An Experiment Cut Short

Federal employees successfully reduced by 271,000, a decrease of 9%, setting a record for the largest layoffs in peacetime. However, at the same time, total federal spending increased rather than decreased, soaring from $6.75-7.135 trillion in 2024 to $7.01-7.6 trillion in 2025, a net increase of $248-480 billion. This phenomenon of "losing weight but gaining mass" is the core contradiction of the DOGE (Department of Government Efficiency) reform.

Initially led by Elon Musk and Vivek Ramaswamy, this "external advisory" agency promised to dismantle the government bureaucracy using commercial methods, cut unnecessary regulations, and reduce wasteful spending, ultimately saving $2 trillion to balance the federal budget. This ambitious plan was expected to last until July 2026, giving them 18 months to transform the government. However, reality proved to be much harsher than expected: Musk hurriedly left in May, having only served a special government employee term of 130 days; by November, DOGE quietly disbanded, with a full 8 months remaining until the original term ended.

This was not an unfinished reform but a complete abandonment. From its launch to its disappearance, DOGE's actual lifespan was only about 10 months. When the savings targets became clearly unattainable, legal challenges mounted, and public disputes with Trump emerged, Musk chose to return to his business empire, leaving behind a gradually disintegrating agency and a pile of unresolved issues. This rapid fall from ambition to disillusionment exposed not only the missteps in reform strategy but also the insurmountable fundamental gap between corporate logic and government operations.

I. A Complete Divergence Between Grand Goals and Harsh Realities

DOGE's reform vision was filled with Silicon Valley-style idealism. They planned to terminate billions of dollars in inefficient contracts through lean management principles, close redundant facilities, reduce the federal workforce from about 3.015 million to a more streamlined size, and replace some bureaucratic functions with AI and automation tools. This methodology has proven effective in the business world; why couldn't it be used to transform the government?

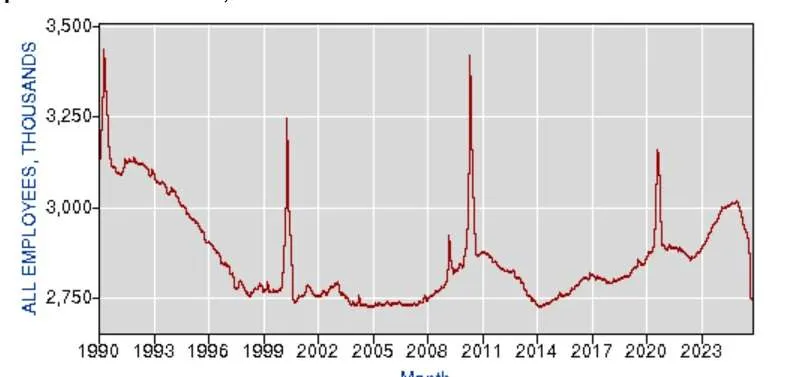

Figure: Number of federal employees since 1990

In January 2025, Musk joined DOGE as a special government employee, with a term set for 130 days. In Silicon Valley, 130 days is enough to launch a product prototype, complete a round of financing, or even turn around a startup's fortunes. In the initial months, DOGE demonstrated dazzling execution. From January to November, the federal workforce decreased from 3.015 million to 2.744 million, a net reduction of 271,000 positions. This was not only the largest peacetime federal layoff since World War II, but the speed of execution was also astonishing. Specific actions included terminating a $290 million refugee facility contract with the Department of Health and Human Services, a $190 million IT redundancy expenditure with the Treasury, and closing hundreds of inefficient agencies and projects, totaling over 29,000 cut actions. DOGE claimed to have saved about $21.4-25 billion through these measures, primarily in non-defense federal discretionary spending, which decreased by 22.4% year-on-year.

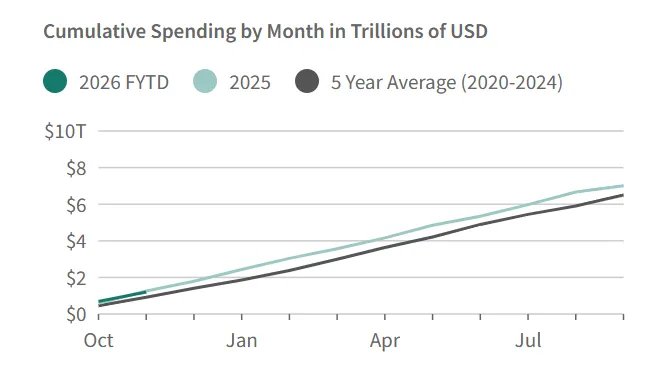

Figure: Cumulative federal government spending

However, the spending data told a completely different story. Overall federal spending rose from about $6.75-7.135 trillion in 2024 to about $7.01-7.6 trillion in 2025, an increase of 4%-6%. Spending in just the first 11 months reached $7.6 trillion, an increase of $248 billion compared to the same period. Ironically, some independent analyses pointed out that the savings figures claimed by DOGE might be severely exaggerated, with actual verifiable savings possibly only in the tens of billions, or even as low as $3 billion. The weakening of IRS enforcement capabilities could lead to a tax revenue loss of at least $350 billion over the next decade, making the so-called "savings" net effect close to zero or even negative.

The resistance of reality soon became apparent. Federal spending continued to climb, with mandatory expenditures such as Social Security, Medicare, and interest on national debt completely unaffected by administrative layoffs. By May, multiple pressures converged. Musk's relationship with Trump began to deteriorate, and the two publicly clashed. Legal challenges followed, questioning DOGE's authority and procedural legitimacy. Tesla's business also called for his return—stock price fluctuations, production issues, and market competition all required the CEO's attention. Most critically, the $2 trillion savings target had clearly become an impossible task; remaining in a project destined to fail was of no benefit to Musk's personal brand. Upon the completion of his 130-day term, Musk announced his return to the private sector. He did not apply for an extension or request more resources but chose to leave decisively. This decision itself was the loudest acknowledgment: transforming government using commercial methods was far more difficult than he had imagined.

II. The Struggle of the Headless Horseman: The Decline from May to November

After Musk's departure, DOGE attempted to prove it could continue to exist. The White House signaled that the "DOGE spirit" would be integrated into the daily operations of the government, becoming part of the "government lifestyle." Some former DOGE employees were embedded in various federal agencies to continue pushing for layoffs and cost reductions. Ramaswamy nominally continued to lead the agency, trying to maintain the momentum of reform.

But DOGE without Musk was like a rocket without an engine; inertia could only last for a while. Without the star founder's aura, the agency's visibility quickly diminished. Without direct communication channels with Trump, DOGE's influence within the government significantly waned. More importantly, the limitations of the reform became increasingly apparent—those large expenditure items that truly required congressional legislation to change were completely beyond DOGE's reach.

During this time, DOGE's achievements became increasingly difficult to define. Although some layoff actions continued, spending data kept rising. Reports of service interruptions began to increase. Social Security applications were delayed, regulatory vacuums emerged, and some key positions remained unfilled due to excessive layoffs. Criticism grew louder: in the name of optimizing efficiency, DOGE was undermining the basic operational capacity of the government. Legal challenges also accumulated, questioning whether many of DOGE's actions exceeded its administrative authority.

By November, several authoritative media outlets began reporting a fact: DOGE had quietly disbanded. Reuters, TIME, CNN, Newsweek, and others described the agency's fate with terms like "disbanded," "quietly shut down," and "no longer exists." There was no formal disbandment announcement, no press conference; DOGE simply disappeared from public view. Its charter, originally set to last until July 2026, was terminated early, with many functions transferred to the Office of Personnel Management or other regular agencies.

This silent ending perhaps speaks more than any failure could. There wasn't even a decent farewell, as acknowledging failure itself is an embarrassment. DOGE transformed from a revolutionary agency promising to change the government into a brief interlude that everyone hoped to forget quickly.

III. The Underlying Logic of "Layoffs Without Savings"

1. The Iron Wall of Mandatory Spending

The most fundamental difference between the government financial system and businesses is that over 70% of federal spending consists of mandatory programs, which are automatically increased by law and are influenced by demographics, economic cycles, and interest rate fluctuations, completely unaffected by administrative layoffs. Data for 2025 clearly illustrates this rigidity: welfare spending such as Social Security and Medicare increased by about $168 billion, primarily driven by an aging population and inflation adjustments; interest costs on national debt surged by $71 billion, with the debt expanding to $36-38.3 trillion, and interest expenditures even exceeding the defense budget, becoming the largest single item of federal spending.

These rigid expenditures directly offset all of DOGE's savings efforts. Even if administrative personnel were cut, Social Security payments still had to be executed according to statutory formulas, Medicare subsidies still had to be distributed based on the number of insured individuals, and interest on national debt had to be paid on time to maintain national credit. As an administrative agency, DOGE could not unilaterally modify welfare programs authorized by Congress, meaning that reform was limited from the start to "peripheral areas," unable to touch the "core areas" of spending.

At a deeper level, this rigidity stems from constitutional and legislative frameworks. The government is not a profit-seeking business but a public institution that bears the function of a social safety net. When a 65-year-old applies for Social Security, the government cannot refuse payment in the name of "optimizing costs." This is the essential difference between government and business, and the fundamental reason why commercial thinking hits a wall here.

2. The "Trade-off" of Inter-departmental Spending

DOGE did achieve some results in the realm of discretionary spending. They terminated 5,200 projects and hundreds of billions of dollars in contracts in departments such as Health and Human Services, Education, and the International Development Agency, saving about $37 billion. However, these savings were quickly consumed by increases in other departments. Defense spending rose due to geopolitical tensions, and infrastructure investments ballooned due to priorities set by the Trump administration, while the spillover effects of mandatory spending further inflated the overall budget.

The result was "localized weight loss, overall expansion." This is similar to the "savings transfer" phenomenon often seen in corporate mergers—costs cut in one department often reappear in another form in other departments. But the government lacks the flexible adjustment mechanisms of businesses and cannot quickly reallocate resources like a company. The spending growth in 2025 also included emergency responses (increased natural disaster funds) and inflation adjustments (CPI rising about 3%-4%), which further amplified the "trade-off" effect.

Specific data shows that DOGE's savings accounted for only 0.3%-0.5% of total spending, far from enough to reverse the overall trend. Mandatory spending increased by $221 billion in 2025, discretionary spending increased by $80 billion, and net interest costs rose by $71 billion. When you save billions in one pocket but pull out hundreds of billions from three other pockets, the so-called "efficiency improvement" becomes a numbers game.

3. The Cost Inertia of Institutional Operations and Transformation Friction

Layoffs are never a zero-cost operation, especially in the government system. Implementing DOGE's reforms generated enormous expenditures: severance pay, paid leave, and costs of re-hiring after wrongful dismissals, totaling an estimated $135 billion. This figure far exceeds many of the "savings" projects claimed by DOGE. More hidden costs arise from productivity losses and service interruptions.

The operation of government agencies heavily relies on institutional memory and human networks. When a large number of experienced employees leave, Social Security applications begin to be delayed, regulatory vacuums emerge, and the efficiency of policy implementation actually declines. Although AI and automation are highly anticipated, these tools are far from mature enough to completely replace human judgment. Algorithmic governance may be efficient, but it also brings new issues such as data privacy breaches and algorithmic bias. In the transition from a "public service apparatus" to a "data-driven terminal," the government is losing certain intangible yet crucial elements—legitimacy, social cohesion, and public trust.

A more practical issue is that the remaining employees' overtime pay increases, and the costs of contract outsourcing rise. The government often pays a higher price when outsourcing work that was originally done internally to private contractors. In the long term, large-scale talent loss may create a "knowledge gap," affecting policy continuity and the accumulation of professional capabilities.

Conclusion: Who Lost? Reflecting on the Costs and Boundaries of Reform

In this clash between ideals and reality, who are the ultimate losers? Perhaps it is primarily the idealistic reformers who underestimated the complexity of government operations, mistakenly believing that business logic could be directly transplanted into the public sector. Taxpayers may benefit in the short term from localized savings, but they face the risk of service reductions and declining quality in the long term. Beneficiaries of public services, especially those reliant on Social Security and Medicare, may suffer from service interruptions and reduced efficiency.

At a deeper level, the potential losers may be the sustainability of the entire system and its democratic legitimacy. When the government is treated as a business to be "optimized," values that cannot be measured in numbers—fairness, stability, social cohesion—are quietly eroding. Polls show that DOGE's approval rating hovers around 40%, reflecting a coexistence of public recognition of efficiency improvements and concerns over service interruptions.

However, this collision is not without significance. If DOGE can prompt Congress to take action and genuinely address core issues such as welfare reform and debt control, it could still become a historical turning point. The key lies in recognizing that the government is not a business; efficiency needs to be balanced with fairness, sustainability, and democratic principles. Businesses can sacrifice everything for profit, but the government must preserve the last line of defense for the most vulnerable members of society. This is the most important lesson that commercial thinking needs to learn, and it is the profound insight that this intense collision leaves us with.

Data for this report was edited and compiled by WolfDAO. For any inquiries, please contact us for updates.

Written by: Nikka / WolfDAO (X: @10xWolfdao)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。