Author: Gino Matos

Translation: Luffy, Foresight News

Since January 2024, the performance comparison between cryptocurrencies and stocks indicates that the so-called new type of "altcoin trading" is essentially just an alternative to stock trading.

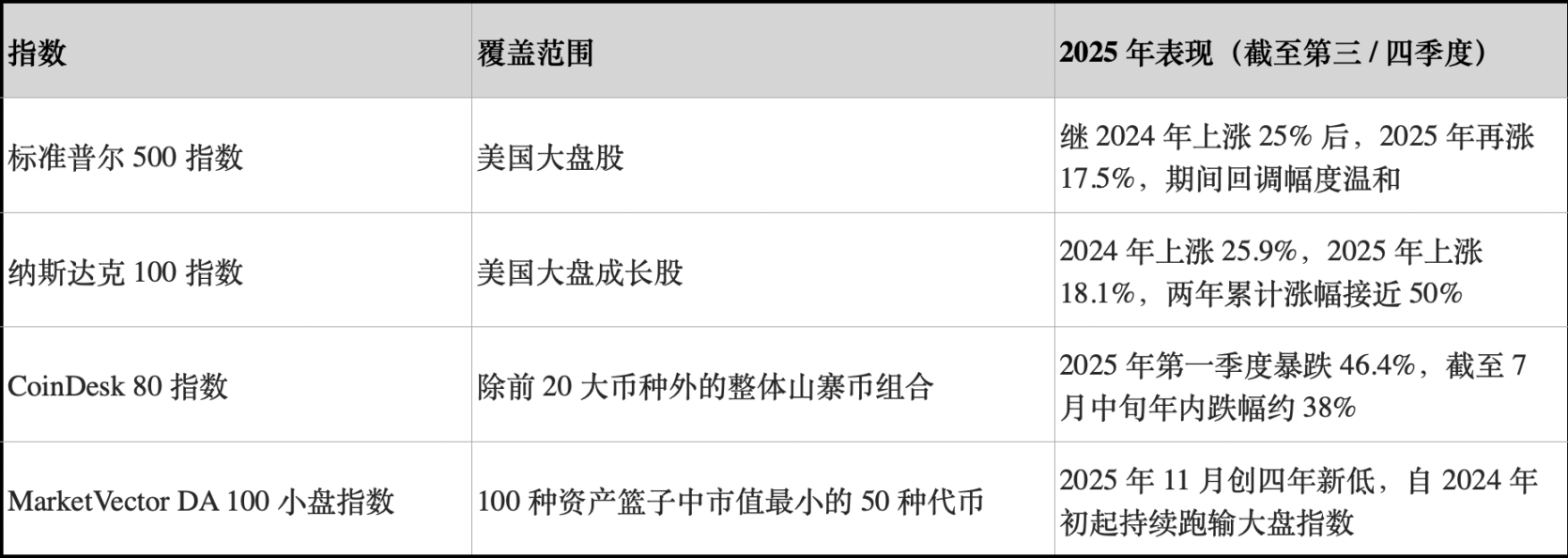

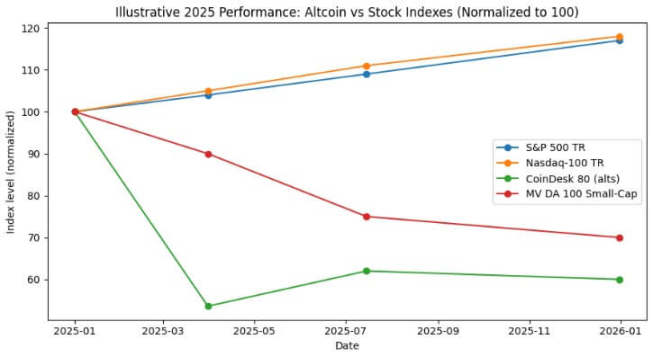

In 2024, the S&P 500 index had a return of about 25%, reaching 17.5% in 2025, with a cumulative increase of about 47% over two years. During the same period, the Nasdaq 100 index increased by 25.9% and 18.1%, with a cumulative increase close to 49%.

The CoinDesk 80 index, which tracks 80 assets outside the top 20 by cryptocurrency market capitalization, plummeted by 46.4% in the first quarter of 2025 alone, and by mid-July, it had fallen about 38% for the year.

By the end of 2025, the MarketVector Digital Assets 100 Small Cap Index fell to its lowest level since November 2020, resulting in a total evaporation of over $1 trillion in cryptocurrency market capitalization.

This divergence in trends is by no means a statistical error. The overall altcoin portfolio not only has a negative return but also exhibits volatility comparable to or even higher than that of stocks; in contrast, the major U.S. stock indices achieved double-digit growth with manageable pullbacks.

For Bitcoin investors, the core question is: can allocating to small-cap tokens actually yield risk-adjusted returns? Or is this allocation merely taking on additional exposure to negative Sharpe ratio risks while maintaining a correlation similar to that of stocks? (Note: The Sharpe ratio is a key metric for measuring the risk-adjusted return of a portfolio, calculated as: portfolio annualized return - annualized risk-free rate / portfolio annualized volatility.)

Choosing a Reliable Altcoin Index

For analysis, CryptoSlate tracked three altcoin indices.

The first is the CoinDesk 80 index, launched in January 2025, which covers 80 assets outside the CoinDesk 20 index, providing a diversified investment portfolio beyond Bitcoin, Ethereum, and other leading tokens.

The second is the MarketVector Digital Assets 100 Small Cap Index, which selects the 50 smallest tokens from a basket of 100 assets, serving as a barometer for measuring "junk assets" in the market.

The third is the small-cap index launched by Kaiko, which is a research product rather than a tradable benchmark, providing a clear sell-side quantitative perspective for analyzing the small-cap asset group.

These three indices depict the market landscape from different dimensions: the overall altcoin portfolio, high beta small-cap tokens, and a quantitative research perspective, yet they point to highly consistent conclusions.

In contrast, the benchmark performance of the stock market shows a completely opposite trend.

In 2024, the U.S. large-cap index achieved an increase of around 25%, with double-digit growth in 2025, while the pullback was relatively limited. During this period, the S&P 500 index had a maximum drawdown of only mid-single digits, while the Nasdaq 100 index maintained a strong upward trend.

Both major stock indices achieved annual compounded growth without significant profit retracement.

The overall altcoin index, however, exhibited a starkly different trajectory. A report from CoinDesk indicated that the CoinDesk 80 index plummeted by 46.4% in the first quarter, while the CoinDesk 20 index tracking large caps fell by 23.2% during the same period.

By mid-July 2025, the CoinDesk 80 index had fallen 38% for the year, while the CoinDesk 5 index, which tracks Bitcoin, Ethereum, and three other mainstream coins, had increased by 12% to 13% during the same period.

Andrew Baehr from CoinDesk described this phenomenon in an interview with ETF.com as "the correlation is exactly the same, but the performance is worlds apart."

The CoinDesk 5 index and the CoinDesk 80 index have a correlation of 0.9, indicating that their trends are completely aligned, yet the former achieved a modest double-digit increase while the latter plummeted nearly 40%.

It has been proven that holding small-cap altcoins provides minimal diversification benefits, while the performance cost is extremely heavy.

The performance of the small-cap asset sector is even worse. According to Bloomberg, by November 2025, the MarketVector Digital Assets 100 Small Cap Index had fallen to its lowest level since November 2020.

Over the past five years, this small-cap index has returned about -8%, while the corresponding large-cap index has increased by around 380%. Institutional funds clearly favor large-cap assets and avoid tail risks.

From the performance of altcoins in 2024, the Kaiko small-cap index fell over 30% for the year, and mid-cap tokens also struggled to keep up with Bitcoin's gains.

Market winners are highly concentrated in a few leading coins, such as SOL and Ripple. Although the total trading volume of altcoins rose to a high point in 2021, 64% of the trading volume is concentrated in the top ten altcoins.

The liquidity in the cryptocurrency market has not disappeared; rather, it has shifted towards high-value assets.

Sharpe Ratio and Drawdown Magnitude

When comparing from the perspective of risk-adjusted returns, the gap widens further. The CoinDesk 80 index and various small-cap altcoin indices not only have returns deeply entrenched in negative territory, but their volatility is comparable to or even higher than that of stocks.

The CoinDesk 80 index plummeted by 46.4% in a single quarter; the MarketVector small-cap index fell to pandemic-era lows after another round of declines in November.

The overall altcoin index has experienced multiple instances of index-level halving-style drawdowns: the Kaiko small-cap index fell over 30% in 2024, the CoinDesk 80 index plummeted 46% in the first quarter of 2025, and the small-cap index fell again to 2020 lows by the end of 2025.

In contrast, the S&P 500 index and the Nasdaq 100 index achieved cumulative returns of 25% and 17% over two years, with maximum drawdowns only in the mid-single digits. While the U.S. stock market has experienced volatility, it remains manageable overall; the volatility of cryptocurrency indices, however, is highly destructive.

Even considering the high volatility of altcoins as a structural feature, their unit risk-return ratio from 2024 to 2025 remains far below that of holding the U.S. large-cap index.

From 2024 to 2025, the overall altcoin index had a negative Sharpe ratio; meanwhile, the S&P and Nasdaq indices exhibited strong Sharpe ratios without adjusting for volatility. After adjusting for volatility, the gap between the two further widened.

Bitcoin Investors and Cryptocurrency Liquidity

The first insight from the above data is the trend of liquidity centralization and migration towards high-value assets. Reports from Bloomberg and Whalebook on the MarketVector small-cap index both indicate that since early 2024, small-cap altcoins have consistently underperformed, with institutional funds flowing into Bitcoin and Ethereum ETFs.

Combining Kaiko's observational conclusions, although the trading volume of altcoins has rebounded to 2021 levels, the funds are concentrated in the top ten altcoins. The market trend is quite clear: liquidity has not completely withdrawn from the cryptocurrency market but has shifted towards high-value assets.

The previous altcoin bull market was essentially just a basis trading strategy, not a structural outperformance of the assets. In December 2024, the CryptoRank altcoin bull market index soared to 88 points, only to plummet to 16 points in April 2025, completely retracing its gains.

The altcoin bull market of 2024 ultimately devolved into a typical bubble burst; by mid-2025, the overall altcoin portfolio had nearly retraced all its gains, while the S&P and Nasdaq indices continued to grow through compounding.

For financial advisors and asset allocators considering diversification beyond Bitcoin and Ethereum, CoinDesk's data provides clear case references.

By mid-July 2025, the CoinDesk 5 index tracking large caps achieved a modest double-digit increase for the year, while the diversified altcoin index CoinDesk 80 plummeted nearly 40%, with a correlation of 0.9 between the two.

Investors allocating to small-cap altcoins did not achieve substantial diversification benefits; instead, they bore far greater losses and drawdown risks compared to Bitcoin, Ethereum, and U.S. stocks, while still being exposed to the same macro drivers.

Current capital views most altcoins as tactical trading targets rather than strategic allocation assets. From 2024 to 2025, the risk-adjusted returns of Bitcoin and Ethereum spot ETFs were significantly better, and U.S. stocks also performed well.

Liquidity in the altcoin market is increasingly concentrating on a few "institution-grade coins," such as SOL, Ripple, and other tokens with independent positive factors or clear regulatory prospects. The asset diversity at the index level is being squeezed by the market.

In 2025, the S&P 500 index and the Nasdaq 100 index rose by about 17%, while the CoinDesk 80 cryptocurrency index fell by 40%, and small-cap cryptocurrencies fell by 30%.

What Does This Mean for Liquidity in the Next Market Cycle?

The market performance from 2024 to 2025 tested whether altcoins could achieve diversified value or outperform large caps in an environment of rising macro risk appetite. During this period, U.S. stocks achieved double-digit growth for two consecutive years, with manageable drawdowns.

Bitcoin and Ethereum gained institutional recognition through spot ETFs and benefited from a more favorable regulatory environment.

In contrast, the overall altcoin index not only had negative returns and larger drawdowns but also maintained a high correlation with major crypto tokens and stocks, failing to provide corresponding compensation for the additional risks borne by investors.

Institutional funds have always chased performance. The MarketVector small-cap index has a five-year return of -8%, while the corresponding large-cap index has increased by 380%. This gap reflects that capital is continuously migrating towards assets with clear regulations, ample liquidity in derivative markets, and robust custody infrastructure.

The CoinDesk 80 index plummeted by 46% in the first quarter and recorded a 38% year-to-date decline by mid-July, indicating that the trend of capital migrating towards high-value assets has not only not reversed but is accelerating.

For Bitcoin and Ethereum investors evaluating whether to allocate to small-cap crypto tokens, the data from 2024 to 2025 provides a clear answer: the absolute returns of the overall altcoin portfolio lag behind U.S. stocks, and the risk-adjusted returns are inferior to those of Bitcoin and Ethereum; despite a high correlation of 0.9 with major crypto tokens, it has failed to provide any diversification value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。