作者:Dovey Wan,Primitive Ventures 创始合伙人

编译:大宇

2025年,加密货币行业几乎实现了所有预期目标。从结构上看,这本该是辉煌的一年。

但为什么它给人的感觉……如此死气沉沉?

并非“价格没涨”就彻底完了。比特币创下了新高。但氛围、情绪、内部确认、其他加密货币的跟进以及散户的热情,都发生了变化。或许最令人担忧的是,曾经的“热钱领头羊资产”如今在财富效应和波动性方面都失去了吸引力。

相关加密货币资产不再像以往周期那样与比特币和以太坊同步:

1、Memecoins 在 2024 年第四季度至 2025 年第一季度期间位居榜首,而 Trump 代币的推出更是将这一趋势推向了高潮。

2、加密货币股票在 Circle IPO 前后达到顶峰,并在 2025 年 5 月至 8 月期间开始回落。

3、大多数山寨币从未形成过持续的趋势。上涨过程中存在不对称性,下跌过程中则完全由所有参与者主导。

放大再看,情况就更奇怪了。

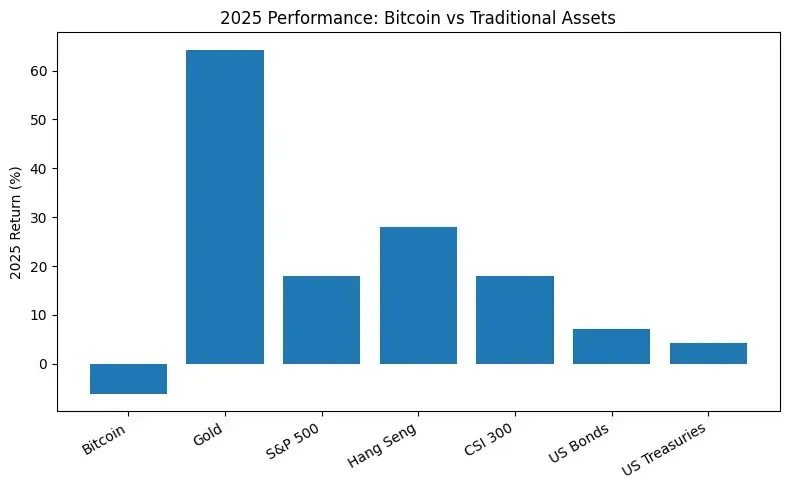

尽管政策环境友好,但比特币在2025年的表现几乎逊于所有主流传统金融资产,包括黄金、美国股票、港股、A股,甚至一些债券基准指数。

(比特币与其他资产比较,表现极差)

这是比特币表现首次与其他所有资产类别脱钩。

这种背离至关重要:价格创下新高,但内部并未确认,而其他市场表现更佳。这揭示了一个简单却令人不安的事实:比特币的流动性供应链发生了重大变化,其原有的四年结算周期已被其他市场更大的力量所改变。

因此,我们将深入探究谁在高位买入,谁退出了市场,以及价格底部在哪里。

巨大鸿沟:陆上作业与离岸作业

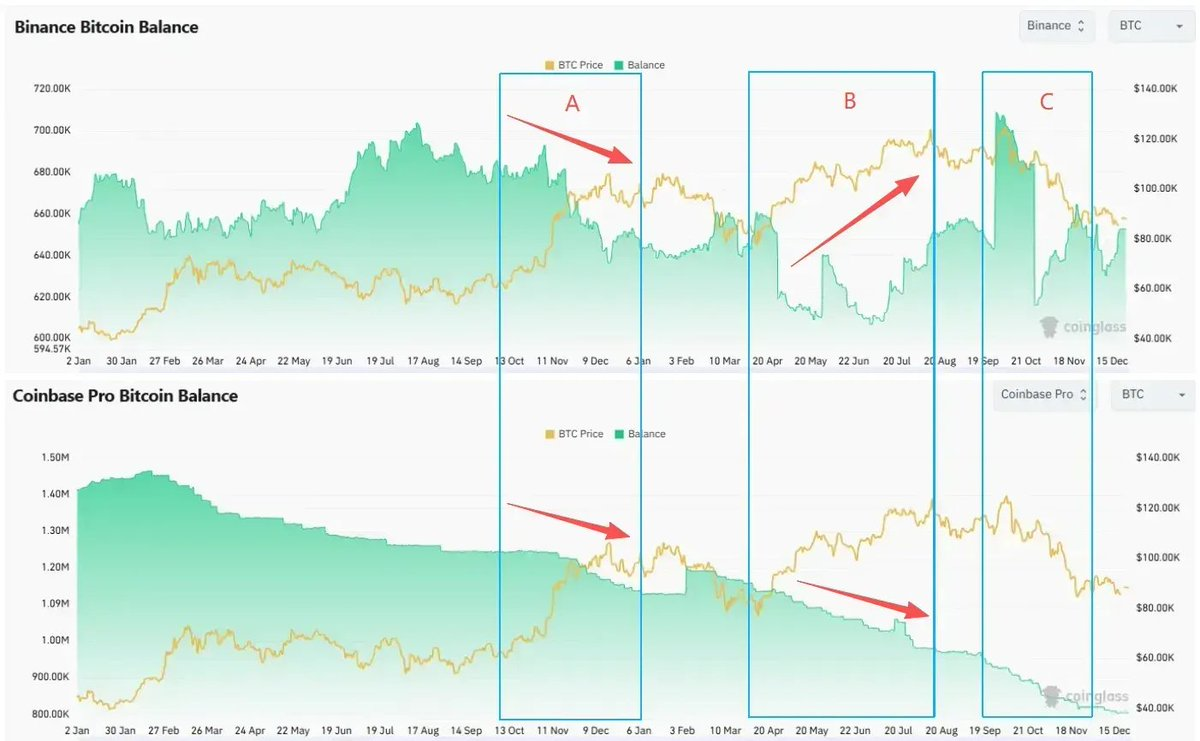

我们在这个周期经历了三个截然不同的阶段——

A阶段(2024年11月至2025年1月):特朗普胜选以及更为友好的监管环境引发了境内外投资者的共同FOMO情绪。比特币价格首次突破10万美元大关。

B 阶段(2025 年 4 月至 8 月中旬):在去杠杆化抛售之后,BTC 恢复上涨势头并突破 12 万美元。

C 阶段(2025 年 10 月初):BTC 在 10 月初创下当前本地历史最高价,然后遭遇 10 月 10 日的闪崩,并进入调整期。

在每个阶段,我们都看到了美国买入和海外卖出之间的巨大差异——

现货:在岸买入突破行情,离岸卖出逢高走强。

Coinbase Premium 在 A、B 和 C 阶段均保持正值。高水平的买盘需求主要来自境内现货资金。

Coinbase BTC 余额在整个周期内呈下降趋势。美国端的可售库存减少。

随着B阶段和C阶段价格反弹,币安余额显著增加。离岸现货持有者补充库存,潜在的卖压也随之增加。

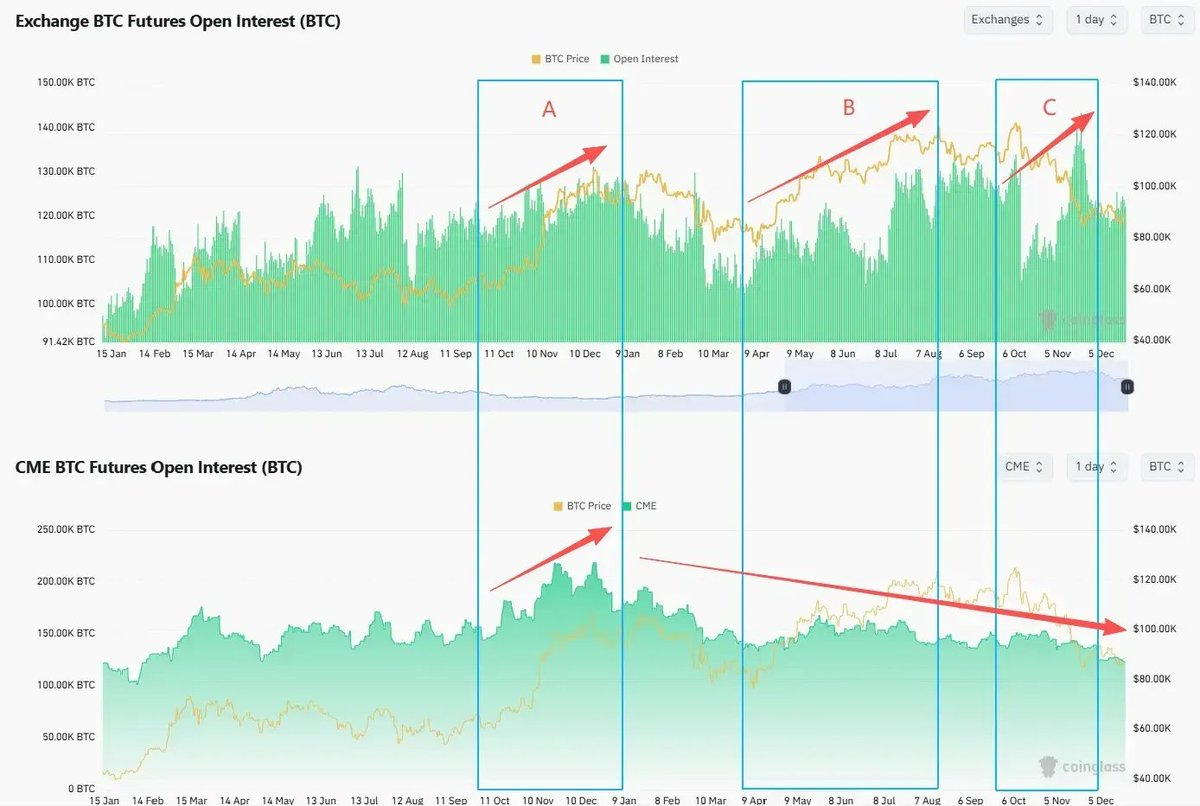

期货:离岸杠杆上升,在岸仓位下降

离岸未平仓合约量(币安和其他离岸交易平台)经历了B阶段和C阶段的攀升。杠杆率上升。即使在10月10日之后,杠杆率也迅速回落,并恢复到或超过了之前的峰值。

自2025年初以来,在岸未平仓合约(CME)呈下降趋势。机构投资者并未因合约创出新高而重新增加风险敞口。

与此同时,比特币波动率与价格走势出现背离。

2025年8月,比特币价格首次突破12万美元时,DVOL接近局部低点。期权市场并未对持续风险给予足够的补偿。

每一次“顶部”似乎都体现了境内外交易者之间的分歧。当境内现货资金推动价格突破时,境外现货交易者会趁机抛售。当境外杠杆资本追涨时,境内期货和期权交易者则会减少持仓并保持观望。

边际买家在哪里?谁还能来接盘?

Glassnode 估计,企业和 DAT 类工具持有的比特币数量从 2023 年初的约 19.7 万枚增至 2025 年底的约 108 万枚,两年内净增约 89 万枚。DAT 已成为比特币系统中最大的结构性投资工具之一。

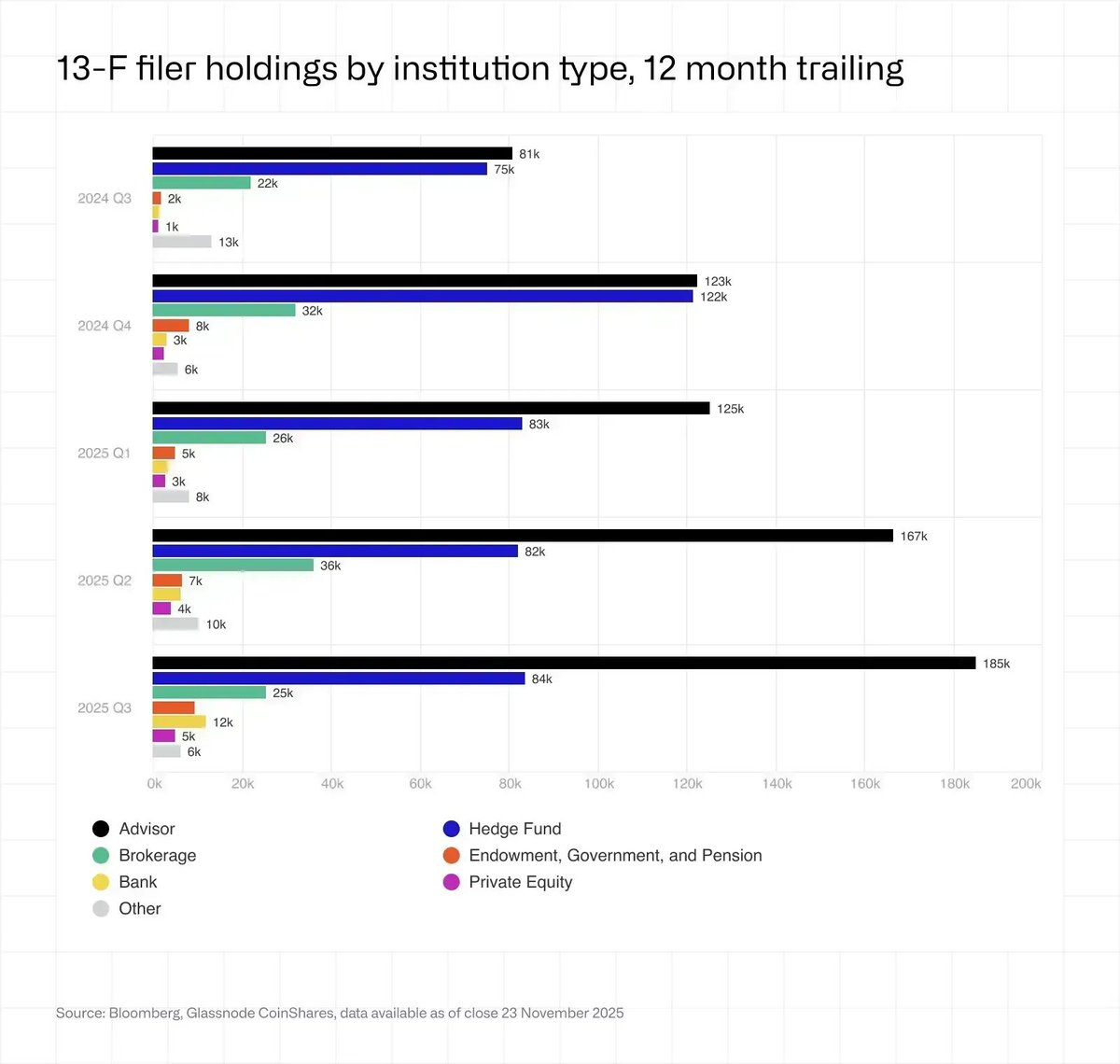

另一个常被误解的领域是 ETF。到 2025 年底,美国现货比特币 ETF 持有约 136 万枚,同比增长约 23%,约占流通供应量的 6.8%。

机构投资者(13F 申报者)持有的 ETF 数量不到总量的四分之一,而且其中大部分是对冲基金和投资顾问,显然并非我们熟知的“钻石手”家族成员。

散户的死掉

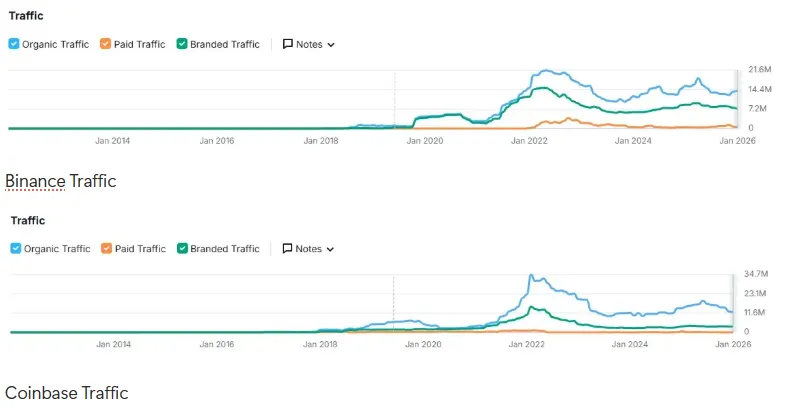

自2025年初以来,币安、Coinbase和其他顶级交易所的流量数据清晰地表明,在特朗普抛售其“梗币”之后,散户投资者的疲软情绪持续存在。

此外,自2024年初以来,散户投资者的整体社交情绪实际上处于看跌状态。

自 2021 年达到峰值以来,网站整体流量呈下降趋势。

比特币价格创下新高并未使访问量回落至先前水平。

您可以在我们去年的文章中阅读更多关于这个主题的内容。“边缘买家是谁?”

交易所的策略也随之调整。面对高昂的获客成本和老用户活跃度低迷,交易所已从“力求增长”转向“通过收益型产品和多资产交易(积极上市美国股票、黄金和外汇)来留住现有资本”。

其他地方,到处都是牛市

2025年真正的“财富效应”并非体现在加密货币领域:标普500指数(+18%)、纳斯达克指数(+22%)、日经指数(+27%)、恒生指数(+30%)、韩国综合股价指数(+75%),甚至A股也上涨了19%,均实现了强劲增长。黄金(+70%)和白银(+144%)也大幅上涨,相比之下,“数字黄金”显得有些滑稽可笑。

人工智能股票、0DTE(零日交易)以及黄金和白银等大宗商品进一步削弱了它的吸引力。

投机者的资金并没有轮动到另类投资。许多人彻底退出,重新回到股票波动率市场,而新来的投机者则在美国股市或他们本国的股票市场中乐此不疲地赚取利润。

就连韩国散户也纷纷抛售Upbit,转而押注KOSPI指数和美国股票:Upbit 2025年的日均交易量较2024年下降了约80%。同期,KOSPI指数上涨了超过75%。韩国散户净买入约310亿美元美国股票

最大的砸盘者是谁?

每个周期都会有老大在局部高点抛售,但有趣的是,本周期卖方的抛售时机与RS背离时间点恰好吻合。

比特币此前一直与美国科技股的走势密切相关,直到2025年8月左右,比特币开始明显落后于ARKK和英伟达,随后遭遇了10月10日的暴跌,至今仍未弥补之前的差距。

就在这种背离出现之前,7月下旬,Galaxy在其财报和媒体简报中披露,它代表一位老牌持有者执行了超过8万枚比特币的卖单。这笔交易让“中本聪时代的巨鲸获利了结”的现象进入了公众视野。

矿业公司出售资产用于人工智能资本支出

从2024年比特币减半到2025年底,矿工储备经历了自2021年以来最持续的下降。到年底,储备量约为180.6万枚比特币。算力同比下降约15%。

根据“AI 外流计划”,矿工们将价值约 56 亿美元的比特币转移到交易所,用于资助 AI 数据中心的建设。

Bitfarms、Hut 8、Cipher、Iren 等公司正在将场地改造成人工智能和高性能计算园区,签署 10 至 15 年的计算合同,将电力和土地视为“人工智能时代的黄金”。

Riot 是 HODL 的代表人物,该公司于 2025 年 4 月宣布将开始销售所有每月挖出的币。

据估计,到 2027 年底,约 20% 的挖矿电力容量可以重新部署到人工智能工作负载中。

中国采取了更为严厉的措施。2025年12月,新疆再次成为中国人民银行和各部委的打击目标。约40万台ASIC矿机被迫下线,导致全球算力在几天内下降了8%至10%。

灰鲸:比特币黑宿醉

与 PlusToken 骗局在 2021 年周期中造成重大影响类似,2025 年发生的几起大规模欺诈和赌博案件,包括钱志敏的庞氏骗局/邪教网络和柬埔寨王子集团/陈志的案件,很可能是推高比特币价格走势的主要幕后推手。

这两起案件都涉及数万枚比特币的查获,总额达到或超过 10 万枚黑币的水平。

这或许还会增加政府的潜在抛售压力,同时也会对长期持有比特币的大型灰色市场产生重大抑制作用,这可能会在中短期内造成抛售压力,但从长远来看总体上是积极的。

2026年展望

在这种新结构下,原有的“四年减半周期”不再是一种可行的自我实现路径。

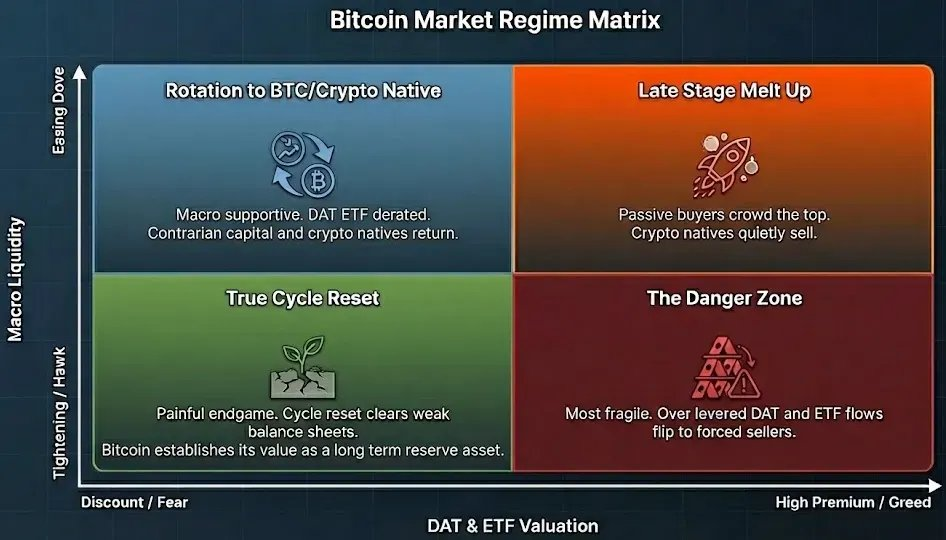

下一阶段的政权主要由两个轴驱动。

垂直领域:宏观流动性和信贷状况、利率、财政立场、人工智能投资周期。

横向分析:DAT、ETF 和其他比特币替代资产的估值和溢价水平

比特币早期赢家,包括元老级玩家、矿工和亚洲灰鲸,正在将代币分发给被动型ETF持有者、DAT结构和长期国家资本。

比特币的发展轨迹似乎与2013年至2020年间FAANG的发展轨迹相似:市场正缓慢从早期零售和成长型基金主导的高贝塔系数投资策略转向以指数基金、养老基金和主权财富基金为主导的被动型配置策略。

比特币现在是无需接触加密货币即可轻松拥有的加密资产。您可以通过经纪账户购买,像管理ETF一样托管,进行清晰的账务处理,并能在五句话内向交易员投资委员会解释清楚。

而大多数其他加密资产的估值并非源于其在实体市场和华尔街的实际效用或合法性。

我们总是期待着新一轮牛市,但如果这次的牛市不仅仅是价格上涨,更是效用上涨,能够将ETF时代的合法性转化为链上需求,将被动持有转化为主动使用,并带来真正的收益回报,而不是因为不断变换的叙事,那就太好了。

如果这种情况发生,今天的“站岗玩家”看起来就不像是一个周期的套牢大冤种,而更像是新周期的首批投资者。

比特币最终成为国家储备金

代码正在吞噬银行

加密货币仍需发展成为一种新的文明工具。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。