Bitcoin’s quirky price movements have largely defied logic over the past couple of months, and today’s market action was no different. BTC treasury firm Strategy (Nasdaq: MSTR) announced a 4.535 million share offering that yielded $748 million in proceeds, bringing the company’s war chest to $2.19 billion in cash, on top of its existing 671,268 BTC stockpile, worth roughly $60 billion at current prices. The transaction effectively diluted current shareholders, a prima facie bearish move. Why then did bitcoin’s price rise in response?

Read more: Saylor Buys Nearly $1B Worth of Bitcoin, Then It Plunges 4%

The sale is a type of transaction called an “at-the-market” offering, or simply ATM. This is where a public company raises additional capital by issuing new shares to the market, typically to fund operations or pay off debt. Strategy’s case falls into the latter category, with the firm’s stated objective being “to support the payment of dividends on its preferred stock and interest on its outstanding indebtedness.”

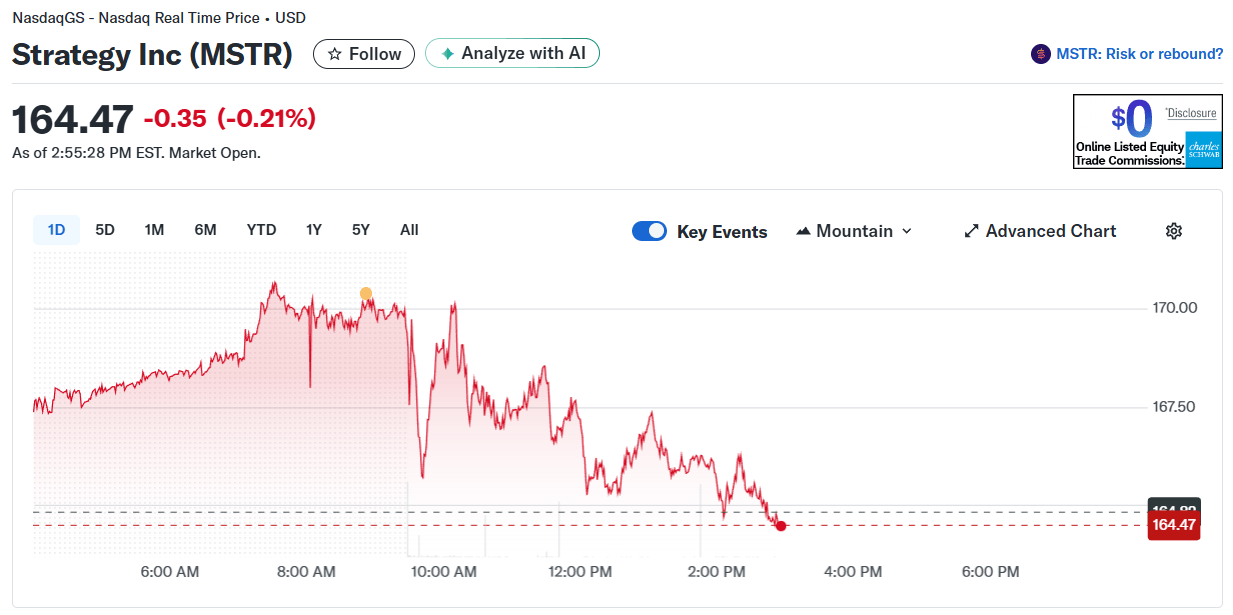

(MSTR was down slightly on Monday, following the announcement of its $748 million ATM. / Yahoo Finance)

But ATMs generally elicit a negative reaction because they dilute existing shareholders. In fact, MSTR was down slightly on Monday afternoon following the announcement. Strategy investors in particular typically seek a gradually increasing bitcoin-per-share ratio, yet today’s ATM decreases that key metric. The transaction has now raised questions: is Strategy already in financial trouble or is the company simply buttressing its balance sheet in the face of what is increasingly resembling a sustained bear market?

“They just diluted common stock holders to increase the cash on hand to pay preferred stock holders their interest payments coming due,” said Vinny Lingham, co-founder of crypto hedge fund Praxos Capital. “This dilutes BTC/share for common holders. This is so antithetical to the narrative over the past couple of years.”

Lingham’s comment is mostly accurate, but given the headwinds digital asset treasury firms (DATs) are currently facing in light of the recent crypto price collapse, Strategy’s ATM could be viewed as a prudent long-term move that prioritizes financial stability despite the resultant dilution. That perspective may help explain BTC’s upward swing earlier today.

“Building a $2.19B cash reserve strengthens their credit profile and ability to issue future preferred at tighter spreads,” said Douglas Borthwick, CEO of equity management startup Token Cap Stack, in response to Lingham’s comment. “Lower cost of capital = more BTC per dollar of dilution. Playing the long game for accretion, not just servicing current obligations.”

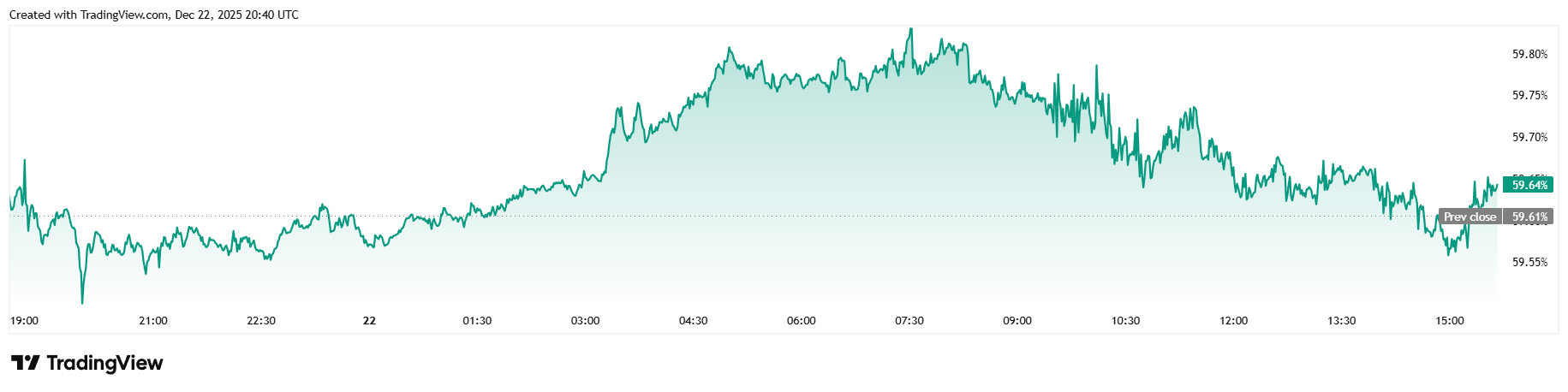

Bitcoin was trading at $88,306.81 at the time of reporting, up 0.11% for the day and 2.84% for the week, according to Coinmarketcap data. The cryptocurrency reached a low of $87,908.07 and traded as high as $90,501.93 over the past 24 hours.

( BTC price / Tradingview)

Daily trading volume jumped 89.98% to $36.76 billion after a weekend lull. Market capitalization was mostly flat at $1.75 trillion. Bitcoin dominance inched upward by 0.07% to 59.65%, as BTC defended its market cap against competing alts.

( BTC dominance / Trading View)

Total bitcoin futures open interest rose 1.49% to $58.90 billion, based on data from Coinglass. Liquidations for the day were similar to Friday’s numbers, coming in at a total of $107.35 million. Long investors and short sellers split the losses $55.74 million and $51.61 million, respectively.

- Why did bitcoin rise even as Saylor sold 4.5 million Strategy shares?

Bitcoin appears to have reacted to broader market sentiment and liquidity conditions rather than Strategy’s shareholder dilution. - What was the purpose of Strategy’s $748 million share sale?

The company raised cash mainly to pay preferred dividends and interest, boosting its balance-sheet flexibility. - Does the sale hurt Strategy’s common shareholders?

Yes, issuing new shares dilutes existing holders and lowers bitcoin per share in the short term. - Could the transaction still be positive long term?

Some investors believe the larger cash buffer improves Strategy’s staying power and supports future bitcoin accumulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。