作者: Chloe, ChainCatcher

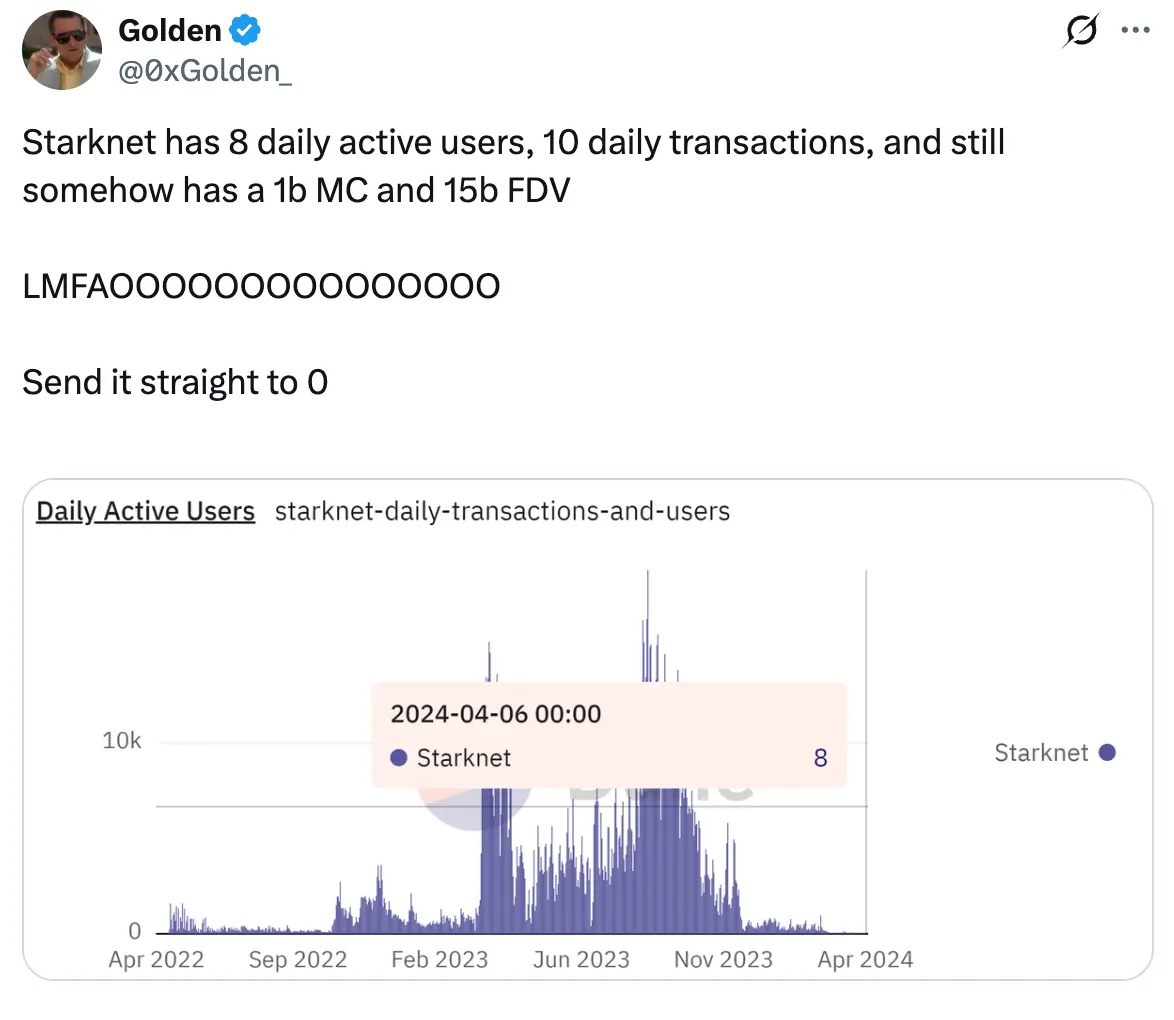

昨晚 Solana 官方 X 账号发文直指,“Starknet 目前日活跃用户仅有 8 人,日交易量仅 10 笔,但其市值仍达 10 亿美元,完全稀释市值(FDV)高达 150 亿美元。”

该推文迅速在市场引发热议,吸引了包括 Bubblemaps、MegaETH 以及 Pump.fun 联创 Alon Cohen 在内的多位业界人士回应。许多用户开始质疑:“8 个日活跃用户、10 笔交易、10 亿美元市值,Starknet 要怎么解释?”

该推文也引来 StarkWare CEO Eli Ben-Sasson 亲自回复表示“Solana 有 8 名市场营销实习生,每天靠发 10 条推文维持高市值。”Solana 联创 Toly 则玩笑回应,“这是不必要的秃头 CEO 之间的暴力冲突”。

而 Starknet 的活跃度真如 Solana 所说的那般惨淡吗?这些数据甚至让部分用户批评其“看起来更像一个不活跃的测试网,而非市值十亿美元的活跃区块链”。

Starknet 经历了一年多的下滑,多项数据已显著复苏

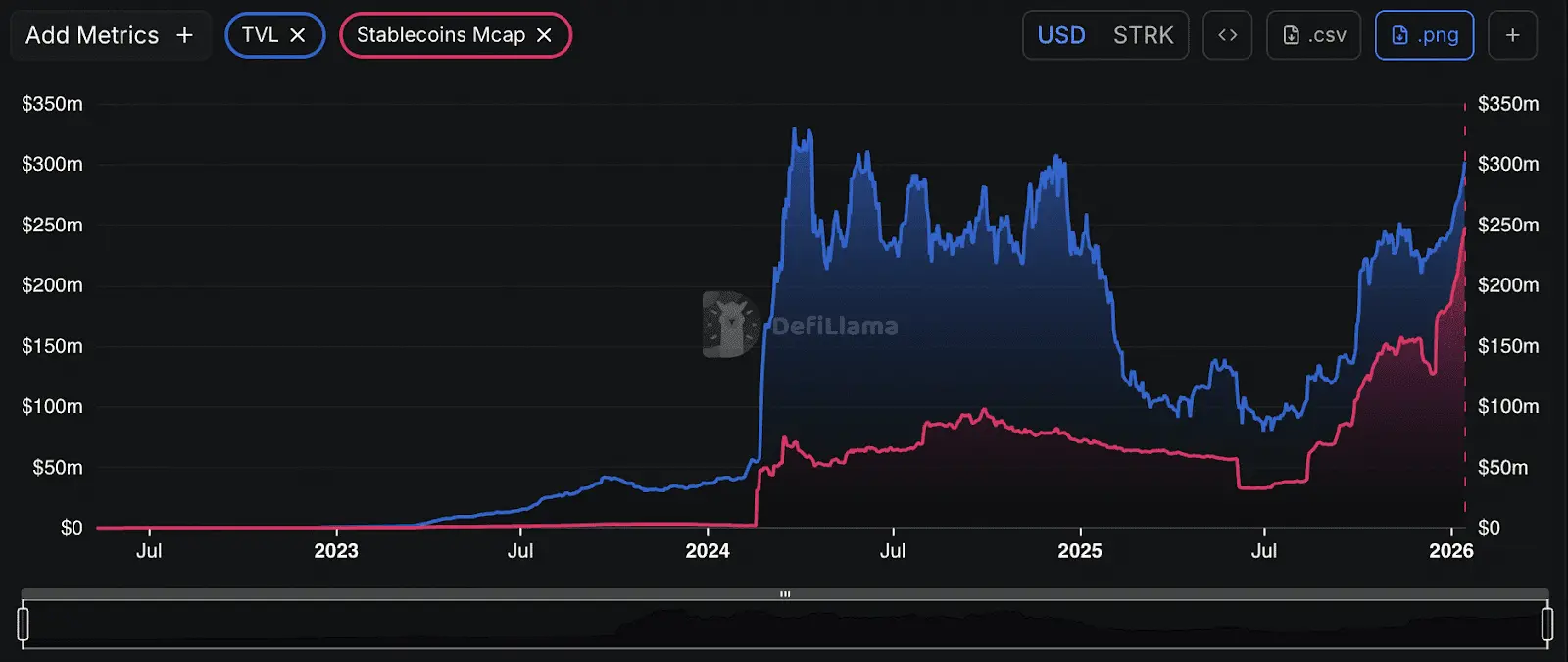

根据 DeFiLlama 数据,Starknet 的 TVL 现已攀升至 3.02 亿美元,这是自 2024 年以来首次重返 3 亿美元,走出当时的低谷。而该网络的稳定币市值也升至约 2.48 亿美元,创下历史新高,稳定币市值的增长通常被视为 DeFi 参与度加深的关键指标。

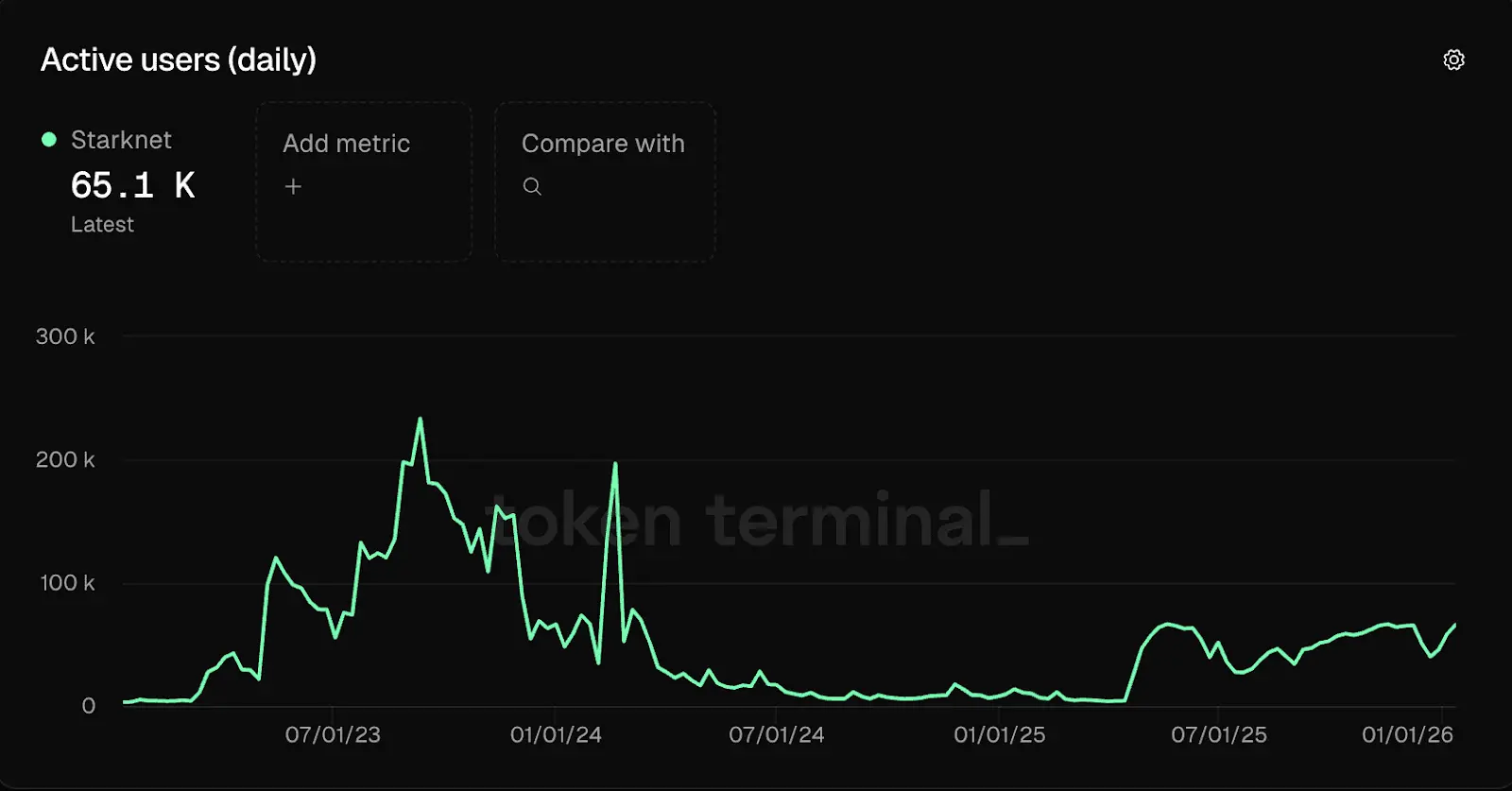

另外根据 Token Terminal 数据显示,Starknet 目前平均每日约 65,000 名活跃用户,远超 Solana 声称的“8 个日活跃用户”说法。

过去因 Layer 2 市场情绪疲软以及链上活动减少,使得 Starknet 在经历了一年多的下滑,如今种种数据都凸显了 Starknet 的复苏,即便仍远低于其历史峰值,且在激烈的 Layer 2 竞争中尚未进入第一梯队,Starknet 整体表现仍落后于 Base、Arbitrum 等头部 Layer 2 网络,但恢复到 3 亿美元水平代表了这一年多以来的资本实力。

不过,Starknet 在复苏过程中也面临技术挑战。上周,该网络发生短时主网宕机事故,官方事后分析报告显示,事故原因为执行层与证明层之间的状态不一致,导致交易执行异常。这已是 2025 年以来第二次重大中断,此前在 9 月因排序器漏洞导致超 5 小时宕机。重大技术故障也成为 Starknet 在与其他 Layer 2 竞争中需要克服的重要问题。

而据最新消息,Starknet 近期正积极建设 BTCFi 生态系统。管理 10 亿美元资产的 Re7 Labs 已在 Starknet 上运营结构化 BTC 收益策略,机构托管商 Anchorage Digital 也新增了比特币质押支持。此外,Starknet 在 2024 年末引入了网络升级和质押功能,并大幅降低了 Gas 成本。不到八周,已有价值超 1.15 亿美元的 BTC 在该网络上完成质押。

Solana 引用数据从何而来?

Solana 官方推文实际是引用两年前的旧数据。Starknet 在 2024 年 2 月 20 日空投后经历了用户大逃亡,日活跃用户从空投当日的 38 万人暴跌 80-90%,到 4 月中旬仅剩约 2 万人。大量空投猎人在领到代币之后退出,加上空投资格规则争议,导致社群情绪极度负面,每个 Starknet 推文都被标记为“#scamnet”。

在这样的背景下,有人半开玩笑地夸张说 Starknet 只剩“8 个日活用户”,以讽刺该网络的冷清程度。如今该数据早已不成立,Solana 在此时重提过时信息,也被市场质疑是刻意炒作。

对 Solana 的推文数据 Starknet 官方也发布一张大猩猩表情图反击:“是谁告诉他们这些数据的?”Solana 联创 Toly 对该争议则表示“要开掉实习生”。

而针对 Solana 调侃 Starknet 事件,以及 Starknet 随后的回应,币安联席 CEO 何一则在 X 发文回应称:“Take a deep breath and relax,都是朋友,大家以和为贵”,呼吁外界以更轻松心态看待相关讨论,避免因链上数据对比引发过度争议。

从被用户嘲“只有 8 个用户”到如今日活 6.5 万、TVL 站上 3 亿美元,Starknet 正艰难走出 2024 年那波大逃杀后的阴影。BTCFi 生态布局、机构级托管与收益策略落地,为其复苏增添动力;但重大技术故障、费用收入远低于 Arbitrum 等头部网络,也让后续的发展充满不确定性。要真正进入 Layer 2 第一梯队,技术稳定性和生态深度仍是绕不开的考验。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。