Author: 137Labs

25% TGE, 24% user allocation, IPO-linked unlock—Backpack's token economic design is challenging the traditional logic for issuing tokens on exchanges. Starting from wallets and the NFT community, obtaining compliance licenses, acquiring European entities, and tying tokens to IPO expectations, Backpack is betting not just on traffic but on a narrative in the capital market. Is this a structural innovation or a high-risk pricing strategy? This article deeply analyzes its team background, development path, and token model.

While most exchanges are still designing token models around transaction fee discounts, buybacks, and ecological incentives, Backpack has chosen a completely different path.

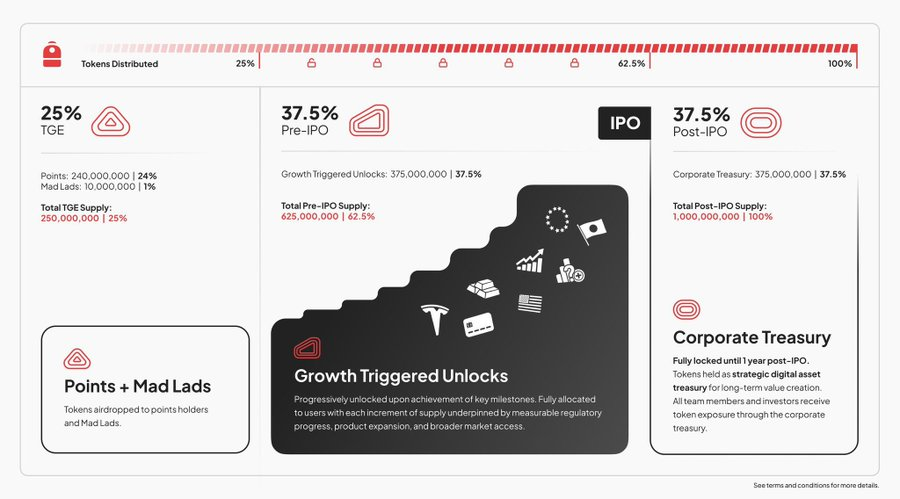

Total supply of 1 billion tokens.

25% released at TGE.

Token structure deeply tied to the IPO process.

This is not just a token distribution plan but more like an experimental model integrating the company's capital structure with token economics.

If we observe Backpack's development history, team background, compliance path, and this token design on the same chart, a more core question emerges:

Is Backpack issuing tokens, or is it pre-setting equity logic for a future digital asset company that may go public?

I. Development Path: Three-Stage Evolution from Wallet to Exchange

Backpack's starting point is not an exchange, but a wallet product built around xNFT.

First Stage: xNFT and Web3 Application Container

The early Backpack focused on supporting executable NFTs (xNFT) as its core selling point.

This design allows developers to embed application logic into NFTs, making the wallet a container for running Web3 applications.

At that stage, it resembled a technology-driven infrastructure company rather than a financial platform.

Keywords include:

·Developer ecosystem

·On-chain application distribution

·User operating system

This marks the product-driven starting point.

Second Stage: Mad Lads and Community Assets

The launch of Mad Lads NFT became a key turning point.

It not only became a representative NFT project in the Solana ecosystem but also established an active community asset pool for Backpack.

The strategic significance of this stage lies in:

·Establishing an identity system

·Gathering core users

·Forming brand assets

This marks a leap from "tool product" to "platform ecosystem."

Third Stage: Exchange and Compliance Expansion

After Backpack obtained regulatory approval and officially launched its exchange business, the narrative fundamentally changed.

It was no longer just a wallet.

It became a centralized trading platform with compliance identity.

This stage signifies:

·Entering a highly regulated track

·Bearing the responsibility for asset security

·Direct participation in market competition

The transition from a technology company to a financial platform is a crucial step determining its valuation logic.

II. Team Background: Entrepreneurs Emerging from the FTX Era

Backpack founder Armani Ferrante previously worked at Alameda Research, and team members have connections to the FTX ecosystem.

After the collapse of FTX, "former FTX background" became a sensitive label.

Backpack's path does not avoid this but chooses to establish credibility through action.

During the restructuring of its European operations, Backpack participated in acquiring related entities and promoting the return of user assets. This was both a business move and a credibility repair.

This equips the team with three unique qualities:

·Deep understanding of exchange mechanisms

·Realistic awareness of risk control failures

·High sensitivity to compliance and regulation

This complex background positions its path more towards a stable financial institution rather than a wildly expanding trading platform.

III. Financing and Capital Narrative: Shifting Valuation Logic

As the exchange business progresses and licenses are issued, Backpack's valuation logic changes.

From:

“Wallet + NFT Project”

To:

“Compliant Exchange + Potential Unicorn Platform”

At this stage, the core variables determining its long-term value are no longer on-chain activity but rather:

·Real trading volume

·Market share

·Regulatory expansion capability

·Profit model

This also lays the foundation for subsequent token structure design.

IV. Token Economic Model Breakdown: Three-Stage Structure and IPO Binding Mechanism

Backpack's total token supply is 1 billion, but the core lies not in the number but in the allocation structure.

The entire model is divided into three clear stages:

1. TGE (Token Generation Event)

2. Pre-IPO (Pre-IPO Stage)

3. Post-IPO (Post-IPO Stage)

This is a token system built around the company's development timeline.

First Stage: TGE —— 25% Initial Release

The TGE stage releases 25% of the total amount, which is 250 million tokens.

Of which:

·About 240 million tokens allocated to participants in the points system

·About 10 million tokens allocated to Mad Lads NFT holders

This phase is essentially a settlement of early user behavior.

The points mechanism accumulates rights through transactions, activity, and ecological participation, ultimately converting into real tokens. NFT holders receive additional incentives as early supporters.

This design reinforces community attributes and also means that the initial circulating chips are mainly in the hands of users.

However, after TGE, it will inevitably face a certain scale of potential selling pressure.

Second Stage: Pre-IPO —— 37.5% Growth Triggered Unlock

The pre-IPO stage accounts for 37.5% of the total supply, approximately 375 million tokens.

This stage is not released linearly over time but adopts a growth-triggered mechanism.

Token unlock is linked to the company's development process, including:

·Regulatory progress

·Market entry breakthroughs

·Product line expansion

·Integration of new asset classes

Strategically, its expansion targets may cover:

·Equity-like assets

·Bank card systems

·Precious metal products

·Major jurisdictions like the US, EU, and Japan

It is worth noting that this part of the token is also entirely allocated to users.

This means that before the IPO, a cumulative 62.5% of the total supply will enter the community system.

Third Stage: Post-IPO —— 37.5% Company Treasury Lockup

The remaining 37.5% of the tokens enter the company treasury.

This portion has two key characteristics:

·Fully locked before the IPO

·Must wait an additional year after the IPO to gain liquidity

More importantly, the team and investors do not have independent early token allocations.

They gain token exposure through the company treasury, which must be tied to the company's listing process.

This means:

Internal benefits are deferred and strongly tied to a long-term compliance path.

Overall, this three-stage structure presents distinct characteristics: over 60% of tokens before the IPO will enter the community system through airdrops and growth incentives, while the interests of the team and investors are postponed and bound to the IPO timeline. The liquidity of internal chips is significantly compressed, and the risk of short-term selling pressure primarily comes from users rather than internal members. The entire model is not designed around market cycles but built around regulatory progress and capital market paths, where the key variable for value realization is whether the company can continue to expand and ultimately complete the IPO narrative.

V. Backpack's Core Proposition: An Exchange or a Future Public Company?

Compliance licenses, European business layout, IPO-linked token structure, high user allocation—these elements collectively form a clear direction.

Backpack resembles a digital asset financial company that is constructing a global compliance framework.

The role of the token within it is no longer just a transaction fee tool but becomes part of the company's growth narrative.

This is an attempt to integrate the traditional exchange model with capital market structures.

VI. Risks and Game Logic

Any high-narrative structure comes with high risks.

Initial Circulation Pressure

A 25% circulation ratio is not low; if the valuation pricing is too high, the market will face selling pressure tests.

IPO Uncertainty

If the IPO plan is delayed or not realized, the core anchor of the lock-up logic will weaken.

Changes in Regulatory Environment

The global regulatory landscape is still changing, and there are variables in cross-jurisdictional expansion.

VII. Conclusion: A Bet on Future Pricing Power

Backpack's token design is not simply an airdrop.

It is a structural experiment:

24% to realize early traffic,

75% locked for future time,

connecting tokens with company growth through IPO expectations.

This is a "time-for-space" strategy.

If the platform's trading volume continues to grow and the compliance path progresses steadily, tokens may become mirrored assets for the company's expansion.

If growth stagnates or the narrative falls short, the high circulation ratio will amplify market volatility.

Backpack is betting not just on the success or failure of issuing tokens.

It is attempting to answer a larger question:

In a period of increased regulation and a return to rationality in capital markets,

can crypto exchanges use token structures to transition to a true financial institutional identity?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。