作者:吴说区块链

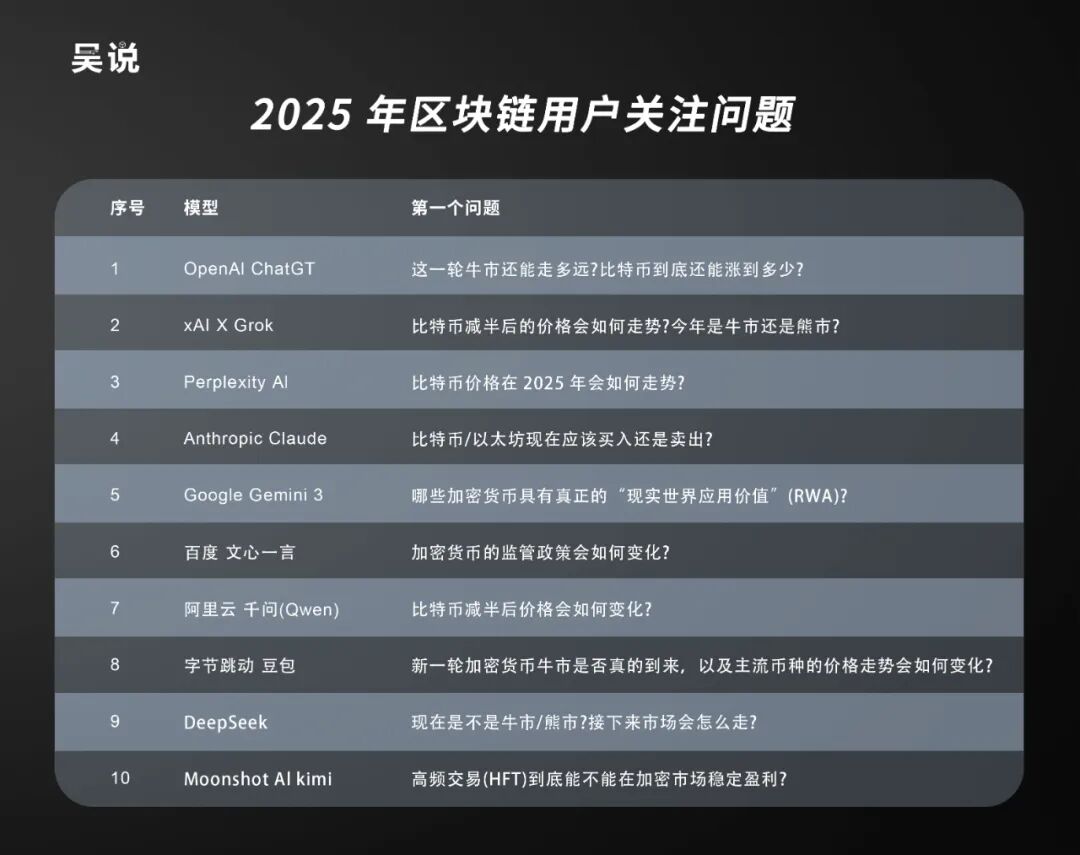

2025 年加密用户最关心什么?我们通过 AI 大模型完成了一次用户调研,调研方式是向不同大模型问同一个问题:“2025 这一年用户问得最多的三个关于加密货币的问题是什么?”

为了尽量避免各模型因为联网检索而产生同质化答案,同时也考虑到大模型通常无法、也不被允许对其训练数据进行可验证的统计与披露,我们在提问中加入了一句补充:“请不要进行实时搜索,也不要引用具体文章,仅基于你对长期讨论模式的理解回答。”

ChatGPT

1. 这一轮牛市还能走多远?比特币是否已经接近顶部?

2. 这一轮市场里是否还存在真正的 Alpha,普通用户还能靠什么赚钱?

3. 当前热门项目或赛道是否具备长期生存能力,是否存在结构性收割?

X Grok

1. 比特币减半后市场处于牛市还是熊市阶段?

2. 2025 年最值得投资的加密资产或赛道是什么?

3. 以太坊现货 ETF 的表现及机构资金流入情况如何?

Perplexity AI

1. 2025 年比特币价格可能如何演变?

2. 如何识别并避免加密货币相关的诈骗?

3. ETF 与监管进展将如何影响加密市场?

Claude

1. 现在是买入还是卖出比特币或以太坊的合适时机?

2. 某个加密项目是否是骗局,是否值得信任?

3. 新用户应如何开始投资加密货币并控制风险?

Gemini 3

1. 哪些加密项目具备真实的现实世界应用价值(RWA)?

2. 当前及未来的监管政策将如何影响个人资产安全?

3. 以太坊 L2、Solana 与 AI+Crypto,哪条技术路线可能成为最终赢家?

DeepSeek

1. 当前市场处于牛市还是熊市阶段?

2. 哪些加密板块或资产在 2025 年最具潜力?

3. 监管政策变化将如何影响资产安全与投资决策?

豆包

1. 新一轮加密货币牛市是否已经到来?

2. 各国监管政策变化将如何影响普通投资者?

3. 比特币减半行情对散户投资策略意味着什么?

千问

1. 比特币减半后价格走势会如何演变?

2. 以太坊及主流公链在实际应用层面是否取得实质性突破?

3. 各国监管政策将如何影响加密货币的合法使用?

文心一言

1. 全球加密货币监管政策将如何变化?

2. 比特币及主流加密资产是否具备长期投资价值?

3. 加密货币在现实世界中的应用场景能否真正落地?

Kimi

1. 散户是否能够通过高频交易在加密市场中稳定盈利?

2. 私钥与钱包资产应如何存储才是最安全的方案?

3. 在链上交易中,如何设置滑点以避免 MEV 损耗?

总结

这些模型给出的“前三问题”之所以不完全一样,可能和它们各自的定位与语境有关。ChatGPT 更像站在交易者视角,把讨论组织成“周期还能走多远 — Alpha 还在不在 — 是否结构性收割”这种偏结构化的焦虑链条;Grok 更贴近社交平台热点,围绕减半、牛熊与 ETF 资金这些市场叙事中心展开;Perplexity 的风格更像检索型摘要,集中在价格走势、防诈骗与 ETF/监管进展;Claude 更谨慎,强调买卖时机、项目可信度和新手风控;Gemini 则更偏产业与技术路线,关注 RWA、监管对资产安全的影响,以及 L2/Solana/AI 的“终局选择”。中文区模型整体更集中在周期、减半与监管这三类“最硬核的确定性变量”,而 Kimi 相对例外,把问题下沉到链上执行细节(钱包安全、滑点/MEV、HFT),更像来自高频链上用户的真实摩擦。

另外一个更次要、但值得留意的可能性是:模型能力差异也会影响输出的“锐度”。水平更强的模型往往更能把同一个话题问得更具体、更成体系;相反,能力较弱的模型更容易落回“价格/监管/骗局”这类最大公约数式表达,导致答案看起来更像、信息增量更小。这个因素未必是主因,但在宏观开放题里,它确实可能放大同质化的观感。

综合来看,这些问题高度集中在三个母主题上:周期位置、赚钱路径、风险边界。加密市场的显著特征是高波动与强叙事驱动,因此“现在处于牛熊哪一段”几乎决定了用户的所有后续行动(拿住、卖出、换仓、加杠杆或离场)。而当市场进入更成熟、更拥挤的阶段,用户会迅速从“有没有机会”转向“机会在哪里、我还能不能吃到”,于是 Alpha、赛道选择与机构资金(ETF)自然成为高频议题。与此同时,诈骗、项目可信度、资产安全与监管合规,反映的是加密用户长期处在“高收益/高不确定”的环境中:一边追逐收益,一边担心踩雷,最终形成一种典型的行为结构 — — 先判断趋势,再寻找机会,最后控制风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。