The market lacks hotspots, and the meme old tune is being repeated.

The crypto market in December is as cold as the weather.

On-chain transactions have been hibernating for a long time, and new narratives are hard to come by. Just look at the bickering and gossip that the Chinese crypto community has been discussing these days, and you’ll know that not many people are playing in this market anymore.

However, the English community has been discussing something new these days.

A meme coin called Snowball launched on pump.fun on December 18, and within four days, its market cap surged to $10 million, still reaching new highs; while hardly anyone in the Chinese circle has mentioned it.

In the current environment where there are no new narratives and even meme coins are not being played, this is one of the few things that stands out and has a bit of a localized wealth effect.

The name Snowball translates to the "snowball effect," which is the story it wants to tell:

A mechanism that allows the token to "roll bigger by itself."

Turning transaction fees into buy orders, rolling the snowball for market making

To understand what Snowball is doing, you first need to know how tokens typically make money on pump.fun.

On pump.fun, anyone can create a token in a few minutes. The token creator can set a "creator fee," which is essentially a percentage taken from each transaction into their own wallet, usually between 0.5% and 1%.

Theoretically, this money can be used for community building and marketing, but in practice, most developers choose to: run away once they have enough.

This is also part of the typical lifecycle of a "meme coin." Launch, pump, harvest fees, and run away. Investors are betting not on the token itself, but on the developer's integrity.

Snowball's approach is to not take this creator fee money.

To be precise, 100% of the creator fees do not go into anyone's wallet but are automatically transferred to an on-chain market-making robot.

This robot performs three tasks at regular intervals:

First, it uses the accumulated funds to buy tokens on the market, creating buy support;

Second, it adds the purchased tokens and corresponding SOL to the liquidity pool, improving trading depth;

Third, it destroys 0.1% of the tokens with each operation, creating deflation.

At the same time, the percentage of creator fees collected by this coin is not fixed and fluctuates between 0.05% and 0.95% based on market cap.

When the market cap is low, it takes a bit more to allow the robot to accumulate ammunition faster; when the market cap is high, it decreases to reduce trading friction.

In one sentence, the logic of this mechanism can be summarized as, every time you trade, a portion of the money automatically becomes buy orders and liquidity, rather than going into the developer's pocket.

Therefore, you can easily understand this snowball effect:

Transaction generates fees → Fees become buy orders → Buy orders push up prices → Prices attract more trades → More fees… theoretically, it can roll by itself.

On-chain data situation

Having explained the mechanism, let’s look at the on-chain data.

Snowball launched on December 18, and now it has been four days. The market cap has surged from zero to $10 million, with a 24-hour trading volume exceeding $11 million.

For a meme coin on pump.fun, this achievement is already considered quite long-lived in the current environment.

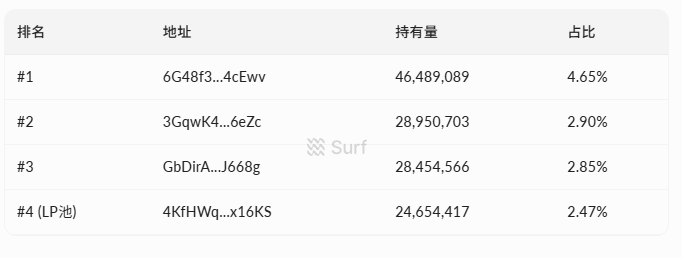

In terms of chip structure, there are currently 7,270 holders. The top ten holders together account for about 20% of the total supply, with the largest single holder accounting for 4.65%.

(Data source: surf.ai)

There is no situation where one address holds 20-30% of the chips, and the distribution is relatively decentralized.

In terms of trading data, there have been over 58,000 transactions since launch, with 33,000 buys and 24,000 sells. The total amount bought is $4.4 million, and the total amount sold is $4.3 million, resulting in a net inflow of about $100,000. Buying and selling are basically balanced, with no one-sided selling pressure.

The liquidity pool holds about $380,000, half in tokens and half in SOL. For this market cap size, the depth is not very thick, and large orders will still have noticeable slippage.

Another noteworthy point is that Bybit Alpha announced the listing of this token less than 96 hours after its launch, which to some extent confirms the short-term popularity.

Opportunities for perpetual motion in a cold market

After browsing around, it can be seen that discussions in the English community about Snowball mainly focus on the mechanism itself. Supporters' logic is straightforward:

This is the first meme coin that locks 100% of the creator fees into the protocol, making it impossible for developers to run away with the money, at least structurally safer than other meme coins.

The developers are also cooperating with this narrative. The developer wallet, market-making robot wallet, and transaction logs are all public, emphasizing "on-chain verifiability."

@bschizojew labels himself as "on-chain schizophrenia, 4chan special forces, first-generation meme coin veteran," with a self-deprecating degen flavor that resonates well with the crypto-native community.

However, the safety of the mechanism and the ability to make money are two different things.

The premise of the snowball effect is that there is enough trading volume to continuously generate fees to feed the robot for buybacks. The more transactions there are, the more ammunition the robot has, the stronger the buy orders, the higher the price, attracting more people to trade…

This is also the ideal state for any meme coin's so-called buyback flywheel to spin in a bull market.

The problem is that the flywheel needs external power to start.

What is the current environment of the crypto market? On-chain activity is sluggish, the overall heat of meme coins is declining, and there is already little capital willing to rush into meme coins. In this context, if new buy orders do not keep up, trading volume shrinks, and the fees the robot can receive will decrease, weakening the buyback force, reducing price support, and further decreasing trading willingness.

The flywheel can turn positively or negatively.

The more realistic problem is that the mechanism addresses only the risk point of "developers running away with money," but meme coins face risks far beyond this.

Market manipulation, insufficient liquidity, and outdated narratives—any one of these can limit the effectiveness of a 100% fee buyback.

Everyone is scared of being cut, and a brother in the Chinese circle summed it up quite well:

Play for fun, but don’t get too carried away.

Not just one snowball is rolling

Snowball is not the only project telling this automatic market-making story.

Also in the pump.fun ecosystem, a token called FIREBALL is doing something similar: automatic buybacks and burns, packaged as a protocol that other tokens can connect to. But its market cap is much smaller than Snowball.

This indicates that the market is currently responsive to the direction of "mechanism-based meme coins."

The traditional methods of shouting orders, pumping, and community speculation are becoming increasingly difficult to attract capital. Using mechanism design to tell a story of "structural safety" may be one of the recent tactics for meme coins.

However, when it comes to artificially creating a certain mechanism, it’s not a new play.

The (3,3) of OlympusDAO in 2021 is the most typical case, using game theory to package the staking mechanism, telling the story that "if everyone doesn’t sell, we can all earn together," with its market cap soaring to tens of billions at its peak. The outcome is well-known, a spiral decline, dropping over 90%.

Even earlier, there was Safemoon's "tax on every transaction distributed to holders," which was also a mechanism innovation narrative, ultimately leading to an SEC lawsuit and the founder being accused of fraud.

Mechanisms can be great narrative hooks, capable of gathering capital and attention in the short term, but the mechanism itself does not create value.

When external capital stops flowing in, even the most sophisticated flywheel will come to a halt.

Finally, let’s summarize what this little meme coin is actually doing:

Turning the creator fees of meme coins into an "automatic market-making robot." The mechanism itself is not complex, and the problem it solves is very clear: it prevents developers from directly taking the money and running away.

Just because developers can’t run away doesn’t mean you can make money.

If you find this mechanism interesting and want to participate, remember one thing: it is primarily a meme coin, and only secondarily an experiment of a new mechanism.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。