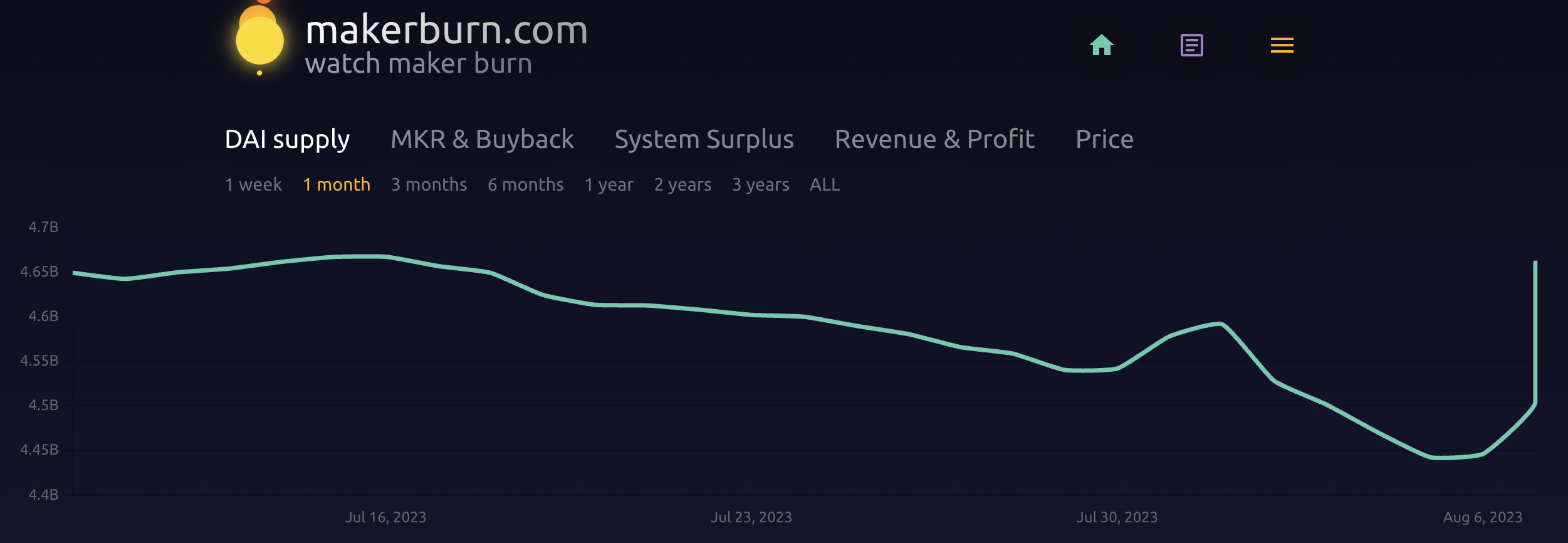

According to Makerburn's data, due to the implementation of EDSR, the issuance of DAI has ended its long-term decline and has begun to rise again. Just from the data observed in the afternoon of August 7th, the issuance of DAI has increased by $200 million in the past day.

- Decrease in Short-term Expected Earnings, Increase in P/E Ratio

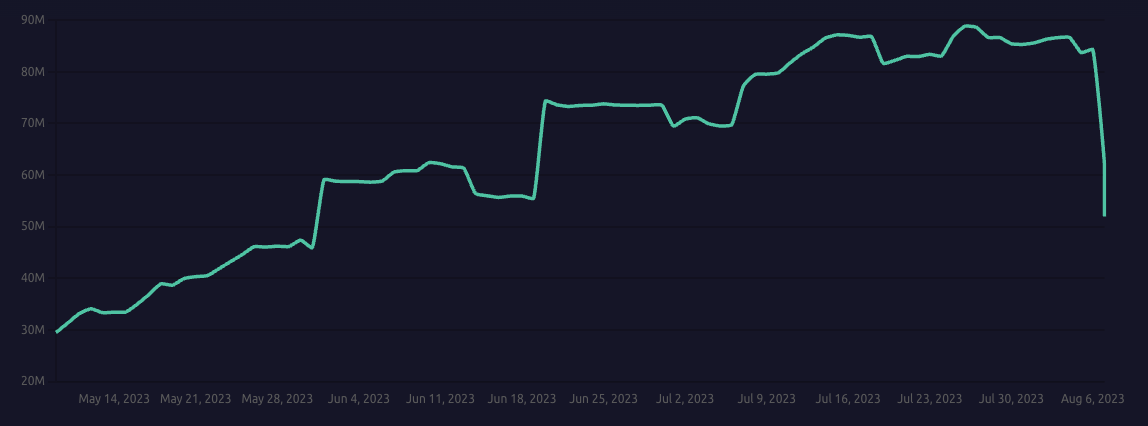

Due to the increase in DSR and more funds participating, Maker's expenditure on DSR has significantly increased, and the expected annual profit has decreased from $84.29 million on August 6th to $61.82 million. The P/E ratio has also increased to 21.15, more than double the P/E of 8.43 at the end of June.

- Potential Increase in Stablecoin Deposit Earnings in Other Lending Protocols

By raising the DSR to 8%, users who deposit DAI in lending protocols like Aave may redeem and deposit it into the DSR. Depositors of other stablecoins such as USDT and USDC may also switch to depositing DAI into the DSR.

- Potential Aggravation of USDC Demand

As the most convenient way to obtain DAI is through PSM using USDC at a 1:1 ratio, aggregators like 1inch have also integrated this solution. Users who do not hold DAI but wish to mint stablecoins may need to purchase USDC, increasing the demand for USDC, which caused the price of USDC to reach 1.002 USDT on August 7th.

- Increase in PSM Balance

According to the aforementioned DeBank data, the reserve balance in the PSM: USDC contract has increased from $280 million on August 5th to the current $350 million. Makerburn data shows that in the past 24 hours, the balance in PSM: USDC has increased by $56 million, indicating that $56 million of DAI was minted through PSM: USDC in the past 24 hours.

Considering that EDSR has just been implemented, the above trends are expected to continue, but it is important to observe how much funds will remain in the protocol after EDSR ends. If more funds can be attracted, increasing the issuance of DAI, it is expected to bring more funds to the subsequent SubDAO and Endgame. However, if only short-term arbitrage funds participate, it will only result in Maker wasting some funds.

Other

Arbitrage Strategy Based on wstETH

Previously, the practice of collateralizing wstETH to mint DAI at the minimum stability fee and depositing the DAI into the DSR had no arbitrage space, only facing the risk of collateral liquidation. The increase in DSR has brought new arbitrage opportunities. Bitfish1 shared an arbitrage strategy on Twitter, which involves pledging ETH as wstETH, using wstETH to collateralize and mint DAI in Maker, and then depositing the DAI into the DSR. This allows for earning ETH collateral income and additional income from the difference between the DAI deposit income in the DSR and the stability fee for minting DAI, thus earning an additional subsidy from Maker.

Statistics on the Newly Issued DAI Supply

Based on the current data, the issuance of DAI has increased by approximately 200 million in the past 24 hours, with an additional 50 million DAI minted through wstETH-B and 57.9 million DAI minted through D3M (Spark) (the proposal to increase the Spark debt ceiling has just taken effect). Additionally, 56 million DAI was minted through PSM: USDC, and the rest was minted through ETH-C, WBTC-A, stETH-A, and others. The main source is still collateralized minting of cryptocurrencies, indicating the presence of a significant amount of arbitrage funds. It will be necessary to observe the implementation of Spark and other SubDAOs in the future. If they cannot bring in returns higher than the stability fee required for minting DAI, this portion of the funds may flee.

Controversy over Front-end Review of Spark

The "Use Dai" link on the MakerDAO official website directly redirects to the Spark website, where users can collateralize DAI. Spark conducts reviews of users' wallet addresses and IP addresses, and users from restricted areas such as the United States, China, and others are unable to use it. Some users using VPNs may also be detected, sparking discussions about decentralization. However, considering that Maker holds a large amount of RWA collateral and needs to comply with regulatory requirements, this approach is acceptable. Restricted users can also consider wrapped products like Chai for DSR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。