Compilation: Biscuit, RootData

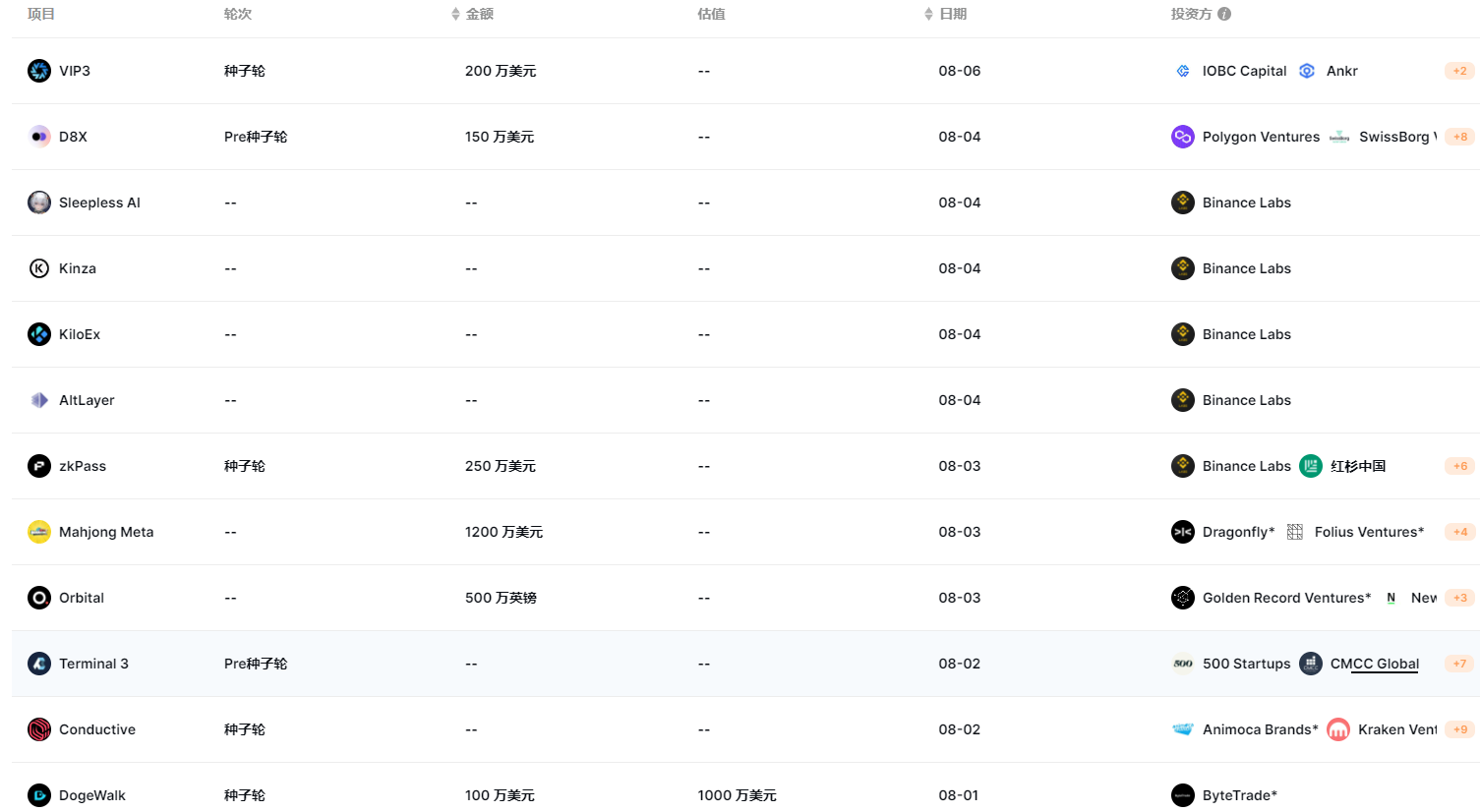

According to RootData's incomplete statistics, from July 31 to August 6, 2023, a total of 13 public financing events occurred in the blockchain and crypto industry, with a cumulative financing amount of only 60 million US dollars.

In terms of track distribution, the main tracks that received financing were infrastructure and gaming. A total of 7 infrastructure projects completed financing, including well-known projects such as Terminal 3, Solv Protocol, and zkPass.

In addition, Web3 game platform developer Conductive.ai completed a seed round of financing led by Animoca Brands, and Web3 Mahjong game Mahjong Meta completed a financing of 12 million US dollars, led by Dragonfly and Folius.

(List of projects that received financing last week, data source: Rootdata)

I. Infrastructure

1. Open-source code vulnerability detection tool Socket completes a $20 million Series A financing, led by a16z

Open-source code vulnerability detection tool Socket announced the completion of a $20 million Series A financing, led by Andreessen Horowitz (a16z), with participation from Abstract Ventures, Wndrco, Unusual Ventures, as well as angel investors including Aaron Levie, co-founder of Box, Dylan Field, co-founder of Figma, Frederic Kerrest, co-founder of Okta, Guillermo Rauch, CEO of Vercel, and Julia and Kevin Hartz, co-founders of Eventbrite. The new funds will be used to expand the team and support the integration of more programming languages.

According to CEO Feross Aboukhadijeh, with the new funds raised in addition to Socket's previous $4.6 million seed investment, the company's total financing amount has reached $24.6 million. (Source link)

2. Decentralized data infrastructure Terminal 3 completes Pre-Seed round financing, with participation from Bixin Ventures

Hong Kong-based decentralized user data infrastructure service provider Terminal 3 announced the oversubscribed completion of its Pre-Seed round financing, with specific amount undisclosed. Participating investment institutions include 500 Global, CMCC Global, Consensys Mesh, Bixin Ventures, BlackPine, DWeb3, Hard Yaka, Bored Room Ventures, and Mozaik Capital.

Terminal 3 aims to replace the low-privacy centralized data storage model, helping enterprises address user data compliance and security issues using decentralized storage and zero-knowledge proofs. (Source link)

3. Web3 liquidity infrastructure Solv Protocol completes a $6 million financing, with participation from Laser Digital, Bytetrade Labs

Singapore-based Web3 liquidity infrastructure Solv Protocol has completed a new round of financing totaling $6 million, with participation from Laser Digital, a subsidiary of Japanese banking giant Nomura Securities, Dahua Venture Capital, Mirana Ventures, Emirates Consortium, Matrix Partners, Apollo Capital, HashCIB, Geek Cartel, and Bytetrade Labs. The funds from this round will be used to expand the team and for technical development.

According to DeFiLlama data, since its launch in the second quarter of this year, Solv Protocol's total locked value has grown to $2.8 million, serving over 25,000 users and facilitating over $100 million in trading volume. According to data from the crypto data platform Rootdata, Solv Protocol previously received strategic financing from Binance Labs in January 2022. (Source link)

4. Privacy data verification protocol zkPass completes a $2.5 million seed round financing, with participation from Binance Labs, Sequoia China

Privacy data verification protocol zkPass has announced the completion of a $2.5 million seed round financing, with participation from Binance Labs, Sequoia China, OKX Ventures, dao5, Susquehanna International Group, Cypher Capital, Leland Ventures, and Blockchain Founders Fund.

zkPass uses a combination of three technologies: zero-knowledge proofs, multi-party computation, and secure transmission layer. This allows users to disclose personal data on any website without the need to disclose or upload documents themselves. (Source link)

5. Key management digital infrastructure Hushmesh completes a $5.2 million financing, led by Paladin Capital Group

Key management digital infrastructure Hushmesh has announced the completion of a $5.2 million financing, led by Paladin Capital Group, with participation from Akamai Technologies. Hushmesh will use these funds to develop Mesh, a global information space with built-in automated security features, allowing individuals and organizations to operate online without worrying about malicious attacks or data leaks.

Hushmesh supports key management services for individuals and organizational entities, unifying identifiers, aliases, keys, and encrypted data in an encrypted manner. This can address the issue of losing access to keys in the Web3 and blockchain fields, which results in the loss of all data, and reduce risks such as data leaks, identity theft, and fraud. (Source link)

6. CBDC infrastructure provider Emtech completes a $4 million seed round financing, led by Matrix Partners India

African CBDC infrastructure provider Emtech has completed a $4 million seed round financing, led by Matrix Partners India, with participation from BTN, Vested, Equity Alliance, and LoftyInc Capital. This round of funding will be used to develop the CBDC stack and its regulatory technology solutions.

Founder Carmelle Cadet stated that Emtech will deploy its first version of the CBDC platform this year, and as of now, Emtech's total financing amount has reached $10 million. (Source link)

7. Blockchain payment platform Orbital completes a £5 million financing, led by Golden Record Ventures

London-based blockchain payment platform Orbital has completed a £5 million (approximately $6.8 million) first round of financing, led by Golden Record Ventures, with participation from New Form Capital, GSRV, Psalion, and Luminous Futures.

This round of funding will be used to further develop the platform's technology and expand market share. Orbital plans to further consolidate its position in the blockchain payment field and expand its business globally through continuous innovation and providing high-quality services. (Source link)

II. Gaming

1. Web3 game platform developer Conductive.ai completes seed round financing, led by Animoca Brands

1. Conductive.ai

Web3 game platform developer Conductive.ai has completed a seed round of financing, with Animoca Brands leading the investment. Other participants include Kraken Ventures, Bixin Ventures, Sound Ventures, Rubik Ventures, Sfermion, Oyster Ventures, Blue Lion Global, Axia8 Ventures, Unanimous Capital, and Everest Ventures. The financing amount has not been disclosed.

Conductive.ai's vision is to address the biggest issues in the current gaming industry by improving user acquisition efficiency and enhancing player engagement. This will allow mainstream users worldwide to access Web3 technology without the need to be familiar with Web3 wallets or technical processes. Conductive.ai's platform includes a "Zero-Click" import tool that simplifies the creation and login of Web3 accounts, eliminating much of the friction commonly found in platforms using Web3 technology.

Additionally, the platform can support the distribution of rewards to global players using stablecoins and digital collectibles in games, and it is scalable for games of any player scale. (Source link)

2. Mahjong Meta

Web3 Mahjong game Mahjong Meta, based on the Ethereum network, has announced the completion of a $12 million financing round, led by Dragonfly Capital and Folius Ventures. Other participants include Meteorite Labs, Find Satoshi Labs, Parallel Ventures, and Emoote. The funds from this round will be used to drive product development for Mahjong Meta and expand the Web3 gaming ecosystem, further enhancing players' gaming experience and expanding its global influence.

Mahjong Meta is a Web3 game platform dedicated to Mahjong esports and is a blockchain-themed park for all players. The core team consists of experienced professionals from leading game companies such as Tencent, NetEase, and Lilith. According to official data, Mahjong Meta successfully launched its beta testing on May 12, attracting over 15,000 players to participate in over 490,000 matches in the following two months. The official version is expected to be launched on August 7.

3. DogeWalk

Web3 social game DogeWalk, focusing on pet dogs, has completed a $1 million seed round financing with a valuation of $10 million, led by ByteTrade Lab. ByteTrade Lab will also provide comprehensive incubation and operational support for DogeWalk in development, product, marketing, and community. The financing funds will be used to initiate global operations and subsequent hardware access, as well as the layout of physical pet matrices, and more.

In DogeWalk, users can equip themselves with NFTs in the form of virtual dogs, and by walking, playing, and sharing pet moments, users can earn tokens, which can be used within the game or to purchase real dog food, supplies, services, etc. The beta version is currently available for trial.

ByteTrade Lab is a Web 3.0 infrastructure, which received a $50 million Series A financing in June 2022 from Susquehanna International Group (SIG) Asia VC Fund and other leading institutional investors, according to crypto data platform RootData. Its investors include INCE Capital, BAI Capital, Sky9 Capital, BlueRun, and PCG.

4. Marquee

Decentralized insurance platform Marquee has completed a $1 million seed round financing, with participation from Cryptogram Venture (CGV), Chain Capital, Waterdrip Capital, Bitrise Capital, ZC Capital, and Coinw Ventures. Marquee supports users to purchase "token price insurance" and "smart contract insurance," and allows users to become insurance underwriters to receive multiple rewards. Marquee will accelerate technological development and market promotion to provide more breakthrough and innovative product solutions. Its goal is to lead the innovation and creative growth of the insurance, options, and other derivative markets, ushering in a new era of creative growth.

5. EdgeIn

Web3 database platform EdgeIn is currently undergoing a $1.5 million Pre-Seed round financing with a company valuation of $8 million. It has raised $400,000 to date, with angel investors including Mike Dinsdale (Akkadian Ventures, DocuSign, DoorDash, Gusto), Mike Borozdin (DocuSign, Google), Jeremy Clover (Circle), Pedram Amini, Bayo Okusanya, and Ulises Merino Núñez. EdgeIn provides datasets for Web3 companies, projects, and investments, with a subscription fee of $14.99 per month, and offers real-time updates on companies, personnel, transactions, and events. The company claims to have indexed over 90% of the Web3 market, listing 50,000 Web3 companies and projects. (Source link)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。