自2025 年第四季度以来,Avalanche 在链上热度回升与机构端落地几乎同步推进。

一边是主网活动指标在年末与 1 月多次刷新阶段高点,另一边是更偏机构工作流与合规分发的事件密集出现。即便行情不佳,但资产上链的故事还在加速发生。

机构化路线推动资产上链

2026年1月,知名加密投行Galaxy Digital宣布在Avalanche上成功发行其首单代币化贷款债权(CLO),总规模达7500万美元,其中5000万美元由机构信贷协议Grove认购。

CLO是一种结构化信贷产品,它将企业贷款打包出售给不同风险等级的投资者。其各档债务分层,由受监管的数字资产平台INX通过Avalanche网络进行代币化及发行,并向合格投资者提供交易。

此次投资实际上是Grove在Avalanche平台上的第二次大规模布局。去年7月,Grove宣布在 Avalanche 平台上线,初始部署策略目标,是在该网络上发行高达约 2.5 亿美元的真实世界资产 (RWA)。Grove将资金配置到通过多链协议Centrifuge原生链上发行的JAAA,并将该份额代币在 Avalanche C-Chain 上发行与流通。

作为专为机构级金融设计的高性能公链,除了EVM 兼容、可快速落地、可接入合规分发渠道等优势外,Avalanche 还主打快速部署可定制化的Avalanche L1(原子网,Subnet),更有利于兼顾准入、合规、性能与风控等要求,也因此成为了金融机构布局链上的优质合作伙伴之一。

例如,新泽西房地产基础设施公司Balcony去年5月宣布,其利用AvaCloud平台,部署了可扩展的、专用的 Avalanche L1 服务,旨在将总价值约2400亿美元、超过37万块地块的产权记录数字化并代币化。AvaCloud是Avalanche L1的托管区块链服务提供商,协助企业构建、部署和扩展Layer-1网络。

数据的“冰火两重天”

Avalanche的机构化路线,促成了其链上资产的稳步增长。据Token Terminal数据,Avalanche主网络上的稳定币和代币化基金的总市值自 2024 年 1 月以来两年间上涨了约 70%。

据RWA.xyz数据显示,截至1月21日,Avalanche网络稳定币资产超过22亿美元,RWA资产总额超13.51亿美元——其中Distributed Assets(可分发资产)约为6.36亿美元,Represented Assets(被表征资产)约为7.15亿美元。

可分发资产表示可在钱包之间点对点转移的代币化资产,侧重于市场覆盖、普惠金融和平台互操作性;被表征资产则不允许将资产转移到发行平台之外,区块链网络更多充当记账、清结算的共享账本。

2025年12月,Avalanche网络所有 L1总交易量突破100亿笔。随着这一里程碑的数据,生态在年底收官时也正式迎来了复苏。该月,Avalanche C-Chain接连创下2025 年最高单日、单周记录,活跃地址数达到6.512亿,每周资金流入4300万美元,一度在所有区块链中排名第二。

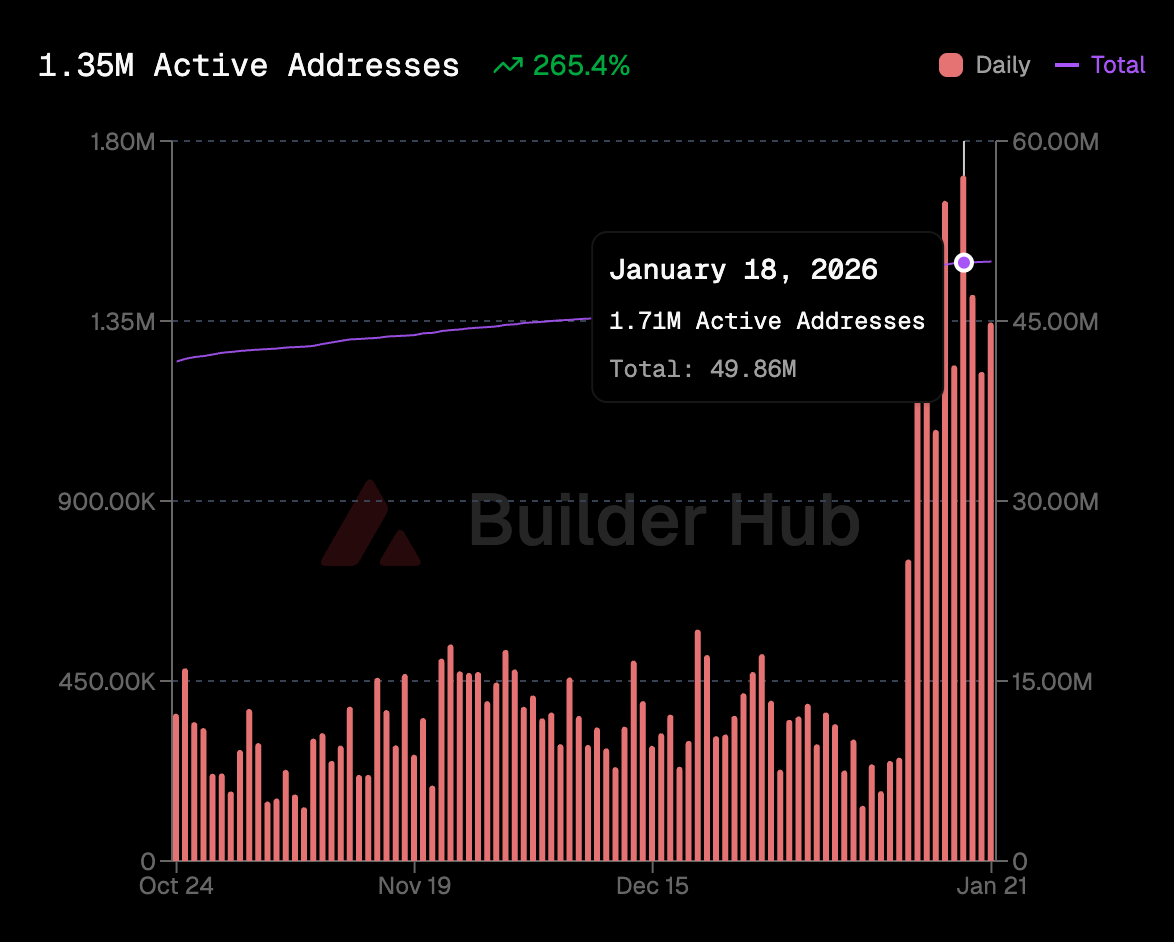

进入新年,Avalanche延续了去年年末的增长势态,其主网络(以C链为主,另有P链、X链)日活跃地址数接连创下新高,并于1月18日创下171万的峰值。

不过,但如果把视线从链上热度切回到资产定价与DeFi活跃度,就见不到同等幅度的“复苏曲线”了。据CoinGecko 行情数据看,1月中旬至今,AVAX收盘价大致在12–15美元区间波动,1月20日收于约12.09美元,创下自2023年11月以来最低值。

再看 DeFiLlama 的链级指标,Avalanche 原生(Native)TVL 约 16.6 亿美元、桥接 TVL 约 36.2 亿美元,同时链上费用/收入在日维度仍偏低,这意味着即便交易笔数与地址数上行,也未必对应可观的协议层价值捕获。

但考虑到宏观层面,加密货币尤其是L1代币整体在一年内普遍承压。即便生态出现机构合作或技术进展,被更强的市场 Beta以及缺乏大规模应用的老问题所覆盖,Avalanche的定价问题并非其一家独有。

筑巢引凤,启动百万美元建设者竞赛

对于基础设施而言,行情低迷期也是厚积薄发的好时机,可以更加心无旁骛的专注于生态建设。

趁着这波链上活跃度回升,Avalanche对开发者供给侧的动作也明显密集起来。1月21日,Avalanche基金会在宣布启动“BuildGames”建设者竞赛,提供100万美元总奖池,官方设定为期六周、总奖池 100 万美元,报名即日开启并滚动审核。本次竞赛没有划定方向,不限定具体类型和赛道。优秀团队还有机会获得Avalanche官方孵化计划的后续指导和资助。

从基金会既有体系看,Avalanche 的开发者扶持并不只靠单次竞赛拉新,而是拆成了几条并行管线。

其一是官方加速器Codebase,主打对早期团队的快速辅导与非稀释性资金支持,入围团队可获得 5 万美元 资金捐赠,并提供从产品到代币设计、验证者/基础设施策略、增长与合规等偏实操的支持。

其二是基金会的 Grants 系统,集中面向基础设施、AI类项目拨款。 最后是 Retro9000,官方口径是最高 4000 万美元资金池,用来奖励已经在 Avalanche L1 或关键工具链上形成实际交付与影响的团队,降低“先融资再交付”的门槛,把资源向已证明价值的构建者倾斜。

在基础设施建设层面上,Avalanche在去年年底完成了代号为“Granite”的网络升级,该升级由三项 ACP 组成(ACP-181/204/226),Granite升级引入了动态区块时间、生物识别认证和更稳定的验证器视图,提升了跨链消息可靠性和性能。

总体而言,近一个月Avalanche生态引入了机构的规模化能力,随着基础设施的构建和开发者激励,为2026年的发展奠定了基础。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。