1 市场现状与格局

1.1 2025 年黄金RWA 市场快速增长

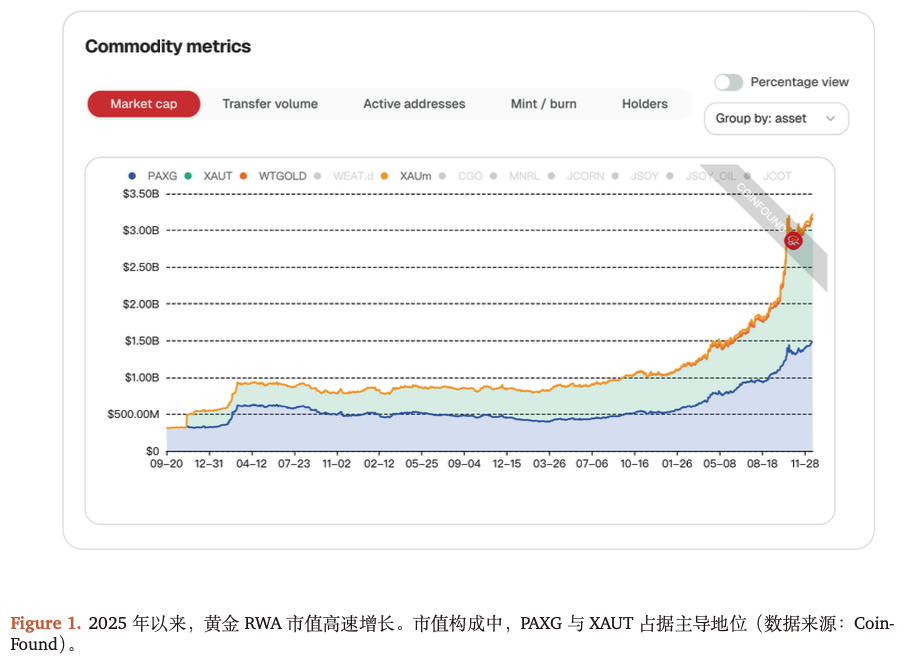

• 从市值来看,黄金RWA市值在今年取得了接近3 倍的增长。根据CoinFound 数据,截止2025 年12 月19日,黄金RWA 整体市值已经超过30亿美金。而且2025 年年初,整体市值甚至没有超过10 亿美金。

• 从参与者来看,此外,黄金RWA 资产及配套生态数量在今年快速增长,越来越多的机构开始进入这个市场。在2025 年初之前,整个黄金RWA 市场显得冷清许多,长期以来只有XAUT (Tether Gold) 和PAXG (Paxos Gold) 唱着二人戏,而WTGOLD ( WisdomTree Gold Token) 则在边缘露出隐约的身影。

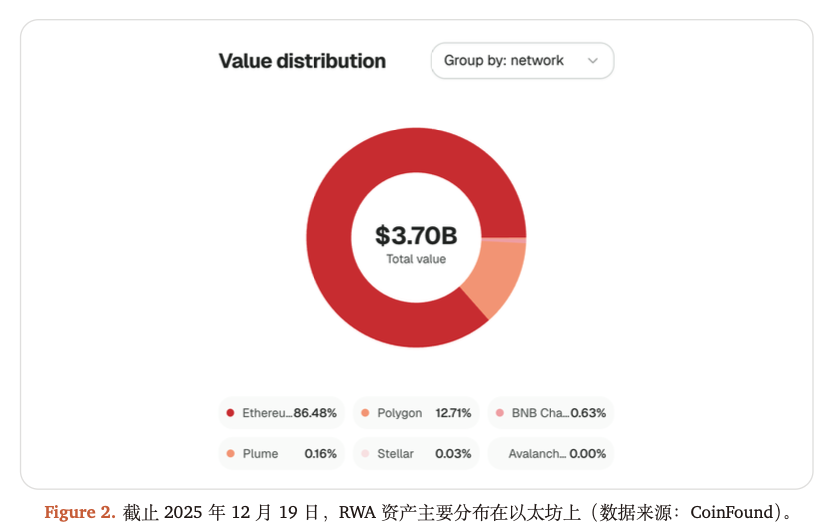

• 目前,黄金RWA 资产主要分布在以太坊链上。

1.2 市场格局:XAUt 与PAXG 双雄争霸,新锐增长瞩目

2025 年,黄金RWA 市场已演变为“双头引领、新锐突围”的多极化分布。截至2025 年12 月19 日,各主流协议根据其定位差异,形成了显著的功能分层。

• XAUt (Tether Gold):流动性与衍生品的霸主

– 市值规模:约16.3 亿美元,稳居赛道首位。

– 核心优势:依托Tether 庞大的稳定币生态,XAUt 拥有黄金RWA 中最深的深度与最广的流动性。

– 应用场景:作为中心化交易所和链上衍生品协议首选的黄金抵押品,极度适合高频交易者及机构进行大额套期保值。

• PAXG (Paxos Gold):合规与监管的标杆

– 市值规模:约14.3 亿美元。

– 核心优势:受纽约州金融服务管理局(NYDFS) 严格监管。其独有的“逐笔对应查询”机制允许用户通过链上地址实时穿透查询对应的金条编号、成色及物理重量。

– 应用场景:传统受规管金融机构(Regulated Entities)进行链上资产配置的首选工具。

• KAU (Kinesis Gold):支付与普惠金融

– 核心创新:引入“持金生息”模型,将网络交易手续费按比例返还持有人,打破了黄金作为“非生产性资产”的传统认知。

– 支付生态:截止2025 年底市值达3 亿美元。依托借记卡系统在40 多个地区实现“刷金消费”,将黄金转化为高频流转的日常货币。

• XAUm (Matrixdock Gold):收益驱动与机构灵活性

– 增长动能:市值从年初百万级飙升至6000 万美元以上,增长率领跑赛道。

– 技术特色:采用“双模资产架构”,支持ERC-20 与ERC-721(NFT)的即时互换。当持仓达到标准金条规格(如1kg)时,可映射为代表特定实物权属的NFT。

– DeFi 引擎:深度集成跨链通信协议(如Chainlink CCIP),支持在多链生态中捕捉套利收益。

1.3 机构级投资者参与度提升

• 金融巨头的入场与产品化:星展银行(DBS) 与渣打银行的试点:在新加坡金管局(MAS) 的监管框架下,这些传统银行已在2025 年开展了基于黄金RWA 的跨境结算试点。它们利用代币化黄金替代传统实物金条的移动,将清算时间从数天缩短至分钟级。

• 托管设施的机构化改造:(1)多签托管方案的普及:2025 年,Fireblocks 和Copper 等机构级托管平台全面集成了XAUt、PAXG 及XAUm。这意味着家族办公室和对冲基金无需直接管理私钥,而是通过符合SOC2 标准的企业级界面进行“金库级”操作;(2)Phemex 机构账户体系:交易平台如Phemex 通过其推出的机构级API 与sub-account 系统,支持机构投资者将黄金代币直接用于跨平台保证金抵押,显著提升了资金利用率。

• 监管与合规体系的成熟:(1)美国GENIUS 法案的影响:2025 年7 月通过的《稳定币GENIUS 法案》为实物抵押型代币(包括黄金代币)提供了清晰的法律定义,极大消除了机构入场的法律顾虑。(2)实时储备证明(PoR) 成为行业标准:2025 年底,主流黄金RWA 项目已普遍接入Chainlink PoR 预言机。例如,PAXG和XAUm 均支持24/7 链上审计,机构投资者可以随时调取托管行(如Paxos Trust 或Matrixport 合作银行)的实物金条库存快照。

2 宏观视角与趋势

2.1 宏观环境不稳定,黄金及黄金RWA 持续上涨

2025 年,全球宏观环境表现出高度不确定性。

• 一方面,债务压力与法币信用风险均呈上升。随着主要经济体公共债务水平升至历史高位,投资者对主权信用法币的信任出现结构性松动。2025 年市场对非债务型资产的需求达到了十年来的高点。

• 另一方面,不仅是通胀风险,地缘政治冲突也在加剧宏观环境的不稳定。在这种情况下,黄金作为避险资产而变得愈发重要。2025 年金价持续上涨,金价多次创历史新高。同样的,这也推动了黄金RWA 资产的价格上涨。短期内,这样的趋势有明显持续的预期。

2.2 从稳定币到支付等场景,“链上黄金”需求扩大

随着稳定币的发展,链上金融资产在支付、交易清结算等场景的应用已经得到了广泛的验证,并正在高速发展。然而,一个值得注意的现象是:

• 目前USDC 等主流稳定币的底层资产是美元现金等价物及短期美债,但其存量仅一万多亿美元,显然难以支撑全球化应用。如果扩大范围,纳入长期美债或其他风险资产,稳定币将不可避免地承担与商业银行类似的期限与信用风险。

• 然而,另一方面,由于全球宏观环境的不稳定,为了保证支付、清结算、甚至未来链上抵押等场景的底层资产价值稳定性,多元化则成为了一个重要的考量。一个仍带有热度的例子是USDT 和Tether,近年来,Tether一直在不断提升储备资产中的黄金和比特币占比,并且一直在增加黄金的储备量,以增强其对通胀和美债信用风险的抵抗能力。

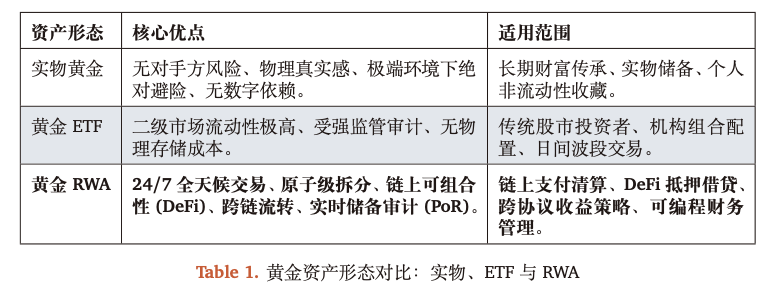

简而言之,当前,“链上金融世界”需要“黄金”,并且,在稳定币的发展推动下、在支付、清结算等应用场景的推动下,这种需求在扩大。然而,实物黄金和黄金ETF 的形式是不足以满足需求的:

1. “实物形态”极大限制了作为支付媒介的可行性。在现有金融体系中,黄金缺乏可编程性、可拆分性与高频流动性,难以嵌入现代金融网络,尤其无法满足跨境支付与链上金融的需求。与法币、稳定币等数字资产相比,实物黄金既不能直接用于电子结算,也缺乏与支付网关、清算网络、智能合约等基础设施的交互能力。

2. 类似的,尽管黄金ETF 在传统框架下为投资黄金提供了便利,但在“链上”的背景下,其适配性与灵活性明显不足,难以满足去中心化时代对资产“高活性、可调用、可组合”的核心要求。具体来说,黄金ETF 作为连接黄金市场与金融市场的重要工具,使投资者无需实际持有实物黄金即可获取价格敞口。但其本质仍是传统金融体系内的受限产品,特别的,黄金ETF 属于证券化资产,无法实现点对点转账或实时结算,难以用于支付,更不具备嵌入链上金融协议的能力。

3. 额外的,对投资者而言,黄金ETF 具有一个额外的缺点,即购买黄金ETF 仅仅是获得了法律意义的权益凭证,不等于获得了黄金的所有权。本质上,它仍是一种“封闭式金融工具”。

因此,链上世界需要“黄金”,并且需要一种“形态匹配”的黄金,具体而言:

• 需要一种可信的“资产组件”的形式,为链上世界提供“黄金”,带来可信、稳定、可组合的价值锚点。

• 需要一种具备编程性与可组合性的“黄金”,灵活的接入DeFi 生态的借贷协议、流动性池、收益聚合机制。

因此,对黄金类RWA 的需求呼之而出。

2.3 新一代金融体系正在到来,黄金RWA 是重要构成

在美国,金融资产上链正在监管的支持下加速,“资产代币化”似乎是下一代金融系统形态。

• 2025 年12 月,美国证券交易委员会(SEC)向美国存托信托与清算公司(DTCC)下属机构存托信托公司(DTC)发出不采取行动函(NoAction Letter),授权其在受控生产环境下为特定现实世界资产提供代币化服务。这项授权覆盖美股、ETF 和美国国债等高流动性资产,为传统资本市场“上链”开辟了合规通道,也表明主流监管正在支持资产上链实践。

• 时间再往前追溯,2025 年下半年,SEC 主席Paul Atkins 多次公开表态,认为“资产代币化是资本市场未来趋势”并推动Project Crypto 相关讨论,包括对代币化证券的分类框架和监管适用性。

• 更早一点的时间,GENIUS Act(2025)的通过,为稳定币合规使用与资产上链打下法律基础。

而且,这样的趋势并不仅仅局限于美国。而是正在演化为全球金融体系层面的共同方向。

• 国际清算银行(BIS)在2025 年年度报告(Annual Economic Report 2025)提出了“下一代金融体系”的技术形态和资产结构的框架:BIS 明确指出,传统金融体系正从以账户和中心化账本为核心的架构,迈向以代币(tokenisation)和可编程平台为基础的新范式。BIS 将这一体系描述为一个由多类代币化资产共同运行的金融基础设施,其中包括:

1. 央行准备金的代币化形式(作为系统的最终结算资产)

2. 商业银行存款代币或受监管稳定币(作为支付与流动性工具)

3. 政府债券及其他高质量资产的代币化形式(作为安全资产和金融市场的抵押基础)

• BIS 强调,代币化的核心价值不在于“将资产简单映射到区块链”,而在于将支付、清算、结算和资产转移整合到同一可编程基础设施之上,从而显著降低跨境交易成本、缩短结算周期,并减少系统性摩擦。这一判断与SEC 支持证券代币化、DTCC 推动清结算链上化的实践高度一致。

• 自然的,这一框架下,现实世界资产(RWA)被视为连接现实金融体系与链上金融基础设施的关键桥梁。而在各类RWA 中,黄金具备独特地位:其作为全球公认的价值储存资产、长期安全资产和高质量抵押物,天然符合BIS 所强调的“高可信、低信用风险资产”要求。当黄金以RWA 形式被引入链上体系后,不仅可以作为价值储存工具存在,还能够参与到链上支付、清算、抵押和跨境结算等核心金融功能之中。

简单的总结,新一代的金融体系正在探索中到来,而这个体系中,需要“RWA”形态的黄金。

3 黄金RWA 用途

3.1 可编程的“避险资产”

黄金长期被视为全球公认的避险资产和价值储存工具,而黄金RWA 在此基础上引入了可编程性与金融可组合性。这带来了额外的好处:

1. 可拆分与可组合:黄金可被细粒度拆分为最小计价单位,嵌入DeFi、托管账户或机构级金融合约中;

2. 可编程规则:通过智能合约设置转移、锁定、清算或触发条件,使黄金从“被动持有资产”转变为“主动参与金融逻辑的资产”;

3. 链上透明度:托管、发行、流通和赎回路径在链上可验证,降低对中心化中介的信任依赖。

这些好处的一个直接体现是在“避险”的同时可以获得收益。以XAUm 举例,其持有者可以参与AlphaLend、Navi、Suilend 等协议获得收益。

3.2 支付、交易与跨境支付网络中的价值媒介

除了抗通胀、储值等功能,黄金更可以嵌入未来数字金融体系的交易媒介与支付资产功能。例如,稳定币生、RWA快速扩张的趋势下,黄金代币有望成为链接链上金融与实体经济的中立支付接口。

具体来说,当前稳定币体系呈现出明显的美元中心化特征,其底层资产结构高度集中于美国国债。这种结构在提升流动性的同时,也引入了地缘政治、监管外溢和信用集中风险。黄金代币的出现,为这一体系提供了制度上的缓冲机制。在全球支付网络逐步多极化的背景下(如mBridge、BRICS Pay 等本币结算系统并行发展),黄金代币具备成为“桥接型清算资产”的潜力:

• 不替代主权货币;

• 但作为不同货币体系与支付网络之间的中性接口,降低摩擦与政治博弈成本。

在这一架构中,黄金RWA 承担的角色已远超“投资资产”,而是演化为新一代全球金融网络中的制度级基础组件。在这一层面,黄金RWA 或许并非与稳定币竞争,而是构成其流动性结构上的战略互补:稳定币负责高频流通,黄金RWA 提供低信用风险的价值底座。

3.3 链上清结算与抵押体系中的核心抵押品

• 一方面,在DeFi 场景中,黄金代币(如XAUT、PAXG)正逐步被视为“中性抵押品”。与法币稳定币不同,黄金不依赖任何单一主权信用,其价格由全球市场共识决定,在极端宏观或地缘政治情境下具备更强的稳定性。这使其在借贷、合成资产和结构化协议中,成为对冲稳定币系统性风险的重要补充。

• 另一方面,在CeFi 与衍生品市场中,黄金RWA 也可以驱动保证金体系的结构性革新。头部交易平台可以支持黄金代币作为跨币种保证金资产,使机构投资者能够在不转换为法币或稳定币的情况下,直接以黄金头寸参与杠杆交易与风险对冲。这种机制实质上实现了“黄金资本效率的释放”:黄金不再只是被动配置资产,而是成为可以持续参与金融活动的流动性单元。

3.4 连接传统金融与链上金融的“桥梁资产”

从系统视角看,黄金RWA 的一项重要作用在于降低传统金融机构进入链上体系的门槛。对银行、资管机构和清算机构而言:

• 黄金是熟悉的资产;

• 托管、审计和合规路径相对成熟;

• 法律属性清晰,跨司法辖区接受度高。

因此,黄金RWA 往往成为机构首次尝试链上资产、链上清算或链上抵押的切入点,是传统金融迈向代币化世界的重要“过渡资产”。

4 风险与挑战

尽管黄金RWA 在流动性、资本效率和制度中立性方面展现出显著优势,但其作为一种连接现实资产与链上金融体系的混合形态,仍面临一系列结构性风险与现实约束。这些风险并不否定黄金RWA 的长期价值,但在当前发展阶段,必须被系统性识别与评估。

4.1 中心化风险

4.1.1 物理托管与兑付风险

黄金RWA 的核心前提,是链上代币与链下实物黄金之间的一一对应关系。这一关系决定性地依赖于现实世界中的托管机构、金库运营方以及赎回机制,因此不可避免地引入中心化信任。主要风险体现在:

• 托管集中度风险:多数黄金RWA 项目依赖少数国际金库或托管机构,一旦发生运营中断、法律纠纷或极端

政治事件,可能影响代币兑付能力;

• 赎回摩擦:实物赎回往往存在最低数量门槛、地域限制和时间成本,使“链上即时性”在链下环节被部分抵消;

• 极端情境下的流动性断裂:在系统性危机或监管冲突中,链上代币可能保持流通,但链下实物交割受限,形成“名义流动性”与“真实流动性”的错配。

因此,黄金RWA 虽然提升了黄金的金融可用性,但其安全性仍然高度依赖于托管体系的稳健性与法律可执行性。

4.1.2 运营与透明度风险

黄金RWA 的价值基础不仅来自黄金本身,也来自市场对发行方、托管方和审计机制的信任。潜在风险包括:

• 审计频率与深度不足:部分项目虽提供储备证明,但审计周期较长或缺乏实时性,难以满足机构级风控要求;

• 信息披露不对称:托管细节、赎回条款、法律结构往往分散在多份文件中,普通用户难以全面评估;

• 声誉外溢效应:一旦个别黄金RWA 项目出现信用事件,可能对整个赛道形成负面冲击,影响市场接受度。

在这一层面,黄金RWA 的风险特征更接近“金融基础设施级产品”,其成败高度依赖长期声誉积累,而非短期市场表现。

4.2 技术风险:链上金融复杂性的系统挑战

尽管黄金RWA 基于成熟公链运行,但其技术栈通常涉及智能合约、跨链桥、预言机和托管接口等多个复杂组件,系统整体安全性取决于最薄弱的一环。

关键技术风险包括:

• 智能合约漏洞风险:代币铸造、销毁、映射与跨链逻辑一旦存在漏洞,可能导致资产冻结、错配或被恶意利用;

•跨链与互操作风险:跨链桥历来是链上安全事件的高发区域,黄金RWA 一旦成为跨链流动资产,其系统性风险敞口随之放大;

• 预言机与数据同步问题:价格、状态或储备信息的链上同步若出现延迟或错误,可能触发连锁清算或市场扭曲。

与原生加密资产不同,黄金RWA 的技术风险不仅影响代币本身,还可能通过抵押、清算和支付系统向更广泛的金融协议传导,具有更强的系统外溢性。

4.3 监管不确定性风险:跨司法辖区的长期变量

黄金RWA 处于商品、证券、支付工具与数字资产的交叉地带,其监管属性在不同司法辖区存在显著差异,这构成了长期的不确定因素。主要体现在:

• 法律定性不统一:黄金代币在不同国家可能被视为商品代币、证券型代币或支付工具,适用的合规框架差异较大;

• 跨境合规复杂性:黄金RWA 天然具备跨境流动属性,但现实中的外汇管理、贵金属监管与反洗钱规则仍以属地原则为主;

• 政策节奏不一致:即便在美国、欧盟等主要市场监管趋于开放,不同监管机构的态度与执行力度仍可能阶段性变化。

这意味着,黄金RWA 在短期内更适合以机构试点、合规沙盒和受限规模应用的方式推进,而非无边界扩张。

风险提示

本报告基于公开资料、行业访谈、第三方研究以及合理分析框架撰写,旨在对黄金RWA的发展趋势与潜在影响进行研究性探讨。但受限于市场发展阶段与信息披露条件,相关结论仍面临以下主要风险与不确定性因素,特此提示:

1. 数据完整性与统计口径风险

黄金RWA 仍处于快速演进阶段,相关市场规模、流通量、使用场景等数据主要来源于项目方披露、链上统计工具及第三方研究机构,不同来源在统计口径、计算方法和时间维度上可能存在差异。部分数据可能存在滞后、估算或覆盖不足的情形。

2. 资产托管与兑付执行风险

黄金RWA 的价值基础依赖于实物黄金的真实存在、合规托管及可执行的兑付安排。尽管主流项目通常引入第三方托管与审计机制,但在极端市场波动、法律争议或跨司法辖区冲突下,仍可能出现兑付延迟、赎回受限或流动性与交割能力不匹配的风险。

3. 技术与系统性运行风险

黄金RWA 通常依托于智能合约、公链基础设施、跨链协议及预言机系统运行,其整体安全性取决于多重技术的协同稳定。潜在的合约漏洞、预言机数据异常或网络拥堵,均可对资产转移、抵押清算及支付结算功能造成不利影响,并引发系统性风险外溢。

4. 监管政策与法律环境不确定性

黄金RWA 涉及商品、证券与支付属性的交叉认定,不同国家和地区在监管分类、合规及政策方面存在显著差异。未来监管框架的调整、执法尺度变化,可能对相关产品的发行、流通、托管及使用场景产生实质性影响。

5. 市场流动性与价格波动风险

尽管黄金本身具备长期价值稳定特征,但黄金RWA 的二级市场仍处于发展初期,其流动性深度、参与主体结构及价格发现机制尚未成熟。在特定环境下,黄金RWA的价格可能出现偏离标的资产价值的情形。

6. 研究假设与前瞻判断风险

本报告涉及的部分分析基于对行业发展趋势、技术路径及政策方向的前瞻性判断,相关假设可能因宏观环境、技术进展或监管变化而发生调整,实际结果可能与预期存在差异。

7. 本报告不构成投资建议

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。