Written by: Zuo Ye Web3

The Redemption Path of Crypto Giants

Sister Wood has ignited the fire.

Haseeb is once again pretending to be a great prophet, while Xu Mingxing plays the role of Prometheus, combining Eastern and Western medicine to jointly burn He Yi and CZ. Carthage must be destroyed, and so must Sodom and Gomorrah.

This religious-style presumption of guilt stems from the widespread psychological contradictions within the crypto industry.

The entire history of cryptocurrency has been challenging the boundaries of rules, navigating the ambiguous gray areas. Now, crypto giants want to come ashore and reform, urgently needing to solve two problems:

How to evolve from being rule arbitrageurs to rule followers? For instance, if the cost of avoiding the "10·11" major liquidation is to sacrifice oneself, how should Binance consider this?

Seizing the power to set crypto rules to gain tangible benefits for the industry. For example, Coinbase's attitude can influence the progress of clear legislation. Where does the power come from?

Moreover, Binance faces an additional identity dilemma. SBF can directly plead for mercy, distorting time and space to become a Republican from 2022, but CZ and Binance's Chinese identity and background always face a cycle of Western scrutiny and self-justification.

Rules Have Value: The Crypto King is Also Meat on the Chopping Block

The purpose of political science is not to create people, but to explore how to use people naturally.

I want to tell a story first, an old tale of a dragon slayer choosing to become the evil dragon.

In 1991, as the Soviet Union was about to collapse, history seemed to be heading towards the end of neoliberalism. The United States seriously passed through the United Nations to govern the Earth. In the face of Saddam's invasion of Kuwait, the U.S. received UN authorization to join 35 countries, easily defeating Saddam in just 100 hours of ground operations and restoring Kuwait's sovereignty.

At that time, the United States received sincere praise from around the world.

Just two years later, the U.S. encountered a shadow falling in the capital of Somalia, failing to achieve the small goal of capturing warlords, leading to a strong backlash in domestic public opinion. From then on, the U.S. began to experience a shattered moral compass; it seemed that doing good deeds did not yield good returns, and doing evil also had no special cost.

Until the 9/11 incident in 2001, the U.S. completely shattered its moral compass and subsequently fell into the quagmire of the global war on terror.

To see the big picture, this story is very interesting; the current crypto dilemma is similar. After winning the cold war against Wall Street and the banking industry, achieving the outstanding hegemony of tokenization and stablecoins, there are severe internal disagreements on the path forward.

Black Hawk Down, the U.S. directly darkened, doing good deeds yields no good returns. Binance once attempted to save the crypto industry but ultimately chose to build its own territory.

Let’s rewind to 2022, when FTX collapsed, Binance once held over 70% of the CEX market share, but the entire industry was shrouded in the shadow of an uncertain future.

Binance decided to step in to save the entire industry, establishing a $1 billion SAFU fund at that time, of course, with some ulterior motives, mainly composed of its own BUSD and BNB. Recently, it gained notoriety for responding to Yi Lihua's call to swap its holdings for BTC.

Unfortunately, this is not the whole story. Alongside SAFU, there was also the Industry Recovery Initiative (IRI) to unite major project parties and exchanges to carry out industry self-rescue plans. Binance promised to invest at least $1 billion, hoping the overall scale could exceed $2 billion.

Now, the application form for the IRI plan is no longer accessible; perhaps the industry has already recovered.

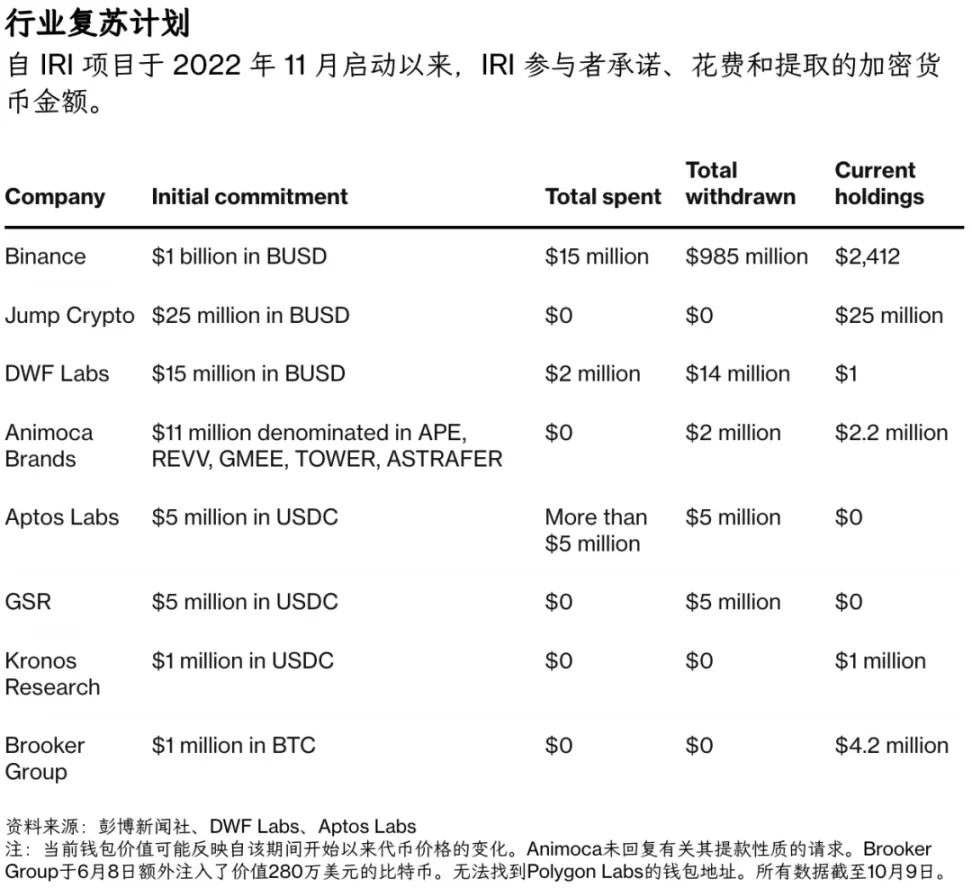

Image caption: IRI funding situation, image source: @business

In fact, as early as 2023, the IRI had ceased operations, and many promised investors, such as Jump/GSR/Kronos and other market makers, had not actually invested at all. Binance only spent $15 million and withdrew the remaining $985 million.

Moreover, the entire operation of the IRI was extremely opaque; you had no idea which project parties received investments and which ones were left to wait for death.

If we delve deeper, Binance's unfulfilled promises extend beyond just IRI. Recently, there was the $400 million mutual aid fund after "10·11," and further back, the $1 billion BSC Growth Fund established in 2021, which years later began spending $50,000 to buy the "I’m Here" meme coin.

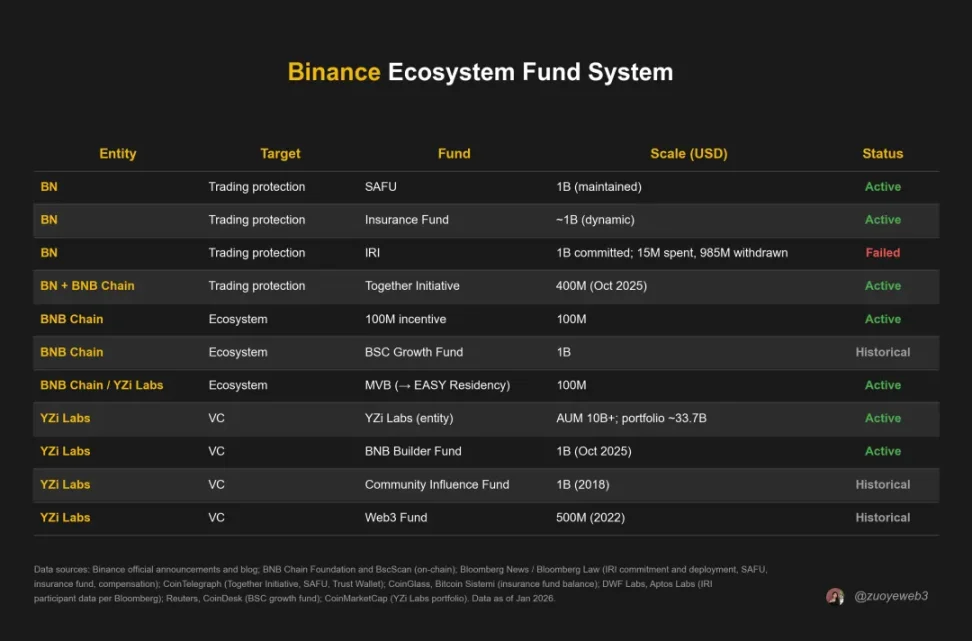

Image caption: Various funds initiated by Binance, image source: @zuoyeweb3

If we count the various plans initiated by Binance, it seems particularly fond of the number 1 billion, akin to Sun Yuchen's eternally unattainable $1 million reward. Excluding the YZi Labs main fund, Binance's promised various funds exceed $5 billion, but the actual amount realized is less than $100 million.

It can be stated very clearly that after the failure of IRI, Binance effectively initiated a process of siphoning off the industry rather than nurturing it, supporting Binance's main site against CEX and supporting BNB Chain against public chains like Solana.

This is also the source of Solana co-founder Anatoly's assertion that the industry needs an 18-month recovery period. Binance does not care about the industry's bull and bear cycles, as long as the BSC ecosystem and Binance's main site maintain trading hegemony.

Binance cannot become the dominant rule-maker; it can only remain king in its own small territory.

However, Coinbase CEO Armstrong does not think so. In his view, one should not obey established rules but should try to tame them. The current entanglement with the banking industry over the USDC interest issue is just the tip of the iceberg; intervening in politics itself is the ultimate answer.

This does not mean Coinbase is going to RPG bomb the mayor's vehicle; Coinbase has a more sophisticated approach—conducting lobbying work with engineering and commercial thinking.

Traditional K Street lobbying relies on the connections of retired politicians, commonly known as the revolving door of politics and business, to influence politics. However, this seems too low for Silicon Valley. From Airbnb to Uber, they all navigate the edge of innovation and compliance. From this perspective, cryptocurrency is not particularly special.

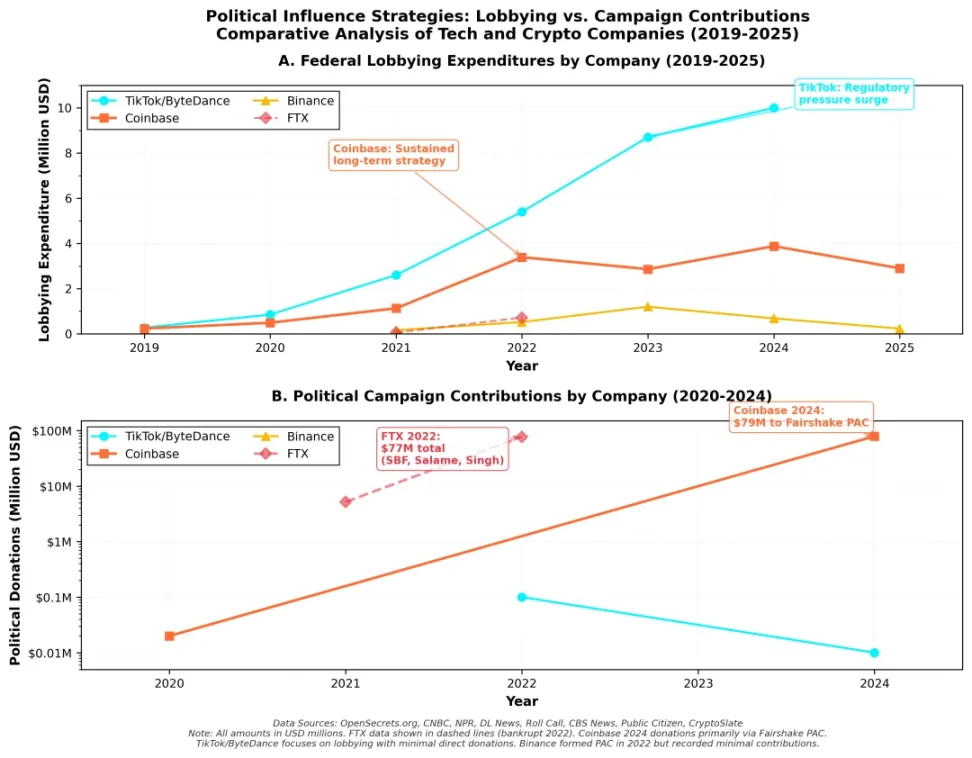

Image caption: Election and donation data, image source: @zuoyeweb3

However, both SBF from FTX and CZ from Binance are oddities. SBF overly favored the Democratic Party, and although he has transformed into a Republican, according to TIME magazine's statistics, his donations to the Democratic Party exceeded $40 million, far surpassing the $29 million given to the Republican Party.

Meanwhile, Binance would rather pay a $4.2 billion fine to the Democratic president than collaborate with the Republican president on a $2 billion USD1 exchange for MGX equity investment. However, the amount allocated for lobbying in 2025 is only $800,000.

Both the top and second players are clear yet foolish. Coinbase, which does not have higher trading volume, has emerged later but has not only found Chris Lehane to form the most powerful lobbying team ever but has also directly partnered with A16Z to create the StandwithCrypto red-black list, directly scoring various politicians. Crypto-friendly politicians can receive donations, while unfriendly ones will not be targeted but will have donations made to their opponents.

The core of American politics is elections, while the lifeblood of Chinese officialdom is selection. It is precisely Coinbase's early layout that led to Trump falling in love with Bitcoin during the election.

Failed foray into the U.S.: The Small Piggy Bank Hides in the Big Piggy Bank

When the U.S. says you have ties to the Chinese government, you better really have them.

I want to tell another story, a tale of a group of evil dragons rolling in the mud.

As Trump was about to take office, Bezos requested that his Washington Post remain neutral during the election. Microsoft urgently disbanded its DEI department, and Zuckerberg restored Trump's Instagram account. However, Peter Thiel had already bet on Trump in 2020, and Musk chose to pledge allegiance in 2022.

In the end, they each received different outcomes. Peter Thiel profited the most, Musk second, while the other wealthy individuals remained relatively safe. If you add the Koch brothers and the Mellon family of New York, you can observe an interesting fact during Trump's second term:

Old money is exempt from liquidation, old money is qualified to bet on both sides, and those in the internet are qualified to sway. Crypto upstarts need to bet cautiously; outsiders are merely meat on the chopping block. Sun Yuchen gets cut (FDUSD rights protection is difficult, blacklisted by WLFI), CZ spends the most but is the least at ease.

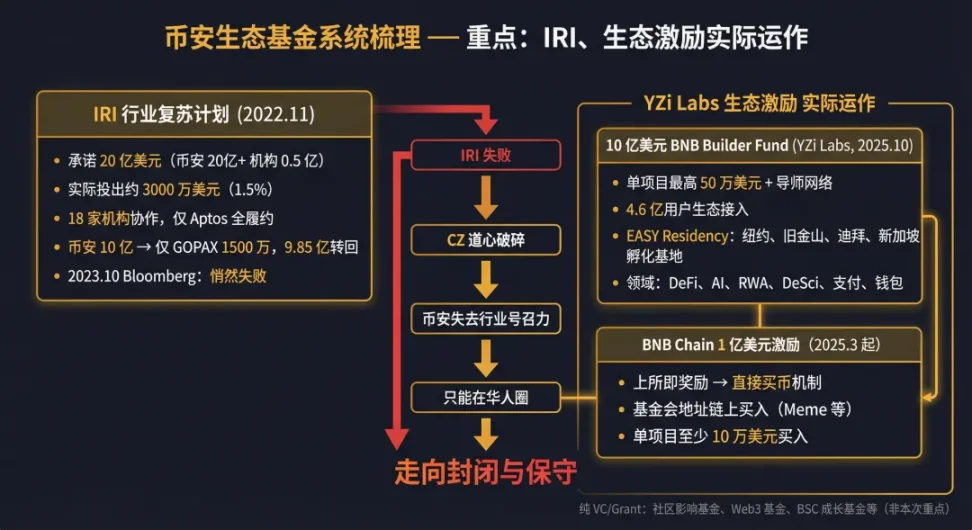

Image caption: Binance's path of self-abandonment, image source: @zuoyeweb3

This unease has always lingered in CZ's heart, especially since the UAE passport neither protects personal safety nor preserves the company's reputation through equity exchange for currency rights.

The Middle Eastern oil-producing countries represented by the UAE are like a large piggy bank for the U.S. The U.S. does not particularly respect their sovereignty, and the scope of this political asylum is extremely limited.

The Trump family's WLFI and the UAE's MGX investments are mutually binding. The only real interests surrendered are those of Binance and CZ themselves, and this obedience is not lasting.

MGX represents the interests of the Abu Dhabi royal family, which is also the fundamental reason why Binance quickly moved from Dubai to Abu Dhabi after receiving its investment. MGX invested $2 billion to purchase WLFI's USD1 token, and subsequently, Binance received investment from MGX.

According to the Washington Post, the technology for WLFI's USD1 is entirely developed by Binance, meaning Binance not only provides funding and technology but also adds its own distribution network, while WLFI only needs to sit back and enjoy the benefits. MGX also managed to obtain equity in Binance.

The market price for pardons during Trump's second term starts at $1 million from lobbying firms. In just five months in office, he pardoned 1,600 people, and CZ is undoubtedly the top donor.

However, this protection has no effect against fellow Americans like Sister Wood and Musk. CZ contributed $500 million to Musk's Twitter acquisition, accounting for about 1% of Musk's $43 billion investment, which indeed fits the position of a small shareholder. However, in Musk's envisioned future blueprint for Twitter, it is hard to say there is a role for Binance.

One can only crazily divert traffic from Twitter to Binance Square, but those coming to the square are not the source of Twitter's crisis; at least Xu Mingxing will not come.

Every drink and every peck, is it not preordained?

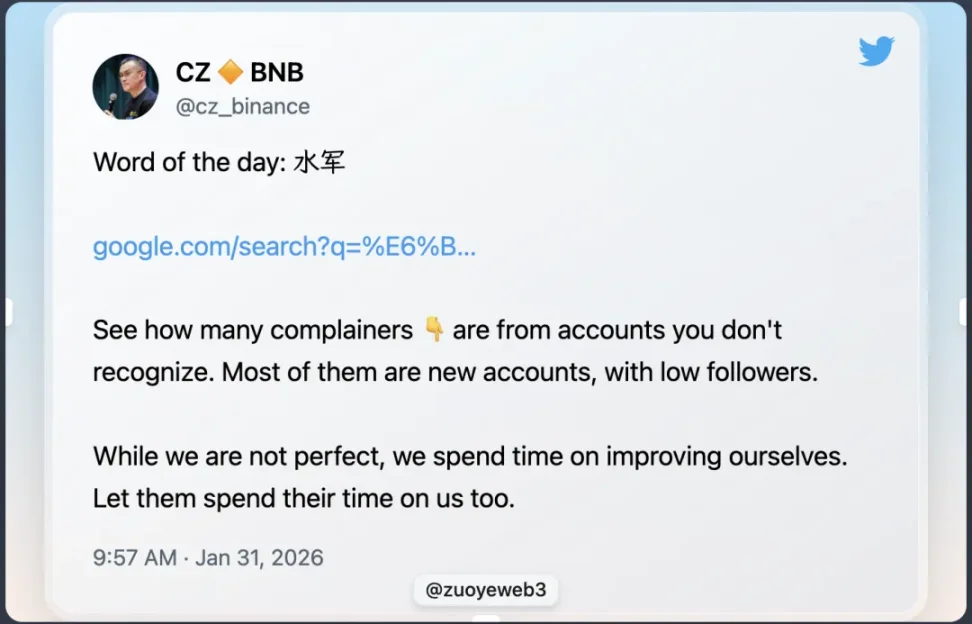

Image caption: Meaning of water army, image source: @cz_binance

After Binance and CZ's failed foray into the U.S., you will be surprised to find that CZ has started tweeting in Chinese and wants to educate the English CT on the meaning of "water army," as if CZ's relationship with Chinese users has taken a step closer.

This is not an illusion; re-embracing the Chinese market has become Binance's main theme, and the reasoning is not complicated: don't force yourself into circles you can't fit into.

CZ's mindset aligns well with the Chinese since the reform and opening up; the rules are sacred, Western civilization is paramount, and he absolutely does not dare to intervene in politics like Coinbase or bet on a side like Musk. In summary: he only knows how to solve problems but does not dare to pose questions.

In the face of U.S. pressure, he has fallen into a slippery slope of thinking, "Because I haven't paid enough, I should pay more." In this regard, it is clear that CZ has not grasped the art of Trump's deal-making; the time to bid is only after conditions are thoroughly negotiated.

He neither dares to participate in the U.S. government's legislative games nor can he take the upper route, and he cannot gain support from grassroots public opinion. Looking left and right, he can only hope for Chinese users, yet he is obsessed with breaking away from the relationship with the Chinese government. This leads to a situation where, regardless of how the U.S. treats him, the Chinese government does not care. He neither receives personal protection from Meng Wanzhou nor gains commercial benefits from TikTok.

In contrast, TikTok is now divided into three parts: Chinese Douyin, the U.S. version TT, and global TT. ByteDance retains a 19.9% stake in the U.S. version of TikTok, while Oracle, MGX, and Silver Lake Capital each hold 15%.

However, the route taken by TT.US is the "Cloud Texas" model, where ByteDance still retains algorithm ownership and profits. After the deal was reached, American public opinion directed the blame for "increased censorship" towards Oracle, which is the best outcome for ByteDance, as it retains some profits while gaining public sympathy.

Oh, and they don't have to pay hefty fines.

Conclusion

The freedom of the British is not the freedom of the French; the investments of the new internet elites are not the speculations of crypto tycoons.

SBF's clumsy plea for mercy brings back memories of the summer of 2022 when FTX briefly became the last hope for crypto. Coinbase's Armstrong seems to lack the charisma and authority.

But compared to them, CZ has exited the collusion of capital and power early, and he has never truly been an insider. Ultimately, he can only reluctantly become a "Canadian of Chinese descent holding an Emirati passport," embracing an extremely awkward narrative of "fighting for space for Chinese people in the crypto world."

But this has never been a reality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。