Original Author: Mankun Brand Department

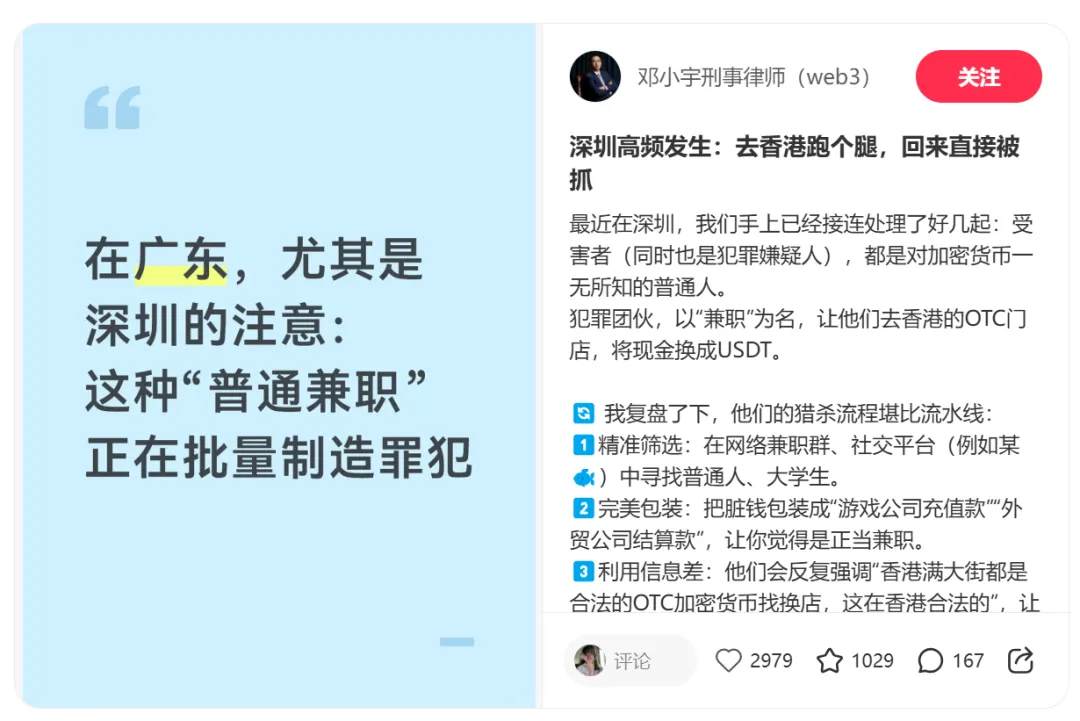

"In Guangdong, especially in Shenzhen, some seemingly ordinary part-time jobs are mass-producing criminal suspects." This is a reminder recently posted by Lawyer Deng Xiaoyu, a partner at Mankun (Shenzhen) Law Firm, on the Xiaohongshu platform. In the post, he pointed out that this type of part-time job, under the guise of "cash for cryptocurrency" and "offline currency exchange errands," has formed a highly procedural "hunting mechanism," with a particular focus on highly educated, risk-averse young people.

In these tasks, part-timers typically only need to follow instructions to exchange funds for Hong Kong dollars and then go to designated OTC cryptocurrency exchange shops to complete the transaction. What seems like a simple "errand" actually completes a crucial step in money laundering crimes—"human smuggling." Once the funds are deemed illegal proceeds, participants may be directly exposed to criminal risks.

Lawyer Deng Xiaoyu believes that in recent years, this type of "low-threshold, high-return" part-time model has been systematically used by criminals for money laundering activities. Many participants, unaware of the nature of their actions, have already crossed the boundaries of criminal law.

Based on the above judgment, Lawyer Deng Xiaoyu (partner at Mankun Law Firm, specializing in criminal law related to crypto assets) and Huang Wenjing (compliance advisor at Mankun Law Firm) were recently interviewed by Shenzhen News Network, where they systematically analyzed related criminal patterns, social harms, and legal risks based on real cases, attempting to "cut" through this hidden and complex money laundering network, allowing more people to see the legal truth behind it.

"Just helping to exchange currency," why could it involve money laundering?

Shenzhen News Network Reporter:

Lawyer Deng Xiaoyu, in the cases you have recently encountered, how do criminal gangs typically recruit young people under the guise of "part-time jobs"?

Deng Xiaoyu:

We recently handled a typical case: a university student from the mainland received a "errand part-time job" on a second-hand goods trading platform, where the other party asked him to go to Hong Kong to purchase a certain amount of Tether (USDT) through a local cryptocurrency exchange shop (OTC shop) and transfer it to a designated blockchain address.

The specific process is: the part-timer first uses their own bank card to receive RMB, then exchanges it for Hong Kong dollars at a local fiat exchange point, and subsequently goes to the designated Hong Kong OTC shop to buy USDT, which is directly transferred to the designated wallet by the shop.

After purchasing USDT worth tens of thousands of RMB through the above method, the student's bank card and WeChat payment account were frozen by mainland law enforcement and was informed that the funds he received originated from a transfer related to an upstream fraud case.

Afterwards, we collaborated with a professional on-chain technology team to analyze and confirmed that this was a typical "card return to U" money laundering method, which is linked to organized crime networks in Southeast Asia.

Since then, we have received multiple similar inquiries. Some participants have been investigated for crimes such as fraud, concealing and disguising criminal proceeds, and assisting in information network crime activities; others, although not criminally detained, have been in a state of frozen bank cards and payment accounts for a long time, severely impacting their daily lives, studies, and work.

Shenzhen News Network Reporter:

Advisor Huang Wenjing, why do criminal gangs frequently choose Hong Kong OTC cryptocurrency exchange shops as operational nodes? Is this model harder to trace?

Huang Wenjing:

From a practical perspective, the reasons why Hong Kong OTC shops are easily exploited by criminal gangs mainly include three aspects.

First, the regulatory boundaries are relatively vague, and anti-money laundering requirements are not uniform.

Currently, Hong Kong has a relatively mature licensing and regulatory system for centralized virtual asset trading platforms, but cryptocurrency OTC shops still exist in a regulatory gray area, with diverse types of entities and inconsistent compliance standards. Some shops have significant shortcomings in verifying the source of funds, transaction monitoring, and anomaly analysis, leaving operational space for criminal activities.

Second, cash transactions are inherently high-risk scenarios.

OTC shops primarily engage in cash transactions, and anonymous cash lacks the account links and structured data that bank transfers provide, making investigations often rely more on physical monitoring, witness testimonies, and physical evidence, increasing the overall difficulty of tracing.

Third, frequent financial activities provide greater concealment opportunities.

The Hong Kong government also mentioned in the 2024 VAOTC consultation background that in some fraud cases, OTC shops have been used for the first round of laundering of involved funds. As an international financial center, Hong Kong's multi-currency circulation and active cross-border transactions make it easier for criminal gangs to package transaction backgrounds and conceal the true use of funds.

Dual Loss for Individuals and Society: Criminal Risks Hidden by "Legitimate Narratives"

Shenzhen News Network Reporter:

Lawyer Deng Xiaoyu, in the cases you have taken on, many so-called "part-timers" are highly educated young people. Why are they easily trapped in such schemes? Once involved, what legal consequences might they face? What long-term impacts could arise?

Deng Xiaoyu:

In my view, the reason these part-time jobs can deceive highly educated groups lies in the construction of a seemingly complete, reasonable, and legal narrative scenario.

When part-time workers raise questions, such as "Why must I go to Hong Kong in person?" the other party usually explains that virtual asset trading is restricted in the mainland but is legal and open in Hong Kong; and since the client is overseas, the cost of going to Hong Kong is too high, so it is more "economical and efficient" for nearby part-timers to operate on their behalf. Under this logically coherent explanation, many students do not perceive obvious anomalies at the rational judgment level, thus lowering their guard and building trust.

However, criminal risks often have a significant lag effect. Many part-timers only discover two or three months later that their bank cards and payment software accounts have been frozen, or they suddenly receive calls from law enforcement, or even get intercepted by customs during normal entry and exit. This sudden change often causes inexperienced students to fall into intense panic, continuously impacting their psychological state and normal studies and lives.

Shenzhen News Network Reporter:

The general public may not be aware of how such part-time jobs, if involved in money laundering, contribute to the black and gray industries. What impact could this have on financial regulatory order and the anti-money laundering system?

Huang Wenjing:

Taking the telecommunications network fraud crimes that the state has focused on cracking down on in recent years as an example, "scamming money" is just the first step; the real key is how to quickly transfer and conceal the flow of funds, making it difficult to recover.

If the involved funds only remain in the criminals' accounts, once the victim reports to the police, tracking and freezing are not difficult. However, through the methods involved in this case, the funds are quickly split and circulate in a "multi-asset, multi-link, multi-node" cross-financial system, ultimately forming a vicious cycle of "scamming faster, transferring faster, and recovering harder." These part-time jobs essentially provide critical funding channel nodes for the black and gray industries, directly promoting the scale and industrialization of upstream crimes.

From a more macro perspective, money laundering transactions often exhibit fragmentation, decentralization, and high frequency, significantly increasing the compliance costs for regulatory authorities and financial institutions. If the proportion of such non-genuine, abnormal economic activity transactions continues to rise in a financial system in a certain region, it will not only distort financial data but also lay hidden dangers for overall financial security.

Once this risk draws the attention of the international community, that region may be labeled as a "high-risk judicial jurisdiction." For example, some countries and regions have been placed on the FATF gray list due to ineffective anti-money laundering regulations, leading to their citizens facing practical difficulties such as restricted account openings and transaction obstacles in cross-border financial activities, causing long-term and far-reaching negative impacts on national reputation and economic development.

Qualitative and Consequences: The Logic of Identifying Money Laundering Behavior and Sentencing Boundaries

Shenzhen News Network Reporter:

Lawyer Deng Xiaoyu, why did you post on social media to specifically remind the public to be wary of such money laundering traps? From the perspective of criminal law and judicial interpretation, how are such behaviors typically classified? How should we distinguish between "individual sporadic transactions" and "operational exchange behaviors"?

Deng Xiaoyu:

I posted on social media partly based on my legal education responsibilities as a member of the Shenzhen Bar Association's Common Crime Defense Committee, and partly to protect the young groups in society as much as possible.

In the cases I have encountered, many part-timers' initial intention is to supplement their living expenses through their labor and reduce their family's burden. However, it is precisely this non-malicious mindset that can easily be exploited by criminals, leading them to become involved in specific aspects of money laundering activities.

From a judicial practice perspective, the behaviors of these part-timers are more often included in the evaluation system for money laundering crimes. For individuals who simply follow instructions to complete fund exchanges and transfers, it is generally inappropriate to directly classify them as "illegal business operations," but rather to focus on whether they objectively participated in the transfer, concealment, or hiding of illegal proceeds.

As for the distinction between "individual sporadic transactions" and "operational exchange behaviors," the key lies not in whether compensation is received, but in whether there is continuity, organization, and external operational attributes. Ordinary part-timers who do not solicit clients externally or form stable trading patterns typically do not meet the constitutive requirements for illegal business operations, but this does not mean that there is no criminal risk.

Shenzhen News Network Reporter:

Advisor Huang Wenjing, if the amount involved reaches "particularly serious circumstances," what penalties might the relevant personnel face? What are the differences in accountability between corporate crimes and individual crimes?

Huang Wenjing:

Taking money laundering as an example, according to the Criminal Law of the People's Republic of China and the Interpretation on Several Issues Concerning the Application of Law in Handling Criminal Cases of Money Laundering, once recognized as "serious circumstances," sentencing usually directly enters the second tier, which is a fixed-term imprisonment of five to ten years, along with a fine.

It is important to emphasize that in judicial practice, the amount involved is only one of the thresholds for conviction and sentencing. Whether it constitutes "serious circumstances" also needs to be judged comprehensively based on behavioral and result factors such as repeated implementation, causing significant losses, and whether there is refusal to cooperate in recovering stolen funds, rather than simply concluding based on the amount.

In addition, money laundering crimes are subject to a "dual penalty system." This means that if the act is carried out in the name of a unit, the unit itself will be fined; however, the directly responsible supervisors and other directly responsible personnel will not be exempt from personal criminal responsibility simply because "the act is under the unit's name," and will still need to bear personal criminal responsibility according to the standards for money laundering crimes. If the circumstances reach a serious level, they may also face fixed-term imprisonment of five to ten years and fines.

Risk Reminder: How to Avoid Becoming a "Money Laundering Accomplice"?

Shenzhen News Network Reporter:

How should the public identify money laundering risks in part-time jobs? What self-protection measures should be taken if they encounter suspicious transactions?

Huang Wenjing:

In fact, identifying these risks boils down to one core judgment:

Any part-time job that asks you to help handle financial transactions or account operations is essentially turning you into a funding channel; 99% of the time, it is fraud or money laundering.

In practice, common "danger signals" include:

- Requests for you to provide or open a new bank card or corporate account;

- Lending WeChat or Alipay payment codes, immediately transferring funds after receiving and paying on behalf of others;

- Requests for offline cash withdrawals, or to exchange cash for virtual currency at exchange shops, then transfer to a designated address;

- Repeatedly emphasizing "buying and selling virtual currency in cash in Hong Kong is legal," "physical stores are open, it can't be illegal," and "just helping to run an errand."

The commonality of these phrases lies in the deliberate diversion of attention. The real risk is not whether a specific operation is legally valid in form, but rather that its purpose is to conceal the true source and flow of funds.

Once the funds come from upstream crimes such as telecommunications fraud or gambling, your account and identity may be seen as a link in the criminal chain, resulting in account freezing, investigation, or, in severe cases, criminal liability.

Shenzhen News Network Reporter:

Lawyer Deng Xiaoyu, what more targeted reminders do you have for young people? Should they be wary of seemingly legal temptations like "arbitrage from exchange rate differences"?

Deng Xiaoyu:

I want to specifically remind young people of one thing:

Any part-time job that treats you as a "funding channel," no matter how "legal and compliant" it is packaged, should be rejected immediately.

Many people think money laundering is far from them, but in reality, it is often disguised as "errand services," "cross-border settlements," "spread or exchange rate arbitrage," "buying coins and flipping," and other terms that sound professional or even reasonable. Essentially, they are asking you to use your real-name identity to "pass through" unfamiliar funds.

In the cases we have encountered, what the other party truly values is not the "labor" of the part-timer, but their real-name account and the transaction traces formed by their operations used to conceal criminal proceeds. Once the upstream funds are traced, the original "part-time worker" can instantly become an "involved person," with the most direct consequences being account freezing and restricted life, and in severe cases, they may also bear corresponding legal responsibilities.

Mankun Lawyers Remind: Beware of These High-Risk Signals

Based on the interview content and practical experience, we particularly remind:

- Maintain a high level of vigilance regarding part-time jobs involving collection and payment on behalf of others, cash handovers, account operations, and cryptocurrency exchanges;

- If the compensation is clearly mismatched with the work content, it is often not a "good opportunity";

- Deliberate avoidance of questions about the source of funds by the other party is an important risk signal;

- Once doubts arise, the earlier you consult a professional lawyer, the more likely you are to avoid serious consequences.

We will continue to participate in public discussions from a professional perspective, and we hope to help the public better understand legal boundaries and stay away from potential criminal risks through real cases and legal analysis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。