Author: Zen, PANews

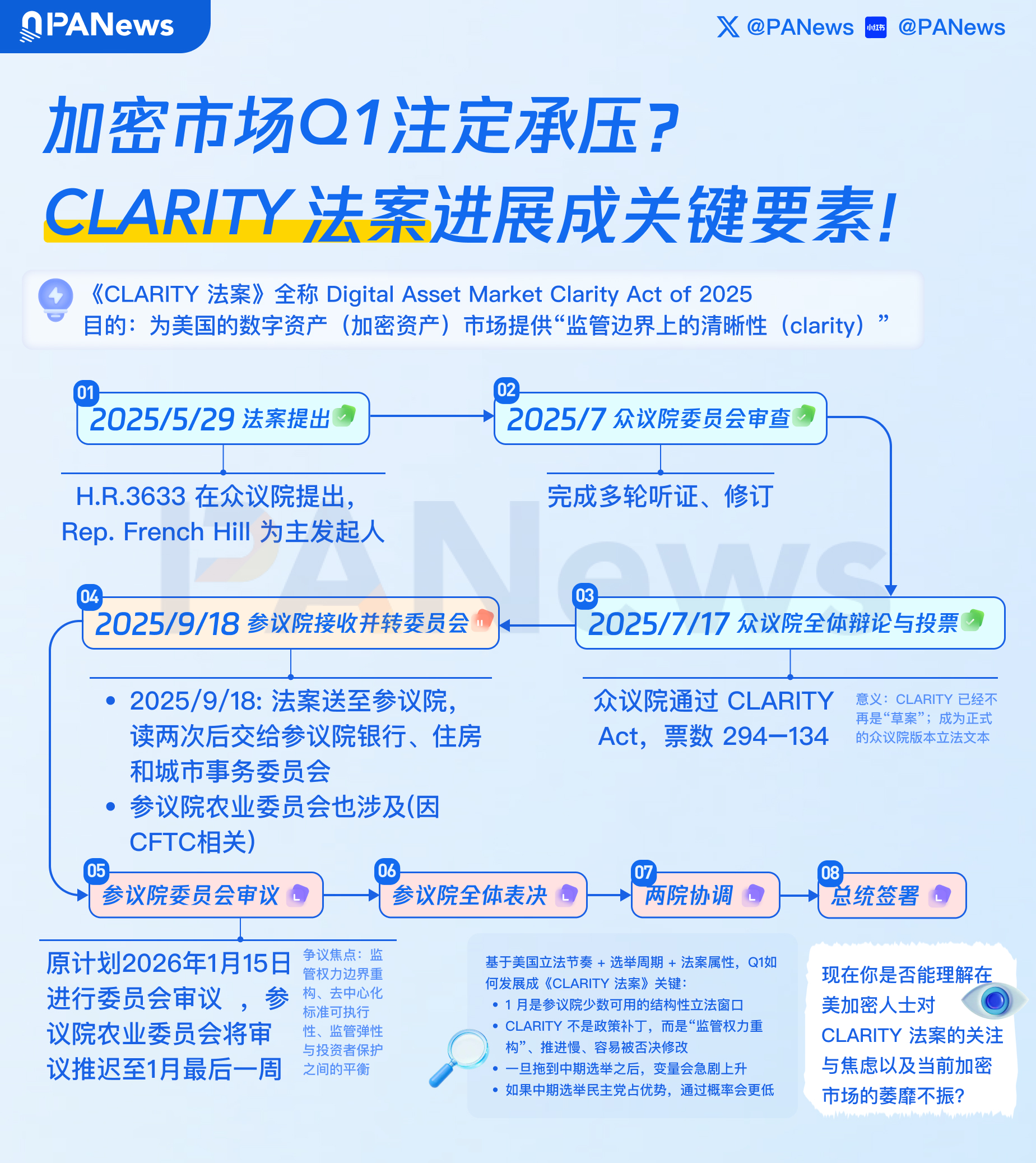

At the end of January 2026, the U.S. Senate Agriculture Committee narrowly passed the "CLARITY Act," aimed at regulating the structure of the cryptocurrency market, with a vote of 12 to 11.

"This is an important step towards establishing clear rules for the digital asset market," said Agriculture Committee Chairman and Republican John Boozman, expressing hope that this move would build momentum for legislative action in the Senate.

However, due to the collective opposition from Democratic senators, the committee vote barely passed amid strict partisan divisions. As a result, many observers view it as a step with "limited substantive progress," and there remains significant uncertainty about whether the bill will successfully become law in the future.

Clarifying the Definition of Digital Commodities and Establishing CFTC's Regulatory Role

The cryptocurrency market structure bill passed by the Senate Agriculture Committee aims to establish a comprehensive federal regulatory framework for the digital asset sector.

As noted by the committee chairman, Republican John Boozman, in his pre-meeting remarks, the U.S. Commodity Futures Trading Commission (CFTC) is the appropriate agency to regulate the spot trading of digital commodities. From a macro perspective, this bill provides a clear definition of digital commodities, protects innovation and technology, establishes consumer protection measures, and provides the necessary resources for the agency to take on this new responsibility.

Senate Agriculture Committee Chairman, Republican John Boozman

Defining "digital commodities" clearly and authorizing the CFTC to establish a regulatory mechanism for intermediaries in the spot market for digital commodities is the core content of the bill. The bill requires the CFTC to coordinate with the SEC to develop rules for cross-sector issues to avoid regulatory vacuums or conflicts. This structure is seen by the industry as favorable for classifying more digital assets as commodities, thereby avoiding the stringent regulations of securities law.

The bill proposes the establishment of a federal registration system for digital commodity exchanges and brokers, requiring relevant platforms to register with the CFTC and comply with regulatory oversight. Legislators hope this will encourage the compliant operation of the digital asset trading market within the U.S., while enhancing market liquidity and resilience. The CFTC will receive new funding sources to support the implementation of this spot market regulatory mechanism.

To strengthen investor protection and market integrity, the bill also establishes a series of investor protection measures, including customer fund segregation, conflict of interest prevention, and mandatory disclosure requirements. These provisions aim to prevent improper behaviors such as the misappropriation of user assets and insider trading, enhancing market transparency.

Additionally, the bill includes protective clauses for software developers and innovative technologies, aiming to ensure that technical innovation activities such as open-source code writing and blockchain node operation are not subjected to unnecessary restrictions due to regulatory uncertainty.

In addition to the aforementioned bill content, Democrats also proposed three amendments during the review, including the "Digital Asset Ethics Act," which restricts the participation of the President, Vice President, members of Congress, and candidates in activities related to the issuance, sponsorship, or endorsement of digital assets, as well as measures to combat "crypto ATM/kiosk" fraud and prohibit federal bailouts for bankrupt crypto institutions. However, all three amendments were rejected by Republicans.

From Bipartisan Cooperation to Sudden Negotiation Breakdown

In November of last year, building on the "Digital Asset Market Transparency Act" passed by the House in July, the Senate Agriculture Committee released a draft of regulatory legislation for the cryptocurrency industry. This discussion draft was jointly released by Boozman and Democratic Senator Cory Booker, and although there were many unresolved issues, it was still seen as a significant positive development.

"From last November to the end of the year, we met daily with all stakeholders for several weeks, gathering feedback and ideas with Boozman's team," a Senate Democratic aide familiar with the situation revealed to The Block. The negotiations in the Senate Agriculture Committee were originally a "very good bipartisan cooperation process," but the situation suddenly changed at the beginning of the new year.

"We really felt we were very close to reaching a bipartisan agreement." This Democratic aide stated that in early January, Boozman's team suddenly informed them of a change in plans, secretly drafting a new version of the bill without informing the Democrats, and intended to begin discussions on January 15. Boozman's team claimed they had made sufficient modifications to the bill text and it was time to vote. However, this version of the bill overturned the collaborative achievements of the past months.

Although cooperation broke down, Democrats still worked to bring Republican members of the Agriculture Committee back to the negotiating table before the hearing, in hopes of reaching a bipartisan consensus before the formal vote. However, the final outcome of the negotiations was still a party-line vote. The bill will be submitted to the full Senate for consideration without Democratic support.

Democratic chief negotiator and New Jersey Senator Cory Booker attributed the shift in partisan positions during the negotiations to the Trump administration. He emphasized that Trump's personal involvement in the cryptocurrency sector was a key obstacle to the bill's eventual passage.

Democratic Senator Cory Booker

Boozman stated that there were fundamental policy differences between the two parties. He also expressed his commitment to continue working with Democrats to push the bill through Congress, adding, "What we want is a bipartisan bill."

However, in reality, the three key amendments proposed by Democrats showed no signs of cooperation or compromise. Ethical issues have always been the main sticking point preventing bipartisan cooperation, with Democrats pushing to include provisions in the bill that restrict officials from participating in cryptocurrency businesses to avoid ongoing corruption among public officials. Such provisions, clearly targeting conflicts of interest involving President Trump, are unlikely to gain broad support or compromise from Republicans.

In addition to ethical provisions, Democratic members also raised objections regarding DeFi regulation and consumer protection measures. They expressed concerns that the Republican version of the draft might inadequately regulate the DeFi sector, potentially allowing decentralized trading platforms to operate outside of regulatory oversight, thus creating loopholes for money laundering and fraud.

Progress Made, but No Substantive Advancement

"The U.S. needs to pass this bill quickly to avoid losing momentum under the current cryptocurrency-friendly government leadership." On January 21, Patrick Witte, Executive Director of the U.S. Presidential Digital Asset Advisory Committee, tweeted in response to Coinbase CEO Brian Armstrong's withdrawal of support for the Senate Banking Committee's version of the cryptocurrency bill.

"You may not like every part of the CLARITY Act, but I can guarantee you will hate the version proposed by Democrats in the future even more." Witte believes that a cryptocurrency bill will inevitably be enacted, and if it passes under a Democratic administration, the final legislation will be very poor, perhaps even worse than having no legislation at all.

Therefore, Witte argues that the current situation should be seized as an opportunity to act decisively and pass legislation quickly. He stated that to secure 60 votes in the Senate, some compromises need to be made, "but do not let perfection become the enemy of excellence."

According to U.S. Senate legislative procedures, most bills require at least 60 votes to overcome filibuster obstruction. Currently, Republicans hold a narrow majority in the Senate with 53 seats, meaning that even if all Republican senators support the bill, they still need to secure at least 7 Democratic senators to cross the 60-vote threshold.

However, Democratic members of the Agriculture Committee have collectively voted against the bill and publicly expressed strong objections. This makes the committee's passage more symbolic, with limited substantive progress, as the core disputes remain unresolved.

During the hearing, Booker pointed out, "The White House has made this incredibly difficult. It is absurd that the President of the United States and his family have made billions from this industry while still trying to create a framework without including ethical provisions that could prevent such severe corruption—this undermines our democracy."

Democrats are concerned that without clear restrictions, the risk of government officials "profiting from the cryptocurrency industry through their positions" will undermine public trust. Senior Democratic Congressman Public Citizen even mockingly referred to the current version of the bill as the "gryfto bill" (a play on "crypto" and "grift," implying profit-seeking under the guise of cryptocurrency), criticizing it for failing to close loopholes for the President and his relatives.

Amid the resolute opposition from Democratic lawmakers, the bill's prospects in the full Senate have become complex and bleak. Given the current situation, without substantive bipartisan compromise, this cryptocurrency market structure bill is likely to face significant obstacles during the full Senate vote.

Additionally, the accompanying legislation overseen by the Senate Banking Committee remains stalled. Due to unresolved disputes over issues such as stablecoin yields, and the more urgent housing legislation affecting people's livelihoods, the Banking Committee has postponed the originally scheduled bill review in January and has not yet rescheduled, which may delay until the second quarter.

This means that even if the Agriculture Committee's version barely makes it to the full Senate discussion, a complete Senate version of the cryptocurrency legislation has yet to take shape, and subsequent coordination may be needed to merge the two committee versions before aligning with the version passed by the House. If the Senate cannot reach an agreement on a unified version, the legislative timeline will be further extended.

Time factors also make the bill's future uncertain. The year 2026 is a midterm election year in the U.S., and generally, Congress's willingness and ability to pass significant legislation in the months leading up to elections decrease. If this cryptocurrency market structure bill does not achieve breakthrough progress in the first quarter of 2026, it may be squeezed out of the annual legislative agenda, thus missing the window of opportunity.

More critically, the elections in November could change the majority party in the Senate. Some analysts point out that if the Democrats regain control of the Senate after the elections, this unfinished cryptocurrency legislation may face significant modifications or even be shelved.

However, Democrats, including Booker, have also stated that they are not completely opposed to the legislation itself. They emphasize that as long as key ethical and protective provisions can be met, they are "willing to work to find common ground." But if partisan divisions persist, the bill's prospects may become increasingly dim as the elections approach.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。