作者:Frank,PANews

回顾2024年,PANews曾调查过“买入10个BNB躺赚”的策略,那时候的快乐很简单,只要把BNB存进Launchpool,剩下的交给时间。

但在2025年,市场变了。有人在链上PVP被手续费磨没了本金,有人在二级市场接盘了“VC空气币”。在这样动荡的行情下,那个“不肝、不赌”的BNB懒人策略还奏效吗?

答案是:虽然逻辑变了,但仍然十分奏效。如果说2024年是靠Launchpool吃“大锅饭”,那么2025年就是靠Binance Alpha吃“私房菜”。本文,PANews将结合币安官方发布的《2025年度报告》及独家数据测算,复盘这一年持有10个BNB的真实账本。

BNB懒人“低保”含金量仍在持续

首先,我们来看看“最懒”的策略。假设你完全不碰Alpha这种高频操作的活动,只是单纯持有BNB,简单参与币安官方Hodler Airdrop、Launchpool、Megadrop这几项“传统”活动,能带来的“低保”收入有多少?

根据币安最新发布的《2025年度报告》披露:2025年,每持有一枚BNB,仅通过参与平台核心活动获得的额外收益就有71.5美元。

具体拆解这71.5美元的构成:

Hodler Airdrop(持币空投): 43.32美元。

Launchpool(新币挖矿): 18.37美元。

Megadrop(Web3任务): 9.81美元。

如果你持有10枚BNB(年初成本约7000美元),这部分的收入将达到715美元。当然,另一个重要的被动收入是来自BNB的增值,BNB价格从年初700美元到年末最高一度突破1375美元,取中间值1000美元计算,10枚BNB增值约3000美元。

以此计算,这种最保守的策略将获得保底的收益约为3715美元,收益率约为53%。从效果上来看,这是一个跑赢绝大多数理财产品的“地板价”。

但在2025年,在币安“薅羊毛”如果只采用这种“躺平”模式,你就只吃到了那条鱼的尾巴。

进阶策略,Alpha才是2025的“胜负手”

2025年,币安生态当中最重要的玩法莫过于Binance Alpha。币安《2025年度报告》里没有细说Binance Alpha的收益,因为这属于“勤奋者的奖赏”,对于不同的资金量和个性化操作有着巨大的差异。但我们无法忽视的一点是,2025年与2024年最大的不同,不仅要持币,还要动手。

根据PANews的统计,2025年全年,币安Alpha共上线了288次空投活动。理论上,如果全部拿到,收益高达1.63万美元。但在实操过程中,我们不仅要看“理论”,更要看“现实”。

对于持有10枚BNB的普通用户,我们做了一次“脱水”后的真实测算:

在机会筛选方面,我们剔除了240分以上的高门槛项目(可能因积分不够而错过),剩下可参与的机会有260次。这样剔除后的总收益降至了1.52万美元左右。

此外,考虑到8月后部分空投采用“先到先得”模式,以及用户可能忘记交易、手速慢等因素,这一阶段的活动我们按30%的错失率进行扣除。最终,修正后预估收入约为12600美元左右。

当然,Alpha是一场“付费游戏”,在参与的过程中磨损的成本必须要考虑。按照10枚BNB的持仓,每天自带积分约2分。为了达到240分的平均参与标准,用户每天需额外刷出14-18分。

这意味着每天需贡献约3万美元的交易量。按平均每天磨损4~8U计算,全年的交易磨损成本约为1250美元(从4月底Alpha上线开始计算)。

Alpha板块净利润:12600(收入)-1250 (成本)≈11350美元。

相比之下,通过“低保”玩法获得的收益是715美元,而勤奋参与Alpha的收益是11350美元。后者是前者的15倍以上,由此看来,“自己动手,丰衣足食”在2025年的币安活动中是最核心的赚钱秘籍。

三种策略,三种人生

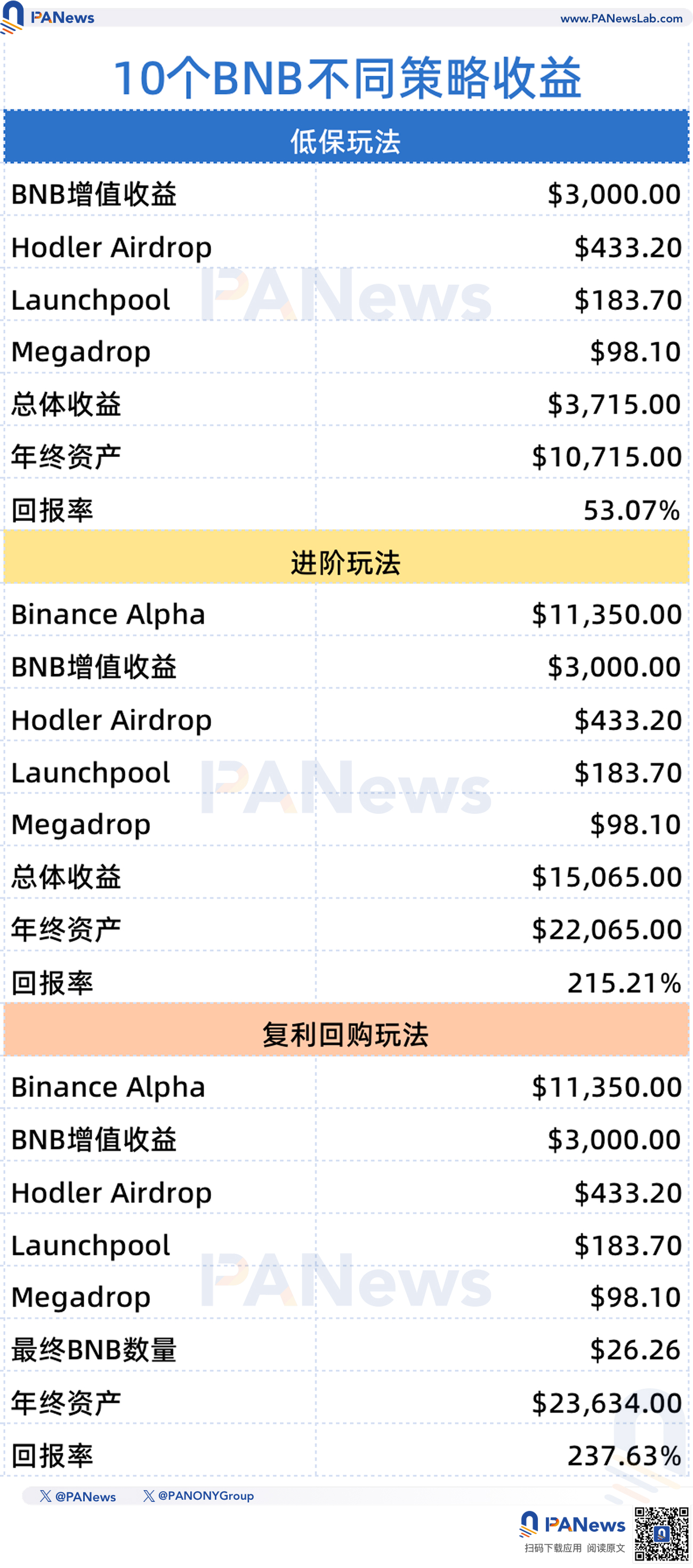

我们将官方数据与Alpha测算数据结合,来看看年初那7000美元的本金,在三种不同操作下最终变成了多少?

方案A:“躺平”型

操作: 仅持有,只拿官方三大核心活动奖励,不看Alpha。

净收益: 715 (现金流) + 3000(增值) = 3715美元

最终资产:10715美元,年化回报约53%。

方案B:勤奋“打金”型

操作: 拿满官方低保+每天花时间分钟维护Alpha积分。

净收益: 715 (官方)+11350(Alpha)+3000 (增值) = 15065美元。

最终资产: 22065美元,年化回报: 215%

这种策略本金翻了3倍。应当跑赢了绝大多数加密投资人在2025年的战绩。

方案C:复利型(收益回购)

操作: 在方案B的基础上,将每月赚到的约1000美元现金流,立即复投BNB。

收益: 按照2025年BNB的平均价格计算,手中的10枚BNB,到年底将变成约26.26枚。以年底约900美元价格计算,资产总额将来到23634美元,年化回报率达到237%。

无疑,这种策略是收益率最高的一种模式,只不过这个过程中还要面临更多的价格波动带来的风险。并且相较不复投的方案来说,并没有太突出的优势。

确定性“懒人”收益打败99%代币

相比于加密圈动辄百倍千倍的财富神话,年化200%左右的收入似乎相形见绌,且还要日复一日的参与到Alpha的交易环节当中。但如果综合风险回报比和对比总体市场在2025年的变化来说,这样的收益其实难能可贵,跑赢了绝大多数的资产收益。

PANews统计了主流443个现货交易对在2025年的涨跌幅情况,这些涵盖了加密领域最主流的资产平均在2025年的平均涨跌幅为-54%,其中,实现正向收益的代币只有40个,不足10%。收益超过200%的代币,只有4个,更是不足1%。

相比而言,与其在1%的机会中博弈,无论是BNB的懒人策略还是勤劳策略,都显得更有优势和确定性。对于那些善于精打细算,喜欢确定性收益的用户来说,这无疑是枯燥,但合理的加密玩法。

这种“确定性”的背后,本质上是平台体量的降维打击。根据币安《2025年度报告》数据显示,2025年参与Alpha的用户超过1700万,共获得了7.82亿美元的奖励。这一连串的天文数字再次印证了一个事实:“宇宙所”依然是“宇宙所”。在行业大洗牌的2025年,当其他平台还在为流动性发愁时,币安已经用碾压级的数据完成了对市场的收割与分发。无论是从用户参与的深度,还是奖励分发的广度来看,币安依然牢牢占据着行业的绝对中心。

对用户而言,在2025年这个“互不接盘”的存量博弈市场里,持有BNB并参与Alpha这种看似枯燥的活动,本质上不是在和庄家博弈K线,而是通过做交易所的“股东”,贡献热度拿走收益。

看起来,有时候正确地“懒”一点,要远强过错误地“勤快”。

最后,再次提示以上内容仅供参考,并不是投资建议。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。