Author: Michel Athayde

Abstract

"In high-frequency trading, transaction fees are not just costs; they are the decisive factor between life and death."

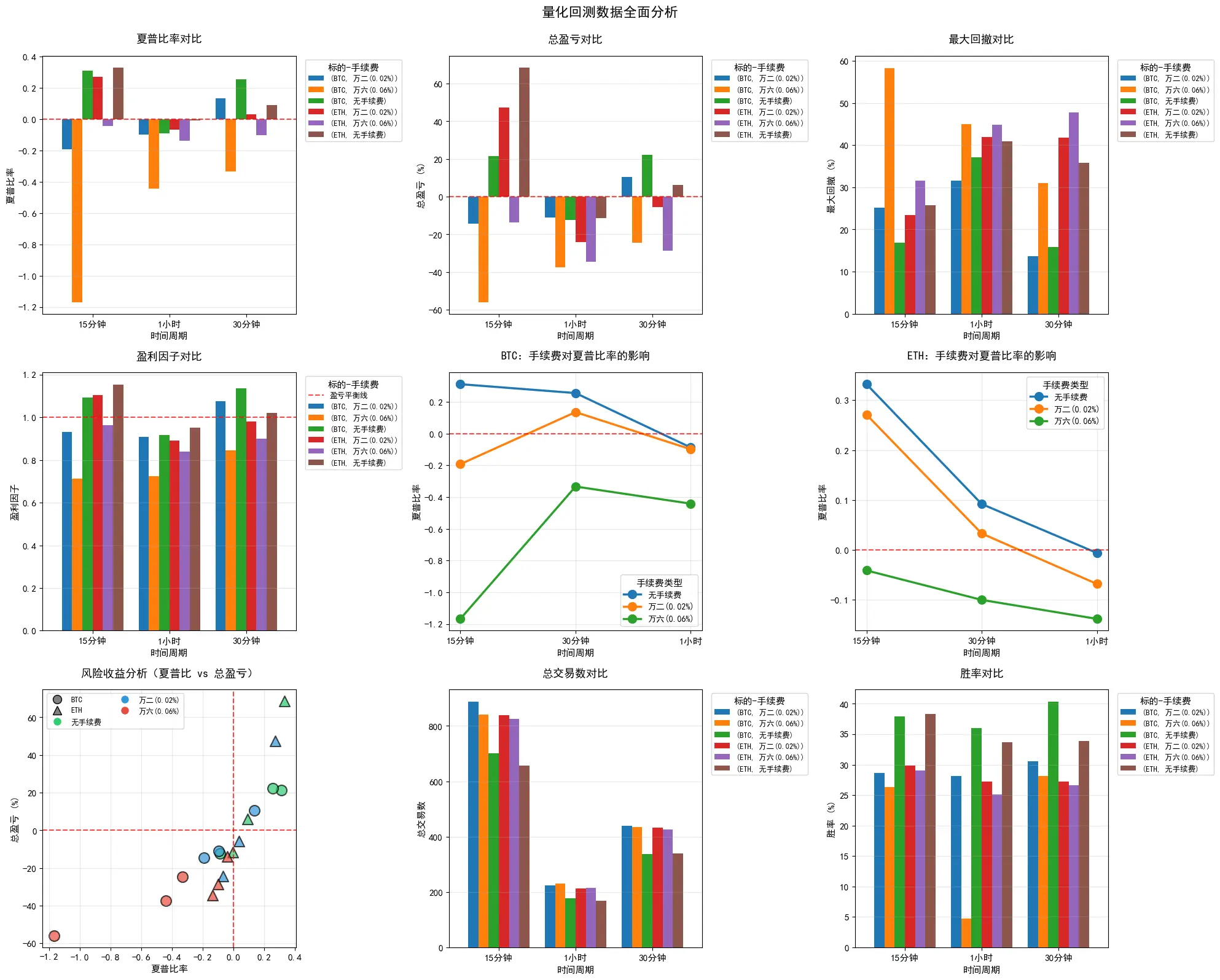

This article conducts a one-year full-position backtest of the popular TradingView strategy Squeeze Momentum (LazyBear) on BTC and ETH, based on an initial capital of $100,000. The data reveals a harsh reality: a mere 0.04% difference in transaction fees is enough to turn the same strategy's performance on ETH at the 15-minute level from a profit of 47% to a loss of 14%. This means that for many retail and novice quantitative traders, the strategy logic itself may be valid, but the fee structure at the execution level directly consumes all Alpha.

(Note: This backtest is based on historical data from mainstream exchange perpetual contracts, using standard Squeeze Momentum parameter settings, and does not account for slippage, aiming solely to compare the marginal impact of different fee structures on strategy net value.)

1. Core Data Insights: Fee Sensitivity of BTC and ETH

This study simulates three typical fee scenarios: 0% (baseline), 0.02% (Maker/Limit order fee), and 0.06% (Taker/Market order fee). The backtest strategy was adjusted to a "Long Only" mode to fit the long-term upward characteristics of the crypto market.

The results are as follows:

1.1 15-Minute Level: The "Profit Meat Grinder" in High Frequency

The 15-minute chart is the period with the densest signals for this strategy (600-800 trades per year) and is also the area where the fee effect is maximally amplified.

Table 1: Core Data Comparison for 15-Minute Time Frame

| Asset | Fee Model | Total Trades | Net Profit (Total PnL) | Total Fees (USD) | Status | |-------|-----------|--------------|-------------------------|-------------------|--------| | BTC | 0% (Ideal) | 701 | +21.47% | $0 | Profit | | BTC | 0.02% (Maker) | 888 | -14.45% | $29,596 | Loss | | BTC | 0.06% (Taker) | 842 | -55.94% | $64,193 | Huge Loss | | ETH | 0% (Ideal) | 657 | +68.66% | $0 | Windfall | | ETH | 0.02% (Maker) | 838 | +47.34% | $33,960 | Profit | | ETH | 0.06% (Taker) | 826 | -13.81% | $76,536 | Loss |

In-Depth Analysis:

BTC's High-Frequency Dilemma: Under the 15-minute high-frequency execution conditions set in this article, BTC's relatively low volatility (Beta) struggles to cover the fixed costs generated by frequent trading. Even with a low fee rate of 0.02%, the strategy still yielded negative returns. This indicates that under the current market maturity, simple technical indicator breakout strategies may struggle to generate sufficient Alpha in BTC's short cycles.

ETH's Volatility Dividend: ETH demonstrated stronger explosive potential. In ideal conditions (0% fee), its 68.66% return far exceeds that of BTC. This high volatility characteristic allows ETH to maintain a substantial profit of 47.34% even at a 0.02% Maker fee.

The Cost of Taker Orders: The most alarming part of the data is the comparison for ETH. Once traders use market orders (0.06% fee), even if they capture a significant ETH trend, the cumulative fees of up to $76,536 will still push the account into a loss (-13.81%).

2. Cycle Paradox: Why Extending the Cycle Does Not Solve the Problem?

It is generally believed that extending the time cycle can reduce trading frequency, thereby decreasing fee erosion. However, this backtest found a counterintuitive phenomenon at the 1-hour (1H) level.

Table 2: Performance at 1-Hour Time Frame

| Asset | Fee (Market 0.06%) | Net Profit | Profit Factor | Phenomenon | |-------|---------------------|------------|---------------|-------------| | BTC | 1H | -37.33% | 0.723 | Severe Loss | | ETH | 1H | -34.49% | 0.840 | Severe Loss |

Analysis:

Even without considering fees (0%), both BTC and ETH recorded losses at the 1-hour level (BTC -12.29%, ETH -11.51%). This may be related to the default parameters (20, 2.0) causing signal lag at higher cycles. When the "squeeze release" signal is confirmed on the 1-hour chart, the trend has often already started for some time, leading the strategy to enter at local highs and subsequently face stop-losses during pullbacks. This warns us that rigidly applying default parameters to different time frames is highly risky.

3. Core Insights: Transitioning from "Win Rate" to "Odds"

3.1 The Mathematical Trap of Break-Even

Squeeze Momentum is a typical trend breakout strategy, which usually has a low win rate (backtests show between 26% - 40%), primarily relying on the profit-loss ratio for profitability.

However, transaction fees mathematically raise the "break-even point."

Taking ETH 15m as an example, $76,536 in fees means that each trade (regardless of profit or loss) implicitly carries an average "entry ticket" of about $92.

The core conclusion is: For strategies with annual trading frequencies exceeding 600 trades, transaction fees have become the primary variable determining the strategy's survival, rather than the predictive ability of the indicators themselves.

3.2 Capital Management and Compounding Erosion

This backtest adopted a 100% position mode. Under high fees, continuous erosion accelerates the shrinkage of capital. The maximum drawdown for BTC 15m (0.06%) reached an astonishing 58.32%, which often means liquidation or psychological collapse in real trading.

4. Practical Insights and Strategy Optimization Directions

Based on the above data, we can provide the following industry recommendations for traders looking to run such momentum strategies:

4.1 Fee Structure Determines Survival Space

Conclusion: In real trading, such high-frequency strategies are only highly feasible when Maker (Limit order) transactions can be consistently obtained.

- Recommendation: At the algorithm execution level, passive limit order logic should be written as much as possible (e.g., placing orders at the best bid price or within market depth), rather than directly taking market orders. If running this strategy on high-fee exchanges (Taker > 0.05%), extreme caution is required.

4.2 Asset Selection: Volatility is the Core Moat

Conclusion: Under fixed fees, the volatility of the asset must be sufficient to cover costs.

- Recommendation: Compared to BTC, the Squeeze Momentum strategy is more suitable for deployment on ETH or other high Beta mainstream altcoins. BTC's gradually "asset-like" low volatility makes it less cost-effective in short-term breakout strategies.

4.3 Introduce Filtering Mechanisms to Reject Ineffective Volatility

Conclusion: The original strategy's frequent entries in choppy markets are the main cause of losses.

Recommendation:

Trend Filtering: Introduce the ADX indicator (e.g., ADX > 20) to confirm trend strength, avoiding repeated erosion in directionless sideways markets.

Multi-Timeframe Resonance: Before opening positions at the 15-minute level, confirm that the 1-hour or 4-hour levels are in a bullish arrangement, aligning with the larger trend against smaller trends.

4.4 Dynamic Parameter Adaptation

Conclusion: The failure at the 1-hour level warns us that parameters are not a universal key.

- Recommendation: For different time frames, targeted optimization of Bollinger Band length (BB Length) and standard deviation multiples (MultFactor) is necessary to reduce the risk of chasing highs caused by signal lag.

5. Conclusion

As a classic open-source strategy, Squeeze Momentum's logic remains effective in capturing trends. However, this backtest clearly indicates that the holy grail of quantitative trading does not lie in discovering a magical indicator, but in the extreme control of execution costs and a profound understanding of the market's microstructure.

For quantitative traders looking to profit in the crypto market, optimizing code is just the first step; optimizing account fee levels and selecting appropriate liquidity provision methods often determine the final PnL more than optimizing the parameters themselves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。