This article will sort out the key contents, market impact, and potential passage of the cryptocurrency-related bills proposed by the US Congress.

Author: Lisa, LD Capital

Recently, the US Congress is voting on multiple cryptocurrency-related bills, which could greatly enhance the clarity of industry regulation. If these bills are successfully passed, they could become a milestone in the regularization of the digital asset industry. The cryptocurrency market may be experiencing the most important legislative period from the US Congress in history. This article will sort out the key contents, market impact, and potential passage of the following bills.

H.R.4763 — Financial Innovation and Technology for the 21st Century Act

H.R.4766 — Clarity for Payment Stablecoins Act of 2023

H.R.4841 — Keep Your Coins Act of 2023

H.R.1747 — Blockchain Regulatory Certainty Act

S.2355 — A bill to clarify the applicability of sanctions and anti-money laundering compliance obligations to United States persons in the decentralized finance technology sector and virtual currency kiosk operators, and for other purposes. (THE CRYPTO-ASSET NATIONAL SECURITY ENHANCEMENT AND ENFORCEMENT (CANSEE) ACT)

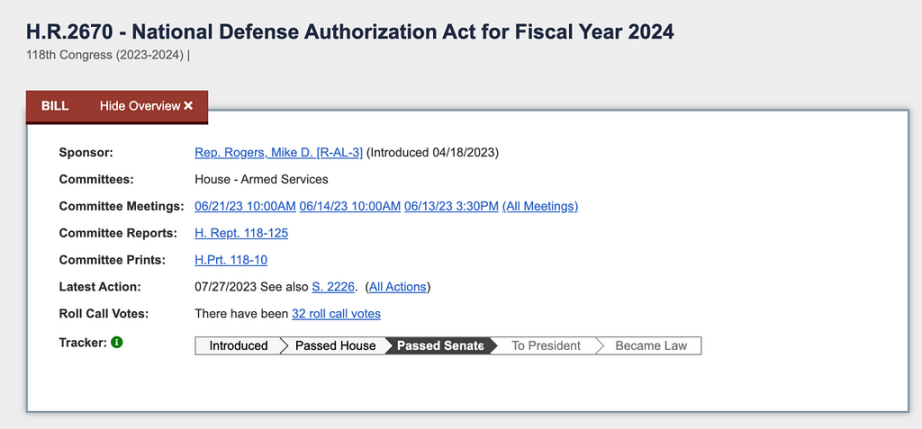

H.R.2670 — National Defense Authorization Act for Fiscal Year 2024

Note: "H.R." stands for House of Representatives, indicating that the bill is proposed by a member of the House of Representatives, and "S" stands for Senate, indicating that the bill is proposed by a member of the Senate.

US Legislative Process

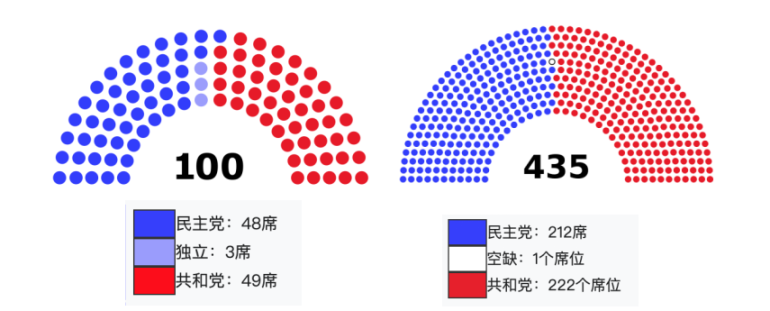

First, it is necessary to have a rough understanding of the US legislative process in order to better understand the contradictions and potential opportunities for the passage of bills. The United States is a country with a separation of powers, with legislative power belonging to Congress; executive power belonging to the President of the United States; and judicial power belonging to the US Supreme Court. Congress is composed of members of the Senate and members of the House of Representatives who are directly elected by the people. The specific composition of the 118th Congress of the United States is as follows:

- Senate: 48 Democrats; 3 Independents (aligned with the Democratic caucus); 49 Republicans

- House of Representatives: 212 Democrats; 222 Republicans

Source: wikipedia

Therefore, the ruling Democratic Party holds the majority in the Senate, while the majority party in the House of Representatives is the Republican Party.

According to the rules of procedure of the two houses of the US Congress, bills fall into four categories: simple resolution, concurrent resolution, joint resolution, and bill. Among them, the bill is the most common and most frequently used form of legislation. Except for tax bills and omnibus bills, which must be proposed by the House of Representatives, bills are proposed by one house, reviewed and passed, and then sent to the other house for review and passage. After being passed by both houses and a unified text is agreed upon, the bill is submitted to the President for signature to become national law. The process involves the following steps:

1. Drafting of the Bill

The idea for a bill can come from a trade association or individual citizens, but only senators or representatives can formally introduce legislative bills. The drafter will seek co-sponsors among colleagues to increase the weight of the proposal.

2. Introduction of the Bill

During a session of Congress, the sponsoring member fills in the title and main content of the bill in a fixed format and signs it. In the House of Representatives, the bill is then placed in the "bill box," completing the bill submission process; in the Senate, the bill is handed to the Senate clerk, or, at a plenary session, the bill title is read and the content of the bill is stated, completing the bill submission process with the permission of the presiding officer.

3. Committee Review

The bill is referred to a specialized committee for study, debate, hearings, and improvement. Once the bill is submitted to the committee, it enters a complex, lengthy, and variable review process. The committee review process is a process of reaching consensus based on various forces competing and compromising. After obtaining committee approval, the bill will be sent to the full chamber for debate and voting.

4. Full Chamber Review

The procedures for full chamber review differ significantly between the House and the Senate. The House emphasizes "the minority is subject to the majority"; the Senate emphasizes "negotiation, compromise, and cooperation" between the majority party and the minority party.

- House of Representatives: For important bills that reflect the interests of the majority party, the Rules Committee may adopt "closed rules," meaning that the bill does not accept amendments or substitutes during the review process; for other bills, the Rules Committee may adopt "open rules," allowing members to propose relevant amendments or substitutes during the review process.

- Senate: Whether a bill that has been approved by the committee can enter the voting process depends on whether it has the support of 60 senators. The Senate has few restrictions on member debates, and as long as they do not violate the rules of procedure, senators can speak freely on any issue without time limits. The Senate can only vote after all members have finished speaking, leading to a special operating mode—filibuster. Senators can use lengthy speeches to prevent the Senate from voting on the bill under consideration. Senators can propose any form and content of amendments or substitutes to any part of the bill, providing space and conditions for the two party leaders to negotiate and seek compromise.

5. Unified Text of Both Houses

Before a bill is submitted to the President for signature, a unified text of the bill must be negotiated by both houses.

6. Presidential Signature

- Presidential Signature: Approval of the bill makes it a law.

- Presidential Veto: The bill is returned to Congress with the reasons for the veto. Both houses can accept the President's opinion, modify the bill or joint resolution, and then submit it to the President for signature. Alternatively, the veto can be overturned by a 2/3 vote in both the House of Representatives and the Senate, making the bill a law.

- Presidential Inaction: If Congress is in session, the bill becomes law automatically after 10 days without a reply from the President; if Congress is in recess within 10 days of submitting the bill to the President, the bill will not become law.

Recent Cryptocurrency-Related Bills

1. The Financial Innovation and Technology for the 21st Century Act (Fit21)

Sponsors

This 212-page bill was jointly drafted by Republican members of the House Agriculture Committee and the Financial Services Committee. It was first released in early June. The co-sponsors include Glenn Thompson, Chairman of the House Agriculture Committee (Republican from Pennsylvania), French Hill, Representative (Republican from Arkansas), and Dusty Johnson (R-SD). Hill leads the first Digital Assets, Financial Technology, and Inclusion Subcommittee, and Johnson leads the Commodity Markets, Digital Assets, and Rural Development Subcommittee.

Some may wonder why the House Agriculture Committee is concerned about cryptocurrency. The reason is that one of the responsibilities of the Agriculture Committee is to oversee commodities. Historically, most commodities have been agricultural products such as corn, soybeans, and wheat. In 1974, the federal government established the Commodity Futures Trading Commission (CFTC) to regulate commodity futures trading, and the Agriculture Committee is still authorized to oversee the CFTC and handle futures trading. The Agriculture Committee stated in a statement that it is interested in all types of commodity markets, including commodities that emerge through new technologies, such as cryptocurrencies and cryptocurrency futures trading.

Content and Impact

The bill clarifies the regulatory roles of the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) in cryptocurrency regulation, granting the CFTC jurisdiction over digital commodities, including exchanges, brokers, and dealers related to digital commodities. According to the bill's summary released by the co-sponsors, about 70% of cryptocurrencies are more suitable to be considered commodities rather than securities, meaning that 70% of tokens should be under the jurisdiction of the CFTC, and it is pointed out that tokens cannot be classified as securities based solely on investment contracts. The bill defines digital assets as digital commodities, with the main condition being decentralization and functional connectivity to a network.

Market participants must comply with new, more comprehensive disclosure requirements, and intermediaries may need to register with the SEC or CFTC based on whether the underlying asset is a digital commodity. If both are involved, they need to register with both the SEC and CFTC (DUAL REGISTRATION).

The bill defines digital assets as "any fungible digital representation of value," thus explicitly excluding NFTs. The bill also lists related "ancillary activities" not subject to the bill, including key blockchain support and operational services and actions such as "compiling network transactions," "providing computational work," "providing user interfaces," and "developing, releasing, building, managing, maintaining, or otherwise distributing blockchain systems."

This bill represents a good first step in appropriately regulating the digital asset industry and is a response to the need for regulatory clarity in the digital asset space.

Progress

On July 27, the bill was passed by the House Financial Services Committee, and on July 28, it was passed by the House Agriculture Committee. The legislation will now be sent to the full House for a vote.

The bill faces opposition from the Democratic Party, with many believing that the SEC should play a larger role than currently allocated by the bill. Democratic Representative Maxine Waters of California has expressed that she did not think the CFTC should be given such strong support. Hilary Allen, a professor at American University Washington College of Law, criticized the bill as a Republican attempt to please cryptocurrency exchanges, Wall Street, and Silicon Valley venture capitalists. The bill's passage in the Democratic-controlled Senate is uncertain.

2. Clarity for Payment Stablecoins Act

Sponsors

The Clarity for Payment Stablecoins Act was proposed by Patrick McHenry, Chairman of the House Financial Services Committee. This is the latest version of a series of stablecoin legislative proposals he has been involved in since last year. The bill aims to provide a regulatory framework for stablecoins and protect consumers by establishing uniform standards for stablecoin issuance.

Main Content and Impact

The bill introduces requirements for capital, liquidity, and risk management, requiring licensed stablecoin issuers to hold reserves to support the issuance of stablecoins, publicly disclose the composition of their reserves monthly, publicly disclose their redemption policies, and establish timely redemption procedures. Reserves held cannot be pledged, rehypothecated, or reused unless it is to create liquidity to meet redemption requests. Issuers operating outside the US must seek registration to conduct business in the country.

While it may increase compliance costs, the bill is beneficial for the further development of stablecoins and DeFi. It also has positive implications for RWAs, as projects involving on-chain assets such as fiat currency and government bonds can legally and compliantly operate, paving the way for the mass development of RWAs. Coinbase's Chief Legal Officer, Paul Grewal, stated on social media that the Clarity for Payment Stablecoins Act provides important protection for US investors.

Progress

On July 28, the US House Financial Services Committee passed the Clarity for Payment Stablecoins Act with a vote of 34 to 16. The bill also faces opposition from the Democratic Party. Democratic Representative Stephen Lynch of Massachusetts suggested postponing the vote until September, stating that Democrats did not have enough opportunity to express their thoughts. Democratic Representative Maxine Waters of California believes the bill could lead to adverse licensing competition and stated that neither the Federal Reserve nor the US Treasury supports the current state of the bill.

3. Keep Your Coins Act of 2023

The bill aims to protect consumers' rights to hold Bitcoin in self-custody wallets, ensuring the freedom and privacy of individual users in managing their cryptocurrency assets. It emphasizes giving individuals full control over their digital assets, which could have a significant impact on the cryptocurrency landscape based on the principles of decentralization and financial autonomy.

On July 28, the Keep Your Coins Act was passed by the House Financial Services Committee and will be submitted for a vote in the House in the future.

4. Blockchain Regulatory Certainty Act

Sponsors

On March 23, 2023, US Representatives Tom Emmer and Darren Soto introduced the Blockchain Regulatory Certainty Act to Congress. Representative Tom Emmer, the Majority Whip of the House, is considered one of the most supportive legislators for the cryptocurrency industry. He previously supported the SEC Stability Act proposed by Representative Warren Davidson, which called for the restructuring of the US SEC and the dismissal of its chairman, Gary Gensler. On May 18, Tom Emmer and Darren Soto also introduced the bipartisan Securities Clarity Act, which has not had further updates.

Main Content and Impact

The bill aims to clarify the regulatory obligations of non-custodial blockchain developers and service providers. It introduces "safe harbor" provisions for blockchain developers and non-custodial service providers (including miners, validators, and wallet providers) who do not control consumer funds, stating that they should not be considered money transmitters and should not be subject to the same level of regulation as cryptocurrency exchanges that provide custody services. As long as these entities do not control the digital assets held by users on their platforms, they will not be classified as money transmitters or financial institutions requiring licensing or registration, and will be exempt from specific licensing requirements.

Progress

On July 27, the Blockchain Regulatory Certainty Act was passed by the House Financial Services Committee.

5. THE CRYPTO-ASSET NATIONAL SECURITY ENHANCEMENT AND ENFORCEMENT (CANSEE) ACT

Sponsors

Introduced on July 18 by Senator Jack Reed and co-sponsored by Senators Mark Warner, Mike Rounds, and Mitt Romney, the bipartisan bill focuses on anti-money laundering and sanctions compliance. Jack Reed named the bill "THE CRYPTO-ASSET NATIONAL SECURITY ENHANCEMENT AND ENFORCEMENT (CANSEE) ACT" on his personal website.

Main Content and Impact

The bill aims to prevent money laundering and sanctions evasion in DeFi and modernize the main anti-money laundering agency of the US Treasury. It requires DeFi protocols to comply with the same anti-money laundering and related economic sanctions rules as other financial institutions, including maintaining anti-money laundering programs, conducting due diligence on their customers, and reporting suspicious transactions to the Financial Crimes Enforcement Network (FinCEN). The bill also requires the controllers of DeFi protocols to ensure effective anti-money laundering programs. If a protocol does not have identifiable controllers, those who invest over $25 million in developing the protocol will be responsible. For example, if a sanctioned individual (such as a Russian oligarch) uses DeFi services to evade US sanctions, the individuals who control the project or those who invest over $25 million in developing the project (in the absence of identifiable controllers) will be held responsible for assisting in such violations.

Currently, there are approximately 30,600 cryptocurrency ATMs in the US. The bill imposes KYC requirements on cryptocurrency ATM operators to ensure they do not become vehicles for money laundering and other illegal activities. The bill could have a negative impact on the development of DeFi in the US.

Progress

The bill is the result of bipartisan cooperation, especially as its goal is to strengthen national security, giving it a better chance of receiving a full House vote. It has not yet entered the committee voting stage.

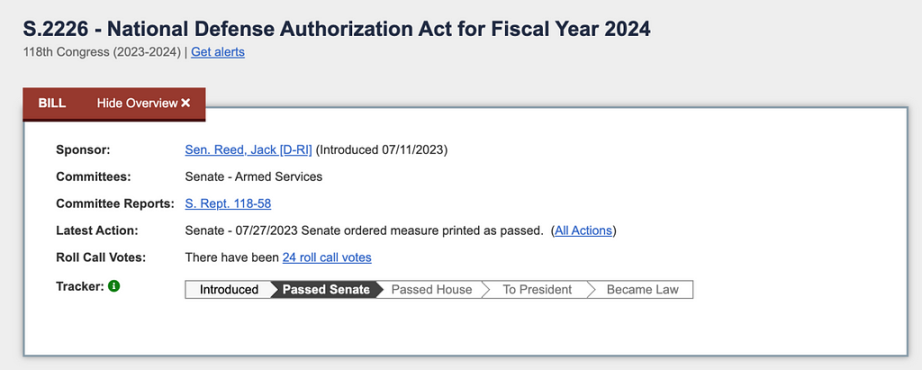

6. National Defense Authorization Act for Fiscal Year 2024 (NDAA)

The National Defense Authorization Act is an annual bill proposed by the United States Congress to redefine the military budget for the following year. The House and Senate have respectively proposed the "2024 Fiscal Year National Defense Authorization Act" H.R. 2670 and S.2226.

On July 28, 2023, the US Senate passed the "2024 Fiscal Year National Defense Authorization Act," which includes amendments to strengthen regulation of cryptocurrency financial institutions, mixers, and "enhanced anonymity" crypto assets. The amendment was proposed by a bipartisan group of US Senators, including Democratic Senator Kirsten Gillibrand of New York, Republican Senator Cynthia Lummis of Wyoming, Democratic Senator Elizabeth Warren of Massachusetts, and Republican Senator Roger Marshall of Kansas.

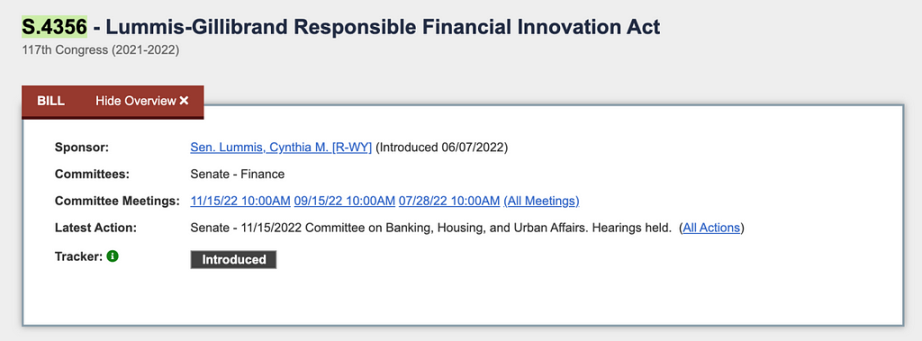

The amendment is based on the "Lummis-Gillibrand Responsible Financial Innovation Act" (S.4356) from 2023 and the "Digital Asset Anti-Money Laundering Act" introduced by Warren and Marshall in 2022. It aims to strengthen anti-money laundering and counter-terrorism regulations for cryptocurrencies and combat anonymous cryptocurrency transactions. It requires the Treasury Secretary to establish review standards for crypto assets to help examiners better assess risks and ensure compliance with anti-money laundering and sanctions laws. It also calls for the Treasury Department to conduct research on "combating anonymous cryptocurrency transactions," especially regarding mixers. The passage of the bill will enhance the US's efforts in combating cryptocurrency money laundering. Now, both houses need to negotiate a unified version for passage.

The "Lummis-Gillibrand Responsible Financial Innovation Act" (S.4356) was reintroduced by Senators Cynthia Lummis (Republican, Wyoming) and Kirsten Gillibrand (Democrat, New York). Cynthia Lummis, known as the "Crypto Queen of the Senate," is a cryptocurrency supporter. The bill was previously considered the most comprehensive and bipartisan cryptocurrency bill in Senate history. It was put on hold after the collapse of FTX, and there have been no new developments since November 2022.

References:

- Foresight News

- House Financial Services Committee

- National People's Congress of China

- 118th United States Congress

- National Defense Authorization Act for Fiscal Year 2024

- US Senate Passes $886B Military Spending Bill with Crypto AML Provision

- S.4356 - Lummis-Gillibrand Responsible Financial Innovation Act

- Binance

- Bipartisan US Senators Unveil Crypto Anti-Money Laundering Bill to Stop Illicit Transfers

- Clarity for Payment Stablecoins Act of 2023

- Financial Innovation and Technology for the 21st Century Act

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。