Author: C Labs Crypto Observer

According to the unaudited financial report disclosed by the Financial Times, Telegram, dubbed the dark version of WeChat, achieved a revenue of $870 million in the first half of 2025, a year-on-year increase of 65%, significantly up from $525 million in the same period of 2024.

From the perspective of "pulling in revenue," this is quite an impressive growth curve.

However, the problem lies in the profit side. Telegram recorded a net loss of over $220 million in the first half of 2025, while it had a net profit of $334 million in the same period last year.

The loss did not stem from a collapse in its core business but was due to a significant drop in the value of its held Toncoin (TON) in 2025, leading the company to write down the value of related assets.

PART 01: Telegram's Development History

Founded in 2013, Telegram is one of the most important instant messaging platforms in the world.

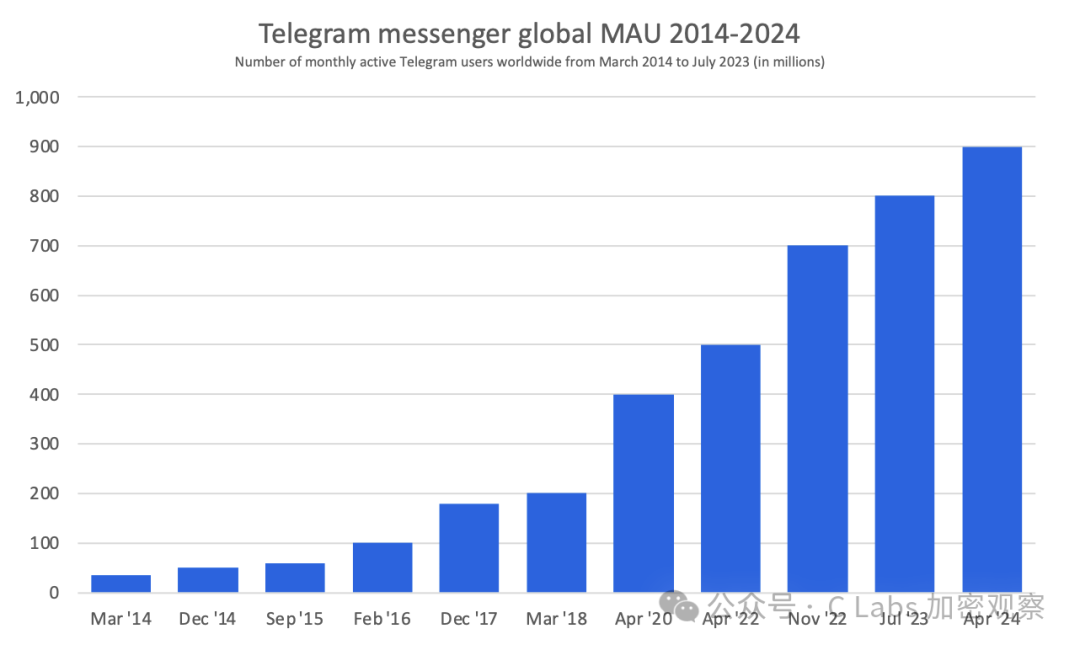

As of 2025, Telegram's monthly active users have exceeded 900 million, covering Europe, the Middle East, South America, and emerging markets, making it one of the fastest-growing social applications globally.

For crypto users, Telegram has become the de facto "public discussion layer" of the crypto industry: a large number of exchange announcements, project governance, airdrop information, OTC trading, and on-chain communities all use Telegram as their core platform.

This gives it a dual attribute of both a social platform and a financial information infrastructure.

PART 02: IPO Plans on Hold

Although Telegram announced it was preparing for an IPO, the reality is that its founder, Pavel Durov, is still under investigation in France (breaking news! tg founder arrested, TON price plummets).

Telegram has made it clear that it will not advance its IPO until compliance issues are clearer.

Fortunately, Telegram is not lacking in capital support; in May 2025, the company completed a $1.7 billion convertible bond financing, backed by top institutions including BlackRock and Mubadala.

PART 03: The Relationship Between Telegram and TON

The relationship between Telegram and TON is also complex.

In 2017, Telegram launched the blockchain project TON (Telegram Open Network), hoping to embed a payment system into the chat application and raised about $1.7 billion in 2018. However, it was forced to halt the project in 2019 due to the SEC's determination that it was involved in an unregistered securities offering. Telegram settled with regulators in 2020 and exited the project.

Subsequently, TON was reborn as a community public chain, with Telegram re-engaging in a "non-official but deeply integrated" manner, shining brightly in 2024.

Unfortunately, in 2024, after founder Durov was arrested, the momentum came to a sudden halt (TON chain collapsed? No new blocks have been produced for a long time).

The once-popular TON ecosystem projects have dwindled, with most coin prices retracting by over 70%:

However, from the latest disclosed financial report, it is clear that the relationship between Telegram and TON has long exceeded the scope of "official support for a public chain."

Significant Proportion of Revenue from TON

The financial report shows that about one-third of Telegram's revenue (approximately $300 million) comes from exclusive agreements related to TON, including wallet access, payment functions, and ecosystem integration.

At the same time, Telegram is also one of the most important sources of circulation for TON, having sold over $450 million of TON since 2025, accounting for about 10% of the current market value of TON.

This means that selling coins is a major business for Telegram, and the biggest market maker behind the TON price drop is Telegram itself!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。