The crypto market has no secrets, only the speed of dissemination.

Indeed, a follow-up should be written for Perp DEX, as nearly 20 projects are set to embark on the TGE journey in Q1 2026. From Aster's trading volume to StandX's order points, the noise being emitted into the market leaves everyone feeling unsettled.

This should not lead to doubts about Hyperliquid. The collaborative flywheel of HyperEVM and HYPE has not been successfully established, but the Lighters cannot eliminate the new king. We are immersed in firsthand information about the rivalry between Binance and FTX, causing the Perp DEX War to become a secondhand memory.

Stuck in a New Chapter of HYPE

“Lighter or not, Hyper is even more Hyper”

Lighter is undoubtedly a successful project, having successfully landed after Hyperliquid confirmed the Perp track, creating the established impression that Hyperliquid is a benchmark for Binance, and Lighter is a benchmark for Hyperliquid.

The turtle cannot continue to stack indefinitely. Referring to the competitive landscape of exchanges, operating OKB outside of Binance is exceptionally difficult, and Coinbase's market value is more than five times that of Kraken.

Trading has a natural monopoly effect; even the second in the industry cannot self-circulate. Perp DEX has now entered a red ocean stage, and large-scale market increments are impossible; what remains is merely a game of existing stock for TGE.

First, let's give BNB a proper name. The Binance main site and BNB Chain need a linker, an action that HYPE has yet to complete.

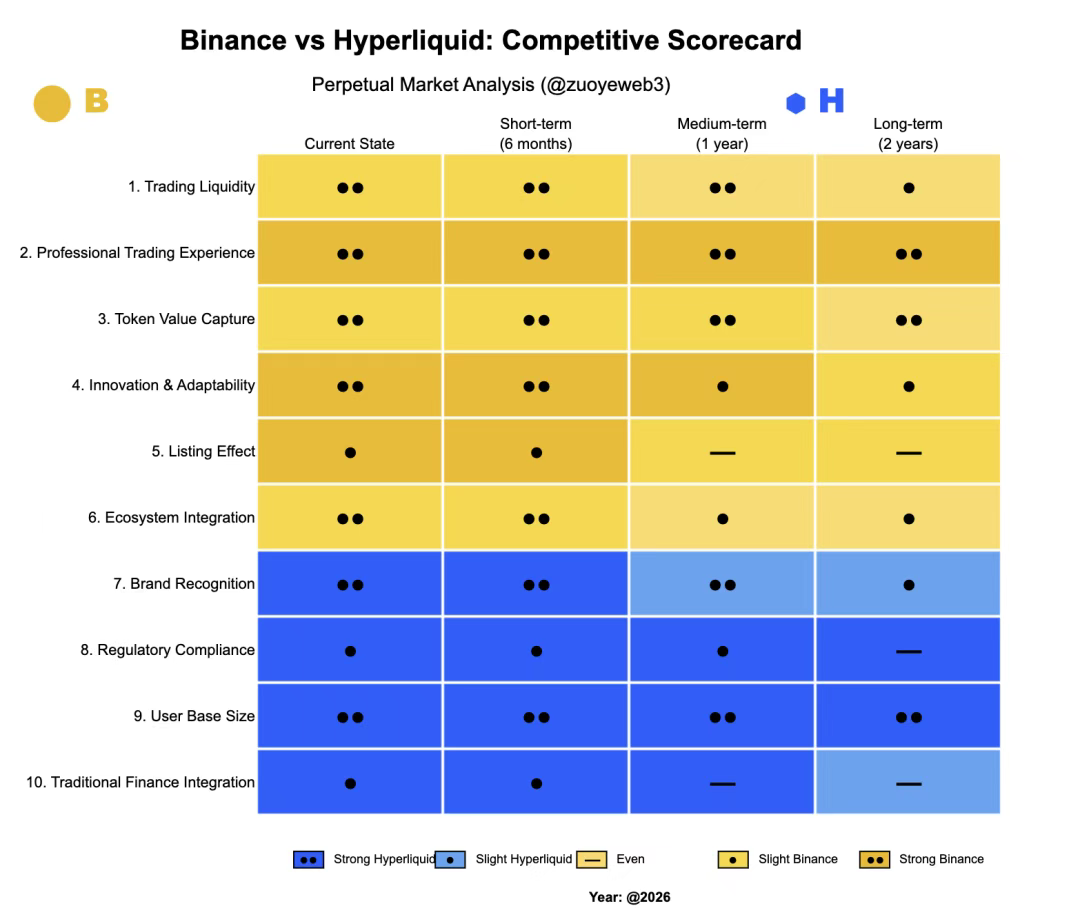

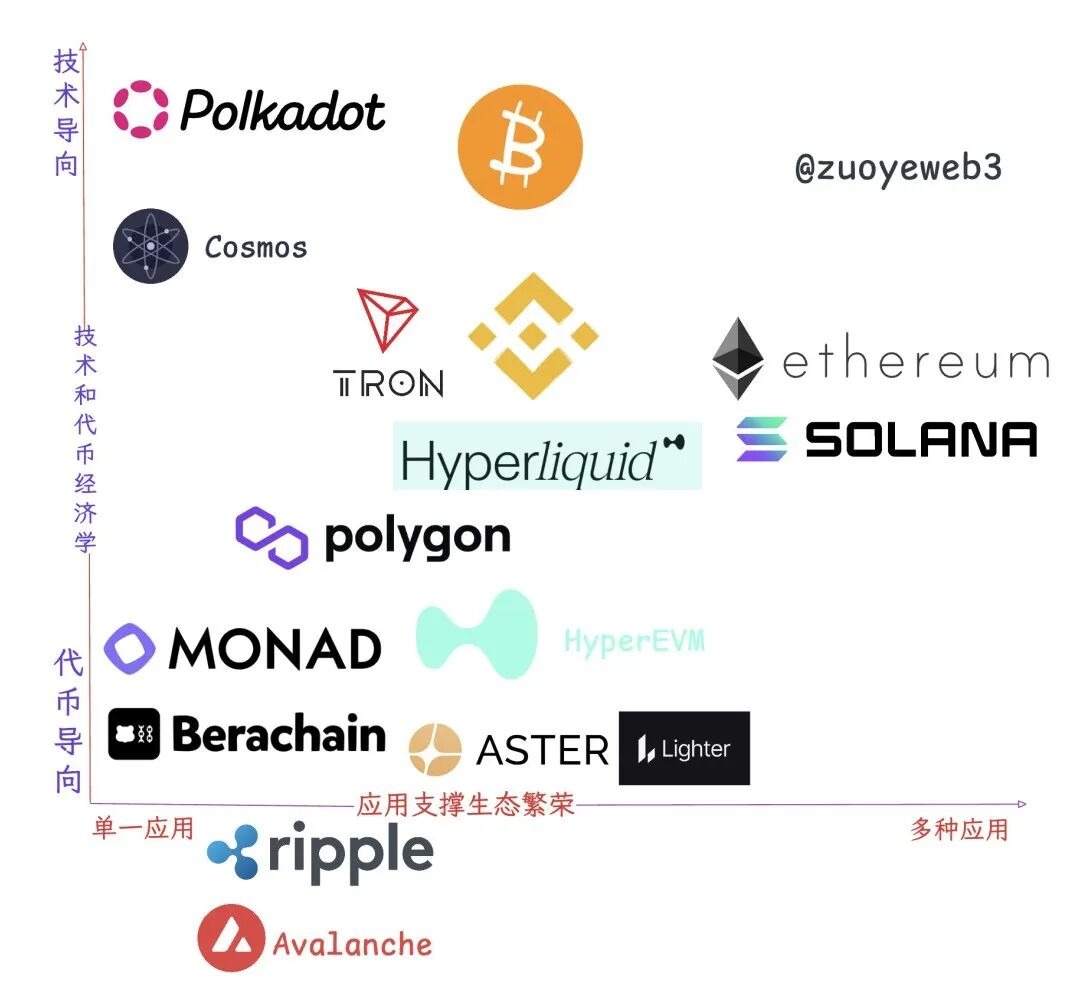

Image caption: Comparison between Binance and Hyperliquid, image source: @zuoyeweb3

Project parties need the "listing effect" from Binance, so they are willing to pay the highest channel fees, from Binance's main site spot and contracts to pre-market trading, and then to wallet Alpha and YZi Labs' EASY Residency, all of which are preferable.

Binance needs project parties to engage in "traffic operations" outside the main site to delay the death curve after listing, so the favored children on BNB Chain (like PancakeSwap and ListaDAO) need to accept the assets of project parties and continue the next wave of listing effects through operational actions.

This is the true role of the entire BNB and BNB Chain for Binance, but it is based on the premise that the Binance main site has a listing effect, which in turn triggers Hyperliquid's self-breakthrough.

If we are to correct the logic above, the rise of Hyperliquid is clear evidence. Perp has long adhered to the established logic of "spot first, then contracts," but Hyperliquid is not like that; it focuses on "trading Perp" itself. This is based on the entire industry, especially as exchanges can no longer guarantee a listing effect, and the mainstreaming of trading has become a consensus in the industry.

OKX cannot maintain project prices after listing, lacking liquidity and an on-chain DeFi ecosystem, and can only serve as a second-tier distributor for project parties. OKB lacks the ability to capture on-chain value and can only be used as an in-site coupon, losing its fundamental purpose;

Hyperliquid provides traders with a professional experience. After the collapse of FTX, HyperCore became synonymous with on-chain trading; the larger the transaction, the more Hyperliquid's liquidity support is needed.

To add, Aster and CZ once promoted "privacy/dark pool trading," but this could not shake Hyperliquid's market share. Outside of a few money laundering needs, privacy does not constitute a priority for traders, and the KYC requirement of the Binance main site is irrelevant.

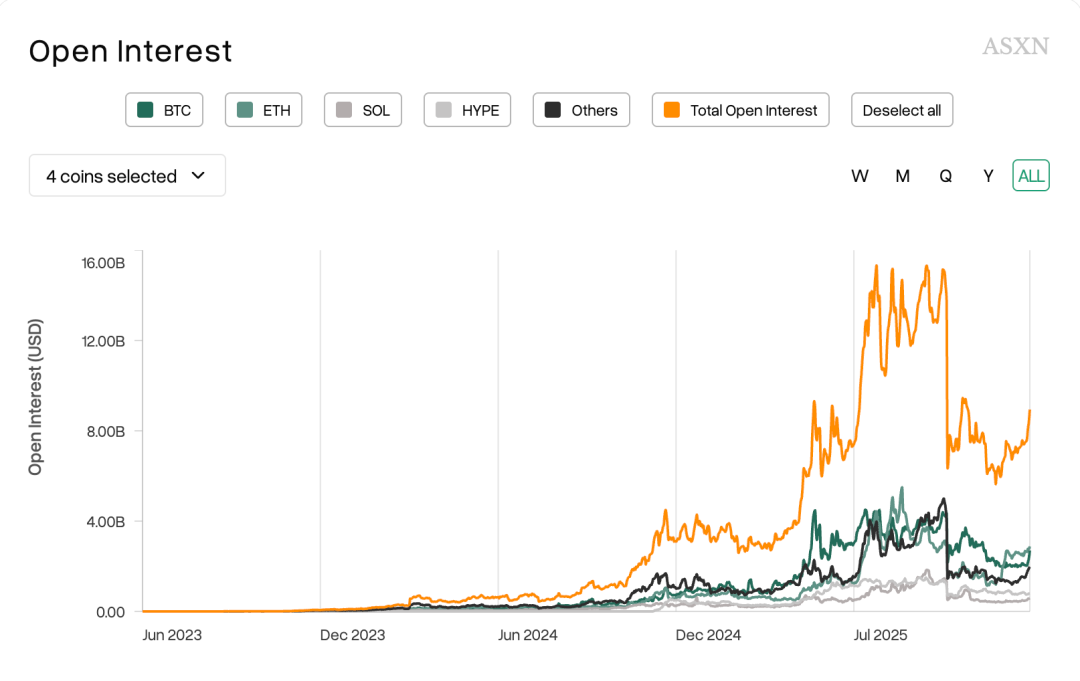

Image caption: Major trading mainstream coins, image source: @asxn_r

The truly fundamental and irreversible trend is that people only trade mainstream coins like BTC/ETH. New coins only have a certain trading volume when they are launched, from BeraChain to Monad, Sonic, and other new-generation L1s.

The "listing effect" that top exchanges rely on for survival, and the transaction fees that second and third-tier exchanges depend on, have helplessly entered history. This may be the real reason for exchanges to operate their own Perp DEX and focus on trading everything, accepting traditional finance (stocks, foreign exchange, and precious metals).

But none of this will harm Hyperliquid's liquidity. In the article RFQ Architecture: Market-Level Market Makers, An Alternative Choice for Latecomer Perp DEX, I pointed out that the advantage/characteristic of Variational lies in opening the market maker structure to ordinary retail investors, which is a real market demand. However, most of the volume competition in Perp DEX is a form of "early-stage debt," waiting to be realized at the TGE moment.

If you think that Bitget's golden marketing can capture Binance's derivatives market, then StandX's order points can challenge Hyperliquid's market share.

The better the liquidity in the market, the more it will become a daily place for traders. In the Perp DEX field, where the listing effect is even more lacking, the profiles of the yield farmers and real users diverge even more. Don't forget, most people are still relying on CEX to buy dual coins to win, let alone actually operating Perp on-chain.

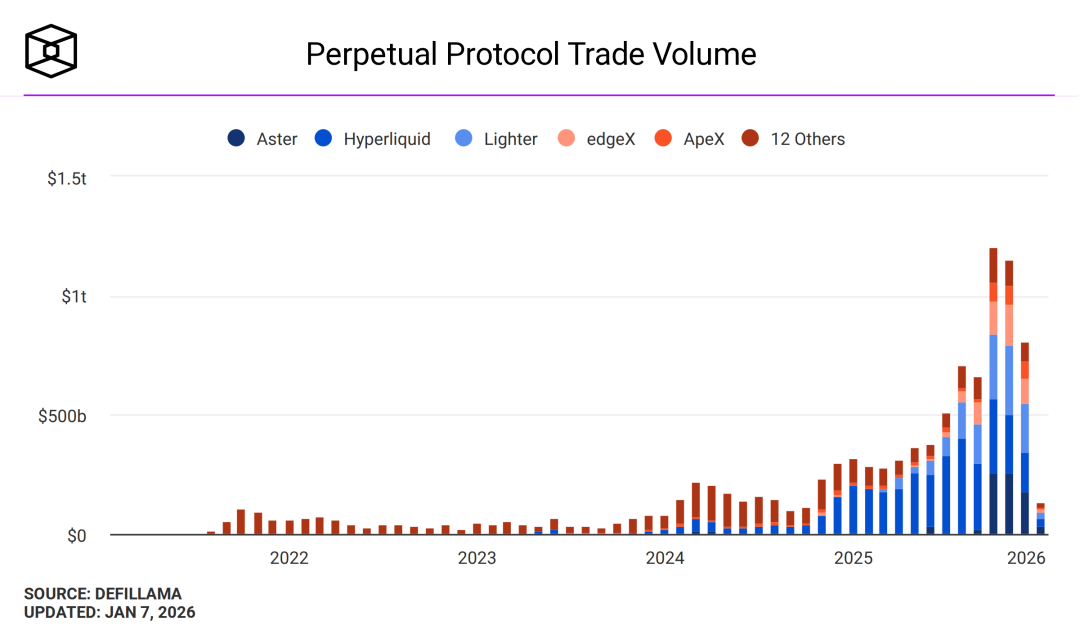

Image caption: Perp DEX trading volume, image source: @TheBlock__

Ligher accepts foreign exchange, and Edge builds its own Chain. Without defeating HyperCore's liquidity, it has inevitably become complex to support the narrative, which will inversely reduce its token value capture ability, evolving into something similar to OKB—a mere in-site coupon. To seriously address the regulatory expectations of Hyperliquid's "discount," since BitMEX, neither CEX nor DEX has ever been rejected by the market due to U.S. regulatory actions; only significant changes in market share have occurred due to theft or crashes.

Theft group: KuCoin (2020), ByBit (2025 stole over $1.4 billion)

Crash group: BitMEX 2020·3·12 unplugged

Reputation group: Huobi—Sun's pGala incident

Moreover, only SBF's FTX was killed by Coindesk's FUD and lost due to less experience in the industry compared to CZ. From this perspective, 1011 is merely an annual routine for established exchanges like Binance.

Now is a rare moment of regulatory relaxation for the SEC. Binance has officially landed in Abu Dhabi, and Hashkey has completed its IPO in Hong Kong. Hyperliquid does not exist in a state that cannot be regulated. Even if the Hyperliquid team insists on a "decentralized" facade, it can refer to Binance's sub-entity regulation, bringing the core clearing part into the regulatory framework.

Law is a barrier to entry for the weak, and compliance is the price of entry for the strong.

Public Chains Need Strong Operations

“Rewinding the historical clock, retro becomes the main melody.”

The listing effect of CEX and the volume brushing effect of DEX are both declining. Hyperliquid's liquidity is not an issue at all. HYPE has crossed the slaughter line and will not become the second FTT.

This is not the whole story. HYPE has yet to align with the HyperEVM ecosystem, failing to create a similar "false prosperity" to BNB's ecosystem, rather than a DeFi system similar to the ETH mainnet. This phenomenon has been detailed in Misalignment: Ethereum Bleeds, Hyperliquid Slows Down, and I will not elaborate further here.

This article focuses on the causes of the phenomenon and where the way out lies.

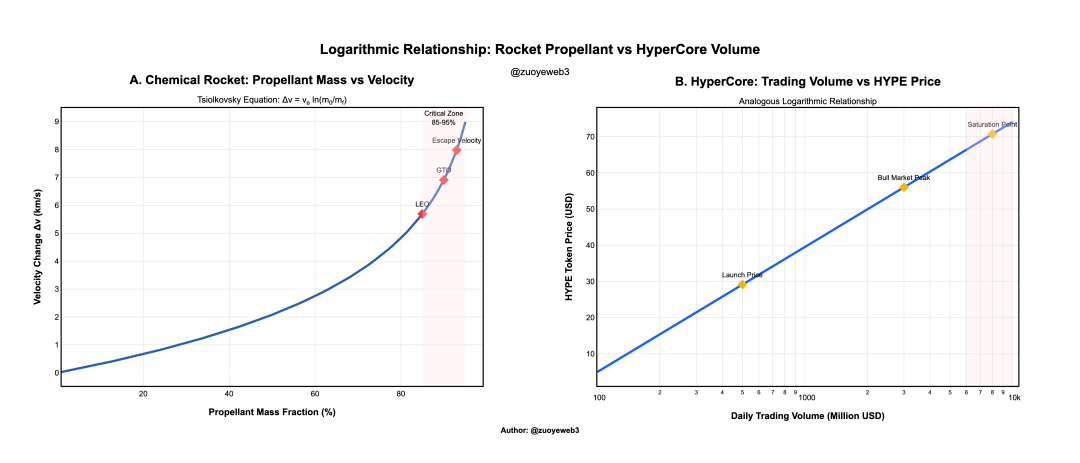

The relationship between rocket fuel and thrust is logarithmic, and the trading volume of HyperCore and the price of HYPE are also logarithmic.

Limited to the chemical rocket structure, this means that the quality of the fuel must increase exponentially to achieve linear speed increases. Currently, HyperCore's transaction fees support HYPE's price, but HyperCore's trading volume cannot increase indefinitely, especially under the full diversion of Binance and Perp DEX.

Image caption: Token price and trading volume, image source: @zuoyeweb3

Note that the above is only an explanation of movement changes. HYPE's initial price is in single digits, but stabilizing at $30 is the "initial fair valuation" in the public's view, and the trading volume has also been modified to illustrate the relationship between token price and HyperCore trading volume.

Note that this does not conflict with the idea that Perp DEX cannot eliminate Hyperliquid; the only assets in the crypto circle are BTC/ETH, and the overall Perp market scale has already reached a peak stage.

Let's deconstruct where the "Buddhist" attitude of the Hyperliquid team comes from. Perhaps this reasoning is not complicated, but it is sufficiently cruel. The Hyper team still regards BTC as the standard for public chains and still uses FTX as a reference for derivatives exchanges, learning from the good and avoiding the bad.

The auction Ticker for USDH is quite persuasive. Hyperliquid's official nodes do not participate in voting, do not designate any team, and do not provide official liquidity support. The current situation is that USDH lacks sufficient development potential and does not have significant advantages compared to USDC and USDe.

The "laissez-faire" approach of the Hyperliquid team is currently the biggest issue with HyperEVM. This is not to say that Hyperliquid lacks operational willingness or capability; perhaps everyone remembers that Hyperliquid first gained attention due to memes, and the subsequently launched Unit also has an "official" cross-chain bridge, with USDC long benefiting from direct access to HyperCore via Arbitrum.

However, all of this is limited to HyperCore. Perhaps the Hyperliquid team sees HyperCore as a product and HyperEVM as an ecosystem, where products require strong operations while ecosystems need to be sufficiently open.

Unfortunately, times have changed. Today's public chains resemble a Super App, and similar to internet giants, there have been no new mass-market products for years. TON, Monad, Berachain, and Sonic are all examples of this, and Plasma doesn't even resemble a stablecoin public chain; it looks more like a sophisticated vault.

The excessive maturity of on-chain infrastructure has led to public chains and L2s lacking direct network effects. They either compete for existing market share like ETH L1/Solana, or introduce RWA as a SaaS variant like Canton, or are artificially maintained like BNB Chain.

However, Jeff wants to avoid the disasters caused by FTX's strong operations, leading to a conservative strategy on the HyperEVM ecosystem. This results in project parties relying solely on community autonomy, unable to build interactions with HYPE, and can only experience rapid rise and fall after distributing HYPE.

Even the operational actions of HyperCore adhere to the principle of minimalism. You can observe the three accounts of Hyperliquid, Jeff, and Hyper Foundation, which have virtually no interaction with project parties.

This situation is suitable for the 2017 or 2020 DeFi Summer era, where the lack of corresponding positioning products on-chain meant that creating something equated to traffic and profit, even leading to excessive imagination about tokens. These conditions have now disappeared.

In fact, Hyperliquid does not need to change its style significantly; it only needs to learn from BNB's approach to build its own unique growth flywheel.

The way out for HYPE lies in imitating BNB.

Image caption: Relationship between ecosystem and applications, image source: @zuoyeweb3

Observing the public chains and L2s that can survive today, it is not simply a matter of ecological prosperity and strong interaction with mainnet token value capture. The reality is far more complex than the theory, with only ETH itself fitting the established impression, while the rest cannot be easily categorized.

In other words, ideals remain ideals and never manifest in reality.

Single application group: TRON and Polygon survive on single applications, the former with USDT and the latter with Polymarket;

Technology-oriented group (Tears of the Era group): Polkadot and ATOM, advanced in technology and philosophy, but their tokens cannot capture economic value;

Pure token-oriented: Monad/Berachain, no need to elaborate, their historical mission is complete once the tokens are issued.

Ecological prosperity group: Solana and Ethereum.

Existential group: Ripple, Avalanche, existence is everything, and everything is existence.

Further subdivisions can be made. The Binance main site and HyperCore are both in the "bucket group," where their tokens have strong value capture capabilities. Their products belong to multiple empowerment categories: spot/Perp trading, wealth management, staking, and even transfers—not public chains, but better than public chains.

The value of BNB Chain is as a component of the Binance main site in the form of a "public chain." With the departure of Daenerys and the arrival of Rong Ma, the reason Binance has not given up on BNB Chain is that many things are easier to manage as public chains than as exchanges; the value of traffic is long-term value.

However, Hyperliquid's HIP-3 is also an overflow of HyperCore liquidity, essentially competing for traffic entry with HyperEVM. This traffic battle is not only happening between HIP-3 project parties but also between Builder Code and HyperEVM project parties.

Hyperliquid aims to become the liquidity AWS, but its internal organizational structure has not been clarified.

BNB Chain is not the perfect form that Binance desires, but it is sufficient for Hyperliquid to learn from.

BNB Chain serves as a distribution channel for the Binance main site and cannot generate self-sustaining capabilities without strong operations, let alone feed back into Binance itself. However, this is already adequate for the current stage of HyperEVM.

Between minimizing operational principles and maintaining the openness of HyperEVM, there exists the possibility of taking a step forward, "designating" leaders in various tracks such as lending, swaps, and LSTs. The aborted HIP-5 proposal was too crude, and using repurchased HYPE to iterate and repurchase project tokens is also unfeasible.

Ecosystem collaboration does not violate any principles. The Hyperliquid team hardly interacts with any project parties, perhaps preferring to adopt off-chain cooperation similar to MM alliances, but on-chain exposure is still necessary.

If even the minimum level of HyperEVM operations is not conducted, we are likely to see HYPE at $50, lacking the imaginative support of HyperEVM's network effects.

Without the assistance of HyperEVM, HyperCore would need to rely on liquidity to reach the level of OKX, but that still wouldn't build the HYPE flywheel.

In summary, for the on-chain ecosystem, the "decentralized" HyperEVM has no way out.

Conclusion

“Hyperliquid is lighter than Binance, with higher capital efficiency. Lighter is not lighter than Hyperliquid, and Aster is even more eager to become complex.”

Perp DEXs like Aster and Edge, which are approaching or at TGE, will create their own L2/public chains as part of their valuation enhancement plans, just like PumpChain is part of the token issuance plan.

Now is the time for Hyperliquid to become complex, exchanging scale advantages for key moments in the future.

As mentioned earlier, Hyperliquid is not adept at innovating certain types of products (Jeff has also worked on prediction markets); it excels in engineering combinatorial capabilities. If FTX is not a good learning object, then BNB Chain is a great model to imitate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。